12631119

1

Sustainability

Global water scarcity: H2O no!

27 November 2023

Key takeaways

• Some 75% of our planet is covered with water, but less than 1% is usable, and even this is depleting quickly. Why? Water

demand is up approximately 40% over the past 40 years and is estimated to increase another 25% by 2050, yet supply has more

than halved since 1970.

• As a result, around half of the world's population already endures extremely high water stress at least one month of the year,

and at the current rate, we could run out of freshwater as soon as 2040. Additionally, as water scarcity worsens, $70 trillion of

global GDP (31%) could be exposed to high water stress by 2050, up from $15 trillion (24%) in 2010.

• But did you know that every dollar invested in water access and sanitation could potentially generate ~$7 in returns? The good

news is, it would cost only 1% of GDP annually until 2030 to solve the global water crisis and BofA Global Research identifies

$200 billion in potential solutions.

Are we running out of freshwater?

Water covers approximately 70% of our planet, but freshwater – what we need to drink, what we need to grow crops, what we

essentially need to live – is rare. Freshwater is only ~3% of the world’s water and a staggering two-thirds of this is in glaciers or

not available for use

1

. The remaining 97% of Earth’s water is ocean water (Exhibit 1). Of freshwater, 69% is in glaciers, 30%

underground and less than 1% is in lakes, rivers, and swamps (Exhibit 2). In essence, only 1% of water on Earth’s surface is

usable by humans, while 99% of the usable quantity is underground.

Exhibit 1: Distribution of the world’s water

3% of the world’s water is freshwater

Source: US Geological Survey

Exhibit 2: Distribution of freshwater

69% of freshwater is in icecaps and glaciers

Source: US Geological Survey

1

World Wildlife Fund (WWF)

I NSTITUTE

Accessible version

2

27 November 2023

I NSTITUTE

Today, we are using natural resources 1.7x faster than our ecosystem can regenerate

2

. And demand has risen approximately 40%

over the past 40 years. In fact, water use has been increasing globally by roughly 1% per year for the past 50 years. Between 1970

and 2019, global renewable freshwater per capita declined by 1.4% per year (or 50.8% in absolute terms; Exhibit 3). As a result,

around half of the world’s population already endures extremely high water stress at least one month of the year

3

and this is

expected to reach 60% by 2050 (Exhibit 4).

Exhibit 3: Global renewable internal freshwater resources per

capita, 1970-2019 (liters per capita)

Freshwater per capita has declined 1.4% per annum since 1970

Source: World Bank

Exhibit 4: Average water stress by region, 2050

By 2050, an additional 1bn people are expected to live with extremely

high water stress

Source: World Resour ces Institute (WRI); Aqueduct

It's clear that the world is transforming faster than ever, with rapid technological, environmental, and demographic change.

Against this backdrop people are demanding more security – including water secu rity. But at the current rate, freshwater could

run out as soon as 2040.

4

Why? Global demand is projected to increase by 20-25% by 2050

5

and two-thirds of the world’s

population could face shortages by 2025.

6

So, while demand is up 40%... supply is down 50%

Water demand already exceeds population growth. With the world’s population set to peak at ~10 billion by 2050, urbanization is

rising dramatically with 25% of the global population moving to cities, driving even more demand. Even gross domestic product

(GDP) growth should translate to a 400% increase in water demand by 2050.

At the same time, water supply is declining in both quality and quantity. Some 80% of global sewage is dumped into the sea

without adequate treatment and microplastics have been found in 83% of tap water.

7

Well over half (57%) of global freshwater

aquifers are beyond the tipping point, and even poor infrastructure limits supply as one-third of all fresh water running through

pipes globally is lost to leakage.

8

Water: The new frontier for geographical interaction

As water becomes scarcer and demand continues to grow, how water resources are shared between countries will become even

more important. Nearly half of all land surface and over 40% of the world’s population spanning 153 countries, are captured by

transboundary surface water basins (i.e., shared by two or more countries).

9

And ~80% of all countries share freshwater

resources with at least one other country. Despite this, a vast majority of them have no operational arrangements. In fact, 39

countries have over 90% of their land contained within transboundary river basins but 84% lack transboundary basin cooperation

agreements (Exhibit 5).

10

This, combined with scarce supply, could create more water-related interactions.

2

Global Footprint Network

3

World Resources Institute (WRI)

4

Aarhus University

5

WRI

6

WWF

7

National Geographic; World Economic Forum (WEF)

8

Liemberger and Wyatt

9

United Nations Educational, Scientific and Cultural Organization (UNESCO)

10

United Nations (UN)

0.0

2.0

4.0

6.0

8.0

10.0

12.0

1970

1972

1974

1976

1978

1980

1982

1984

1986

1988

1990

1992

1994

1996

1998

2000

2002

2004

2006

2008

2010

2012

2014

2016

2018

27 November 2023

3

I NSTITUTE

Exhibit 5: Transboundary river basins

39 countries have over 90% of their land contained within transboundary river basins

Source: Oregon State University, Transboundary Freshwater Dispute Database

So far, not enough investment has gone towards water

We need a four-fold increase in the current rate of reaching 100% global coverage of drinking water, sanitation and hygiene

services by 2030.

