Guide to Solvent

Schemes of Arrangement

f

o

r

t

h

e

In

su

r

a

n

ce

In

dust

r

y

for

the

Insurance

Industry

1 May 2010

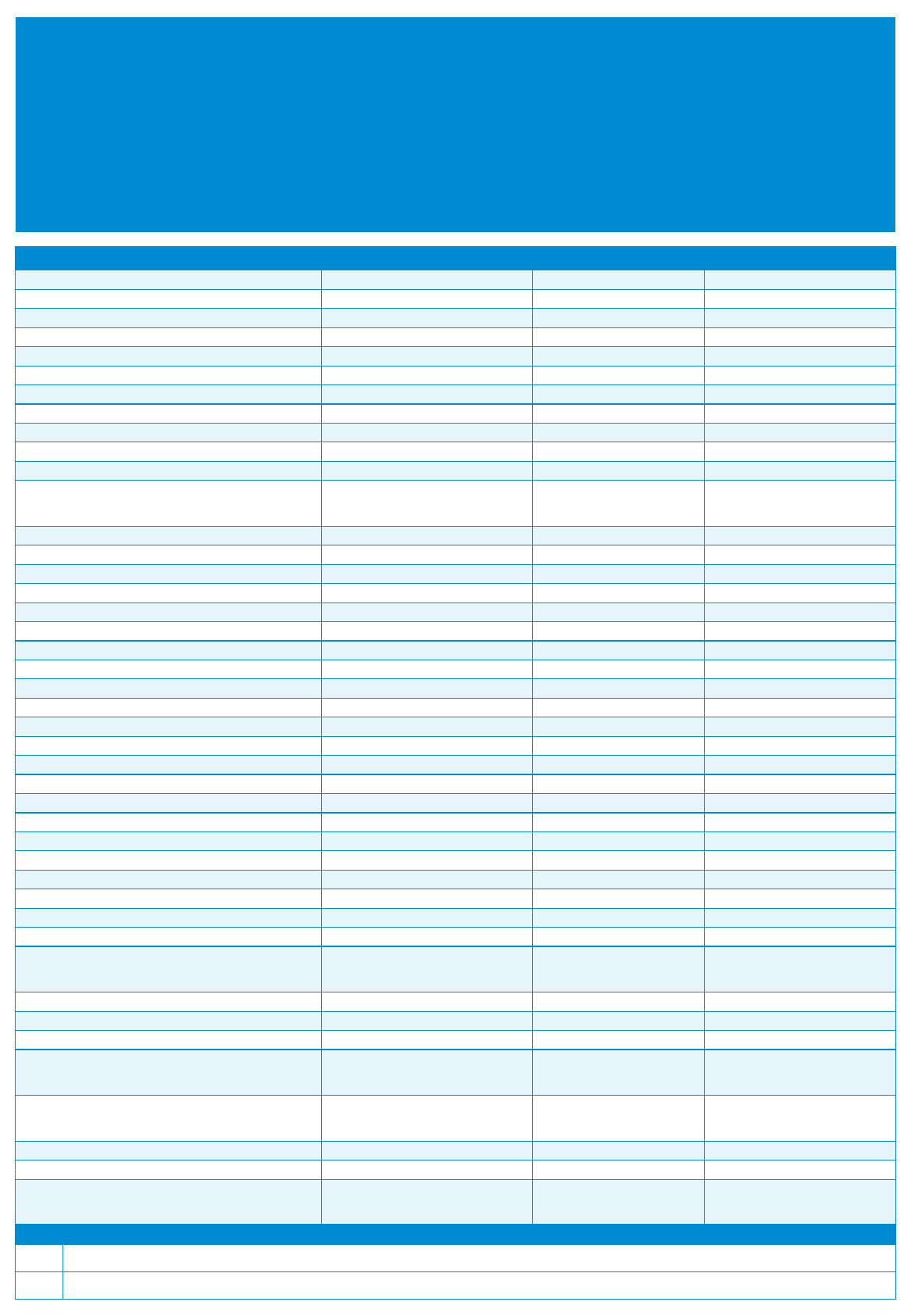

Solvent Schemes of Arrangement

(1)

Scope

(2)

