Medium Term Debt Management

Strategy (MTDS)

Debt Policy Coordination Office

Ministry of Finance

Government of Pakistan

Islamabad,

Medium Term Debt Management

Strategy (MTDS)

(2014-18)

Debt Policy Coordination Office

Ministry of Finance

Government of Pakistan

Islamabad,

April 2014

Medium Term Debt Management

Debt Policy Coordination Office

i

Table of Contents

Table of Contents .................................................................................................... i

List of Figures ........................................................................................................ iii

Abbreviations ........................................................................................................ iv

Foreword ................................................................................................................ v

Acknowledgement ................................................................................................. vi

Executive Summary ..............................................................................................vii

1.0

INTRODUCTION ............................................................................................. 1

2.0

OVERVIEW OF PUBLIC DEBT PORTFOLIO (2012-13) ................................. 3

2 (i) Domestic Debt .......................................................................................... 5

2 (ii) External Debt and Liabilities (EDL) ........................................................... 6

2 (iii) Cost and Risk Indicators of Public Debt - End June, 2013 ....................... 7

3.0

MEDIUM TERM MACROECONOMIC FRAMEWORK .................................. 10

3 (i)

Macroeconomic Assumptions ................................................................. 10

3 (ii)

Risks Associated with the Macroeconomic Indicators ............................ 13

4.0

POTENTIAL FUNDING SOURCES ............................................................... 14

4 (i)

Domestic Wholesale Market ................................................................... 14

4 (ii)

Domestic Retail Market - National Saving Schemes ............................... 14

4 (iii)

External Market ....................................................................................... 15

5.0

MEDIUM TERM DEBT MANAGEMENT STRATEGY (MTDS) ...................... 17

5 (i)

Funding Instruments and Baseline Assumptions .................................... 17

5 (ii)

Shock Scenarios ..................................................................................... 19

5 (iii)

Alternative Financing Strategies ............................................................. 21

5 (iv)

Cost - Risk Analysis of Alternative Strategies ......................................... 23

5 (v)

Recommended Strategy ......................................................................... 27

6.0

CONCLUSION AND WAY FORWARD ......................................................... 28

ii

List of Tables

Table 1: Public Debt .............................................................................................. 3

Table 2: Public Debt Servicing - (2012-13) ........................................................... 4

Table 3: Public Debt Cost and Risk Indicators ...................................................... 7

Table 4: Macro-Economic Indicators ................................................................... 10

Table 5: External Inflow ...................................................................................... 16

Table 6: Stylized Instruments .............................................................................. 17

Table 7: Pakistan Financing Strategies ............................................................... 22

Table 8: Pakistan: Portfolio Composition by Strategies ...................................... 23

Table 9: Pakistan Cost and Risk Indicators by Strategies ................................... 24

iii

List of Figures

Fig-1: Evolution of Public Debt …………………………………………………………….4

Fig-2: Outstanding Domestic Debt…………………………………………………………5

Fig-3: Composition of EDL, end-June, 2013……………………………………………..7

Fig-4: External Debt Redemption Profile………………………..…………………….…..9

Fig-5: Domestic Debt Redemption Profile………………………..…………………….…9

Fig-6: Exchange Rate Projections…………………………………………………….….19

Fig-7: Pakistani Domestic Yield Curve……………………………………………….….20

Fig-8: Debt to GDP...………………………………………………………...……….……25

Fig-9: Interest to GDP…………..…………………………………………………………25

Fig-10: Redemption Profile - S1………………………………………….………………26

Fig-11: Redemption Profile - S2……………………………………….…………………26

Fig-12: Redemption Profile - S3….………………………………………………………26

Fig-13: Redemption Profile - S4………………………………………….………………26

iv

Abbreviations

ADB Asian Development Bank

ATM Average Time to Maturity

ATR Average Time to Re-fixing

CDNS Central Directorate of National Savings

DPCO Debt Policy Coordination Office

EAD Economic Affairs Division

EDL External Debt and Liabilities

FRDLA Fiscal Responsibility and Debt Limitation Act, 2005

GDP Gross Domestic Product

GP Fund General Provident Fund

GIS Government Ijara Sukuk

IDB Islamic Development Bank

IMF International Monetary Fund

JPY Japanese Yen

MoF Ministry of Finance

MRTBs Market Related Treasury Bills

MTDS Medium Term Debt Management Strategy

NSS National Saving Schemes

PIBs Pakistan Investment Bonds

PLI Postal Life Insurance

PPG Public and Publically Guaranteed

SBA Stand by Arrangements

SBP State Bank of Pakistan

SDR Special Drawing Rights

T-Bills Treasury Bills

v

Foreword

The present government took office in June 2013 and immediately initiated

actions for restoring economic sustainability and growth. It articulated its economic

vision based on trade and investment, market considerations, enhancing private

sector involvement, limiting itself within the broader limits imposed by the available

resources and broadening the base of resource mobilization for running the

government. It also accorded high priority to resolve energy crisis, up-gradation of

infrastructure base, building up foreign exchange reserves and correcting fiscal

and external imbalances. Such developmental plans/reforms require borrowings

from external and domestic markets. To guide the borrowing activities, the

Government of Pakistan has developed a Medium Term Debt Management

Strategy (MTDS) that is closely linked to its fiscal framework.

The MTDS is a plan that the government intends to implement over the medium

term in order to achieve desired composition of the government debt portfolio,

which captures the government’s preference with regards to cost-risk tradeoff. It

contains a policy advice on an appropriate mix of financing from different sources

with the spirit to uphold the integrity of the Fiscal Responsibility & Debt Limitation

(FRDL) Act, 2005. It will provide a policy framework and enable the government to

take informed decisions based on the evaluation of cost-risk tradeoffs. It will also

enhance the coordination with fiscal and monetary management while helping to

achieve greater clarity and accountability for public debt management.

I sincerely appreciate the Finance Secretary and his team for their determined

efforts in preparation of Medium Term Debt Management Strategy.

Muhammad Ishaq Dar

Minister for Finance, Revenue, Economic

Affairs, Statistics and Privatization

Government of Pakistan

vi

Acknowledgement

The preparation of Medium Term Debt Management Strategy would not have

been possible without the valuable contribution, assistance and support of many

individuals, organizations, ministries and departments particularly Debt Policy

Coordination Office, State Bank of Pakistan, Economic Affairs Division, Central

Directorate of National Savings, External Finance Wing and Budget Wing.

I would like to recognize the efforts put in by Mr. Sajjad Ahmad Shaikh, Joint

Secretary, Mr. Muhammad Ikram, Deputy Secretary, Mr. Muhammad Umar Zahid,

Financial Analyst, Mr. Arsalan Ahmed, Financial Analyst, Ms. Saadiya Razzaq,

Consultant, Mr. Arslan Shahid, Consultant, Ms. Myra Qazi, Consultant in

preparation and execution of Medium Term Debt Management Strategy. I would

also like to take this opportunity to express gratitude to IMF/World Bank Team for

their technical input.

Waqar Masood Khan

Secretary Finance

Government of Pakistan

vii

Executive Summary

It is imperative to have a comprehensive debt management strategy aiming at

debt sustainability and enhancing the debt servicing capacity of the country.

Owing to its vital importance and indispensable nature, Government of Pakistan

has developed its first Medium Term Debt Management Strategy (MTDS) for the

year 2014-18. The prime objective of MTDS is to provide the financing for the

government at low cost over the medium to long term by giving due consideration

to the risks.

The analysis of public debt reveals that the debt to GDP ratio stood at 62.7

percent in 2012-13, consequently the debt servicing consumed around 41 percent

of the total revenues. Over the past few years, the composition of public debt has

shifted towards domestic debt and furthermore into shorter duration instruments

which is a source of vulnerability and entails high rollover and refinancing risk. As

on June 30, 2013, around 34 percent of total public debt stock was denominated

in foreign currencies which exposes debt portfolio to exchange rate risk.

The MTDS provides alternative strategies to meet the financing requirements of

the government. The four different borrowing strategies have been assessed with

associated costs and risks analysis under the alternative interest and exchange

rates scenarios. The cost and risk trade-off analysis is based on the existing debt

cash flows, market and macroeconomic projections and alternative borrowing

strategies. The robustness of alternative debt management strategies was

evaluated by applying stress/shock scenarios for interest rates and exchange

rates.

