Summary of Government of Canada

Direct Securities and Loans

Outstanding as at 31 December 2016

bankofcanada.ca

Table of Contents

Part 1—General Tables..................................................... 1

Part 2—Marketable Securities ...........................................18

Section 2.1—Treasury Bills................................................19

General Characteristics .................................................19

Section 2.2—Marketable Bonds .........................................21

General Characteristics .................................................21

Bearer and Registered Bonds..........................................21

Global Certificates ...................................................21

Section 2.3—Foreign Currency Securities...............................89

General Characteristics .................................................89

Canada Bills..........................................................89

Canada Notes........................................................89

Euro Medium-Term Notes (EMTNs)...................................89

Bonds .............................................................. 90

Section 3.1—Canada Savings Bonds .....................................98

General Characteristics .................................................98

Interest Payments.......................................................98

Denominations.......................................................99

Valid Forms of Registration ...........................................99

Information by Series ................................................101

Section 3.2—Canada Premium Bonds .................................116

General Characteristics ................................................116

Interest Payments......................................................116

Regular Interest “R” Bonds (beginning with Series P3) .................116

Compound Interest “C” Bonds ....................................... 117

Denominations and Serial Letters .................................... 117

Closing of Books for Interest (R-bonds) ............................... 117

Valid Forms of Registration .......................................... 117

Information by Series ................................................119

Part 1—General Tables

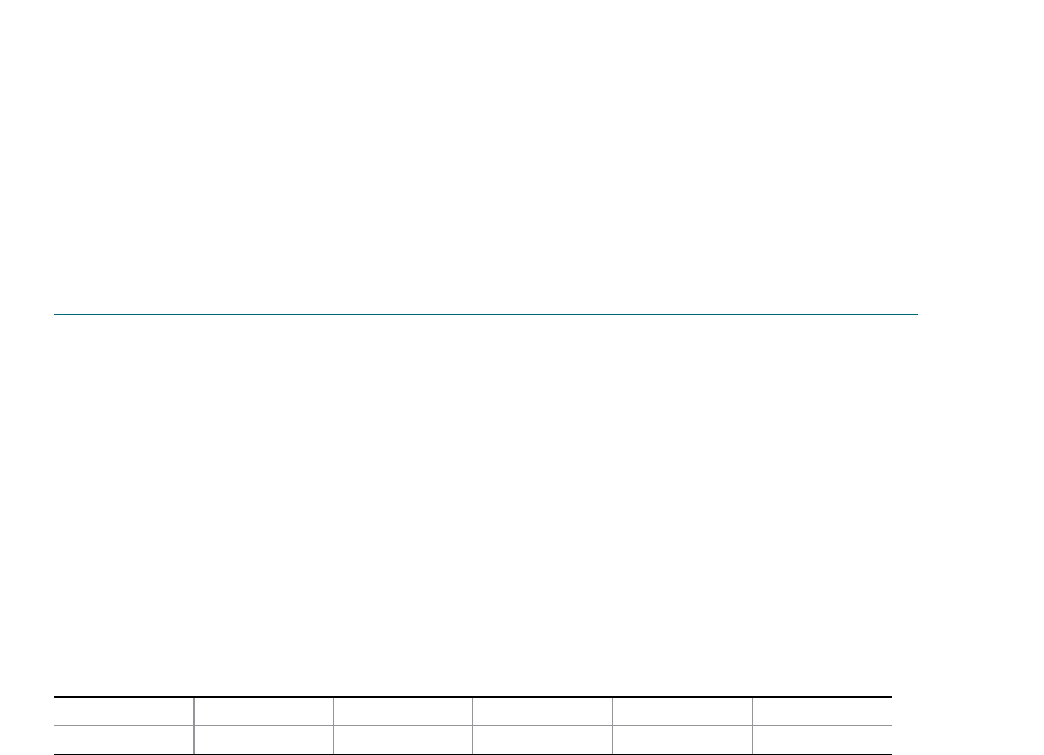

Table 1.1: Summary of Outstanding Domestic and Foreign Pay Securities and Loans of the

Government of Canada

Marketable Securities

Domestic

Treasury Bills $137,100,000,000

Marketable Bonds 518,634,338,000

Real Return Bonds—Ination

Adjustment

11,503,200,000

$6 67, 237,538,00 0

Foreign Currency

Canada Bills 4,671,063,979

Canada Notes 1,946,915,000

Euro Medium-Term Notes 883,882,626

Bonds 15,615,708,416

23,117,570,021

Non-Marketable Securities

Retail

Canada Savings Bonds $3,359,719,114

Canada Premium Bonds $1,298,440,516

Unprocessed Retail Transactions -$19,061,180

$4,639,098,450

Total Outstanding including Real

Return Bonds—

Ination Adjusted $671,801,163,444

1

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

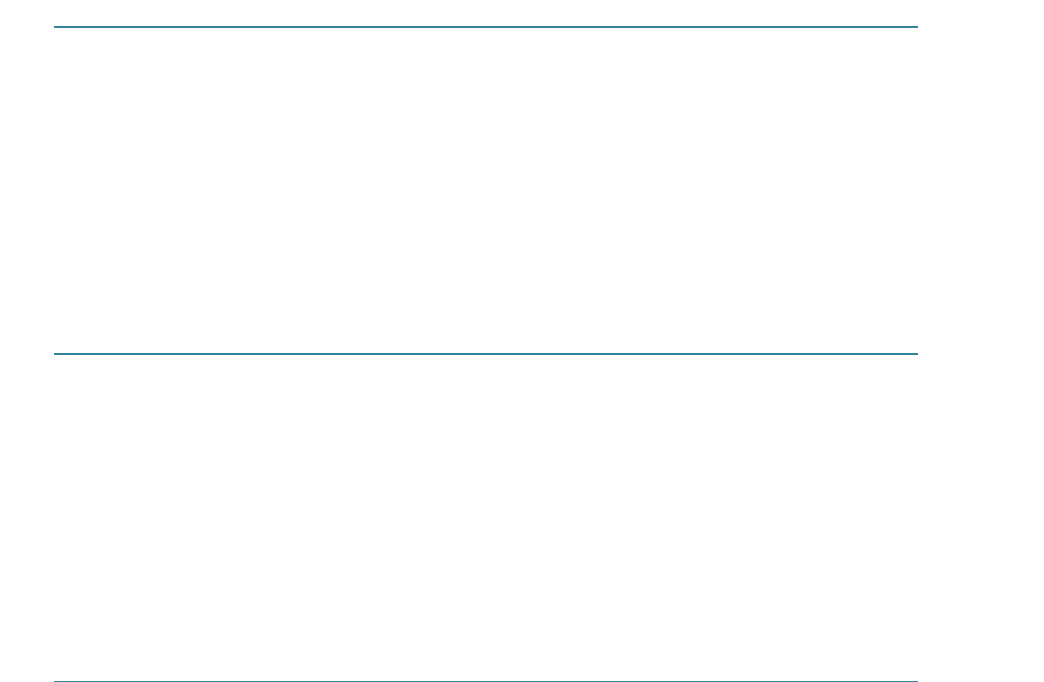

Table 1.2: Government of Canada Can$/US$ Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a US-dollar liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(US$)

2017 11 Jan. 3.3800 51,900,000 Fixed 50,000,000

20 Jan. 3.6938 76, 237,50 0 Fixed 75,000,000

20 Feb. 4.4067 80,925,000 Fixed 75,000,000

20 Feb. 4.6263 52,150,000 Fixed 50,000,000

20 Feb. 4.6564 104,860,000 Fixed 100,000,000

20 Mar. 4.4898 79,350,000 Fixed 75,000,000

20 Mar. 4.6458 53,675,000 Fixed 50,000,000

20 Apr. 4.2287 55,150,000 Fixed 50,000,000

20 Apr. 4.2892 54,900,000 Fixed 50,000,000

20 May 4.1826 55,400,000 Fixed 50,000,000

20 May 4.21876 110,800,000 Fixed 100,000,000

20 May 4.5388 104,630,000 Fixed 100,000,000

20 May 4.5433 104,300,000 Fixed 100,000,000

20 May 4.5773 104,200,000 3-month LIBOR 100,000,000

20 May 4.5823 103,700,000 Fixed 100,000,000

20 May 4.5926 104,300,000 Fixed 100,000,000

20 May 4.6273 52,195,000 Fixed 50,000,000

20 May 4.6325 53,350,000 Fixed 50,000,000

01 Jun. 3.9835 117,800,000 Fixed 100,000,000

01 Jun. 4.0122 116,890,000 Fixed 100,000,000

01 Jun. 4.0207 117,530,000 Fixed 100,000,000

01 Jun. 4.0262 117,600,000 Fixed 100,000,000

01 Jun. 4.0313 117,170,000 Fixed 100,000,000

01 Jun. 4.1118 116,140,000 Fixed 100,000,000

01 Jun. 4.1274 115,650,000 Fixed 100,000,000

01 Jun. 4.176 3 114,750,000 Fixed 100,000,000

01 Jun. 4.2051 115,190,000 Fixed 100,000,000

01 Jun. 4.21744 113,250,000 Fixed 100,000,000

20 Jul. 4.6740 53,375,000 3-month LIBOR 50,000,000

20 Aug. 4.5517 53,250,000 3-month LIBOR 50,000,000

20 Aug. 4.6200 80,212,500 Fixed 75,000,000

20 Sep. 4.3226 99,920,000 3-month LIBOR 100,000,000

20 Sep. 4.4428 49,330,000 3-month LIBOR 50,000,000

03 Oct. 4.4070 75,000,000 3-month LIBOR 76,336,000

20 Oct. 4.2830 49,000,000 Fixed 50,000,000

20 Dec. 1.5362 52,450,000 Fixed 50,000,000

2018 20 Jan. 3.5834 75,517,500 Fixed 75,000,000

20 Jan. 3.8380 50,225,000 Fixed 50,000,000

20 Jan. 3.8670 49,875,000 Fixed 50,000,000

20 Mar. 3.5553 51,100,000 Fixed 50,000,000

20 Mar. 3.5679 76,612,500 Fixed 75,000,000

20 Mar. 3.6000 76,350,000 Fixed 75,000,000

2

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.2: Government of Canada Can$/US$ Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a US-dollar liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(US$)

