Page 1 of 5

LAND RECORDS DIVISION FEE SCHEDULE

Effective August 28, 2017, pursuant to the Court en Banc order dated August 4, 2017, the

building fund fee is now a uniform fee. The uniform fee is $30.00.

Effective August 1, 2017 pursuant to La. R.S. 13:844, the following fee schedule reflects

the recording fees. Recording fees shall be paid to the Clerk of Court at the time documents are

recorded.

Costs: The following costs shall be paid to the Clerk of Court at the time of recording of

the document specified. In all instances, the amount provided for is not a deposit, but is a non-

refundable recording fee.

_________________________________________________________________________

DOCUMENT RECORDING FEES

All document recording fees were established in accordance with La. R.S. 13:844 as

amended by Act no. 173 of the 2017 regular legislative session.

EVERY DOCUMENT FILED FOR RECORDATION SHALL BE CAPTIONED

AS TO TYPE OF ACT ON THE FIRST PAGE, AND SHALL HAVE ON THE FIRST

PAGE A MARGIN OF TWO INCHES AT THE TOP AND ONE INCH AT THE

BOTTOM AND SIDES. THE TYPE SIZE SHALL NOT BE LESS THAN EIGHT

POINT.

As used in this section, a "document" is defined as those pages presented together for

filing or recording, inclusive of the act, together with exhibits, riders, or additional documents

attached thereto, including but not limited to powers of attorney, property description exhibits,

tax certificates and researches, mortgage certificates, resolutions, certificates, and surveys.

NOTE: AN ACT OF DEPOSIT MUST BE RECORDED TO SUPPLEMENT

RECORDED DOCUMENTS WITH ATTACHMENTS NOT PRESENTED AT THE

TIME OF RECORDING. THIS INCLUDES BUT IS NOT LIMITED TO SURVEYS,

TAX CERTIFICATES, MORTGAGE AND/OR CONVEYANCE CERTIFICATES, ETC.

If a document is to be recorded in both the mortgage and conveyance records, THE

FEES PROVIDED IN THIS SECTION SHALL BE ASSESSED SEPARATELY for

recording in the mortgage records and in the conveyance records.