11

The same progress to achieve 100% coverage must be 5x faster in rural areas globally, 10x faster in the least

developed countries and 25x faster in urban areas globally.

12

Exhibit 6: Annual estimated cost until 2030 required to address

water scarcity (2015 US$ bn)

The estimated costs to address water scarcity annually are the largest in

North America and in East Asia and the Pacific

Source: WRI, BofA Global Research

Exhibit 7: Private finance mobilized through official development

finance across sectors, 2016-20 (US$ bn)

Private finance mobilized through ODA in energy is 11x larger than in

water supply and sanitation

Source: Organization for Economic Co-operation and Development (OECD)

Amongst water subsectors, water supply and sanitation need the biggest investment ($116 – $229 billion per year), but large

gaps also exist in flood protection ($23 - $335 billion per year) and irrigation ($43 - $100 billion per year).

13

Of the official

development assistance (ODA) to water, the category ‘sanitation, water and hygiene’ had the largest contribution at 57% from

1995-2014.

14

The overall ODA contribution to water has started to decline relative to other sectors, and only 4% of total ODA in

2021 was for water, while energy was 11x larger (Exhibit 7).

15

11

World Health Organization (W HO), United Nations Children’s Fund (UNICEF); UN’s Sustainable Development Goals Report 2022

12

WHO

13

UN

14

Goksu et al

15

Winpenny et al

119.5

118.2

68.4

58.8

36.5

32.4

11.5

0.0

20.0

40.0

60.0

80.0

100.0

120.0

140.0

Business,

banking and

financial

services

35%

Energy

23%

Industry,

mining and

constr uction

20%

Agriculture,

forestry, fishing

5%

Water supply

and sanitation

2%

Health

2%

Other

13%

4

27 November 2023

I NSTITUTE

Global warming exacerbates water stress and is costly

The climate and water crises are intertwined, and rising temperatures have reverberating effects around the world. For every

+1°C increase in global temperatures, there is a 20% drop in renewable water sources.

16

To put this in context, the average

global temperature has increased by at least 1.1°C since 1880

17

and July 2023 was the hottest month on record.

18

Rising temperatures increase the moisture in the atmosphere, leading to more storms and heavy rains. These, in turn, raise the

risk of floods, which can destroy or contaminate entire water supplies. Since 2000, floods in the tropics have quadrupled

compared with a 2.5-fold increase in the north mid-latitudes.

19

Over 2000-2019, floods affected 1.65 billion people, causing

$650 billion in economic losses.

In addition to more rainstorms, global warming can also lead to more dry spells, which pressures the water supply and increases

demand. Between 1970-2019, drought was one of the hazards that led to the largest human losses. In the past two years alone

(2020-2022), 23 countries have experienced droughts, affecting 1.43 billion people, with losses of nearly $130 billion.

20

By 2050, over half of the world’s population is projected to live in water-stressed regions with 1.6 billion people at risk of

floods.

21

As mentioned, floods and droughts can destroy or contaminate entire water supplies, which exacerbates water pollution

where sediments, pathogens and pesticides give rise to diseases like cholera and typhoid.

22

To address these issues, we would

need to invest $6.7 trillion by 2030 to $22.6 trillion by 2050,

23

which suggests a further $957.1 billion and $837 billion are

needed annually, respectively (from 2023).

Exhibit 8: Drought frequency is the number of years per decade in which at least one summer month

(June, July, or August) has had moderate to extreme drought severity

(Palmer Modified Drought Index (PMDI) less than or equal to -2)

Regional variation in drought risk in the US

Source: US Department of Agriculture (USDA ), Economic Research Service analysis using NOAA historical data by climate district

International mobilization on water security

Sustainable Development Goals

The 2030 Agenda for Sustainable Development was adopted by all United Nations (UN) Member States in 2015. It highlights 17

Sustainable Development Goals (SDGs), which prompt an urgent call to action for all countries. While investment in water is key

because it underpins all 17 of the UN’s SDGs, SDG 6 targets water, specifically the sustainable water management of water

resources. As it stands today, 107 countries are off track to reach SDG 6 by 2030, with acceleration needed most in South and

Central America, the Caribbean, Oceania, South Asia, Central Asia, Central Africa and West Africa.

24

16

UN

17

NASA

18

Goddard Institute for Space Studies

19

Najabi and Devineni

20

UN

21

UN

22

Intergovernmental Panel on Climate Change (IPCC)

23

Winpenny

24

World Meteorological Organization

27 November 2023

5

I NSTITUTE

UN Water Conference 2023

The Water Action Agenda was a result of the UN Water Conference 2023. It is a collection of all voluntary commitments to

accelerate progress to achieve the Water Action Decade 2018-2028 and 2030 Agenda for Sustainable Development. World

Resources Institute (WRI) analyzed the 719 water commitments the UN received as of March 28, 2023, and found that more

than one-quarter of them are potential game-changers, but the rest may not be effective enough to create substantial change.

