Urban Institute ▪ 500 L’Enfant Plaza SW ▪ Washington DC 20037 urban.org

Impacts of COVID-19-Era Economic Policies on Consumer

Debt in the United Kingdom

Mingli Zhong

Urban Institute

Breno Braga

Urban Institute

Signe-Mary McKernan

Urban Institute

Mark Hayward

Lowell

Elizabeth Millward

Lowell

Christopher Trepel

Fenway Summer LLC

January 27, 2023

The authors welcome feedback on this working paper. Please send all inquiries to [email protected].

Urban Institute working papers are circulated for discussion and comment. Though they may have been

peer reviewed, they have not been formally edited by the Department of Editorial Services and

Publications. The views expressed are those of the authors and should not be attributed to the Urban

Institute, its trustees, or its funders.

Acknowledgements: This research is a joint project of the Urban Institute and Lowell. Urban and Lowell

researchers collaborated on all stages of the research. In addition, Lowell provided funds and operational

and research data. The Urban Institute is grateful to all its funders, who make it possible for Urban to

advance its mission. The views expressed are those of the authors and should not be attributed to the

Urban Institute, its trustees, or its funders. Funders do not determine research findings or the insights and

recommendations of our experts. Further information on the Urban Institute’s funding principles is

available at urban.org/fundingprinciples. We thank Maddie Pickens, Jen Andre, and Noah Johnson for

excellent technical assistance. We also thank Nathan Blascak, Thea Garon, Cormac O’Dea, Miranda

Santillo, and attendees at the Urban Wealth and Financial Well-being Brown Bag and 2022 APPAM Fall

Conference for helpful comments.

Copyright © January 2023. Zhong, Braga, McKernan, Hayward, Millward, Trepel. All rights reserved.

ii

Abstract

We examine the effects of the expanded Universal Credit and mortgage forbearance on the

financial well-being of United Kingdom (UK) residents during the pandemic. Using anonymized

individual-level consumer financial data on 2 million UK consumers, each with one or more

defaulted accounts accrued before the pandemic, we found that average nonmortgage debt

increased by 17 percent from October 2019 (£5,497) to December 2021 (£6,456). Using a

difference-in-difference approach, we found mixed policy impacts on the debt people carried.

Although the expansion of Universal Credit was intended to help financially vulnerable families,

consumers who were more likely to benefit from the Universal Credit expansion took on 1

percent more total nonmortgage debt after the policy expansion. By contrast, during the period of

mortgage forbearance, mortgage holders accumulated 1 percent less total nonmortgage debt

compared with nonmortgage holders. These results suggest that policies implemented in the UK

to protect financially vulnerable families might have exacerbated prepandemic inequalities.

1

Introduction

Financial vulnerability skyrocketed at the onset of the COVID-19 pandemic, when many people

suddenly found themselves out of work (see, e.g., Braga et al. 2021, 2022). In response, many

governments provided stimulus payments and other relief measures (IMF 2021) to buffer

households and individuals against financial difficulties and stimulate the economy in Asia

(Beirne, Morgan, and Sonobe 2021), the European Union (Almeida et al. 2021), Italy (Core and

De Marco 2021), the UK (Blundell et al. 2022), the United States (Marinescu, Skandalis, and

Zhao 2021; Romer 2021), and a number of low- and middle-income countries (Miguel and

Mobarak 2022).

Recent research shows that economic policies enacted in response to COVID-19

appeared to prevent households from suffering immediate financial catastrophes (Chetty et al.

2022). However, we know little about individuals in financial distress before the pandemic,

mostly due to lack of high-quality data.

1

Studying financially distressed populations is important

for two reasons. First, financially distressed individuals could be more financially vulnerable

than others during the pandemic. Second, they were highly likely to be eligible for social

benefits. Thus, studying this group provides evidence on whether COVID-19-era economic

policies were developed and enacted in ways that ultimately helped individuals in need.

To fill this gap in understanding, we used individual-level administrative data from one

of Europe’s largest credit management service companies to track two million financially

distressed UK consumers. Because major COVID-19-era policies targeting households and

individuals were implemented between March 2020 and October 2021, we studied the time

interval between October 2019 and December 2021 to cover the entire period that policies were

active and compare consumer debt outcomes before and after the policy interventions. During

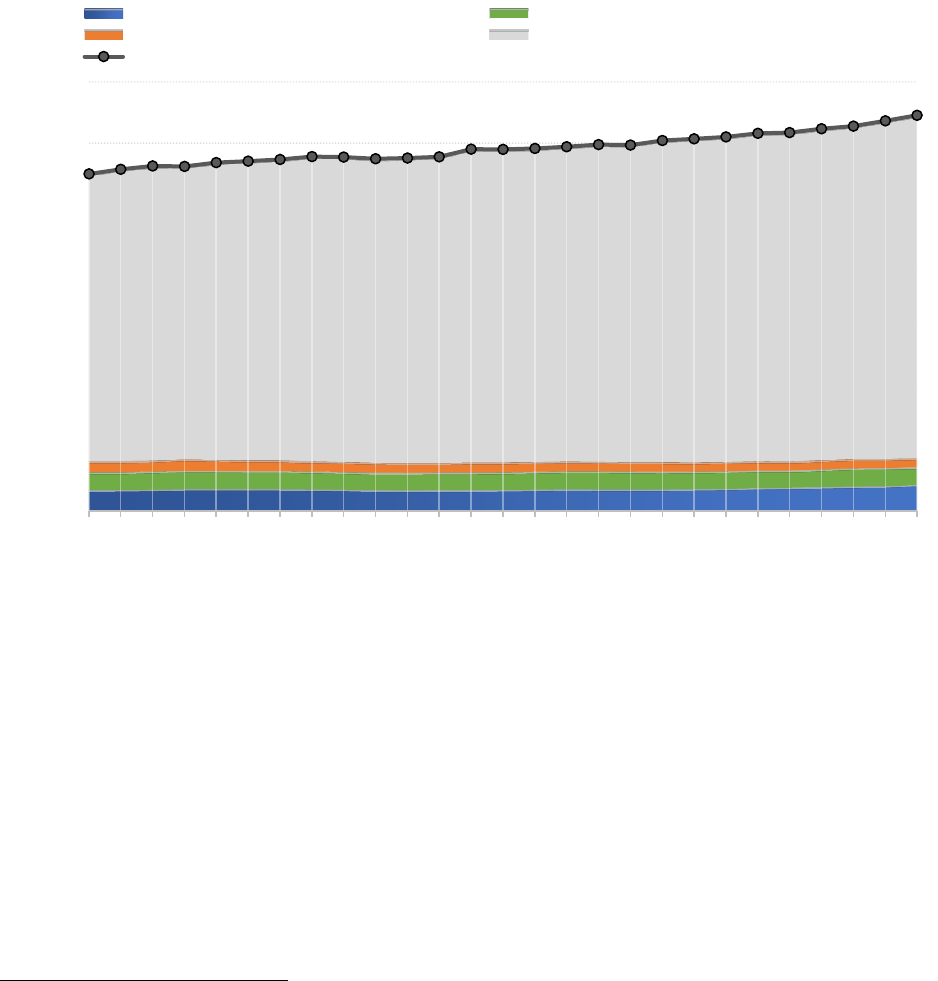

this window, we found that the debt levels of financially distressed individuals steadily increased

in the United Kingdom. The average nonmortgage debt for individuals with defaulted consumer

debt increased by 17 percent from £5,497 in October 2019 to £6,456 in December 2021 (figure

1). Disaggregating monthly nonmortgage debt by types, we found the debt on average consists of

1

In this working paper, individuals with financial distress are defined as those with one or more charged-off and

defaulted accounts accrued before the pandemic.