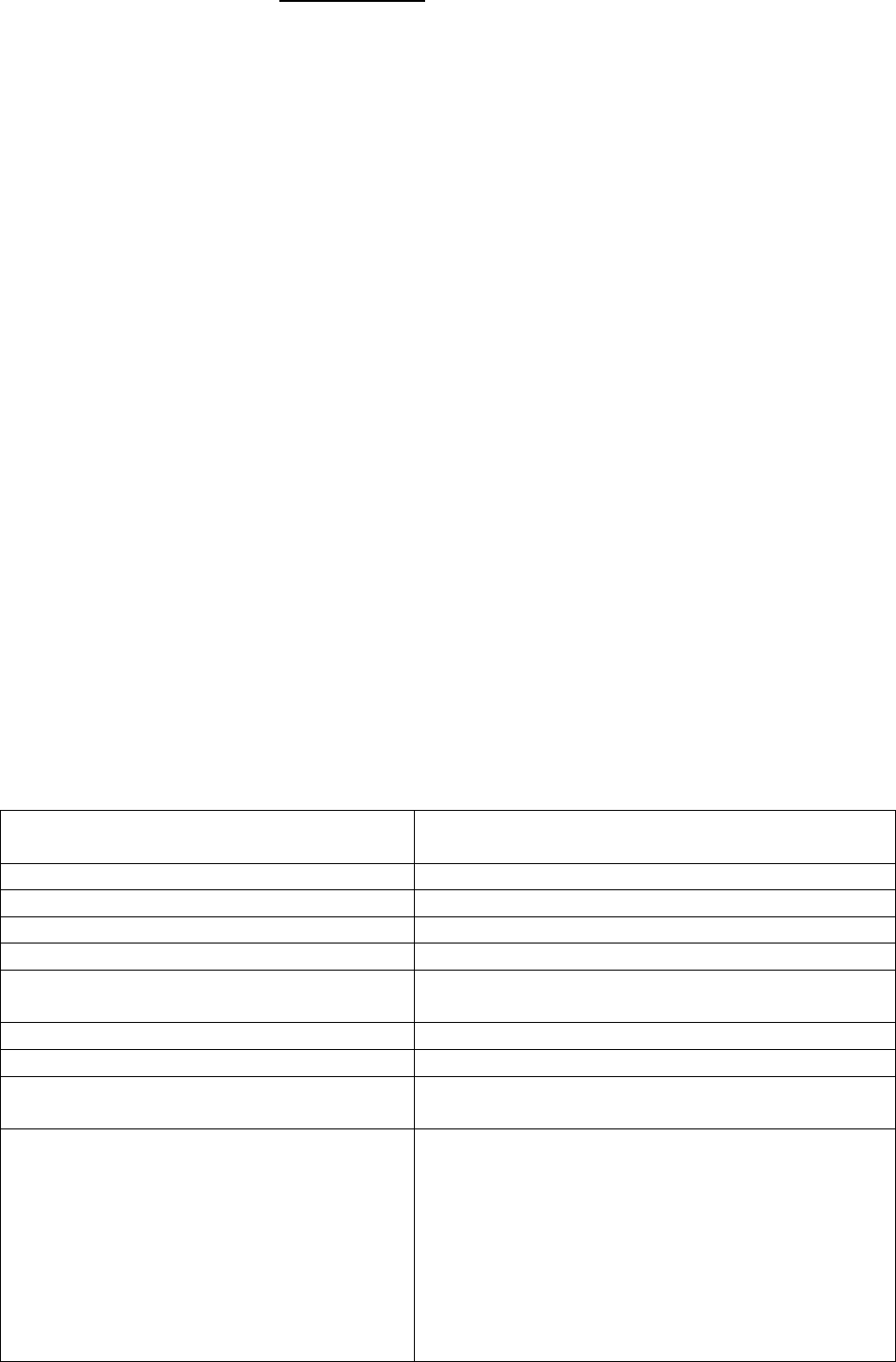

Ex-Officio Recorders shall charge the following fees for filing and recording documents:

Number of Pages

Fee

1-5 pages

$100.00

6-25 pages

$200.00

26-50 pages

$300.00

Over 50 pages

$300.00 for the first 50 pages, plus $5.00 for

each additional page

CLERK OF CIVIL DISTRICT COURT

CIVIL DIVISION

421 Loyola Avenue, Room 402

New Orleans, Louisiana 70112

cdcclerk@orleanscdc.com

Telephone: (504) 407-0000

Fax: (504) 592-9128

LAND RECORDS DIVISION

1340 Poydras Street, 4th Floor

New Orleans, Louisiana 70112

civilclerklandrecords@orleanscdc.com

Telephone: (504) 407-0005

Chelsey Richard Napoleon

Clerk of Court and Ex-Officio Recorder

Page 2 of 5

Services included in the costs above include:

1. ONE CERTIFIED COPY OF THE RECORDED DOCUMENT

2. INDEXING OF ALL NAMES UP TO TEN NAMES.

The following documents are EXCEPTIONS from the fee schedule outlined above:

Pursuant to La. R.S. 6:966.1, the fee for a Notice of Repossession is $75.00.

Notwithstanding any other provision of law to the contrary, the recorder of mortgages

shall not assess any additional fees for the filing of the Notice of Repossession.

Pursuant to La. R.S. 9:5503, the recordation of an Affidavit of Identity shall be recorded

without charge.

Pursuant to La. R.S. 44:20, the recordation of a Military Discharge certificate shall be

recorded without charge.

ADDITIONAL DOCUMENT RECORDING FEES

The fees listed below will be charged as applicable. Pursuant to La. R.S. 13:844,

NAMES INDEXED BEYOND THE FIRST 10 NAMES WILL BE CHARGED AN

ADDITIONAL FEE OF $5.00 PER NAME. Documents on any size paper other than 8.5” x

11” or 8.5” x 14” will be charged an additional $20.00 for each non-compliant page.

Pursuant to changes to Civil Code Article 3352, the recorder shall display only the last

four digits of the social security number or taxpayer identification numbers listed on instruments

that his office makes available for viewing on the internet. Per Code of Civil Procedure Article

1922, a recorded lien having the effect of a money judgment shall also include the last four digits

of the social security number of the debtor, or the Internal Revenue Service taxpayer

identification number of the debtor in the case of a debtor doing business other than as an

individual, if known by the attorney preparing the lien. If any judgment or lien being recorded

does not include the information required by this article, the recorder shall be entitled to collect a

fee not to exceed twenty-five dollars per debtor in addition to the applicable fee set forth in La.

R.S. 13:844.

