(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

Date of commencement of electronic provision measures: May 27, 2024

The 158th Ordinary General Meeting of Shareholders

Other matters subject to the electronic provision measures

(Matters for which document delivery is omitted)

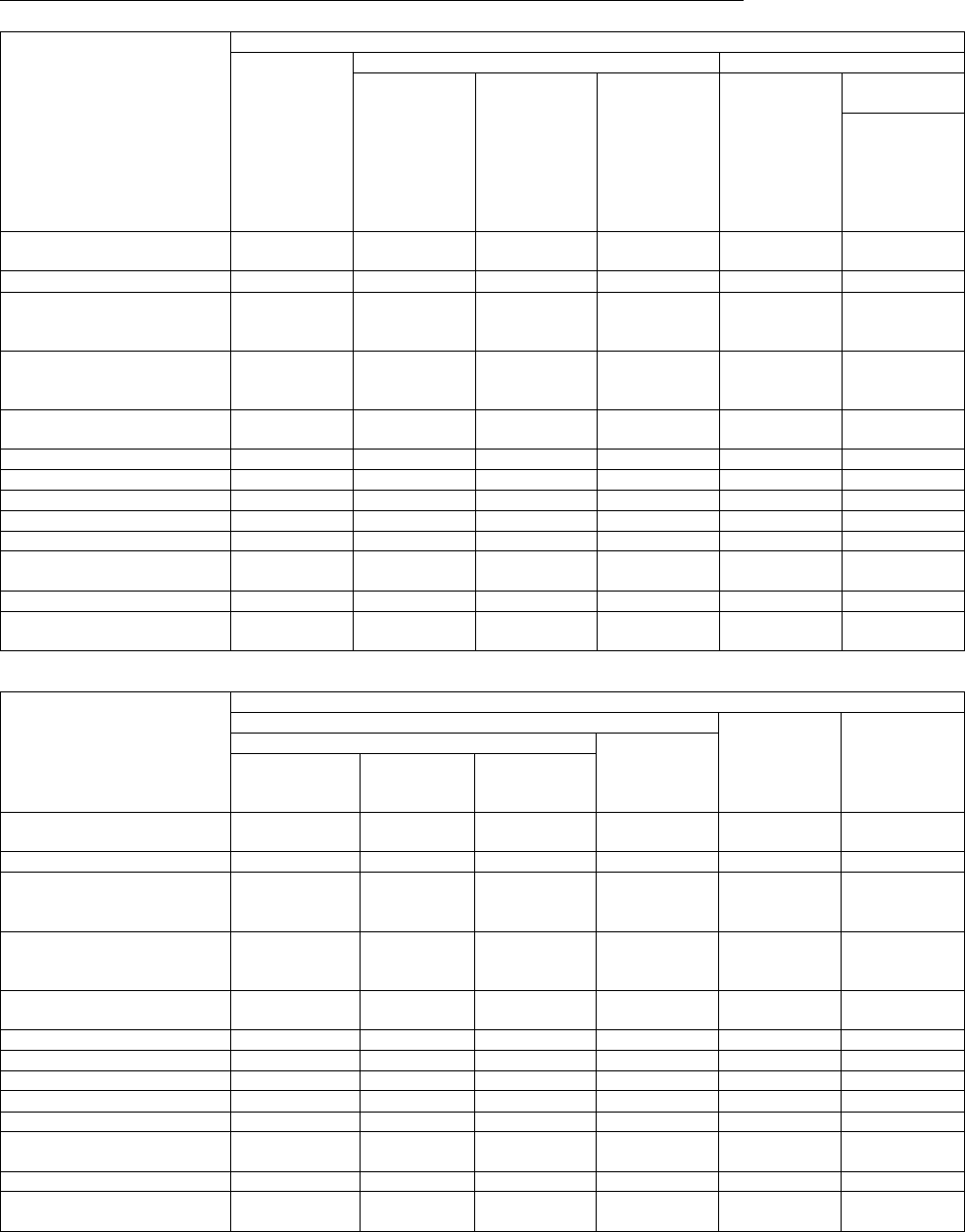

Consolidated Statement of Changes in Net Assets

Notes to Consolidated Financial Statements

Non-Consolidated Statement of Changes in Net Assets

Notes to Non-Consolidated Financial Statements

(April 1, 2023 – March 31, 2024)

Suzuki Motor Corporation

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

1

Consolidated Statement of Changes in Net Assets (April 1, 2023 – March 31, 2024)

(Amount: Millions of yen)

Shareholders’ equity

Share capital

Capital surplus

Retained earnings

Treasury shares

Total shareholders’

equity

Balance at the beginning

of current fiscal year

138,370

138,180

1,813,209

(19,396)

2,070,363

Changes during period

Dividends of surplus

(50,836)

(50,836)

Profit attributable to

owners of parent

267,717

267,717

Purchase of shares of

consolidated

subsidiaries

(69,137)

(69,137)

Purchase of treasury

shares

(20,029)

(20,029)

Disposal of treasury

shares

42

125

168

Net changes in items

other than

shareholders’ equity

Total changes during

period

–

(69,095)

216,881

(19,903)

127,881

Balance at the end of

current fiscal year

138,370

69,084

2,030,090

(39,300)

2,198,245

Accumulated other comprehensive income

Share

acquisition

rights

Non-

controlling

interests

Total net

assets

Valuation

difference

on

Available-

for-sale

securities

Deferred

gains or

losses on

hedges

Foreign

currency

translation

adjustment

Remeasure-

ments of

defined

benefit plans

Total

accumulate

d other

comprehens

ive income

Balance at the beginning

of current fiscal year

117,885

(167)

(86,742)

(23,321)

7,653

41

430,561

2,508,620

Changes during period

Dividends of surplus

(50,836)

Profit attributable to

owners of parent

267,717

Purchase of shares of

consolidated

subsidiaries

(69,137)

Purchase of treasury

shares

(20,029)

Disposal of treasury

shares

168

Net changes in items

other than

shareholders’ equity

118,835

(16)

150,695

15,599

285,114

–

216,781

501,895

Total changes during

period

118,835

(16)

150,695

15,599

285,114

–

216,781

629,777

Balance at the end of

current fiscal year

236,720

(183)

63,953

(7,722)

292,768

41

647,342

3,138,397

[Note] Amounts less than one million yen are rounded down.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

2

Notes to Consolidated Financial Statements

1.