According to WRI, one that stood out was a joint commitment from the Niger River Basin Authority and the German Federal

Ministry for the Environment, Nature Conservation, Nuclear Safety and Consumer Protection (BMUV). It involves investing $21.2

million through 2029 to strengthen climate change adaptation and mitigation in all nine countries that the Niger River runs

through and includes nature-based solutions such as smart agriculture and wetland restoration. On another note, CDP, a not-for-

profit that runs the global disclosure system for investors, companies, cities, states, and regions, has included 1,800 companies

in one of its Water Action Agenda commitments. They have pledged to invest in 2,719 water-smart products and services by

2028, representing at least $436 billion in opportunities.

COP28: An opportunity for water

As another example, COP27, the 2022 UN climate change conference held in November 2022, was the first COP (Conference of

the Parties) to include water on its official agenda. This year’s event, COP28, which will be held from November 30-December

12, 2023, also includes water on its official agenda, and will look to increase the awareness of international water-related risks

and opportunities in areas that have not received as much coordinated attention, such as agriculture. The Water Action Agenda

(from the UN Water Conference 2023) is hoped to develop into binding agreements, but there is also room for improvement on

the UN’s Water Action Agenda:

25

• Dedicated finance: The commitments need more financial backing; only 28% of commitments identified a clear

source of funding.

• Quantified targets: More water action commitments need quantitative targets for outcomes – only 22% of the 719

water action commitments submitted as of March 28, 2023, include quantitative targets. The ability to track progress in

a tangible way through measurable targets e.g., additional quantities of water made available, improved water quality,

increased number of protected/restored landscapes, increased percentage of the population with access to water could

prove to be essential.

• Great emphasis on the link between climate change and water: Water and climate change cannot be seen as

siloed issues. Water management extends to reducing emissions and undertaking adaptation projects. Climate

resilience means fixing leaky pipes, restoring water ecosystems and expanding access to sanitation and other water

services.

• Cooperation across borders and sectors: Only 12% of commitments (as of March 28, 2023) include cooperation.

Water is a cross-boundary issue, with transboundary waters comprising 60% of the world’s freshwater flows. One way

of improving on cooperation may be the implementation of more transboundary agreements.

• More commitments from governments and multilateral institutions: Approximately 43% of the Water Action

Agenda commitments came from NGOs (non-governmental organizations) and, as of March 28, 2023, only 26% are

from governments and 11% are from multilateral institutions, e.g., the UN and development banks. Governments have a

lot of control over how water is managed and allocated through water policies and regulation. They also have access to

the funding through international grants or lending programs, and they can shape policies and pool money that can be

dedicated to improving the provision of water services.

• Plans targeting agricultural and industrial water users: Only 13% of plans target agriculture and 5% target

industry, yet these two sectors are some of the largest water consumers. Agriculture represents ~70% of the world’s

freshwater withdrawals and industry uses ~19%.

The problem and the solutions are well-known; what’s missing is the funding and collective political will to act. The Paris

Agreement sets a global goal to limit temperature rise to 1.5°C and is underpinned by national climate action plan s. A similar

agreement for water is necessary, with COP28 and other such international conventions likely to become opportunities for

governments and policymakers to further address the water crisis.