2

6 percent credit card debt, 5 percent subprime loans, 3 percent checking account overdrafts, and

86 percent other forms of nonmortgage debt not directly observed from the data.

Figure 1. Average Nonmortgage Debt for Individuals with Defaulted Consumer Debt

Increased from October 2019 to December 2021

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: The dark gray dotted line is the average nonmortgage balance for individuals in our sample. Debt levels have

steadily increased for individuals with financial distress in the UK. The average nonmortgage debt for individuals

with defaulted consumer debt increased from £5,497 in October 2019 to £6,456 in December 2021. The total

nonmortgage debt consisted of 6 percent credit card debt (blue bars), 5 percent subprime loans (green bars), 3

percent checking account overdrafts (orange bars), and 86 percent other forms of nonmortgage debt that we do not

directly observe from the data (grey bars). N = 1,959,170.

In this working paper, we examine the effects of two COVID-19-era UK economic

policies:

2

expanded Universal Credit and mortgage forbearance.

2

Unlike the US, the UK did not implement student loan forbearance during the pandemic. An overview of the UK

COVID-19-era economic policies can be found here (IMF 2021): https://www.imf.org/en/Topics/imf-and-

covid19/Policy-Responses-to-COVID-19#U. We do not study other policies, such as the Coronavirus Job Retention

Scheme, which transferred money to employers rather than directly to consumers.

5,497

5,576

5,627

5,623

5,682

5,707

5,734

5,782

5,773

5,747

5,757

5,778

5,903

5,898

5,914

5,943

5,976

5,968

6,045

6,071

6,102

6,161

6,172

6,234

6,280

6,364

6,456

0

1000

2000

3000

4000

5000

6000

7000

OCT-19

NOV-19

DEC-19

JAN-20

FEB-20

MAR

-20

APR-20

MAY

-20

JUN-20

JUL-20

AUG-20

SEP-20

OCT-20

NOV-20

DEC-20

JAN-21

FEB-21

MAR

-21

APR-21

MAY

-21

JUN-21

JUL-21

AUG-21

SEP-21

OCT-21

NOV-21

DEC-21

Average Monthly Balance (£)

Credit cards Subprime loans

Checking account overdraft Other non-mortgage debts

Total non-mortgage debts

3

Universal Credit expansion:

3

From March 2020 through October 2021, in addition to the

standard Universal Credit payment, each eligible UK household received an additional £20 per

week. This increase was applied uniformly across the UK.

4

Mortgage forbearance: Homeowners with mortgages in the UK were able to request

mortgage forbearance from March 2020 through March 2021.

5

Once mortgage forbearance was

granted, mortgage holders were allowed to defer full or partial mortgage payments by up to six

months if they experienced difficulties making payments during the pandemic. Mortgage holders

were eligible to claim mortgage forbearance even if they were in payment shortfall or already

benefiting from an alternative forbearance program. The policy was applied uniformly across the

UK.

6

We used difference-in-difference models to describe the impacts of COVID-19-era

economic policies on consumer debt outcomes and constructed a treatment group (individuals

likely to benefit from the policy) and comparison group (individuals unlikely to benefit but

descriptively similar to those in the treatment group). To find a suitable comparison group, we

used propensity score matching to pair individuals in the treatment group with those with similar

baseline characteristics in the comparison group. We then tracked the two groups before and

after each policy was implemented.

Overall, the results are mixed. We found no evidence that the £20 per week additional

Universal Credit policy reduced nonmortgage debt reliance among consumers more likely to

benefit from the policy. Although the Universal Credit expansion was intended to help

3

Universal Credit in the UK is similar to unemployment insurance in the US. Workers who have low incomes or are

unemployed are eligible for Universal Credit and its expansion.

4

For more details about the changes in the Universal Credit payments during COVID-19, see Hobson (2021):

https://researchbriefings.files.parliament.uk/documents/CBP-8973/CBP-8973.pdf. The Working Tax Credit (WTC)

was also increased by £20 per week and claimants received a one-off payment of £500 in April 2021. The Local

Housing Allowance (LHA) was increased to the 30th percentile of local rents (it had previously been frozen for four

years and fell below most rents).

5

Mortgage forbearance was not automatically applied; eligible mortgage holders needed to apply. For additional

details about mortgage forbearance, see Cromarty, Wilson, and Barton (2021):

https://commonslibrary.parliament.uk/research-

briefings/sn04769/#:~:text=Coronavirus%20(Covid%2D19)%3A%20mortgage%20support%20measures&text=A%

20moratorium%20on%20possession%20proceedings,2020%20to%201%20April%202021.

6

Deferrals were available through July 31, 2021, but the last date to apply for a new deferral was March 31, 2021

(to get a full six months of deferrals, borrowers were required to apply in February and could defer through July 31).

Those already in forbearance could extend after March 31 through July 31, 2021, but the extended deferral payments

had to be consecutive. Source: Financial Conduct Authority (2020): https://www.fca.org.uk/publication/finalised-

guidance/mortgages-coronavirus-payment-deferral-guidance.pdf.

4

financially vulnerable families, residents living in areas with a high share of Universal Credit

beneficiaries took on 1 percent more nonmortgage debt than residents living in areas with a low

share of beneficiaries. On the other hand, we found that mortgage holders benefited from

mortgage forbearance by accumulating less nonmortgage debt. In precise terms, during the

period of mortgage forbearance, mortgage holders accumulated 1 percent less nonmortgage debt

than nonmortgage holders.

These two results combined suggest that policies implemented in the UK to protect

families might have exacerbated prepandemic inequalities. The Universal Credit is a means-

tested program aimed at vulnerable populations, such as those out of work or disabled. Our

findings suggest that the small (£20 per week) payment Universal Credit increments were

insufficient to prevent beneficiaries from accumulating additional debt during the pandemic. On

the other hand, mortgage forbearance benefits homeowners who tend to be more financially

secure. Our results suggest that mortgage holders used the extra resources to pay down their

nonmortgage debt.

Our findings contribute to the literature across three dimensions. First, our research

speaks to an important policy debate about the design and delivery of cash transfers and

mortgage forbearance to families with low incomes, existing debt relief evidence (Cherry et al.

2021), and expanded child tax credits (Pilkauskas et al. 2022). In studying the US response to the

2007–09 Great Recession, Schanzenbach and colleagues (2016) concluded that the most

stimulative fiscal spending types are (1) programs directed at people with low incomes or who

are newly unemployed, followed by (2) tax cuts focused on people with lower incomes because

people with lower incomes are more likely than people with higher incomes to spend what they

receive. We found supportive evidence that, when debt relief is large enough, consumers spend

more on credit cards and pay down high-cost loans (such as subprime loans).

Second, while many studies focus on the US (Federal Reserve Board 2020; Han, Meyer,

and Sullivan 2020; New York Fed 2021), we provide additional evidence from the UK to

identify policies that are universally effective at alleviating the adverse economic effects on

households and individuals during significant economic shocks. Previous UK studies document

increases in poverty (Legatum Institute 2020) and unemployment (ONS 2020) during the first

year of the pandemic. Using scanner data, O’Connell, De Paula, and Smith (2021) found large

increases in demand for storable products in the days before the first UK lockdown in March

5

2020, with the largest demand spikes for wealthier households. Based on these previous UK

studies documenting the macroeconomic conditions and household spending behavior, little is

known about whether pandemic-era economic policies helped alleviate financial distress. Our

research complements previous research by identifying policy impacts using administrative

credit data that covers the whole time frame when major policies were enacted. Lastly, our focus

on financially distressed populations sheds light on the question of whether stimulus and relief

programs are well-targeted to those in greatest need (Braga et al. 2019; Braga, Mckernan, and

Hassani 2019).