Pakistan needs to follow the strategy which results in lengthening of its maturity

profile to reduce the refinancing risk along with providing sufficient external inflows

in the medium term to reduce the pressure on domestic resources keeping in view

cost-risk tradeoffs. A strategy with an increased reliance on domestic short term

sources is the least attractive. MTDS also provides strategic guidelines for

comprehensive debt management which include: (i) widening of investor base; (ii)

development of domestic debt markets (iii) lengthening of maturities of debt

instruments; and (iv) stimulation of external finance.

Pakistan: Medium Term Debt Management Strategy (MTDS)

1

1.0 INTRODUCTION

1.1 The developing countries need to borrow in order to facilitate their

development process. Debt may well act as catalyst in the course of growth

of an economy if it is undertaken to facilitate the well thought out road map

devised with due diligence. Unsustainable level of debt coupled with

absence of prudent debt management strategy plagues economic growth

by lowering the development expenditure due to heavy debt servicing

requirement. This intricate scenario calls for comprehensive and prudent

debt management strategy which ensures the right choices among several

options keeping in view cost and risk tradeoffs, addresses financial

constraints and ensures intergenerational welfare impact.

1.2 Government has developed its first Medium Term Debt Management

Strategy (MTDS) to ensure that both the level and rate of growth in public

debt is fundamentally sustainable and can be serviced under different

circumstances while meeting cost and risk objectives. The MTDS contains

a policy advice on an appropriate mix of financing from different sources

with the spirit to uphold the integrity of the Fiscal Responsibility & Debt

Limitation (FRDL) Act, 2005.

Objectives & Scope of Medium Term Debt Management Strategy

1.3 The prime objective of MTDS is to provide financing at the lowest possible

cost while giving due consideration to the risks. The MTDS has the

following main objectives:

− Fulfil the financing needs of the government.

− Minimize the cost of debt while maintaining the acceptable level of

risks.

− Facilitate the development of domestic debt market.

1.4 Time horizon of the debt management strategy is medium term i.e. till

2017/18. Starting point for the analysis is the debt portfolio as of end-June,

2013.

1.5 The scope of MTDS analysis in this report covers debt contracted by the

federal government which includes on-lending to the provinces. Federal

Pakistan: Medium Term Debt Management Strategy (MTDS)

2

government debt consists of external debt from multilateral and bilateral

sources as well as Eurobonds, domestic wholesale instruments such as

PIBs, T-Bills, GIS), domestic retail instruments (National Savings

Schemes), as well as borrowing from State Bank of Pakistan through

MRTBs. The analysis also includes the portion of IMF debt which was

utilized towards budgetary support. The remaining portion of IMF debt is

not included as it was only utilized towards balance of payment support and

reflected in foreign currency reserves of the country.

Pakistan: Medium Term Debt Management Strategy (MTDS)

3

2.0 OVERVIEW OF PUBLIC DEBT PORTFOLIO (2012-13)

2.1 The portion of total debt which has a direct charge on government

revenues as well as the debt obtained from IMF is taken as public debt.

Public debt stock recorded at Rs.14,366 billion as on June 30, 2013 (table

1) representing an increase of Rs.1,699 billion or 13 percent higher as

compared with last fiscal year. This increase in public debt is attributed to

financing of fiscal deficit which was recorded at 8 percent of GDP against

the budgeted estimate of 4.7 percent.

2.2 Over the past few years, government relied mainly on the domestic

borrowing which resulted in gradual increase of its share to around 66

percent of the total public debt in 2012-13 compared to 51 percent in 2008-

09. Government borrowings from domestic sources were actually higher

than the overall fiscal deficit in 2012-13 as net external debt payment had

to be paid owing to insufficient fresh external inflows which apart from

putting pressure on domestic resources also resulted in a fall in SBP’s

foreign exchange reserves during 2012-13.

Table 1: Public Debt

2008 2009

2010

2011

2012(P)

2013(P)

(Rs. in billion)

Domestic Debt 3,266 3,852

4,651

6,016

7,637

9,517

External Debt 2,778 3,776

4,260

4,685

5,016

4,849

Total Public Debt 6,044 7,629

8,911

10,700

12,653

14,366

(In percent of GDP)

Domestic Debt 30.7 29.2

31.3

32.9

38.0

41.5

External Debt 26.1 28.6

28.7

25.6

25.0

21.2

Total Public Debt

56.8

57.8

59.9

58.5

63.0

62.7

(In percent of Total Debt)

Domestic Debt 54.0 50.5

52.2

56.2

60.4

66.2

External Debt

46.0 49.5

47.8

43.8

39.6

33.8

(In percent of revenues)

Domestic Debt 217.8 208.1

223.8

267.0

297.6

319.1

External Debt 185.3 204.0

205.0

208.0

195.4

162.6

Total Public Debt

403.1

412.2

428.8

475.0

493.0

481.7

P:Provisional

- The base of Pakistan’s GDP has been changed from 1999-00 to 2005-06

Source: State Bank of Pakistan,

Economic Affairs Division, Budget Wing and Debt Policy Coordination

Office Staff Calculations

2.2 The debt to GDP ratio has remained below 60 percent since 2005-06 until

2010-11. It increased to 63 percent in 2011-12. In 2012-13, the debt to

Pakistan: Medium Term Debt Management Strategy (MTDS)

4

GDP ratio was 62.7 percent. The evolution of public debt along with debt to

GDP ratio is depicted through Fig-1.

2.3 In 2012-13, debt servicing comprised around 41 percent of the total

revenues whereas the debt servicing below 30 percent of the government

revenues is generally considered to be a sustainable level. Public debt

servicing reached at Rs.1,209 billion against the budgeted estimate of

Rs.1,178 billion (table 2). The variation is explained by increased quantum

of domestic borrowing which exceeded the budgeted amount by

approximately Rs.75 billion. Further, analysis reveals that the deviation

from budgeted amount was mainly witnessed in T-Bills and PIBs for the

amount of Rs.48 billion and Rs.21 billion respectively.

Table 2: Public Debt Servicing - (2012-13)

Budgeted Actual (P) Percent of

Revenue

Percent of

Current

Expenditure

(Rs. in billion)

Servicing of External Debt 80.2 70.6 2.4 1.9

Repayment of External Debt 252.0 217.9 7.3 6.0

Servicing of Domestic Debt 845.6 920.4 30.9 25.1

Servicing of Public Debt 1,177.8 1,208.9 40.5 33.0

P: Provisional

Source: Budget Wing and Debt Policy Coordination Office Staff Calculations, Finance Division

3.3

3.9

4.7

6.0

7.6

9.5

2.8

3.8

4.3

4.7

5.0

4.8

56.0%

57.0%

58.0%

59.0%

60.0%

61.0%

62.0%

63.0%

64.0%

-0.5

1.5

3.5

5.5

7.5

9.5

11.5

13.5

15.5

2007-08 2008-09 2009-10 2010-11 2011-12 2012-13

Fig:1 Evolution of Public Debt

(LHS: in trillions of PKR)

(RHS: percent of GDP)

Domestic (PKR in Trillion) External (PKR in Trillion) Public Debt to GDP

Pakistan: Medium Term Debt Management Strategy (MTDS)

2 (i) Domestic Debt

2.4

Pakistan’s domestic debt comprises permanent debt (medium and long

term), floating debt (short

instruments available under the National Savings Scheme).

2.5

The analysis of domestic debt reveals that the gov

short term borrowing especially from the banking system in 2012

despite the mobilization through National Savings Schemes doubled which

is a predominant source of non

bank borrowing led

servicing in view of higher domestic interest rates. The domestic debt was

increased by Rs.1,880 billion in 2012

recorded at Rs.9,517 billion constituting 41 percent of

component wise

details of domestic debt).

2.6

The composition of domestic debt has witnessed a shift from a high

dominance of unfunded debt to floating debt over past few years. The

unfunded debt comprised 23 percent of total domestic de

compared with 31

floating debt to total domestic debt

This trend shows the government dependence on shorter duration

instruments

over past few years

shorter maturities involve high refinancing and interest rate risk.

617

1,637

1,020

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2007-08

Percentage Distribution

Pakistan: Medium Term Debt Management Strategy (MTDS)

Pakistan’s domestic debt comprises permanent debt (medium and long

term), floating debt (short

-

term) and unfunded debt (made up of the various

instruments available under the National Savings Scheme).

The analysis of domestic debt reveals that the gov

ernment relied more on

short term borrowing especially from the banking system in 2012

despite the mobilization through National Savings Schemes doubled which

is a predominant source of non

-

bank borrowing. This increased reliance on

to inflationary pressure and translated

into higher debt

servicing in view of higher domestic interest rates. The domestic debt was

increased by Rs.1,880 billion in 2012

-

13 as compared to last year and

recorded at Rs.9,517 billion constituting 41 percent of

GDP (Annex

details of domestic debt).