Home Jurisdiction Scheme Advisers

Arig (UK) Company UK PricewaterhouseCoopers

Arion Company Bermuda PricewaterhouseCoopers

Aviation & General Company UK PricewaterhouseCoopers

Blackfriars Company UK PricewaterhouseCoopers

CEAI Certain business Belgium PricewaterhouseCoopers

City General Company UK PricewaterhouseCoopers

City General (Ex Generali Assurances Générales Business) Company UK None

Colonia (Ireland) Company Ireland Ernst & Young

Crombie (UK) Company UK KPMG

Deutsche Rück UK Reinsurance Company Ltd Certain business UK KPMG

Dunedin Pool

(4 companies)

For full details of companies and/or

business included in the scheme please go

to http://brsuk.pwc.com/solvent.asp

UK PricewaterhouseCoopers

(4 companies)

Dutch Aviation Pool

For full details of companies and/or

Netherlands

PricewaterhouseCoopers

Dutch

Aviation

Pool

(18 companies)

For

full

details

of

companies

and/or

business included in the scheme please go

to http://brsuk.pwc.com/solvent.asp

Netherlands

PricewaterhouseCoopers

(18 companies)

European Re of Zurich Certain business Switzerland PricewaterhouseCoopers

E W Payne Excess of Loss Pools

(82 companies)

For full details of companies and/or

business included in the scheme please go

to http://brsuk.pwc.com/solvent.asp

Various KPMG

(82 companies)

FIGRE Company UK PricewaterhouseCoopers

GLOBAL General Certain direct insurance business UK PricewaterhouseCoopers

GLOBAL General Certain reinsurance business UK PricewaterhouseCoopers

GLOBALE Rückversicherungs-AG Certain business Germany PricewaterhouseCoopers

Global London Market Pool

(5 companies)

For full details of companies and/or

business included in the scheme please go

to http://brsuk.pwc.com/solvent.asp

Various PricewaterhouseCoopers

(4 companies)

KPMG (1 company)

Gordian RunOff (UK) Company UK Deloitte

Great Lakes Re (UK) Certain business UK PricewaterhouseCoopers

Harrington International Certain business Bermuda KPMG

Hassneh (UK)

Company

UK

PricewaterhouseCoopers

Hassneh

(UK)

Company

UK

PricewaterhouseCoopers

HIR (UK) Company UK RSM Robson Rhodes

Hopewell International Company Bermuda None

ING

(5 companies)

For full details of companies and/or

business included in the scheme please go

to http://brsuk.pwc.com/solvent.asp

Various PricewaterhouseCoopers

(5 companies)

ING Re (UK) Company UK PricewaterhouseCoopers

Korean (UK) Company UK Ernst & Young

PwC

PwC

To find out more about us please visit our website http://www.pwc.co.uk/discontinuedinsurance

For more details of Solvent Schemes of Arrangement, including some which have been issued but are not yet effective and therefore not

shown above, please see http://brsuk.pwc.com/solvent.asp

Guide to Solvent Schemes of Arrangement for the Insurance Industry

1 May 2008

Guide to Solvent Schemes of

Arran

g

ement for the Insurance Industr

y

Guide

to

Solvent

Schemes

of

Arrangement

for

the

Insurance

Industry

Solvent Schemes of Arrangement

(1)

Scope

(2)

Home Jurisdiction Scheme Advisers

La Metropole Certain business of UK branch Belgium PricewaterhouseCoopers

gy

1 May 2010

La Mutuelle du Mans Assurances Certain business of UK branch France Scottish Lion Underwriting Agencies

Lakewood Company UK PricewaterhouseCoopers

LaSalle Re Company Bermuda KPMG

Lion City Run-Off Private Company Singapore KPMG

Ludgate Company UK PricewaterhouseCoopers

Malayan (UK) Company UK Chiltington

Mariner Reinsurance Company Limited Company Bermuda KPMG

Marlon Certain business UK PricewaterhouseCoopers

Meadows Indemnity Company Limited Company UK Ambant Limited

Mercantile & General Re Company UK PricewaterhouseCoopers

Minster (7 companies) For full details of companies and/or

business included in the scheme please go

to http://brsuk.pwc.com/solvent.asp

UK PricewaterhouseCoopers

Moorgate Certain business UK KPMG

Mutual of Omaha (UK) Company UK PricewaterhouseCoopers

National Insurance & Guarantee Corporation Certain business UK PricewaterhouseCoopers