Data and Methods

Our analyses combined anonymized, individual-level, monthly financial data from Lowell, one

of Europe’s largest credit management service companies, with socioeconomic data from the

Offices for National Statistics (ONS). The Lowell data are generally representative of financially

vulnerable consumers in the UK. Braga and colleagues (2021) compared the share of adults who

are Lowell consumers in default with the share of consumers from one of the UK’s major credit

reference agencies whose credit record contains a defaulted debt in the same geographic area and

found a very strong (0.97) correlation.

We tracked approximately two million Lowell consumers monthly between October 2019

and December 2021. The data included information on credit balances, mortgage balances, and

nonmortgage balances. All individuals had an active account from October 2019 through

December 2021 and/or an account that was closed up to two years before October 2019. Lowell

consumers are typically in financial distress, having defaulted on at least one unsecured credit

account (and often more than one).

7

Lowell has detailed credit records for each consumer from two major credit reference

agencies, including data on the balances of all debt types (including subprime loans) and credit

use. Basic socioeconomic characteristics are also available, such as age, gender, and location

data. The Office for National Statistics (ONS) provides data on race, ethnicity, and income at the

7

In the Lowell data, we do not know when consumers entered default.

6

district level, as well as the share of Universal Credit beneficiaries at the ward level; we merged

the ONS and Lowell data at their respective geographic levels.

8

The two policies of interest, mortgage forbearance and Universal Credit, both started in

March 2020. In February 2020, the average nonmortgage debt load (our primary outcome) in our

sample was £5,682, the share of Lowell customers with mortgages was 7.5 percent, and the

average mortgage balance for mortgage holders was £8,161 (table 1). These credit balances

come from the Lowell data and were reported before any pandemic-related policies came into

effect. The median percent of Universal Credit beneficiaries by ward was 3.7 percent (table 1),

based on data from the ONS. To estimate the likelihood that an individual received the Universal

Credit, we used the percentage of Universal Credit beneficiaries in each ward. In other words,

the higher the share of Universal Credit beneficiaries within a ward, the more likely a given

individual living in that area received base Universal Credit benefits and the expansion. Table 1

also presents sample demographic characteristics used as control variables in our analyses: 48

percent female and median age 40 (from the Lowell data) and 8.1 percent median people color

by ward. To understand the racial and ethnic makeup of the local area of each individual in our

sample, we used ONS data describing the percentage of people of color in their home ward.

Table 1. Summary Statistics of a Sample Representative of the Financially Distressed

Population in the UK in February 2020

Variables

Summary Statistics (February 2020)

Panel A: Data from Lowell

Percent female

48.0%

Median age

40

Percent mortgage holders

7.5%

Average mortgage balance

£8,161

Average nonmortgage balance

£5,682

Panel B: Data from the Office for National Statistics

Median percentage people of color, by ward

8.1%

Median share of Universal Credit beneficiaries, by ward

3.7%

Number of unique consumers

1,959,170

8

Districts and wards are geographic units in the UK, and wards are more granular than districts—see Office for

National Statistics (2021):

https://www.ons.gov.uk/methodology/geography/ukgeographies/administrativegeography/england#metropolitan-

counties-and-districts.

7

Source: Summary statistics of the full sample in February 2020 based on individual-level administrative data from

Lowell, one of Europe’s largest credit management service companies.

Notes: Panel A shows gender, age, percent of mortgage holders, and average nonmortgage balance from the Lowell

data in February 2020. Panel B shows additional statistics from the Office for National Statistics (ONS). We provide

additional race and ethnicity data at the ward level for the sample, where wards are the most granular geographic

levels standardized across the UK (see ONS 2021). We also show the median share of Universal Credit beneficiaries

by ward. All statistics are prepandemic. See page 11 in Breno and colleagues (2021) comparing a similar sample to

the UK general population in financial distress. Our sample is representative of the UK population in financial

distress. N = 1,959,170.

We relied on a difference-in-difference research design. We compared the debt outcomes

of the matched treatment and comparison groups before and after the policy implementation. The

underlying assumption was that the treatment and comparison groups would have parallel

outcome trajectories in the absence of the policy. We used propensity score matching to find a

group who looked like those affected by the policy before the pandemic and thereby constructed

a comparison group. Specifically, the propensity score matching process used debt status from

before the pandemic to identify similar individuals across the treatment and comparison groups.

We found that prepandemic debt markers are strong predictors for estimating debt status during

the pandemic. This means that, without policy interventions, individuals in the treatment and

matched comparison groups would follow similar personal debt trajectories. Therefore, the

observed differences in debt trajectories between the two groups helped us causally identify the

impacts of policy interventions on consumer debt levels.

To further control for confounding factors that could drive debt outcomes differentially

between the treatment and comparison groups, we controlled for gender, age, race, ethnicity, time

fixed effects, and geographic fixed effects in our regression analyses. We also controlled for other

policies implemented concurrently with the policy of interest to distinguish the impact of each.

Universal Credit Expansion

The comparison and treatment groups that we created to empirically identify the impact of

Universal Credit expansion share similar socioeconomic characteristics and debt outcomes (table

2). We defined our treatment group as individuals living in wards with a share of Universal

Credit beneficiaries above the median (i.e., 3.7 percent, as shown in table 1). The comparison

group is defined as individuals living in wards with a share of Universal Credit beneficiaries

below the median.

8

Table 2. Socioeconomic Characteristics Are Similar between Individuals Living in Wards

with a Share of Universal Credit Beneficiaries above Median and Those Living in Wards

with a Share of Universal Credit Beneficiaries below Median.

Variables

Summary Statistics in February 2020

Individuals living in

wards with a share of

Universal Credit

Matched individuals

living in wards with a

share of Universal Credit

Individuals living in wards

with a share of Universal

Credit beneficiaries

beneficiaries above

median

beneficiaries below

median

below median

Panel A: Data from Lowell

Percent female

47.9%

48.5%

48.7%

Median age

40

41

41

Percent mortgage

holders

7.0%

8.8%

9.6%

Average mortgage

balance

£6,840

£12,314

£13,748

Average nonmortgage

balance

£5,455

£5,480

£6,652

Panel B: Data from the Office for National Statistics

Median percent of

people of color by ward

10.9%

4.0%

3.9%

Median share of

Universal Credit

beneficiaries by ward

4.2%

1.5%

1.5%

Number of unique

consumers

1,580,609

329,343

376,741

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Summary statistics for the two groups presented in Figure 2: Lowell consumers living in wards with a share

of Universal Credit beneficiaries below (and including) the median and those living in wards with a share of

beneficiaries above median. The median share of Universal Credit beneficiaries was 3.7 percent (as shown in table

1). To match individuals in the treatment group with individuals in the control group, we used propensity score

matching using three prepandemic debt outcomes as covariates: nonmortgage debt in February 2020, December

2019, and October 2019. Comparing Columns (2) and (3), socioeconomic characteristics including the share of

female, median age, and percent of mortgage holders between the two groups are close. Average nonmortgage

balance was also close because we used this nonmortgage debt to match individuals between the two groups. People

living in low-share areas had a higher average mortgage balance, likely because their home values were higher.