Notes to Basic Significant Matters for Preparing Consolidated Financial Statements

(1)

Scope of consolidation

1)

Number of consolidated subsidiaries and name of main consolidated subsidiaries

Number of consolidated subsidiaries 119 companies

Name of main consolidated subsidiaries

Domestic ……… Suzuki Auto Parts Mfg. Co., Ltd.

Suzuki Motor Sales Kinki Inc.

Overseas ……… Magyar Suzuki Corporation Ltd.

SUZUKI ITALIA S.p.A.

Maruti Suzuki India Ltd.

Suzuki Motor Gujarat Private Ltd.

Suzuki Motorcycle India Private Ltd.

Pak Suzuki Motor Co., Ltd.

PT. Suzuki Indomobil Motor

TDS Lithium–Ion Battery Gujarat Private Ltd.

2)

Change in the scope of consolidation

Increase: 1 company Decrease: 2 companies

3)

Name of unconsolidated subsidiaries

Name of main unconsolidated subsidiaries ……… Suzuki Motor Co., Ltd.

Reason for exclusion:

Because these unconsolidated subsidiaries are small, and total influence by their total

assets, net sales, net income or loss (the amounts equivalent to the Company’s interest in

the companies) and retained earnings (the amounts equivalent to the Company’s interest

in the companies) on the consolidated financial statements are insignificant.

(2)

Application of the equity methods

1)

Number of companies accounted for using equity method and name of main companies

accounted for using equity method

Number of companies accounted for using equity method: 31 companies

Name of main companies accounted for using equity method ……… Krishna Maruti Ltd.

2)

Change in the scope of application of the equity method

Increase: 1 company Decrease: 2 companies

3)

Name of unconsolidated subsidiaries and entities that are not accounted for using equity method

Name of main unconsolidated subsidiaries and associates that are not accounted for

using equity method ............. Suzuki Motor Co., Ltd.

Reason for non–application:

In terms of net income or loss and retained earnings (the amounts equivalent to the

Company’s interest in the companies), influence of these companies on consolidated

financial statements is insignificant even if equity method is not applied to the companies,

and it is not important as a whole.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

3

(3)

Fiscal year and others of consolidated subsidiaries

1)

The number of consolidated subsidiaries for which the account settlement date is different

from the consolidated account settlement date (March 31) is as follows.

December 31……… 14, including Magyar Suzuki Corporation Ltd.

2)

The above consolidated subsidiaries are consolidated based on the financial statements on the

provisional settlement of accounts on the consolidated account settlement date.

(4)

Accounting policy

1)

Evaluation standards and evaluation methods of significant assets

(a) Securities

Available-for-sale securities…… Items other than equity securities for which market values

are unavailable:

Fair value method (The evaluation differences shall be

reported as a component of net assets, and sales costs shall

be calculated mainly by the moving average method.)

Equity securities for which market values are unavailable:

Cost method by the moving average method

(b) Derivatives…………………………… Fair value method

(c) Inventories……………………………. Cost method mainly by the gross average method (Figures on

the consolidated balance sheet are calculated by the method

of book devaluation based on the reduction of profitability.)

2)

Method of depreciation and amortization of significant depreciable assets

(a) Property, plant and equipment (excluding lease assets)

…………………… Mainly declining balance method

(b) Intangible assets (excluding lease assets)

…………………… Straight line method

(c) Lease assets

Finance leases which transfer ownership

…………………… The same method as depreciation and amortization of self-

owned noncurrent assets

Finance leases which do not transfer ownership

…………………… Straight-line method with the lease period as the durable

years. With regard to lease assets with guaranteed residual

value under lease agreement, remaining value is the

guaranteed residual value. And with regard to other lease

assets, remaining value would be zero.

3)

Accounting treatment for deferred assets

…………………… They are treated as expenses at the time of expenditure.

4)

Basis for significant allowances and provisions

(a) Allowance for doubtful accounts

In order to allow for loss from bad debts, estimated uncollectible amount based on actual

ratio of bad debt is appropriated as to general receivable. With regard to specific receivable

with higher default possibility, possibility of collection is estimated, respectively and

uncollectible amount is appropriated.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

4

(b) Allowance for investment loss

The differences between the book value and the fair value of equity securities for which

market values are unavailable are determined and appropriated as reserve in order to allow

for losses from these investments.

(c) Provision for product warranties

The provision is recorded into this account based on the warranty agreement, laws and

regulations and past experience in order to allow for expenses related to the maintenance

service of products sold.

(d) Provision for bonuses for directors

In order to pay bonuses for directors and audit & supervisory board members, estimated amount

of such bonuses is appropriated.

(e) Provision for retirement benefits for directors

The amount to be paid at the end of year had been posted pursuant to the Company’s

regulations on the retirement allowance of directors and audit & supervisory board members.

However, the Company’s retirement benefit system for them was abolished at the closure of the

ordinary general shareholders’ meeting held on June 29, 2006. And it was approved at the

shareholders’ meeting that reappointed directors and audit & supervisory board members were

paid their retirement benefit at the time of their retirement, based on their years of service.

Estimated amount of such retirement benefits is appropriated.

Furthermore, for the directors and audit & supervisory board members of some consolidated

subsidiaries, the amount to be paid at the end of the year was posted pursuant to their

regulation on the retirement allowance of directors and audit & supervisory board members.

(f) Provision for disaster

Reasonably estimated amount is appropriated for anticipated loss mainly caused by relocation

of plants and facilities located in the Ryuyo Region in Iwata City, Shizuoka Prefecture where

massive tsunami damages caused by Tokai and Tonankai Earthquake are anticipated.

(g) Provision for product liabilities

With regards to the products exported to North American market, to prepare for the payment of

compensation not covered by “Product Liability Insurance,” the anticipated amount to be borne

by the Company is computed and provided on the basis of actual results in the past.

