FINANCIAL SECTOR SCIENCE-BASED

TARGETS GUIDANCE

VERSION 1.1

August 2022

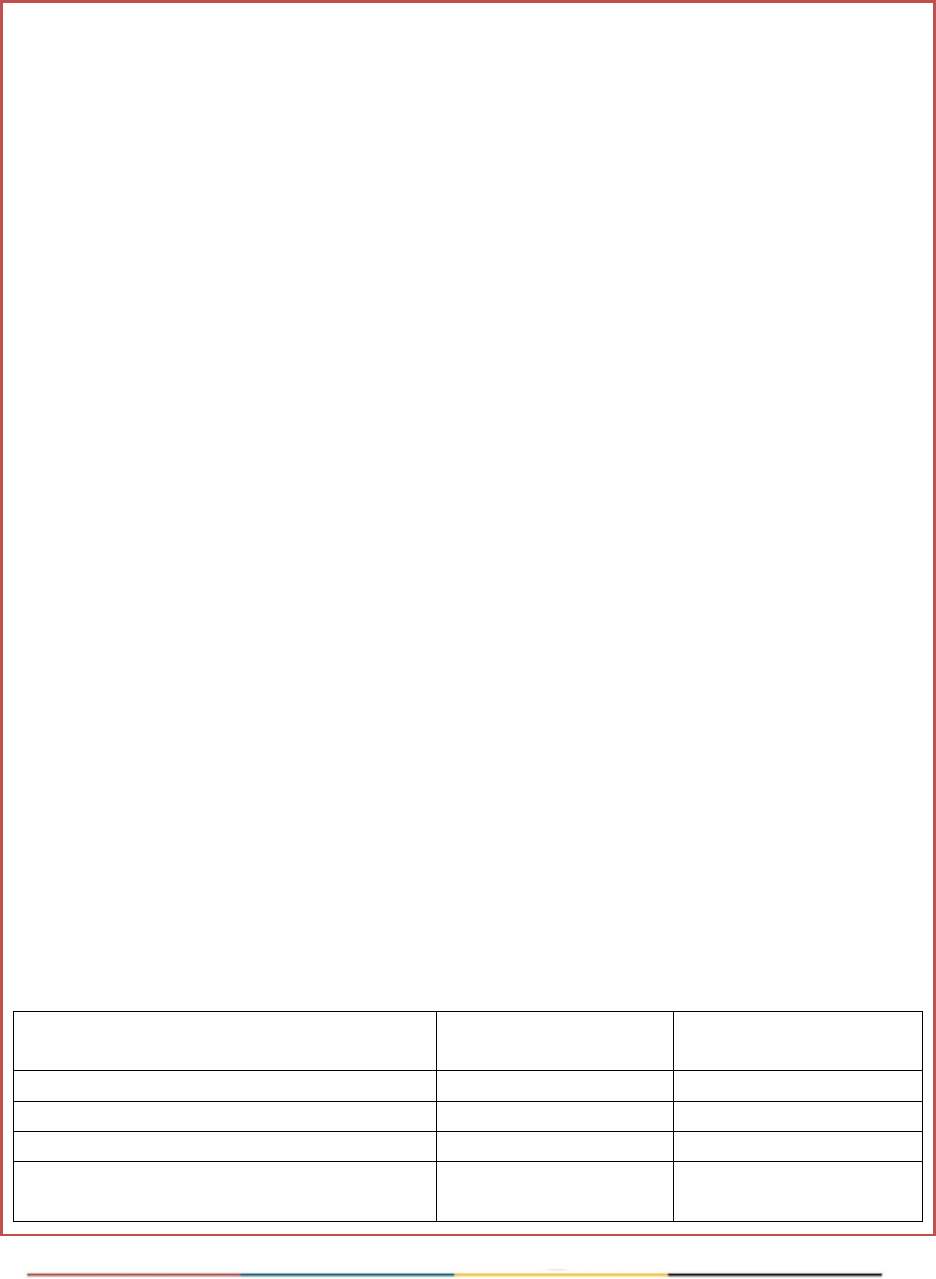

Version

Change/update description

Date

Finalized

Effective Dates

Pilot

The pilot version of the FI Guidance and Criteria

October

2020

October 2022

to January

2022

1.0

No changes made to criteria/guidance. Version changed

from pilot to 1.0 to recognize the end of the pilot phase

February

2022

February 2022

to July 2022

1.1

Clarification for loan coverage metric, that financed

emissions can be used to cover the 67% minimum

threshold.