25

WRI

6

27 November 2023

I NSTITUTE

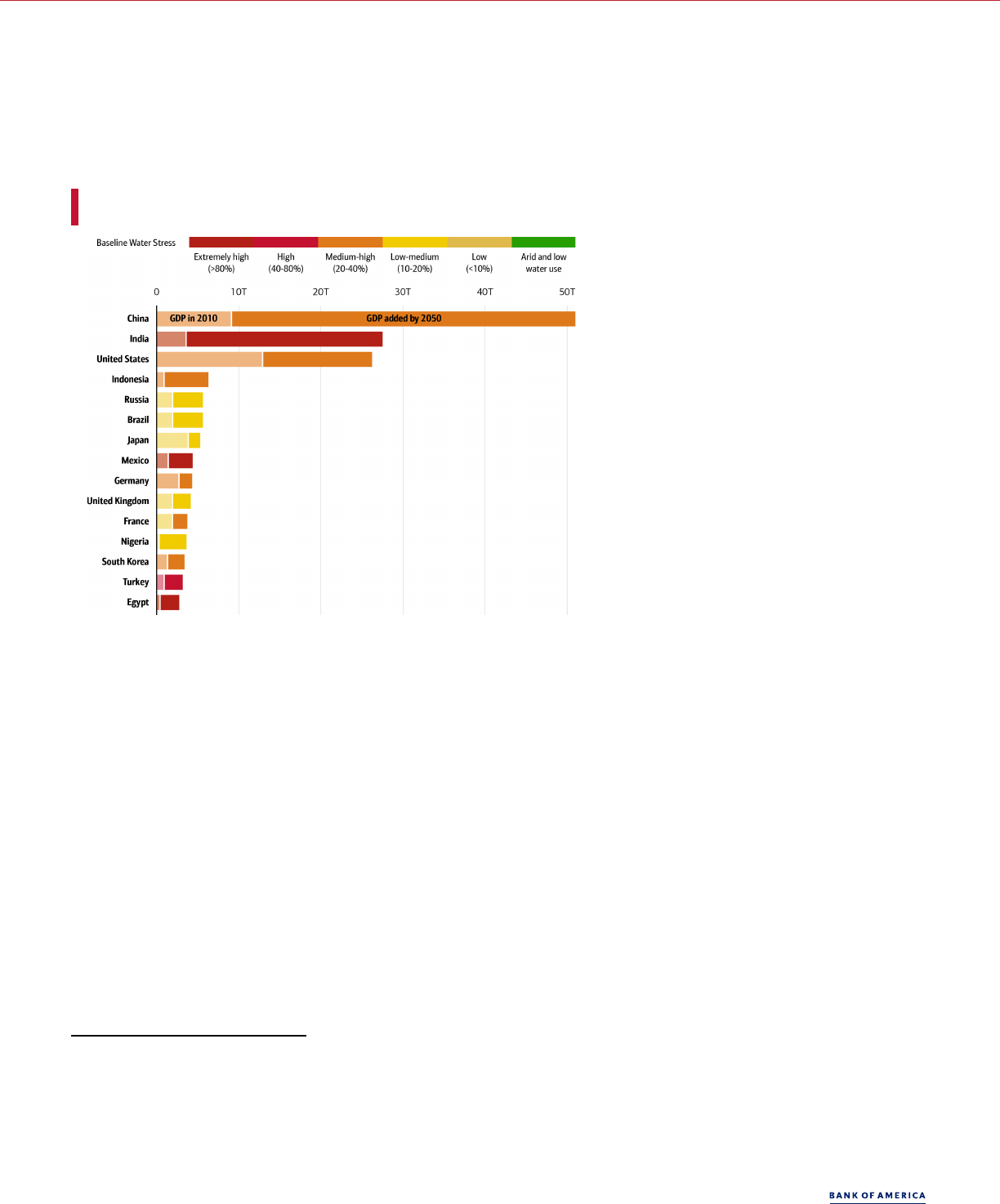

Structural pressures are putting GDP at risk

As water scarcity worsens, $70 trillion of global GDP (31%) could be exposed to high water stress by 2050, up from $15 trillion

(24%) in 2010 (Exhibit 9).

26

India, Mexico, Egypt and Turkey alone account for >50% of the exposed GDP in 2050E. As the

competition for water intensifies, the World Bank predicts some regions will see a growth rate decline of 6% of GDP by 2050.

Total economic losses cost $260 billion annually in 2010 due to water insecurity, including inadequate water supply and

sanitation.

27

This is equivalent to an average loss of ~1.5% of annual global GDP.

28

Failing to implement better water

management policies could result in regional GDP losses of between 2% and 10% by 2050.

29

Exhibit 9: Top 15 largest GDPs by 2050 (projected GDP and water stress)

According to Aqueduct, 31% of global GDP will be exposed to high water stress by 2050

Source: WRI; Aqueduct

The good news: Only 1% of GDP until 2030 can solve the water crisis

Every dollar invested in water access and sanitation could potentially generate ~$7 in returns

30

and the good news is it would

cost only 1% of GDP each year until 2030 to solve the global water crisis. It would cost $1.04 trillion annually from 2015 to 2030

to deliver sustainable water management for all countries and major basins,

31

which means it would take only 1% of GDP to

solve the global water crisis, or $0.29 per person, per day, from 2015-2030.

32

In fact, the cost of water risks is five times higher

than the cost of taking action.

33

Investment in water is accretive to GDP, adding 3.6pp to growth. If developing countries had

improved access to safe water and sanitation services, their average annual GDP growth could rise to 3.7% from 0.1%.

34

Each country and region’s investment gaps are different

WRI analyzed what it could take in terms of costs to achieve a combination of six strategies that can provide sustainable water

management (access to water and sanitation for all by 2030): 1) delivering safely managed drinking water to all populations

without access, 2) delivering safely managed sanitation and hygiene services to all populations without access, 3) treating all

industrial wastewater to tertiary treatment levels, 4) reducing nutrient loading to acceptable concentrations within water bodies,

5) addressing water scarcity by bringing water withdrawals in line with water demand while accounting for environmental flow

rates, and 6) adopting water management, regulations and legislation to accompany the above sets of solutions.

