1

UNITED STATES DISTRICT COURT

FOR THE EASTERN DISTRICT OF TEXAS

SHERMAN DIVISION

UNITED STATES OF AMERICA,

ex rel. STF, LLC,

Plaintiff,

v.

CHRISTOPHER GROTTENTHALER, SUSAN

HERTZBERG, JEFFREY “BOOMER” CORNWELL,

STEPHEN KASH, MATTHEW THEILER, WILLIAM

TODD HICKMAN, COURTNEY LOVE, LAURA

HOWARD, CHRISTOPHER GONZALES, JEFFREY

MADISON, PEGGY BORGFELD, STANLEY JONES,

JEFFREY PARNELL, THOMAS GRAY HARDAWAY,

RUBEN MARIONI, JORDAN PERKINS, GINNY

JACOBS, SCOTT JACOBS, ASCEND

PROFESSIONAL MANAGEMENT, INC., ASCEND

PROFESSIONAL CONSULTING, INC., BENEFITPRO

CONSULTING LLC, NEXT LEVEL HEALTHCARE

CONSULTANTS LLC, LGRB MANAGEMENT

SERVICES LLC, S&G STAFFING, LLC, and JACOBS

MARKETING, INC.,

Defendants.

Civil Action No. 4:16-CV-547

UNITED STATES’

COMPLAINT AND

DEMAND FOR JURY TRIAL

FILED UNDER SEAL

The United States of America, for its complaint, states:

NATURE OF ACTION

1. This is an action against laboratory and hospital executives, employees, and

recruiters to recover treble damages and civil penalties under the False Claims Act (FCA), 31

U.S.C. §§ 3729–33, and to recover money for common law or equitable causes of action for

payment by mistake and unjust enrichment.

2. From at least 2010 to 2014, various laboratories encouraged healthcare providers

to order blood tests by directly paying providers kickbacks disguised as processing and handling

(P&H) fees. Laboratories competed to offer the highest P&H fees to providers, topped by Health

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 1 of 154 PageID #: 884

2

Diagnostics Laboratory, Inc. (HDL) paying $20 per referral. Various FCA suits against

laboratories and individual defendants were filed regarding these kickbacks to referring providers,

including FCA suits against HDL and Boston Heart Diagnostics Corporation (BHD). In June 2014,

the Office of the Inspector General for the Department of Health and Human Services (HHS-OIG)

issued a special fraud alert warning about kickbacks for laboratory referrals. In April 2015, the

Department of Justice (DOJ) intervened in an FCA suit alleging that HDL and three executives

had offered and paid kickbacks for laboratory referrals. HDL settled for $47 million and each of

the three executives were found liable for over $111 million in a judgment affirmed in all respects

by the Fourth Circuit, with certiorari denied by the Supreme Court. Similarly, BHD paid over $26

million to settle allegations of paying P&H fees and other kickbacks.

3. Despite HHS-OIG’s published warning and DOJ’s enforcement action, a new

laboratory kickback scheme began in or about August 2014, just two months after HHS-OIG’s

special fraud alert. The kickback scheme involved payments to healthcare providers through

purported management services organizations (MSOs) to induce the providers’ laboratory

referrals. The MSO kickback scheme began by executives Jeffrey Madison and Peggy Borgfeld at

Rockdale Hospital d/b/a Little River Healthcare (LRH), a small critical access hospital system

based in Rockdale, Texas. While the MSO kickback scheme initially concerned toxicology testing,

it expanded to include diagnostic blood testing in or about May 2015, just one month after DOJ’s

enforcement action against HDL and three executives.

4. Through the MSO kickback scheme, many of those previously involved in the

laboratory P&H fee kickback scheme continued to use kickbacks to induce laboratory referrals.

Both BHD and HDL’s successor, True Health Diagnostics, LLC (THD), joined and participated

in the MSO kickback scheme. So did their executives, including THD’s Chief Executive Officer

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 2 of 154 PageID #: 885

3

(CEO) Christopher Grottenthaler, Vice President (VP) of Sales Boomer Cornwell, Director of

Strategic Accounts Stephen Kash, and Account Executive Courtney Love, and BHD’s CEO Susan

Hertzberg, VP of Sales Matthew Theiler, and Area Sales Manager Laura Howard. Cornwell, Kash,

Love, and Howard each had worked as employees or contractors for HDL and had offered P&H

fee kickbacks to providers in Texas. With their new kickback schemes, they targeted many of the

same providers who had received P&H fee kickbacks.

5. In the MSO kickback scheme, BHD and THD conspired with small Texas hospitals

to submit false claims to Medicare, Medicaid, and TRICARE. Pursuant to the kickback scheme,

the hospitals paid recruiters to arrange for and recommend referrals, and the recruiters kicked back

a portion of the hospital payments to the referring providers who ordered BHD or THD laboratory

tests from the hospitals or from BHD or THD themselves. BHD and THD, though competitors,

worked with the same hospitals and recruiters to pay kickbacks to providers. Their executives and

sales force leveraged the MSO kickbacks to gain and increase provider referrals and, in turn, to

increase their own pay. To increase reimbursement, one of the hospitals, LRH, falsely billed the

laboratory tests as hospital outpatient services. Moreover, as part of the scheme, providers were

encouraged by the laboratories, hospitals, and recruiters to routinely order large panels of

laboratory tests for patients, even when not reasonable and necessary.

6. In addition to the MSO kickback scheme, numerous defendants participated in

additional schemes to pay kickbacks in the form of (a) P&H fees to draw site companies that were

purportedly independent of referring providers, but in fact were conduits to pay P&H fees to

providers and their employees to induce referrals for laboratory testing; (b) monthly fees to a high-

referring provider, disguising the payments as consulting fees for participating in THD’s advisory

board, even though no such board actually existed at THD; and (c) waiving patient copayments

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 3 of 154 PageID #: 886

4

and deductibles. These kickbacks were paid to induce referrals to federal healthcare programs for

laboratory testing.

7. Further, numerous defendants knowingly submitted and/or caused LRH and THD

to submit to Medicare claims for laboratory testing that were improperly referred by physicians

with a financial relationship with LRH and THD, respectively, in violation of the physician self-

referral law (commonly referred to as the Stark Law). The laboratory testing referrals were

improper because the physicians had financial relationships with LRH or THD that did not satisfy

any applicable Stark Law exception.

8. Lastly, defendants arranged for and recommended that healthcare providers

routinely order laboratory testing from THD, BHD, and LRH without regard to specific patient

needs, and encouraged providers to order laboratory tests that were not reasonable and necessary

for the diagnosis or treatment of any illness or injury of the patient or to improve the functioning

of any malformed body member of the patient.

JURISDICTION AND VENUE

9. This action arises under the FCA and the common law.

10. This Court has subject matter jurisdiction over this action under 28 U.S.C. § 1345

because the United States is the plaintiff. The Court also has subject matter jurisdiction over this

action under 28 U.S.C. §§ 1331 and 1367(a).

11. The Court may exercise personal jurisdiction over the defendants under 31 U.S.C.

§ 3732(a) because acts proscribed by the FCA, 31 U.S.C. § 3729, occurred in this District, and one

or more defendants can be found, reside, or transact business in this District.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 4 of 154 PageID #: 887

5

12. Venue is proper in the Eastern District of Texas under 31 U.S.C. § 3732(a) and 28

U.S.C. § 1391(b) because a substantial part of the events giving rise to this action occurred in this

District, and one or more defendants can be found, reside, or transact business in this District.

PARTIES

13. Plaintiff, the United States of America, acting through the Department of Health

and Human Services (HHS), administers the Health Insurance Program for the Aged and Disabled

established by Title XVIII of the Social Security Act (SSA), 42 U.S.C. §§ 1395 et seq. (Medicare),

and Grants to States for Medical Assistance Programs pursuant to Title XIX of the Act, 42 U.S.C.

§§ 1396 et seq. (Medicaid). The United States, acting through the Defense Health Agency (DHA),

administers the TRICARE program (formerly CHAMPUS). Relator STF, LLC has filed this case

under the FCA’s qui tam provisions, and the United States has intervened in part, declined in part,

and added additional claims pursuant to 31 U.S.C. § 3731(c).

14. Relator STF, LLC is a limited liability company, whose members are Felice Gersh,

M.D. and Chris Riedel.

15. Defendant Christopher Grottenthaler was the founder and CEO of THD, Outreach

Management Solutions LLC d/b/a True Health Outreach (THD-Outreach), and Health Core

Financial LLC d/b/a True Health Financial (THD-Financial). During the relevant period, he

resided in Frisco, Texas, and the headquarters for THD, THD-Outreach, and THD-Financial were

in Frisco, Texas.

16. Defendant Susan Hertzberg was BHD’s Chief Executive Officer. She oversaw

BHD’s business in Texas, including its relationship with LRH. Hertzberg transacts business in

Texas and is CEO and director of BrainScope Company, Inc., a company registered to do business

in Texas.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 5 of 154 PageID #: 888

6

17. Defendant Jeffrey “Boomer” Cornwell resides in McKinney, Texas, in this District,

and was hired by and reported to Grottenthaler as THD’s VP of Sales for the Southwestern Region,

which included the State of Texas.

