UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(MarkOne)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

ForthefiscalyearendedDecember31,2021

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Forthetransitionperiodfrom________to________

CommissionFileNo.1-7259

SOUTHWEST AIRLINES CO.

(Exactnameofregistrantasspecifiedinitscharter)

Texas 74-1563240

(Stateorotherjurisdictionof (IRSEmployer

incorporationororganization) IdentificationNo.)

P.O.Box36611

Dallas, Texas 75235-1611

(Addressofprincipalexecutiveoffices) (ZipCode)

Registrant'stelephonenumber,includingareacode:(214) 792-4000

Securities registered pursuant to Section 12(b) of the Act:

Titleofeachclass TradingSymbol Nameofeachexchangeonwhichregistered

CommonStock($1.00parvalue) LUV NewYorkStockExchange

Securities registered pursuant to Section 12(g) of the Act:

None

Indicatebycheckmarkiftheregistrantisawell-knownseasonedissuer,asdefinedinRule405oftheSecuritiesAct.YesxNoo

IndicatebycheckmarkiftheregistrantisnotrequiredtofilereportspursuanttoSection13orSection15(d)oftheAct.YesoNox

Indicatebycheckmarkwhethertheregistrant(1)hasfiledallreportsrequiredtobefiledbySection13or15(d)oftheSecuritiesExchangeActof1934duringthepreceding12months(orfor

suchshorterperiodthattheregistrantwasrequiredtofilesuchreports),and(2)hasbeensubjecttosuchfilingrequirementsforthepast90days.YesxNoo

IndicatebycheckmarkwhethertheregistranthassubmittedelectronicallyeveryInteractiveDataFilerequiredtobesubmittedpursuanttoRule405ofRegulationS-Tduringthepreceding12

months(orforsuchshorterperiodthattheregistrantwasrequiredtosubmitsuchfiles).YesxNoo

Indicatebycheckmarkwhethertheregistrantisalargeacceleratedfiler,anacceleratedfiler,anon-acceleratedfiler,asmallerreportingcompany,oranemerginggrowthcompany.Seethe

definitionsof"largeacceleratedfiler,""acceleratedfiler,""smallerreportingcompany,"and"emerginggrowthcompany"inRule12b-2oftheExchangeAct.

Largeacceleratedfiler

x

Acceleratedfiler ☐

Non-acceleratedfiler ☐ Smallerreportingcompany ☐

Emerginggrowthcompany ☐

Ifanemerginggrowthcompany,indicatebycheckmarkifthe registrant has elected nottousetheextendedtransitionperiodforcomplying with any neworrevisedfinancialaccounting

standardsprovidedpursuanttoSection13(a)oftheExchangeAct.¨

Indicatebycheckmarkwhethertheregistranthasfiledareportonandattestationtoitsmanagement'sassessmentoftheeffectivenessofitsinternalcontroloverfinancialreportingunder

Section404(b)oftheSarbanes-OxleyAct(15U.S.C.7262(b))bytheregisteredpublicaccountingfirmthatpreparedorissueditsauditreport.x

Indicatebycheckmarkwhethertheregistrantisashellcompany(asdefinedinRule12b-2oftheAct).Yes☐☐Nox

Theaggregatemarketvalueofthecommonstockheldbynon-affiliatesoftheregistrantwasapproximately$31,305,364,914computedbyreferencetotheclosingsalepriceofthecommon

stockontheNewYorkStockExchangeonJune30,2021,thelasttradingdayoftheregistrant’smostrecentlycompletedsecondfiscalquarter.

NumberofsharesofcommonstockoutstandingasofthecloseofbusinessonFebruary2,2022:592,341,878shares

DOCUMENTS INCORPORATED BY REFERENCE

PortionsoftheDefinitiveProxyStatementfortheCompany’sAnnualMeetingofShareholderstobeheldMay18,2022,areincorporatedintoPartIIIofthisAnnualReportonForm10-K.

TABLE OF CONTENTS

PART I

Item1. Business 3

Item1A. RiskFactors 28

Item1B. UnresolvedStaffComments 42

Item2. Properties 43

Item3. LegalProceedings 44

Item4. MineSafetyDisclosures 46

PART II

Item5. MarketforRegistrant’sCommonEquity,RelatedStockholderMatters,andIssuerPurchasesofEquitySecurities 49

Item7. Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations 52

LiquidityandCapitalResources 69

CriticalAccountingPoliciesandEstimates 72

Item7A. QuantitativeandQualitativeDisclosuresAboutMarketRisk 76

Item8. FinancialStatementsandSupplementaryData 80

SouthwestAirlinesCo.ConsolidatedBalanceSheet 80

SouthwestAirlinesCo.ConsolidatedStatementofIncome(Loss) 81

SouthwestAirlinesCo.ConsolidatedStatementofComprehensiveIncome(Loss) 82

SouthwestAirlinesCo.ConsolidatedStatementofStockholders’Equity 83

SouthwestAirlinesCo.ConsolidatedStatementofCashFlows 84

NotestoConsolidatedFinancialStatements 85

Item9. ChangesinandDisagreementsWithAccountantsonAccountingandFinancialDisclosure 134

Item9A. ControlsandProcedures 134

Item9B. OtherInformation 135

Item9C. DisclosureRegardingForeignJurisdictionsthatPreventInspections 135

PART III

Item10. Directors,ExecutiveOfficers,andCorporateGovernance 136

Item11. ExecutiveCompensation 136

Item12. SecurityOwnershipofCertainBeneficialOwnersandManagementandRelatedStockholderMatters 137

Item13. CertainRelationshipsandRelatedTransactions,andDirectorIndependence 137

Item14. PrincipalAccountingFeesandServices 137

PART IV

Item15. ExhibitsandFinancialStatementSchedules 139

Item16. Form10-KSummary 142

Signatures 143

2

TableofContents

-PART I-

Item 1.Business

Company Overview

Southwest Airlines Co. (the "Company" or "Southwest") operates Southwest Airlines, a major passenger airline that provides scheduled air

transportation in the United States and near-international markets. Southwest commenced service on June 18, 1971, with three Boeing 737

aircraftservingthreeTexascities:Dallas,Houston,andSanAntonio.AtDecember31,2021,Southwesthadatotalof728Boeing737aircraftin

its fleet and121 destinations in 42 states, the District of Columbia, the Commonwealth of Puerto Rico, and ten near-international countries:

Mexico,Jamaica,TheBahamas,Aruba,DominicanRepublic,CostaRica,Belize,Cuba,theCaymanIslands,andTurksandCaicos.

During 2021, the Company began service to 14 new destinations including Chicago (O'Hare), Illinois; Houston (Bush), Texas; Jackson,

Mississippi;ColoradoSprings,Colorado;Savannah,Georgia/HiltonHead,SouthCarolina;Sarasota,Florida;SantaBarbara,California;Fresno,

California;Destin,Florida;Bozeman,Montana;MyrtleBeach,SouthCarolina;Eugene,Oregon;Bellingham,Washington;andSyracuse,New

York.

Worldwide Pandemic

InMarch2020,theWorldHealthOrganizationclassifiedthenovelcoronavirus,COVID-19,asapandemic.Thespeedwithwhichtheeffectsof

theCOVID-19 pandemic changed the U.S.economic landscape,outlook, andin particularthe travelindustry, was swift and unexpectedand

resultedinasignificantnegativeimpactontraveldemand,revenues,andbookingsthroughout2020.TheCompanyrespondedbycancellinga

significant portion of its scheduled flights, grounding a significant portion of its fleet, significantly reducing planned capital spending, and

significantlyreducingitspreviouslyscheduledcapacity.Further,theCompanysubstantiallyenhanceditscashholdingsbyobtainingsignificant

financinginthecapital markets, throughpayroll fundingsupport ("PayrollSupport") withthe U.S.Department ofTreasury ("Treasury"),and

elsewhere.Inaddition,theCompanyofferedvoluntaryseparationandextendedtime-offprogramsforitsEmployees,whichsignificantlyreduced

theCompany'sactiveheadcount.

TheCompanycontinuedtoexperiencenegativeandunpredictablefluctuatingpandemic-relatedimpactstopassengerdemandandbookingsin

2021.Modestimprovementsinleisurebookingsbeganinmid-February2021andfurtherimprovedinMarch2021.Traveldemandandbookings

accelerated during second quarter 2021 as a result of declining reported COVID-19 cases throughout the United States, the easing of travel

restrictions,andanincreaseinthenumberofindividualsvaccinated.Despitesomesoftnessinbookingsandelevatedtripcancellationsdueto

surgingCOVID-19casesinAugustandSeptemberas aresultoftheDeltavariant,andinDecemberasaresultoftheOmicronvariant,third

quarterandfourthquarter2021domesticleisuredemandwasalsostrongandadramaticimprovementfrom2020.

Theunpredictablefluctuatingextentofthetraveldemandimprovementoverthecourseof2021,combinedwiththereductionintheCompany's

available workforce, contributed to operational challenges and resulting declines in the Company's operational performance as the Company

struggledtoreturntothestaffinglevelsnecessaryforoperationaldemands.Inresponse,theCompanycontinueditseffortstocorrespondingly

adjust capacitythroughout 2021and into firstquarter 2022. Inaddition, the Companyaggressively hired new Employees inthird and fourth

quarter2021,andiscontinuingtheseeffortsin2022,tobalanceitsschedulewithitscrewandgroundoperationsresources.

ForfurtherinformationonrisksrelatedtoCOVID-19,aswellasthesignificantimpactsofCOVID-19ontheCompany'soperations,financial

performance,andliquidity,see"RiskFactors,""Management’sDiscussionandAnalysisofFinancialConditionandResultsofOperations,"and

Notes2,7,and9totheConsolidatedFinancialStatements.

3

TableofContents

Industry

Asdiscussedaboveunder"Business–WorldwidePandemic,"thetravelindustrywasadverselyimpactedin2020and2021bytheCOVID-19

pandemic,includingtherecentDeltaandOmicronvariants.LiketheCompany,otherU.S.airlinesexperiencedsignificantnegativeimpactsto

passengerdemandandrevenues;howevertheimpactoftheCOVID-19pandemiconsomeoftheseairlineswasparticularlyseverebecauseofthe

percentageoftheiroperationsthathadhistoricallybeendependentonbusinessandinternationaltravel,eachofwhichsufferedparticularharmas

aresultofthepandemic.Demandforbusinesstraveldeclinedsignificantlyduetocompaniestighteningorevensuspendingcorporatetravel.This

notonlyreducedoveralldemandforairtravel,butalsoresultedinadecreaseinthepercentageoffull-farepurchases.Demandforinternational

travel was significantly harmed by the imposition of international travel restrictions. Like the Company, these other airlines responded with

adjustments to their flight schedules, capacity, operating costs and capital expenditures, and fleet plans. Unlike the Company, certain other

airlinesalsofurloughedemployeesand/orceasedserviceincertainmarkets.

LiketheCompany,otherU.S.airlinesbegantomitigatecashlossesandrecoverfromtheCOVID-19pandemicin2021,whilefacingchallenges

suchastheDeltaandOmicronvariants,lowerpassengerrevenueyields(i.e.,pricing),higherfuelpricesandothercostinflation,andsurgesin

leisuretraveldemandagainstconstrainedpersonnelresourcesresultinginoperationalchallenges.Overall,theU.S.airlineindustrysawastrong

recoveryofdomesticleisuretraveldemandduringpeaktravelperiodsin2021asaresultofdecliningreportedCOVID-19casesthroughoutthe

UnitedStates,theeasingoftravelrestrictions,andanincreaseinthenumberofindividualsvaccinatedagainstCOVID-19.However,business

travelremainedatasignificantlyreducedlevelthroughout2021,ascomparedwithpre-pandemiclevels.

Theairlineindustryhashistoricallybeenanextremelyvolatileindustrysubjecttonumerousotherchallenges.Amongotherthings,ithasbeen

cyclical,energy intensive,labor intensive,capitalintensive, technologyintensive, highlyregulated, heavilytaxed,and extremelycompetitive.

Theairlineindustryhasalsobeenparticularlysusceptibletodetrimentaleventssuchaseconomicrecessions,jetfuelpricevolatility,unscheduled

maintenancedisruptions,U.S.governmentshutdowns,actsofterrorism,poorweather,andnaturaldisasters.