The composition of domestic debt has witnessed a shift from a high

dominance of unfunded debt to floating debt over past few years. The

unfunded debt comprised 23 percent of total domestic de

bt in 2012

percent in 2007-08 (Fig-2).

Whereas, the

floating debt to total domestic debt

stood at

55 percent at end

This trend shows the government dependence on shorter duration

over past few years

which

can be source of vulnerability as

shorter maturities involve high refinancing and interest rate risk.

686

798

1,126

1,697

1,904

2,399

3,235

4,143

1,271 1,458 1,656 1,798

2008-09 2009-10 2010-11 2011-12

Fig-2: Outstanding Domestic Debt

(in billion of PKR and percent of Domestic Debt)

Permanent Debt Floating Debt Unfunded Debt

Pakistan: Medium Term Debt Management Strategy (MTDS)

5

Pakistan’s domestic debt comprises permanent debt (medium and long

-

term) and unfunded debt (made up of the various

ernment relied more on

short term borrowing especially from the banking system in 2012

-13

despite the mobilization through National Savings Schemes doubled which

bank borrowing. This increased reliance on

into higher debt

servicing in view of higher domestic interest rates. The domestic debt was

13 as compared to last year and

GDP (Annex

-I for

The composition of domestic debt has witnessed a shift from a high

dominance of unfunded debt to floating debt over past few years. The

bt in 2012

-13

Whereas, the

share of

55 percent at end

-June 2013.

This trend shows the government dependence on shorter duration

can be source of vulnerability as

shorter maturities involve high refinancing and interest rate risk.

2,179

5,196

2,147

2012-13

Pakistan: Medium Term Debt Management Strategy (MTDS)

6

2.7 In 2012-13, the floating debt increased by Rs.1,053 billion. Most of the

proceeds accrued through T-Bills as Rs.538 billion was added in the stock

of June 30, 2012. On the other hand, government borrowed Rs.516 billion

through MRTBs. Government could only adhere to keep its net quarterly

borrowing from the State Bank of Pakistan at zero during the first quarter of

2012-13 as market conditions were more supportive and government

mopped up more than targeted amount from the commercial banks.

However, the government was unable to finance its maturing amount from

commercial banks especially in second quarter of 2012-13 as market

dynamics changed and banks were sensing higher interest rates in view of

large funding needs of the government.

2.8 The amount of permanent debt in the government’s total domestic debt

stood at Rs. 2,179 billion as at end-June 2013, registering an increase of

Rs.482 billion compared with that of last fiscal year. The stock of

permanent debt recorded a 28 percent increase, mainly on account of

higher mobilization through PIBs i.e. Government mopped up net of

retirement Rs.347 billion through PIBs. Government also mobilized net of

retirement Rs.76 billion through GIS and Rs. 56 billion through prize bonds.

2.9 Mobilization through unfunded debt witnessed a sizeable growth as the

government raised Rs.349 billion during 2012-13 compared with Rs.142

billion during the same period last year. In terms of composition, more than

half of the incremental mobilization went into Special Savings Certificates

and Accounts.

2 (ii) External Debt and Liabilities (EDL)

2.10 External Debt and Liabilities (EDL) stock was recorded at US$ 59.8 billion

at end-June 2013 compared with US$ 65.5 billion in 2011-12. Out of EDL,

external public debt amounted to US$ 48.7 billion as at end-June, 2013.

EDL stock witnessed a decline of approximately US$ 5.7 billion during

2012-13 which is a largest ever drop in a single year mainly due to around

US$ 3 billion repayment to the IMF and translation gain of US$ 2.7 billion

on account of appreciation of US Dollar against Japanese Yen. As at end-

June, 2013, EDL is dominated by Public and Publically Guaranteed (PPG)

Debt having share of 74 percent followed by IMF having share of 7 percent

Pakistan: Medium Term Debt Management Strategy (MTDS)

7

(Annex-II for components wise details of external debt). This composition of

EDL is depicted through Fig-3:

2 (iii) Cost and Risk Indicators of Public Debt - End June, 2013

Table 3: Public Debt Cost and Risk Indicators

Risk Indicators

External

Debt

Domestic

Debt

Public

Debt

Amount (Rs. in billion) 4,849 9,517 14,366

Nominal Debt as Percentage of GDP 21.2 41.5 62.7

Cost of Debt Weighted Average IR (%) 1.8 10.7 7.6

Refinancing Risk

Average Time to Maturity (ATM) – Years 9.5 1.8 4.5

Debt Maturing in 1 Year (% of total) 12.8 64.2 46.6

Interest Rate Risk

Average Time to Re-Fixing (ATR) – Years 8.7 1.8 4.2

Debt Re-Fixing in 1 year (% of total) 25.3 67.2 52.8

Fixed Rate Debt (% of total) 84.4 39.6 54.9

Foreign Currency

Risk (FX)

Foreign Currency Debt (% of total debt)

34.2

Other Public Debt

Indicators

Public Debt to Revenue (Percentage)

482

Revenue Balance / GDP

2.8

Primary Balance / GDP

3.6

* Adjusted for grants

Source: Debt Policy Coordination Office Staff Calculations, Finance Division

2.11 The cost and especially risks of the debt portfolio can be described with a

few key parameters. However it is better to consider more than one

indicator as risks to debt composition have several dimensions. Normally,

three kinds of indicators are used for analyzing public debt’s risk level –

measurement of risk that current economic conditions generate over public

debt (foreign currency risk); evaluation of government’s ability to face

PPG

74%

Private Non-

Guaranteed

5%

Public Sector

Enterprises

2%

IMF

7%

Banks

3%

Liabilities to

direct investors

5%

Foreign

Exchange

Liabilities

4%

Fig-3: Composition of EDL, end-June, 2013

(in percent)

Pakistan: Medium Term Debt Management Strategy (MTDS)

8

upcoming contingencies considering certain expected circumstances

(refinancing risk); financial indicators which show the liabilities of market

performance (interest rate risk).

2.12 Pakistan’s total public debt as a percentage of revenues stood at 482

percent during 2012-13, whereas, public debt around 350 percent of

government revenues is generally believed to be within the bounds of

sustainability. Revenue deficit stood at Rs.649 billion or 2.8 percent of GDP

in 2012-13 which reflects the non-availability of fiscal space for undertaking

development spending. Primary deficit stood at Rs.814 billion or 3.6

percent of GDP in 2012-13 which essentially implies that the government is

borrowing to pay interest on the debt stock.

2.13 The cost of current debt portfolio of Pakistan is determined by the weighted

average interest rate which stands at 7.6 percent including National

Savings Schemes (NSS). This number is a combination of average interest

rate of 1.8 percent on external debt and about 10.7 percent on domestic

debt. While interest rates on domestic debt are almost 6 times higher than

those on external debt, this differential fluctuates with the changes in the

exchange rate. For instance, Pak Rupee depreciated against US Dollar on

average by 8 percent in the past 5 years which resulted in increase in

external debt in local currency. This capital loss on foreign currency debt,

however, is mitigated by the strong concessionality element associated

with Pakistan’s external loans. Hence, the cumulative cost of adverse

currency movement and existing external debt rate is still lower than the

cost of domestic debt by 0.9 points.

2.14 Refinancing risk is probably the most significant in Pakistan’s debt portfolio,

driven primarily by the concentration of domestic debt in short maturities.

The Average Time to Maturity (ATM) of total public debt is 4.5 years, with

payment of about Rs.6 trillion of domestic debt is due in 2013-14.

Therefore, in the absence of sufficient external financing inflows and the

current unfavorable Balance of Payment position, refinancing of such a

huge amount will further accentuate the economic situation, thus

compelling the Government to revert to SBP. The ATM of domestic debt is

1.8 years with NSS instruments further compounding the refinancing risk

Pakistan: Medium Term Debt Management Strategy (MTDS)

9

owing to embedded put option. In contrast, ATM of external debt is 9.5

years, indicating limited exposure. Nonetheless, the unfavorable balance of

payment situation and pressure mounting on foreign exchange reserves,

payment of USD 6.2 billion due in 2013-14 may become a challenge if

external position further tightens.

2.15 Around 34 percent of total public debt stock is denominated in foreign

currencies, exposing Pakistan’s debt portfolio to exchange rate risk.

Adjusted for Special Drawing Rights (SDR), the main exposure of

exchange rate risk comes from USD denominated loans (14 percent of total

debt), followed by Japanese Yen (9 percent) and loans denominated in

Euro (7 percent). Depreciation of Pak Rupee would affect both the stock of

government debt as well as debt servicing flows.