18. Defendant Stephen Kash resides in Beaumont, Texas and was hired by and reported

to Grottenthaler as THD’s Director of Strategic Accounts. Kash also was a recruiter for MSOs that

paid kickbacks to providers in Texas, including in this District.

19. Defendant Matthew Theiler was BHD’s VP of Sales. In that role, he supervised

BHD employees responsible for sales in Texas, including in this District.

20. Defendant William Todd Hickman resides in Lumberton, Texas and owned and

operated defendants Ascend Professional Management, Inc. (APM) and Ascend Professional

Consulting, Inc. (APC), each of which was a corporation incorporated in Texas with its principal

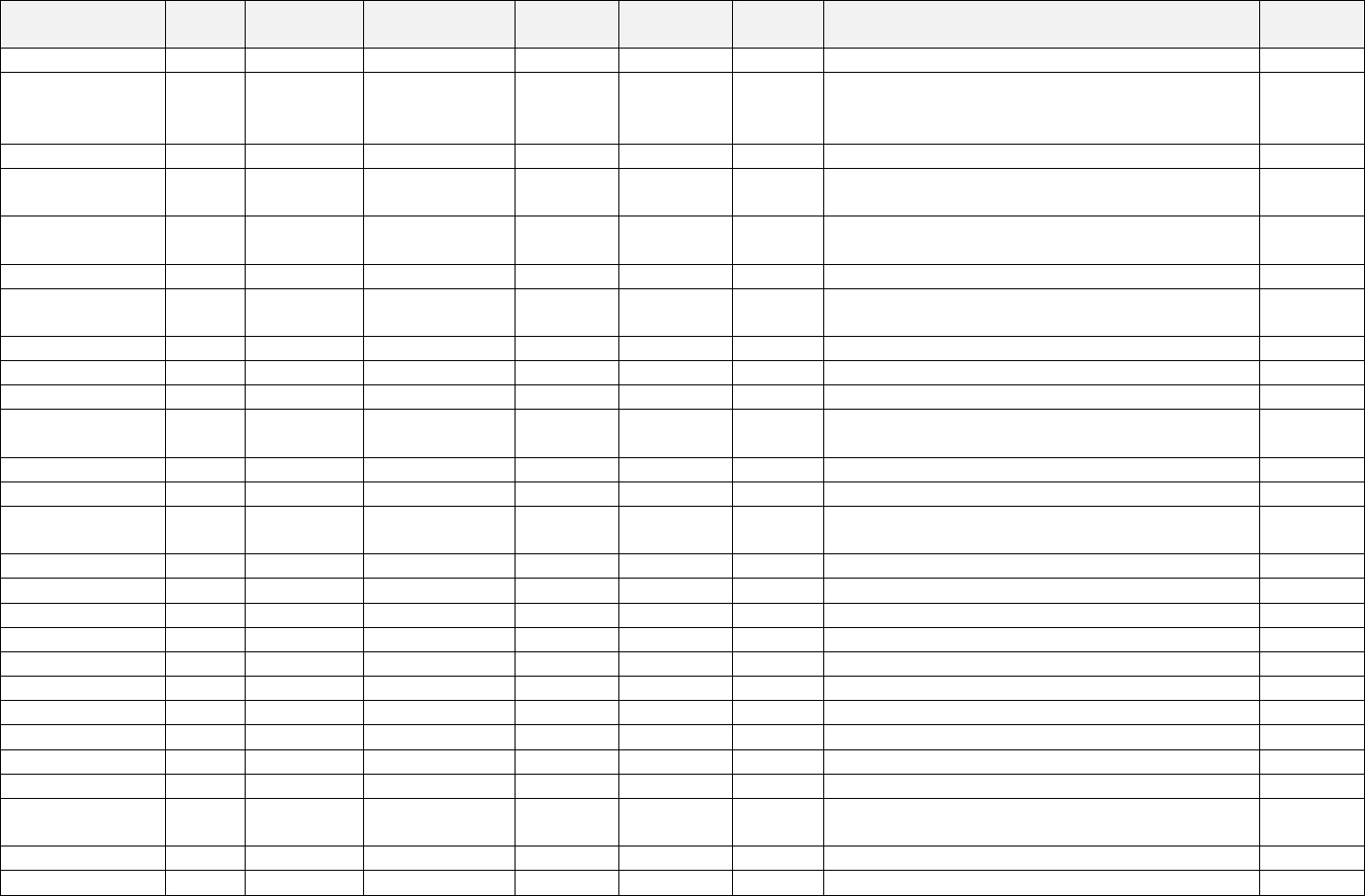

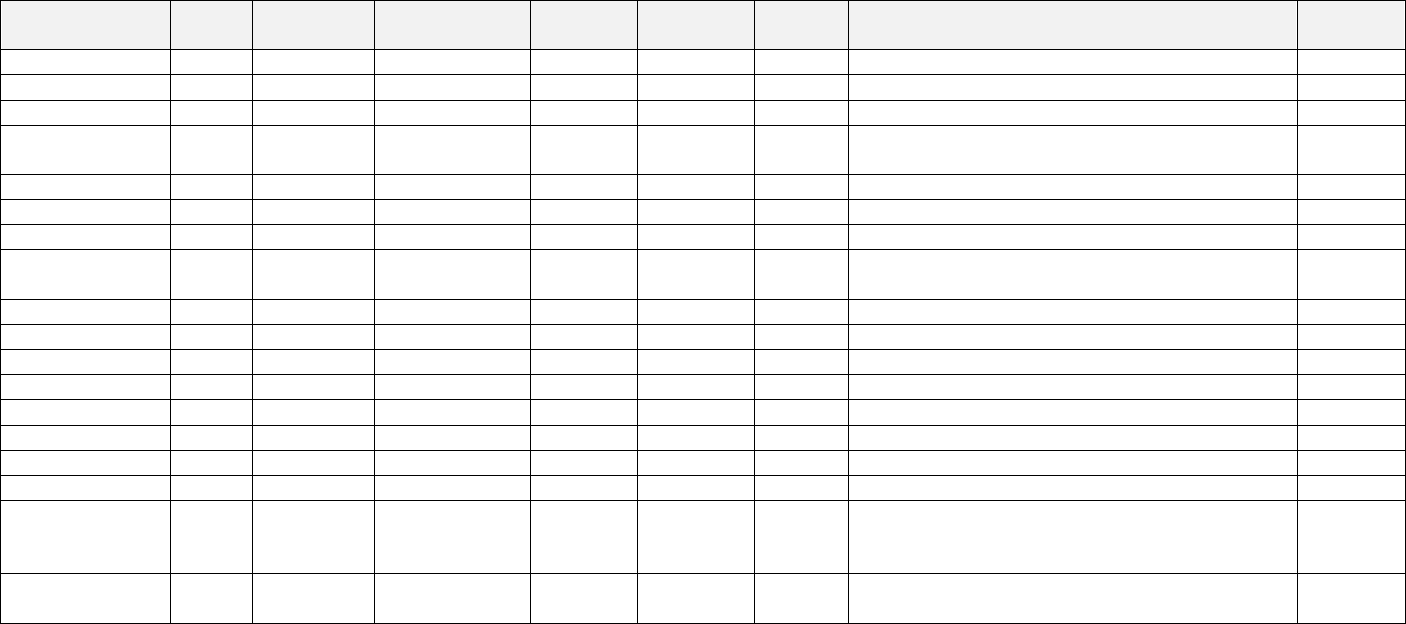

place of business in Texas. Hickman also owned and operated defendant BenefitPro Consulting

LLC (BenefitPro), a company formed in Texas with its principal place of business in Texas.

21. Defendant Courtney Love resides in Dallas, Texas. She was a THD Account

Executive in Texas, and her sales territory included this District.

22. Defendant Laura Howard resides in Allen, Texas. She was a BHD Area Sales

Manager, whose sales territory included this District. She also was a recruiter for MSOs that paid

kickbacks to providers in Texas, including in this District.

23. Defendant Christopher Gonzales resides in McKinney, Texas. He was a recruiter

for MSOs that paid kickbacks to providers in Texas, including in this District.

24. Defendant Jeffrey Madison resides in Georgetown, Texas and was the CEO of

LRH, which was headquartered in Rockdale, Texas.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 6 of 154 PageID #: 889

7

25. Defendant Peggy Borgfeld resides in Lexington, Texas and at various points during

the relevant period was LRH’s Chief Financial Officer (CFO) and Chief Operations Officer

(COO).

26. Defendant Stanley Jones resides in San Antonio, Texas, defendant Jeffrey Parnell

resides in Dallas, Texas, and defendant Thomas Gray Hardaway resides in San Antonio, Texas.

Jones, Parnell, and Hardaway owned and operated defendant LGRB Management Services LLC

(LGRB), which was formed in Texas with its principal place of business in Texas.

27. Defendant Ruben Marioni resides in Spring, Texas, and defendant Jordan Perkins

resides in Conroe, Texas. Marioni and Perkins owned and operated defendant Next Level

Healthcare Consultants LLC (Next Level), which was formed in Texas with its principal place of

business in Texas.