Historically, airline industry results have been particularly susceptible to fuel price volatility. In 2021, the industry experienced a very

challengingfuelenvironment,ascomparedwithrecentyears,withyear-over-yearfuelpricessignificantlyhigherthroughoutmostof2021.

Company Operations

Route Structure

Southwest has historically principally provided point-to-point service, rather than the "hub-and-spoke" service provided by most major U.S.

airlines.Thehub-and-spokesystemconcentratesmostofanairline'soperationsatalimitednumberofcentralhubcitiesandservesmostother

destinations in the system by providing one-stop or connecting service through a hub. By not concentrating operations through one or more

central transfer points, Southwest's point-to-point route structure has allowed for more direct nonstop routing than hub-and-spoke service.

However,inresponsetotheeffectsoftheCOVID-19pandemic,theCompanyplacedgreaterreliancein2020and2021onconnectingtrafficin

aneffort tocapture Customerdemand. Approximately73 percent ofthe Company'sCustomers flewnonstop during2021, comparedwith 72

percent during 2020, and compared with 77 percent during 2019, and, as of December 31, 2021, Southwest served 788 nonstop city pairs,

comparedwith667asofDecember31,2020,andcomparedwith720asofDecember31,2019.For2021,theCompany’saverageaircrafttrip

stagelengthwas790miles,withanaveragedurationofapproximately2.1hours,ascomparedwithanaverageaircrafttripstagelengthof743

milesandanaveragedurationofapproximately2.0hoursin2020,andascomparedwithanaverageaircrafttripstagelengthof748milesandan

averagedurationofapproximately2.0hoursin2019.

4

TableofContents

Southwest’spoint-to-pointservicehasalsoenabledittoprovideitsmarketswithfrequent,convenientlytimedflightsandlowfares.Forexample,

Southwest currently offers ten weekday roundtrips between DallasLove Field and Houston Hobby (andan additional six to Houston Bush),

sevenweekdayroundtripsbetweenDenverandChicagoMidway(andanadditionalsixtoChicagoO'Hare),sevenweekdayroundtripsbetween

LosAngeles Internationaland LasVegas,twelve weekdayround tripsbetween BurbankandOakland, andnine weekdayroundtrips between

Phoenix and Denver. Southwest complements its high-frequency short-haul routes with long-haul nonstop service including flights between

HawaiiandCalifornia,LasVegas,andPhoenix,andbetweenmarketssuchasLosAngelesandNashville,LosAngelesandBaltimore,Oakland

andHouston,LasVegasandOrlando,andSanDiegoandBaltimore.

TheCompanycontinuallyworkstooptimizeitsroutenetworkandschedulethroughtheadjustmentoffrequenciesinitsexistingmarketsandthe

addition of new markets and itineraries, while also pruning less profitable flights from its schedule. The Company's network and schedule

optimization efforts have been particularly beneficial in addressingthe impacts of the COVID-19pandemic. For example, these efforts have

enabledtheCompanytocontinuetoaddcitiesinkeyexistingmarkets,suchasCalifornia,aswellasopportunisticallyintroduceserviceinother

marketsduringthepandemic.AspartoftheCompany'srecoveryfromtheimpactsoftheCOVID-19pandemic,theCompanyremainsfocused

onrestoringitsnetworktopre-pandemiclevelsthroughaddingbackdepthandfrequencytotheCompany'snetworkwhilebalancingitsnetwork

schedulewithitscrewresources.

Despitethepandemic,theCompanyhasbeenabletocontinuetobolsteritspresenceinCaliforniathroughtheadditionofnewdestinationoptions

andflightsforCaliforniaCustomers.In2021,theCompanyaddedmanynewdestinationstoitsroutemap,includingnewCaliforniaserviceto

SantaBarbaraandFresno.Further,theCompanyexpandeditsCaliforniatoHawaiinetworkin2021byaddinginauguralservicebetweenLos

Angeles and Hawaii in June 2021. The Company also added inaugural service to Hawaii from Las Vegas and Phoenix in June 2021. The

Company also expanded its service at John Wayne Airport (Orange County) in2021, includingreinstated internationalservice beginning in

March2021.Inaddition,theCompanyiscurrentlyscheduledtoofferover700departuresfromCaliforniaonpeakflyingdaysinthesummerof

2022.BasedonthemostrecentdataavailablefromtheU.S.DepartmentofTransportation(the"DOT"),fortheyearendedSeptember30,2021,

SouthwestcarriedmoreCaliforniatravelersto,from,andwithinCaliforniathananyotherairline.

TheCompany'snetwork andschedule optimizationeffortshave also enabledittouseotherwise idleaircraft, whileoveralltravel demand has

been reduced. This, in turn, has enabled the Company to better optimize its service amongst its core markets and, in 2021, it enabled the

Companytoprovideserviceto14newdestinations.Theadditionalservicehascreatedadditionalregionalandinternationalconnectivitythathas

beenstructuredtogrowtheCompany'spresenceinstrategicmarketsthatserveascornerstonesforitsnetworkandprovideadditionaloptionsfor

Customerstoreachtheirfinaldestinations.TheCompanyexpectstocomplementandstrengthenitsexistingroutenetworkinornearcitieswhere

itsCustomerbaseislarge,alongwithaddingeasieraccesstopopularleisure-orienteddestinations.

TheCOVID-19pandemichadaparticularlynegativeimpactontheCompany'sinternationaloperationsandledtotheCompany'ssuspensionof

internationaloperationsatthebeginningofthepandemic.TheCompanyhassinceresumedserviceto13ofits14internationaldestinations.The

Company’soperationstotheCaymanIslandsaretemporarilysuspendedduetoimpactsfromtheCOVID-19pandemic,butwiththeeasingof

governmentrestrictionsandthecontinuedincreaseindemandforbeachandleisuredestinations,theCompanyintendstoresumeservicetothe

CaymanIslandsin2022.

Boeing 737 MAX

InMarch2019,theFederalAviationAdministration(the"FAA")issuedanemergencyorderforallU.S.airlinestogroundallBoeing737MAX

("MAX")aircraft. TheCompanyimmediately compliedwiththe orderandgrounded all34Boeing 737MAX8 ("-8")aircraft in itsfleet.In

November2020,theFAArescindedtheemergencyorderandissuedofficialrequirementstoenableU.S.airlinestoreturntheMAXtoservice.

TheCompanyreturnedtheMAXtoserviceinMarch2021,aftertheCompanymetallFAArequirementsandPilotsreceivedupdated,MAX-

5

TableofContents

relatedtraining.FollowingtheFAArescissionoftheemergencyorder,theCompanytookdeliveryof35-8aircraftthroughtheendof2021and

had69-8aircraftinitsfleetat2021year-end.

During 2021, the Company entered into supplemental agreements with The Boeing Company ("Boeing") to increase its 2022 firm orders of

Boeing737MAX7("-7")aircraft,accelerateoptionsinto2022,2023,2024,and2025,andaddnewoptionsin2026and2027,ineachcasewith

thegoalofimprovingpotentialgrowthopportunities,restoringtheCompany'snetworkclosertopre-pandemiclevels,loweringoperatingcosts,

reducingcarbonemissionsperavailableseatmile,andfurthermodernizingtheCompany'sfleetwithmorefuelefficientaircraft.Additionally,

during2021,theCompanyexercised422022optionsfor-7aircraftandexercised222023optionsfor-7aircraft.Fleetandcapacityplanswill

continuetoevolveastheCompanymanagesthroughthepandemicrecoveryperiod,andtheCompanywillcontinuetoevaluateitsremaining

MAX options. However, with its cost-effective order book, the Company retains significant flexibility to manage its fleet size, including

opportunities to accelerate fleet modernization efforts if growth opportunities do not materialize. The Company continues to plan for 30-35

Boeing737-700 retirementsannually. Additionalinformation regardingtheCompany's currentfleet andfleetdelivery scheduleisincluded in

"Item2–Properties"below.Thedeliveryscheduleforthe-7isdependentontheFAAissuingrequiredcertificationsandapprovalstoBoeing

andtheCompany.TheFAAwillultimatelydeterminethetimingofthe-7certificationandentryintoservice,andtheCompanythereforeoffers

noassurancesthatcurrentestimationsandtimelinesarecorrect.

Cost Structure

AkeycomponentoftheCompany'sbusinessstrategyisitsfocusoncostdisciplineandchargingcompetitivelylowfares.TheCompany'slow-

cost strategy includes, among other elements, (i) the use of a single aircraft type, the Boeing 737, (ii) the Company's point-to-point route

structure,and(iii)itshighlyproductiveEmployees.Southwest'suseofasingleaircrafttypehashistoricallyallowedforsimplifiedscheduling,

maintenance,flightoperations,safetymanagement,andtrainingactivities.Southwest'spoint-to-pointroutestructureincludesservicetoandfrom

many secondary or downtown airports such as Dallas Love Field, Houston Hobby, Chicago Midway, Baltimore-Washington International,

Burbank, Manchester, Oakland, San Jose, Providence, and Ft. Lauderdale-Hollywood. These conveniently located airports are typically less

congestedthanotherairlines'hubairports,whichhascontributedtoSouthwest'sabilitytoachievehighassetutilizationbecauseaircraftcanbe

scheduledtominimizetheamountoftimetheyareontheground.This,inturn,hasreducedthenumberofaircraftandgatefacilitiesthatwould

otherwiseberequiredandallowsforhighEmployeeproductivity(lowerheadcountperaircraft).

TheCompany'sfocusoncontrollingcostsalsoincludesacontinuedcommitmenttopursuing,implementing,andenhancinginitiativestoreduce

fuelconsumption and improvefuelefficiency. TheCompanyfocuses onminimizingfuel consumption andimprovingfuel efficiencythrough

fleetmodernizationandotherfuelinitiatives.Forexample,in2021theCompanyreturnedits-8aircrafttoservice,whicharemorefuel-efficient

andreleasefewerCO emissionsperavailableseatmilethantheCompany'sotheraircraft.

2

6

TableofContents

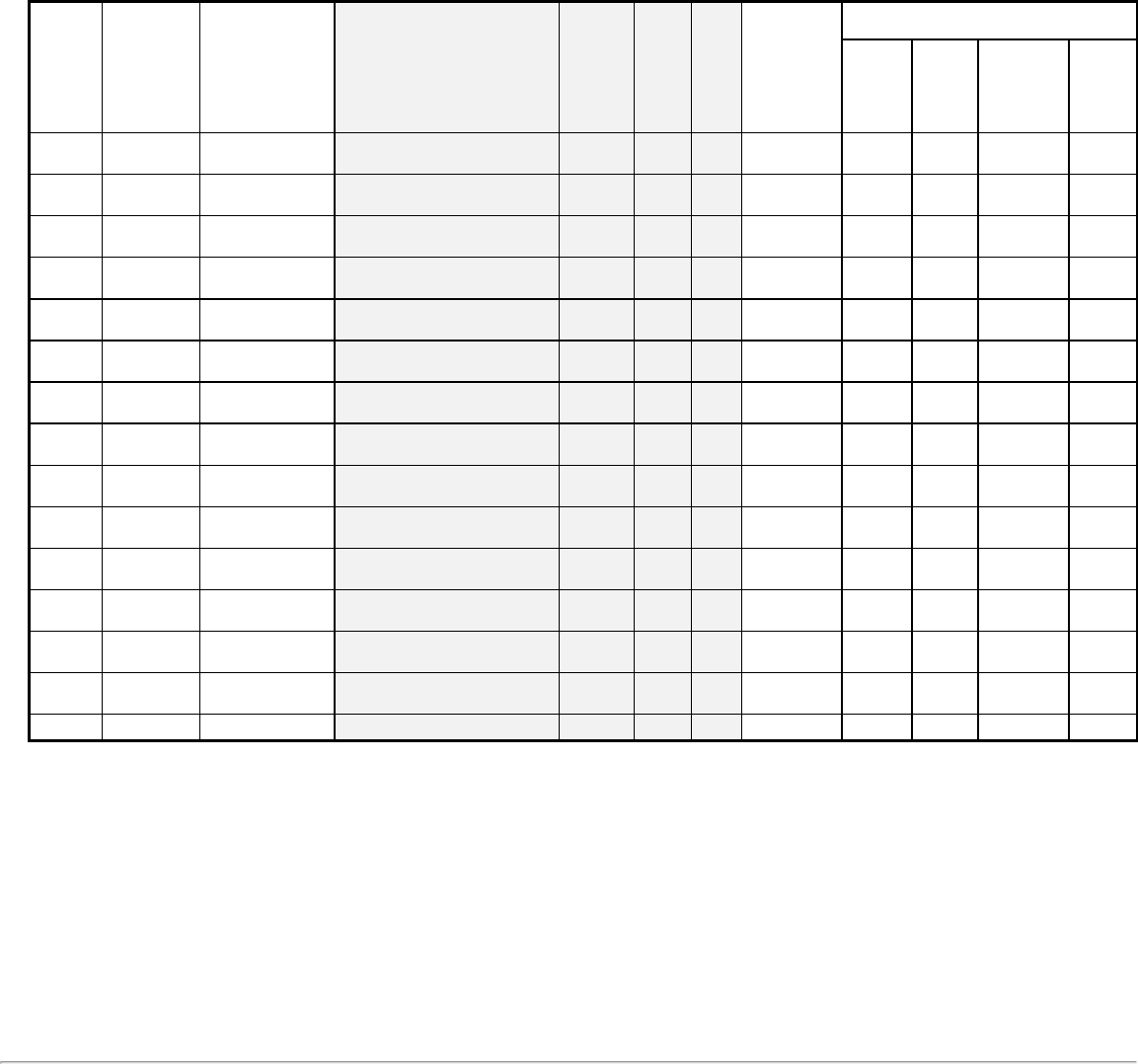

Fuel and oil expense can be extremely volatile and unpredictable, and even a small change in market fuel prices can significantly affect