20 Mar. 3.6027 76,500,000 Fixed 75,000,000

20 Mar. 3.6046 50,735,000 Fixed 50,000,000

20 Mar. 3.6064 76,650,000 Fixed 75,000,000

20 Mar. 3.6216 50,325,000 Fixed 50,000,000

20 Mar. 3.7441 50,685,000 Fixed 50,000,000

20 Apr. 3.5660 52,600,000 Fixed 50,000,000

20 Apr. 3.5748 75,450,000 Fixed 75,000,000

20 Apr. 3.5912 50,250,000 Fixed 50,000,000

20 Apr. 3.6115 100,000,000 Fixed 100,000,000

20 Apr. 3.6233 99,250,000 Fixed 100,000,000

20 Apr. 3.6371 76,350,000 Fixed 75,000,000

20 Apr. 3.6992 102,475,000 Fixed 100,000,000

20 Apr. 3.7029 99,400,000 Fixed 100,000,000

20 May 3.5552 79,725,000 Fixed 75,000,000

20 May 3.5874 106,300,000 Fixed 100,000,000

20 May 3.6656 100,400,000 Fixed 100,000,000

20 May 3.6742 75,465,000 Fixed 75,000,000

20 May 3.8752 101,000,000 Fixed 100,000,000

20 Jun. 3.4819 106,100,000 Fixed 100,000,000

20 Jun. 3.6492 75,450,000 Fixed 75,000,000

20 Jun. 3.6669 50,600,000 Fixed 50,000,000

20 Jun. 3.6706 75,975,000 Fixed 75,000,000

20 Jun. 3.6743 51,000,000 Fixed 50,000,000

20 Jun. 3.6870 50,650,000 Fixed 50,000,000

20 Jun. 3.7363 50,085,000 Fixed 50,000,000

20 Jul. 3.4673 53,500,000 Fixed 50,000,000

20 Jul. 3.6476 104,850,000 Fixed 100,000,000

20 Aug. 3.4930 106,900,000 Fixed 100,000,000

20 Aug. 3.6614 103,500,000 Fixed 100,000,000

20 Oct. 3.6682 125,000,000 Fixed 100,000,000

20 Nov. 1.9102 101,200,000 Fixed 100,000,000

20 Nov. 1.9730 50,135,000 Fixed 50,000,000

20 Nov. 3.1375 85,950,000 Fixed 75,000,000

20 Nov. 3.2852 110,000,000 Fixed 100,000,000

20 Nov. 3.3194 109,850,000 Fixed 100,000,000

20 Nov. 3.3360 55,975,000 Fixed 50,000,000

20 Nov. 3.3456 84,037,500 Fixed 75,000,000

20 Nov. 3.3783 55,500,000 Fixed 50,000,000

20 Nov. 3.3920 55,500,000 Fixed 50,000,000

20 Nov. 3.4346 136,275,000 Fixed 125,000,000

20 Dec. 1.7384 101,790,000 Fixed 100,000,000

20 Dec. 1.7389 101,800,000 Fixed 100,000,000

3

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.2: Government of Canada Can$/US$ Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a US-dollar liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(US$)

20 Dec. 1.7572 102,000,000 Fixed 100,000,000

20 Dec. 1.7665 101,400,000 Fixed 100,000,000

20 Dec. 1.7989 101,800,000 Fixed 100,000,000

2019 20 Jan. 1.7168 50,550,000 Fixed 50,000,000

20 Jan. 1.7178 50,650,000 Fixed 50,000,000

20 Feb. 3.3200 106,850,000 Fixed 100,000,000

20 Feb. 3.3201 106,780,000 Fixed 100,000,000

20 Apr. 3.4600 175,500,000 Fixed 150,000,000

20 May 3.3076 116,560,000 Fixed 100,000,000

20 May 3.3258 58,000,000 Fixed 50,000,000

20 May 3.3313 116,000,000 Fixed 100,000,000

20 May 3.3435 116,400,000 Fixed 100,000,000

20 May 3.3600 57,000,000 Fixed 50,000,000

20 Aug. 3.3510 108,650,000 Fixed 100,000,000

20 Aug. 3.3547 54,400,000 Fixed 50,000,000

20 Aug. 3.3835 163,875,000 Fixed 150,000,000

20 Aug. 3.4300 104,700,000 Fixed 100,000,000

20 Aug. 3.4388 107,900,000 Fixed 100,000,000

20 Aug. 3.4476 52,550,000 Fixed 50,000,000

20 Oct. 3.5067 54,964,000 3-month LIBOR 52,000,000

20 Nov. 3.3985 52,415,000 3-month LIBOR 50,000,000

20 Nov. 3.4095 110,400,000 Fixed 100,000,000

20 Nov. 3.4625 110,000,000 Fixed 100,000,000

23 Nov. 3.4101 53,445,000 3-month LIBOR 50,000,000

25 Nov. 3.4055 66,316,800 3-month LIBOR 62,800,000

27 Nov. 3.2949 52,750,000 3-month LIBOR 50,000,000

2020 20 Jan. 3.2663 106,000,000 3-month LIBOR 100,000,000

20 Jan. 3.3197 52,750,000 3-month LIBOR 50,000,000

20 Jan. 3.3747 52,600,000 3-month LIBOR 50,000,000

20 Jan. 3.4990 15,427,500 3-month LIBOR 15,000,000

20 Jan. 3.5145 18,562,536 3-month LIBOR 17,995,672

20 Feb. 3.3900 53,130,000 3-month LIBOR 50,000,000

20 Feb. 3.4030 53,500,000 Fixed 50,000,000

20 Feb. 3.4258 86,395,588 3-month LIBOR 81,528,346

20 Mar. 3.3910 53,500,000 Fixed 50,000,000

20 Mar. 3.4221 106,570,000 Fixed 100,000,000

20 Mar. 3.4370 157,050,000 Fixed 150,000,000

20 Mar. 3.4761 103,300,000 Fixed 100,000,000

20 Mar. 3.4944 105,750,000 Fixed 100,000,000

20 Mar. 3.5531 205,600,000 Fixed 200,000,000

20 Mar. 3.5577 103,050,000 Fixed 100,000,000

20 Apr. 3.3537 96,450,000 3-month LIBOR 100,000,000

4

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.2: Government of Canada Can$/US$ Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a US-dollar liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(US$)

20 Apr. 3.3554 95,800,000 3-month LIBOR 100,000,000

20 Apr. 3.4263 95,750,000 3-month LIBOR 100,000,000

20 Apr. 3.4551 105,450,000 Fixed 100,000,000

20 Apr. 3.4810 157,350,000 Fixed 150,000,000

20 Apr. 3.4945 104,580,000 Fixed 100,000,000

20 Apr. 3.5241 104,250,000 Fixed 100,000,000

20 Apr. 3.5363 157,305,000 Fixed 150,000,000

20 May 3.1879 95,000,000 3-month LIBOR 100,000,000

20 May 3.21258 95,200,000 3-month LIBOR 100,000,000

20 May 3.2304 96,700,000 3-month LIBOR 100,000,000

20 May 3.2708 95,600,000 3-month LIBOR 100,000,000

20 May 3.2899 95,500,000 3-month LIBOR 100,000,000

20 May 3.2931 96,350,000 3-month LIBOR 100,000,000

20 May 3.4123 96,350,000 3-month LIBOR 100,000,000

20 May 3.6560 50,895,000 Fixed 50,000,000

20 May 3.7121 100,500,000 Fixed 100,000,000

20 Jun. 2.9176 49,040,000 3-month LIBOR 50,000,000

20 Jun. 2.9730 98,000,000 3-month LIBOR 100,000,000

20 Jun. 3.0377 96,770,000 3-month LIBOR 100,000,000

20 Jun. 3.0730 96,070,000 3-month LIBOR 100,000,000

20 Jun. 3.2828 79,792,500 Fixed 75,000,000

20 Jun. 3.2970 53,090,000 Fixed 50,000,000

20 Jun. 3.3006 53,425,000 Fixed 50,000,000

20 Jun. 3.4058 51,700,000 Fixed 50,000,000

20 Jun. 3.4655 51,825,000 Fixed 50,000,000

20 Jun. 3.5847 51,000,000 Fixed 50,000,000

22 Jun. 3.2882 52,550,000 Fixed 50,000,000

22 Jun. 3.3000 105,600,000 Fixed 100,000,000

22 Jun. 3.3118 52,525,000 Fixed 50,000,000

22 Jun. 3.3315 104,000,000 Fixed 100,000,000

22 Jun. 3.3647 104,150,000 Fixed 100,000,000

20 Jul. 2.7559 49,050,000 3-month LIBOR 50,000,000

20 Jul. 2.8281 48,635,000 3-month LIBOR 50,000,000

20 Jul. 2.8550 48,800,000 3-month LIBOR 50,000,000

20 Jul. 3.2942 51,060,000 Fixed 50,000,000

20 Jul. 3.3248 51,250,000 Fixed 50,000,000

20 Jul. 3.3700 76,252,500 3-month LIBOR 75,000,000

20 Aug. 2.7655 47,280,000 3-month LIBOR 50,000,000

20 Aug. 2.7806 47,250,000 3-month LIBOR 50,000,000

20 Aug. 2.7943 47,265,000 3-month LIBOR 50,000,000

20 Aug. 2.8200 48,000,000 3-month LIBOR 50,000,000

20 Aug. 2.8275 47,525,000 3-month LIBOR 50,000,000

5

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.2: Government of Canada Can$/US$ Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a US-dollar liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(US$)

20 Aug. 2.8339 47,400,000 3-month LIBOR 50,000,000

20 Aug. 2.9470 47,925,000 3-month LIBOR 50,000,000

20 Aug. 3.0731 103,950,000 3-month LIBOR 100,000,000

20 Aug. 3.0789 98,393,300 3-month LIBOR 94,700,000

20 Aug. 3.0890 51,200,000 Fixed 50,000,000

20 Aug. 3.1462 52,740,000 Fixed 50,000,000

20 Aug. 3.1601 52,750,000 Fixed 50,000,000

20 Aug. 3.1857 52,000,000 Fixed 50,000,000

20 Aug. 3.2031 104,000,000 Fixed 100,000,000

20 Aug. 3.2298 51,600,000 Fixed 50,000,000

20 Aug. 3.2321 103,100,000 Fixed 100,000,000

20 Aug. 3.2555 103,620,000 Fixed 100,000,000

20 Sep. 2.3180 49,200,000 3-month LIBOR 50,000,000

20 Sep. 2.3302 49,450,000 3-month LIBOR 50,000,000

20 Sep. 2.7500 47,445,000 3-month LIBOR 50,000,000

20 Sep. 2.8800 18,358,980 3-month LIBOR 17,560,000

20 Oct. 2.9630 62,502,178 3-month LIBOR 60,593,483

20 Oct. 2.9735 51,180,000 Fixed 50,000,000

20 Oct. 3.0142 51,425,000 Fixed 50,000,000

20 Dec. 3.3038 50,550,000 Fixed 50,000,000

20 Dec. 3.3429 50,375,000 Fixed 50,000,000

2021 20 Jan. 3.1781 74,625,000 Fixed 75,000,000

20 Jan. 3.2328 74,265,000 Fixed 75,000,000

20 Jan. 3.2631 74,077,500 Fixed 75,000,000

20 Jan. 3.3126 76,256,630 Fixed 76,371,187

20 Feb. 3.2877 99,500,000 Fixed 100,000,000

20 Feb. 3.2954 100,170,000 Fixed 100,000,000

20 Feb. 3.3000 100,000,000 Fixed 100,000,000

20 Feb. 3.3143 49,900,000 Fixed 50,000,000

20 Feb. 3.3231 99,420,000 Fixed 100,000,000

20 Feb. 3.3345 99,500,000 Fixed 100,000,000

20 Feb. 3.3442 99,500,000 Fixed 100,000,000

20 Feb. 3.3500 99,300,000 Fixed 100,000,000

20 Feb. 3.3500 99,410,000 Fixed 100,000,000

20 Feb. 3.3511 49,715,000 Fixed 50,000,000

20 Feb. 3.3627 99,000,000 Fixed 100,000,000

20 Feb. 3.4051 107,334,370 3-month LIBOR 108,3 0 9,152

20 Feb. 3.4160 49,495,000 Fixed 50,000,000

20 Feb. 3.4208 99,120,000 Fixed 100,000,000

20 Feb. 3.4616 98,750,000 Fixed 100,000,000

20 Mar. 3.3035 98,150,000 Fixed 100,000,000

20 Mar. 3.3072 97,200,000 Fixed 100,000,000

6

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.2: Government of Canada Can$/US$ Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a US-dollar liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(US$)