28. Defendants Ginny Jacobs and Scott Jacobs reside in Magnolia, Texas. They owned

and operated defendant S&G Staffing, LLC (S&G), a company formed in Texas with its principal

place of business in Texas, and defendant Jacobs Marketing, Inc. (Jacobs Marketing), a corporation

incorporated in Texas with its principal place of business in Texas.

LEGAL AND REGULATORY BACKGROUND

I. THE FALSE CLAIMS ACT

29. The FCA provides, in pertinent part, that any person who:

(a)(1)(A) knowingly presents, or causes to be presented, a false or fraudulent

claim for payment or approval;

(a)(1)(B) knowingly makes, uses, or causes to be made or used, a false record

or statement material to a false or fraudulent claim; [or]

(a)(1)(C) conspires to commit a violation of subparagraph (A) [or] (B) . . .

is liable to the United States for three times the amount of damages which the United States

sustains, plus a civil penalty per violation. 31 U.S.C. § 3729(a)(1).

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 7 of 154 PageID #: 890

8

30. FCA penalties are regularly adjusted for inflation, pursuant to the Federal Civil

Penalties Inflation Adjustment Act Improvements Act of 2015. See 28 U.S.C. § 2461 note. For

violations occurring between September 28, 1999 and November 2, 2015, the civil penalty

amounts range from a minimum of $5,500 to a maximum of $11,000. See 28 C.F.R. § 85.3; 64

Fed. Reg. 47099, 47103 (1999). For violations occurring after November 2, 2015, the civil penalty

amounts currently range from a minimum of $11,803 to a maximum of $23,607. 28 C.F.R. § 85.5.

31. For purposes of the FCA, the terms “knowing” and “knowingly”

(A) mean that a person, with respect to information—

(i) has actual knowledge of the information;

(ii) acts in deliberate ignorance of the truth or falsity of the information; or

(iii) acts in reckless disregard of the truth or falsity of the information; and

(B) require no proof of specific intent to defraud.

31 U.S.C. § 3729(b)(1).

32. Under the FCA, a “claim” includes direct requests to the United States for payment

as well as reimbursement requests made to the recipients of federal funds under federal benefits

programs. 31 U.S.C. § 3729(b)(2)(A).

33. The FCA defines “material” to mean “having a natural tendency to influence, or be

capable of influencing, the payment or receipt of money or property.” 31 U.S.C. § 3729(b)(4).

II. THE MEDICARE PROGRAM

34. In 1965, Congress enacted the Health Insurance for the Aged and Disabled Act,

known as the Medicare program, to pay for the costs of certain healthcare services. 42 U.S.C.

§ 1395 et seq. Entitlement to Medicare benefits is based on age, disability, or affliction with end-

stage renal disease. See 42 U.S.C. §§ 426 to 426-1.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 8 of 154 PageID #: 891

9

35. HHS is responsible for administration and supervision of the Medicare program.

The Centers for Medicare & Medicaid Services (CMS), an agency within HHS, is directly

responsible for administering the Medicare program.

36. To participate in the Medicare program, a healthcare provider must file an

agreement with the Secretary of HHS. 42 U.S.C. § 1395cc. The agreement requires compliance

with the requirements that the Secretary deems necessary for participation in the Medicare program

in order to receive reimbursement from Medicare.

37. To enroll in the Medicare program, suppliers of laboratory services must submit a

Medicare Enrollment Application, Form CMS-855B. These providers also must complete Form

CMS-855B to change information or to reactivate, revalidate, and/or terminate Medicare

enrollment.

38. Form CMS-855B requires, among other things, signatories to certify:

I agree to abide by the Medicare laws, regulations and program

instructions that apply to me or to the organization listed in section

2A1 of this application. The Medicare laws, regulations, and

program instructions are available through the Medicare

Administrative Contractor. I understand that payment of a claim by

Medicare is conditioned upon the claim and the underlying

transaction complying with such laws, regulations and program

instructions . . . .

* * *

I will not knowingly present or cause to be presented a false or

fraudulent claim for payment by Medicare, and I will not submit

claims with deliberate ignorance or reckless disregard of their truth

or falsity.

See https://www.cms.gov/Medicare/CMS-Forms/CMS-Forms/Downloads/cms855b.pdf.

39. An authorized official must sign the “Certification Statement” in Section 15 of

Form CMS-855B, which “legally and financially binds this supplier to the laws, regulations, and

program instructions of the Medicare program.” Id.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 9 of 154 PageID #: 892

10

40. To enroll in the Medicare program, institutional providers such as hospitals must

submit a Medicare Enrollment Application, Form CMS-855A. These providers also must complete

Form CMS-855A to change information or to reactivate, revalidate, and/or terminate Medicare

enrollment.

41. Form CMS 855A requires, among other things, signatories to certify:

I agree to abide by the Medicare laws, regulations and program

instructions that apply to this provider. . . . I understand that payment

of a claim by Medicare is conditioned upon the claim and the

underlying transaction complying with such laws, regulations, and

program instructions (including, but not limited to, the Federal anti-

kickback statute and the Stark law), and on the provider’s

compliance with all applicable conditions of participation in

Medicare.

* * *

I will not knowingly present or cause to be presented a false or

fraudulent claim for payment by Medicare, and I will not submit

claims with deliberate ignorance or reckless disregard of their truth

or falsity.

See https://www.cms.gov/Medicare/CMS-Forms/CMS-Forms/Downloads/cms855a.pdf.

42. An authorized official must sign the “Certification Section” in Section 15 of Form

CMS-855A, which “legally and financially binds [the] provider to the laws, regulations, and

program instructions of the Medicare program.” Id.

43. In addition, within five months of the end of the cost reporting period, hospitals are

required to submit to CMS annual reports known as “cost reports” on Form CMS-2552, see 42

C.F.R. §§ 413.20(b), 413.24(f)(2). The top of Form CMS-2552 states:

This report is required by law (42 USC 1395g; 42 CFR 413.20(b)).

Failure to report can result in all interim payments made since the

beginning of the cost reporting period being deemed overpayments

(42 USC 1395g).

https://www.cms.gov/Regulations-and-Guidance/Guidance/Transmittals/Downloads/R3P240f.pdf.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 10 of 154 PageID #: 893

11

44. Part II of Form CMS-2552 and 42 C.F.R. § 413.24(f)(4)(iv)(B) require a mandatory

certification, which includes the following certification statement:

MISREPRESENTATION OR FALSIFICATION OF ANY

INFORMATION CONTAINED IN THIS COST REPORT MAY

BE PUNISHABLE BY CRIMINAL, CIVIL AND

ADMINISTRATIVE ACTION, FINE AND/OR IMPRISONMENT

UNDER FEDERAL LAW. FURTHERMORE, IF SERVICES

IDENTIFIED IN THIS REPORT WERE PROVIDED OR

PROCURED THROUGH THE PAYMENT DIRECTLY OR

INDIRECTLY OF A KICKBACK OR WERE OTHERWISE

ILLEGAL, CRIMINAL, CIVIL AND ADMINISTRATIVE

ACTION, FINES AND OR IMPRISONMENT MAY RESULT.

Id.

45. Form CMS-2552 and 42 C.F.R. § 413.24(f)(4)(iv)(B) require a chief financial

officer or administrator of the hospital to certify that “I have read the above certification statement

and that I have examined the accompanying electronically filed or manually submitted cost report

and the Balance Sheet and Statement of Revenue and Expenses prepared by [Provider Name(s)

and Number(s)] for the cost reporting period beginning [date] and ending [date] and to the best of

my knowledge and belief, this report and statement are true, correct, complete and prepared from

the books and records of the provider in accordance with applicable instructions, except as noted.”

Id.

46. Form CMS-2552 and 42 C.F.R. § 413.24(f)(4)(iv)(B) also require a chief financial

officer or administrator of the hospital to certify that “I am familiar with the laws and regulations

regarding the provision of health care services, and that the services identified in this cost report

were provided in compliance with such laws and regulations.” Id.

47. To enroll in the Medicare program, physicians must submit a Medicare Enrollment

Application, Form CMS-855I. These providers also must complete Form CMS-855I to change

information or to reactivate, revalidate, and/or terminate Medicare enrollment.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 11 of 154 PageID #: 894

12

48. Form CMS-855I requires, among other things, signatories to certify:

I agree to abide by the Medicare laws, regulations and program

instructions that apply to me or to the organization listed in section

4A of this application. The Medicare laws, regulations, and program

instructions are available through the Medicare Administrative

Contractor. I understand that payment of a claim by Medicare is

conditioned upon the claim and the underlying transaction

complying with such laws, regulations and program instructions

(including, but not limited to, the Federal Anti-Kickback Statute, 42

U.S.C. section 1320a-7b(b) (section 1128B(b) of the Social Security

Act) and the Physician Self-Referral Law (Stark Law), 42 U.S.C.

section 1395nn (section 1877 of the Social Security Act)).

* * *

I will not knowingly present or cause to be presented a false or

fraudulent claim for payment by Medicare and will not submit

claims with deliberate ignorance or reckless disregard of their truth

or falsity.

See https://www.cms.gov/Medicare/CMS-Forms/CMS-Forms/Downloads/cms855i.pdf.