(h) Provision for recycling expenses

The provision is appropriated for an estimated expenses related to the recycle of products of

the Company based on number of vehicles owned in the market, etc.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

5

5)

Recognition criteria for revenue and expenses

(a) Revenue

The Group is engaged in manufacturing and sale of automobiles, motorcycles, outboard

motors, electric wheelchairs, etc. in addition to the logistics services associated to these

businesses and other service businesses. The Group recognizes revenue from sale of the

above goods at the time when it satisfies a performance obligation by transferring control

of the goods or services to a customer in an amount that the Group expects to be entitled

in exchange for those goods and services.

Such amounts exclude the amount of consumption tax and value added tax levied on

behalf of tax authorities.

For contracted prices with customers, which include variable consideration, the Group

measures revenue less variable consideration only to the extent that it is highly probable

that there will be no significant reversal when the uncertainty associated with the variable

consideration is subsequently resolved.

Variable consideration mainly consists of sales rebates calculated based on past

transactions using the most likely amount method.

The Group recognizes revenue when it satisfies performance obligation over time or at a

point in time. As for the sale of automobiles, since the performance obligation is

considered fulfilled at the point in time when the products are delivered and the control of

such products is acquired by the customers, the revenue is recognized at the delivery of

the products.

If the Group provides services other than the warranty that the finished goods comply with

the agreed-upon specifications, such as a customer-paid extended warranty covering

longer than the standard period of time, revenue from such services is recognized over

the duration of the warranty in proportion to expenses to be incurred to satisfy

performance obligations under the contract.

The Group receives consideration mainly as advance payment during the period from the

time of receipt of a purchase order until the fulfillment of the performance obligation or

within one year after the fulfilment of the performance obligation. No significant financing

component is included in such transaction.

(b) Revenue recognition of finance lease transactions:

Net sales and costs of sales are recognized when due for payment of lease fees has

come.

6)

Accounting treatment pertaining to retirement benefits

(a) Method of attributing expected benefit to periods

With regard to calculation of retirement benefit obligations, benefit formula basis method

was used to attribute expected benefit to period up to the end of this fiscal year.

(b) Method to recognize actuarial gains or losses and past service costs as expenses

With regard to past service costs, they are treated as expense on a straight-line basis over

the certain years within the period of average length of employees’ remaining service years

at the time when it occurs.

With regard to the actuarial gains or losses, the amounts, prorated on a straight-line basis

over the certain years within the period of average length of employees’ remaining service

years in each year in which the differences occur, are respectively treated as expenses from

the next term of the year in which they arise.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

6

7)

Standards for translation of significant assets or liabilities in foreign currencies into the

Japanese currency

Receivable and payable in foreign currencies are translated into yen on the spot exchange rate of

the consolidated account settlement date, and the exchange difference shall be processed as gain

or loss. Further, assets and liabilities of foreign consolidated subsidiaries and others shall be

translated into yen by the spot exchange rate as of the consolidated account settlement date,

profits and expenses are translated into yen by the average exchange rate during the year, and

exchange differences shall be recorded to foreign currency translation adjustment and non–

controlling interests of the net assets.

8)

Method of significant hedge accounting

The deferred hedge processing is applied in principle.

9)

Other significant matters for preparing consolidated financial statements

The Company and certain of its domestic consolidated subsidiaries have applied the Group Tax

Sharing System. Accounting and disclosure for income taxes, local income taxes, and tax effect

accounting are in accordance with the “Treatment of Accounting and Disclosure under the Group

Tax Sharing System” (Practical Solution Report No. 42, August 12, 2021.)

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

7

2.

Notes to Accounting Estimates

(1)

Provision for product warranties

1)

Amount recorded in the consolidated financial statements for the current fiscal year

(Amount: Millions of yen)

End of the current

consolidated fiscal year

Balance at the beginning of the period

208,282

Amount paid during the period

(29,758)

Transferred amount

11,529

Balance at the end of the period

190,053

2)

Information regarding the details of the accounting estimate for the identified item

The Group recognizes provision for product warranties for costs related with future product

warranties.

Costs related to product warranty include (i) free repair costs based on the product warranty,

and (ii) free repair costs based on notification to a government agency. (i) Free repair costs

based on the product warranty are recognized at the time the product is sold. Regarding (ii) free

repair costs based on notifications to a government agency, if there is a high possibility that

costs will be incurred and the amount can be reasonably estimated, the provision will be

recognized based on comprehensive and individual estimates based on past occurrences.

The amount of these provisions is estimated and calculated regarding the estimated number of

units and the cost per forecasted units based on currently available information, such as past

sales, repairs, and experience, and reflects the amount expected to be recovered by claiming

compensation from the supplier. Provision for product warranties contain uncertainties as it is

calculated by estimation. Therefore, the actual repair cost may differ from the estimate.

(2)

Retirement benefits asset and retirement benefits liability

1)

Amount recorded in the consolidated financial statements for the current fiscal year

Retirement benefits asset 19,241 Million Yen

Retirement benefits liability 59,894 Million Yen

2)

Information regarding the details of the accounting estimate for the identified item

The Group's retirement benefit expenses, retirement benefit asset and retirement benefits liability

are calculated based on various assumptions such as discount rate, expected rate of return on

long-term investment, revaluation rate, salary increase rate, mortality rate, etc. Of these, the

discount rate is determined based on safe long-term bond yields and the expected rate of return on

long-term investment is determined based on the pension asset management policy of each

pension plan.

The decline in long-term bond yields will reduce the discount rate and adversely affect the

calculation of retirement benefit costs. However, in the cash-balanced pension system adopted by

the Company, the revaluation rate, which is one of the basic rates, has the effect of reducing the

adverse effects of a decrease in the discount rate.

Additionally, if the investment yield of pension assets is lower than the expected rate of return on

long-term investment, it will adversely affect the calculation of retirement benefit costs, but the

impact on our corporate pension and the Group's corporate pension fund, which strive for stable

management, is minor.

The difference between these assumptions and the actual results is expensed mostly by the

straight-line method over a fixed number of years within the average remaining service period of

the employee at the time of occurrence.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

8

(3)

Deferred tax assets

1)

Amount recorded in the consolidated financial statements for the current fiscal year

Deferred tax assets 85,444 Million Yen

Deferred tax liabilities 4,114 Million Yen

2)

Information regarding the details of the accounting estimate for the identified item

We are examining whether the recoverability of deferred tax assets has an effect of reducing future

tax burdens, etc. for some or all of the deductible temporary differences, loss carryforwards and

tax credits carried forward.