Clarification to the coverage footnote (footnote B), that

SME lending does not have to be included in the

calculation of the minimum 67% coverage

July 2022

From August

2022

Table of Contents

Table of Contents ...............................................................................................................................1

Acknowledgments .............................................................................................................................3

Executive Summary ............................................................................................................................6

Glossary........................................................................................................................................... 10

1. Introduction ............................................................................................................................. 16

1.1 Purpose of this Document ................................................................................................................ 16

1.2 The SBTi’s Financial Sector Project Audience ................................................................................... 19

1.3 The SBTi’s Financial Sector Project Context ...................................................................................... 19

1.4 What Are Science-Based Targets (SBTs)? ......................................................................................... 20

1.5 How is the Financial Sector Addressing Climate? ............................................................................. 22

2. Business Case for Financial Institutions to Set Science-Based Targets ......................................... 25

3. SBTi Target Validation Criteria and Recommendations for Financial Institutions ......................... 26

3.1 GHG Emissions Inventory and Target Boundary ............................................................................... 27

3.2 Scope 1 and 2 Target Time Frame..................................................................................................... 29

3.3 Scope 1 and 2 Target Ambition ......................................................................................................... 29

3.4 Scope 2 .............................................................................................................................................. 30

3.5 Scope 3 – Portfolio Target Setting Requirements ............................................................................. 31

3.6 Reporting........................................................................................................................................... 34

3.7 Recalculation and Target Validity ..................................................................................................... 35

4. How to Set Science-Based Targets ................................................................................................. 37

4.1 Compiling a GHG Inventory............................................................................................................... 37

4.2 Measuring Financed Emissions to Facilitate Target Setting ............................................................. 40

4.3 How to Set a SBT for Scope 1 and 2 Emissions ................................................................................. 44

5. Approaches to Setting Scope 3 Portfolio Targets ........................................................................... 49

5.1 Background and Brief Literature Review .......................................................................................... 49

5.2 Overview of Available Asset Class–Specific Methods, Broader Methods, and Existing Gaps .......... 50

5.3 Defining the Boundary of Portfolio Targets ...................................................................................... 53

5.4 Description of Methods to Set Portfolio Targets .............................................................................. 58

Financial Sector Science-Based Targets Guidance

2

5.5 Approaches to Setting Targets on the Rest of the Scope 3 Categories ............................................ 92

5.6 Coal Phaseout and Fossil Fuel Disclosure ......................................................................................... 93

6. How to Communicate Science-Based Targets and Tracking Progress .............................................. 96

6.1 Tracking and Reporting Target Progress ........................................................................................... 99

6.2 Target Recalculation and Validity ................................................................................................... 100

7. How to Achieve SBTs .............................................................................................................. 102

7.1 Integration of Climate Change in Governance and Decision-Making ............................................. 102

7.2 Engaging Key Stakeholders: Companies, Service Providers, and Policymakers ............................. 103

7.3 Public Disclosure of Climate Actions ............................................................................................... 107

8. SBTi Call to Action Process: Commit, Develop Target, Validate, Announce, Disclose ................. 109

Step 1: Commit to Set a Science-based Target ..................................................................................... 109

Step 2: Develop a Target ....................................................................................................................... 110

Step 3: Submit the Targets for a Validation .......................................................................................... 111

Step 4: Announce the Targets ............................................................................................................... 112

Step 5: Target Disclosure ...................................................................................................................... 112

9. Discussion and Areas for Further Research .............................................................................. 113