49. The provider must sign the “Certification Section” in Section 15 of Form CMS-

855I, and in doing so, is “attesting to meeting and maintaining the Medicare requirements”

excerpted above, among others. Id.

50. Medicare reimburses only those services furnished to beneficiaries that are

“reasonable and necessary for the diagnosis or treatment of illness or injury or to improve the

functioning of a malformed body member . . . .” 42 U.S.C. § 1395y(a)(l)(A).

51. The Secretary of HHS (Secretary) is responsible for specifying services covered

under the “reasonable and necessary” standard and has wide discretion in selecting the means for

doing so. See 42 U.S.C. § 1395ff(a). The Secretary acts through formal regulations, and

periodically CMS and HHS-OIG issue industry guidance.

52. The Secretary provides guidance to eligible providers pursuant to a series of

Manuals, published by CMS, which are available to the public on the Internet. See generally CMS

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 12 of 154 PageID #: 895

13

Internet-Only Manuals, available at https://www.cms.gov/regulations-and-guidance/guidance/

manuals/internet-only-manuals-ioms.html.

53. At all times relevant to this Complaint, CMS contracted with private contractors,

known as Medicare Administrative Contractors (MACs), to perform various administrative

functions on its behalf, including reviewing and paying claims submitted by healthcare providers.

42 U.S.C. §§ 1395h, 1395u; 42 C.F.R. §§ 421.3, 421.100, 421.104. MACs generally act on behalf

of CMS to process and pay Medicare claims and perform administrative functions on a regional

level. MACs may issue Local Coverage Determinations regarding whether or not a particular item

or service is covered. 42 U.S.C. § 1395ff(f)(2).

54. Medicare regulations require providers and suppliers to certify that they meet, and

will continue to meet, the requirements of the Medicare statute and regulations. 42 C.F.R.

§ 424.516(a)(1). In submitting claims for payment to Medicare, providers must certify that the

information on the claim form accurately describes the services rendered and that the services were

reasonable and medically necessary for the patient.

55. To obtain Medicare reimbursement, healthcare providers (including suppliers)

submit claims using paper forms or their electronic equivalents. Providers identify by code on the

appropriate form, among other things, the principal diagnosis of the patient and the procedures and

services rendered.

A. Medicare Part A

56. Under Medicare Part A, hospitals agree with Medicare to provide covered

healthcare items and services to treat Medicare patients. The hospital, also called a “provider,” is

authorized to bill Medicare for that treatment. During the relevant time period, CMS reimbursed

hospitals for inpatient Part A services through MACs (formerly known as fiscal intermediaries).

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 13 of 154 PageID #: 896

14

57. Since 2007, in order to get paid, a hospital must complete and submit to the MAC

a claim for payment on a Form UB-04 (also known as CMS-1450) or its electronic equivalent.

This form contains patient-specific information including the diagnosis and types of services that

are assigned or provided to the Medicare patient. The Medicare program relies on the accuracy

and truthfulness of the UB-04 Forms to determine whether the service is payable and the amounts,

if any, the hospital is owed or has been overpaid.

58. In addition, as noted previously, hospitals are required to submit to the MAC an

annual report known as a Medicare “cost report” on Form CMS-2552, which identifies any

outstanding costs that the hospital is claiming for reimbursement for that year. The cost report

serves as the final claim for payment that is submitted to Medicare. Failure to submit a cost report

can result in all interim payments made since the beginning of the cost reporting period being

deemed overpayments. The Medicare program relies on the accuracy and truthfulness of the cost

report to determine the amounts, if any, the hospital is owed or has been overpaid during the year.

B. Medicare Part B

59. Part B of the Medicare program is a federally subsidized, voluntary insurance

program that pays for various medical and other health services and supplies, including laboratory

testing, hospital outpatient services, physician services, and physical, occupational, and speech

therapy services. See 42 U.S.C. §§ 1395j to 1395w-5.

60. Medicare Part B is funded by insurance premiums paid by enrolled Medicare

beneficiaries and by contributions from the Federal Treasury. Eligible individuals who are 65 or

older or disabled may enroll in Medicare Part B to obtain benefits in return for payments of

monthly premiums. Payments under Medicare Part B typically are made directly under assignment

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 14 of 154 PageID #: 897

15

to service providers and practitioners, such as physicians, rather than to the patient/beneficiary. In

that case, the physician bills the Medicare program directly.

61. CMS provides reimbursement for Medicare Part B claims from the Medicare Trust

Fund. To assist in the administration of Medicare Part B, CMS contracts with MACs (formerly

known as carriers). 42 U.S.C. § 1395u. MACs perform various administrative functions for CMS,

including processing the payment of Medicare Part B claims to providers.

62. To obtain Medicare reimbursement for certain outpatient items or services,

providers and suppliers submit a claim form known as the CMS 1500 form or its electronic

equivalent, known as the 837P format. When a CMS-1500 claim is submitted, the provider certifies

that he or she is knowledgeable of Medicare’s requirements and that the services for which

payment is sought were “medically indicated and necessary for the health of the patient.”

63. Providers wishing to submit an electronic or hard-copy CMS-1500 claim must first

seek to enroll in the Medicare program by submitting a provider enrollment form. During the

Medicare enrollment process, providers must certify that the claims they submit will be “accurate,

complete, and truthful.”

64. For a claim to be paid by Medicare Part B, it must identify each service rendered to

the patient by the provider. The service is identified by a code in an American Medical Association

(AMA) publication called the Current Procedural Terminology (CPT) Manual. The CPT Manual

is a systematic list of codes for procedures and services performed by or at the direction of a

provider. Each procedure or service is identified by a five-digit CPT code.

65. In addition to the CPT Manual, the AMA publishes the International Classification

of Diseases (ICD) Manual, which assigns a unique numeric identifier to each medical condition.

To be payable by Medicare, the claim must identify both the CPT code that the provider is billing

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 15 of 154 PageID #: 898

16

for and the corresponding ICD code(s) for the patient’s medical condition that supports the medical

necessity of the provider’s service.

66. When submitting claims on the CMS-1500 to Medicare, providers certify, among

other things, that: (a) the services rendered are medically indicated and necessary for the health

of the patient; (b) the information in the claim is “true, accurate, and complete”; and (c) the

provider understands that “payment and satisfaction of this claim will be from Federal and State

funds, and that any false claims, statements, or documents, or concealment of material fact, may

be prosecuted under applicable Federal and State laws.” After a February 2012 revision to the

CMS-1500, providers further certify that their claims comply “with all applicable Medicare and/or

Medicaid laws, regulations, and program instructions for payment including but not limited to the

Federal anti-kickback statute and Physician Self-Referral law (commonly known as Stark law).”

CMS-1500 also requires providers to acknowledge that: “Any person who knowingly files a

statement of claim containing any misrepresentation or any false, incomplete or misleading

information may be guilty of a criminal act punishable under law and may be subject to civil

penalties.”

67. When enrolling to submit claims electronically, providers certify that they will

submit claims that are “accurate, complete, and truthful.” When a provider submits an electronic

claim, the provider’s identification number and password serve as the provider’s signature, just as

if the provider physically signed the claim form.

68. Healthcare providers are prohibited from knowingly presenting or causing to be

presented claims for items or services that the person knew or should have known were not

medically necessary, or knew or should have known were false or fraudulent. E.g., 42 U.S.C.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 16 of 154 PageID #: 899

17

§ 1395y(a)(1)(A); 42 U.S.C. § 1320a-7(b)(7) (providers may be excluded for fraud, kickbacks, and

other prohibited activities).

69. A provider has a duty to familiarize itself with the statutes, regulations, and

guidelines regarding coverage for the Medicare services it provides. Heckler v. Cmty. Health Servs.

of Crawford Cty., Inc., 467 U.S. 51, 64 (1984).

70. Because it is not feasible for the Medicare program or its contractors to review

medical records corresponding to each of the millions of claims for payment it receives from

providers, the program relies on providers to comply with Medicare requirements and relies on

providers to submit truthful and accurate certifications and claims.

71. Generally, once a provider submits a CMS-1500 or the electronic equivalent to the

Medicare program, the claim is paid directly to the provider, in reliance on the foregoing

certifications, without any review of supporting documentation, including medical records.

III. TEXAS MEDICAID PROGRAM

72. State Medicaid programs are authorized by the Social Security Act, Title XIX. 42

U.S.C. §§ 1396 et seq. Medicaid is a joint federal-state program that provides healthcare benefits

for certain groups including the poor and disabled. Each state Medicaid program must implement

a “State Plan” containing specified minimum criteria for coverage and payment of claims to qualify

for federal funds for Medicaid expenditures. 42 U.S.C. § 1396a.