The appraisal of recoverability of deferred tax assets takes into account elimination of taxable

temporary differences, estimation of future taxable income, and tax planning.

Regarding this estimate, in the event of a changes in future market trends, business activity

status, or other assumptions related to the Group, it may affect the amount of deferred tax assets

and income taxes–deferred from the next fiscal year onward.

3.

Notes to Consolidated Balance Sheets

(1)

Assets pledged as collateral and secured liabilities

1)

Assets pledged as collateral

Machinery and equipment 814 Million Yen

2)

Secured liabilities

Long-term borrowings 734 Million Yen

(2)

Accumulated depreciation of property, plant and equipment 2,597,890 Million Yen

(3)

Guarantee obligations

The Group guarantees borrowing from financial institution etc. by other companies which are

not consolidated subsidiaries.

2,212 Million Yen

(4)

The Company has the commitment line contract with 6 banks for effective financing.

The outstanding balance of the contract at the end of the current consolidated fiscal year is as follows.

Commitment line contract total 300,000 Million Yen

Actual loan balance –

Undrawn balance 300,000 Million Yen

4.

Notes to Consolidated Statements of Income

Revenue from contracts with customers

The Company does not disaggregate revenues from contracts with customers and other revenue. The

amount of revenue from contracts with customers is presented in “7. Notes to Revenue Recognition,

(1) Breakdown of revenue from contracts with customers” in Notes to Consolidated Financial

Statements.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

9

5.

Notes to Consolidated Statement of Changes in Net Assets

(1)

Type and number of outstanding shares

(Shares)

Type of shares

Number of shares at

the beginning of

current fiscal year

Increased number

of shares during the

period

Decreased number

of shares during the

period

Number of shares at

the end of current

fiscal year

Common stock

491,146,600

–

–

491,146,600

[Notes] A four–for-one common stock split was conducted on April 1, 2024; however, the items

listed above are based on the number of shares held before the split.

(2)

Dividends

1)

Dividends paid

Resolution

Type of shares

Total amount

of dividends

Dividends per

share

Record date

Effective date

Ordinary general

shareholders’

meeting held on

June 23, 2023

Common stock

24,305

Million Yen

50.00 Yen

March 31,

2023

June 26,

2023

Meeting of the

Board of Directors

held on

November 7, 2023

Common stock

26,530

Million Yen

55.00 Yen

September

30, 2023

November 30,

2023

2)

Dividends, which record date is during the current consolidated fiscal year, with their effective

date in the next consolidated fiscal year

The following dividends are proposed as a matter of resolution at the ordinary general

shareholders’ meeting scheduled to be held on June 27, 2024.

(a) Total amount of dividends 32,319 Million Yen

(b) Dividends per share 67.00 Yen

(c) Record date March 31, 2024

(d) Effective date June 28, 2024

Dividends will be paid from retained earnings.

[Notes] A four–for-one common stock split was conducted on April 1, 2024; however, the items

listed above are based on the number of shares held before the split.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

10

6.

Notes to Financial Instruments

(1)

Matters for conditions of financial instruments

With regard to the fund management, the Group uses short-term deposits and securities, and with

regard to the fund-raising, the Group uses borrowings from financial institutions such as banks and

issuance of bonds.

The Group mitigates customers’ credit risks from notes and accounts receivable-trade in line with

our rules and regulations for credit control. The Group hedges risks of exchange-rate fluctuations

from operating receivables denominated in foreign currency by forward exchange contract in

principle. Investment securities are mainly stocks and mutual funds, and with regard to listed

stocks and mutual funds, the Group quarterly identifies those fair values.

Applications of borrowings are operating capital (mainly short term) and fund for capital

expenditures (long term). The Group uses cross currency interest rate swap as hedge instruments

for the risk of fluctuation in interest rate and foreign exchange rate of some long-term borrowings.

In addition, the Group uses derivatives within the actual demand in accordance with our

administrative rules.

(2)

Matters for fair values of the financial instruments

Carrying amounts in the consolidated balance sheet, fair value and differences between them at

March 31, 2024 (consolidated settlement date of current fiscal year) are as follows.

“Cash and deposits,” “Accounts payable-trade,” “Short-term borrowings,” and “Accrued

expenses” are omitted because they comprise cash and are short-term instruments whose

carrying amount approximates their fair value.

(Amount: Millions of yen)

Carrying

amount

Fair value

Difference

Assets

(a) Notes and accounts receivable-trade

565,011

559,746

(5,265)

(b) Securities and investment securities (*1, *2)

Available-for-sale securities

1,377,620

1,377,620

–

Stocks of associates

1,336

3,271

1,935

Total assets

1,943,968

1,940,637

(3,330)

Liabilities

Long-term borrowings

619,638

617,094

2,544

Total liabilities (*3)

619,638

617,094

2,544

Derivatives (*4)

(3,727)

(3,727)

–

[Notes] 1. Equity securities for which market values are unavailable are not included in the above

(b) Securities and investment securities.

(Amount: Millions of yen)

Account Title

Carrying Amount

Available-for-sale securities

Unlisted stocks other than stocks of

associates

27,216

Unlisted stocks of associates

65,110

2.

Notes on investments in partnerships and other similar entities for which equity interests

are recorded on a net basis on the consolidated balance sheet are omitted. The amount of

these investments recorded on the consolidated balance sheet is 32,368 million yen.

3.

Total liabilities include current portion of long-term borrowings.

4.

Assets or liabilities derived from derivatives are shown on a net basis and net liabilities are

shown as ( ).

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

11

(3)

Fair value information by level within the fair value hierarchy

The fair value of financial instruments is classified into the following three levels according to the

observability and significance of inputs used to measure fair value.

Level 1 fair value: Fair value measured using quoted prices (unadjusted) in active markets

for the same assets or liabilities.

Level 2 fair value: Fair value measured using directly or indirectly observable inputs other

than Level 1 inputs.

Level 3 fair value: Fair value measured using significant unobservable inputs.

If multiple inputs are used that are significant to the fair value measurement, the fair value

measurement is categorized in its entirety in the level of the lowest level input that is significant

to the entire measurement.