Nichido Fire & Marine of Japan UK branch Japan None

NRC Re Company Bermuda PricewaterhouseCoopers

NRG London Australian branch UK None

NRG Victory Australia Company Australia None

Osiris Company UK KPMG

Oslo Re (UK) Certain business UK KPMG

Oslo Re ASA Certain business Norway KPMG

PanFinancial Com

p

an

y

UK None

py

Pender Mutual Certain business Isle of Man KPMG

QBE Re (UK) Certain business UK PricewaterhouseCoopers

Quincy Mutual Fire UK branch USA Begbies Traynor

Ramus Company Bermuda PricewaterhouseCoopers

Reliance National Asia Re Company Singapore Ernst & Young

Reliance National (Europe) Certain business UK KPMG

Scottish & Commonwealth Company Bermuda PricewaterhouseCoopers

S tti h E l

C

UK

Pi t h C

S

co

tti

s

h

E

ag

l

e

C

ompan

y

UK

P

r

i

cewa

t

er

h

ouse

C

oopers

Seven Continents Company Bermuda KPMG

Sphere Drake Certain business UK PricewaterhouseCoopers

SRO Run-Off Company Bermuda PricewaterhouseCoopers

St Helen’s Trust (5 companies) and, in relation to Prudential

Assurance, certain London Market business

For full details of companies and/or

business included in the scheme please go

to http://brsuk.pwc.com/solvent.asp

UK PricewaterhouseCoopers

(5 companies)

Tanker Company UK PricewaterhouseCoopers

Transcon

Company

Bermuda

PricewaterhouseCoopers

Transcon

Company

Bermuda

PricewaterhouseCoopers

Trent Company Bermuda PricewaterhouseCoopers

Trident Pool

(2 companies)

For full details of companies and/or

business included in the scheme please go

to http://brsuk.pwc.com/solvent.asp

UK PricewaterhouseCoopers

(2 companies)

Trimark Pool

(47 solvent companies)

For full details of companies and/or

business included in the scheme please go

to http://brsuk.pwc.com/solvent.asp

Various KPMG

(47 companies)

Unione Italiana (UK) Re Certain business UK PricewaterhouseCoopers

Walton

Company

Bermuda

KPMG

PwC

Walton

Company

Bermuda

KPMG

WFUM Pools

(14 solvent companies)

For full details of companies and/or

business included in the scheme please go

to http://brsuk.pwc.com/solvent.asp

Various PricewaterhouseCoopers

(6 companies)

KPMG (8 companies)

Winterthur Swiss Certain business Switzerland None

Notes

(1) This table includes Solvent Schemes of Arrangement that have become legally effective. The information contained in this schedule has been derived solely from statutory notices and other data available from national

newspapers, industry journals and appropriate scheme web-sites. The information has not been independently verified by PricewaterhouseCoopers.

(2) In some cases certain policies have been excluded from the scope of the Solvent Scheme of Arrangement. Full details are provided in the relevant Solvent Scheme of Arrangement document, some of which can be found

at http://brsuk.pwc.com/solvent.asp

Guide to London Market

Insolvencies since 1989

Insolvency Procedure Organisation

Administration Date of Administration Administrators

1 May 2010

Folksam International (UK) 19 July 2002 PricewaterhouseCoopers

Highlands Insurance (UK)

(1)

1 November 2007 PricewaterhouseCoopers

Provisional Liquidation Date of Provisional Liquidation Provisional Liquidators

Återfőrsäkrings AB LUAP – UK Branch 1 July 2002 PricewaterhouseCoopers

Home – UK Branch 8 May 2003 Ernst & Young

Independent Insurance 17 June 2001 PricewaterhouseCoopers

Run-off Scheme of Arrangement Current Dividend Scheme Administrators

BAI (Run-off) 5% PricewaterhouseCoopers

Chester Street 5% PricewaterhouseCoopers

Drake 63% Deloitte

English & American 35% KPMG

HIH

(2)

(8 companies) See note (2) KPMG/McGrathNicol

Home

(3)

Undeclared Ernst & Young

Insurance Corporation of Singapore (UK) 100% PricewaterhouseCoopers

Monument

(4)

36.9% (final) PricewaterhouseCoopers

New Cap Reinsurance Corporation Limited

(5)

23.64% Ernst & Young

OIC Run-Off (formerly Orion) London & Overseas

(6)