73. The federal portion of each state’s Medicaid payments, known as the Federal

Medical Assistance Percentage (FMAP), is based on a state’s per capita income compared to the

national average. 42 U.S.C. § 1396d(b). During the relevant time period, the federal portion of

Medicaid payments for Texas is set forth below:

Time Period

Texas FMAP

10/1/14 - 9/30/15

58.05%

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 17 of 154 PageID #: 900

18

Time Period Texas FMAP

10/1/15 - 9/30/16 57.13%

10/1/16 - 9/30/17

56.18%

10/1/17 - 9/30/18 56.88%

10/1/18 - 9/30/19 58.19%

79 Fed. Reg. 3385, 3387 (Jan. 21, 2014) (FY 2015); 79 Fed. Reg. 71,426, 71,428 (Dec. 2, 2014)

(FY 2016); 80 Fed. Reg. 73,779, 73,781–82 (Nov. 25, 2015) (FY 2017); 81 Fed. Reg. 80,078,

80,080 (Nov. 15, 2016) (FY 2018); 82 Fed. Reg. 55,383, 55,385 (Nov. 21, 2017) (FY 2019).

74. The Texas Health and Human Services Commission (HHSC) is responsible for

administering the Medicaid program in the State of Texas. HHSC contracts with the Texas

Medicaid and Healthcare Partnership (TMHP) to receive applications from prospective Medicaid

providers, assign Medicaid provider numbers, educate providers as to Medicaid policies and

regulations, and process and pay Medicaid claims. TMHP has issued Texas Medicaid Provider

Manuals for the purpose of furnishing Medicaid providers with the policies and procedures needed

to receive reimbursement for covered services provided to eligible Texas Medicaid recipients.

Throughout the relevant time period, the Texas Medicaid Provider Manuals were available for

review at the State office and in each local and district office, as well as online at

https://www.tmhp.com/resources/provider-manuals/tmppm.

75. To participate in the Texas Medicaid program, providers such as physicians and

hospitals must certify in their Medicaid provider agreement that they will “agree[] to abide by all

Medicaid regulations, program instructions, and Title XIX of the Social Security Act” and “comply

with all of the requirements of the [Texas Medicaid] Provider Manual, as well as all state and

federal laws governing or regulating Medicaid.”

76. Providers participating in the Texas Medicaid program must certify that they

“understand[] that payment of a claim by Medicaid is conditioned upon the claim and the

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 18 of 154 PageID #: 901

19

underlying transaction complying with such laws, regulations, and program instructions

(including, but not limited to, the Federal anti-kickback statute and the Stark law), and on the

provider’s compliance with all applicable conditions of participation in Medicaid.”

77. To receive payments from the Texas Medicaid program, providers must agree that

“information submitted regarding claims or encounter data will be true, accurate, and complete,

and that the Provider’s records and documents are both accessible and validate the services and

the need for services billed and represented as provided.” Likewise, such providers must

acknowledge that they have “an affirmative duty to verify that claims and encounters submitted

for payment are true and correct” and that “payments received are for actual services rendered and

medically necessary.”

78. Pursuant to Texas regulations, the Texas Medicaid program covers medical

services, including laboratory testing, only if the services are “medically necessary for diagnosis

or treatment, or both, of illness or injury” or “appropriately authorized for prevention of the

occurrence of a medical condition, and is prescribed by a physician or other qualified practitioner,

as appropriate to the particular benefit, in accordance with federal or state law or policy and the

[Texas Medicaid] utilization review provisions of this chapter.” 1 Texas Admin. C. § 354.1131(a).

79. A laboratory enrolled as a Texas Medicaid provider must submit claims on a CMS-

1500 claim form or its electronic equivalent, which contains the certifications in Section II above.

80. A hospital enrolled as a Texas Medicaid provider must submit claims on a UB-04

claim form, CMS-2552 form, or its electronic equivalent, which contain the certifications in

Section II above.

81. Because it is not feasible for the Texas Medicaid program or its contractors to

review medical records corresponding to each of the claims for payment it receives from providers,

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 19 of 154 PageID #: 902

20

the program relies on providers to comply with Medicaid requirements and relies on providers to

submit truthful and accurate certifications and claims.

IV. THE TRICARE PROGRAM

82. DHA administers TRICARE (formerly CHAMPUS), a medical benefits program

established by federal law. 10 U.S.C. §§ 1071–1110b. TRICARE covers eligible beneficiaries,

including active duty members of the Uniformed Services and their dependents as well as retired

members of the Uniformed Services and their dependents. The federal government reimburses a

portion of the cost of covered healthcare services and prescription medications provided to

TRICARE beneficiaries.

83. TRICARE covers only medically necessary care; specifically, services or supplies

provided by a hospital, physician, and/or other provider for the prevention, diagnosis, and

treatment of an illness, when those services or supplies are determined to be consistent with the

condition, illness, or injury; are provided in accordance with approved and generally accepted

medical or surgical practice; are not primarily for the convenience of the patient, the physician, or

other providers; and do not exceed (in duration or intensity) the level of care which is needed to

provide safe, adequate, and appropriate diagnosis and treatments. See 32 C.F.R. § 199.4(a)(1)(i)

and applicable definitions at 32 C.F.R. § 199.2.

84. Federal regulations provide that TRICARE may deny payment in “abuse

situations.” 32 C.F.R. § 199.9(b). To avoid abuse situations, providers are obligated to provide

services and supplies under TRICARE that are: “Furnished at the appropriate level and only when

and to the extent medically necessary . . .; of a quality that meets professionally recognized

standards of health care; and, supported by adequate medical documentation as may reasonably be

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 20 of 154 PageID #: 903

21

required under this part . . . to evidence the medical necessity and quality of services furnished, as

well as the appropriateness of the level of care.” Id.

85. TRICARE regulations, in turn, define “appropriate” medical care as that which is,

among other things, “[f]urnished economically”—i.e., “in the least expensive level of care or

medical environment adequate to provide the required medical care.” 32 C.F.R. § 199.2.

86. As with Medicare, providers submit claims to TRICARE using the CMS-1500 or

an electronic equivalent. Providers therefore make the same certifications in submitting claims to

TRICARE as they do when submitting claims to Medicare.

87. Because it is not feasible for the TRICARE program or its contractors to review

medical records corresponding to each of the claims for payment it receives from providers, the

program relies on providers to comply with TRICARE requirements and submit truthful and

accurate certifications and claims.

V. THE ANTI-KICKBACK STATUTE

88. The Anti-Kickback Statute (AKS), 42 U.S.C. § 1320a-7b(b), arose out of

Congressional concerns involving physicians’ conflicts of interest and overutilization of medical

services and items. First enacted in 1972, Congress strengthened the statute in 1977 and 1987 to

ensure that kickbacks masquerading as legitimate transactions did not evade its reach. See Social

Security Amendments of 1972, Pub. L. No. 92-603, § 242(b), (c); 42 U.S.C. § 1320a-7b, Medicare-

Medicaid Anti-Fraud and Abuse Amendments, Pub. L. No. 95-142; Medicare and Medicaid

Patient and Program Protection Act of 1987, Pub. L. No. 100-93. The AKS prohibits kickback

payments to protect the integrity of federal healthcare programs such as Medicare, Medicaid, and

TRICARE.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 21 of 154 PageID #: 904

22

89. The AKS prohibits any person from knowingly and willfully offering, paying,

soliciting, or receiving any remuneration, directly or indirectly, overtly or covertly, in cash or in

kind, to induce or reward a person for, inter alia, purchasing, ordering, arranging for, or

recommending the purchase or ordering of any goods or services for which payment may be made,

in whole or in part, under a federal healthcare program.

90. In pertinent part, the AKS provides:

b. Illegal remunerations

(1) Whoever knowingly and willfully solicits or receives any remuneration

(including any kickback, bribe, or rebate) directly or indirectly, overtly or

covertly, in cash or in kind—

(A) in return for referring an individual to a person for the furnishing or

arranging for the furnishing of any item or service for which payment may

be made in whole or in part under a Federal health care program, or

(B) in return for purchasing, leasing, ordering, or arranging for or

recommending purchasing, leasing, or ordering any good, facility, service,

or item for which payment may be made in whole or in part under a Federal

health care program,

shall be guilty of a felony and upon conviction thereof, shall be fined not

more than $100,000 or imprisoned for not more than ten years, or both.

(2) Whoever knowingly and willfully offers or pays any remuneration

(including any kickback, bribe, or rebate) directly or indirectly, overtly or

covertly, in cash or in kind to any person to induce such person

(A) to refer an individual to a person for the furnishing or arranging for the

furnishing of any item or service for which payment may be made in whole

or in part under a Federal health care program, or

(B) to purchase, lease, order or arrange for or recommend purchasing,

leasing or ordering any good, facility, service, or item for which payment

may be made in whole or in part under a Federal health care program,

shall be guilty of a felony and upon conviction thereof, shall be fined not

more than $100,000 or imprisoned for not more than ten years, or both.

42 U.S.C. § 1320a-7b(b). “[A] person need not have actual knowledge of [the AKS] or specific

intent to commit a violation of [the AKS].” Id. § 1320a-7b(h).

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 22 of 154 PageID #: 905

23

91. Pursuant to the AKS, “a claim that includes items or services resulting from a

violation of [the AKS] constitutes a false or fraudulent claim for purposes of [the FCA].” 42 U.S.C.

§ 1320a-7b(g); see also, e.g., Guilfoile v. Shields, 913 F.3d 178, 190–91 (1st Cir. 2019) (“§ 1320a-

7b(g)’s obviation of the ‘materiality’ inquiry essentially codifies the long-standing view that AKS

violations are ‘material’ in the FCA context.”).