1) Financial assets and financial liabilities measured at fair value

(Amount: Millions of yen)

Category

Fair value

Level 1

Level 2

Level 3

Total

Securities and investment securities

Available-for-sale securities

Stocks

295,628

–

–

295,628

Bonds

–

75,106

–

75,106

Mutual funds

968,864

6,928

1,092

976,885

Others

–

30,000

–

30,000

Total assets

1,264,493

112,034

1,092

1,377,620

Derivatives

–

(3,727)

–

(3,727)

2) Financial assets and financial liabilities not measured at fair value

(Amount: Millions of yen)

Category

Fair value

Level 1

Level 2

Level 3

Total

Accounts receivable-trade

–

559,746

–

559,746

Securities and investment securities

Stocks of associates

3,271

–

–

3,271

Total assets

3,271

559,746

–

563,017

Long-term borrowings

–

617,094

–

617,094

Total liabilities

–

617,094

–

617,094

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

12

[Notes] 1. Description of the valuation techniques and inputs used in the fair value measurement

Assets

Accounts receivable-trade

The fair value of these items is measured using the discounted cash flow method

based on the amount of receivables, period to maturity and an interest rate reflecting

credit risk, for each receivable categorized by a specified period, and is classified as

Level 2.

Securities and investment securities

Listed shares and bonds are valued using quoted prices. As listed shares are traded in

active markets, their fair value is classified as Level 1. On the other hand, the fair value

of bonds held by the Company are classified as Level 2 because they are not traded

frequently in the public market and not considered to have quoted prices in active

markets. In addition, beneficiary certificates of mutual funds whose market value is

the price presented by a third party are classified into Level 1, Level 2, or Level 3

based on the obtained price and the observability in the inputs used for pricing.

Liabilities

Long-term borrowings

The fair value of these items is measured using the discounted cash flow method

based on the sum of principal and interest, remaining maturities and an interest rate

reflecting credit risk, and is classified as Level 2.

Derivatives transactions

The fair value of cross currency interest rate swaps and forward exchange contracts is

measured using the discounted cash flow method based on observable inputs, such as

interest rates and exchange rates, and is classified as Level 2.

2. Assets or liabilities derived from derivatives are shown on a net basis and net

liabilities are shown as ( ).

3. Information on fair values of Level 3 financial assets and financial liabilities with

the carrying amount not recorded using the fair value

Note is omitted because it is insignificant.

7.

Notes to Revenue Recognition

(1)

Breakdown of revenue from contracts with customers

(Amount: Millions of yen)

Automobiles

Business

Motorcycles

Business

Marine

Business

Other

Business

Total

Japan

1,253,124

19,765

3,357

11,235

1,287,482

Europe

634,531

46,876

18,933

–

700,341

Asia

2,393,389

185,142

13,829

–

2,592,360

Others

574,133

114,797

76,157

–

765,089

Revenue from

contracts with

customers

4,855,179

366,581

112,278

11,235

5,345,274

Other revenue

[Note] 2

28,624

353

3

–

28,981

Net sales to

external

customers

4,883,804

366,934

112,281

11,235

5,374,255

[Notes] 1. Revenue is disaggregated by region based on the location of customers.

2. Other revenue includes income from lessor lease, etc.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

13

(2)

Basic information for understanding revenue

The details are the same as described in “1. Notes to Basic Significant Matters for Preparing

Consolidated Financial Statements (4) Accounting Policy 5) Recognition criteria for revenue

and expenses” in the Notes to Consolidated Financial Statements.

(3)

Basic information for understanding the revenue amounts in the current and next fiscal years

1)

Receivables from contracts with customers and contract liabilities

Receivables from contracts with customers and contract liabilities in the current fiscal year are as

follows:

(Amount: Millions of yen)

Balance at the end

of

the period

Receivables from contracts with

customers

529,699

Notes receivable-trade

949

Accounts receivables-trade

528,750

Contract liabilities

177,932

Other current liabilities

120,074

Other non-current liabilities

57,858

Contract liabilities are mainly consideration received from customers prior to delivery of the product. Of the

revenue recognized in the current fiscal year, the amount included in the contract liability balance as of the

beginning of the period was 92,985 million yen. The amount of revenue recognized from performance

obligations fulfilled (or partially fulfilled) in the past period is not significant.

2)

Transaction price allocated to the remaining performance obligations

The Company and consolidated subsidiaries have applied the practical expedient to the notes

on transaction prices allocated to the remaining performance obligations, and does not disclose

contracts with an original expected duration of one year or less. Consideration arising from

contracts with customers does not have any significant amounts not included in the transaction

price.

As of the end of the current fiscal year, the total transaction price allocated to unfulfilled

performance obligations and the period during which revenue is expected to be recognized are

as follows:

(Amount: Millions of yen)

Current fiscal year

Within one year

42,883

Over one year

67,107

Total

109,991

Remaining performance obligations consist primarily of extended warranty income and

maintenance income.

8.

Notes to Information about Per Share Amount

Net assets per share 1,291.25 Yen

Profit per share, Basic 138.40 Yen

[Notes] A four–for-one common stock split was conducted on April 1, 2024.

Net assets per share and profit per share, basic are calculated on the assumption that the stock

split was conducted at the beginning of this consolidated fiscal year.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

14

9.

Notes to Significant Subsequent Events

(Stock split and Related Amendment to the Articles of Incorporation)

The Company conducted stock split and partially amended its Articles of Incorporation on April 1, 2024 based on

a resolution of the Board of Directors meeting held on December 13, 2023.

(1)

Stock Split

1)

Purpose of the Stock Split

The purpose is to lower the minimum investment amount through the stock split, thereby creating

an environment where it is easier to invest in the Company’s shares and expanding the Company’s

investor base.

2)

Outline of the Stock Split

(a) Stock Split Method

The record date for the stock split was Sunday, March 31, 2024. Since this day falls on a

non-business day of the shareholder registry administrator, the substantial record date

was Friday, March 29, 2024. Each share of the Company’s common stock held by

shareholders as of the record date was split into 4 shares.