50% PricewaterhouseCoopers

Paramount 40% PricewaterhouseCoopers

Valuation Scheme of Arrangement Current Dividend Scheme Administrators

AA Mutual International

(7)

31.4% (final) PricewaterhouseCoopers

AFG Insurance Undeclared Ernst & Young

Andrew Weir (converted from run-off)

(7)

49.65% (final) PricewaterhouseCoopers

Anglo American (converted from run-off) 100% (final) KPMG

Aneco

(8)

72.6%

(

final

)

PricewaterhouseCoo

p

ers

()

p

Bermuda Fire & Marine (converted from run-off) 87% Ernst & Young

Black Sea & Baltic

(7)

57.69% (final) PricewaterhouseCoopers

BNIB

(9)

100% (final) PricewaterhouseCoopers

Bristol Re

(8)

55.1% (final) PricewaterhouseCoopers

Bryanston (converted from run-off) 60.61% (final) PricewaterhouseCoopers

Chancellor (converted from run-off) 42.1% (final) Deloitte

Charter Re

(10)

90.58% (final) PricewaterhouseCoopers

Compagnie Europeenne de Reassurances

(

11

)

0 52% (final)

PricewaterhouseCoopers

Compagnie

Europeenne

de

Reassurances

()

0

.

52%

(final)

PricewaterhouseCoopers

Fremont (UK)

(4)

38.34% (final) PricewaterhouseCoopers

Hawk

(4)

23% (final) PricewaterhouseCoopers

ICS Re

(12)

88.8% (final) PricewaterhouseCoopers

KWELM (converted from run-off) K-84%, W-100%, E-100%, L-87%, M-75% CJ Hughes and CG Reynolds

Marina Mutual Insurance 34% (final) Grant Thornton

Municipal General Insurance

(13)

90% JB Stephenson and GR Gadsby

New Cap Reinsurance (Bermuda)

(14)

33.85% (final) Ernst & Young

N th Atl ti

24%

Pi t h C

N

or

th

Atl

an

ti

c

24%

P

r

i

cewa

t

er

h

ouse

C

oopers

Pacific & General Insurance Undeclared Grant Thorton

Pan Atlantic 6.93% (final) Grant Thornton

Pine Top

(15)

24.9% (final) Ernst & Young

RMCA Re

(12)

93.04% (final) PricewaterhouseCoopers

Scan Re (converted from run-off)

(15)

80.5% (final) Ernst & Young

Sovereign 80% KPMG

Stockholm Re (Bermuda) 36.37% (final) Deloitte

PwC

Taisei Fire & Marine

(16)

62% Ernst & Young

Trinity (converted from run-off) 76.75% (final) PricewaterhouseCoopers

UIC 134% (final) Grant Thornton

United Standard 27% PricewaterhouseCoopers

Guide to London Market

Insolvencies since 1989

Liquidation Current Dividend Liquidators

Belvedere Insurance (Bermuda) Undeclared KPMG

1 May 2010

Continental Assurance

(17)

Nil (final) PricewaterhouseCoopers

Dai Ichi Kyoto Reinsurance Company SA

(18)

Funds remitted to Belgian liquidator PricewaterhouseCoopers

Kobe Reinsurance SA

(18)

Funds remitted to Belgian liquidator PricewaterhouseCoopers

National Employers Mutual General (NEMGIA) 37.58% (final) KPMG

Oaklife Nil (final) PricewaterhouseCoopers

Notes

(1) A scheme of arrangement in relation to the Company's direct insurance creditors became effective on 19 August 2009.

(2)

Companies subject to English and Australian Schemes of Arrangement (dual run-off and estimation schemes)

(All in liquidation in Australia and Provisional Liquidation in England)

HIH Casualty and General Insurance Limited - 13%, and to creditors with insurance liabilities - 19.96%

FAI Insurances Limited - Nil

FAI General Insurance Company Limited - 40%, and to creditors with insurance liabilities - 41.2%

World Marine and General Insurances Pty Limited: creditors with insurance liabilities in Australia - 56%, creditors with insurance liabilities outside of Australia - 20%, creditors with non insurance liabilities in Australia - 45%

Companies subject to Australian Schemes of Arrangement (dual run-off and estimation schemes)

(All in liquidation in Australia)

CIC Insurance Limited - 45%

FAI Traders Insurance Company Limited - Nil

FAI Reinsurances Pty Limited - Nil

HIH Underwriting and Insurance (Australia) Pty Limited - Nil

(3) This scheme relates to business written by The Home Insurance Company through the AFIA Pool.