profitability.Fuelandoilexpensefor2021increasedsignificantlycomparedwith2020,primarilyduetohighermarketjetfuelprices,andinpart

duetohighercapacityinresponsetoconsumerdemand.FuelandoilexpenseremainedtheCompany'ssecondlargestoperatingcostfor2021.As

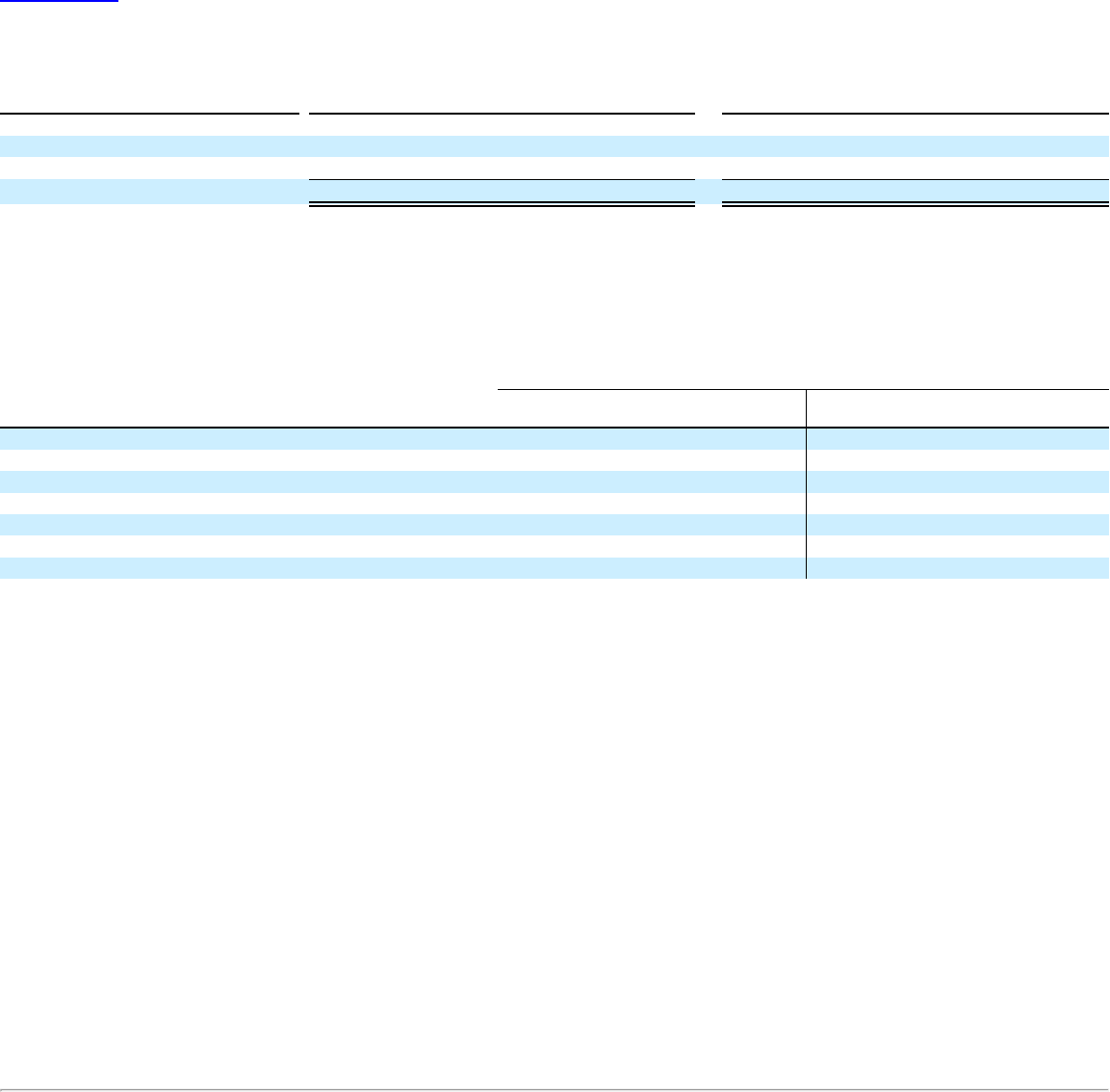

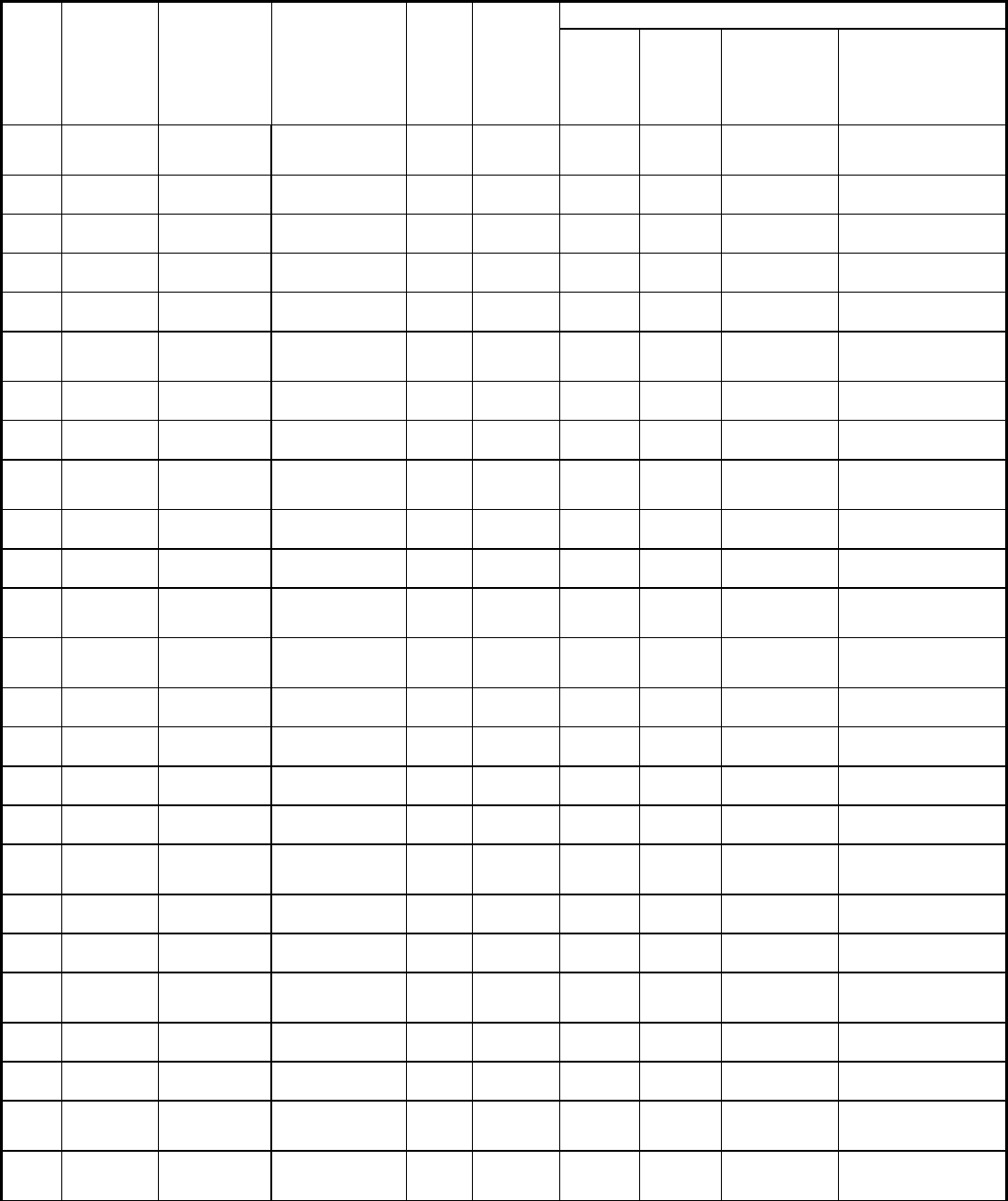

evidencedbythetablebelow,energypricescanfluctuatesignificantlyinarelativelyshortamountoftime.ThetablebelowshowstheCompany's

averagecostofjetfuelforeachyearbeginningin2011andduringeachquarterof2021.

Year

Cost

(Millions)

Average

Cost Per

Gallon

Percentage of

Operating

Expenses

2011 $ 5,751 $ 3.25 38.2 %

2012 $ 6,156 $ 3.32 37.3 %

2013 $ 5,823 $ 3.19 35.3 %

2014 $ 5,355 $ 2.97 32.6 %

2015 $ 3,740 $ 1.96 23.6 %

2016 $ 3,801 $ 1.90 22.7 %

2017 $ 4,076 $ 1.99 23.0 %

2018 $ 4,616 $ 2.20 24.6 %

2019 $ 4,347 $ 2.09 22.3 %

2020 $ 1,849 $ 1.45 14.4 %

2021 $ 3,310 $ 1.98 23.5 %

FirstQuarter2021 $ 469 $ 1.63 25.3 %

SecondQuarter2021 $ 803 $ 1.88 23.5 %

ThirdQuarter2021 $ 990 $ 2.01 25.1 %

FourthQuarter2021 $ 1,049 $ 2.25 21.6 %

TheMAXgroundingsinearly2019resultedintheremovalofthesemorefuel-efficientaircraftfromtheCompany'sschedule,which,inturn,

droveadeclineintheCompany'soverallfuelefficiencyin2019.AlthoughtheCompany'sMAXaircraftremainedgroundedthroughout2020,

theCompanyimproveditsfuelefficiencyin2020,ascomparedwith2019,primarilybyoperatingfewerofitsoldest,leastfuel-efficientBoeing

737-700aircraftasaresultofcapacitycutsinresponsetotheeffectsoftheCOVID-19pandemic.Lowerloadfactors,duetoCOVID-19,also

contributedtofuelefficiencyduring2020.DespitethereturntoserviceoftheMAXaircraft,theCompany's2021fuelefficiencydeclined,as

comparedwith2020,duetohigherloadfactorsandtheCompany'sreturntoserviceofmoreofitsoldest,leastfuelefficient Boeing 737-700

aircraft,whichhadbeenplacedintostoragein2020duetocapacitycutsinresponsetotheeffectsoftheCOVID-19pandemic.TheCompany

continuestoundertakeanumberofotherfuelconservationinitiatives,whicharediscussedindetailunder"EnvironmentalSustainability."