(b) Increase in Number of Shares as a Result of the Stock Split

Total number of issued shares before the stock split

491,146,600 shares

Increase in number of shares due to the stock split

1,473,439,800 shares

Total number of issued shares after the stock split

1,964,586,400 shares

Total number of issuable shares after the stock split

6,000,000,000 shares

(c) Stock Split Schedule

Public notice of record date

Friday, March 15, 2024

Record date

Sunday, March 31, 2024

Effective date

Monday, April 1, 2024

3)

Impact for information of per share

The impact of the stock split is described in the relevant section.

(2)

Partial Amendment to Articles of Incorporation

1)

Reason for Amendment

Due to the stock split described above, the Company partially amended its Articles of Incorporation,

effective as of Monday, April 1, 2024, pursuant to Article 184, Paragraph 2 of the Companies Act.

2)

Details of Amendment to Articles of Incorporation

The details of the amendment are as follows: (Underlined part indicates amendment)

Articles of Incorporation before Amendment

After Amendment

(Total Number of Issuable Shares)

Article 6.

The total number of the Company’s issuable

shares shall be 1,500,000,000 shares.

(Total Number of Issuable Shares)

Article 6.

The total number of the Company’s issuable

shares shall be 6,000,000,000 shares.

3)

Schedule of Amendments to the Articles of Incorporation

Effective Date: Monday, April 1, 2024

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

15

10.

Other Notes

(Business Combinations)

Transaction under common control, etc.

(1)

Outline of the Transaction

1)

Name of the acquired company and its business

Maruti Suzuki India Limited ("MSIL") Production and Sale of products of the Company

Suzuki Motor Gujarat ("SMG") Production of products of the Company

2)

Date of business combination

November 24, 2023 (Deemed date of acquisition: December 31, 2023)

3)

Legal form of the business combinations

In relation to change of SMG, an Indian subsidiary, to a sub-subsidiary, the Company transferred all of the

shares of SMG held by the Company to MSIL, and subscribed shares issued by MSIL on a preferential

allotment basis as consideration for the transfer.

4)

Name of the company after the business combination

No change

5)

Other matters on the outline of the transaction

The purpose of this transaction was to further enhance competitiveness through streamlining production

operations by MSIL’s controlling production of automobiles in India.

The ratio of shares held by the Company in MSIL became 58.19% from 56.48% before the capital increase.

(2)

Outline of Accounting treatment applied

In accordance with the Accounting Standard for Business Combinations (ASBJ Statement No. 21, January 16,

2019) and the Implementation Guidance on Accounting Standard for Business Combinations and Accounting

Standard for Business Divestitures (ASBJ Guidance No. 10, January 16, 2019), the transaction is treated as a

transaction under common control.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

16

Non-Consolidated Statement of Changes in Net Assets (April 1, 2023 – March 31, 2024)

(Amount: Millions of yen)

Shareholders' equity

Share capital

Capital surplus

Retained earnings

Legal capital

surplus

Other capital

surplus

Total capital

surplus

Legal retained

earnings

Other retained

earnings

Reserve for

tax purpose

reduction

entry of

non-current

assets

Balance at the beginning of

current fiscal year

138,370

144,720

1,568

146,289

8,269

12,841

Changes during period

Provision of reserve for tax

purpose reduction entry of

non-current asset

4,743

Reversal of reserve for tax

purpose reduction entry of

non-current asset

(4,641)

Provision of reserve for

promoting open innovation

Provision of general reserve

Dividends of surplus

Profit

Purchase of treasury shares

Disposal of treasury shares

42

42

Net changes in items other

than shareholders' equity

Total changes during period

–

–

42

42

–

101

Balance at the end of current

fiscal year

138,370

144,720

1,611

146,331

8,269

12,942

Shareholders' equity

Retained earnings

Treasury

shares

Total

shareholders'

equity

Other retained earnings

Total retained

earnings

Reserve for

promoting open

innovation

General

reserve

Retained

earnings brought

forward

Balance at the beginning of

current fiscal year

–

458,000

143,480

622,592

(19,331)

887,920

Changes during period

Provision of reserve for tax

purpose reduction entry of

non-current asset

(4,743)

–

–

Reversal of reserve for tax

purpose reduction entry of

non-current asset

4,641

–

–

Provision of reserve for

promoting open innovation

412

(412)

–

–

Provision of general reserve

94,000

(94,000)

–

–

Dividends of surplus

(50,836)

(50,836)

(50,836)

Profit

203,112

203,112

203,112

Purchase of treasury shares

(20,004)

(20,004)

Disposal of treasury shares

125

168

Net changes in items other

than shareholders' equity

Total changes during period

412

94,000

57,761

152,275

(19,878)

132,439

Balance at the end of current

fiscal year

412

552,000

201,242

774,867

(39,209)

1,020,359

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

17

(Amount: Millions of yen)

Valuation and translation adjustments

Share acquisition

rights

Total net assets

Valuation difference

on Available-for-

sale securities

Deferred gains or

losses on hedges

Total valuation and

translation adjustments

Balance at the beginning of

current fiscal year

44,850

69

44,920

41

932,882

Changes during period

Provision of reserve for tax

purpose reduction entry of

non-current asset

–

Reversal of reserve for tax

purpose reduction entry of

non-current asset

–

Provision of reserve for

promoting open innovation

Provision of general reserve

–

Dividends of surplus

(50,836)

Profit

203,112

Purchase of treasury shares

(20,004)

Disposal of treasury shares

168

Net changes in items other

than shareholders' equity

81,323

(156)

81,167

–

81,167

Total changes during period

81,323

(156)

81,167

–

213,606

Balance at the end of current

fiscal year

126,173

(86)

126,087

41

1,146,488

[Note] Amounts less than one million yen are rounded down.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

18

Notes to Non-Consolidated Financial Statements

1. Notes to Significant Accounting Policies

(1)

Evaluation standards and evaluation methods of assets

1) Securities

Stocks of subsidiaries and associates……… Cost method by the moving average method

Other securities of affiliated companies… Investments in partnerships like Investment

Limited Partnership (which are regarded as securities

under Article 2–2 of the Financial Instruments and

Exchange Act) are recorded on a net basis equivalent

to the equity interest based on the most recent

financial statements available on the reporting date

stipulated in the contract.