20 Mar. 3.3100 97,600,000 Fixed 100,000,000

20 Mar. 3.3131 49,160,000 Fixed 50,000,000

20 Mar. 3.3300 49,100,000 Fixed 50,000,000

20 Mar. 3.3331 49,620,000 Fixed 50,000,000

20 Mar. 3.3832 98,600,000 Fixed 100,000,000

20 Mar. 3.4756 98,500,000 Fixed 100,000,000

20 Mar. 3.4874 197,200,000 Fixed 200,000,000

20 Mar. 3.5177 98,600,000 Fixed 100,000,000

20 Apr. 3.1875 141,932,739 3-month LIBOR 144,167,333

20 Apr. 3.1939 147,750,000 3-month LIBOR 150,000,000

20 Apr. 3.4312 96,050,000 3-month LIBOR 100,000,000

20 Apr. 3.4540 105,782,464 3-month LIBOR 110,443,16 6

09 May 0.7627 97,70 6,14 6 3-month LIBOR 76,243,579

20 May 3.3030 4,889,148 3-month LIBOR 5,135,660

20 May 3.3703 133,206,690 3-month LIBOR 138,324,704

20 Jul. 3.0571 135,617,347 3-month LIBOR 140,028,236

2022 06 Feb. 0.9446 188,295,000 Fixed 150,000,000

12 Feb. 1.0430 125,250,000 Fixed 100,000,000

20 Feb. 1.9896 48,066,474 3-month LIBOR 47,216,576

16 Mar. 0.9040 132,750,000 Fixed 100,000,000

20 Mar. 2.0698 67,549,554 3-month LIBOR 67,414,725

20 Apr. 2.1610 118,258,207 3-month LIBOR 119,392,436

20 Apr. 2.2224 13,045,854 3-month LIBOR 13,144,437

20 May 2.0181 150,480,000 3-month LIBOR 150,000,000

20 May 2.0409 49,715,000 3-month LIBOR 50,000,000

20 May 2.0464 100,140,000 3-month LIBOR 100,000,000

20 May 2.0464 100,200,000 3-month LIBOR 100,000,000

20 May 2.0787 24,737,50 0 3-month LIBOR 25,000,000

20 May 2.0942 24,762,500 3-month LIBOR 25,000,000

20 May 2.1200 49,265,000 3-month LIBOR 50,000,000

20 May 2.1220 24,837,500 3-month LIBOR 25,000,000

20 May 2.1630 24,905,000 3-month LIBOR 25,000,000

10 Jun. 1.3449 124,140,000 3-month LIBOR 100,000,000

11 Jun. 1.3584 52,649,285 3-month LIBOR 42,631,000

16 Jun. 1.3669 123,150,000 3-month LIBOR 100,000,000

20 Jun. 1.8500 86,606,176 3-month LIBOR 84,551,573

20 Jun. 1.8506 102,290,000 3-month LIBOR 100,000,000

20 Jun. 1.9105 50,150,000 3-month LIBOR 50,000,000

20 Jun. 1.9774 24,890,000 3-month LIBOR 25,000,000

20 Jun. 2.0830 24,622,500 3-month LIBOR 25,000,000

20 Jun. 2.0852 150,084,800 3-month LIBOR 152,000,000

20 Jun. 2.0895 98,720,000 3-month LIBOR 100,000,000

7

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.2: Government of Canada Can$/US$ Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a US-dollar liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(US$)

10 Jul. 1.0632 159,819,000 3-month LIBOR 125,250,000

20 Jul. 1.1167 129,300,000 3-month LIBOR 100,000,000

20 Jul. 1.7273 51,300,000 3-month LIBOR 50,000,000

20 Jul. 1.7346 51,325,000 3-month LIBOR 50,000,000

20 Jul. 1.7400 51,425,000 3-month LIBOR 50,000,000

20 Jul. 1.7755 77,325,000 3-month LIBOR 75,000,000

20 Jul. 1.7820 51,325,000 3-month LIBOR 50,000,000

20 Jul. 1.7942 51,000,000 3-month LIBOR 50,000,000

20 Jul. 1.8000 102,550,000 3-month LIBOR 100,000,000

20 Jul. 1.8030 102,600,000 3-month LIBOR 100,000,000

20 Aug. 1.5800 101,805,000 3-month LIBOR 100,000,000

20 Aug. 1.5895 50,915,000 3-month LIBOR 50,000,000

20 Aug. 1.5999 50,800,000 3-month LIBOR 50,000,000

20 Aug. 1.6484 50,400,000 3-month LIBOR 50,000,000

20 Aug. 1.6600 51,025,000 3-month LIBOR 50,000,000

20 Aug. 1.6670 69,052,452 3-month LIBOR 67,566,000

20 Aug. 1.6670 71,470,000 3-month LIBOR 70,000,000

25 Aug. 0.8909 131,250,000 3-month LIBOR 100,000,000

15 Sep. 1.0770 66,290,000 3-month LIBOR 50,000,000

20 Sep. 1.7152 100,200,000 3-month LIBOR 100,000,000

20 Sep. 1.7164 100,400,000 3-month LIBOR 100,000,000

20 Sep. 1.8080 98,940,000 3-month LIBOR 100,000,000

20 Sep. 1.8351 49,750,000 3-month LIBOR 50,000,000

20 Sep. 1.9248 49,475,000 3-month LIBOR 50,000,000

24 Sep. 1.0867 132,820,000 3-month LIBOR 100,000,000

16 Oct. 1.0638 133,714,600 3-month LIBOR 103,000,000

20 Oct. 1.8550 97,620,000 3-month LIBOR 100,000,000

20 Oct. 1.9045 97,600,000 3-month LIBOR 100,000,000

20 Oct. 1.9206 97,500,000 3-month LIBOR 100,000,000

2023 20 Feb. 1.9140 50,135,000 Fixed 50,000,000

20 Feb. 1.9289 49,680,000 Fixed 50,000,000

20 Feb. 1.9335 99,420,000 Fixed 100,000,000

20 Feb. 1.9380 19,832,670 3-month LIBOR 20,100,000

20 Feb. 1.9390 49,400,000 3-month LIBOR 50,000,000

20 Feb. 1.9400 51,027,90 0 3-month LIBOR 51,700,000

20 Feb. 1.9970 100,900,000 Fixed 100,000,000

20 Mar. 1.9783 50,325,000 Fixed 50,000,000

20 Mar. 1.9848 100,700,000 Fixed 100,000,000

20 Mar. 1.9848 50,150,000 Fixed 50,000,000

20 Mar. 2.0168 101,200,000 Fixed 100,000,000

20 Mar. 2.0200 101,250,000 Fixed 100,000,000

20 Mar. 2.0250 100,100,000 Fixed 100,000,000

8

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.2: Government of Canada Can$/US$ Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a US-dollar liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(US$)

20 Mar. 2.0270 99,900,000 Fixed 100,000,000

20 Mar. 2.0283 100,100,000 Fixed 100,000,000

20 Mar. 2.0310 100,120,000 Fixed 100,000,000

20 Mar. 2.0316 50,150,000 Fixed 50,000,000

20 Mar. 2.0440 150,465,000 Fixed 150,000,000

20 Mar. 2.0450 101,680,000 Fixed 100,000,000

20 Mar. 2.0471 100,420,000 Fixed 100,000,000

20 Apr. 1.8398 204,900,000 Fixed 200,000,000

20 Apr. 1.8846 78,771,000 3-month LIBOR 77,000,000

20 Apr. 1.8970 102,970,000 Fixed 100,000,000

20 Apr. 1.9051 103,030,000 Fixed 100,000,000

20 Apr. 1.9410 102,650,000 Fixed 100,000,000

20 Apr. 1.9420 102,600,000 Fixed 100,000,000

20 Apr. 1.9507 205,700,000 Fixed 200,000,000

20 Apr. 1.9538 102,760,000 Fixed 100,000,000

20 Apr. 1.9588 102,800,000 Fixed 100,000,000

20 Apr. 1.9711 205,420,000 Fixed 200,000,000

20 Apr. 1.9746 102,650,000 Fixed 100,000,000

03 May 1.1363 125,100,000 Fixed 100,000,000

20 May 1.6872 100,780,000 3-month LIBOR 100,000,000

20 May 1.6958 101,720,000 3-month LIBOR 100,000,000

20 May 1.7193 89,812,800 3-month LIBOR 88,000,000

20 May 1.7193 114,307,20 0 3-month LIBOR 112,000,000

20 Jun. 1.8780 102,950,000 3-month LIBOR 100,000,000

20 Jun. 1.9305 103,100,000 3-month LIBOR 100,000,000

20 Jun. 1.9557 103,470,000 3-month LIBOR 100,000,000

22 Jun. 1.4896 121,550,000 3-month LIBOR 100,000,000

30 Jun. 1.5517 148,680,000 3-month LIBOR 120,000,000

20 Jul. 2.0419 103,200,000 3-month LIBOR 100,000,000

20 Jul. 2.1500 102,070,000 3-month LIBOR 100,000,000

20 Jul. 2.1660 101,700,000 3-month LIBOR 100,000,000

20 Jul. 2.1769 102,000,000 3-month LIBOR 100,000,000

20 Jul. 2.1950 101,900,000 3-month LIBOR 100,000,000

20 Jul. 2.2870 207,000,000 3-month LIBOR 200,000,000

20 Jul. 2.2895 103,690,000 3-month LIBOR 100,000,000

20 Jul. 2.3036 103,500,000 3-month LIBOR 100,000,000

20 Jul. 2.4909 48,650,400 3-month LIBOR 46,400,000

20 Aug. 1.1344 130,900,000 3-month LIBOR 100,000,000

20 Aug. 2.4043 104,400,000 3-month LIBOR 100,000,000

20 Aug. 2.4297 104,000,000 3-month LIBOR 100,000,000

20 Aug. 2.4740 130,055,150 3-month LIBOR 123,100,000

20 Aug. 2.4915 105,850,000 3-month LIBOR 100,000,000

9

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.2: Government of Canada Can$/US$ Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a US-dollar liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(US$)