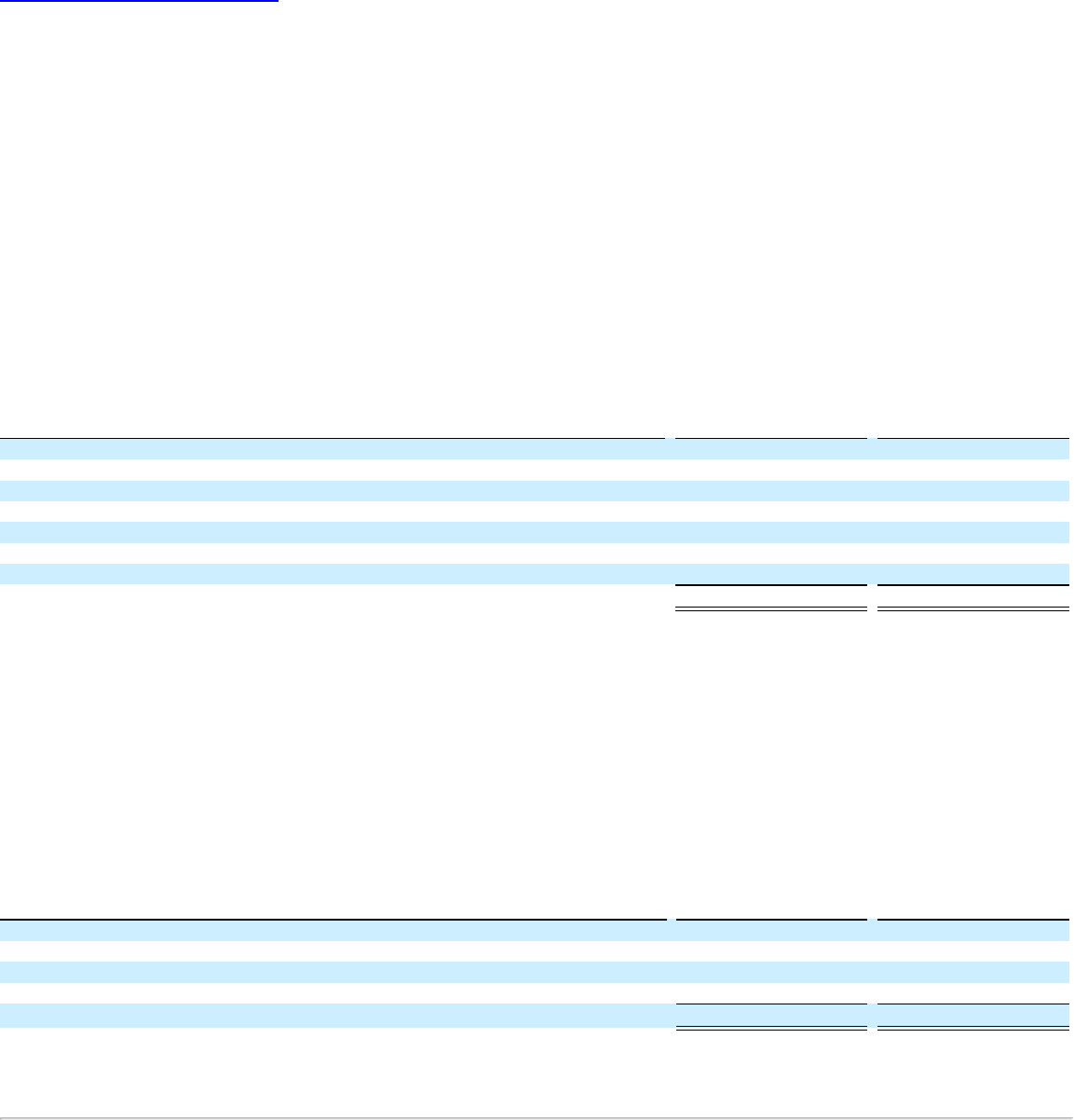

ThetablebelowsetsforththeCompany'savailableseatmilesproducedperfuelgallonconsumedoverthelastfiveyears:

Year ended December 31,

2021 2020 2019 2018 2017

Availableseatmilesperfuelgallonconsumed 79.2 81.3 75.7 76.3 75.2

TheCompanyalsoentersintofuelderivativecontractstomanageitsriskassociatedwithsignificantincreasesinfuelprices.TheCompany'sfuel

hedgingactivities,aswellastherisksassociatedwithhighand/orvolatilefuelprices,arediscussedinmoredetailbelowunder"RiskFactors,"

"Management’s Discussion and Analysis of Financial Condition and Results of Operations," and Note 11 to the Consolidated Financial

Statements.

Salaries, wages, and benefits expense constituted approximately 55.0percent of the Company's operatingexpenses during 2021 and was the

Company'slargestoperatingcost.TheCompany'sabilitytocontrollaborcostsislimitedbythetermsofitscollective-bargainingagreements,

and increased labor costs have negatively impacted the Company's low-cost competitive position. The Company's labor costs, and risks

associatedtherewith,arediscussed

7

TableofContents

inmoredetailbelowunder"RiskFactors,""Business-Employees,"and"Management’sDiscussionandAnalysis of FinancialConditionand

ResultsofOperations."

Fare Structure

General

Southwestoffersarelativelysimplefarestructure that featurescompetitive fares andproductbenefits, including unrestrictedfares, as wellas

lower fares available on a restricted basis. Southwest fare products include three major categories: "Wanna Get Away ," "Anytime," and

"BusinessSelect ,"toprovideCustomersoptionswhenchoosingafare.Allfareproductsincludetheprivilegeoftwofreecheckedbags(weight

andsizelimitsapply).Southwestdoesnotchargefeesforchangestoflightreservationsalthoughfaredifferencesmayapply.

• "Wanna Get Away" fares are generally the lowest fares and are typically subject to advance purchase requirements. They are

nonrefundable, but, subject to Southwest'sNo Show Policy, flight credit for the fare paid for unused travel by the Customer ("flight

credit")maybeappliedtowardsfuturetravelonSouthwest.WannaGetAwayfaresearnsixRapidRewards points,underSouthwest's

RapidRewardsloyaltyprogram,foreachdollarspentonthebasefare.TheCompany'sloyaltyprogramisdiscussedbelowunder"Rapid

RewardsLoyaltyProgram."

• "Anytime"faresare,subjecttoSouthwest'sNoShowPolicy,refundableifcanceled,orflightcreditmaybeappliedtowardsfuturetravel

onSouthwest.Ifthisfareispurchasedwithnonrefundableflightcredit,thentheresultingflightcreditwillbenonrefundableiftravelis

canceled.Anytimefaresearn10RapidRewardspointsforeachdollarspentonthebasefare.

• "BusinessSelect"faresare,subjecttoSouthwest'sNoShowPolicy,refundableifcanceled,orflightcreditmaybeappliedtowardsfuture

travelonSouthwest. Ifthis fareispurchased with nonrefundableflightcredit,then theresultingflightcredit willbe nonrefundableif

traveliscanceled.BusinessSelectfaresalsoincludeadditionalperkssuchaspriorityboardingwithaboardingpositioninthefirst15

boarding positions withinboarding group "A," 12 Rapid Rewardspoints per dollar spent on thebase fare - the highest loyalty point

multiplierofallSouthwestfareproducts,and"FlyBy "prioritysecurityand/orticketcounteraccessinparticipatingairports.Business

Select fares also ordinarily include one complimentary premium beverage coupon for the day of travel (Customers must be of legal

drinkingagetodrinkalcoholicbeverages);however,theCompanyhastemporarilysuspendedpremiumdrinkserviceinresponsetothe

COVID-19pandemic.

Southwest'sNoShowPolicyappliesifaCustomerdoesnotchangeorcancelaflightsegmentatleasttenminutespriortoscheduleddeparture

andtheCustomerdoesnottravelonthescheduledflight.Insuchevent,subjecttocertainexceptions,allsegmentsassociatedwiththereservation

willbecanceled,and(i)withrespecttoa"WannaGetAway"fare,thefarepaidforunusedtravelwillbeforfeited;and(ii)withrespecttoan

"Anytime"or"BusinessSelect"fare,thefarepaidforunusedtravelwillbeheldasaflightcreditforfuturetravelonSouthwest.

TheCompanyhasannouncedplanstoaddanew,fourthfareproductthatenhancestheoverallproductofferingforCustomers.TheCompany

alsocurrentlyplanstoincreasebenefitstiedtoexistingfareproductcategoriesatvarioustimesinthefuture.Theanticipatedlaunchdateforthe

newfareproductisduringsecondquarter2022.

InresponsetotheCOVID-19pandemic,inordertoenhanceandexpanduponitsalreadygenerousandflexibleticketingpolicies,theCompany

extendedtheexpirationofthefollowingCustomerflightcreditstoSeptember7,2022:

• FlightcreditscreatedbecauseofaflightcancellationbetweenMarch1,2020andSeptember7,2020;and

• FlightcreditsthatwouldhaveexpiredbetweenMarch1,2020andSeptember7,2020.

®

®

®

®

8

TableofContents

Ancillary Services

The Company offers ancillary services such as Southwest's EarlyBird Check-In , Upgraded Boarding, and transportation of pets and

unaccompaniedminors,inaccordancewithSouthwest'srespectivepolicies.

EarlyBirdCheck-InprovidesCustomerswithautomaticcheck-inandanassignedboardingpositionbeforegeneralboardingpositionsbecome

available, thereby improving Customers' seat selection options (priority boarding privileges are already a benefit of being an "A-List" tier

memberundertheCompany'sRapidRewardsLoyaltyProgram).TheCompanyhasimplementedavariablepricingmodelforEarlyBirdCheck-

InbasedonthelengthoftheflightandthehistoricalpopularityofEarlyBirdCheck-Inontheroute.

Whenavailable,SouthwestsellsUpgradedBoardingattheairport,whichallowsaCustomertopayforanopenpriorityboardingpositioninthe

first15positionsinits"A"boardinggroup.

Southwest’sPetPolicyprovidesCustomersanopportunitytotravelwithasmallcatordogintheaircraftcabinondomesticflights.Southwest

alsohasanunaccompaniedminortravelpolicy,withpricingtoaddresstheadministrativecostsandtheextracarenecessarytosafelytransport

theseCustomers.

Inflight Entertainment Portal and WiFi Service

Southwest offers inflight entertainment and connectivity service on WiFi-enabled aircraft on the majority of its fleet, where available.

Southwest'ssuiteofcomplimentaryofferingsonboardWiFi-enabledaircraftincludesmovies-on-demand,messaging,music,liveandon-demand

television, a flight tracker, and connecting flight information. The inflight entertainment service allows Customers to enjoy gate-to-gate

entertainmentdirectlyontheirpersonalwirelessdevices.CustomerscanalsopurchasesatelliteinternetservicewhileonWiFi-enabledaircraft,

whereavailable.

Thefreeinflightentertainmentofferingsincludeapproximately45freemovies-on-demandeachmonthandfreeappmessagingviaiMessageor

WhatsApp.Thetelevisionproductconsistsofover15livechannelsandupto75on-demandrecordedepisodesfrompopulartelevisionseries.In

addition, the onboard entertainment portal offers free digital music and live streaming radio service to Customers within the onboard

entertainmentportal.

Rapid Rewards Loyalty Program

Southwest's RapidRewards loyalty program enables program members ("Members") to earn pointsfor every dollarspent on Southwestbase

fares, also including purchases paid with LUV Vouchers, gift cards, or flight credit, with no portion of the purchase price paid with Rapid

Rewardspoints.Theamountofpointsearnedundertheprogramisbasedonthebasefareandfareclasspurchased,withhigherfareproducts

(e.g., Business Select) earning more points than lower fare products (e.g., Wanna Get Away). As discussed above under "Fare Structure -

General,"eachfareclassisassociatedwithapointsearningmultiplier,andpointsforflightsarecalculatedbymultiplyingthebasefareforthe

flightbythefareclassmultiplier.Theamountofpointsrequiredtoberedeemedforaflightisbasedonthebasefareandamultiplier.Underthe

program,(i)Membersareabletoredeemtheirpointsforeveryavailableseat,everyday,oneveryflight,withnoblackoutdates;and(ii)points

donotexpire.