A. AKS “Safe Harbors”

92. The HHS Office of Inspector General (OIG) has promulgated “safe harbor”

regulations that define practices that are not subject to the AKS because such practices are unlikely

to result in fraud or abuse. 42 C.F.R. § 1001.952. The safe harbors set forth specific conditions

that, if met, assure persons involved of not being sanctioned for the arrangement qualifying for the

safe harbor. However, safe harbor protection is an affirmative defense that is afforded to only those

arrangements that meet all requirements of the safe harbor.

93. Under the investment interests safe harbor, a payment to an investor that is a return

on an investment is not remuneration for purposes of the AKS only if all eight of the safe harbor’s

requirements are satisfied. See 42 C.F.R. § 1001.952(a).

94. The safe harbor for investment interests is narrowly tailored to prevent improper

economic inducements from being disguised as ordinary investments. Among other things, the

safe harbor for investment interests requires:

• The terms on which an investment interest is offered to an investor who is in a position to

. . . generate business for the entity must not be related to the previous or expected volume

of referrals . . . or the amount of business otherwise generated from that investor to the

entity;

• No more than 40 percent of the entity’s gross revenue related to the furnishing of health

care items and services in the previous fiscal year or previous 12 month period may come

from referrals or business otherwise generated from investors;

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 23 of 154 PageID #: 906

24

• No more than 40 percent of the value of the investment interests . . . may be held in the

previous fiscal year or previous 12 month period by investors who are in a position to make

or influence referrals to . . . or otherwise generate business for the entity; [and]

• The amount of payment to an investor in return for the investment interest must be directly

proportional to the amount of the capital investment (including the fair market value of any

pre-operational services rendered) of that investor.

42 C.F.R. § 1001.952(a)(2)(i), (iii), (vi), (viii).

95. The direct and indirect payments alleged herein did not satisfy the requirements of

this or any other AKS safe harbor, and at all relevant times defendants were aware that their

conduct was unlawful.

B. OIG Special Fraud Alerts and Related Guidance

96. To alert the public to “trends of health care fraud and certain practices of an

industry-wide character,” OIG issues special fraud alerts, which are published online and in the

Federal Register. 59 Fed. Reg. 65,372, 65,373 (Dec. 19, 1994). The fraud alerts “provide general

guidance to the health care industry” and assist others “in identifying health care fraud schemes.”

Id.

97. In 1989, OIG issued a Special Fraud Alert on Joint Venture Arrangements. OIG

warned that physician joint venture arrangements may violate the AKS where the arrangement was

“intended not so much to raise investment capital legitimately to start a business, but to lock up a

stream of referrals from the physician investors and to compensate them indirectly for those

referrals.” OIG, Special Fraud Alert: Joint Venture Arrangements, reprinted in 59 Fed. Reg.

65,372, 65,374 (Dec. 19, 1994).

98. In 1994, OIG issued a Special Fraud Alert on transfers of value from laboratories

to referral sources. OIG, Special Fraud Alert: Arrangements for the Provision of Clinical

Laboratory Services, reprinted in 59 Fed. Reg. 65,372, 65,377 (Dec. 19, 1994). OIG warned of

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 24 of 154 PageID #: 907

25

“inducements offered by clinical laboratories which may implicate the [AKS],” such as providing

items, services, and financial benefits. Id. OIG warned that “[w]hen one purpose of these

arrangements is to induce the referral of program-reimbursed laboratory testing, both the clinical

laboratory and the health care provider may be liable under the [AKS] and may be subject to

criminal prosecution and exclusion from participation in the Medicare and Medicaid programs.”

Id. at 65,377–78.

99. OIG reiterated its concerns in a special bulletin in 2003 about the “proliferation of

arrangements between those in a position to refer business, such as physicians, and those providing

items or services for which Medicare or Medicaid pays.” OIG, Special Advisory Bulletin:

Contractual Joint Ventures, reprinted in 68 Fed. Reg. 23,148, 23,148 (Apr. 30, 2003) (warning

that such “questionable contractual arrangements” may violate the AKS).

100. In March 2013, OIG issued another Special Fraud Alert about physician-owned

entities, including entities “referred to as physician-owned distributorships, or ‘PODs.’” OIG

Special Fraud Alert: Physician-Owned Entities (Mar. 26, 2013), reprinted in 78 Fed. Reg. 19,271,

19,272 (Mar. 29, 2013). OIG noted that it had previously warned that physician-owned entities

create “the strong potential for improper inducements” to physician-investors and “should be

closely scrutinized under the fraud and abuse laws,” including the AKS. Id. at 19,272 (quoting

Letter from Vicki Robinson, “Response to Request for Guidance Regarding Certain Physician

Investments in the Medical Device Industries” (Oct. 6, 2006)).

101. The 2013 fraud alert reiterated longstanding AKS concerns regarding physician-

owned entities, including: (1) the corruption of medical judgment, (2) overutilization,

(3) increased costs to federal healthcare programs, and (4) unfair competition. Id. at 19,272.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 25 of 154 PageID #: 908

26

102. The 2013 fraud alert warned that PODs are “inherently suspect” under the AKS,

and it reiterated OIG’s prior guidance that providing a referring physician the opportunity to earn

a profit, including through an investment return from an entity for which the physician generates

business, could constitute illegal remuneration under the AKS. Id.

103. OIG identified the following five features, among others, that may render PODs

particularly suspect under the AKS: (1) the POD “exclusively serves its physician-owners’ patient

base,” rather than selling “on the basis of referrals from nonowner physicians”; (2) the POD

“generate[s] disproportionately high rates of return for physician-owners”; (3) the POD “enable[s]

the physician-owners to profit from their ability to dictate the [items] to be purchased for their

patients”; (4) the physician-owner(s) “are few in number, such that the volume or value of a

particular physician-owner’s recommendations or referrals closely correlates to that physician-

owner’s return on investment”; and (5) the physician-owner(s) “alter their medical practice after

or shortly before investing in the POD.” Id. at 19,273.

104. In June 2014, OIG issued a Special Fraud Alert regarding laboratory payments to

referring physicians. OIG Special Fraud Alert: Laboratory Payments to Referring Physicians (June

25, 2014), reprinted in 79 Fed. Reg. 40,115 (July 11, 2014). OIG noted that “[a]rrangements

between referring physicians and laboratories historically have been subject to abuse and were the

topic of one of the OIG’s earliest Special Fraud Alerts.” Id. at 40,116 (citing 1994 Special Fraud

Alert).

105. As OIG recognized, “the choice of laboratory, as well as the decision to order

laboratory tests, typically is made or strongly influenced by the physician, with little or no input

from patients.” Id. at 40,116. Transfers of value to physicians “may induce physicians to order

tests from a laboratory that provides them with remuneration, rather than the laboratory that

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 26 of 154 PageID #: 909

27

provides the best, most clinically appropriate service.” Id. Such transfers “also may induce

physicians to order more laboratory tests than are medically necessary, particularly when the

transfers of value are tied to, or take into account, the volume or value of business generated by

the physician.” Id.

106. With respect to P&H fees paid to physicians and physician practices in connection

with orders for laboratory tests, OIG warned that such payment arrangements “are suspect under

the [AKS].” Id. at 40,116. OIG noted that the AKS prohibits the knowing and willful payment of

remuneration “if even one purpose of the payment is to induce or reward referrals of Federal health

care program business.” Id. at 40,117. Payments to physicians are particularly suspect, OIG

indicated, when the physician is paid for services the laboratory does not actually need or for which

the physician is otherwise compensated, or when the payment is for more than fair market value

for the physician’s services or takes into account the volume or value of business generated by the

referring physician. Id. at 40,116–17.

107. Further, OIG warned of payment arrangements with physicians that purport to

“carve out” federal healthcare program beneficiaries or business. Id. at 40,117. Specifically, OIG

stated that its concerns with such payment arrangements “are not abated when those arrangements

apply only to specimens collected from non-Federal health care program patients.” Id. Rather,

“[a]rrangements that ‘carve out’ Federal health care program beneficiaries or business from

otherwise questionable arrangements implicate the anti-kickback statute and may violate it by

disguising remuneration for Federal health care program business through the payment of amounts

purportedly related to non-Federal health care program business.” Id. OIG noted that “physicians

typically wish to minimize the number of laboratories to which they refer for reasons of

convenience and administrative efficiency,” so payment arrangements “that carve out Federal

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 27 of 154 PageID #: 910

28

health care program business may nevertheless be intended to influence physicians’ referrals of

Federal health care program business to the offering laboratories.” Id.

108. OIG also warned that physicians who receive payments in connection with their

laboratory test orders “may be at risk under the [AKS]” because liability attaches to “parties on

both sides of an impermissible ‘kickback’ arrangement.” Id. at 40,117.

109. Each defendant was on notice of the foregoing Special Fraud Alerts and Bulletins

published in the Federal Register. Moreover, each defendant knew that paying kickbacks to

physicians to induce referrals of federal healthcare program business was illegal.