18 Sep. 1.3032 38,309,000 3-month LIBOR 29,000,000

20 Sep. 2.4821 154,470,000 3-month LIBOR 150,000,000

20 Sep. 2.5103 104,300,000 3-month LIBOR 100,000,000

20 Sep. 2.5597 205,800,000 3-month LIBOR 200,000,000

01 Oct. 1.2098 134,100,000 3-month LIBOR 100,000,000

20 Oct. 2.6104 103,000,000 3-month LIBOR 100,000,000

20 Oct. 2.6104 51,500,000 3-month LIBOR 50,000,000

20 Oct. 2.6104 25,750,000 3-month LIBOR 25,000,000

20 Oct. 2.6104 25,750,000 3-month LIBOR 25,000,000

20 Oct. 2.7413 207,880,000 3-month LIBOR 200,000,000

20 Oct. 2.7907 105,200,000 3-month LIBOR 100,000,000

13 Dec. 1.3323 197,550,000 Fixed 150,000,000

2024 20 Jan. 2.5316 78,345,000 3-month LIBOR 75,000,000

20 Jan. 2.5869 132,000,000 3-month LIBOR 125,000,000

20 Jan. 2.5878 105,250,000 3-month LIBOR 100,000,000

20 Jan. 2.6370 104,850,000 3-month LIBOR 100,000,000

20 Jan. 2.6400 104,900,000 3-month LIBOR 100,000,000

20 Feb. 2.4424 78,120,000 3-month LIBOR 70,000,000

20 Feb. 2.5768 117,390,000 3-month LIBOR 107,500,000

20 Feb. 2.6122 109,600,000 3-month LIBOR 100,000,000

20 Mar. 2.3645 111,100,000 3-month LIBOR 100,000,000

20 Mar. 2.3910 83,835,000 3-month LIBOR 75,000,000

20 Mar. 2.4044 111,350,000 3-month LIBOR 100,000,000

20 Mar. 2.4382 110,520,000 3-month LIBOR 100,000,000

20 Mar. 2.4657 109,329,300 3-month LIBOR 99,300,000

20 Apr. 2.3959 110,530,000 3-month LIBOR 100,000,000

20 Apr. 2.4191 110,780,000 3-month LIBOR 100,000,000

20 Apr. 2.4730 110,760,000 3-month LIBOR 100,000,000

20 Apr. 2.4846 111,050,0 00 3-month LIBOR 100,000,000

20 Apr. 2.4932 84,000,000 3-month LIBOR 75,000,000

20 May 2.3868 65,899,650 3-month LIBOR 60,100,000

20 May 2.4483 137,212,50 0 3-month LIBOR 125,000,000

20 May 2.4561 109,310,000 3-month LIBOR 100,000,000

20 May 2.4750 50,458,500 3-month LIBOR 45,000,000

20 Jun. 2.3443 109,740,000 3-month LIBOR 100,000,000

20 Jun. 2.3675 81,757,50 0 3-month LIBOR 75,000,000

20 Jun. 2.4057 109,640,000 3-month LIBOR 100,000,000

20 Aug. 2.1120 135,137,500 3-month LIBOR 125,000,000

20 Aug. 2.1142 136,813,205 3-month LIBOR 126,550,000

20 Aug. 2.1144 107,360,000 3-month LIBOR 100,000,000

20 Aug. 2.1413 107,370,000 3-month LIBOR 100,000,000

20 Aug. 2.2189 107,320,000 3-month LIBOR 100,000,000

10

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.2: Government of Canada Can$/US$ Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a US-dollar liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(US$)

20 Aug. 2.2536 106,750,000 3-month LIBOR 100,000,000

20 Aug. 2.2594 106,730,000 3-month LIBOR 100,000,000

20 Sep. 2.0773 109,370,000 3-month LIBOR 100,000,000

20 Sep. 2.0884 109,380,000 3-month LIBOR 100,000,000

20 Sep. 2.1084 109,150,000 3-month LIBOR 100,000,000

20 Oct. 2.0844 54,375,000 3-month LIBOR 50,000,000

20 Nov. 1.8812 113,080,000 3-month LIBOR 100,000,000

20 Nov. 1.9580 112,300,000 3-month LIBOR 100,000,000

20 Nov. 1.9834 112,240,000 3-month LIBOR 100,000,000

20 Nov. 2.0021 113,040,000 Fixed 100,000,000

20 Nov. 2.0272 111,800,000 3-month LIBOR 100,000,000

02 Dec. 1.9052 113,790,000 3-month LIBOR 100,000,000

03 Dec. 1.8539 113,780,000 3-month LIBOR 100,000,000

11 D e c. 1.8703 114,180,000 3-month LIBOR 100,000,000

15 Dec. 2.0106 13,745,295 3-month LIBOR 12,150,000

2025 16 Jan. 1.5504 119,390,000 3-month LIBOR 100,000,000

20 Jan. 2.0460 114,150,000 3-month LIBOR 100,000,000

22 Jan. 1.4957 121,050,000 3-month LIBOR 100,000,000

22 Jan. 1.6175 59,780,000 Fixed 50,000,000

30 Jan. 1.3553 124,490,000 3-month LIBOR 100,000,000

05 Feb. 1.2298 125,240,000 Fixed 100,000,000

05 May 1.6253 91,125,000 3-month LIBOR 75,000,000

11 May 1.2051 64,925,000 Fixed 50,000,000

31 May 1.2374 258,800,000 Fixed 200,000,000

02 Jun. 1.2003 262,000,000 Fixed 200,000,000

03 Jun. 1.18618 196,275,000 Fixed 150,000,000

06 Jun. 1.1725 196,710,000 Fixed 150,000,000

07 Jun. 1.0701 64,745,000 Fixed 50,000,000

13 Jun. 1.0384 127,300,000 Fixed 100,000,000

14 Jun. 1.0286 127,110,000 Fixed 100,000,000

14 Jun. 1.03916 127,400,000 Fixed 100,000,000

08 Dec. 1.6180 133,730,000 Fixed 100,000,000

10 Dec. 1.5417 271,120,000 Fixed 200,000,000

14 Dec. 1.5016 271,800,000 Fixed 200,000,000

17 Dec. 1.4858 274,800,000 Fixed 200,000,000

18 Dec. 1.5262 275,720,000 Fixed 200,000,000

2026 04 Feb. 1.1557 140,450,000 Fixed 100,000,000

03 Mar. 1.1828 202,290,000 Fixed 150,000,000

18 Apr. 1.2857 128,420,000 Fixed 100,000,000

18 Apr. 1.3094 128,400,000 Fixed 100,000,000

19 Apr. 1.2848 160,662,500 Fixed 125,000,000

21 Apr. 1.3176 127,180,000 Fixed 100,000,000

11

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.2: Government of Canada Can$/US$ Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a US-dollar liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(US$)

22 Apr. 1.3136 633,750,000 Fixed 500,000,000

18 Jul. 1.0360 258,440,000 Fixed 200,000,000

18 Jul. 1.0394 129,310,000 Fixed 100,000,000

21 Jul. 1.0895 195,555,000 Fixed 150,000,000

05 Aug. 1.0781 262,000,000 Fixed 200,000,000

11 Aug. 1.0029 262,340,000 Fixed 200,000,000

12 Aug. 0.9962 260,960,000 Fixed 200,000,000

22 Aug. 1.0487 255,320,000 Fixed 200,000,000

01 Sep. 1.0218 130,620,000 Fixed 100,000,000

01 Sep. 1.2017 156,960,000 Fixed 120,000,000

07 Sep. 1.0605 162,687,500 Fixed 125,000,000

19 Sep. 1.2139 198,045,000 Fixed 150,000,000

21 Sep. 1.1988 131,690,000 Fixed 100,000,000

30 Sep. 0.9599 132,470,000 Fixed 100,000,000

30 Sep. 0.9663 66,290,000 Fixed 50,000,000

30 Sep. 0.9705 132,190,000 Fixed 100,000,000

03 Oct. 0.9769 196,485,000 Fixed 150,000,000

04 Oct. 0.9995 131,250,000 Fixed 100,000,000

05 Oct. 0.9906 164,000,000 Fixed 125,000,000

17 Oct. 1.1890 131,930,000 Fixed 100,000,000

24 Oct. 1.1771 230,982,500 Fixed 175,000,000

25 Oct. 1.1357 99,922,500 Fixed 75,000,000

26 Oct. 1.1380 133,480,000 Fixed 100,000,000

26 Oct. 1.1521 133,870,000 Fixed 100,000,000

28 Oct. 1.1607 133,660,000 Fixed 100,000,000

01 Nov. 1.2317 334,900,000 Fixed 250,000,000

02 Nov. 1.2151 200,955,000 Fixed 150,000,000

03 Nov. 1.2420 267,740,000 Fixed 200,000,000

08 Nov. 1.1735 100,822,500 Fixed 75,000,000

08 Nov. 1.1844 147,664,000 Fixed 110,000,000

21 Nov. 1.5266 201,195,000 Fixed 150,000,000

25 Nov. 1.5580 200,925,000 Fixed 150,000,000

$45,345,203,888 $41,137,603,265

Table 1.3: Government of Canada Can$/Euro Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a euro liability.

Year

Maturity

Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(Euro)

2017 20 Apr. 4.1792 74,700,000 Fixed 50,000,000

20 Apr. 4.1888 75,225,000 Fixed 50,000,000

01 Jun. 4.0051 154,450,000 Fixed 100,000,000

01 Jun. 4.1594 153,650,000 Fixed 100,000,000

20 Jul. 4.3963 70,550,000 Fixed 50,000,000

12

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.3: Government of Canada Can$/Euro Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a euro liability.

Year

Maturity

Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(Euro)

20 Jul. 4.4350 70,510,000 Fixed 50,000,000

20 Jul. 4.4817 71,250,000 Fixed 50,000,000

20 Jul. 4.4994 114,744,000 Fixed 80,000,000

20 Jul. 4.5535 142,620,000 Fixed 100,000,000

20 Jul. 4.6186 70,875,000 Fixed 50,000,000

20 Aug. 4.4080 72,675,000 Fixed 50,000,000

20 Aug. 4.5002 142,820,000 Fixed 100,000,000

20 Aug. 4.5694 72,850,000 Fixed 50,000,000

20 Sep. 4.3410 10 6 ,0 87,50 0 Fixed 75,000,000

20 Sep. 4.3690 71,800,000 Fixed 50,000,000

2018 20 Jan. 3.7843 72,600,000 Fixed 50,000,000

20 Jan. 3.7957 73,200,000 Fixed 50,000,000

20 Jan. 3.8340 73,750,000 Fixed 50,000,000

20 Jan. 3.8530 72,250,000 Fixed 50,000,000

20 Jan. 3.8568 145,750,000 Fixed 100,000,000

20 Apr. 3.8430 73,625,000 Fixed 50,000,000

20 May 3 month CDOR 233,040,000 Fixed 150,000,000

20 May 3.1750 156,500,000 Fixed 100,000,000

20 Jul. 3 month CDOR 154,030,000 Fixed 100,000,000

20 Jul. 3 month CDOR 231,720,000 Fixed 150,000,000

20 Jul. 3.2480 155,000,000 Fixed 100,000,000

20 Jul. 3.3135 77,950,000 Fixed 50,000,000

20 Jul. 3.6220 155,100,000 Fixed 100,000,000

20 Aug. 1.6980 136,480,000 Fixed 100,000,000

20 Aug. 1.7140 136,300,000 Fixed 100,000,000

20 Aug. 1.8600 135,110,000 Fixed 100,000,000

2019 20 Jan. 2.8313 159,290,000 Fixed 100,000,000

20 Jan. 2.9800 157,000,000 Fixed 100,000,000

20 Jan. 2.9822 156,200,000 Fixed 100,000,000

20 Jan. 3.0603 39,485,000 Fixed 25,000,000

20 Jan. 3.1400 78,075,000 Fixed 50,000,000

20 Apr. 3 month CDOR 158,800,000 Fixed 100,000,000

20 Jul. 3.4256 77,325,000 Fixed 50,000,000

20 Jul. 3.4649 154,000,000 Fixed 100,000,000

20 Jul. 3.5051 155,100,000 Fixed 100,000,000

20 Jul. 3.5825 153,750,000 Fixed 100,000,000

20 Jul. 3.5825 115,612,500 Fixed 75,000,000

20 Jul. 3.5885 154,000,000 Fixed 100,000,000

2020 20 Jul. 3.1415 66,750,000 Fixed 50,000,000

09 Oct. 0.8207 131,355,000 Fixed 90,000,000

27 Oct. 0.8538 131,130,000 Fixed 90,000,000

13 Nov. 1.0348 135,004,500 Fixed 95,000,000

13

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.3: Government of Canada Can$/Euro Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a euro liability.