26

WRI

27

Organization for Economic Co-operation and Development (OECD)

28

Sadoff et al

29

World Bank

30

World Bank

31

WRI; Strong et al

32

WRI

33

CDP

34

Sanitation and Wate r for All

27 November 2023

7

I NSTITUTE

WRI found that 75 countries can achieve sustainable water management at 2% or less of their annual GDP e.g., US and South

Africa; 70 can achieve it with 2-8% of GDP; and 17 will require more than 8%. Water scarcity is the overall cost driver globally

(Exhibit 10) but at a regional level, the estimated costs of addressing water scarcity are largest in North America and in East Asia

and the Pacific (Exhibit 11). Sub-Saharan Africa and Latin America and the Caribbean have relatively lower water scarcity

estimated costs.

Exhibit 10: Global breakdown of annual estimated costs for a

sustainable water future until 2030 (2015 US$ bn)

Water scarcity is the largest component (43%) of global costs

Source: WRI

Exhibit 11: Annual estimated cost until 2030 required to address

water scarcity (2015 US$ bn)

The estimated costs to address water scarcity annually are the largest in

North America and in East Asia and the Pacific

Source: WRI, BofA Global Research

Breaking it down: The problems and $200 billion in potential solutions

Water links in with nearly every other crisis we face. The World Economic Forum’s (WEF) Global Risks Perception Survey 2022-

23 put natural resource crises within the top 10 risks in the next two and 10 years, and water certainly falls under this category.

Through indirect channels, water has relevance to all the other top risks for both the two-year and 10-year time horizon with

cybercrime and cyber insecurity (e.g., impact on water infrastructure), and large-scale involuntary migration as examples. In a

similar vein, water has an impact on many other areas such as energy, food, biodiversity, and migration.

An investment in infrastructure could be one of the first lines of defense against the water crisis. The implementation of water

management and tech like smart meters, artificial intelligence (AI) and smart irrigation could also result in better water use.

Additionally, treatment like desalination is key for securing supply and already accounts for 90% of drinking water in some

countries.

However, countries have different freshwater resources, population pressures, and water sector structures – privatized vs.

nationalized etc. – which means that there is no one-size-fits-all solution to address the world’s issues. Instead, a combination of

solutions is needed to solve the water problem: technology, investment, government regulation/policy, corporates and individuals

managing water demand.

1. Water infrastructure

Ageing infrastructure poses potential health problems, and also water loss

Ageing infrastructure is struggling to meet rising demand as populations grow and higher incomes and industrialization lead to

more intense water use. As an example, much of the US’ water and waste infrastructure was built in the 1970s and 1980s. Aged

pipes can contaminate the water supply and lead to illness. Globally 32 billion cubic meters of water is lost annually, with 45

million cubic meters lost daily in developing countries, costing $3 billion a year.

Utilities: global market valued at $67.3 billion in 2022

Funding for US water utilities has consistently lagged investment needs. Despite growing at 5% each year over the past 10

years, water rates are lower in the US than in peer countries in the European Union (EU) and United Kingdom (UK). In a 2019

survey, 31% of utilities expressed doubts about their ability to cover the full cost of service.

35

In fact, the cost of service rose to

42% of total costs during 2020.

However, raising tariff rates to cover this might not be a practical solution because water bills are already high for many US

households.

36

In 2019, 20% of US households were spending more than 4.5% of their household income on water bills – a

35

American Water Works Association State of the Water Industry

36

McKinsey

Water scarcity

445

43%

Water

management

172

17%

Water pollution

(industrial &

agricultural)

153

15%

Access to

sanitation

services

150

14%

Access to

drinking water

113

11%

119.5

118.2

68.4

58.8

36.5

32.4

11.5

0.0

20.0

40.0

60.0

80.0

100.0

120.0

140.0

8

27 November 2023

I NSTITUTE

percentage that is considered unaffordable. Looking at the bigger picture, according to a recent Institute publication, utility

payments have risen nearly 20% since 2018. Overall, the global water utility services market was valued at ~$67.3 billion in 2022

and is expected to grow at an 8% C A GR (compound annual growth rates) until 2030 to reach $89.7 billion.

37

PVC pipes market: 4.4% CAGR 2021-30E

One of the biggest investments in the water industry is maintaining and upgrading infrastructure — the pipes, pumps, valves,

and tanks that make water systems work. This segment is growing at around 10% a year,

38

and in the US, water-pipe

replacement rates are likely to peak in 2035 at 16,000 to 20,000 miles each year,

39

which is 4x the current annual replacement

rate of 4,000 to 5,000 miles.

Over the next 10 years, $50 billion is expected to be spent on shifting from iron and steel to plastic pipes.

40

PVC (polyvinyl

chlorine) is a synthetic polymer of plastic, which, along with similar materials, is 30-70% cheaper than typical pipe materials. PVC

pipes are environmentally friendly, noncorrosive, and durable with some having an expected design life of more than 100 years

without the need for extensive corrosion treatment. They can help reduce water loss by up to 40% compared to old technology

piping networks.