Item

Fee

Additional Index Name Fee

$5.00 per name (after the first 10 names)

Additional Square Fee

$13.00 per square (after first square)

Additional Address Fee

$13.00 per address (after first address)

Additional Lot Fee

$5.00 per lot (after second lot)

Failure to Comply with Margin

Requirements

$20.00 (per document)

Oversized Drawing Fee

$20.00

Sketch, Blueprint, or Survey

$30.00

Any Size Paper Other Than 8.5” x 11” or

8.5” x 14”

$20.00 per page

Judgments, tax liens, Department of Social

Services liens, & liens that have the effect

of judgments recorded without the last 4

digits of debtor's SSN or the IRS taxpayer

identification number of the debtor in the

case of a debtor doing business other than

as an individual will include an additional

fee per debtor in accordance with CCP art.

1922.

$25.00 per debtor

Page 3 of 5

BUILDING FUND FEES

Pursuant to La. R.S. 13:996.67, the Clerk of Court of the Civil District Court for the

parish of Orleans is authorized to impose additional charges up to thirty dollars ($30.00) per

recordation for the courthouse building fund. The costs and charges may be any amount up to

and including the maximum amount set forth and shall be imposed on order of the judges en

banc. Fees for the building fund are in addition to fees assessed pursuant to La. R.S. 13:844.

Pursuant to the Court en Banc order dated August 4, 2017; effective Monday, August 28,

2017, the building fund fee is now a uniform fee. The uniform fee is $30.00. The building fund

fee is listed below:

Document Type

Building Fund Fee

ALL EXCEPT THE DOCUMENT TYPES LISTED

BELOW

$30.00

Affidavit of Identity

Building Fund Fee is Not Applicable

Military Discharge

Building Fund Fee is Not Applicable

Notary Bond

Building Fund Fee is Not Applicable

Repossession Notification Report

Building Fund Fee is Not Applicable

CANCELLATIONS

Pursuant to La. R.S. 13:844, there shall be a fee of fifty dollars ($50.00) for the

recordation of an act or affidavit to cancel a SINGLE MORTGAGE, LIEN, OR PRIVILEGE.

If a real estate mortgage is cancelled with an original note, the fee is ten dollars ($10.00).

Type

Fee

Cancellation of Mortgage, Lien or Privilege

$50.00 per Instrument / MIN / MOB

Cancellation With Original Note

$10.00 per Instrument / MIN / MOB

Partial Cancellation

$50.00 per Instrument / MIN / MOB

Cancellation of Liens In Favor of City or State

$50.00 per Instrument / MIN / MOB

Certificate of Cancellation

$13.00 per Instrument / MIN / MOB

CERTIFICATES

Pursuant to La. R.S. 13:844, the fee for a certificate of real estate mortgage and lien

certificate with seal, for each name in which search is made, and for one definable property only,

twenty dollars ($20.00) for the first name and ten dollars ($10.00) for each additional name.

THERE SHALL BE AN ADDITIONAL CHARGE OF ONE DOLLAR ($1.00) PER

EXCEPTION IN THE EVENT THAT MORE THAN TEN EXCEPTIONS ARE

CONTAINED ON A CERTIFICATE.

Mortgage Certificate Type

Base Fee

Additional

Name

Notes

Mortgage Certificate – Regular

$20.00

$10.00

Includes 1 square and 2

lots

Mortgage Certificate – Re-Subdivision

$20.00

$10.00

Includes 1 square and 2

lots

Mortgage Certificate – Property Bond

$20.00

$10.00

Includes 1 square and 2

lots

Mortgage Certificate – Sheriff

$20.00

$10.00

Includes 1 square and 2

lots

Mortgage Certificate – Federal Tax Lien Only

$20.00

$10.00

Mortgage Certificate – General

$20.00

$10.00

Mortgage Certificate – Renewal

$20.00

$10.00

Mortgage Certificate – Date & Sign

$0.00

N/A

Mortgage Certificate – Lien & Privilege

$20.00

$10.00

$7.00 Fee for each

additional acceptance MIN

on the certificate request

Mortgage Certificate – Added Name

$20.00

$10.00

Certificate Exceptions in Excess of 10

$1.00

N/A

$1.00 per exception

Page 4 of 5

Conveyance Certificate Type

Base Fee

Additional

Name

Notes

Conveyance Certificate – Regular

$35.00

$30.00

Includes 1 square and 2

lots

Conveyance Certificate – Property Bond

$35.00

$30.00

Includes 1 square and 2

lots

Conveyance Certificate – Sheriff

$35.00

$30.00

Includes 1 square and 2

lots

Conveyance Certificate – Renewal

$35.00

$30.00

Includes 1 square and 2

lots

Conveyance Certificate – Added Name

$30.00

$30.00

Conveyance Certificate – Date & Sign

$0.00

N/A

FEDERAL TAX LIENS

Federal tax liens are recorded in both the real estate and UCC records. Pursuant to La.