They were also more likely to live in areas with a low share of people of color. Column (4) presents summary

statistics unweighted by propensity scores for individuals living in wards with a share of Universal Credit

beneficiaries below the median. The number of unique consumers in Columns (3) is slightly less than in Column (4)

because some individuals in Column (3) were not matched with anyone in Column (2) during the propensity score

matching process. Although some people were not matched, the socioeconomic characteristics were similar to those

shown in Columns (3) and (4).

In table 2, Columns (2) and (3) show summary statistics for the treatment and matched

comparison groups. Column (4) presents summary statistics for the unmatched comparison

group. The number of unique consumers in Columns (3) is slightly smaller than in Column (4) as

9

some individuals’ characteristics prevented matching with anyone in the treatment group.

Although some people in the comparison group were not matched, socioeconomic characteristics

before and after the matching were similar to those shown in Columns (3) and (4). To match

individuals in the treatment group with individuals in the comparison group with similar

characteristics, we used three prepandemic nonmortgage debt outcomes measured in February

2020, December 2019, and October 2019. The underlying assumption was that without Universal

Credit expansion, matched individuals in these two groups would have parallel debt trajectories

from March 2020 onward.

However, individuals who were more likely to receive the Universal Credit expansion

accumulated more nonmortgage debt than those who were less likely to receive it (figure 2).

Regression results further quantify the differences in debt accumulation: during the period that

Universal Credit was expanded by £20 per week, UK residents living in areas with a high share

of Universal Credit beneficiaries accumulated about 1 percent more nonmortgage debt than those

living in areas with a low share of Universal Credit beneficiaries (table 3). The results are

statistically significant, robust across difference specifications, and based on difference-in-

difference regression results that quantify the causal impact of the expanded Universal Credit.

All regression specifications used the same matched individuals as described in figure 2.

Figure 2. Residents Living in Areas with a High Share of Universal Credit Beneficiaries

Took on More Nonmortgage Debt Than Those Living in Areas with a Low Share of

Beneficiaries during the Universal Credit Expansion.

2,800

2,900

3,000

3,100

3,200

3,300

3,400

3,500

3,600

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Feb-21

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Average Monthly Nonmortgage

Balance (£)

UC low share UC high share

March-20: Universal Credit

expansion start

Oct-21: Universal Credit

expansion end

10

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Average nonmortgage balance for individuals living in wards with a share of Universal Credit beneficiaries

below median (blue line) compared with those living in wards with a share of Universal Credit beneficiaries above

median (red line) from October 2019 through December 2021. After the Universal Credit expansion was

implemented (from March 2020 through October 2021), residents living in high-share wards took on more

nonmortgage debt than those living in low-share wards. To match individuals in the treatment group with

individuals in the control group, we used propensity score matching using three prepandemic debt outcomes:

nonmortgage debt in February 2020, December 2019, and October 2019. Number of unique consumers in the red

line (living in areas where the share of Universal Credit beneficiaries was above the median) = 1,580,609. Number

of unique consumers in the blue line (living in areas where the share of Universal Credit beneficiaries was below the

median) = 329,343. See table 2 for more summary statistics. See table 3 for regression results that quantify the

differences in nonmortgage debt.

11

Table 3. Residents Living in Areas with a High Share of Universal Credit Beneficiaries

Took on 1 Percent More Nonmortgage Debt Than Those Living in Areas with a Low Share

of Beneficiaries during the Universal Credit Expansion.

Outcome: Log of Nonmortgage Balances

(1)

(2)

(3)

(4)

During Universal Credit

(UC) expansion

0.175***

0.162***

-0.0198

-0.0204

(0.001)

(0.001)

(6.937)

(6.912)

UC share above median

0.00389***

0.0833***

0.0561***

0.0655***

(0.001)

(0.001)

(0.001)

(0.001)

UC expansion X UC share

above median

0.00896***

0.00910***

0.00944***

0.00998***

(0.001)

(0.001)

(0.001)

(0.001)

Female

0.0850***

0.0807***

0.0828***

(0.000)

(0.000)

(0.000)

Age

0.00471***

0.00452***

0.00290***

(0.000)

(0.000)

(0.000)

Percent of people of color

by ward

-0.00661***

-0.00495***

-0.00480***

(0.000)

(0.000)

(0.000)

Mortgage holders in

February 2020

0.377***

(0.001)

Month fixed effects

x

x

x

x

Parliamentary constituency

fixed effects

x

x

N

51,029,729

50,742,539

50,282,178

50,282,178

Mean dependent:

8.052

8.057

8.057

8.057

R2

0.00184

0.0151

0.0261

0.0330

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Regression results from difference-in-difference models to quantify the impact of Universal Credit expansion

(March 2020–October 2021) on nonmortgage debt. The outcome variable is the log of nonmortgage balances from

October 2019 to December 2021. The comparison group is defined based on propensity score matching on three

prepandemic characteristics: nonmortgage debt in February 2020, December 2019, and October 2019 (same as in

figure 2). Specification (1) is the baseline regression model with three covariates: the time dummy variable

indicating whether the individual was observed during the period that the Universal Credit was expanded, a dummy

variable indicating whether the individual lived in an area where the share of Universal Credit beneficiaries was

above the median in February 2020, and the interaction of the two dummy variables. In specification (2), we add

socioeconomic characteristics including gender, age, and race and ethnicity. Because we did not have the individual-

level racial and ethnic information, we used the percent of people of color by ward, which was the most granular

geographic area with race data available. We added month-time fixed effects to all the specifications. In

specification (3), we added another geographic fixed effect, parliamentary constituency specifically, to further

control for underlying variations across location. In specification (4), we added another control—an indicator of

mortgage holders in February 2020. This indicator approximates the likelihood that the given individual would be

eligible and apply for mortgage forbearance. Because the period of mortgage forbearance from March 2020 through

March 2021 overlapped with the Universal Credit expansion, we controlled for the potential impact of mortgage

forbearance to have a cleaner identification for the impact of the expansion.

12

Specification (1) is the baseline regression model with three covariates: the time dummy

variable indicating whether the individual was observed during the Universal Credit expansion

period (i.e., March 2020–October 2021), a dummy variable indicating whether the individual

lived in an area where the share of Universal Credit beneficiaries was above the median in

February 2020,

9

and the interaction of the two dummy variables. In specification (2), we added

socioeconomic characteristics, including gender, age, and race and ethnicity. Because we did not

have individual-level racial and ethnic information, we used the percentage of people of color by

ward, which provided the most granular geographic data available. In specification (3), we added

another geographic fixed effect, parliamentary constituency, to further control for underlying

variations across location. In specification (4), we added another control—an indicator for

mortgage holders in February 2020. This indicator approximates the likelihood that the given

individual would be eligible, and apply, for mortgage forbearance. Because the period of

mortgage forbearance from March 2020 through March 2021 overlapped with the Universal

Credit expansion, we controlled for the potential impact of mortgage forbearance to better

identify the expansion’s impact. We discuss more results about mortgage forbearance in the next

section, adding month-time fixed effects to all the specifications.

In addition to the overall increase in nonmortgage debt for people who were likely to

receive Universal Credit, we also found shifts in specific debt types. During the period when

Universal Credit was expanded, residents living in areas with a high share of Universal Credit

beneficiaries took on 2 percent less credit card debt, no significant increase in subprime loan

balances, and 1 percent less in the amounts overdrafted from their checking accounts compared

with those living in areas with a low share of beneficiaries (figures 3–5 and tables 4–6). For each

debt type, we matched individuals using debt-specific prepandemic levels. For example, we used

three prepandemic credit card debts (February 2020, December 2019, and October 2019) to find

appropriate consumers in the comparison group.