Year

Maturity

Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(Euro)

17 Nov. 0.9683 200,340,000 Fixed 140,000,000

23 Nov. 0.9635 133,997,000 Fixed 94,000,000

15 Dec. 0.7904 278,642,930 Fixed 185,000,000

2021 08 Jan. 0.7269 196,625,000 Fixed 130,000,000

15 Jan. 0.6167 308,600,000 Fixed 200,000,000

20 Jan. 0.5439 158,300,000 Fixed 100,000,000

20 Feb. 2.3166 146,970,000 Fixed 100,000,000

18 Apr. 0.7558 216,975,000 Fixed 150,000,000

26 Apr. 0.8802 199,262,000 Fixed 140,000,000

10 May 0.7178 199,165,500 Fixed 135,000,000

16 May 0.7324 189,813,000 Fixed 130,000,000

19 May 0.7004 329,310,000 Fixed 225,000,000

20 May 3.1250 144,092,256 Fixed 100,000,000

20 May 3.1335 71,190,000 Fixed 50,000,000

20 Jun. 3.1880 137,710,9 0 0 Fixed 100,000,000

20 Sep. 2.3200 71,095,000 Fixed 50,000,000

20 Sep. 2.4000 72,100,000 Fixed 50,000,000

20 Sep. 2.4000 71,110,000 Fixed 50,000,000

20 Sep. 2.4580 106,212,673 Fixed 75,000,000

30 Sep. 0.9691 134,010,000 Fixed 90,000,000

15 Oct. 2.0739 69,275,000 Fixed 50,000,000

15 Oct. 2.2141 104,550,000 Fixed 75,000,000

15 Oct. 2.2239 3 4,787, 500 Fixed 25,000,000

15 Oct. 2.2247 69,430,000 Fixed 50,000,000

20 Oct. 2.1210 67,920,000 Fixed 50,000,000

20 Oct. 2.1350 68,000,000 Fixed 50,000,000

20 Oct. 2.1880 67,750,000 Fixed 50,000,000

20 Oct. 2.2051 67,500,000 Fixed 50,000,000

20 Oct. 2.2399 138,800,000 Fixed 100,000,000

20 Oct. 2.2448 68,925,375 Fixed 50,000,000

20 Oct. 2.2580 101,775,000 Fixed 75,000,000

20 Oct. 2.2805 68,470,000 Fixed 50,000,000

20 Oct. 2.3960 70,880,760 Fixed 50,000,000

20 Oct. 2.4163 70,220,000 Fixed 50,000,000

20 Nov. 2.1400 69,775,000 Fixed 50,000,000

20 Nov. 2.2409 70,400,000 Fixed 50,000,000

20 Nov. 2.2708 69,618,275 Fixed 50,000,000

20 Nov. 2.2861 69,800,000 Fixed 50,000,000

20 Nov. 2.2983 105,075,000 Fixed 75,000,000

20 Nov. 2.3266 69,865,000 Fixed 50,000,000

20 Nov. 2.3316 104,700,000 Fixed 75,000,000

20 Nov. 2.3646 70,050,000 Fixed 50,000,000

14

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.3: Government of Canada Can$/Euro Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a euro liability.

Year

Maturity

Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(Euro)

20 Nov. 2.3923 105,375,000 Fixed 75,000,000

20 Nov. 2.4028 140,800,000 Fixed 100,000,000

20 Dec. 2.2056 139,270,000 Fixed 100,000,000

20 Dec. 2.2080 140,000,000 Fixed 100,000,000

20 Dec. 2.2144 139,800,000 Fixed 100,000,000

20 Dec. 2.4343 140,990,000 Fixed 100,000,000

2022 20 Jan. 2.0224 67,825,000 Fixed 50,000,000

20 Feb. 2.4820 147,510,000 Fixed 100,000,000

21 Aug. 1.0148 129,915,000 Fixed 90,000,000

16 Sep. 1.0469 134,595,000 Fixed 90,000,000

2023 18 Jun. 1.4465 138,600,000 Fixed 100,000,000

20 Sep. 2.6948 137,000,000 Fixed 100,000,000

20 Oct. 2.6957 138,800,000 Fixed 100,000,000

20 Oct. 2.8185 68,750,000 Fixed 50,000,000

2024 20 May 2.3790 114,270,000 Fixed 75,000,000

20 May 2.3845 151,950,000 Fixed 100,000,000

20 Jul. 2.2921 147,100,000 Fixed 100,000,000

20 Jul. 2.2975 110,6 02,500 Fixed 75,000,000

20 Aug. 2.2500 109,312,500 Fixed 75,000,000

28 Aug. 1.2983 136,170,000 Fixed 90,000,000

01 Sep. 1.2937 134,550,000 Fixed 90,000,000

04 Sep. 1.3479 134,586,000 Fixed 90,000,000

20 Oct. 2.1213 105,652,500 Fixed 75,000,000

20 Oct. 2.1850 42,672,000 Fixed 30,000,000

20 Oct. 2.1903 85,056,000 Fixed 60,000,000

20 Oct. 2.2009 99,449,000 Fixed 70,000,000

20 Oct. 2.2148 128,925,000 Fixed 90,000,000

28 Nov. 1.9980 139,900,000 Fixed 100,000,000

10 Dec. 1.9489 140,550,000 Fixed 100,000,000

15 Dec. 2.0396 105,825,000 Fixed 75,000,000

2025 09 Feb. 1.2820 142,380,000 Fixed 100,000,000

03 Sep. 1.4661 133,425,000 Fixed 90,000,000

2026 08 Feb. 1.1753 153,574,400 Fixed 100,000,000

15 Aug. 1.7046 244,125,000 Fixed 175,000,000

$14,962,481,569 € 10,264,000,000

15

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.4 : Government of Canada Can$/Yen Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a yen liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(Yen)

2018 20 Apr. 1.3363 107,738,53 5 Fixed 10,000,000,000

2019 20 Mar. 1.7354 67,729,619 Fixed 6,300,000,000

20 Jul. 1.5826 122,245,000 Fixed 11,500,000,000

20 Jul. 1.6409 110,670,000 Fixed 10,500,000,000

20 Jul. 1.6499 111,69 0, 246 Fixed 10,500,000,000

20 Jul. 1.6583 111,773,472 Fixed 10,500,000,000

20 Jul. 1.6670 30,557,300 Fixed 2,900,000,000

$662,404,172 ¥62,200,000,000

Table 1.5: Government of Canada Can$/Pound Sterling Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a pound sterling liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(Pound sterling)

2019 20 Apr. 1.6293 102,250,500 Fixed 55,000,000

20 Apr. 1.7674 100,315,800 Fixed 54,000,000

20 May 1.6970 138,675,000 Fixed 75,000,000

20 Jul. 1.6300 138,277,500 Fixed 75,000,000

20 Sep. 1.5408 138,555,000 Fixed 75,000,000

20 Oct. 1.5824 132,382,500 Fixed 75,000,000

20 Oct. 1.6492 150,875,000 Fixed 85,000,000

20 Oct. 1.6524 98,781,250 Fixed 54,500,000

20 Oct. 1.6711 159,660,000 Fixed 90,000,000

20 Oct. 1.6780 152,209,500 Fixed 85,000,000

20 Oct. 1.7566 152,796,000 Fixed 85,000,000

04 Dec. 1.4290 142,496,000 Fixed 80,000,000

12 Dec. 1.4310 144,400,000 Fixed 80,000,000

2020 20 Jan. 1.1042 154,045,500 Fixed 85,000,000

28 Jan. 0.8453 168,444,000 Fixed 90,000,000

29 Jan. 0.7295 160,140,000 Fixed 85,000,000

03 Feb. 0.6887 134,309,000 Fixed 70,000,000

2023 08 Sep. 1.2519 167,535,000 Fixed 85,000,000

2024 08 Sep. 1.3753 133,510,000 Fixed 65,000,000

08 Sep. 1.4063 132,223,000 Fixed 65,000,000

2025 08 Sep. 1.1358 101,385,000 Fixed 50,000,000

08 Sep. 1.1771 99,760,000 Fixed 50,000,000

08 Sep. 1.1895 101,650,000 Fixed 50,000,000

08 Sep. 1.2287 281,848,000 Fixed 140,000,000

08 Sep. 1.2551 282,940,000 Fixed 140,000,000

08 Sep. 1.2574 141,225,000 Fixed 70,000,000

08 Sep. 1.3147 204,800,000 Fixed 100,000,000

08 Sep. 1.3250 133,835,000 Fixed 65,000,000

08 Sep. 1.3334 288,174,000 Fixed 140,000,000

16

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 1.5: Government of Canada Can$/Pound Sterling Swaps

For the cross-currency swaps listed below, the Government’s Canadian-dollar liability has been swapped into a pound sterling liability.

Year Maturity Date Coupon %

Notional Amount

(Can$) Basis

Notional Amount

(Pound sterling)

08 Sep. 1.4529 131,365,000 Fixed 65,000,000

08 Sep. 1.4538 207,800,000 Fixed 100,000,000

08 Sep. 1.4580 198,950,000 Fixed 100,000,000

08 Sep. 1.4621 202,120,000 Fixed 100,000,000

08 Sep. 1.4788 131,690,000 Fixed 65,000,000

08 Sep. 1.4817 132,795,000 Fixed 65,000,000

08 Sep. 1.4982 132,632,500 Fixed 65,000,000

08 Sep. 1.5052 133,009,500 Fixed 65,000,000

08 Sep. 1.5578 131,787,500 Fixed 65,000,000

08 Sep. 1.5725 203,300,000 Fixed 100,000,000

08 Sep. 1.5835 200,970,000 Fixed 100,000,000

08 Sep. 1.5955 123,825,000 Fixed 65,000,000

08 Sep. 1.6108 140,777,000 Fixed 70,000,000

08 Sep. 1.6630 153,120,000 Fixed 80,000,000

08 Sep. 1.6671 131,950,000 Fixed 65,000,000

08 Sep. 1.6836 131,625,000 Fixed 65,000,000

08 Sep. 1.7711 104,208,500 Fixed 55,000,000

08 Sep. 1.7750 142,905,000 Fixed 75,000,000

08 Sep. 1.7984 165,18 0,50 0 Fixed 85,000,000

08 Sep. 1.8166 98,587,800 Fixed 54,000,000

08 Sep. 1.8258 164,900,000 Fixed 85,000,000

2026 07 Mar. 1.2682 142,327,500 Fixed 75,000,000

22 Mar. 1.3194 131,383,000 Fixed 70,000,000

24 Mar. 1.2983 93,100,000 Fixed 50,000,000

02 Dec. 1.5803 200,280,000 Fixed 120,000,000

$8,168,086,350 £4,222,500,000

17

PART 1—GENERAL TABLES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Part 2—Marketable Securities

18

PART 2—MARKETABLE SECURITIES

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Section 2.1—Treasury Bills

General Characteristics

The following general characteristics apply to Government of Canada treasury bills:

As of 18 September 1997, treasury bills are issued every two weeks.

Primary distributors submit treasury bill tenders electronically to the Bank of Canada.

Treasury bills are generally issued with a term to maturity of 98 days, 168 or 182 days, and 350 or

364days.

For cash-management reasons, treasury bills may also be issued with a term to maturity of (usually)

less than 91 days.

Treasury bills are priced at a discount. The return is the difference between the purchase price and

the par value. The rate of return (yield) is conventionally calculated by dividing this difference by the

purchase price and expressing the result as an annual percentage rate, using a 365-day year. The

rate of return is computed as follows:

yield = par value - purchase price

X

365 X 100

purchase price term

Effective April 2008, all new issues of treasury bills are issued in book-entry form only.

The full amount of the treasury bills is registered in fully registered form in the name of “CDS & Co.,”

a nominee of the Canadian Depository for Securities Limited (CDS), and recorded in book-entry form

by the registrar.

Principal is paid in lawful money of Canada to CDS & Co.

Treasury bills must be purchased, transferred or sold directly or indirectly through a participant of

CDSX, the debt clearing and money market system operated by CDS.