41

The global PVC pipes market size was valued at $6.77 billion in 2021 and is expected to hit $9.95 billion by

2030, growing at a CAGR of 4.4%.

42

Storm surge gates and flood barriers: a $25.2 billion market by 2030E

Fixed installations that allow water to pass in normal conditions but have gates or bulkheads that can be closed against storm

surges or high tides, can be essential in preventing future flooding. They can be complemented with dikes, seawalls, levees, and

beach nourishments.

43

The global flood barrier market was worth $17.4 billion in 2022 and is expected to reach $25.2 billion by

the end of 2030E,

44

growing at a CAGR of 4.7%. Flood barriers can deflect water waves, absorb wave energy, and protect cliff

bases and beaches, but potential challenges to the flood barrier market involve high upfront installation costs, oscillating raw

material costs, and disruption to supply chain activities.

2. Water management

Population growth and food supply also puts pressure on water

The growing global population, expected to reach 8.6 billion in 2030, 9.7 billion in 2050, and 10.4 billion by 2100

45

(Exhibit 12)

implies greater food demand. As mentioned in Food (in)security: Hungry for change

, by 2050, the population will require 56%

more food than today.

46

The world will have 43 megacities (cities with more than 10 million inhabitants) by 2030 compared with 31 today. By 2050, the

global urban population is projected to reach 6.7 billion from 4.2 billion today, with a consequent 50-70% increase in water

demand.

47

The number of city dwellers facing water scarcity is expected to rise from 933 million (one-third of the global urban

population) in 2016 to 1.7-2.4 billion people (one-half of the global urban population) in 2050, with India to be the most severely

affected.

48

The challenge, however, is that agriculture is already the largest user of water, representing more than 70% of withdrawals

(Exhibit 13). In fact, it takes between 2,000 and 5,000 liters of water per year to produce a person’s daily food intake.

49

Furthermore, meat production accounts for a third of the freshwater used for agriculture. Agricultural land used for irrigation has

more than doubled, and the use of fertilizers has risen by >10x since the 1960s and is projected to increase from ~90 million

tonnes in 2000 to more than 150 million tons by 2050. And this is costly as fertilizer run-off costs the environment $200-800

billion annually.

50

So, more people mean more food demand, means more water stress. One potential solution is ‘future food’ (think: alternative

dairy, plant-based meat, smart/micro irrigation, and precision agriculture), which can alleviate water demand pressures from

agriculture (see Feeding the future

for more).

37

Zion Market Research

38

Canaccord Genuity

39

US Environmental Protection Agency (EPA)

40

NASDAQ

41

Think Pipes Think PVC

42

Precedence Research

43

US EPA; Climate ADAPT

44

Zion Market Research

45

UN

46

UN Environment Programme (UNEP)

47

World Bank

48

He et al

49

Food and Agriculture Organization of the United Nations (FAO)

50

FAO, United Nations Development Programme (UNDP)

27 November 2023

9

I NSTITUTE

Exhibit 12: Total population (bn) with 10-year CAGR

Global population expected to reach 8.6bn in 2030 and 10bn by 2060

Source: UN

Exhibit 13: Annual freshwater withdrawals by usage (2019)

At a global level, agriculture is the #1 user of water

Source:

FAO, AQUASTAT, World Bank, BofA Global Research. NOTE: Withdrawals for

agriculture are total withdrawals for irrigation and livestock production. Withdrawals for

domestic uses include drinking water, municipal use

or supply, and use for public services,

commercial establishments, and homes. Withdrawals for industry are total withdrawals for

direct industrial use (including withdrawals for cooling thermoelectric plants).

Digital solutions expenditure: $55.2 billion in ~2030

The increased use of the internet of things (IoT), big data, blockchain, artificial intelligence (AI), and sensor technologies and

modelling applications is creating opportunities to monitor water management systems more accurately.

51

Companies are

starting to use technology (connectivity, mobility, automation and analytics) to monitor their water supplies and detect leaks,

thus reducing costs and improving efficiencies. US water utilities, typically smaller ones, have been slow to invest in technology

to improve health and safety.

52

Water and wastewater utility expenditure on digital solutions, including smart meters and

upgrades to supervisory control and data-acquisition systems, is forecast to grow from $25.9 billion in 2021 to $55.2 billion in

2030, a CAGR of 8.8%.

53

Industrial water withdrawals

Global GDP could double by 2050E

54

and there could be an increase in water demand of 400% in manufacturing and 140% in

thermal power generation globally between 2000 and 2050.

55

Water use by industry is dominated by energy production, which is

responsible for ~75%, with the remaining 25% of industrial water withdrawals being used for manufacturing.

56

By 2035, water

withdrawals for energy production could go up by 20% and consumption by 85%, driven by a shift to higher efficiency power

plants with more advanced cooling systems and increased production of biofuel.