9

We used the prepandemic share of Universal Credit beneficiaries to avoid endogeneity between the covariates and

the outcomes. For example, the decision of claiming Universal Credit might be affected by the expansion. Using the

share of Universal Credit beneficiaries in February 2020 provides the relative differences in benefit concentration

across regions without being endogenous with our outcomes.

13

Figure 3. Residents Living in Areas with a High Share of Universal Credit Beneficiaries

Took on Less Credit Card Debt Than Those Living in Areas with a Low Share of

Beneficiaries during the Universal Credit Expansion.

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Average credit card balance for individuals living in wards with a share of Universal Credit beneficiaries

below median (blue line) compared with those living in wards with a share of Universal Credit beneficiaries above

median (red line) from October 2019 through December 2021. To match individuals in the treatment group with

individuals in the control group, we used propensity score matching using three prepandemic debt outcomes: credit

card debt in February 2020, December 2019, and October 2019. See table 4 for regression results that quantify the

differences in credit card debt.

700

750

800

850

900

950

1,000

1,050

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Feb-21

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Average Monthly Credit Card Balance (£)

UC low share UC high share

March-20: Universal Credit

expansion start

Oct-21: Universal Credit

expansion end

14

Figure 4. Residents Living in Areas with a High Share of Universal Credit Beneficiaries

Followed Similar Subprime Loan Balance Trajectories, Compared with Those Living in

Areas with a Low Share of Beneficiaries, during the Universal Credit Expansion.

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Average subprime loan balances for individuals living in wards with a share of Universal Credit beneficiaries

below median (blue line) compared with those living in wards with a share of Universal Credit beneficiaries above

median (red line) from October 2019 through December 2021. To match individuals in the treatment group with

individuals in the control group, we used propensity score matching using three prepandemic debt outcomes:

subprime loans in February 2020, December 2019, and October 2019. Although the two lines in this figure reveal

differences from August 2020 through May 2021, those differences were absorbed by socioeconomic characteristics,

the location fixed effect, and the time fixed effect in table 5. See table 5 for regression results showing that subprime

loan trajectories were not significantly different between these two groups.

580

600

620

640

660

680

700

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Feb-21

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Average Monthly Subprime Loan

Balances (£)

UC low share UC high share

March-20: Universal Credit

expansion start

Oct-21: Universal Credit

expansion end

15

Figure 5. Residents Living in Areas with a High Share of Universal Credit Beneficiaries

Carried Less in Checking Account Overdraft Amounts Than Those Living in Areas with a

Low Share of Beneficiaries during the Universal Credit Expansion.

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Average checking account overdraft amounts for individuals living in wards with a share of Universal Credit

beneficiaries below median (blue line) compared with those living in wards with a share of Universal Credit

beneficiaries above median (red line) from October 2019 through December 2021. To match individuals in the

treatment group with individuals in the control group, we used propensity score matching using three prepandemic

debt outcomes: checking account overdraft amounts in February 2020, December 2019, and October 2019. While

the two lines in this figure show similar checking account overdraft levels for the two groups during the Universal

Credit expansion, the red group (UC high share) accumulated less in checking account overdraft amounts after

controlling for socioeconomic characteristics, the location fixed effect, and the time fixed effect in table 6. See table

5 for regression results showing that checking account overdraft levels were significantly different between these

two groups.

165

170

175

180

185

190

195

200

205

210

215

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Feb-21

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Average Monthly Checking Account

Overdraft (£)

UC low share UC high share

March-20: Universal Credit

expansion start

Oct-21: Universal Credit

expansion end

16

Table 4. Residents Living in Areas with a High Share of Universal Credit Beneficiaries

Took on 2 Percent Less Credit Card Debt Than Those Living in Areas with a Low Share of

Beneficiaries during the Universal Credit Expansion.

Outcome: Log of Credit Card Balances

(1)

(2)

(3)

(4)

During Universal Credit

(UC) expansion

0.256***

0.213***

0.213***

0.214***

(0.003)

(0.003)

(0.003)

(0.003)

UC share above median

-0.00641***

0.00389*

0.0273***

0.0386***

(0.002)

(0.002)

(0.002)

(0.002)

UC expansion X UC share

above median

-0.0235***

-0.0214***

-0.0211***

-0.0207***

(0.002)

(0.002)

(0.002)

(0.002)

Female

-0.108***

-0.108***

-0.101***

(0.001)

(0.001)

(0.001)

Age

0.0169***

0.0168***

0.0145***

(0.000)

(0.000)

(0.000)

Percent of people of color by

ward

0.000830***

-0.00191***

-0.00171***

(0.000)

(0.000)

(0.000)

Mortgage holders in February

2020

0.434***

(0.001)

Month fixed effects

x

x

x

x

Parliamentary constituency

fixed effects

x

x

N

8,847,719

8,797,326

8,722,622

8,722,622

Mean dependent:

6.733

6.731

6.731

6.731

R2

0.00194

0.0270

0.0318

0.0458

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Regression results from difference-in-difference models to quantify the impact of Universal Credit expansion

(March 2020–October 2021) on credit card debt. The outcome variable is the log of credit card balances from

October 2019 to December 2021. The comparison group is defined based on propensity score matching on three

prepandemic characteristics: credit card debt outcomes in February 2020, December 2019, and October 2019 (same

as in figure 3). All specifications are identical to those in table 3.

17

Table 5. Residents Living in Areas with a High Share of Universal Credit Beneficiaries

Took on Similar Levels of Subprime Loan Balances as Those Living in Areas with a Low

Share of Beneficiaries during the Universal Credit Expansion.

Outcome: Log of Subprime Loan Balances

(1)

(2)

(3)

(4)

During Universal Credit

(UC) expansion

0.0534***

0.00624**

0.00301

0.00314

(0.002)

(0.002)

(0.002)

(0.002)

UC share above median

-0.00476***

0.00128

0.01000***

0.0102***

(0.001)

(0.001)

(0.001)

(0.001)

UC expansion X UC share

above median

-0.00855***

0.000937

0.000776

0.000799

(0.002)

(0.002)

(0.002)

(0.002)

Female

0.0984***

0.0879***

0.0880***

(0.001)

(0.001)

(0.001)

Age

0.0200***

0.0189***

0.0189***

(0.000)

(0.000)

(0.000)

Percent of people of color

by ward

-0.00106***

-0.000510***

-0.000505***

(0.000)

(0.000)

(0.000)

Mortgage holders in

February 2020

0.0280***

(0.002)

Month fixed effects

x

x

x

x

Parliamentary constituency

fixed effects

x

x

N

12,165,031

12,131,928

12,013,280

12,013,280

Mean dependent:

6.474

6.475

6.476

6.476

R2

0.000216

0.0441

0.0728

0.0728

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Regression results from difference-in-difference models to quantify the impact of Universal Credit expansion

(March 2020–October 2021) on subprime loans. The outcome variable is the log of subprime loan balances from

October 2019 to December 2021. The comparison group is defined based on propensity score matching on three

prepandemic characteristics: subprime loan balances in February 2020, December 2019, and October 2019 (same as

in figure 4). All specifications are identical to those in table 3.