Available-for-sale securities…………………… Items other than equity securities for which market

values are unavailable:

Fair value method (The evaluation differences shall be

reported as a component of net assets, and costs of

securities sold shall be calculated by the moving

average method)

Equity securities for which market values are

unavailable:

Cost method by the moving average method

2) Derivatives .............................................….. Fair value method

3) Inventories ...........................................….... Cost method mainly by the gross average method

(figures on the balance sheet are calculated by the

method of book devaluation based on the reduction of

profitability.)

(2)

Method of depreciation and amortization of non-current assets

1) Property, plant and equipment (excluding lease assets)

………………… Declining-balance method

2) Intangible assets (excluding lease assets)

………………… Straight-line method

3) Lease assets

Finance leases which transfer ownership

………………… The same method as depreciation and amortization of

self-owned non-current assets

Finance leases which do not transfer ownership

………………… Straight-line method with the lease period as the

durable years. With regard to lease assets with

guaranteed residual value under lease agreement,

remaining value is the guaranteed residual value. And

with regard to other lease assets, remaining value

would be zero.

(3)

Accounting treatment for deferred assets

………………… They are treated as expenses at the time of

expenditure.

(4)

Allowances and provisions

1) Allowance for doubtful accounts

In order to allow for loss from bad debts, estimated uncollectible amount based on actual ratio

of bad debt is appropriated as to general receivable. With regard to specific receivable with

higher default possibility, possibility of collection is estimated respectively and estimated

uncollectible amount is appropriated.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

19

2) Allowance for investment loss

The differences between the book value and the fair value of equity securities for which

market values are unavailable are determined and appropriated as reserve in order to allow for

losses from these investments.

3) Provision for product warranties

The provision is appropriated into this account based on the warranty agreement, laws and

past experience in order to allow for expenses related to the maintenance service of products

sold.

4) Provision for retirement benefits

In order to allow for payment of employees’ retirement benefits, provision is recognized based

on estimated amount of retirement benefits liabilities and pension assets at the end of current

fiscal year is appropriated.

(a) Method of attributing expected benefit to periods

With regard to calculation of retirement benefit liability, benefit formula basis method was

used to attribute expected benefit to period up to the end of this fiscal year.

(b) Method to recognize actuarial gains or losses and past service costs as expenses

With regard to past service costs, they are treated as expense on a straight line basis over

the certain years within the period of average length of employees’ remaining service years

at the time when it occurs.

With regard to the actuarial gains or losses, the amounts, prorated on a straight-line basis

over the certain years within the period of average length of employees’ remaining service

years in each year in which the differences occur, are respectively treated as expenses

from the next term of the year in which they arise.

5) Provision for retirement benefits for directors

The amount to be paid at the end of year had been posted pursuant to the Company’s

regulations on the retirement allowance of directors and audit & supervisory board members.

However, the Company’s retirement benefit system for them was abolished at the closure of

the ordinary general shareholders’ meeting held on June 29, 2006. And it was approved at the

shareholders’ meeting that reappointed directors and audit & supervisory board members were

paid their retirement benefit at the time of their retirement, based on their years of service.

Estimated amount of such retirement benefits is appropriated.

6) Provision for product liabilities

With regards to the products exported to North American market, to prepare for the payment

of compensation not covered by “Product Liability Insurance,” the anticipated amount to be

borne by the Company is computed and provided on the basis of actual results in the past.

7) Provision for recycling expenses

The provision is recorded for an estimated expense related to the recycle of products of the

Company based on number of vehicles owned in the market, etc.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

20

(5)

Recognition criteria for revenue and expenses

The Company is engaged in manufacturing and sale of automobiles, motorcycles, outboard motors,

electric wheelchairs, etc. in addition to the logistics services associated to these businesses and

other service businesses. The Company recognizes revenue from sale of the above goods at the

time when it satisfies a performance obligation by transferring control of the goods or services to

a customer in an amount that the Group expects to be entitled in exchange for those goods and

services.

Such amounts exclude the amount of consumption tax and value added tax levied on behalf of tax

authorities.

For contracted prices with customers, which include the variable consideration, the Company

measures the revenue less variable consideration only to the extent that it is highly probable that

there will be no significant reversal when the uncertainty associated with the variable

consideration is subsequently resolved.

Variable consideration mainly consists of sales rebates calculated based on past transactions using

the most likely amount method.

The Company recognizes revenue from sale of automobiles when it satisfies performance

obligation mainly at a point in time. As for the sale of automobiles, since the performance

obligation is considered fulfilled at the point in time when the products are delivered and the

control of such products is acquired by the customers, the revenue is recognized at the delivery of

the products.

The Company receives consideration mainly as advance payment during the period from the time

of receipt of a purchase order until the fulfillment of the performance obligation or within one year

after the fulfilment of the performance obligation. No significant financing component is included

in such transaction.

(6)

Standards for translation of significant assets and liabilities in foreign currencies into the Japanese

currency

Receivable and payable in foreign currencies are translated into yen on the spot exchange rate of the

account settlement date, and the translation difference shall be processed as gain or loss.

(7)

Method of hedge accounting

The deferred hedge processing is applied in principle.

(8)

Other significant matters for preparing financial statements

Application of group tax sharing system

The group tax sharing system is applied.

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

21

2. Notes to Accounting Estimates

(1)

Provision for product warranties

1) Amount recorded in the Non-Consolidated financial statements for the current fiscal year

(Amount: Millions of yen)

End of the current fiscal year

Balance at the beginning of the period

196,447

Amount paid during the period

(29,740)

Transferred amount

10,327

Balance at the end of the period

177,034

2) Information regarding the details of the accounting estimate for the identified item

The details are the same as described in “2. Notes to Accounting Estimates (1) Provision for

product warranties” in the Notes to Consolidated Financial Statements.

(2)

Prepaid pension costs and provision for retirement benefits

1) Amount recorded in the Non-Consolidated financial statements for the current fiscal year

Prepaid pension costs 30,474 Million Yen

Provision for retirement benefits 22,510 Million Yen

2) Information regarding the details of the accounting estimate for the identified item

The details are the same as described in “2. Notes to Accounting Estimates (2) Retirement

benefits asset and retirement benefits liability” in the Notes to Consolidated Financial

Statements.