Under the program, Members continue to accumulate points until the time they decide to redeem them. As a result, the program provides

Memberssignificant flexibilityandoptions forearningand redeemingrewards.For example,Memberscan earnmorepoints (and/orachieve

tieredstatussuchasA-ListandCompanionPassfaster)bypurchasinghigherfaretickets.Membersalsohavesignificantflexibilityinredeeming

points,suchastheopportunitytobookinadvancetotakeadvantageofalowerfareticket(includingmanyfaresales)andredeemfewerpointsor

by being able to redeem more points and book at the last minute if seats are still available for sale. Members can also earn points through

qualifyingpurchaseswithRapidRewardsPartners(whichinclude,forexample,carrentalagencies,hotels,andrestaurants),aswellasbyusing

Southwest'sco-brandedChase Visacreditcard.InadditiontoearningpointsforrevenueflightsandqualifyingpurchaseswithRapidRewards

Partners,

®

®

9

TableofContents

Membersalsohavetheabilitytopurchase,gift,andtransferpoints,aswellastheabilitytodonatepointstoselectedcharities.

Southwest'sRapidRewardsloyaltyprogramfeaturestierstatusandCompanionPassprogramsforthemostactiveMembers,including"A-List"

and "A-List Preferred" status. A Member who flies 25 qualifying one-way flight segments booked through Southwest or earns 35,000 tier

qualifyingpointspercalendaryearwillqualifyforA-Liststatus.AMemberwhoflies50qualifyingone-wayflightsbookedthroughSouthwest

orearns70,000tierqualifyingpointspercalendaryearwillqualifyforA-ListPreferredstatus.Exceptasnotedbelowwithrespecttoactions

takenbytheCompanyinresponsetotheCOVID-19pandemic,theMemberwillmaintainA-ListorA-ListPreferredstatusfortheremainderof

thecalendaryearinwhichthestatusisearnedandfortheentirecalendaryearimmediatelyfollowing.BothA-ListandA-ListPreferredMembers

enjoybenefitssuchas"FlyBy "prioritycheck-inandsecuritylaneaccess,whereavailable,aswellasdedicatedphonelines,standbypriority,

and anearnings bonus oneligible revenue flights (25 percentfor A-List and100 percent forA-List Preferred). Inaddition, A-List Preferred

MembersenjoyfreeinflightsatelliteinternetserviceonWiFi-enabledaircraft,whereavailable.MemberswhoattainA-ListorA-ListPreferred

status receivepriority boarding privileges.When these Customers purchase travelat least 36hours prior toflight time, theyreceive the best

boardingpositionavailable(generally,an"A"boardingpass).Duringthedayoftravel,ifanA-ListorA-ListPreferredMember'splanschange,

theyhavefreesame-daystandbyprivileges,whichallowthemtoflyonearlierflightsbetweenthesamecitypairsifspaceisavailable,butare

requiredtopayanyadditionalgovernmenttaxesandfeesassociatedwithchangesintheiritinerary.AnotherfeatureoftheRapidRewardsloyalty

program is the Companion Pass. Members who fly 100 qualifying one-way flights or earn 125,000 qualifying points in a calendar year

automaticallyreceiveaCompanionPass,whichprovidesforunlimitedtravelforthedesignatedCompanionfreeofcharges(otherthantaxesand

fees).ExceptasnotedbelowwithrespecttoactionstakenbytheCompanyinresponsetotheCOVID-19pandemic,theCompanionPassisvalid

fortheremainderofthecalendaryearinwhichstatusisearnedandforthefollowingfullcalendaryeartoanydestinationavailableonSouthwest

foradesignatedCompanionofthequalifyingMember.TheMemberanddesignatedCompanionmusttraveltogetheronthesameflight.

During 2021, the Company added Rapid Rewards Business, giving businesses the ability to earn Rapid Rewards points. By joining Rapid

RewardsBusiness, companies earnRapidRewards pointsthat canbe appliedtoward travelon thecompany's behalf,while travelerswho are

RapidRewardsMembersalsoearnRapidRewardspointsintheirpersonalaccounts.RapidRewardsbusinessaccountsgenerallyhavethesame

opportunitiesandbenefitstoearnandredeempointsasindividualMemberaccounts.

Southwest'sRapidRewardsloyaltyprogramhasbeendesignedtodrivemorerevenueby(i)bringinginnewCustomers,includingnewMembers,

aswellasnewholdersofSouthwest'sco-brandedChaseVisacreditcard;(ii)increasingbusinessfromexistingCustomers;and(iii)strengthening

theCompany'sRapidRewardshotel,rentalcar,creditcard,andotherpartnerships.

For 2021,Customers of Southwest redeemed approximately 8.1 million flight awards, accounting for approximately 17.3 percent of revenue

passengermilesflown.For2020,CustomersofSouthwestredeemedapproximately4.1millionflightawards,accountingforapproximately15.8

percentofrevenuepassengermilesflown.For2019,CustomersofSouthwestredeemedapproximately10.7millionflightawards,accountingfor

approximately 14.1 percent of revenue passenger miles flown. The Company's accounting policies with respect to its loyalty programs are

discussedinmoredetailinNote1totheConsolidatedFinancialStatements.

TheCompanyhastakensignificantmeasuresinresponsetotheCOVID-19pandemictoenhanceitsRapidRewardsloyaltyprogramincluding

thefollowing:

• ForA-ListandA-ListPreferredMemberswhoearnedtierstatusin2020,earnedstatuswasextendedthroughDecember31,2021;and

• ForCompanionPassMemberswhoearnedCompanionPassbenefitstobeusedthroughDecember2020,CompanionPassbenefitswere

extendedthroughJune30,2021.

®

10

TableofContents

Additionally,inJanuary2021,inresponsetotheCOVID-19pandemic,theCompanymadeadditionalchangesthataffectedtierstatusaswellas

CompanionPasseligibility,allwiththeintentionofenhancingtheCompany'sRapidRewardsloyaltyprogramanditsMembers’experiences:

• AllRapidRewardsMemberswithvalidRapidRewardsaccountsasofDecember31,2020,receiveda“boost”of15,000tierqualifying

pointsand10flightcreditstowardA-ListandA-ListPreferredstatus,and25,000CompanionPassqualifyingpointsand25flightcredits

towardCompanionPassstatus;

• Through December 31, 2021, for Members with Southwest's co-branded Chase Visa Premier or Priority Consumer credit cards, or

Premier or Performance Business credit cards, for every $10,000 in spend on their credit cards, they were eligible for 1,500 Tier

QualifyingPoints(withnocap);and

• For Companion Pass Members who earned Companion Pass benefits to be used through December 2020, which were previously

extendedthroughJune30,2021,thoseCompanionPassbenefitswerefurtherextendedthroughDecember31,2021.

Southwest.com and Direct to Customer Distribution Approach

TheCompanyprimarilyoffersitsfareproductsdirectlytoCustomersthroughitsInternetwebsite,Southwest.com.FortheyearsendedDecember

31,2021,andDecember31,2020,approximately86percentand83percent,respectively,oftheCompany’sPassengerrevenuesoriginatedfrom

Southwest.com(including revenues fromSWABIZ , theCompany's online booking tool designed for business Customers who prefer a self-

serviceandlow-costsolutionforbookingtheirairtravelonSouthwest).This"directtoCustomer"distributionapproachhashistoricallyprovided

acostadvantagefortheCompanybecauseiteliminatesfeesassociatedwiththeuseofthirdpartydistributionchannelssuchasthirdpartyonline

travelplatforms.TheCompanyaugmentsitsdirecttoCustomerdistributionapproachbyofferingabroadsuiteofdigitalplatformstosupport

Customers'travelneeds,includingfullfeaturedwebsitesandapps.ThesedigitalplatformshelpCustomersbookandmanagetheirSouthwestair

travelandalsofacilitatethepurchaseoftheCompany’sancillaryproducts,includingEarlyBird,vacationpackages,rentalcarreservations,hotel

reservations,andtravelactivities.Inaddition,thedigitalplatformsprovideself-servicetoolsforreservationmanagementandCustomersupport.

During2021,theCompanycontinuedtoinvestintechnologydesignedtoenhancerevenuesandlowercosts,whilealsoenhancingdigitaloptions

foritsCustomers.Toenhancerevenues,theCompanyimprovedthedigitalairbookingexperiencethroughfurtherimprovementstotheshopping

page,theadditionoffareupgradeoffers,andincreasedprominenceofexpandedpaymentoptions.Tohelplowercosts,in2021theCompany

increased its focus on improving the day of travel experience. For example, trip related messaging was added to improve awareness of the

Company'sbaggageandboardingprocess,andanewcustomercenterwasaddedtoprovide key content abouttheSouthwestexperience. The

resultingincreasedawareness ofself-serviceoptionsincreased Customerself-serviceusageand therebycontributedto reduced costs.Further,

improvementsweremadetothedigitalticketchangeprocess,leadingtoahigherpercentageofticketchangesoccurringindigitalexperiences.

Earlyin2021,theCompanyaddedanupdatedCOVIDtravelcenter,providinglocationspecificdetailsaboutwhattoexpectwhiletraveling.This

material was prominently focused across all shopping and trip related materials. Due to changing U.S. regulations regarding U.S. entry, the

Company also deployed self-service workflows for Customers to complete their travelattestations andcontact tracing information to reduce

transactionsattheairport.Automatingtheseexperiencesreducedwhatwouldhavebeenmuchlongerlineswhiledepartingcountriesoutsideof

theUnitedStates.Theseexperiencesweresupplementedwithadditionaldayoftravelalertstoincreasereadinessfortravel.

Southwest Business Initiatives

InadditiontoimprovementsintheCompany'sdirectSouthwest.comchannelofdistribution,inrecentyearstheCompanyhastakensignificant

actiontogrowitscorporatetravelbusinesswiththegoalofmakingiteasierforcorporatetravelCustomersandtravelmanagementcompaniesto

dobusinesswithSouthwest.

®

®

®

11

TableofContents

In2019,theCompanyenteredintoanagreementwithAmadeusITGroup,S.A.("Amadeus"),andexpandeditsagreementwithTravelport,LP

and Travelport International Operations Limited (collectively, "Travelport"), to enable corporate travel Customers and travel management

companies to book Southwest products on the Amadeus and Travelport global distribution system ("GDS") platforms. The Company began

accepting corporate travel bookings through (i) Travelport's Apollo and Worldspan GDS platforms in second quarter 2020, (ii) Travelport's

Galileo GDSplatform in third quarter2020, and (iii)the Amadeus GDS platformin fourth quarter 2020.The Company's expansion intothe

Travelport and Amadeus GDS channels is intended to facilitate corporate travel managers' ability to book, modify, and cancel Southwest

reservations.

In2020,theCompanyenteredintoanewfullparticipationdistributionagreementwithSabreCorporation("Sabre"),toenableSabretocontinue

todistributeSouthwestcontentthroughtraditionalconnectivitytocorporations,governmentagencies,andtravelmanagementcompaniesthrough

Sabre'sGDS.InJuly2021,theCompanybeganofferingflightsforsalewithinSabre'sGDS,theleadingcorporatebookingchannelintheUnited

States.Asaresult,theCompanynowofferstheabilityforbusinesstravelersandtraveldecisionmakerstobookSouthwestfareswithinallmajor

GDSplatforms.

TheCompanyalsoutilizesAirlinesReportingCorporationtoimplementindustry-standardprocessestohandlethesettlementofticketsbooked

throughTravelport,Amadeus,andSabrechannels.

SouthwestBusinesshascontinuedtoinvestinandenhanceitsonlinebookingtoolSWABIZ ,withnewmobilecapabilitiesnowavailable,as

wellasitsdirectconnectchannel,withconnectionstoonlinebookingtools,travelmanagementcompanies,andcorporatecustomers.SWABIZis

designedforbusinessCustomerswhopreferaself-serviceandlow-costsolutionforbookingtheirairtravelonSouthwest.Thesitealsofacilitates

carandhotelbooking.