Appendices .................................................................................................................................... 115

A. SDA for Residential Mortgage ....................................................................................................... 115

B. SDA for Commercial Real Estate ................................................................................................... 125

C. SDA Electricity Generation Project Finance .................................................................................. 135

D. SDA for Corporate Debt and Equity .............................................................................................. 144

E. Temperature Rating Method ........................................................................................................ 151

F. SBTi Finance Temperature Rating and Portfolio Coverage Tool ................................................... 156

References ..................................................................................................................................... 169

Financial Sector Science-Based Targets Guidance

3

Acknowledgments

PRIMARY AUTHORS

Chendan Yan, World Resources Institute

Nate Aden, World Resources Institute

Cynthia Cummis, World Resources Institute

Eoin White, CDP Worldwide

Jan Vandermosten, World Wildlife Fund

Donald Linderyd, World Wildlife Fund

Chris Weber, World Wildlife Fund

TECHNICAL PARTNERS

Giel Linthorst, Guidehouse

Angélica Afanador, Guidehouse

EXPERT ADVISORY GROUP

The following individuals provided expert feedback and direction on guidance development. They did so

in a personal capacity, and their views did not necessarily represent the views of their employers.

1

Anna Viefhues, AMF Pension

Stuart Palmer, Australian Ethical Investment

Jochen Krippner, Barclays

Jean-Yves Wilmotte, Carbone 4

Tim Stumhofer, ClimateWorks Foundation

Ian Monroe, Etho Capital and Stanford University

Kaitlin Crouch, ING Bank

Maximilian Horster, ISS ESG

Dr. Nicole Röttmer, PricewaterhouseCoopers GmbH Wirtschaftsprüfungsgesellschaft

Marcus Lun, RBC Global Asset Management

John Gelston, Standard Chartered

Greg Liddell, Suncorp Group

Jes Andrews, United Nations Environment Programme, Finance Initiative

Neil Patel, Voya Financial

Philip Tapsall, Westpac

Eric Christensen, WSP

1

This list does not represent all Expert Advisory Group (EAG) members who have contributed to the framework development.

More members may be added to the list.

Financial Sector Science-Based Targets Guidance

4

METHOD ROAD TESTERS

The following organizations provided valuable feedback on the robustness and practicality of the draft

science-based target setting methods through the method road-testing process led by Science Based

Targets initiative (SBTi) in 2019.

ABN AMRO Bank

ACTIAM

AMF Pension

ASN Bank

ASR Nederland NV

Bank Australia

Bankinter

BNP Paribas

ING

Itaú Unibanco

La Banque Postale and La Banque Postale Asset Management

Morgan Stanley

Netherlands Development Finance Company (FMO)

Nordea Life and Pension

Skandia

Sompo Holdings, Inc.

Swedbank AB

YES BANK, Ltd.

TEMPERATURE RATING AND SBT PORTFOLIO COVERAGE TOOL

The SBTi tool development process included many partners and beta testers. We would like to

particularly thank: Christian Schmidli; representatives from Allianz; Bloomberg; ISS ESG; MSCI; Ortec

Finance; OS-Climate; Trucost; Storebrand; and Urgentum for their participation. We would also like to

thank all beta testers who provided valuable feedback on the tool development process.

Project Team

Technical Partners

Daan van de Meeberg, Ortec Finance

Lisa Eichler, Ortec Finance

Joris Cramwinckel, Ortec Finance

Hewson Baltzell, Helios Exchange

Truman Semans, OS-Climate

Wilder Marsh, OS-Climate

Financial Sector Science-Based Targets Guidance

5

Data and Service Provider Collaborators

Bloomberg L.P.

CDP

ISS ESG

MSCI

Trucost

Urgentem

User Group Collaborators

Allianz

Net Zero Asset Owner Alliance

Storebrand

Tool Beta Testers

Mohammad Fesanghary and Arun Verma, Bloomberg L.P.