110. In or about June 2014, defendants Grottenthaler, Cornwell, Kash, Love, Hertzberg,

Theiler, and Howard had actual knowledge of HHS-OIG’s June 2014 Special Fraud Alert.

VI. THE STARK LAW

111. The Stark Law prohibits an entity from submitting claims to Medicare for certain

categories of “designated health services” (DHS), including clinical laboratory services, if such

services were referred to the entity by a physician with whom the entity had a financial relationship

that did not satisfy the requirements of an applicable statutory or regulatory exception. 42 U.S.C.

§ 1395nn(a)(1). The Stark Law further prohibits Medicare from paying any claims for DHS

referred in violation of the law. 42 U.S.C. § 1395nn(g)(1). The statute was designed specifically

to prevent losses that might be suffered by the Medicare program due to overutilization of DHS,

patient steering, and the corruption of physicians’ medical judgment by improper financial

incentives.

112. As initially enacted in 1989, the Stark Law applied to referrals of Medicare patients

for clinical laboratory services by a physician to a laboratory with which the physician had a

financial relationship unless the requirements of an applicable statutory or regulatory exception

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 28 of 154 PageID #: 911

29

were satisfied. See Omnibus Budget Reconciliation Act of 1989, Pub. L. No. 101-239, § 6204, 103

Stat. 2106, 2236-43. In 1993, Congress extended the Stark Law’s application to referrals for ten

additional DHS. See Omnibus Reconciliation Act of 1993, Pub. L. No. 103-66, § 13562, 107 Stat.

312, 596-605; Social Security Act Amendments of 1994, Pub. L. No. 103-432, § 152, 108 Stat.

4398, 4436-37.

113. Compliance with the Stark Law is a condition of payment by the Medicare program.

Medicare is prohibited from paying for any DHS provided in violation of the Stark Law. See 42

U.S.C. §§ 1395nn(a)(1), (g)(1). Moreover, “[a]n entity that collects payment for a designated

health service that was performed pursuant to a prohibited referral must refund all collected

amounts on a timely basis[.]” 42 U.S.C. § 411.353(d).

114. In pertinent part, the Stark Law provides:

(a) Prohibition of certain referrals

(1) In general

Except as provided in subsection (b), if a physician (or an immediate family member of

such physician) has a financial relationship with an entity specified in paragraph (2), then

(A) the physician may not make a referral to the entity for the furnishing of designated

health services for which payment otherwise may be made under this subchapter, and

(B) the entity may not present or cause to be presented a claim under this subchapter

or bill to any individual, third party payor, or other entity for designated health services

furnished pursuant to a referral prohibited under subparagraph (A).

42 U.S.C. § 1395nn(a)(1).

115. As noted above, DHS includes clinical laboratory services. 42 U.S.C.

§ 1395nn(h)(6) and 42 C.F.R. § 411.351 (2014).

1

1

The physician self-referral law regulations were amended effective on or after January 19,

2021, 85 Fed. Reg. 77,492 (Dec. 2, 2020), and on January 1, 2022, 86 Fed. Reg. 64,996 (Nov.

19, 2021). Those amendments did not apply during the relevant period in this case.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 29 of 154 PageID #: 912

30

116. Under the Stark Law, an “entity is considered to be furnishing DHS if it . . . [i]s the

person or entity that has performed services that are billed as DHS or . . . that has presented a claim

to Medicare for the DHS, including the person or entity to which the right to payment for the DHS

has been reassigned. . . .” 42 C.F.R. § 411.351 (2014).

117. A “financial relationship” includes a “compensation arrangement,” which means

any arrangement involving any “remuneration” paid to a referring physician “directly or indirectly,

overtly or covertly, in cash or in kind” by the entity furnishing the DHS. 42 U.S.C.

§§ 1395nn(h)(1)(A), (h)(1)(B); 42 C.F.R. § 411.351 (2014).

118. A direct compensation arrangement exists “if remuneration passes between the

referring physician . . . and the entity furnishing DHS without any intervening persons or entities.”

42 C.F.R. § 411.354(c)(1)(i) (2014).

119. An indirect compensation arrangement exists if (i) there is an unbroken chain of

persons or entities that have financial relationships between the referring physician and the entity

furnishing DHS; (ii) the referring physician receives from the person or entity with whom the

physician has a direct financial relationship aggregate compensation that varies with, or otherwise

takes into account, the volume or value of the physicians’ referrals to, or other business generated

by the referring physician for, the entity furnishing the DHS; and (iii) the entity furnishing the

DHS has knowledge of the fact that the referring physician (or immediate family member) receives

aggregate compensation that varies with, or takes into account, the volume or value of referrals or

other business generated by the referring physician for the entity furnishing DHS. See 42 C.F.R.

§ 411.354(c)(2) (2014).

120. For purposes of the Stark Law, a “referral” includes any request by a physician for,

or ordering of, or the certifying or recertifying of the need for, any DHS for which Medicare

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 30 of 154 PageID #: 913

31

payment may be made, including a request for a consultation with another physician and any test

or procedure ordered by or to be performed by (or under the supervision of) that other physician,

but does not include any DHS personally performed by the referring physician. 42 U.S.C.

§ 1395nn(h)(5); 42 C.F.R. § 411.351 (2014).

121. “Other business generated” means “any other business generated by the referring

physician, including other Federal and private pay business.” 66 Fed. Reg. 856, 877 (Jan. 4, 2001).

122. Compensation is “deemed not to take into account ‘other business generated

between the parties,’ provided that the compensation is fair market value for items and services

actually provided and does not vary during the course of the compensation arrangement in any

manner that takes into account referrals or other business generated by the referring physician,

including private pay healthcare business. . . .” 42 C.F.R. § 411.354(d)(3) (2014).

123. The Stark Law and its companion regulations set forth exceptions for certain

financial relationships that meet specific enumerated requirements. The Stark Law’s exceptions

operate as affirmative defenses to alleged violations of the statute. Once it has been shown that a

party submitting Medicare claims has a financial relationship with a referring physician, the

defendant bears the burden of demonstrating that the relationship meets all of the requirements of

an applicable statutory or regulatory exception. See, e.g., United States ex rel. Drakeford v. Tuomey

Healthcare Sys., Inc., 675 F.3d 394, 405 (4th Cir. 2012).

124. The Stark Law and its implementing regulations contain exceptions for certain

compensation arrangements, including “personal service arrangements” and “indirect

compensation arrangements.”

125. To qualify for the Stark Law’s exception for personal service arrangements, a

compensation arrangement must meet, inter alia, the following statutory requirements: the

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 31 of 154 PageID #: 914

32

compensation (A) is set in advance, (B) does not exceed fair market value, and (C) is not

determined in a manner that takes into account the volume or value of any referrals or other

business generated between the parties, except for compensation received pursuant to a “physician

incentive plan” as defined by the Stark Law. See 42 U.S.C. § 1395nn(e)(3)(A); see also 42 C.F.R.

§ 411.357(d) (2014). A “physician incentive plan” under § 1395nn(e)(3) is narrowly defined and

only applies to personal service arrangements that “may directly or indirectly have the effect of

reducing or limiting services provided with respect to individuals enrolled with the entity.” 42

U.S.C. § 1395nn(e)(3)(B)(ii).

126. To qualify for the Stark Law’s exception for indirect compensation arrangements,

the following requirements, inter alia, must be satisfied: (A) the compensation received by the

referring physician is fair market value for items and services actually provided by the physician,

(B) the physician’s compensation is not determined in any manner that takes into account the

volume or value of referrals or other business generated by the referring physician for the DHS

entity, (C) the compensation is for identifiable services, and the arrangement is commercially

reasonable even in the absence of referrals to the entity, and (D) the arrangement does not violate

the AKS. See 42 C.F.R. § 411.357(p) (2014).

127. The Stark Law is a strict liability statute, with no scienter element. Those who

knowingly submit or cause to be submitted claims to Medicare in violation of the Stark Law also

violate the FCA. A knowing violation of the Stark Law also may result in exclusion from federal

healthcare programs. 42 U.S.C. §§ 1395nn(g)(3), 1320a-7a(a).

VII. LABORATORY TESTING OVERVIEW

128. Clinical laboratory services involve the “examination of materials derived from the

human body for the diagnosis, prevention, or treatment of a disease or assessment of a medical

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 32 of 154 PageID #: 915

33

condition.” Medicare Benefit Policy Manual (MBPM), Pub. 100-02, Ch. 15, § 80.1, available at

http://www.cms.gov/Regulations-and-Guidance/Guidance/Manuals/Downloads/bp102c15.pdf.

129. Pursuant to Medicare regulations, (1) laboratory tests must be ordered by the

physician treating the patient for the treatment of a specific illness or injury; (2) laboratory test

orders that are not individualized to patient need, or for which the need is not documented in the

medical record, are not covered services; and (3) claims for laboratory services that do not meet

these requirements are ineligible for payment. See 42 C.F.R. § 410.32.

130. All diagnostic laboratory tests “must be ordered by the physician who is treating

the beneficiary, that is, the physician who furnishes a consultation or treats a beneficiary for a

specific medical problem and who uses the results in the management of the beneficiary’s specific

medical problem. Tests not ordered by the physician who is treating the beneficiary are not

reasonable and necessary.” 42 C.F.R. § 410.32(a).