Marketing

During2020,inresponsetotheCOVID-19pandemic,theCompanyimplementedandmarketedthe"SouthwestPromise"toreassureCustomers

andEmployeesof theCompany's commitmenttotheir well-being,byfocusing on cleanlinessfromcheck-in to deplaningtheaircraft through

additionalstringentcleaningpracticesacrossthefleetandthroughouttheday,aswellasmeasurestosupportphysicaldistancingandpersonal

protectionandwellnessthroughouttheCustomerexperience.

Duringearly2021,theCompanycontinuedtomarkettheSouthwestPromise.Inaddition,during2021,theCompanymarketeditscompetitive

pointsofdifferentiation,specificallyfocusingonflexibilityandeaseforCustomers.SouthwestcontinuestobetheonlymajorU.S.airlinethat

offerstoallticketedCustomersuptotwocheckedbagsthatflyfree(subjecttoweightandsizelimits).Further,Southwestcontinuestoofferlow

faresandnounexpectedbagfees,changefees(althoughfaredifferencesmayapply),orhiddenfees.Southwestalsodoesnotimposeadditional

feesforitemssuchasseatselection,softdrinksandsnackswhereavailable,curb-sidecheck-inwhereavailable,andtelephonereservations.

The Company also continues to promote all of the many other reasons to fly Southwest in its marketing, such as its hospitality, low fares,

expandednetwork and newdestinations, CustomerService, freeinflight entertainment, Southwest Business offerings,and itsRapid Rewards

loyaltyprogram.

Technology Initiatives

Although during 2020 the Company narrowed its near-team technology focus and deferred a significant number of technology projects in

responsetotheCOVID-19pandemic,overthepastseveralyearstheCompanyhascommittedsignificantresourcestotechnologyimprovements

insupportofitsongoingoperationsandinitiatives.During2021,theCompanyachievedthelong-awaitedmilestoneofgettingallofitsaircraft

intoasinglesystemforaircraftmaintenanceandrecord-keeping.ThiswastheCompany'slargesttechnologyinitiativefor2021,andwas

®

12

TableofContents

oneof the most critical system updates theCompany hasundertaken inthe historyof itsmaintenance program.In addition,during 2021the

CompanycontinueditsimplementationofcorporateGDScapabilitiesinconnectionwithSouthwestBusinessinitiativesbyinitiatingflightsfor

salewithinSabre'sGDS.

TheCompanycontinuestofocusontheprioritizationandexecutionofitstechnologyinvestmentsandisintheprocessofcontinuallyexecuting

anevolvingmulti-yearplanfortechnology,withthegoalofdevelopingastronger,moreadaptable,andmoreefficientandreliabletechnology

foundation to support the Company’s strategic priorities. The Company continues to invest significantly in technology resources including,

amongothers,theCompany'ssystemsrelatedto(i)humanresourcesmanagement;(ii)flightplanningandscheduling,includingwithrespectto

schedulechangesandCustomerreaccommodations;(iii)crewscheduling;(iv)revenuemanagement;and(v)technologyinfrastructure.

Environmental Sustainability

TheCompanyremainssteadfastinitsdesiretopursue,implement,andenhanceinitiativestoaddresstheCompany'simpactontheenvironment.

Overtheyears,theCompanyhasundertakenanumberoffuelconservationandemissions-relatedinitiatives,suchasthefollowing:

• introductionoftheMAXaircraftintotheCompany'sfleet,whichismorefuel-efficientandreleasesfewerCO₂emissionsperavailable

seatmilethantheCompany'sotheraircraft;

• installationofwinglets,whichreducedragandincreasefuelefficiency,onallaircraftintheCompany'sfleet;

• applicationofperiodicenginewashes;

• useofelectricgroundpowerandpre-conditionedairforaircraftatthegate,whenavailable;

• replacementofeligibleinternalcombustiongroundsupportequipmentwithelectricequipmentatselectlocations;

• deploymentofauto-throttleandverticalnavigationtomaintainoptimumcruisingspeeds;

• implementationofenginestartprocedurestosupporttheCompany'ssingleenginetaxiprocedures;

• adjustmentofthetimingofauxiliarypowerunitstartsonoriginatingflightstoreduceauxiliarypowerunitusage;

• implementationoffuelplanninginitiativestosafelyreduceloadingofexcessfuel;

• retrofittingofaircraftcabininteriorstoreduceweight;

• reductionofaircraftengineidlespeedwhileontheground,whichalsoincreasesenginelife;

• utilizationofCompany-optimizedroutes(flyingthebestwindroutestotakeadvantageoftailwindsortominimizeheadwinds);

• improvementsinflightplanningalgorithmstobettermatchtheCompany'saircraftflightmanagementsystemandtherebyenablingthe

Companytoflyatthemostefficientaltitudes;

• substitutionofPilotandFlightAttendantflightbagswithlighterElectronicFlightBagtablets;and

• implementationof RealTime DescentWinds (automaticuplinking of up-to-datewind datato theaircraft, allowingcrews totime the

descenttominimizethrustinputs).

TheCompanyhasalsoparticipatedinRequiredNavigationPerformance("RNP")operationsaspartoftheFAA'sPerformanceBasedNavigation

program, a key component of the Next Generation Transportation System (“NextGen”), which is intended to modernize the U.S. air traffic

system by addressing limitations on air transportation capacity and making more efficient use of airspace. RNP combines the capabilities of

advanced aircraft avionics, satellite navigation (instead of less precise ground-based navigation), and new flight procedures to enhance

navigationalandoperationalcapabilities,improvefuelefficiency,andminimizegreenhousegasemissions.RNPapproaches,whicharepublished

bytheFAA,arecurrentlyavailableat66oftheairportsSouthwestserves.

13

TableofContents

SouthwestcontinuestoworkwiththeFAAtodevelopandseekmoreuseofRNPapproachesandtoevolveairtrafficcontrolrulestosupport

greaterutilizationofRNP.

In2021,theCompanyannouncedgoalsto(i)achievecarbonneutralityby2050,(ii)maintaincarbonneutralgrowth(to2019levels)throughthe

endofthedecade,and(iii)reducecarbonemissionsintensityperavailableseatmile(includingscope1andscope2emissions)byatleast20

percent by 2030. The Company also announced a series of actions and initiatives designed to assist the Company in achieving these goals,

including agreements with various third parties intended to facilitate the development, production, and usage of commercialized sustainable

aviationfuel;thelaunchofacarbon-offsetprogramthatallowsCustomerstocontributefundsforthepurchaseofcarbonoffsetsforSouthwest;

andarrangementswithnonprofitorganizationsseekingtoaddressclimatechangeandreducecarbonemissionsinaviation.

As part of its commitment to corporate sustainability, the Company has published the Southwest One Report describing the Company's

environmentalsustainabilitygoals,actions,initiatives,andstrategies,whichincludetheforegoingandothereffortstominimizegreenhousegas

emissions and address other environmental matters such as energy and water conservation, waste minimization, and recycling. Information

contained in the Southwest One Report is not incorporated by reference into, and does not constitute a part of, this Form 10-K. While the

CompanybelievesthatthedisclosurescontainedintheSouthwestOneReportandothervoluntarydisclosuresregardingenvironmental,social,

andgovernance(“ESG”)mattersareresponsivetovariousareasofinvestorinterest,theCompanybelievesthatthesedisclosuresdonotcurrently

addressmattersthatarematerialtotheCompany’soperations,strategy,financialcondition,orfinancialresults,althoughthisviewmaychangein

thefuturebasedonnewinformationthatcouldmateriallyaltertheestimates,assumptions,ortimelinesusedtocreatethesedisclosures.Giventhe

estimates, assumptions and timelines used to create the Southwest One Report and other voluntary disclosures, the materiality of these

disclosuresisinherentlydifficulttoassessinadvance.

Regulation

Theairlineindustryisheavilyregulated,especiallybythefederalgovernment,andthereareasignificantnumberofgovernmentalagenciesand

legislativebodiesthat have theabilitytodirectly or indirectlyaffecttheCompanyand/or theairlineindustryfinanciallyand/or operationally.

ExamplesofregulationsaffectingtheCompanyand/ortheairlineindustry,imposedbyseveralofthesegovernmentalagenciesandlegislative

bodies,arediscussedbelow.

Economic and Operational Regulation

Consumer Protection Regulation by the U.S. Department of Transportation

The DOT regulates economic operating authority for air carriers and consumer protection for airline passengers. The DOT may take legal

enforcementactionagainstaircarriersforviolatingtheirregulationsbyimposingcivilpenaltiesupto$35,188peroccurrence.

To provide passenger transportation in the United States, a domestic airline is required to hold both a Certificate of Public Convenience &

NecessityfromtheDOTandanAirCarrierOperatingCertificatefromtheFAA.ACertificateofPublicConvenience&Necessityisunlimitedin

duration, and the Company’s certificate generally permits it to operate among any points within the United States and its territories and

possessions.AdditionalDOTauthority,intheformofacertificateorexemptionfromcertificaterequirements,isrequiredforaU.S.airlineto

serve foreign destinations either with its own aircraft or via code-sharing with another airline. Exemptions granted by the DOT to serve

internationalmarketsaregenerallylimitedindurationandaresubjecttoperiodicrenewalrequirements.TheDOTmayrevokeacertificateor

exemption,inwholeorinpart,forfailuretocomplywithfederalaviationstatutes,regulations,orders,orthetermsofthecertificateorexemption

itself.

The DOT's consumer protection and enforcement authority is derived primarily from a federal statutory prohibition on "unfair or deceptive

practicesorunfairmethodsofcompetition"byaircarriers.AnewDOTruletookeffectinJanuary2021,codifyingthedefinitionsfortheterms

‘‘unfair’’and‘‘deceptive’’intheDOT’sregulationsby

14

TableofContents

adoptingthedefinitionsusedbytheFederalTradeCommission,andamendingandclarifyingtheprocedurestheDOTwillfollowwhenengaging

inaviationconsumerprotectionrulemakingandenforcement.Thepurposeofthisnewruleistohelpestablishclearandconsistentcriteriafor

unfairordeceptivepracticeswhilealigningDOT’soversightofaviationentitieswithothergovernmentagencies’oversightofothersectorsofthe

economywithregardtounfairordeceptivepractices.

Undertheabove-describedauthority,theDOThasalsoadoptedso-called"PassengerProtectionRules,"whichaddressawidevarietyofmatters,

includingflightdelaysonthetarmac,chronicallydelayedflights,deniedboardingcompensation,baggageliabilityrequirements,ticketrefunds,

andadvertisingofairfares,amongothers.Forexample,undertheDOT'starmacdelayruleandsubjecttolimitedexceptions,aircarriersmustnot

allowanaircrafttoremainonthetarmacformorethan3hours(fordomesticdelays)ormorethan4hours(forinternationaldelays),without

allowingpassengerstodeplane.

Inaddition,thePassengerProtectionRulesrequireairlinesto(i)displayontimeperformanceontheirwebsites;(ii)adoptcustomerserviceplans,

publishthoseplansontheirwebsite,andaudittheirowncompliancewiththeirplans;(iii)designateanemployeetomonitortheperformanceof

their flights; (iv) provide information to passengers on how to file complaints; (v) respond in a timely and substantive fashion to consumer

complaints;(vi)paycompensationtoeachpassengerdeniedboardinginvoluntarilyfromanoversoldflight;(vii)refundanycheckedbagfeefor

permanentlylostluggage;(viii)prominentlydiscloseallpotentialfeesforoptionalancillaryservicesontheirwebsites;and(ix)refundpassenger

feespaidforancillaryservicesifaflightcancelsoroversellsandapassengerisunabletotakeadvantageofsuchservices.

ThePassengerProtectionRulesalsorequirethat(i)advertisedfaresincludeallgovernment-mandatedtaxesandfees;(ii)passengersbeallowed

toeither holda reservationfor upto 24 hours without making a paymentor cancela paidreservation withoutpenalty for24 hoursafter the

reservationismade,aslongasthereservationismadeatleastsevendaysinadvanceoftravel;(iii)faresmaynotincreaseafterpurchase;(iv)

baggage fees must bedisclosed to thepassenger atthe time ofbooking; (v) the same baggageallowances and feesmust applythroughout a

passenger’strip;(vi)baggagefeesmustbedisclosedone-ticketconfirmations;and(vii)passengersmustbepromptlynotifiedintheeventof

delaysofmorethan30minutesorifthereisacancellationordiversionoftheirflight.