Carbon Intelligence

CEMAsys.com AS

Dr. Nicole Röttmer, PricewaterhouseCoopers GmbH Wirtschaftsprüfungsgesellschaft

EcoAct

Goldman, Sachs & Co.

Lombard Odier Investment Managers

Manulife Investment Management

Oliver Canosa

ShareAction

Tribe Impact Capital LLP

We are thankful to Caisse de dépôt et placement du Québec (CDPQ), ClimateWorks Foundation,

Partnership for Carbon Accounting Financials (PCAF), Keeling Curve Prize, Hewlett Foundation, and the

Bank of New York Mellon for their generous financial support.

Financial Sector Science-Based Targets Guidance

6

Executive Summary

Context

The COVID-19 pandemic has accelerated several ongoing transitions, including the interdependence

between financial institutions and our changing climate. While financial institutions’ business models are

vulnerable to climate disruptions, greater attention is also being given to the influence of investment

and lending portfolios on climate outcomes. This transition is marked by unprecedented growth of

environmental, social, and corporate governance (ESG) investments, a profusion of high-level climate

commitments by financial institutions, and burgeoning financial regulatory action on climate-related

financial disclosures.

2

Financial institutions are seeking to lead zero-carbon transformation rather than

just minimize risks related to climate impacts.

To decarbonize the global economy in alignment with the goals established by the Paris Agreement, all

economic actors in the real economy need to reduce their greenhouse gas (GHG) emissions at a rate

sufficient to be consistent with the emissions pathways established by climate science.

Financial institutions (FIs) differ from other economic sectors: they provide finance and other services to

the companies that are responsible for reducing GHG emissions, rather than exercise direct control over

GHG emission reductions. The central enabling role of finance is recognized in the Paris Agreement’s

Article 2.1(c) on “making finance flows consistent with a pathway towards low greenhouse gas

emissions and climate-resilient development.” The Science Based Targets initiative (SBTi) defines

financial institutions as companies whose business involves the dealing of financial and monetary

transactions, including deposits, loans, investments, and currency exchange. If 5 percent or more of a

company’s revenue or assets comes from activities such as those described above, they are considered

to be financial institutions.

The SBTi framework for financial institutions aims to support FIs in their efforts to address climate

change by providing resources for science-based target setting. The framework includes target setting

methods, criteria, a target setting tool, and this guidance document. This guidance document includes

the following:

● Business case for setting science-based targets (SBTs);

● Guidance for FIs to use the target validation criteria and recommendations, target setting

methodologies and tools to prepare targets for submission to the SBTi for approval;

● Case studies from global financial institutions on their application of target setting methods;

2

On September 14, 2020, New Zealand announced it was the first country to require annual climate risk reporting by large

banks, asset managers, and insurers; see https://www.afr.com/companies/financial-services/new-zealand-makes-climate-

reporting-compulsory-20200915-p55vno.

Financial Sector Science-Based Targets Guidance

7

● Recommendations about how FIs can communicate their science-based targets, as well as how

they aim to contribute to reducing greenhouse gas emissions in the real economy through the

implementation of their targets; and

● Recommendations on steps that FIs can take to achieve their targets, building on the

understanding that setting targets is only one of various steps (high-level commitments,

measuring financed emissions, scenario analysis, target setting, enabling action, reporting) that

FIs need to take to ultimately reduce greenhouse gas emissions in the real economy.

The business case for setting SBTs

Financial institutions have historically focused on maximizing economic return on investment as a

guiding principle and business model. However, the meaning of fiduciary duty, that is financial

institutions’ legal and ethical obligation to act in their clients’ best interests, is shifting in the face of

climate change. The new business case for financial institutions to set SBTs for their investment and

lending portfolios is based on a four-part rationale: resilience, policy, demand, and innovation. Adoption

of SBTs can help financial institutions augment their resilience and competitiveness in the face of

extreme weather events and other climate-related risks. By becoming change makers rather than

change takers, financial institutions can effectively anticipate climate policy and regulatory shifts. Clients

are increasingly demanding climate actions by their financial institutions, and SBTs help to provide

transparent credibility. Finally, SBTs help direct financial institution innovation toward potentially

higher-margin products that support emissions reductions in the real economy.