18

Table 6. Residents Living in Areas with a High Share of Universal Credit Beneficiaries

Took on 1 Percent Less in Checking Account Overdraft Amounts Than Those Living in

Areas with a Low Share of Beneficiaries during the Universal Credit Expansion.

Outcome: Log of Checking Account Overdraft Amounts

(1)

(2)

(3)

(4)

During Universal Credit

(UC) expansion

0.0942***

0.0441***

0.0738***

0.0794***

(0.006)

(0.006)

(0.005)

(0.005)

UC share above median

0.00838**

0.0735***

-0.130***

-0.104***

(0.003)

(0.003)

(0.003)

(0.003)

UC expansion X UC share

above median

0.00303

0.00693*

-0.0174***

-0.0139***

(0.003)

(0.003)

(0.003)

(0.003)

Female

0.195***

0.137***

0.131***

(0.001)

(0.001)

(0.001)

Age

0.0207***

0.0224***

0.0166***

(0.000)

(0.000)

(0.000)

Percent of people of color

by ward

-0.00482***

-0.00563***

-0.00520***

(0.000)

(0.000)

(0.000)

Mortgage holders in

February 2020

1.011***

(0.003)

Month fixed effects

x

x

x

x

Parliamentary constituency

fixed effects

x

x

N

5,990,424

5,959,751

5,900,122

5,900,122

Mean dependent:

5.284

5.283

5.283

5.283

R2

0.000404

0.0230

0.126

0.149

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Regression results from difference-in-difference models to quantify the impact of Universal Credit expansion

(March 2020–October 2021) on checking account overdraft amounts. The outcome variable is the log of checking

account overdraft amounts from October 2019 to December 2021. The comparison group is defined based on

propensity score matching on three prepandemic characteristics: checking account overdraft amounts in February

2020, December 2019, and October 2019 (same as in figure 5). All specifications are identical to those in table 3.

These results—that people who live in areas with a high share of Universal Credit

beneficiaries accumulated more nonmortgage debt than their counterparts, but also carried less

credit card debt and lower checking account overdraft amounts, with no change in subprime loan

balances—suggest that consumers who were more likely to receive Universal Credit likely

carried other forms of nonmortgage debt, such as auto loans, during the first two years of the

pandemic.

19

Mortgage Forbearance

In this section, we present the effect of mortgage forbearance on nonmortgage debt. During

mortgage forbearance, from March 2020 through March 2021, mortgage holders were allowed to

defer full or partial mortgage payments by up to six months; therefore, one might expect

mortgage holders to have extra liquidity available during this period. We studied whether

mortgage holders used any extra cash to pay down their nonmortgage debt.

Although mortgage holders benefited from mortgage forbearance, no similar relief

policies were in place for adults without mortgages (i.e., probable renters). Given the policy

variation, we split the sample into two groups: mortgage holders (treatment group) and adults

without mortgages (control group). We assumed that, without expansive rental relief programs,

renters did not have additional liquidity to pay down their nonmortgage debt.

Mortgage holders and matched nonmortgage holders had similar prepandemic

nonmortgage debt levels in February 2020 (table 7, columns 2 and 3).

10

We found that the

average nonmortgage balance was £10,219 for mortgage holders and £9,989 for adults without

mortgages in February 2020. Mortgage holders tended to be older and lived in areas with fewer

people of color than adults without mortgages. The propensity scores matching process followed

the same procedure as described in the Universal Credit section, where we used three lagged

nonmortgage debt outcomes as baseline characteristics. Column (4) presents statistics for all

adults without mortgages. Comparing the number of unique consumers in Columns (3) and (4),

only a fraction of adults without mortgages were matched with mortgage holders because many

nonmortgage holders did not share similar debt characteristics to mortgage holders.

10

Similar to using the prepandemic share of Universal Credit beneficiaries, we used the prepandemic indicator of

mortgage holders. When the mortgage forbearance took into effect starting in March 2020, people might have been

inclined to apply for mortgages, which could cause endogeneity between our mortgage-holder indicator and our

outcome. Using February 2020 data to indicate mortgage holders helped us avoid endogeneity problems.

20

Table 7. The Socioeconomic Characteristics of Mortgage Holders and Adults without

Mortgages Are Very Similar.

Variables

Summary Statistics in February 2020

Mortgage

holders

Matched Adults

without

mortgages

Adults without mortgages

Panel A: Data from Lowell

Percent female

48.0%

48.8%

48.0%

Median age

50

40

39

Percent mortgage holders

100.0%

0

0

Average mortgage balance

£108,885

0

0

Average nonmortgage

balance

£10,219

£9,989

£5,314

Panel B: Data from the Office for National Statistics

Median percent of people of

color by ward

5.1%

8.0%

8.4%

Median share of Universal

Credit beneficiaries by ward

3.4%

3.6%

3.7%

Number of unique consumers

146,851

132,436

1,812,434

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Summary statistics for the two groups presented in figure 6: mortgage holders and adults without mortgages.

Column (1) lists the descriptions of each summary statistic. To match individuals in the treatment group with

individuals in the control group, we used propensity score matching based on three prepandemic characteristics:

nonmortgage debt in February 2020, December 2019, and October 2019. Column (4) presents summary statistics

unweighted by propensity scores for adults without mortgages. The number of unique consumers in Columns (3) is

less than in Column (4) because only a fraction of adults without mortgages were matched with mortgage holders

with similar nonmortgage balances during the propensity score matching process. After matching, the average

nonmortgage balances between the two matched groups (Columns 2 and 3) were close. Comparing Columns (2) and

(3), the share of female and the share of Universal Credit beneficiaries were similar between the two groups.

Mortgage holders tended to be older and lived in areas with lower shares of people of color.

Longitudinal trends of nonmortgage debt between adults without mortgages and

mortgage holders show that mortgage holders took on less nonmortgage debt than nonmortgage

holders during the mortgage forbearance period (figure 6). To further quantify the difference in

debt accumulation, we ran a series of regression models and present our results in table 8.

Overall, mortgage holders accumulated 1 percent less nonmortgage debt than adults without

mortgages (table 8). Results are statistically significant and robust across different regression

specifications.

21

Figure 6. Mortgage Holders Accumulated Less Nonmortgage Debt Than Adults Without

Mortgages during Mortgage Forbearance.

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Average nonmortgage balance between adults without mortgages (blue line) and mortgage holders (red line)

from October 2019 through December 2021. After the mortgage forbearance period (March 2020 through March

2021), mortgage holders accumulated less nonmortgage debt than nonmortgage holders (who are most likely

renters). We used mortgage balances in February 2020 to split our sample into two groups: if mortgage balance was

positive in February 2020, this given individual is defined as a mortgage holder. If the mortgage balance was zero,

this given individual is defined as an adult without mortgages. To match individuals in the treatment group with

individuals in the control group, we used propensity score matching using three prepandemic debt outcomes:

nonmortgage debt in February 2020, December 2019, and October 2019. Number of unique mortgage holders (red

line) = 132,436. Number of unique adults without mortgages (blue line) = 146,851. See table 7 for more summary

statistics.

4,800

4,900

5,000

5,100

5,200

5,300

5,400

5,500

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Feb-21

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Average Monthly Nonmortgage Balance

(£)

Adults without mortgages Mortgage holders

March-20: Mortgage

forbearance start

March-21: Mortgage

forbearance end

22

Table 8. Mortgage Holders Took on 1 Percent Less Nonmortgage Debt Than Adults

Without Mortgages during Mortgage Forbearance.