TheDOTtookactionsthroughout2021tobolsteritsPassengerProtectionRulesincertainrespects.Forexample,inJanuary,theDOTissueda

final rule increasing involuntary denied boarding and mishandled baggage compensation, and prohibiting airlines from denying boarding to

passengersthat havealready boarded.In September,reacting tocomplaints filedin theearlier monthsof theCOVID-19 pandemic related to

carriers’refund practices,theDOT announceditplans tosolicitcomments onaproposed rulethatwould enhancepassengers’ rights whena

flightisoperatingbutthepassengerdecidesnottoflybecauseofgovernmentrestrictions(possiblyrequiringrefundsofnon-refundableticketsin

thosesituations).TheCompanydoesnotbelievethatpendingregulatorydevelopmentswithrespecttothe DOT’s PassengerProtectionRules

willhaveamaterialeffectontheCompany'scapitalexpenditures,earnings,orcompetitiveposition.

In addition to its statutory authority to prohibit unfair or deceptive practices or unfair methods of competition, the DOT is charged with

prohibitingdiscriminationbyairlinesagainstconsumersonthebasisof(i)disability;and(ii)race,religion,nationalorigin,sex,orancestry.

Underthisauthority,the DOThas proposed arulethatwouldprovideforchangestotheaccessibilityoflavatoriesonsingle-aisleaircraftfor

passengerswithdisabilities.Theseproposedchangesincludemodificationstotheinteriorofthelavatory,additionalservicesthatairlineswould

providewithrespecttolavatoryaccess,trainingrequirements,andimprovementstotheaircraft'sonboardwheelchair.TheDOThasindicatedit

intendstoalsoproposeandseekcommentsonaseparaterulein2022thatwouldeventuallyrequireairlinestoofferalargerlavatoryonsingle-

aisleaircraft.RequirementstoexpandthesizeoflavatoriescouldimposesubstantialcostsontheCompanyandhaveamaterialeffectonthe

Company'scapitalexpenditures,earnings,andcompetitiveposition.WhethertheDOTwill

15

TableofContents

ultimatelyadoptanewrulerequiringlargerlavatories,andthetimingandapplicationofanynewrule,areunknownatthistime.

Aviation Taxes and Fees

The statutory authority for the federal government to collect most types of aviation taxes, which are used, in part, to finance programs

administered by the FAA, must be periodically reauthorized by the U.S. Congress. The FAA Reauthorization Act of 2018 (the "2018

ReauthorizationAct")extendsmostcommercialaviationtaxesthroughSeptember30,2023.

InadditiontoFAA-relatedtaxes,thereareadditionalfederaltaxesrelatedtotheU.S.DepartmentofHomelandSecurity.Thesetaxesdonotneed

to be reauthorized periodically. Congress has set the Transportation Security Fee paid by passengers at $5.60 per one-way passenger trip

originatingintheU.S.Inaddition,internationalpassengersarrivingintheU.S.aresubjecttoU.S.immigrationandcustomsfeesthatareindexed

to inflation. These fees are used to support the operations of U.S. Customs and Border Protection ("CBP"). Finally, the U.S. Department of

Agriculture'sAnimalandPlantHealthInspectionServiceimposesanagricultureinspectionfeeoninternationalpassengersarrivingintheUnited

States.

Airlinepassengers arealso requiredto paya PassengerFacility Charge,a userfee that isauthorized viafederal statutebut assessedby each

airport.ThemaximumPassengerFacilityChargeis$4.50perpassengerenplanement.Newaviationtaxesorregulationsmaybeimposedthrough

the annual congressional budget process. The annual appropriations bill funds the federal government - including the DOT, the FAA, the

TransportationSecurityAdministration(the"TSA"),andCBP.Passageofthefiscalyear2021and2022appropriationsbillwillbeconsidered

throughout2022andcouldresultinanincreaseinoneormoreofthetaxesandfeesdiscussedabove,aswellasnewmandatesontheDOTto

beginorcompleterulemakingsrelatedtoairlineconsumerprotection.

Operational and Safety Regulation

TheFAA,an agencywithinthe DOT, hastheauthority toregulatesafetyaspects ofcivilaviation operations. Specifically,theCompany and

certainofitsthird-partyserviceprovidersaresubjecttothejurisdictionoftheFAAwithrespecttoaircraftmaintenanceandoperations,including

equipment, ground facilities, dispatch, communications, training, and other matters affecting air safety. The FAA, from time to time, issues

orders or directives relating to the maintenance and operation of aircraft that require significant expenditures or operational restrictions. The

FAA, acting through its own powers or through the appropriate U.S. Attorney, has the power to bring proceedings for the imposition and

collectionofcivilpenaltiesforviolationoftheFAA'sregulations.

TheFAArequiresairlinestoobtainandmaintainanAirCarrierOperatingCertificate,aswellasothercertificates,approvals,andauthorities.

Thesecertificates,approvals,andauthoritiesaresubjecttoamendment,suspension,orrevocationforcause.

Astheairlines’safetyregulator,theFAAusestools,suchastemporaryflightrestrictions,tocontrolaircraftoperationswithindesignatedareas.

The FAA may also issue advisory circulars to provide guidance for compliance with aircraft and pilot certification standards, operational

standards, training standards, and other FAA rules. These regulatory tools may create additional costs and/or operational restrictions for the

Company.Forexample,theFAAhasexpressedconcernaboutthedeploymentofcertainwirelesstelecommunicationssystemsthatmaycause

interference with certain aircraftavionics, such asradio altimeters. In response, theFAA could imposetemporary flight restrictions until the

agencybelievesany safetyconcerns areresolved.The FAA couldalsorequiremitigations fromaircraftoperators(e.g., aircraftretrofits) asa

meanstoavoidanypotentialinterference.

Withrespecttoairlineoperations,theFAAhasrulesineffectwithrespecttocrewflight,duty,andresttimes.Amongotherthings,therules(i)

requireatenhourminimumrestperiodpriortoapilot’sflightdutyperiod;(ii)mandatethatapilotmusthaveanopportunityforeighthoursof

uninterruptedsleepwithintherestperiod;and(iii)imposepilot"flighttime"and"dutytime"limitationsbaseduponreporttimes,thenumberof

scheduledflight

16

TableofContents

segments, andother operational factors.The FAA has establishedflight attendant dutyperiod limitations and rest requirements based onthe

lengthofaflightattendant’sscheduleddutyperiod,numberofflightattendantsassignedtoaflight,andotheroperationalfactors.

The2018ReauthorizationActcontainsaprovisionrequiringamodificationtotheFAA'srulestoincreasetherequiredflightattendantrestperiod

betweendutyperiods.FAArulescurrentlyprovidethataflightattendantscheduledtoadutyperiodoffourteenhoursorlessmustbegivena

scheduledrestperiodofatleastnineconsecutivehours.Thisrestperiodcanbereducedtoeightconsecutivehoursundercertaincircumstances.

OnNovember2,2021,theFAAissuedaproposedruleincreasingtheminimumrestperiodtotenconsecutivehoursandprohibitingareduction

oftheminimumrestperiodunderanycircumstances.ThecommentperiodontheproposedruleclosedonJanuary3,2022.Theimplementation

oftheruleasproposedcouldrequiretheCompanytomodifyitstechnologysystemsandflightattendantstaffingpractices,whichcouldhavea

material effect on the Company’s operational performance, costs, earnings, competitive position, and Customer Experience. The FAA has

indicateditexpectstofinalizetherulein2022.

Pursuanttothe2018ReauthorizationAct,theFAAisrequiredtoissueanorderrequiringinstallationofaphysicalsecondarycockpitbarrieron

"eachnewaircraftthatismanufactured"fordeliverytoapassengeraircarrier.Aworkinggroupcomprisedofindustrytechnicalexpertsprovided

adviceandrecommendationstotheFAAin2020onthemosteffectivewaystoimplementthephysicalsecondarycockpitbarrierrequirement.

Depending on if and how the FAA reacts to the working group’s advice and recommendations, as well as the FAA's interpretation and

applicationofthestatutoryrequirement,compliancewiththefutureFAAordercouldimposeasubstantialcostontheCompany.TheFAAhas

indicateditplanstoissueaproposedrulein2022.

The2018 ReauthorizationActalsocontainsprovisionsdirectingtheFAAtoexaminewhethertoissuenewregulationsestablishingminimum

dimensionsforseatsizebasedonsafetyconsiderations.Further,the2018ReauthorizationActexpandshumantraffickingtrainingrequirements

beyondflightattendantstoincludeseveralpublic-facingEmployeeworkgroups,aswellasrequiresaircarrierstoimplementaplananddevelop

trainingwithprotocolsforpreventingandrespondingtoverbalorphysicalassaultcommittedagainstcustomerserviceagents.Humantrafficking

trainingisrequiredfortheCompany’sfrontlineEmployeesandrecommendedasvoluntarycurriculumforotherEmployees.TheCompanyhas

alsoimplementedanEmployeeAssaultPreventionandResponsePlanthatincludestrainingtode-escalatehostilesituations,writtenprotocolsfor

dealingwithhostilesituations,andreportingofrelevantincidentstoappropriateauthorities.

Inadditiontoitsroleassafetyregulator,theFAAoperatesthenation’sairtrafficcontrolsystemandhascontinueditslengthyandongoingeffort

toimplementamulti-faceted,airspacemodernizationprogram,NextGen.AccordingtotheU.S.government,NextGenwillhelpcontributetoa

safer,moreefficient,andmorepredictablesystem,whichmaypotentiallycontributetoreducedfuelburn,emissions,andnoise.Aspartofthe

NextGeninitiative,in2010theFAApublishedrulesrequiringmostcommercialaircraftoperatinginthenationalairspacesystemtobeequipped

withAutomaticDependentSurveillance-Broadcast("ADS-B")technologybyJanuary1,2020.ADS-Btechnologyisintendedtoenhancesafety

andefficiencybymovingfromground-basedradarandnavigationalaidstoprecisetrackingusingsatellitesignals.Inadditiontoenvironmental

andefficiencybenefits,ADS-Btechnologygivespilotsandairtrafficcontrollersnewtoolstoreducetheriskofrunwayincursionsandaircraft

collisions.TheCompanyhasimplementedtechnologyandprogramsintendedtocomplywithallapplicableADS-Brequirements.OnNovember

9, 2021, the U.S. government announced an Aviation Climate Action Plan to reduce emissions by, among other initiatives and efforts,

operationalizing NextGen to realize the full potential of modernized infrastructure and systems, and enhancing data quality and information

distributiontoenableoperatorstoflymorefuel-efficienttrajectories.

TheAirTrafficOrganization("ATO")istheoperationalarmoftheFAA.TheATOisresponsibleforprovidingsafeandefficientairnavigation

servicestoalloftheUnitedStatesandlargeportionsoftheAtlanticandPacificOceansandtheGulfofMexico.TheCompanyissubjecttoany

operationalchangesimposedbytheFAA/ATOastheyrelatetotheNextGenprogram,aswellastheday-to-daymanagementoftheairtraffic

controlsystem.

17

TableofContents

Passenger and Occupational Health Regulation

The Company is subject to various other federal, state, and local laws and regulations relating to health and occupational safety, including

Department of Health and Human Services, Centers for Disease Control and Prevention (“CDC”), Occupational Safety and Health

Administration,and Foodand Drug Administrationregulations. Inresponseto theCOVID-19 pandemic,federal,state, andlocal government

authoritiesimplementeddirectives,orders,andregulationsintendedtomitigatethespreadofthevirus,andinresponse,theCompanymodified

itspractices,policies,andprocedures,asappropriate.Forexample,theCDCandTSAissuedorders,effectiveFebruary1,2021,mandatingthe

wearingoffacemasksonallcommercialflightsandwithinairports,subjecttocertainlimitedexceptions.Themaskmandatehasbeenextended

throughMarch18,2022,andcouldbeextendedagain.Inaddition,onOctober25,2021,theCDCandCBPissuedorders,effectiveNovember8,

2021,requiringthatadultnon-citizen,non-immigrantpassengerstravelingtotheUnitedStatesbyairbefullyvaccinatedagainstCOVID-19and

show proofof their vaccination status. The orders also require that all passengers traveling tothe United States byair provide basic contact

tracinginformationtoairlinesbeforeboarding.