(4)

Scheme exited via compulsory liquidation handled by PricewaterhouseCoopers No additional dividend

(4)

Scheme

exited

via

compulsory

liquidation

handled

by

PricewaterhouseCoopers

.

No

additional

dividend

.

(5) This scheme is a hybrid scheme comprising a 'reserving phase' and a 'cut-off' phase. For queries please contact Hugh Armenis: [email protected]

NCRA made two dividend payments on 15 April 2009 and 4 December 2009. The dividends totalled was 17c in the dollar from the Reinsurance Asset pool and 8c in the dollar from the Other Asset pool. The insurance

creditor's distribution from the Other Asset pool is calculated after the distribution from the Reinsurance pool is deducted, so the effective rate of the dividend for insurance creditors to date is 23.64c in the dollar.

(6) Certain claims are presently being paid in full by OIC Run-Off and London & Overseas.

(7) Scheme exited via compulsory liquidation handled by the official receiver. No further dividend expected.

(8) Also in liquidation handled by PricewaterhouseCoopers.

(9) Company was dissolved on 31 May 2007 following settlement of all liabilities within the Scheme.

(10)

Scheme exited via compulsory liquidation handled by PricewaterhouseCoopers. Final additional dividend of 2.78%.

(11) Company in liquidation in France. The French liquidator is M. Jean Claude Pierrel.

(12) Scheme closed and company dissolution achieved via a members' voluntary liquidation handled by KPMG Singapore. No dividend was paid.

(13) JB Stephenson and GR Gadsby, the Scheme Administrators to Municipal General Insurance are assisted by Mazars LLP.

(14) Also in liquidation handled by Ernst & Young.

(15) Scheme exited via compulsory liquidation handled by Ernst & Young. No dividend was paid.

(16) Payments pursuant to the Reorganisation Plan for international reinsurance creditors.

(17) Joint appointment with David Buchler.

(18) PricewaterhouseCoopers’ role in respect of these estates was to collect in the assets. PricewaterhouseCoopers have now concluded their role and funds have been passed to the Belgian liquidator.

Contact Details

P i t h C i f th l di fi f d i t th i i d t If h ti i l ti

t

P

r

i

cewa

t

er

h

ouse

C

oopers

i

s one o

f

th

e

l

ea

di

ng

fi

rms o

f

a

d

v

i

sers

t

o

th

e

i

nsurance

i

n

d

us

t

ry.

If

you

h

ave any ques

ti

ons

i

n re

l

a

ti

on

t

o

Schemes of Arrangement or insurance company insolvencies, please contact one of our team:

Dan Schwarzmann Mark Batten Neil Gayner Nigel Rackham Clare Whitcombe

+44 (0) 20 7804 5067 +44 (0) 20 7804 5635 +44 (0) 20 7212 6117 +44 (0) 20 7212 6270 +44 (0) 20 7804 4844

[email protected]c.com [email protected]c.com [email protected] [email protected]c.com [email protected]

Plumtree Court, London, EC4A 4HT, UK

Telephone number: +44 (0) 20 7583 5000

Facsimile number: +44 (0) 20 7804 4578

You can also visit our website: www.pwc.co.uk/discontinuedinsurance

A

lternativel

y,

email

y

our

q

uestions to us at discontinuedinsurance

@

uk.

p

wc.com

y, y q

@p

This publication has been prepared for general guidance on matters of interest only, and does not constitute professional advice. You should not act upon the information contained in this

publication without obtaining specific professional advice. You shall not copy this publication, in whole or in part, in any manner. No representation or warranty (express or implied) is given as to

the accuracy or completeness of the information contained in this publication, and, to the extent permitted by law, PricewaterhouseCoopers LLP, its members, employees and agents do not accept

or assume any liability, responsibility or duty of care for any consequences of you or anyone else acting, or refraining to act, in reliance on the information contained in this publication or for any

decision based on it.

© 2010 PricewaterhouseCoopers LLP. All rights reserved “PricewaterhouseCoopers” refers to PricewaterhouseCoopers LLP (a limited liability partnership in the United Kingdom) or, as the context

requires, other member firms of PricewaterhouseCoopers International Limited, each of which is a separate and independent legal entity.