2.16 Exposure to interest rate changes is a substantial risk given the short term

nature of domestic securities and external borrowing in floating rates.

Around 67 percent of total domestic debt is exposed to interest rate re-

fixing within 1 year as compared to 25 percent of external debt. Average

time to Re-Fixing (ATR) for domestic debt stands at 1.8 years, comparable

to ATM for domestic debt, while ATR on external debt is significantly longer

at 8.7 years.

-

1

2

3

4

5

6

7

2014

2016

2018

2020

2022

2024

2026

2028

2030

2032

2034

2036

2038

2040

2042

2044

(US Dollar in billion)

Years

Fig-4: External Debt Redemption

Profile

(US Dollar in billion)

0

1

2

3

4

5

6

7

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

(Pak Rupee in trillion)

Years

Fig-5: Domestic Debt Redemption

Profile

(Pak Rupee in trillion)

Pakistan: Medium Term Debt Management Strategy (MTDS)

10

3.0 MEDIUM TERM MACROECONOMIC FRAMEWORK

3 (i) Macroeconomic Assumptions

3.1 Government estimated set of macro-economic projections as part of its

medium term budgetary framework. These projections are consistent with

the macro-economic assumptions outlined in the first review of the IMF’s

Extended Fund Facility (EFF) program. The EFF arrangement is expected

to have the support of additional annual US$ 5-6 billion on average from

other development partners during the program period. In addition, the

government aims economic restructuring through measures such as

revenue mobilization, rationalizing expenditure, revitalizing the key public

sector enterprises and resolving energy sector issues to ensure sustainable

growth. The resultant economic growth is expected to contain the future

fiscal deficits. The expected increased external financing along with

curtailed current account deficit will reduce pressure on SBP reserves over

the medium term.

Table 4: Macro-Economic Indicators

Macro

-

Economic Projections

2012/13

2013/14

2014/15

2015/16

2016/17

2017/18

GDP growth percent (fc) 3.6 2.8 3.6 3.9 4.7 5.0

Consumer price index

(period average) percent

7.4 11.0* 9.0 7.0 6.0 6.0

Current account deficit

(US $ billion)

(2.5) (2.3) (2.0) (2.6) (4.5) (5.6)

Gross official reserves

(US $ billion)

- in month of imports

6.0 9.4 12.3 16.7 16.8 16.7

1.4 2.1 2.5 3.2 2.9 2.8

(In percent of GDP)

External Debt 24.9 27.7 26.6 25.5 23.9 22.5

Revenues including grants 13.2 14.9 14.9 15.4 15.3 15.2

- Tax revenues 9.7 10.6 11.6 12.2 12.8 12.8

Expenditure 21.0 20.4 19.4 18.8 18.7 18.7

- Current 16.3 16.8 16.3 15.6 15.4 15.2

- Development 4.6 3.6 3.1 3.2 3.4 3.5

Primary Balance (3.5) (0.8) 0.7 1.0 0.8 0.7

Fiscal Balance (7.8) (5.5) (4.4) (3.5) (3.5) (3.5)

*The IMF projection for inflation rate was 7.9 percent for 2013-14, however, in consultation with all stakeholders, it was

unanimously decided to keep it at 11 percent to make it more realistic for MTDS purpose.

Source: Government of Pakistan and IMF Staff Estimates and Projections

Pakistan: Medium Term Debt Management Strategy (MTDS)

11

Economic Growth

3.2 Over the last few years, Pakistan’s economy has been marred with a

deepening security and energy crises, crippling policy inactions and natural

disasters in the shape of floods and torrential rains. These factors have

culminated in economic slowdown with GDP growth rates averaging

around 3 percent during the last five years. However, economic

restructuring as envisaged by the government would improve economic

growth to 5 percent by 2017-18. The steady economic growth would mainly

stem from macro-economic reforms adopted by the government to tackle

the energy crises and revitalize the public sector enterprises; stimulating

economic activity and controlling the resource drainage in the forthcoming

years.

Fiscal Policy

3.3 Fiscal policy is an important component of macroeconomic management.

The government is responding to the current fiscal predicaments through

adopting measures to mobilize tax revenues, expansion of tax base in the

medium term along with raising non-tax revenue. It is expected to

progressively raise the total revenue from 13.2 percent of GDP in 2012-13

to 15.2 percent in 2017-18. Revenue mobilization efforts would be followed

by measures to rationalize non-developmental expenditure through reforms

in the energy sector and public sector enterprises, phasing out subsidies to

curb the drainage of government resources. The government’s fiscal policy

measures are projected to yield a gradual improvement in the fiscal deficit

from its current level of 8 percent to 3.5 percent in 2017-18. Moreover, the

primary balance is expected to be revitalized as the primary deficit of 3.5

percent is forecasted to reach a surplus of 0.7 percent by 2017-18. The

improving fiscal outlook would help contain the government’s financing

needs over the medium term.

Balance of Payments

3.4 Current account deficit stems from imports surpassing exports owing to

economic slowdown and deteriorating exchange rate. During the last few

years, worker remittances have emerged as the key source of foreign

exchange earnings. The launch of Pakistan Remittances Initiative (PRI)

has been instrumental in raising the remittances through official sources

Pakistan: Medium Term Debt Management Strategy (MTDS)

12

from 75 percent in 2009-10 to 90 percent in 2012-13; this trend is expected

to continue in the medium term, enabling the government to stabilize the

current account balance. However, the current account deficit is set to be

poised at 1 percent for 2013-14 before widening to 2 percent by 2017-18.

On the other hand, the capital flows are set to improve through the

issuance of Pakistan Sovereign Bonds and the disbursement of other

program loans hinged with the successful implementation of structural

reforms as envisaged by the government. The improved economic outlook

would lead to a progressive rise in the foreign direct investment from US $

2.6 billion in 2013-14 to US $ 4 billion in 2017-18. The rise in the foreign

direct investment along with the rising net capital inflows and a sustainable

current account balance is projected to stabilize the balance of payments

over the medium term.

Monetary policy

3.5 In the near term, inflation may rise to 11 percent for the year 2013-14

based on the consultation held with various stakeholders. However,

prudent setting of interest rates and a reduction in the funding of deficit

financing through the central bank is projected to account for a reduction in

the inflation rate to 9 percent by 2014-15. The government aims to reduce

inflation to 6 percent by the year 2017-18 providing stability to the overall

macroeconomic outlook of the country.

3.6 Owing to weaker growth in exports, deteriorating exchange rates and

drying external inflows, the foreign exchange reserves with the State Bank

of Pakistan have substantially declined. The external deficit financing

amounting to US$ 2 billion and IMF SBA repayments of US$ 2.5 billion

executed through liquid foreign exchange reserves resulted in decline in

SBP reserves from US$ 10.8 billion at the start of the year to around US$ 6

billion at the end of 2012-13. However, the official foreign reserves are

projected to rise to US $ 9.4 billion in 2013-14 and US $ 16.7 billion by

2017-18. The growth in the foreign exchange reserves is hinged with

positive capital inflows and a rise in direct foreign investment. The

exchange rate is expected to stabilize over the period owing to sustained

economic growths, reduction in fiscal deficits and easing pressure on

balance of payments.

Pakistan: Medium Term Debt Management Strategy (MTDS)

13

3 (ii) Risks Associated with the Macroeconomic Indicators

3.7 The above mentioned estimates are exposed to certain risks and

vulnerabilities that could cause deviations from the projections. The

adverse security situation along with impeding energy crises, high fiscal

deficits, rising inflation and inefficient public sector enterprises could peg

back the growth projections.

3.8 A stifled economy could slow down revenue mobilization, create pressure

on the government’s resources through increased subsidies, thereby

widening the fiscal deficits. The rising fiscal deficits could increase the

country’s borrowing requirements, thereby raising the public debt which can

be translated into higher debt servicing. Moreover, inefficient Public Sector

Entities could further expose the economy to rising contingent liabilities

carrying the impediment for such liabilities to be consolidated into the public

debt stock.

3.9 Reduction in external inflows could depreciate the rupee leading to rising

import bills and increasing inflation. This could also cause a shift in the

funding strategies from external to the domestic markets carrying the risk of

crowding out of private sector credit and rising domestic interest rates. The

lack of structural reforms to the economy could slow down the exports

causing a widening current account deficit which may hamper the growth

and accumulation of the foreign exchange reserves and create pressure on

the country’s exchange rates. In addition, reduction in foreign direct

investment and a potential curtailment of the donors’ loans could pose

balance of payments crises.