Table 2.1: Treasury Bills

Listed by Maturity Date and Outstanding Amount

Maturity Date

2017

Issue Date

2016

Average Price

at Tender

Average Yield

at Tender (%)

Outstanding

Amount ($)

04 Jan. 12 Dec. 99.968 0.506 2,600,000,000

05 Jan. 14 Dec. 99.969 0.516 2,800,000,000

12 Jan. 14 Jan. 99.605 0.398 2,600,000,000

12 Jan. 28 Jan. 99.568 0.452 2,700,000,000

12 Jan. 06 Oct. 99.866 0.498 5,000,000,000

26 Jan. 28 Jul. 99.729 0.545 2,500,000,000

26 Jan. 11 Aug. 99.759 0.525 2,700,000,000

26 Jan. 20 Oct. 99.865 0.504 5,000,000,000

09 Feb. 11 Feb. 99.595 0.408 2,400,000,000

19

SECTION 2.1—TREASURY BILLS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 2.1: Treasury Bills

Listed by Maturity Date and Outstanding Amount

Maturity Date

2017

Issue Date

2016

Average Price

at Tender

Average Yield

at Tender (%)

Outstanding

Amount ($)

09 Feb. 25 Feb. 99.544 0.478 2,200,000,000

09 Feb. 03 Nov. 99.873 0.472 5,300,000,000

23 Feb. 25 Aug. 99.733 0.536 3,100,000,000

23 Feb. 08 Sep. 99.753 0.539 2,600,000,000

23 Feb. 17 Nov. 99.865 0.502 6,200,000,000

09 Mar. 10 Mar. 99.482 0.522 2,000,000,000

09 Mar. 24 Mar. 99.482 0.543 2,000,000,000

09 Mar. 01 Dec. 99.864 0.509 7,100,000,000

23 Mar. 22 Sep. 99.730 0.542 2,200,000,000

23 Mar. 06 Oct. 99.757 0.529 2,000,000,000

23 Mar. 15 Dec. 99.866 0.500 5,900,000,000

06 Apr. 07 Apr. 99.456 0.548 2,400,000,000

06 Apr. 21 Apr. 99.430 0.598 2,900,000,000

06 Apr. 29 Dec. 99.873 0.473 5,000,000,000

20 Apr. 20 Oct. 99.732 0.539 2,000,000,000

20 Apr. 03 Nov. 99.767 0.507 2,100,000,000

04 May 05 May 99.388 0.617 3,300,000,000

04 May 19 May 99.451 0.576 3,200,000,000

18 May 17 Nov. 99.733 0.537 2,400,000,000

18 May 01 Dec. 99.749 0.547 2,700,000,000

01 Jun. 02 Jun. 99.387 0.618 2,700,000,000

01 Jun. 16 Jun. 99.505 0.519 2,200,000,000

15 Jun. 15 Dec. 99.727 0.550 2,300,000,000

15 Jun. 29 Dec. 99.741 0.564 2,000,000,000

29 Jun. 30 Jun. 99.494 0.510 2,000,000,000

29 Jun. 14 Jul. 99.518 0.505 2,400,000,000

27 Jul. 28 Jul. 99.431 0.574 2,500,000,000

27 Jul. 11 Aug. 99.497 0.527 2,700,000,000

24 Aug. 25 Aug. 99.452 0.553 3,100,000,000

24 Aug. 08 Sep. 99.454 0.573 2,600,000,000

21 Sep. 22 Sep. 99.431 0.574 2,200,000,000

21 Sep. 06 Oct. 99.479 0.546 2,000,000,000

19 Oct. 20 Oct. 99.426 0.579 2,000,000,000

19 Oct. 03 Nov. 99.484 0.541 2,100,000,000

16 Nov. 17 Nov. 99.418 0.587 2,400,000,000

16 Nov. 01 Dec. 99.446 0.581 2,700,000,000

14 Dec. 15 Dec. 99.391 0.614 2,300,000,000

14 Dec. 29 Dec. 99.381 0.650 2,000,000,000

Total 137,100,000,000

20

SECTION 2.1—TREASURY BILLS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Section 2.2—Marketable Bonds

General Characteristics

The following general characteristics apply to Government of Canada domestic marketable bonds unless

otherwise indicated in the details of each maturity:

Bearer and Registered Bonds

Principal is payable without charge in lawful money of Canada at the Bank of Canada, Ottawa.

Interest is payable without charge in lawful money of Canada at any branch of any authorized nan-

cial institution in Canada.

Bearer and registered bonds are interchangeable as to denomination and/or form, if available.

The denominations, serial letters and forms of bearer and registered bonds are as follows:

$1,000 $5,000 $25,000 $100,000 $1,000,000

Bearer E C D W K

Registered M V X Y L

Effective December 1993, all new issues of Government of Canada domestic marketable bonds are

issued in registered format only.

Registration is at the Bank of Canada, Ottawa.

Government of Canada marketable bonds payable in Canadian dollars are non-callable.

The dates under “The Closing of Books for Interest” are subject to change without notice. Unless

otherwise indicated, the date for the closing of books for interest is the 12th day of the month prece-

ding the interest payment.

Since 1992, all domestic marketable bonds are sold by auction.

Global Certificates

From October 1995 to March 2008, all new issues of domestic marketable bonds were issued in

global-certicate form only. These global certicates were subsequently replaced by a book-entry

register.

A book-entry position for the full amount of the bonds is issued in fully registered form in the name of

“CDS & Co.,” a nominee of the Canadian Depository for Securities Limited (CDS).

Principal and interest are paid in lawful money of Canada to CDS & Co.

The bonds must be purchased, transferred or sold directly or indirectly through a participant of

CDSX, the debt clearing and money market system operated by CDS, and only in denominations of

$1,000 and integral multiples thereof.

21

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 2.2.1 : Marketable Bonds

Listed by Series, ISIN, and Outstanding Amount

Series ISIN Maturity Coupon (%) Outstanding Amount ($)

A39 CA135087-TZ75 15 Mar. 2021 10½ 567,361,000

A43 CA135087-UE28 01 Jun. 2021 9¾ 286,188,000

A461 CA135087-A461 01 Sep. 2017 1½ 7,968,079,000

A49 CA135087-UM44 01 Jun. 2022 9¼ 206,022,000

A55 CA135087-UT96 01 Jun. 2023 8 2,358,552,000

A610 CA135087-A610 01 Jun. 2023 1½ 14,200,000,000

A76 CA135087-VH40 01 Jun. 2025 9 2,303,156,000

A875 CA135087-A875 01 Mar. 2018 1¼ 10,200,000,000

B378 CA135087-B378 01 Sep. 2018 1¼ 10,200,000,000

B451 CA135087-B451 01 Jun. 2024 2½ 13,800,000,000

B600 CA135087-B600 01 Feb. 2017 1½ 9,303,720,000

B865 CA135087-B865 01 Mar. 2019 1¾ 10,200,000,000

B949 CA135087-B949 01 Dec. 2047 1¼ 7,643,392,000

C855 CA135087-C855 01 Sep. 2019 1¾ 16,700,000,000

C939 CA135087-C939 01 Dec. 2064 2¾ 3,500,000,000

D275 CA135087-D275 01 Aug. 2017 1¼ 12,511,691,000

D358 CA135087-D358 01 Dec. 2048 2¾ 11,700,000,000

D507 CA135087-D507 01 Jun. 2025 2¼ 13,100,000,000

D929 CA135087-D929 01 Mar. 2020 1½ 16,700,000,000

E265 CA135087-E265 01 Feb. 2018 1¼ 18,765,598,000

E349 CA135087-E349 01 May 2017 ¼ 7,940,190,000

E596 CA135087-E596 01 Sep. 2020 ¾ 13,000,000,000

E679 CA135087-E679 01 Jun. 2026 1½ 13,500,000,000

E752 CA135087-E752 01 Nov. 2017 ¼ 11,685,192,000

F254 CA135087-F254 01 Mar. 2021 ¾ 13,800,000,000

F338 CA135087-F338 01 May 2018 ¼ 14,618,524,000

F585 CA135087-F585 01 Sep. 2021 ¾ 15,000,000,000

F668 CA135087-F668 01 Aug. 2018 ½ 15,600,000,000

F825 CA135087-F825 01 Jun. 2027 1 6,000,000,000

F908 CA135087-F908 01 Nov. 2018 ½ 15,600,000,000

G328 CA135087-G328 01 Mar. 2022 ½ 7,500,000,000

G401 CA135087-G401 01 Feb. 2019 ½ 11,700,000,000

L25 CA135087-UL60 01 Dec. 2021 4¼ 8,041,225,500

VS05 CA135087-VS05 01 Dec. 2026 4¼ 7,716,712,500

VW17 CA135087-V W17 01 Jun. 2027 8 4,035,975,000

WL43 CA135087-WL43 01 Jun. 2029 5¾ 10,914,933,000

WV25 CA135087-W V25 01 Dec. 2031 4 8,193,312,000

XG49 CA135087-XG49 01 Jun. 2033 5¾ 12,617,905,000

XQ21 CA135087-XQ21 01 Dec. 2036 3 7,332,448,500

XW98 CA135087-XW98 01 Jun. 2037 5 13,375,249,000

YF56 CA135087-YF56 01 Jun. 2017 4 7,995,404,000

YK42 CA135087-YK42 01 Dec. 2041 2 7,602,519,500

YL25 CA135087-YL25 01 Jun. 2018 4¼ 10,622,764,000

22

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 2.2.1 : Marketable Bonds

Listed by Series, ISIN, and Outstanding Amount

Series ISIN Maturity Coupon (%) Outstanding Amount ($)

YQ12 CA135087-YQ12 01 Jun. 2041 4 15,528,000,000

YR94 CA135087-YR94 01 Jun. 2019 3¾ 17,650,000,000

YZ11 CA135087-YZ11 01 Jun. 2020 3½ 13,100,000,000

ZH04 CA135087-ZH04 01 Dec. 2044 1½ 8,598,590,000

ZJ69 CA135087-ZJ69 01 Jun. 2021 3¼ 11,500,000,000

ZS68 CA135087-ZS68 01 Dec. 2045 3½ 16,400,000,000

ZU15 CA135087-ZU15 01 Jun. 2022 2¾ 12,700,000,000

ZV97 CA135087-Z V97 01 Mar. 2017 1½ 8,054,835,000

530,137,538,000

Table 2.2.2 : Marketable Bonds

Listed by Maturity Date

Year Maturity Date Coupon (%) Certicate Type Series

2017 01 Feb. 1½ Book-entry B600

01 Mar. 1½ Book-entry ZV97

01 May ¼ Book entry E349

01 Jun. 4 Book-entry

a

YF56

01 Aug. 1¼ Book-entry D275

01 Sep. 1½ Book-entry A461

01 Nov. ¼ Book-entry E752

2018 01 Feb. 1¼ Book-entry E265

01 Mar.

01 May

1¼

¼

Book-entry

Book-entry

A875

F338

01 Jun.

01 Aug.

4¼

½

Book-entry

a

Book-entry

YL25

F668

01 Sep.

01 Nov.

1¼

½

Book-entry

Book-entry

B378

F908

2019 01 Feb.

01 Mar.

½

1¾

Book-entry

Book-entry

G401

B865

01 Jun. 3¾ Book-entry YR94

01 Sep. 1¾ Book-entry C855

2020 01 Mar. 1½ Book-entry D929

01 Jun. 3½ Book-entry YZ11

01 Sep. ¾ Book-entry E596

2021 01 Mar. ¾ Book-entry F254

15 Mar. 10½ Bearer and Registered A39

01 Jun. 9¾ Bearer and Registered A43

01 Jun.

01 Sep.

3¼

¾

Book-entry

Book-entry

ZJ69

F585

01 Dec. 4¼ Book-entry

a

L25

2022 01 Mar.