131. A laboratory test order is “a communication from the treating physician/practitioner

requesting that a diagnostic test be performed for a beneficiary.” MBPM, Ch. 15, § 80.6.1.

Medicare requires that an ordering physician “must clearly document, in the medical record, his

or her intent that the test be performed.” Id.

132. Clinical laboratory services must be used promptly by the physician who is treating

the beneficiary as described in 42 C.F.R. § 410.32(a). See MBPM, Ch. 15, § 80.1.

133. Medicare requires proper and complete documentation of laboratory services

rendered to beneficiaries. In particular, the Medicare statute provides that:

No payment shall be made to any provider of services or other person under this

part unless there has been furnished such information as may be necessary in order

to determine the amounts due such provider or other person under this part for the

period with respect to which the amounts are being paid or for any prior period.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 33 of 154 PageID #: 916

34

42 U.S.C. § 1395l(e); see also 42 U.S.C. § 1395u(c)(2)(B)(i) (“The term ‘clean claim’ means a

claim that has no defect or impropriety (including any lack of any required substantiating

documentation) . . . .”).

134. A laboratory’s claim for a service is ineligible for payment if there is not sufficient

documentation in the patient’s medical record to establish that the service was reasonable and

necessary. 42 C.F.R. § 410.32(d)(3).

135. Medicare regulations allow laboratories to request documentation from physicians

regarding medical necessity:

Medical necessity. The entity submitting the claim may request additional

diagnostic and other medical information from the ordering physician or

nonphysician practitioner to document that the services it bills are reasonable and

necessary.

42 C.F.R. § 410.32(d)(3)(iii).

136. Likewise, under the Texas Medicaid program, services must be individualized to

the medical needs of each patient; providers must maintain appropriate documentation for each

beneficiary, substantiating the need for services, including all findings and information supporting

medical necessity, and detailing all treatment provided. For laboratory services or tests to be

covered by Texas Medicaid, those services must be ordered by a professional practitioner within

the scope of his or her practice.

137. Similarly, TRICARE covers laboratory tests only if the tests are “medically or

psychologically necessary” and “required in the diagnosis and treatment of illness or injury.” 32

CFR § 199.4(a)(1). TRICARE will not cover tests that are “not related to a specific illness or injury

or a definitive set of symptoms.” Id. at § 199.4(g)(2).

138. As noted above, TRICARE regulations provide that TRICARE may deny payment

in “abuse situations.” 32 C.F.R. § 199.9(b). The regulations expressly include as examples of

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 34 of 154 PageID #: 917

35

“abuse or possible abuse situations” the following: (i) “a battery of diagnostic tests are given

when, based on the diagnosis, fewer tests were needed,” and (ii) “[f]ailure to maintain adequate

medical or financial records.” Id.

LABORATORY FRAUD SCHEMES

139. Laboratory executives and employees in Texas conspired with hospital executives

and employees, recruiters, and healthcare providers (HCPs), among others, to pay kickbacks to

HCPs to induce their referrals of laboratory testing, even when medically unnecessary. As part of

the conspiracy, LRH falsely represented to federal healthcare programs that the beneficiaries were

hospital outpatients, in order to fraudulently secure higher reimbursements.

I. LITTLE RIVER HOSPITAL FRAUD SCHEMES

A. LRH Submitted False Outpatient Claims to Receive Higher Reimbursement

1. Reimbursement to CAHs

140. To ensure that Medicare beneficiaries in rural communities can access necessary

hospital care, Congress authorized favorable Medicare reimbursements for hospitals certified by

CMS as critical access hospitals (CAHs). Balanced Budget Act of 1997, P.L. No. 105-33 § 4201.

141. To be certified as a CAH, hospitals participating in Medicare generally must,

among other things, have 25 or fewer inpatient beds, provide emergency services 24 hours per day,

and be located in underserved rural areas some distance from other hospitals or CAHs. 42 C.F.R.

§§ 485.610, 485.618, 485.620.

142. A hospital certified as a CAH is eligible to receive favorable Medicare

reimbursements, generally being paid 101 percent of reasonable costs for most inpatient and

outpatient services provided to Medicare beneficiaries. 42 U.S.C. § 1395m(g). The cost-based

payments to CAHs generally are much higher than the predetermined rates that Medicare pays

acute care hospitals (non-CAHs) and laboratories for the same services.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 35 of 154 PageID #: 918

36

143. Because Medicare’s favorable reimbursement to CAHs is meant to ensure access

to care by those in rural communities, a CAH is not eligible for cost-based reimbursement for

services provided to individuals who are neither inpatients nor outpatients of the CAH, i.e., non-

patients of the hospital. See 42 C.F.R. § 413.70 (2015).

144. As relevant here, for outpatient clinical diagnostic laboratory services, Medicare

will pay 101 percent of reasonable costs to a CAH “only if [1] the individual is an outpatient of

the CAH” and [2] either “[t]he individual is receiving outpatient services in the CAH on the same

day the specimen is collected” or “[t]he specimen is collected by an employee of the CAH.” 42

C.F.R. § 413.70(b)(7)(iv) (2015). Although an individual Medicare beneficiary need not be

“physically present in the CAH at the time the specimen is collected,” the individual must be “an

outpatient of the CAH.” Id.

145. The CAH can bill for outpatient services only if the individual beneficiary [1] “has

not been admitted as an inpatient,” [2] “is registered on the hospital or CAH records as an

outpatient and [3] receives services (rather than supplies alone) directly from the hospital or CAH.”

42 C.F.R. § 410.2.

146. If a Medicare beneficiary is neither an inpatient nor an outpatient of the CAH, then

reimbursement for the non-patient’s clinical diagnostic laboratory tests is based on the Medicare

clinical laboratory fee schedule (CLFS). 42 C.F.R. § 413.70(b)(7)(vi) (2015).

2. LRH Submitted False Outpatient Claims for Non-Patients of LRH

147. LRH was a CAH headquartered in Rockdale, Texas (population under 6,000).

148. LRH received cost-plus payments when it submitted hospital outpatient claims to

Medicare for laboratory testing. Such cost-plus payments significantly exceeded the payments

available under the CLFS for claims to Medicare for laboratory testing on non-patients of LRH.

Case 4:16-cv-00547-ALM Document 57 Filed 01/31/22 Page 36 of 154 PageID #: 919

37

149. For example, the chart below includes laboratory tests in a panel that Elizabeth

Seymour, M.D., of Denton, Texas, ordered from LRH on or about August 1, 2016 for a Medicare

beneficiary in return for MSO kickbacks. LRH submitted claims for the tests to Medicare, falsely

representing that the services were provided to LRH outpatients. The chart lists the amounts that

Medicare paid to LRH for purported outpatient services. In comparison, the chart lists the

corresponding Medicare payment amount in 2016 in Texas under the CLFS.

CPT

Code

CPT Description

LRH

Payment

CLFS

Payment

80053

Blood test, comprehensive group of blood chemicals

$99.06

$14.39

80061

Blood test, lipids (cholesterol and triglycerides)

$112.84

$18.24

82172

Apolipoprotein level

$94.59

$21.11

82306

Vitamin D-3 level

$125.13

$37.02

82533

Cortisol (hormone) measurement, total

$54.00

$22.21

82542

Chemical analysis using chromatography technique

$91.53

$24.60

82542

Chemical analysis using chromatography technique

$45.77

$24.60

82607

Cyanocobalamin (vitamin B-12) level

$70.76

$20.54

82610

Cystatin C (enzyme inhibitor) level

$41.34

$18.52

82627

Dehydroepiandrosterone (DHEA-S) hormone level

$67.78

$30.29

82664

Electrophoresis, laboratory testing technique

$79.32

$35.62

82670

Measurement of total estradiol (hormone)

$94.22

$38.06

82725

Fatty acids measurement

$40.59

$18.13

82747

Folic acid level, RBC

$125.50

$23.55

82777

Galectin-3 level

$67.03

$29.96

83001

Gonadotropin, follicle stimulating (reproductive hormone) level

$58.09

$25.31

83002

Gonadotropin, luteinizing (reproductive hormone) level

$66.29

$25.22

83090

Homocysteine (amino acid) level

$109.11

$22.98

83525

Insulin measurement, total

$46.92

$15.57

83698

Lipoprotein-associated phospholipase A2 (enzyme) level

$103.15

$46.24

83704

Lipoprotein level, quantitation of lipoprotein particle number(s)

$197.37

$42.98

83789

Mass spectrometry (laboratory testing method)

$24.58

$24.60

83876

Myeloperoxidase (white blood cell enzyme) measurement

$103.15

$46.24

83880

Natriuretic peptide (heart and blood vessel protein) level

$103.15

$46.24

83921

Organic acid level

$121.40

$22.41

84140

Pregnenolone (reproductive hormone) level

$36.70

$28.16

84144

Progesterone (reproductive hormone) level

$63.31

$28.42

84206

Proinsulin (pancreatic hormone) level

$54.00

$24.26

84311

Chemical analysis using spectrophotometry (light)

$10.80

$9.52

84378