57

All sources of energy use water in the production process, e.g., raw material extraction and the cooling processes. Industry and

energy use ~19% of the world’s freshwater withdrawals,

58

with energy alone accounting for ~10%.

59

While this is significantly

less than the 70% used in agriculture, it is still a large amount. Solutions to this may include renewables (solar, wind), because

switching to even 75% renewables would reduce water use by 47% by 2040 (given their lower relative water use vs. fossil fuels),

and energy efficiency enablers (insulation, heat pumps, lighting etc.).

Data centers require water for cooling purposes: On the rise with the AI evolution

In the US, data centers can consume ~660 billion liters of water each year, making this market one of the largest users of water.

BofA Global Research believes that generative AI will change our world (see Me, myself and AI

) and the continued unfolding of

this AI evolution implies greater demand for data centers (see The AI evolution: Reality justified the hype). Graphics processing

units (GPUs) are more efficient for AI purposes than existing central processing units (CPUs), but they require roughly twice as

much more power and more cooling. According to BofA Global Research, demand for uninterruptible power supply, cooling

systems (traditional air, as well as liquid) and ancillary electrical equipment could rise at CAGRs of well above 10% to 2030. An

51

UN

52

McKinsey

53

Bluefield Research

54

PwC

55

OECD

56

UN

57

International Energy Agency ( IEA)

58

Ritchie and Roser

59

IEA

2.5

3.0

3.7

4.4

5.3

6.1

7.0

7.8

8.5

9.2

9.7

10.1

10.3

10.4

10.4

10.3

-0.5%

0.0 %

0.5 %

1.0 %

1.5 %

2.0 %

2.5 %

0.0

2.0

4.0

6.0

8.0

10.0

12.0

World 10 - yea r CA GR

10

27 November 2023

I NSTITUTE

incremental 1 megawatt of power supplied would require ~285 tons of cooling, similar to the requirements for a 115,000 square

foot commercial building.

60

Waste decreases water quality

Waste generation rates are rising. In 2020, the world generated an estimated 2.24 billion tonnes of solid waste or 0.79kg per

person per day.

61

With rapid population growth and urbanization, waste generation is expected to increase by 73% from 2020

levels to 3.88 billion tonnes in 2050.

62

Water can be contaminated from a variety of sources such as fertilizers, pesticides, sewer

overflows, wildlife, cracks in waterpipes, but solutions include sustainable product packaging like bioplastics and biodegradables.

3. Water treatment

Water supply has more than halved since 1970; waste pollutes our water systems

Water demand is up ~40% over the past 40 years and estimated to go up another 25% by 2050,

63

but supply has more than

halved since 1970.

64

Water supply, both in terms of quality and quantity, has been decreasing. In fact, every year 80% of global

sewage is dumped into the sea without adequate treatment and ~8 million tons of plastic waste escapes into the ocean.

65

Alarmingly, current levels of nitrogen and phosphorus pollution from agriculture may already exceed globally sustainable limits.

And nitrogen concentrations in the ocean have increased three-fold since pre-industrial times, causing overgrowth of plants and

algae, which prevents aquatic life from getting oxygen. Furthermore, microplastics have been found in 83% of tap water.

66

And

what about food? Well, people eating seafood could be ingesting up to 11,000 pieces of microplastic each year.

67

Additionally, underground aquifers supply 35% of the world’s water, but we are depleting them at an alarming rate, which is

contributing to water salinity increasing by 10% per year and requires solutions to ensure a greater supply of freshwater moving

forward.

Water treatment chemicals market: 3.2% CAGR in 2022-27E

Water treatment involves the removal of various contaminants, including bacteria, algae, viruses, fungi, minerals such as iron,

manganese and sulphur, and other chemical pollutants such as fertilizers. Public drinking water systems use different treatment

methods to provide safe drinking water and involve a variety of steps: coagulation, flocculation, sedimentation, filtration, and

disinfection.

68

Various chemicals can be used, such as chlorine, chloramine, or chlorine dioxide for disinfection, and hydrochloric

acid, nitric acid, sulphuric acid, and calcium carbonate for pH adjustment. The water treatment chemicals market was worth

$35.9 billion in 2022 and is projected to reach $42.2 billion by 2027E, a CAGR of 3.2%.

69

Water testing: 6% CAGR from 2022 to 2030E

Drinking water quality varies but it must meet the local country’s regulations. While tap water is generally deemed safe,

contamination can still occur from many sources: sewage releases; naturally occurring chemicals and minerals; local land use

practices (e.g., fertilizers, pesticides, livestock); and manufacturing processes (e.g., heavy metals, cyanide). Water testing is

carried out to meet regulatory requirements and to adhere to pollutant-free water. In the US, the EPA sets standards and

regulations for the presence and levels of more than 90 contaminants in public drinking water, including E.coli, Salmonella,

Cryptosporidium and lead.

70

The water testing market was worth $4.5 billion in 2021 and is expected to reach ~$8 billion by

2030E, growing at a CAGR of 6%.