InSeptember2021,thePresidentoftheUnitedStatesissuedanExecutiveOrderestablishingavaccinationrequirementforemployeesofcovered

federalcontractors.Thefederalgovernmentrequiredthatfederalcontractorshavetheirworkforcevaccinated(orrequestanaccommodation)by

December8,2021.ThedeadlinewaslaterextendedtoJanuary4,2022.TheCompanystartedanactivecampaigntonotifyEmployeesofthe

need to submit proof of COVID-19 vaccination, or apply for an accommodation, by January 4, 2022. On December 3, 2021, the company

announced that 93 percent of its Employees were vaccinated, or had requested an accommodation. Due to legal challenges to the vaccine

mandate,theCompanyannouncedonDecember20,2021,thatitisnolongertargetingaJanuary4,2022,deadlineforcompliance.However,if

thevaccinemandateisrevived,theCompanywillresumeeffortstoworkwithEmployeeswhohavenotyeteithersubmittedproofofvaccination

orrequestedanaccommodation.

Additionalhealthrequirementsorstandards,whethermandatedbygovernmentagenciesorvoluntarilyadoptedbytheCompany,relatedtothe

COVID-19pandemicorotherwiseintendedtomitigatethespreadofcommunicablediseasescouldaffecttheCompany’scostsandperformance.

ForfurtherinformationpertainingtotheFAA’soversightandregulatoryauthority,aswellashealthandsafetyregulationsrelatedtoCOVID-19,

see“RiskFactors-Legal,Regulatory,Compliance,andReputationalRisks,andCOVID-19Risks.”

Security Regulation

PursuanttotheAviationandTransportationSecurityAct("ATSA"),theTSA,afederalagencyoftheU.S.DepartmentofHomelandSecurity,is

responsible for certain civil aviation security matters. ATSA and subsequent TSA regulations and procedures implementing ATSA address,

amongotherthings,(i)flightdecksecurity;(ii)theuseoffederalairmarshalsonboardflights;(iii)airportandaircraftaccesssecurity;(iv)airline

crewsecurity training;(v) security screening of passengers, baggage, cargo, mail, employees,and vendors;(vi) trainingand qualificationsof

securityscreeningpersonnel;(vii)provisionofpassengerdatatoCBP;and(viii)backgroundchecks.

UnderATSA,substantiallyallsecurityofficersatairportsarefederalemployees,andsignificantotherelementsofairlineandairportsecurityare

overseenandperformedbyfederalemployees,includingfederalsecuritymanagers,federallawenforcementofficers,andfederalairmarshals.

TSApersonnel andTSA-mandatedsecurityprocedurescanaffecttheCompany'soperations,costs,andCustomerexperience.Forexample,as

partofitssecuritymeasures,theTSAregulatesthetypesofliquiditemsthatcanbecarriedonboardaircraft.Inaddition,aspartofitsSecure

Flightprogram,theTSArequiresairlinestocollectapassenger'sfullname(asitappearsonagovernment-issuedID),dateofbirth,gender,and

RedressNumber(ifapplicable).AirlinesmusttransmitthisinformationtoSecureFlight,whichusestheinformationtoperformmatchingagainst

terroristwatchlists.Aftermatchingpassengerinformationagainstthewatchlists,SecureFlighttransmitsthematchingresultsbacktoairlines.

Thisservesto

18

TableofContents

identifyindividualsformoreextensivesecurityscreeningandtopreventindividualsonwatchlistsfromboardinganaircraft.Italsohelpsprevent

themisidentificationofpassengerswhohavenamessimilartoindividualsonwatchlists.TheTSA'smulti-layeredapproachtoairportsecurity

alsoincludesphysicalpatdownproceduresatsecuritycheckpoints.Theseprocedureshaveraisedprivacyconcernsbysomeairtravelers,and

havecauseddelaysatscreeningcheckpoints.

TheCompany,inconjunctionwiththeTSA,participatesinTSAPreCheck™,apre-screeninginitiativethatallowspassengersdeemedlowrisk

by the TSA to move through security checkpoints with greater efficiency and ease when traveling. Eligible passengers may use dedicated

screeninglanesatcertainairportstheCompanyservesforscreeningbenefits,whichincludeleavingonshoes,lightouterwear,andbelts,aswell

asleavinglaptopsandpermittedliquidsincarryonbags.AsimilarCBP-administeredprogram,GlobalEntry ,allowsexpeditedclearancefor

pre-approved, low-risk international travelers upon arrival in the United States. The TSA has expressed its plans to leverage advanced

transportationsecurityscreeningtechnologies,includingbiometricsolutions,toimprovesecurityeffectivenessandoperationalefficiency,while

alsoenhancingthepassengerexperience.Theadvancedtechnologieshavepromptedprivacy,cost,andlegalconcernsfromaircarriers,travelers,

andadvocacygroups,whichcouldaffectthetimingandviabilityoftheTSA'splans.

TheCompanyalsoparticipatesintheTSAKnownCrewmember program,whichisarisk-basedscreeningsystemthatenablesTSAsecurity

officerstopositivelyverifytheidentityand employment statusof flight-crew members.Theprogram expedites flightcrew member accessto

sterileareasofairports.

The Company works collaboratively with TSA, foreign national governments, and airports to provide risk-based security measures at

internationallocationsservedbytheCompany.

TheDepartmentofHomelandSecurityhasgrantedtheCompanydesignationcoverageundertheSupportAnti-TerrorismbyFosteringEffective

TechnologiesActof2002(the"SAFETYAct")throughSeptember29,2022.DesignationcoverageaffordstheCompanycertainlimitationsof

liabilityforclaimsarisingoutofan"actofterrorism,"asdefinedundertheSAFETYAct.Thedesignationisbasedonthesecurityprogramused

bytheCompanytoprotectitsEmployees,Customers,andassetsfromterroristsandothercriminalactivities.

The Company has made significant investments in facilities, equipment, and technology to process Customers, checked baggage, and cargo

efficiently in compliance with applicable security regulations; however, the Company is not able to predict the impact, if any, that various

securitymeasuresorTSAresourcelimitationsatcertainairportswillhaveonPassengerrevenuesandtheCompany’scosts,eitherintheshort-

termorthelong-term.

Environmental Regulation

TheCompanyissubjecttovariousfederallawsandregulationsrelatingtotheprotectionoftheenvironment,includingtheCleanAirAct,the

ResourceConservationandRecoveryAct,theCleanWaterAct,theSafeDrinkingWaterAct,andtheComprehensiveEnvironmentalResponse,

Compensation and Liability Act, as well as state and local laws and regulations. These laws and regulations govern aircraft drinking water,

emissions,stormwaterdischargesfromoperations,andthedisposalofmaterialssuchasjetfuel,chemicals,hazardouswaste,andaircraftdeicing

fluid.

Additionally,in conjunctionwith airport authorities, other airlines, and state and localenvironmental regulatoryagencies, theCompany, asa

normalcourseofbusiness,undertakesvoluntaryinvestigationorremediationofsoilorgroundwatercontaminationatvariousairportsites.The

Company has not historically experienced any airport site environmental liability that has had a material adverse effect on its capital

expenditures, earnings, or competitive position. However, many airports, as well as federal, state and local governmental authorities, are

increasinglyfocusedongroundwatercontaminationcausedbyso-called“foreverchemicals,”mostnotablyper-andpolyfluoroalkylsubstances

(“PFAS”).PFAShavebeenusedinmanymanufacturingandindustrialapplicationsovermanydecadesandcanbefoundinnumerousproducts,

including building materials and household products. Most notably for aviation, PFAS are a key component in aqueous film-forming foam

(“AFFF”),whichiswidelyusedto

®

®

19

TableofContents

fight petroleum-based fires at both commercial and military aviation facilities. The FAA and the U.S. Department of Defense have strict

performancespecifications for firesuppression systems, whichhascontributed totheuse ofAFFF/PFASover thedecades.PFAS isnowthe

focus of regulatory oversight at airports, as well as the source of litigation by airports against AFFF manufacturers. Moreover, regulatory

authoritiesatthefederal,state,andlocallevelsarecontemplatingboththeprohibitionofPFAS-basedAFFFandcostlyremediationeffortsat

airportstoaddressgroundwatercontamination.TheevolvinglegalandregulatoryactivitysurroundingPFAScouldleadtoaninadequatesupply

ofFAA-certifiedAFFFthroughouttheaviationsystemand/orincreasedoperatingcostsatcertainairports.

Thefederalgovernment,aswellasseveralstateandlocalgovernments,thegovernmentsofothercountries,andtheUnitedNations’International

CivilAviationOrganization("ICAO")haveimplementedlegislativeandregulatoryproposalsandvoluntarymeasurestoaddressclimatechange

by reducing greenhouse gas emissions. At the federal level, in July 2016, the Environmental Protection Agency (the "EPA") issued a final

endangermentfindingforgreenhousegasemissionsfromcertaintypesofaircraftengines,whichtheagencydeterminedcontributetopollution

thatcausesclimatechangeandendangerspublichealthandtheenvironment.Followingthisendangermentfinding,perthefederalCleanAirAct,

the EPA adopted aircraft greenhouse gas emissions standards in December 2020. These standards apply to airframe and aircraft engine

manufacturers, and align with the standards previously adopted by ICAO. On November 15, 2021, the EPA affirmed the agency will not

reconsidertheruleadoptingthestandards;however,severalstatesandnon-governmentorganizationshavefiledlegalpetitionschallengingthe

EPA’sadoptionoftherule.

Inadditiontoaircraftemissionsstandards,ICAOimplementeda"globalmarket-basedmeasure"frameworkinanefforttocontrolcarbondioxide

emissionsfrominternationalaviation.Thefocalpointofthisframeworkisacarbonoffsettingsystemapplicabletoaircraftoperatorsdesignedto

cap the growth of emissions related to international aviation emissions. ICAO's Carbon Offsetting and Reduction Scheme for International

Aviation("CORSIA")programisaglobalmarket-basedmeasureintendedtocapcarbonemissionsfrominternationalcivilaviationattheir2019

levels,enablingcarbon-neutralgrowthfortheinternationalaviationsectorbyrequiringthatinternationalaviationemissionsabove2019levels

areoffsetorreducedthroughtheuseofeligiblesustainableaviationfuels.TheU.S.federalgovernmenthasoptedtoparticipateinthevoluntary

phasesof the CORSIAprogram from 2021-2026(additionalphases extendthrough2035). Aspartof theCORSIAprogram, theCompanyis

currentlymonitoringitsinternationalemissionsforreportingpurposes.Datacollectedfromapplicableinternationalflightactivityin2019forms

thebaselineandisusedinthecalculationstodeterminesubsequentcarbonoffsettingrequirementsundertheCORSIAprogram.Regardlessof

themethodofregulationorapplicationofCORSIA,furtherpolicychangeswithregardtoclimatechangearepossible,whichcouldsignificantly

increaseoperatingcostsintheairlineindustryand,asaresult,adverselyaffectoperations.

Inadditiontoclimatechange,aircraftnoisecontinuestobeanenvironmentalfocus,especiallyastheFAAimplementsnewflightproceduresas

partofitsNextGenairspacemodernizationprogramdiscussedabove.TheAirportNoiseandCapacityActof1990givesairportoperatorsthe

right,undercertaincircumstances,toimplementlocalnoiseabatementprograms,providedtheydonotunreasonablyinterferewithinterstateor

foreign commerce or the national air transportation system. Some airports have established airport restrictions to limit noise, including

restrictions on aircraft types to be used and limits on the number of hourly or daily operations or the time of operations. These types of

restrictionscancausecurtailmentsinserviceorincreasesinoperatingcostsandcanlimittheabilityofaircarrierstoexpandoperationsatthe

affectedairports.

Atthefederallevel,theFAAhascommittedtoinformandinvolvethepublic,engagewithcommunities,andgivemeaningfulconsiderationto

community concernsand views when developing new flight procedures,and there is apossibility that Congress may enact legislation inthe

futuretoaddresslocalnoiseconcernsatoneormorecommercialairportsintheUnitedStates.Inaddition,the2018ReauthorizationActrequires