01 Jun.

½

9¼

Book-entry

Bearer and Registered

G328

A49

01 Jun. 2¾ Book-entry ZU15

23

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Table 2.2.2 : Marketable Bonds

Listed by Maturity Date

Year Maturity Date Coupon (%) Certicate Type Series

2023 01 Jun. 8 Bearer and Registered A55

01 Jun. 1½ Book-entry A610

2024 01 Jun. 2½ Book-entry B451

2025 01 Jun. 9 Registered A76

01 Jun. 2¼ Book-entry D507

2026 01 Jun. 1½ Book-entry E679

01 Dec. 4¼ Book-entry

a

VS05

2027 01 Jun.

01 Jun.

1

8

Book-entry

Book-entry

a

F825

VW17

2029 01 Jun. 5¾ Book-entry

a

WL43

2031 01 Dec. 4 Book-entry

a

WV25

2033 01 Jun. 5¾ Book-entry

a

XG49

2036 01 Dec. 3 Book-entry

a

XQ21

2037 01 Jun. 5 Book-entry

a

XW98

2041 01 Jun. 4 Book-entry YQ12

01 Dec. 2 Book-entry

a

YK42

2044 01 Dec. 1½ Book-entry ZH04

2045 01 Dec. 3½ Book-entry ZS68

2047 01 Dec. 1¼ Book-entry B949

2048 01 Dec. 2¾ Book-entry D358

2064 01 Dec. 2¾ Book-entry C939

a. Initially issued in Global form

24

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

Information by Maturity Date

½% Bonds due 1 February 2017

B600 CA135087-B600

Interest Payable: 01 Feb. and 01 Aug.

Issue Information: 15 Oct. 2013 — $2,700,000,000 issued, auction average 1.539% (99.876)

16 Dec. 2013 — $2,700,000,000 issued, auction average 1.316%

(100.562) plus accrued interest from 15 Oct. 2013

13 Jan. 2014 — $2,700,000,000 issued, auction average 1.365%

(100.402) plus accrued interest from 15 Oct. 2013

31 Oct. 2014 — $3,000,000,000 issued, auction average 1.063%

(100.970) plus accrued interest from 01 Aug. 2014

21 Nov. 2014 — $3,000,000,000 issued, auction average 1.061%

(100.950) plus accrued interest from 01 Aug. 2014

16 Jan. 2015 — $3,000,000,000 issued, auction average 0.885%

(101.243) plus accrued interest from 01 Aug. 2014

Cancellation Information: 06 Nov. 2015 — $117,333,000 cancelled

20 Nov. 2015 — $272,400,000 cancelled

04 Dec. 2015 — $25,060,000 cancelled

24 Dec. 2015 — $150,000,000 cancelled

05 Feb. 2016 — $441,000,000 cancelled

19 Feb. 2016 — $175,000,000 cancelled

26 Feb. 2016 — $579,379,000 cancelled

04 Mar. 2016 — $229,000,000 cancelled

11 Mar. 2016 — $532,250,000 cancelled

28 Mar. 2016 — $410,885,000 cancelled

01 Apr. 2016 — $101,552,000 cancelled

08 Apr. 2016 — $230,000,000 cancelled

15 Apr. 2016 — $300,000,000 cancelled

06 May 2016 — $339,573,000 cancelled

13 May 2016 — $11,000,000 cancelled

20 May 2016 — $235,000,000 cancelled

27 May 2016 — $7,371,000 cancelled

24 Jun. 2016 — $268,000,000 cancelled

08 Jul. 2016 — $280,000,000 cancelled

19 Aug. 2016 — $42,538,000 cancelled

07 Oct. 2016 — $663,475,000 cancelled

21 Oct. 2016 — $380,952,000 cancelled

04 Nov. 2016 — $631,000,000 cancelled

14 Nov. 2016 — $115,000,000 cancelled

18 Nov. 2016 — $267,762,000 cancelled

25 Nov. 2016 — $194,046,000 cancelled

02 Dec. 2016 — $231,340,000 cancelled

09 Dec. 2016 — $44,964,000 cancelled

16 Dec. 2016 — $520,400,000 cancelled

Outstanding: $9,303,720,000

25

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

1½% Bonds due 1 March 2017

ZV97 CA135087-ZV97

Interest Payable: 01 Mar. and 01 Sep.

Issue Information: 17 Oct. 2011 — $3,500,000,000 issued, auction average 1.729% (98.830)

28 Nov. 2011 — $3,500,000,000 issued, auction average 1.441%

(100.298) plus accrued interest from 17 Oct. 2011

21 Feb. 2012 — $3,500,000,000 issued, auction average 1.424%

(100.367) plus accrued interest from 17 Oct. 2011

Cancellation Information: 04 Mar. 2016 — $271,000,000 cancelled

11 Mar. 2016 — $407,000,000 cancelled

28 Mar. 2016 — $225,115,000 cancelled

01 Apr. 2016 — $3,072,000 cancelled

08 Apr. 2016 — $325,000,000 cancelled

22 Apr. 2016 — $19,000,000 cancelled

13 May 2016 — $91,000,000 cancelled

20 May 2016 — $125,000,000 cancelled

12 Aug. 2016 — $6,992,000 cancelled

07 Oct. 2016 — $166,941,000 cancelled

04 Nov. 2016 — $69,000,000 cancelled

25 Nov. 2016 — $194,045,000 cancelled

02 Dec. 2016 — $477,000,000 cancelled

09 Dec. 2016 — $40,000,000 cancelled

16 Dec. 2016 — $25,000,000 cancelled

Outstanding: $8.054,835,000

26

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

¼% Bonds due 1 May 2017

E349 CA135087-E349

Interest Payable: 01 May and 01 Nov.

Issue Information: 13 Feb. 2015 — $3,400,000,000 issued, auction average 0.425% (99.615)

27 Mar. 2015 — $3,400,000,000 issued, auction average 0.492%

(99.496) plus accrued interest from 13 Feb. 2015

24 Apr. 2015 — $3,600,000,000 issued, auction average 0.674% (99.151)

plus accrued interest from 13 Feb. 2015

Cancellation Information: 18 Dec. 2015 — $50,000,000 cancelled

22 Jan. 2016 — $174,000,000 cancelled

26 Feb. 2016 — $42,981,000 cancelled

18 Mar. 2016 — $115,113,000 cancelled

01 Apr. 2016 — $392,539,000 cancelled

08 Apr. 2016 — $27,000,000 cancelled

15 Apr. 2016 — $200,000,000 cancelled

06 May 2016 — $105,175,000 cancelled

13 May 2016 — $8,437,000 cancelled

27 May 2016 — $92,629,000 cancelled

10 Jun. 2016 — $87,500,000 cancelled

04 Jul. 2016 — $246,875,000 cancelled

05 Aug. 2016 — $262,085,000 cancelled

26 Aug. 2016 — $115,000,000 cancelled

21 Oct. 2016 — $190,476,000 cancelled

18 Nov. 2016 — $350,000,000 cancelled

Outstanding: $7,940,190,000

27

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

4% Bonds due 1 June 2017

YF56 CA135087-YF56

Interest Payable: 01 Jun. and 01 Dec.

Issue Information: 16 Oct. 2006 — $2,300,000,000 issued, auction average 4.149% (98.734)

27 Nov. 2006 — $243,812,000 issued, switch replacement priced at

99.915 plus accrued interest from 16 Oct. 2006

29 Jan. 2007 — $2,300,000,000 issued, auction average 4.188% (98.431)

plus accrued interest from 01 Dec. 2006

19 Mar. 2007 — $163,038,000 issued, switch replacement priced at

99.862 plus accrued interest from 01 Dec. 2006

23 Apr. 2007 — $2,600,000,000 issued, auction average 4.192% (98.428)

plus accrued interest from 01 Dec. 2006

07 Aug. 2007 — $2,600,000,000 issued, auction average 4.513%

(95.962) plus accrued interest from 01 Jun. 2007

17 Sep. 2007 — $135,676,000 issued, switch replacement priced at

97.542 plus accrued interest from 01 Jun. 2007

Cancellation Information: 18 Dec. 2015 — $469,000,000 cancelled

22 Jan. 2016 — $295,000,000 cancelled

18 Mar. 2016 — $297,247,000 cancelled

28 Mar. 2016 — $50,000,000 cancelled

27 May 2016 — $100,000,000 cancelled

10 Jun. 2016 — $82,500,000 cancelled

04 Jul. 2016 — $133,375,000 cancelled

08 Jul. 2016 — $161,000,000 cancelled

12 Aug. 2016 — $100,000,000 cancelled

23 Sep. 2016 — $404,000,000 cancelled

30 Sep. 2016 — $155,000,000 cancelled

14 Nov. 2016 — $100,000,000 cancelled

Outstanding: $7,995,404000

28

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

1¼% Bonds due 1 August 2017

D275 CA135087-D275

Interest Payable: 01 Feb. and 01 Aug.

Issue Information: 20 May 2014 — $2,700,000,000 issued, auction average 1.252% (99.994)

29 Aug. 2014 — $2,700,000,000 issued, auction average 1.214%

(100.103) plus accrued interest from 01 Aug. 2014

26 Sep. 2014 — $2,700,000,000 issued, auction average 1.288% (99.894)

plus accrued interest from 01 Aug. 2014

15 May 2015 — $3,700,000,000 issued, auction average 0.707% (101.191)

plus accrued interest from 01 Feb. 2015

12 Jun. 2015 — $3,700,000,000 issued, auction average 0.701%

(101.163) plus accrued interest from 01 Feb. 2015

10 Jul. 2015 — $3,600,000,000 issued, auction average 0.450%

(101.639) plus accrued interest from 01 Feb. 2015

Cancellation Information: 13 May 2016 — $250,000,000 cancelled

27 May 2016 — $300,000,000 cancelled

10 Jun. 2016 — $330,000,000 cancelled

17 Jun. 2016 — $66,982,000 cancelled

24 Jun. 2016 — $112,000,000 cancelled

04 Jul. 2016 — $406,000,000 cancelled

08 Jul. 2016 — $59,000,000 cancelled

15 Jul. 2016 — $150,000,000 cancelled

22 Jul. 2016 — $333,333,000 cancelled

05 Aug. 2016 — $132,175,000 cancelled

12 Aug. 2016 — $695,860,000 cancelled

26 Aug. 2016 — $810,000,000 cancelled

09 Sep. 2016 — $200,000,000 cancelled

16 Sep. 2016 — $371,892,000 cancelled

23 Sep. 2016 — $568,480,000 cancelled

30 Sep. 2016 — $345,000,000 cancelled

07 Oct. 2016 — $169,584,000 cancelled

14 Oct. 2016 — $330,000,000 cancelled

21 Oct. 2016 — $125,000,000 cancelled

14 Nov. 2016 — $65,967,000 cancelled

18 Nov. 2016 — $208,817,000 cancelled

02 Dec. 2016 — $74,660,000 cancelled

09 Dec. 2016 — $38,560,000 cancelled

16 Dec. 2016 — $24,600,000 cancelled

23 Dec. 2016 — $170,399,000 cancelled

30 Dec. 2016 — $250,000,000 cancelled

Outstanding: $12,511,691,000

29

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

1½% Bonds due 1 September 2017

A461 CA135087-A461

Interest Payable: 01 Mar. and 01 Sep.