Pakistan: Medium Term Debt Management Strategy (MTDS)

14

4.0 POTENTIAL FUNDING SOURCES

4.1 Government meets its financing requirements from both domestic and

external sources. Local sources mainly include issuance of government

securities and receipt of deposits through National Savings Schemes

(NSS). The external sources include loans from multilateral, bilateral

creditors, issuance of bonds in the international capital markets and raising

of short term foreign currency loans.

4 (i) Domestic Wholesale Market

4.2 The MTBs, PIBs, MRTBs and GIS are the main instruments for domestic

debt. PIBs and MTBs are issued through auction in primary market

whereas MRTBs are purchased and held by SBP. The PIBs and GIS are

medium and long term securities, whereas, MTBs are short term

instruments having maturity up to one year. MRTBs are issued for a

period of six months. The issuance of MTBs, PIBs and GIS will continue

to be a source of funding for the government. Government has already

listed these securities on the stock exchanges which will help in

strengthening the debt capital market, creating a competitive environment,

widening the investor base through taping the retail investor.

4.3 Government will focus on the Islamic and long term financial instruments to

augment the absorption capacity of the market. The growth in Islamic

securities and PIBs since 2009 suggests that these instruments may

absorb the increasing demand to the tune of over Rs.500 billion each

in nominal terms in the entire financial market.

4 (ii) Domestic Retail Market - National Saving Schemes

4.4 National Saving Schemes (NSS) are designed to collect savings mainly

from retail investors which was 26 percent of total domestic debt at end-

June, 2013. They grew continuously in real terms due to the attractive

rates of return combined with the option for early redemption. NSS seems

supportive to absorb growing need for financing.

4.5 The future trend of existing instruments depict that the average share of

Prize Bonds, Regular Income Certificates (RIC), and Pensioners Benefit

Account (PBA) & Behbood Savings Certificates (BSC) in NSS during the

last 5 years remained 15%, 8.5%, 7.5% & 21% respectively. Similar trend

Pakistan: Medium Term Debt Management Strategy (MTDS)

15

is also expected in comings years in the light of response of investors

during last 5 years.

4.6 Government has already introduced unconventional schemes to cater

social & ethnic dimension of the country i.e. PBA & BSC. Moreover,

proposals like Sharia Compliant Paper and Registered Prize Bonds are in

process. In the recent past, CDNS introduced Student Welfare Prize

Bond having denomination of Rs.100/-. CDNS has also successfully

launched prize bond of Rs.25,000/- denomination and Short Term Savings

Certificates (03 Month, 06 Months and 12 Month maturity) during last

two years to attract the potential investment and to diversify the basket

of retail government securities.

4.7 CDNS has also taken measures to enhance its coverage through

developing secondary domestic market. Efforts are also underway to

facilitate Non-Resident Pakistanis (NRPs) to invest in NSS through an

online investment portal in coordination with sophisticated banking

channels.

4 (iii) External Market

4.8 External debt is mainly obtained through loans from multilateral and

bilateral donors with medium and long term maturity. Disbursement of

project based loans is dependent on the implementation capacity and

efficiency of the implementing entity. It is expected that as a result of

special attention to enhance the project implementation process, project

based disbursements would increase in the medium term. Policy based

funding is linked with the macroeconomic stability. The structural changes

initiated by the government would result in macroeconomic stability

augmenting the path for policy lending from multilateral partners during the

coming years. Government is also planning to obtain loans from IDB to

fulfill short term financing requirements. Besides, the government plan to

secure external financing from the international financial markets which is

expected to reduce pressure on the domestic liquidity. The estimates of

external flows are given in table 5.

Pakistan: Medium Term Debt Management Strategy (MTDS)

16

Table 5:

External Inflow

2013

-

14

2014

-

15

2015

-

16

2016

-

17

Euro Bond 2,000 500-750 500-750 500-750

Commercial 400 - - -

IDB 782 500 500 500

Program Loans

- World Bank

- ADB

- SAFE China Deposits

2,400

2,500

2,000

2,000

1000 1,000 500 500

400 500 500 500

1,000 1,000 1,000 1,000

Project Loans

2,978

2,200

2,300

2,400

Source: External Finance Wing, Finance Division

Multilateral and Bilateral

4.9 With improved macroeconomic indicators coupled with enhancing the pace

of project implementation process, disbursement from multilateral and

bilateral creditors would increase during the next few years. It is anticipated

that average yearly financial support from these partners would be around

US$ 6 billion during the program period.

Eurobonds

4.10 Pakistan had earlier issued three Eurobonds that mature in 2016, 2017,

and 2036. Government recently tapped International Bond and was

received with a overwhelming response i.e. government was able to raise

US$ 2,000 million against the target of US$ 500 in 2013-14. It is envisaged

that Pakistan Sovereign Bond amounting US$ 500 million will be issued

every year until 2017-18.

Pakistan: Medium Term Debt Management Strategy (MTDS)

17

5.0 MEDIUM TERM DEBT MANAGEMENT STRATEGY (MTDS)

5.1 The MTDS is developed for the period 2014-18 based on the public debt

outstanding as on June 30, 2013 in accordance with the scope defined

in section 1.

5.2 Under the alternative interest rates and exchange rates scenarios, the four

different borrowing strategies have been assessed with associated cost/risk

analysis. These alternative strategies are evaluated using the MTDS

analytical tool. The cost and risk trade off analysis is based on the existing

debt cash flows, market and macroeconomic projections and alternative

borrowing strategies under different scenarios.

5 (i) Funding Instruments and Baseline Assumptions

5.3 For future borrowing strategies, the MTDS analysis considers fourteen

stylized instruments (table 6) consisting six instruments reflecting external

sources of financing and eight instruments in domestic currency. Further

details of these instruments include interest rate type (fix or variable),

degree of concessionality (concessional, semi concessional or market

rate).

Table 6: Stylized

Instruments

# Instrument Type / Name DX / FX

Interest

Type

Concessionality

Maturity

(years)

Grace

Period

(years)

1 Concessional_USD_Fixed_40 External Fixed Concessional 40

10

2 Concessional_EUR_Fixed_40 External Fixed Concessional 40

10

3 Semiconc_USD_Fixed_25 External Fixed Semi-Concessional

25

10

4 Semiconc_USD_Var_25 External Variable

Semi-Concessional

25

10

5 Semiconc_JPY_Fixed_25 External Fixed Semi-Concessional

25

10

6 Eurobond_USD_Fixed_10 External Fixed Market 10

9

7 Bonds_PKR_Fixed_10 Domestic

Fixed Market 10

9

8 Bonds_PKR_Fixed_5 Domestic

Fixed Market 5

4

9 Bonds_PKR_Var_3 Domestic

Variable

Market 3

2

10 Retail_PKR_Fixed_10 Domestic

Fixed Market 10

9

11 Retail_PKR_Fixed_3 Domestic

Fixed Market 3

2

12 T-bills_PKR_Fixed_1 Domestic

Variable

Market 1

0

13 MR T-bills_PKR_Fixed_1 Domestic

Variable

Market 1

0

14 Bonds_PKR_Var_10 Domestic

Variable

Market 10

9

Source: Debt Policy Coordination Office Staff Calculations, Finance Division

Pakistan: Medium Term Debt Management Strategy (MTDS)

18

5.4 The loans from multilateral sources are labeled as “Concessional” and

aggregated under two similar stylized instruments i.e. one in US Dollar

(with an average interest rate of 0.8 percent) and other in Euro (with an

average interest rate of 1.5 percent).

5.5 “Semi-Concessional” loans include budget support and project loans from

bilateral sources. These loans are categorized in three instruments; two in

US Dollar (one with fixed interest rate and other with floating rate) and one

in JPY with fixed interest rate. The US Dollar instruments are priced on the

forward swap curve and the 6 month JPY LIBOR plus the historic premia,

whereas, the JPY instrument is priced at current ADB premium i.e. this

premium represents the degree of concessionality at which the creditors

are providing loans to Pakistan.

5.6 For Eurobonds, 10 years interest rate projections are based on US treasury

forward rate and the risk premium taken from the implied risk premium from

current Eurobonds in the secondary market.

5.7 Wholesale domestic market instrument are categorized as one year T-Bill,

MRTBs, 3 year GIS, 5 year and 10 year PIBs. The T-Bills (3, 6 and 12

months) are categorized in one year instrument given the functionality of

analytical tool. Projected short-term interest rates are based on the

expected future real SBP policy rate plus the projected inflation. Yield curve

is constructed by adding a term premia to the nominal policy rate with the

term premia derived from the spot yield curve and assumed to be constant

over time in the baseline scenario.