R.S. 13:844, the fee to record a federal tax lien in the real estate records is $100.00. Pursuant to

Louisiana Secretary of State, the fee to record a federal tax lien in the UCC records is $35.00

total with $28.00 to the Clerk of Civil District Court and $7.00 to the Secretary of State. This

results in a total fee to file and record a federal tax lien of $135.00.

Pursuant to La. R.S. 13:844, there shall be a fee of fifty dollars ($50.00) for the

recordation of an act or affidavit to cancel a single mortgage, lien, or privilege.

Type

Cost

Federal Tax Lien

$135.00

Release of Federal Tax Lien

$50.00

COPY AND MISCELLANEOUS SERVICE FEES

Pursuant to La. R.S. 13:844, the fee for attesting any record or copy thereof, is ten dollars

($10.00).

A CERTIFIED COPY MUST BE PRINTED BY THE CLERK’S OFFICE AND IS

SUBJECT TO THE $10.00 FEE OUTLINED ABOVE, PLUS A $1.00 PER PAGE COPY

FEE.

THE FEE FOR A FILE-STAMPED CONFORMED COPY IS FIVE DOLLARS

($5.00). A FILE-STAMPED CONFORMED COPY IS ONLY AVAILABLE AT THE

TIME OF RECORDING.

Service

Fee

Notes

Copy

$1.00

per page

Certified Copy

$10.00

$10.00 certification fee in addition to

the applicable per page copy fee – one

certified included in recording

File-Stamped Conformed Copy

$5.00

$5.00 plus any applicable per page

copy fees. (Only available at the time

of recording.)

13 x 19 Color Copy

$35.00

per page

8.5 x 11 Color Copy

$15.00

per page

8.5 x 14 Color Copy

$20.00

per page

11 x 17 Color Copy

$25.00

per page

24 x 36 B&W Plan Copy

$10.00

per page

12 x 18 B&W Plan Copy

$5.00

per page

Fax Fee

$1.00

per page

Remote Access Image Download

$0.50

per page

Remote Access Image Print

$0.50

per page

Page 5 of 5

Service

Fee

Notes

Remote Access Index Detail Print

$0.50

per page

Remote Access Search Results Print

$0.50

per page

Oversized Copy - Mounted

$350.00

per print

Oversized Copy - Unmounted

$250.00

per print

CD

$5.00

Plus copy fees. CD is only available

from the Research Center

Mailing and Handling Domestic

$2.00

flat fee

Mailing and Handling Foreign

$5.00

flat fee

Digital Copy of Plan

$5.00

per page

Research Fee

$8.00

per item (Search of Electronic Indices

Only)

UNIFORM COMMERCIAL CODE (UCC)

The following fees for Uniform Commercial Code (UCC) filings are pursuant to La. R.S.

10:9-525.

UCC – 1

Fee

Financing Statement

$30.00

Financing Statement w/Assignment

$35.00

Financing Statement relative to

“as extracted collateral” or fixture filing

$40.00

Financing Statement (Transmitting Utility)

$205.00

Financing Statement (Public Finance

Transaction)

$105.00

Additional Pages

$2.00 per page

Additional Debtor Names

$10.00

Non-Standard Form Fee

$15.00 each

UCC – 3

Fee

Amendment

$25.00

Continuation

$25.00

Assignment

$25.00

Debtor Correction

$25.00

Master Assignment/Amendment

$5.00 per financing statement

Termination

($5.00 per debtor paid at time of original filing)

N/A

Additional Debtors Named on Original

$5.00 each

UCC – 5 Information Statement

$25.00

UCC–1F and UCC–3F Central Registry

Filings

Fee

UCC and Crop Filings

$35.00

Crop Filings

$20.00

Amendments, Continuations, Assignments

$20.00

UCC COPY AND MISCELLANEOUS SERVICE FEES

Service

Fee

Notes

UCC-11 Search

$30.00

$30.00 per search for up to 10 results

UCC-11 Search (Results Beyond 10)

$1.00

Charged in addition to UCC11 - $1.00

for each additional result after 10

UCC Certified Copy

$5.00

$5.00 flat fee in addition to per page

UCC Copy fee

UCC Copy

$2.00

Per Page

Updated: 6-19-2018