71

Water recycling: 11% CAGR until 2028E

Only 44% of withdrawn freshwater is consumed. The remainder, which is emitted as wastewater and agricultural drainage,

provides a minimally tapped water resource, which is equal to ~50% of forecast unfilled water demand by 2030E.

72

Water

recycling alleviates the pressure on freshwater resources by reclaiming water from different sources and then treating and

reusing it in agriculture and irrigation, groundwater replenishment, industrial processes, municipal water supply and dust

control.

73

Treatment systems can even return the water to higher purification levels than at the start.

74

60

BofA Global Research

61

World Bank

62

World Bank

63

WRI

64

World Bank

65

National Geographic; WEF

66

WEF

67

WEF

68

Centers for Disease Control and Prevention

69

Markets and Marke ts

70

Centers for Disease Control and Prevention

71

Custom Market

72

UNESCO

73

US EPA

74

Smart Water Magazine

27 November 2023

11

I NSTITUTE

4. Water technology

Desalination: 10.5% CAGR 2022 to 2030E

Desalination is the process that removes mineral salts from saline water. It can also be used to treat wastewater or brackish

water. There are two main types of desalination technology: membrane (reverse osmosis, electrodialysis, electrodialysis reversal,

nanofiltration, ultrafiltration, microfiltration) and thermal (multi-effect distillation, mechanical vapour compression and multi-

stage flash distillation). With 97% of all water on Earth being seawater, desalination appears an attractive solution, but it

currently only provides 1% of the world’s drinking water.

75

However, some Middle Eastern countries use desalination for up to

90% of their drinking water needs. This region, mainly Saudi Arabia, Kuwait, United Arad Emirates, Qatar and Bahrain, supplies

~40% of global desalinated water.

76

The desalination market was worth $15.2 billion in 2022 and is set to grow at 10.5% per

year to $33.38 billion in 2030.

77

Moonshot solutions: Space and oceans

Asteroid mining: $700 “quintillion” in Mars/Jupiter asteroid belt

Asteroids contain water, which could be the key to getting to Mars and deep-space exploration. Water is an invaluable

commodity in space, given the potential difficulties of mining ice in Mars and/or bringing an asteroid back to Earth. Mining water

from asteroids is called ‘optical mining’ and the process involves using sunlight concentrated by mirrors to extract water and

other materials from asteroids. Looking ahead, a proposed NASA plan involves harvesting up to 100 metric tons of water from a

near-Earth asteroid.

Oceans = ~35% of greenhouse gases cuts to limit temperature increases to 1.5C

Ocean opportunities include blue carbon ecosystems, which can store up to 5x more carbon per area than tropical forests

78

and

absorb it from the atmosphere ~3x as fast;

79

scaling ocean-based renewable energy, which could cut greenhouse gas emissions

by an amount equal to the total combined emissions of all 27 EU member states in 2021;

80

and expanding ocean-based food

production of sustainable seafoods such as algae, fish and invertebrates.

75

International Water Association

76

WEF

77

Research and Markets

78

National Ocean Service

79

Alongi

80

European Environment Agency

12

27 November 2023

I NSTITUTE

Contributors

Vanessa Cook

Content Strategist, Bank of America Institute

Sources

Haim Israel

Research Analyst, BofA Global Research

Lauren-Nicole Kung

Research Analyst, BofA Global Research

Felix Tran

Research Analyst, BofA Global Research

Martyn Briggs

Research Analyst, BofA Global Research

27 November 2023

13

I NSTITUTE

Disclosures

These materials have been prepared by Bank of America Institute and are provided to you for general information purposes only. To the extent these materials reference Bank of

America data, such materials are not intended to be reflective or indicative of, and should not be relied upon as, the results of operations, financial conditions or performance of Bank

of America. Bank of America Institute is a think tank dedicated to uncovering powerful insights that move business and society forward. Drawing on data and resources from across

the bank and the world, the Institute delivers important, original perspectives on the economy, sustainability and global transformation. Unless otherwise specifically stated, any

views or opinions expressed herein are solely those of Bank of America Institute and any individual authors listed, and are not the product of the BofA Global Research department or

any other department of Bank of America Corporation or its affiliates and/or subsidiaries (collectively Bank of America). The views in these materials may differ from the views and

opinions expressed by the BofA Global Research department or other departments or divisions of Bank of America. Information has been obtained from sources believed to be

reliable, but Bank of America does not warrant its completeness or accuracy. Views and estimates constitute our judgment as of the date of these materials and are subject to change

without notice. The views expressed herein should not be construed as individual investment advice for any particular client and are not intended as recommendations of particular

securities, financial instruments, strategies or banking services for a particular client. This material does not constitute an offer or an invitation by or on behalf of Bank of America to

any person to buy or sell any security or financial instrument or engage in any banking service. Nothing in these materials constitutes investment, legal, accounting or tax advice.

Copyright 2023 Bank of America Corporation. All rights reserved.