Outcome: Log of Nonmortgage Balances

(1)

(2)

(3)

(4)

During mortgage forbearance

0.0564***

0.0461***

0.0463***

0.0462***

(0.00297)

(0.00349)

(0.00350)

(0.00350)

Mortgage holders in February 2020

0.000126

-0.0455***

-0.0524***

-0.0554***

(0.00176)

(0.00211)

(0.00212)

(0.00212)

Mortgage forbearance X mortgage

holders in Feb 2020

-0.0156***

-0.0130***

-0.0130***

-0.0128***

(0.00207)

(0.00243)

(0.00243)

(0.00243)

Female

-0.0931***

-0.0915***

-0.0907***

(0.00109)

(0.00109)

(0.00110)

Age

0.00113***

0.000860***

0.000780***

(0.0000518)

(0.0000522)

(0.0000522)

Percent of people of color by ward

-0.00425***

-0.00579***

-0.00540***

(0.0000283)

(0.0000594)

(0.0000597)

UC share above median

-0.104***

(0.00167)

Month fixed effects

x

x

x

x

Parliamentary constituency fixed

effects

x

x

N

8,168,074

5,543,745

5,495,510

5,489,916

Mean dependent:

8.521

8.543

8.544

8.543

R2

0.000154

0.00544

0.0128

0.0135

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Regression results from difference-in-difference models to quantify the impact of mortgage forbearance

(March 2020–March 2021) on nonmortgage debt. The outcome variable is the log of nonmortgage balances from

October 2019 to December 2021. To match individuals in the treatment group with individuals in the control group,

we used propensity score matching on three prepandemic debt outcomes: nonmortgage debt in February 2020,

December 2019, and October 2019 (same as in figure 6). Specification (1) presents results from the baseline

regression model with three covariates: the time dummy variable indicating whether the individual was observed

during mortgage forbearance March 2020–March 2021, a dummy variable indicator of whether the individual was a

mortgage holder in February 2020, and the interaction of the two dummy variables. We used data in February 2020

to indicate whether a given individual was a mortgage holder. Because mortgage forbearance started in March 2020,

mortgage holders in February 2020 were most likely to be eligible for mortgage forbearance. In specification (2), we

added socioeconomic characteristics including gender, age, and race and ethnicity. We also added month-time fixed

effects to all the specifications. In specification (3), we added another geographic fixed effect, parliamentary

constituency specifically, to further control for underlying variations across location. In specification (4), we added

another control, which is an indicator of whether the given individual lived in an area with a share of Universal

Credit beneficiaries above the median. This was to control for the effect of the concurrent Universal Credit

expansion to have a cleaner identification for the impact of mortgage forbearance.

Similar to regression specifications for the Universal Credit expansion in table 3,

Specification (1) in table 8 presents results from the baseline regression model with three

covariates: the time dummy variable indicating whether the individual was observed during the

mortgage forbearance period, a dummy variable indicating whether the individual was a

mortgage holder in February 2020, and the interaction of the two dummy variables. We used

23

February 2020 data to indicate whether a given individual was a mortgage holder. Because

mortgage forbearance started in March 2020, mortgage holders in February 2020 were most

likely to be eligible for mortgage forbearance.

In specification (2), we added socioeconomic characteristics including gender, age, and

race and ethnicity. In specification (3), we added another geographic fixed effect—parliamentary

constituency—to further control for underlying variations across location. In specification (4) we

added a further control, which is an indicator of whether the given individual lives in an area

with a share of Universal Credit beneficiaries above the median. This was to control for the

concurrent Universal Credit expansion policy and more clearly delineate the impact of mortgage

forbearance. We also added month-time fixed effects to all specifications.

Comparing the trajectories of the specific debt types between mortgage holders and

adults without mortgages, we found that mortgage holders took on 1 percent more credit card

debt, 5 percent more in the amounts overdrafted from their checking accounts, and 2 percent less

in subprime loan balances than adults without mortgages during mortgage forbearance (figures

7–9 and tables 9–11).

11

These results suggest that, given the extra liquidity benefiting mortgage

holders during mortgage forbearance, they spent more by borrowing more on their credit cards

and even overdrawing on their checking accounts compared with adults with mortgages. At the

same time, they relied less on high-cost credit channels such as subprime loans. Overall,

mortgage holders accumulated less nonmortgage debt than nonmortgage holders.

11

For each debt type, we created debt-specific propensity scores using individuals’ prepandemic debt levels. For

example, we used three prepandemic credit card debts (February 2020, December 2019, and October 2019) as

covariates to predict individuals’ credit card debt since mortgage forbearance.

24

Figure 7. Mortgage Holders Carried More Credit Card Debt Than Adults without

Mortgages during Mortgage Forbearance.

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Average credit card balance between adults without mortgages (blue line) and mortgage holders (red line)

from October 2019 through December 2021. After the mortgage forbearance period (March 2020 through March

2021), mortgage holders accumulated more credit card debt than nonmortgage holders (who are most likely renters).

We used mortgage balances in February 2020 to split our sample into two groups: if mortgage balance was positive

in February 2020, the individual is defined as a mortgage holder. If the mortgage balance was zero, the individual is

defined as an adult without mortgages. To match individuals in the treatment group with individuals in the control

group, we used propensity score matching using three prepandemic debt outcomes: credit card debt in February

2020, December 2019, and October 2019. See table 9 for regression results that quantify the differences in credit

card debt between mortgage holders and adults without mortgages.

1,250

1,300

1,350

1,400

1,450

1,500

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Feb-21

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Average Monthly Credit Card Balance (£)

Adults without mortgages Mortgage holders

March-20: Mortgage

forbearance start

March-21: Mortgage

forbearance end

25

Figure 8. Mortgage Holders Accumulated Less in Subprime Loan Balances Than Adults

Without Mortgages during Mortgage Forbearance.

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Average subprime loan balances between adults without mortgages (blue line) and mortgage holders (red

line) from October 2019 through December 2021. After the mortgage forbearance period (March 2020 through

March 2021), mortgage holders accumulated less in subprime loan balances than nonmortgage holders (who are

most likely renters). We used mortgage balances in February 2020 to split our sample into two groups: if mortgage

balance was positive in February 2020, the given individual is defined as a mortgage holder. If the mortgage balance

was zero, the given individual is defined as an adult without mortgages. To match individuals in the treatment group

with individuals in the control group, we used propensity score matching using three prepandemic debt outcomes:

subprime loan balance in February 2020, December 2019, and October 2019. See table 10 for regression results that

quantify the differences in subprime loans between mortgage holders and adults without mortgages.

740

760

780

800

820

840

860

880

900

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Feb-21

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Average Monthly Subprime Loan

Balances (£)

Adults without mortgages Mortgage holders

March-20: Mortgage

forbearance start

March-21: Mortgage

forbearance end

26

Figure 9. Mortgage Holders Took on More in Checking Account Overdraft Amounts Than

Adults without Mortgages during Mortgage Forbearance.

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Average checking account overdraft amounts between adults without mortgages (blue line) and mortgage

holders (red line) from October 2019 through December 2021. After the mortgage forbearance period (March 2020

through March 2021), mortgage holders accumulated more in checking account overdraft amounts than

nonmortgage holders (who are most likely renters). We used mortgage balances in February 2020 to split our sample

into two groups: if mortgage balance was positive in February 2020, the given individual is defined as a mortgage

holder. If the mortgage balance was zero, the given individual is defined as an adult without mortgages. To match

individuals in the treatment group with individuals in the control group, we used propensity score matching using

three prepandemic debt outcomes: checking account overdraft amounts in February 2020, December 2019, and

October 2019. See table 11 for regression results that quantify the differences in checking account overdraft amounts

between mortgage holders and adults without mortgages.