5.8 The retail NSS instruments are categorized by two stylized instruments of 3

and 10 years which reflect the assumption of likelihood of realizing these

maturities. The NSS instruments are priced at 95 percent of the rates used

for PIBs of the respective tenors.

5.9 As the government envisages extending the maturities in the domestic

market, a 10 year maturity floating rate PIB has been added to the analysis.

The reference interest rate is one year treasury bill rate.

5.10 The forward rates of US$, JPY and Euro are used to project the future

exchange rates for Pak Rupee which include the adjustments expected by

the government for 2014 and 2015. Future exchange rates of the Pak

Rupee against the JPY and Euro are based on US Dollar vs. Pak Rupee

Pakistan: Medium Term Debt Management Strategy (MTDS)

19

exchange rate projections and forward cross currency rates between the

US Dollar and the JPY and Euro respectively.

5 (ii) Shock Scenarios

5.11 The robustness of alternative debt management strategies was evaluated

by applying four stress/shock scenarios for exchange rates and interest

rates. These shocks to market variable are assumed not to affect other

macroeconomic parameters such as inflation, GDP and primary deficit. In

addition, the probability of the shocks happening is assumed to be same for

all strategies.

I. Exchange Rate Shock

5.12 A 30 percent depreciation of Pak Rupee against US Dollar and Euro, and

50 percent depreciation against JPY in the fourth year of analysis i.e. 2017

has been assumed. This estimation is based on the maximum annual

changes recorded between 2005 and 2013.

II. Large Interest Rate Shock

5.13 For the domestic interest rate flattening of the yield curve is assumed i.e.

an increase of 350 bps for MTBs and 170 bps for 10 year PIBs. This shock

is taken according to the historic trend of increase in the policy rate

80

90

100

110

120

130

140

150

160

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023

Fig-6:Exchange Rate Projections

Baseline 30% FX Shock

Pakistan: Medium Term Debt Management Strategy (MTDS)

20

coincided with a reduction in term spread between MTBs and PIBs. The

foreign currency reference rates are assumed to increase in-line with their

maximum annual increase over last 18 years. Additionally, Pakistani credit

spread is assumed to increase by 400 bps which is still less than the

extreme point observed historically.

III. Limited Interest Rate Shock

5.14 For this stress scenario, an increase in Pakistani credit spread over US

treasury rates of 200 bps is assumed which will also affect the Eurobond

yield. The domestic yield curve is shocked by a parallel upward shift of 200

bps. The US treasury rates are assumed at 1 percent and increase in

Japanese government rate is assumed at 0.5 percent which is half of the

historic observation in last 18 years.

IV. Combined Shock

5.15 Under this scenario, both exchange rate and interest rate are changed

simultaneously i.e. 15 percent depreciation of Pak Rupee against the US$

and Euro and 25 percent depreciation against JPY has been assumed in

2017. The interest rate sock is assumed according to the limited interest

rate shock scenario.

7%

8%

9%

10%

11%

12%

13%

1 Year 3 Years 5 Years 10 Years

Fig-7:-Pakistani Domestic Yield Curve

Baseline Scenario

Limited Interest Rate Shock

Large Interest Rate Shock

Pakistan: Medium Term Debt Management Strategy (MTDS)

21

5 (iii) Alternative Financing Strategies

5.16 The MTDS provides alternative strategies to meet the financing

requirements for Pakistan. The strategies are shown by the breakdown of

funding mix (domestic vs. external debt) and within the broad categories of

domestic and external, the share of each stylized instrument has also been

illustrated. While designing these strategies, the refinancing and exchange

rate risk was given more importance. Following four strategies are

assessed by the government:

I. Strategy 1 (S1: Planned Strategy)

5.17 This strategy represents the borrowing from external and domestic sources

as planned by the government for 2014 onwards. Gross external borrowing

accounts on average 7 percent mainly through Eurobonds, commercial

sources and project loans. The remaining 93 percent borrowing need is

expected to be met by MTBs, PIBs, 3 year GIS, NSS instruments, and

MRTBs. The MTBs is expected to contribute on an average over half of the

gross domestic funding and the rest absorbed by the longer tenor

instruments. The strategy represents a scenario where new external

borrowing is projected to be more than 20 percent of net borrowings over

the MTDS period.

II. Strategy 2 (S2: Lengthening of Maturity Profile - Fixed Rate

Instruments)

5.18 This strategy represents the cost and risk scenario of debt portfolio by

shifting part of MTBs to 10 year PIBs and increasing the external funding

slightly at the same time. The additional external financing will be sought as

per official estimate i.e. the higher project loans as compared to S1. The

share of stylized instruments under external debt has been slightly changed

compared with S1. The domestic financing will be available from PIBs, GIS,

NSS instruments and MTBs which will be rolled over with slight growth.

III. Strategy 3 (S3: Reliance on Short Term Domestic Instruments)

5.19 S3 assumes more reliance on domestic market and reduced external

funding. Under this strategy, it is assumed that on an average, 97 percent

of financing requirements would be derived from domestic sources mainly

Pakistan: Medium Term Debt Management Strategy (MTDS)

22

by issuance of MTBs and MRTBs. This scenario assumed the unavailability

of the projected disbursements from multilateral, bilateral and international

capital market. However, this strategy can complicate the domestic market

by creating high demand for short term maturity instruments.

IV. Strategy 4 (S4: Lengthening of Maturity Profile - Floating Rate

Instruments)

5.20 This strategy is similar to S2 in terms of share of domestic and external

financing except a new instrument having 10 year maturity with floating rate

is included i.e. the instrument accounts for almost 9 percent of the domestic

borrowing on an average basis over the MTDS period. This strategy aims

to lengthen the maturity profile while reducing refinancing risk. The said

instrument can be PIBs or GIS.

Table 7: Pakistan Financing Strategies (in percent of gross borrowing over

2014-18)

New debt

S1

S2

S3

S4

Concessional_USD_Fixed_40 External 0.6

0.8

0.3

0.8

Concessional_EUR_Fixed_40 External 0.6

0.8

0.3

0.8

Semiconc_USD_Fixed_25 External 1.9

2.4

1.1

2.4

Semiconc_USD_Var_25 External 1.9

2.4

1.1

2.4

Semiconc_JPY_Fixed_25 External 0.8

1.0

0.4

1.0

Eurobond_USD_Fixed_10 External 1.1

1.3

0.0

1.3

Bonds_PKR_Fixed_10 Domestic 2.3

9.1

1.1

1.0

Bonds_PKR_Fixed_5 Domestic 1.9

0.9

0.9

0.8

Bonds_PKR_Var_3 Domestic 2.6

2.0

2.7

1.9

Retail_PKR_Fixed_10 Domestic 1.9

1.8

1.0

1.8

Retail_PKR_Fixed_3 Domestic 9.1

9.0

7.0

9.0

T-bills_PKR_Fixed_1 Domestic 48.3

41.1

57.0

41.1

MR T-bills_PKR_Fixed_1 Domestic 27.0

27.4

27.2

27.4

Bonds_PKR_Var_10 Domestic 0.0

0.0

0.0

8.2

External 6.9

8.6

3.2

8.7

Domestic 93.1

91.4

96.8

91.3

Total 100.0

100.0

100.0

100.0

Source: Debt Policy Coordination Office Staff

Calculations, Finance Division

Pakistan: Medium Term Debt Management Strategy (MTDS)

23

Table 8: Pakistan: Portfolio Composition by Strategies

Outstanding by instrument

(in percent of Total)

2012

-

13

As at end of 2017

-

18

Current

S1

S2

S3

S4

Concessional_USD_Fixed_40 5.4

4.6

4.7

4.0

4.7

Concessional_EUR_Fixed_40 8.5

7.0

7.1

6.4

7.2

Semiconc_USD_Fixed_25 3.8

6.1

6.6

4.7

6.6

Semiconc_USD_Var_25 5.4

6.3

6.8

5.0

6.9

Semiconc_JPY_Fixed_25 8.6

7.4

7.5

6.5

7.6

Eurobond_USD_Fixed_10 1.1

2.5

2.7

0.2

2.7

Bonds_PKR_Fixed_10 4.1

6.9

18.7

4.6

4.0

Bonds_PKR_Fixed_5 5.4

3.8

1.7

2.0

1.5

Bonds_PKR_Var_3 3.3

3.0

2.5

4.2

2.5

Retail_PKR_Fixed_10 3.2

5.1

4.5

3.5

4.6

Retail_PKR_Fixed_3 13.9

13.4

11.4

11.8

11.3

T-bills_PKR_Fixed_1 21.0

23.0

16.3

33.0

16.0

MR T-bills_PKR_Fixed_1 16.3

10.9

9.7

14.1

9.5

Bonds_PKR_Var_10 0.0

0.0

0.0

0.0

15.0

External 32.9

33.9

35.3

26.8

35.7

Domestic 67.1

66.1

64.7

73.2

64.3

Total 100.0

100.0

100.0

100.0

100.0

Source: Debt Policy Coordination Office Staff Calculations, Finance Division

5 (iv) Cost - Risk Analysis of Alternative Strategies

5.21 The cost indicators (ratios) selected for the analysis are debt to GDP and

interest payment to GDP. The performance of each strategy is reviewed to

evaluate the variations in these cost indicators. Exchange rate variations

can have an impact on the debt stock, accordingly, the debt to GDP ratio is

critical to analyze in this context. Similarly, interest payments to GDP

evaluate the impact on budget balance in case of each strategy.