Issue Information: 14 May 2012 — $3,400,000,000 issued, auction average 1.534% (99.828)

16 Jul. 2012 — $3,400,000,000 issued, auction average 1.244% (101.268)

plus accrued interest from 14 May 2012

20 Aug. 2012 — $3,400,000,000 issued, auction average 1.538%

(99.817) plus accrued interest from 14 May 2012

Cancellation Information: 24 Jun. 2016 — $50,000,000 cancelled

04 Jul. 2016 — $198,750,000 cancelled

15 Jul. 2016 — $393,890,000 cancelled

05 Aug. 2016 — $105,740,000 cancelled

19 Aug. 2016 — $357,462,000 cancelled

26 Aug. 2016 — $75,000,000 cancelled

09 Sep. 2016 — $270,000,000 cancelled

16 Sep. 2016 — $64,174,000 cancelled

14 Oct. 2016 — $113,333,000 cancelled

21 Oct. 2016 — $303,572,000 cancelled

04 Nov. 2016 — $300,000,000 cancelled

Outstanding: $7,968,079,000

30

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

¼% Bonds due 1 November 2017

E752 CA135087-E752

Interest Payable: 01 May and 01 Nov.

Issue Information: 07 Aug. 2015 — $3,300,000,000 issued, auction average 0.451%

(99.554)

28 Aug. 2015 — $3,300,000,000 issued, auction average 0.403%

(99.669) plus accrued interest from 07 Aug. 2015

25 Sep. 2015 — $3,400,000,000 issued, auction average 0.517% (99.443)

plus accrued interest from 07 Aug. 2015

09 Oct. 2015 — $3,400,000,000 issued, auction average 0.536% (99.414)

plus accrued interest from 07 Aug. 2015

Cancellation Information: 19 Aug. 2016 — $100,000,000 cancelled

16 Sep. 2016 — $50,000,000 cancelled

14 Oct. 2016 — $56,667,000 cancelled

14 Nov. 2016 — $219,033,000 cancelled

25 Nov. 2016 — $106,725,000 cancelled

09 Dec. 2016 — $175,000,000 cancelled

16 Dec. 2016 — $430,000,000 cancelled

23 Dec. 2016 — $77,383,000 cancelled

30 Dec. 2016 — $500,000,000 cancelled

Outstanding: $11,685,192,000

31

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

¼% Bonds due 1 May 2018

F338 CA135087-F338

Interest Payable: 01 May and 01 Nov.

Issue Information: 05 Feb. 2016 — $3,700,000,000 issued, auction average 0.401% (99.664)

26 Feb. 2016 — $3,700,000,000 issued, auction average 0.479% (99.504)

plus accrued interest from 05 Feb. 2016

28 Mar. 2016 — $3,700,000,000 issued, auction average 0.577% (99.321)

plus accrued interest from 05 Feb. 2016

18 Apr. 2016 — $3,900,000,000 issued, auction average 0.598% (99.297)

plus accrued interest from 05 Feb. 2016

Cancellation Information: 09 Dec. 2016 — $201,476,000 cancelled

23 Dec. 2016 — $180,000,000 cancelled

Outstanding: $14,618,524,000

32

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

½% Bonds due 1 November 2018

F908 CA135087-F908

Interest Payable: 01 May and 01 Nov.

Issue Information: 12 Aug. 2016 — $3,900,000,000 issued, auction average 0.513% (99.971)

02 Sep. 2016 — $3,900,000,000 issued, auction average 0.589%

(99.809) plus accrued interest from 12 Aug. 2016

26 Sep. 2016 — $3,900,000,000 issued, auction average 0.572%

(99.850) plus accrued interest from 12 Aug. 2016

14 Oct. 2016 — $3,900,000,000 issued, auction average 0.614% (99.768)

plus accrued interest from 12 Aug. 2016

Outstanding: $15,600,000,000

33

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

1¼% Bonds due 1 February 2018

E265 CA135087-E265

Interest Payable: 01 Feb. and 01 Aug.

Issue Information: 10 Nov. 2014 — $2,700,000,000 issued, auction average 1.269% (99.941)

12 Jan. 2015 — $2,700,000,000 issued, auction average 1.065%

(100.555) plus accrued interest from 10 Nov. 2014

09 Mar. 2015 — $2,700,000,000 issued, auction average 0.628%

(101.785) plus accrued interest from 01 Feb. 2015

20 Nov. 2015 — $3,700,000,000 issued, auction average 0.655%

(101.296) plus accrued interest from 01 Aug. 2015

11 Dec. 2015 — $3,700,000,000 issued, auction average 0.566%

(101.454) plus accrued interest from 01 Aug. 2015

08 Jan. 2016 — $3,700,000,000 issued, auction average 0.424%

(101.697) plus accrued interest from 01 Aug. 2015

Cancellation Information: 18 Nov. 2016 — $140,000,000 cancelled

25 Nov. 2016 — $5,184,000 cancelled

02 Dec. 2016 — $217,000,000 cancelled

23 Dec. 2016 — $72,218,000 cancelled

Outstanding: $18,765,598,000

34

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

½% Bonds due 1 August 2018

F668 CA135087-F668

Interest Payable: 01 Feb. and 01 Aug.

Issue Information: 06 May 2016 — $3,900,000,000 issued, auction average 0.600%

(99.778)

30 May 2016 — $3,900,000,000 issued, auction average 0.632% (99.716)

plus accrued interest from 06 May 2016

04 Jul. 2016 — $3,900,000,000 issued, auction average 0.519% (99.961)

plus accrued interest from 06 May 2016

22 Jul. 2016 — $3,900,000,000 issued, auction average 0.605% (99.789)

plus accrued interest from 06 May 2016

Cancellation Information:

Outstanding: $15,600,000,000

35

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

1¼% Bonds due 1 March 2018

A875 CA135087-A875

Interest Payable: 01 Mar. and 01 Sep.

Issue Information: 13 Nov. 2012 — $3,400,000,000 issued, auction average 1.367% (99.404)

14 Jan. 2013 — $3,400,000,000 issued, auction average 1.494% (98.800)

plus accrued interest from 13 Nov. 2012

04 Mar. 2013 — $3,400,000,000 issued, auction average 1.360% (99.471)

plus accrued interest from 01 Mar. 2013

Outstanding: $10,200,000,000

36

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

4¼% Bonds due 1 June 2018

YL25 CA135087-YL25

Interest Payable: 01 Jun. and 01 Dec.

Issue Information: 29 Oct. 2007 — $2,500,000,000 issued, auction average 4.311% (99.489)

11 Feb. 2008 — $2,600,000,000 issued, auction average 3.887%

(103.053) plus accrued interest from 01 Dec. 2007

25 Mar. 2008 — $222,764,000 issued, switch replacement priced at

105.821 plus accrued interest from 01 Dec. 2007

21 Apr. 2008 — $2,500,000,000 issued, auction average 3.760%

(104.087) plus accrued interest from 01 Dec. 2007

23 Jun. 2008 — $300,000,000 issued, switch replacement priced at

102.676 plus accrued interest from 01 Jun. 2008

14 Jul. 2008 — $2,500,000,000 issued, auction average 3.773%

(103.901) plus accrued interest from 01 Jun. 2008

Outstanding: $10,622,764,000

37

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

1¼% Bonds due 1 September 2018

B378 CA135087-B378

Interest Payable: 01 Mar. and 01 Sep.

Issue Information: 13 May 2013 — $3,400,000,000 issued, auction average 1.325% (99.618)

15 Jul. 2013 — $3,400,000,000 issued, auction average 1.884% (96.913)

plus accrued interest from 13 May 2013

03 Sep. 2013 — $3,400,000,000 issued, auction average 1.957%

(96.652) plus accrued interest from 01 Sep. 2013

Outstanding: $10,200,000,000

38

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

½% Bonds due 1 February 2019

G401 CA135087-G401

Interest Payable: 01 Feb. and 01 Aug.

Issue Information: 07 Nov. 2016 — $3,900,000,000 issued, auction average 0.564%

(99.858)

02 Dec. 2016 — $3,900,000,000 issued, auction average 0.727%

(99.513) plus accrued interest from 07 Nov. 2016

23 Dec. 2016 — $3,900,000,000 issued, auction average 0.865%

(99.239) plus accrued interest from 07 Nov. 2016

Outstanding: $11,700,000,000

39

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

1¾% Bonds due 1 March 2019

B865 CA135087-B865

Interest Payable: 01 Mar. and 01 Sep.

Issue Information: 12 Nov. 2013 — $3,400,000,000 issued, auction average 1.907% (99.213)

20 Jan. 2014 — $3,400,000,000 issued, auction average 1.887% (99.336)

plus accrued interest from 12 Nov. 2013

24 Feb. 2014 — $3,400,000,000 issued, auction average 1.688%

(100.297) plus accrued interest from 12 Nov. 2013

Outstanding: $10,200,000,000

40

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

3¾% Bonds due 1 June 2019

YR94 CA135087-YR94

Interest Payable: 01 Jun. and 01 Dec.

Issue Information: 06 Oct. 2008 — $2,500,000,000 issued, auction average 3.807%

(99.508)

10 Nov. 2008 — $300,000,000 issued, switch replacement priced at

98.798 plus accrued interest from 06 Oct. 2008

09 Feb. 2009 — $3,300,000,000 issued, priced at 3.346% (103.494) plus

accrued interest from 01 Dec. 2008

02 Mar. 2009 — $3,500,000,000 issued, priced at 3.151% (105.209) plus

accrued interest from 01 Dec. 2008

10 Mar. 2009 — $750,000,000 issued, switch replacement priced at

106.997 plus accrued interest from 01 Dec. 2008

14 Apr. 2009 — $600,000,000 issued, switch replacement priced at

107.096 plus accrued interest from 01 Dec. 2008

15 Jun. 2009 — $3,500,000,000 issued, priced at 3.636% (100.944) plus

accrued interest from 01 Jun. 2009

18 Aug. 2009 — $3,200,000,000 issued, priced at 3.527% (101.828) plus

accrued interest from 01 Jun. 2009

Outstanding: $17,650,000,000

41

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

1¾% Bonds due 1 September 2019

C855 CA135087-C855

Interest Payable: 01 Mar. and 01 Sep.

Issue Information: 14 Apr. 2014 — $3,400,000,000 issued, auction average 1.839% (99.547)

12 May 2014 — $3,400,000,000 issued, auction average 1.738%

(100.061) plus accrued interest from 14 Apr. 2014

11 Aug. 2014 — $3,400,000,000 issued, auction average 1.546%

(100.989) plus accrued interest from 14 Apr. 2014

19 Jul. 2016 — $3,200,000,000 issued, auction average 0.547% (103.716)

plus accrued interest from 01 Mar. 2016

29 Aug. 2016 — $3,300,000,000 issued, auction average 0.575%

(103.499) plus accrued interest from 01 Mar. 2016

Outstanding: $16,700,000,000

42

SECTION 2.2—MARKETABLE BONDS

BANK OF CANADA • SUMMARY OF GOVERNMENT OF CANADA DIRECT SECURITIES AND LOANS • OUTSTANDING AS AT 31 DECEMBER 2016

1½% Bonds due 1 March 2020

D929 CA135087-D929

Interest Payable: 01 Mar. and 01 Sep.

Issue Information: 14 Oct. 2014 — $3,400,000,000 issued, auction average 1.591% (99.533)

01 Dec. 2014 — $3,400,000,000 issued, auction average 1.540%

(99.799) plus accrued interest from 14 Oct. 2014