540

560

580

600

620

640

660

680

700

720

Oct-19

Nov-19

Dec-19

Jan-20

Feb-20

Mar-20

Apr-20

May-20

Jun-20

Jul-20

Aug-20

Sep-20

Oct-20

Nov-20

Dec-20

Jan-21

Feb-21

Mar-21

Apr-21

May-21

Jun-21

Jul-21

Aug-21

Sep-21

Oct-21

Nov-21

Dec-21

Average Monthly Checking Account

Overdraft Amount (£)

Adults without mortgages Mortgage holders

March-20: Mortgage

forbearance start

March-21: Mortgage

forbearance end

27

Table 9. Mortgage Holders Carried 1 Percent More Credit Card Debt Than Adults without

Mortgages during Mortgage Forbearance.

Outcome: Log of Credit Card Balances

(1)

(2)

(3)

(4)

During mortgage forbearance

0.0442***

0.0120

0.0126*

0.0127*

(0.005)

(0.006)

(0.006)

(0.006)

Mortgage holders in February 2020

0.00207

-0.0719***

-0.0467***

-0.0484***

(0.003)

(0.004)

(0.004)

(0.004)

Mortgage forbearance X mortgage

holders in Feb 2020

0.00733*

0.0110**

0.0114**

0.0115**

(0.004)

(0.004)

(0.004)

(0.004)

Female

-0.157***

-0.149***

-0.147***

(0.002)

(0.002)

(0.002)

Age

0.0172***

0.0165***

0.0164***

(0.000)

(0.000)

(0.000)

Percent of people of color by ward

0.000491***

-0.00228***

-0.00172***

(0.000)

(0.000)

(0.000)

UC share above median

-0.118***

(0.003)

Month fixed effects

x

x

x

x

Parliamentary constituency fixed

effects

x

x

N

2,828,251

1,970,499

1,954,087

1,952,064

Mean dependent:

7.215

7.214

7.215

7.214

R2

0.000266

0.0223

0.0334

0.0343

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Regression results from difference-in-difference models to quantify the impact of mortgage forbearance

(March 2020–March 2021) on credit card debt. The outcome variable is the log of credit card balances from October

2019 to December 2021. To match individuals in the treatment group with individuals in the control group, we used

propensity score matching on three prepandemic credit card balances in February 2020, December 2019, and

October 2019 (same as in figure 7). All specifications are identical to those in table 8.

28

Table 10. Mortgage Holders Carried 2 Percent Less Subprime Loan Balances Than Adults

without Mortgages during Mortgage Forbearance.

Outcome: Log of Subprime Loan Balances

(1)

(2)

(3)

(4)

During mortgage forbearance

-0.000160

-0.0317***

-0.0320***

-0.0322***

(0.007)

(0.009)

(0.009)

(0.009)

Mortgage holders in February 2020

-0.0156***

-0.134***

-0.149***

-0.148***

(0.004)

(0.005)

(0.005)

(0.005)

Mortgage forbearance X mortgage

holders in Feb 2020

-0.0221***

-0.0229***

-0.0229***

-0.0228***

(0.005)

(0.006)

(0.006)

(0.006)

Female

0.0911***

0.0717***

0.0714***

(0.003)

(0.003)

(0.003)

Age

0.0163***

0.0155***

0.0155***

(0.000)

(0.000)

(0.000)

Percent of people of color by ward

0.000911***

0.00119***

0.00106***

(0.000)

(0.000)

(0.000)

UC share above median

0.0445***

(0.005)

Month fixed effects

x

x

x

x

Parliamentary constituency fixed

effects

x

x

N

960,299

675,227

668,180

667,288

Mean dependent:

6.678

6.666

6.668

6.668

R2

0.000378

0.0250

0.0624

0.0626

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Regression results from difference-in-difference models to quantify the impact of mortgage forbearance

(March 2020–March 2021) on subprime loans. The outcome variable is the log of subprime loan balances from

October 2019 to December 2021. To match individuals in the treatment group with individuals in the control group,

we used propensity score matching on three prepandemic subprime loan balances in February 2020, December

2019, and October 2019 (same as in figure 8). All specifications are identical to those in table 8.

29

Table 11. Mortgage Holders Carried 5 Percent More in Checking Account Overdraft

Amounts Than Adults without Mortgages during Mortgage Forbearance.

Outcome: Log of Checking Account Overdraft Amounts

(1)

(2)

(3)

(4)

During mortgage forbearance

-0.0416***

-0.0798***

-0.0950***

-0.0956***

(0.011)

(0.013)

(0.013)

(0.013)

Mortgage holders in February 2020

0.0103

-0.111***

-0.0867***

-0.0902***

(0.006)

(0.007)

(0.007)

(0.007)

Mortgage forbearance X mortgage

holders in Feb 2020

0.0459***

0.0359***

0.0462***

0.0468***

(0.007)

(0.009)

(0.008)

(0.008)

Female

-0.0754***

-0.0814***

-0.0813***

(0.004)

(0.004)

(0.004)

Age

0.0244***

0.0207***

0.0205***

(0.000)

(0.000)

(0.000)

Percent of people of color by ward

0.00191***

-0.00211***

-0.00134***

(0.000)

(0.000)

(0.000)

UC share above median

-0.183***

(0.006)

Month fixed effects

x

x

x

x

Parliamentary constituency fixed

effects

x

x

N

1,158,219

802,432

794,565

793,432

Mean dependent:

6.459

6.437

6.439

6.439

R2

0.000388

0.0217

0.0862

0.0874

Source: We used individual-level administrative data from Lowell, one of Europe’s largest credit management

service companies, to track financially distressed consumers in the UK between October 2019 and December 2021.

Notes: Regression results from difference-in-difference models to quantify the impact of mortgage forbearance

(March 2020–March 2021) on checking account overdraft amounts. The outcome variable is the log of checking

account overdraft amounts from October 2019 to December 2021. To match individuals in the treatment group with

individuals in the control group, we used propensity score matching on three prepandemic checking account

overdraft amounts in February 2020, December 2019, and October 2019 (same as in figure 9). All specifications are

identical to those in table 8.

Conclusion

We described the impacts of two economic policies the UK government implemented during the

first two years of the COVID-19 pandemic. During the expansion of Universal Credit, between

March 2020 and October 2021, we found that residents living in areas with a high share of

Universal Credit beneficiaries took on 1 percent more nonmortgage debt than those living in

areas with a low share of beneficiaries. Additionally, we described shifts in the mix of consumer

debt; specifically, residents living in areas with a high share of Universal Credit beneficiaries

took on 2 percent less credit card debt, no significant difference in subprime loan balances, and 1

percent less in checking account overdraft amounts than those living in areas with a low share of

30

beneficiaries. Universal Credit recipients may have carried other forms of nonmortgage debt,

such as loans,

12

during the first two years of the pandemic. During mortgage forbearance,

between March 2020 and March 2021, mortgage holders accumulated 1 percent less

nonmortgage debt than adults without mortgages. Additionally, mortgage holders carried 1

percent more credit card debt, 2 percent less in subprime loan balances, and 5 percent more in

checking account overdraft amounts than nonmortgage holders during mortgage forbearance.

Our results suggest that when debt relief is of the magnitude of mortgage forbearance, consumers

pay down high-cost subprime loans and spend more on credit cards. Future research is needed to

study the factors that cause these shifts within nonmortgage debt types.