5.22 To evaluate the strategies, the number of risk indicators have been

examined such as ATM and ATR which reflect rollover and interest rate risk

respectively. The methodology and analysis of cost-risk indicators will

assist in obtaining the desired portfolio mix for debt effective management.

The risk has been computed by taking the maximum deviation from the

Pakistan: Medium Term Debt Management Strategy (MTDS)

24

baseline scenario. The outcome at the end of 2017-18 is used and the cost

and risks comparison of the alternative strategies under the shock scenario

is discussed in detail.

Table 9: Pakistan Cost and Risk Indicators by Strategies

Risk Indicators

2012-13

Current

As at end of 2017-18

S1 S2 S3 S4

Nominal debt as percent of GDP 60.9*

51.5

52.0

51.2

51.4

Implied interest rate (percent) 7.7

7.1

7.4

7.1

7.0

Refinancing risk

ATM External Portfolio (years) 10.1

12.8

13.0

12.1

13.0

ATM Domestic Portfolio (years) 1.8

2.5

3.6

1.9

3.6

ATM Total Portfolio (years) 4.5

6.2

7.1

4.8

7.1

Debt maturing in 1 year percent of total

46.0

40.0

31.6

53.3

31.2

Domestic debt maturing in 1 year

percent of total

64.2

59.8

47.9

71.9

47.5

Interest rate risk

ATR (years) 4.2

5.4

6.3

4.2

5.3

Debt Re-fixing in 1yr (percent of total) 52.4

49.1

40.6

61.6

55.2

Fixed rate debt (percent of total) 54.0

56.7

64.8

43.8

50.2

Foreign Currency

Risk

FX debt as percent of total 32.9

33.9

35.3

26.8

35.7

FX debt (payable in one year) as

percent of reserves

68.5

15.5

15.5

15.5

15.5

*Based on the MTDS Scope

Source: Debt Policy Coordination Office Staff Calculations, Finance Division

5.23 For the baseline scenario, the estimation shows a decrease in debt to GDP

ratio (60.9 percent in 2012-13) in the range of 51.2 percent to 52 percent by

end of 2017-18, depending upon the selection of strategy. The decrease in

debt to GDP ratio is mainly due to the primary surplus expected to realize

from 2014-15 onwards.

5.24 In terms of cost, strategies follow almost the same order for both indicators.

In terms of risk, they show substantial variation. The trade- offs between

cost and risk need to be made to arrive at the preferred strategy. There is a

large deviation from baseline scenario for all strategies for debt to GDP

ratio when exchange rate shock is applied. The interest rate shock also

generated high variations for all the strategies.

Pakistan: Medium Term Debt Management Strategy (MTDS)

25

5.25 As depicted above, S3 seems to perform well in terms of debt to GDP ratio

as lower proportion of financing from external sources are assumed i.e.

there is non-issuance of expensive Eurobonds which appear to

compensate the lower than expected disbursement of the cheaper

multilateral debt. The foreign exchange risk in S3 is also less due to lower

proportion of external debt. However, a caution is needed while making any

conclusion as the S3 represents the scenario where macroeconomic

indicators would not be the same as projected and higher funding would be

required from domestic sources at higher cost.

5.26 S3 seems to perform well in terms of foreign exchange risk due to lesser

external financing, however, it will result in increasing the refinancing risk

with total repayment reaching around 72 percent of domestic debt portfolio

by the end of 2018. Keeping in view the market absorption capacity, such

strategy may not be practical and feasible. Identification of relevant strategy

needs a meticulous appraisal of the cost and risk keeping in view the debt

portfolio’s exposure to different risks.

5.27 Both S2 and S4 are targeting the reduction of refinancing risk. From cost

perspective, S4 has the lowest interest cost which can be attributed to the

introduction of 10 year floating instrument along with the increased external

financing. S2 seems a costly alternative due to the higher rate of 10 year

instrument with fixed interest rate as compared with floating one.

5.28 From the risk perspective, S2 and S4 perform well as compared with S3

due to the fact that S3 have higher share of domestic debt with short term

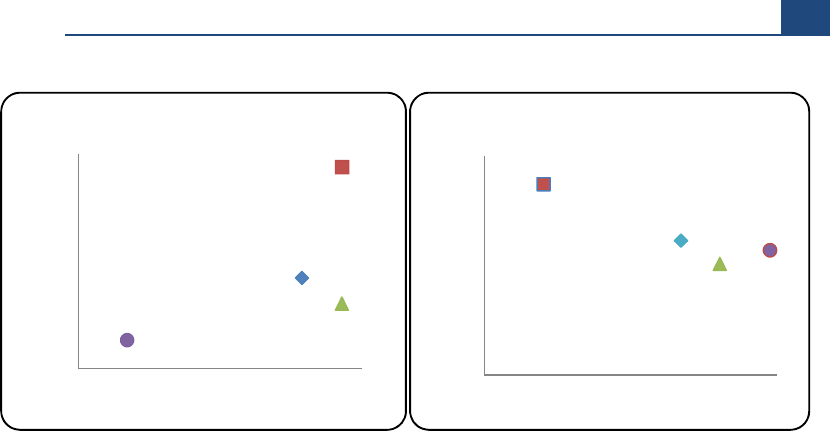

S1

S2

S3

S4

51.1

51.2

51.3

51.4

51.5

51.6

51.7

51.8

51.9

52.0

52.1

4.70 5.20 5.70

Cost (%)

Risk

Fig-8: Debt to GDP

(as at end of 2017-18)

S1

S2

S3

S4

3.0

3.1

3.2

3.3

3.4

3.5

3.6

3.7

1.20 1.25 1.30 1.35 1.40

Cost (%)

Risk

Fig-9: Interest to GDP

(as at end of 2017-18)

Pakistan: Medium Term Debt Management Strategy (MTDS)

26

maturities and thus entails higher refinancing risk. S2 and S4 have similar

risk trend for debt to GDP as both have same share of external funding and

thus foreign exchange risk is similar. But in terms of interest rate risk, S2

seems better than S4 owing to the 10 year fixed instrument.

5.29 The S1, the planned strategy is somewhere at the middle in terms of cost

and risk. It is a strategy which aims to manage the refinancing risk as well

as foreign exchange risk at the same time assuming the realized

disbursement of project loans and utilizing all the domestic instruments of

different maturities.

5.30 The average time to maturity is improving for all the strategies even for the

domestic debt. Whereas, the share of domestic debt maturing in 1 year is

more than 50 percent in S1 and S3. The redemption profile reflects a

0

2

4

6

8

10

12

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

2035

2036

2037

2038

2039

2040

Fig-11: Redemption Profile - S2

(PKR in trillion)

Domestic External

0

2

4

6

8

10

12

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

2035

2036

2037

2038

2039

2040

Fig-10: Redemption Profile - S1

(PKR in trillion)

Domestic External

0

2

4

6

8

10

12

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

2035

2036

2037

2038

2039

2040

Fig-12: Redemption Profile - S3

(PKR in trillion)

Domestic External

0

2

4

6

8

10

12

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

2035

2036

2037

2038

2039

2040

Fig-13: Redemption Profile - S4

(PKR in trillion)

Domestic

External

Pakistan: Medium Term Debt Management Strategy (MTDS)

27

higher refinancing risk in the short term even if the government is able to

attract all external funding sources as envisaged under S2 and S4.

5.31 Average time to re-fixing is higher in S2 as compared to S4 while the

refinancing risk is similar for both the strategies. S2 has highest ATR as it

assumes the instant shifting to the longer maturity instruments with fixed

rate.