(3)

Deferred tax assets

1) Amount recorded in the Non-Consolidated financial statements for the current fiscal year

Deferred tax assets 96,383 Million Yen

2) Information regarding the details of the accounting estimate for the identified item

The details are the same as described in “2. Notes to Accounting Estimates (3) Deferred tax

assets” in the Notes to Consolidated Financial Statements.

3. Notes to Non-Consolidated Balance Sheets

(1)

Monetary receivables from and payables to subsidiaries and associates

Short-term receivables 376,482 Million Yen

Short-term payables 325,394 Million Yen

(2)

Accumulated depreciation of property, plant and equipment 927,401 Million Yen

(3)

Guarantee obligations

The Company guarantees the other companies’ borrowings from financial institutions.

Suzuki Thilawa Motor Co., Ltd. 4,466 Million Yen

Other 299 Million Yen

Total 4,766 Million Yen

(4)

The Company has the commitment line contract with 6 banks for effective financing.

The outstanding balance of the contract at the end of current fiscal year is as follows.

Commitment line contract total 300,000 Million Yen

Actual loan balance –

Undrawn balance 300,000 Million Yen

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

22

4. Notes to Non-Consolidated Statements of Income

Amount of transactions with subsidiaries and associates

Amount of net sales 1,949,541 Million Yen

Amount of purchase 658,815 Million Yen

Amount of other operating transactions 120,525 Million Yen

Amount of transactions other than operating transactions 69,447 Million Yen

5. Notes to Non-Consolidated Statement of Changes in Net Assets

Type and number of treasury shares

(Shares)

Type of shares

Number of shares

at the beginning of

current fiscal year

Increased number

of shares during the

period

Decreased number

of shares during the

period

Number of shares

at the end of

current fiscal year

Common stock

5,031,544

3,768,383

31,200

8,768,727

[Notes] 1. The increase of 3,768,383 shares in treasury shares of common stock consists of purchase of 3,767,600

shares in treasury shares based on resolution of board of directors’ meeting s and purchase of 783

shares in odd stocks.

2. The decrease of 31,200 shares in treasury shares of common stocks consists of restricted stock

compensation.

3. A four–for-one common stock split was conducted on April 1, 2024. However, the above items are based

on the number of shares prior to the stock split.

6. Notes to Tax Effect Accounting

(1)

Breakdown of deferred tax assets and deferred tax liabilities by their main occurrence

causes

(Deferred tax assets) (Millions of yen)

Impairment losses and excess

depreciation

47,501

Various reserves

67,089

Loss on valuation of securities

50,509

Others

64,735

Sub–total deferred tax assets

229,835

Valuation reserve

(65,123)

Total deferred tax assets

164,712

(Deferred tax liabilities)

Valuation difference on available-for-sale

securities

(53,714)

Prepaid pension costs

(9,099)

Others

(5,514)

Total deferred tax liabilities

(68,328)

Deferred tax assets, net

96,383

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

23

(2)

Details of differences which cause important differences between statutory tax rate and the

effective tax rate after application of tax effect accounting

Statutory tax rate

(Adjustment)

29.9 %

Valuation reserve

3.9 %

Tax credit

(8.4)%

Tax-deductible of dividend income

(5.5)%

Others

1.8 %

Effective tax rate after application of tax

effect accounting

21.6 %

(3)

Application of Accounting treatment and disclosure in the case of applying the Group Tax Sharing

System

The Company have applied the Group Tax Sharing System. Accounting and disclosure for income taxes, local

income taxes, and tax effect accounting are in accordance with the “Treatment of Accounting and Disclosure

under the Group Tax Sharing System” (Practical Solution Report No. 42, August 12, 2021.)

(This is an English translation of the original document in Japanese language provided on our website and is for reference purpose only.

If there are any discrepancies between this document and original Japanese one, the original prevails.)

24

7. Notes to Related Party Transactions

Subsidiaries and associates, etc.

Type

Name

Own

(owned)

voting right

(%)

Relation with related

parties

Details of

transaction

[Note] 1

Amounts of

transaction

(Million Yen)

Account

Balance at

the end of

current fiscal

year

(Million Yen)

Subsidiary

Suzuki Finance

Co., Ltd.

Owning

direct

95.9

Financial services

related to sale of

products of the

Company

Loan transaction.

Concurrent post of

Directors/Company

auditors

Collection of

credit

47,751

Other

current

assets

50,899

Subsidiary

Suzuki Motor

de Mexico S.A.

de C.V.

Owning

direct

100.0

Indirect

0.0

Sale of products of the

Company

Sale of

products

111,672

Accounts

receivable-

trade

42,950

Subsidiary

Maruti Suzuki

India Ltd.

Owning

direct

58.2

Manufacture and sale of

products of the

Company

Concurrent post of

Directors/Company

Auditors

Sale of

products

142,677

Accounts

receivable-

trade

48,383

Subscription

of increased

shares

(Note) 3

204,090

–

–

Subsidiary

Magyar Suzuki

Corporation

Ltd.

Owning

direct

97.5

Manufacture and sale of

products of the

Company

Purchase of

products

308,142

Accounts

payable-

trade

11,710

Subsidiary

Suzuki

Deutschland

GmbH

Owning

direct

100.0

Sale of products of the

Company

Receiving

deposits of

funds

[Note] 2

37,928

Deposits

received

32,796

[Notes] 1. Conditions of transaction are determined taking into consideration arms-length basis based on market prices.

2. The interest rates of deposits are determined by taking the market interest rate into consideration. The

transaction amounts are the average balance during the period.

3. The Company subscribed all amount of the third-party allotment conducted by Maruti Suzuki India Ltd. See the

details of the transaction in “10. Other Notes (Business Combinations)” in Notes to Consolidated Financial

Statements.

8. Notes to Information about Per Share Amount

Net assets per share 594.16 Yen

Profit per share, Basic 104.98 Yen

[Notes] A four–for-one common stock split was conducted on April 1, 2024.

Net assets per share and profit per share, basic are calculated on the assumption that the stock

split was conducted at the beginning of the previous fiscal year.

9. Notes on Significant Subsequent Events

This information is omitted because it appears in the “9. Notes to Significant Subsequent Events” section of the

Notes to Consolidated Financial Statements.