5 (v) Recommended Strategy

5.32 An important consideration when comparing alternative debt management

strategies is a strategy which would best satisfy government's stated debt

management objectives to insure its financing at minimum cost and risk

while developing domestic debt market. Government needs to follow the

strategy which results in lengthening of its maturity profile to reduce the

refinancing risk along with providing sufficient external inflows in the

medium term to reduce the pressure on domestic resources keeping in

view cost-risk tradeoffs.

5.33 On the basis of cost and risk analysis of alternative strategies, a strategy,

such as S3, with an increased reliance on domestic short term sources is

least attractive. S2 and S4 assume lengthening of maturity profile by

issuing fixed and floating rate instruments, respectively. Moreover, S2 and

S4 have similar risk trend for debt to GDP as both have same share of

external funding and thus foreign exchange risk is similar. Both S2 and S4

are targeting the reduction in refinancing risk. However, S2 is expected to

result in greater average time to re-fixing i.e. there is less interest rate risk

in case of S2 as compared with S4 owing to more financing through

issuance of fixed interest rate instruments. The implementation of S2

seems feasible than others considering the current appetite for the fixed

rate longer tenor instruments. This is further supported by the fact that the

Government of Pakistan was able to raise substantial amount during 2013-

14 through PIBs. In the light of above mentioned facts, S2 seems to be a

preferential strategy for the government.

Pakistan: Medium Term Debt Management Strategy (MTDS)

28

6.0 CONCLUSION AND WAY FORWARD

6.1 Medium Term Debt Strategy is suggestive in nature which guides the

government to meet its financing requirements taking into consideration

cost and risk objectives. The MTDS estimation shows a decrease in debt to

GDP ratio in the range of 51.2 percent to 52 percent by end of 2017-18,

depending upon the selection of strategy.

Proposed Short Term Actions

6.2 To start with, debt management function within the Ministry of Finance

could be centralized with DPCO assuming enhanced responsibilities.

However, this would only be possible after its capacity building through

hiring of qualified staff on permanent basis. Currently, there is a ban on

recruitment which could delay this process.

6.3 The MTDS guidelines could be translated in to annual borrowing plan

which may specify types of instruments, volume and distribution of

financing throughout the year. A detailed borrowing plan is especially

important for domestic borrowing, where transparency and predictability are

essential for the well-functioning of auctions and also for the secondary

market.

Proposed Medium to Long Term Actions

6.4 Government intends to strengthen public debt management functions as

the debt management operations are fragmented across several agencies

and presently the DPCO has a limited role in public debt management. In

the medium term, the government plans to convert DPCO into a Debt

Management Unit with enhanced responsibilities to administer the

government’s financial obligations and cash flows. The unit will ensure the

government’s financing at the lowest possible cost given risk exposure

parameters, and will seek to improve the benchmarking of issues to

develop a deeper financial market. As a prerequisite,

− DPCO needs recruitment of additional qualified professional staff on

permanent basis.

− There is a need to revisit the FRDL Act, 2005.

Under this vision, the DPCO will become a pool of financial expertise with prime

focus on public debt management.

Annex:I - Domestic Debt

2008 2009 2010 2011 (P) 2012 (P) 2013 (P)

Permanent Debt 616.8 685.9 797.7 1125.6 1,697 2,179.2

Market Loans 2.9 2.9 2.9 2.9 2.9 2.9

Government Bonds 9.4 7.3 7.2 0.7 0.7 0.7

Prize Bonds 182.8 197.4 236.0 277.1 333.4 389.6

Foreign Exchange Bearer Certificates 0.2 0.2 0.1 0.1 0.1 0.1

Bearer National Fund Bonds 0.0 0.0 0.0 0.0 0.0 0.0

Federal Investment Bonds 1.0 1.0 0.0 0.0 0.0 0.0

Special National Fund Bonds 0.0 0.0 0.0 0.0 0.0 0.0

Foreign Currency Bearer Certificates 0.0 0.0 0.0 0.0 0.0 0.0

U.S. Dollar Bearer Certificates 0.0 0.0 0.0 0.0 0.0 0.0

Special U.S. Dollar Bonds 8.3 7.7 2.7 1.0 0.9 4.2

Government Bonds Issued to SLIC 0.6 0.6 0.6 0.6 0.6 0.6

Pakistan Investment Bonds (PIB) 411.6 441.0 505.9 618.5 974.7 1,321.8

Government Bonds issued to HBL 0.0 0.0 0.0 0.0 - -

GOP Ijara Sukuk 0.0 27.8 42.2 224.6 383.5 459.2

Floating Debt 1,637.4 1,904.0 2,399.1 3,235.4 4,143.1 5,196.2

Treasury Bills through Auction 536.4 796.1 1,274.1 1,817.6 2,383.4 2,921.0

Rollover of Treasury Bills discounted SBP 0.6 0.5 0.5 0.5 0.5 0.5

Treasury Bills purchased by SBP (MRTBs) 1,100.4 1,107.3 1,124.4 1,417.3 1,759.2 2,274.7

Outright Sale of MTBs

Unfunded Debt 1,020.4 1,270.5 1,457.5 1,655.8 1,798.0 2,146.5

Defence Savings Certificates 284.6 257.2 224.7 234.5 241.8 271.7

Khas Deposit Certificates and Accounts 0.6 0.6 0.6 0.6 0.6 0.6

National Deposit Certificates 0.0 0.0 0.0 0.0 0.0 0.0

Savings Accounts 27.7 16.8 17.8 17.2 21.2 22.3

Mahana Amadni Account 2.5 2.4 2.2 2.1 2.0 2.0

Postal Life Insurance 67.1 67.1 67.1 67.1 67.1 67.1

Special Savings Certificates and Accounts 227.6 377.7 470.9 529.1 537 734.6

Regular Income Scheme 51.0 91.1 135.6 182.6 226.6 262.6

Pensioners' Benefit Account 87.7 109.9 128.0 146.0 162.3 179.9

Bahbood Savings Certificates 229.0 307.5 366.8 428.5 480.8 528.4

National Savings Bonds - - 3.6 3.6 3.6 0.2

G.P. Fund 42.5 40.1 39.9 44.3 54.5 73.1

Short Term Saving Certificate 4.0

Total Domestic Debt 3274.5 3860.4 4654.3 6016.7 7638.1 9,521.9

Total Domestic Debt (Excluding Foreign

Currency Debt included in External Debt)

3,266.0 3,852.5 4,651.4 6,015.5 7,637.0 9,517.4

P: Provisional

Rs.in billion

2008 - 2013

Source: State Bank of Pakistan, Budget Wing and Debt Policy Coordination Office Staff Calculations

Annex:II - External Debt and Liabilities (EDL)

2008 2009 2010 2011 (P) 2012 (P) 2013 (P)

1. Public and Publically Guaranteed Debt 40.6 42.6 43.1 46.5 46.4 44.4

i) Public Debt 40.4 42.4 42.9 46.4 46.2 43.5

A. Medium and Long Term(>1 year) 39.7 41.8 42.1 45.7 45.6 43.5

Paris Club 13.9 14.0 14.0 15.5 15.0 13.5

Multilateral 21.4 23.0 23.7 25.8 25.3 24.2

Other Bilateral 1.1 1.4 1.8 1.9 2.5 2.9

Euro Bonds/Saindak Bonds 2.7 2.2 1.6 1.6 1.6 1.6

Military Debt 0.0 0.2 0.2 0.1 0.1 0.1

Commercial Loans/Credits 0.1 0.2 - - - -

Local Currency Bond (PIBs) 0.0 - 0.0 0.0 - 0.0

Saudi Fund for Development (SFD) - - 0.2 0.2 0.2 0.2

SAFE China Deposits - 0.5 0.5 0.5 1.0 1.0

NBP/BOC Deposits 0.4 0.3 0.2 0.1 - -

B. Short Term (<1 year) 0.7 0.7 0.9 0.6 0.5 0.0

Commercial Loans/Credits

IDB 0.7 0.7 0.8 0.6 0.5 -

Local Currency Securities (T-Bills) 0.0 - 0.1 0.0 0.0 0.0

ii) Publicly Guaranteed Debt 0.2 0.2 0.2 0.1 0.2 0.9

A. Medium and Long Term(>1 year) 0.2 0.2 0.2 0.1 0.2 0.9

Paris Club - - - - - -

Multilateral 0.1 0.1 0.1 0.0 0.0 0.3

Other Bilateral 0.1 0.1 0.0 0.0 0.2 0.6

Commercial Loans/Credits 0.0 - 0.1 - - -

Saindak Bonds - - - - - -

B. Short Term (<1 year) - - - - - -

IDB - - - - -