How to set SBTs

FIs’ largest impact on climate change is through their investment and lending activities; thus, it is

essential they prioritize target setting in these areas. The SBTi has adopted an asset class–specific

approach to enable robust and meaningful targets. After an extended stakeholder engagement process,

the SBTi has selected three methods that link financial institutions’ investment and lending portfolios

with climate stabilization pathways, each of which can be used for one or more asset classes:

● Sectoral Decarbonization Approach (SDA): Emissions-based physical intensity targets are set for

real estate and mortgage–related investments and loans, as well as for the power generation,

cement, pulp and paper, transport, iron and steel, and buildings sectors within corporate

instruments.

● SBTi Portfolio Coverage Approach: Engagement targets are set by financial institutions to have a

portion of their investees set their own SBTi-approved science-based targets such that the

financial institution is on a linear path to 100 percent portfolio coverage by 2040.

● The Temperature Rating Approach: Financial institutions can use this approach to determine the

current temperature rating of their portfolios and take actions to align their portfolios to

ambitious long-term temperature goals by engaging with portfolio companies to set ambitious

targets.

Financial Sector Science-Based Targets Guidance

8

The SBTi recognizes that these methods are neither exhaustive nor comprehensive and welcomes

review of additional methods. In addition to setting targets for their investment and lending activities,

FIs are required to set targets for their operations (i.e., scope 1 and 2 emissions) consistent with a well-

below 2°C pathway, and are encouraged to set them for a more ambitious 1.5°C scenario. Financial

institutions may also set targets for the remaining scope 3 categories, as defined by the GHG Protocol

Scope 3 Standard.

How to communicate targets

Science-based targets give FIs an indication of how much is needed to align their activities with the Paris

climate goals. As outlined above, FIs’ primary means for affecting GHG emission reductions is through

the companies they invest in or finance. To preserve credibility and robustness, FIs must communicate

clearly about their SBTs and the actions they take to implement their SBTs. The SBTi has developed a

template that provides instructions for FIs on how best to do the following:

● Define a headline target that sets out which asset classes are included in their targets and how

much of their total portfolio is covered;

● Define targets for individual asset classes that include the method they have used as well as

specific target language; and

● Outline the actions they will take to reach their headline and asset class–specific target(s).

The SBTi recognizes that currently there is insufficient clarity about which FI actions lead to greenhouse

gas emissions in the real economy. To make further progress in this field the SBTi requires that, after

target approval, FIs disclose actions or strategies taken during the year to meet scope 3 portfolio

targets, and disclosure of progress against all approved targets on an annual basis. As FIs set targets, this

reporting will help to identify which actions are most effective to realize GHG emission reductions in the

real economy.

How to track progress and achieve targets

Actions FIs can take to fully integrate climate change in their organizations and services and potentially

influence greenhouse gas emission reductions in the real economy include the following:

● Engaging key stakeholders, such as companies, service providers, and policymakers on

complementary components of climate action;

● Public disclosure of strategies employed to reduce the impact of the FI on climate change; and

● Integration of climate change in governance and decision-making.

Financial Sector Science-Based Targets Guidance

9

How to join the SBTi and submit targets for approval

The publication of this framework in October 2020 commenced a pilot target validation project for 20

financial institutions. As with companies, the first generation of SBTs provides proof of concept that

catalyses further action and target setting among peer financial institutions. Following the conclusion

of the pilot in February 2022, all interested FIs are invited to follow the five-step SBTi Call to Action

process: commit to set an SBT, develop a target, submit the targets for validation, announce the

approved targets, and disclose target progress. In 2022, the SBTi plans to publish updated target

criteria and recommendations for financial institutions based on the latest available climate science

and target-setting methods, as well as lessons learned in the early target validation phase.

Financial Sector Science-Based Targets Guidance

10

Glossary

Term

Definition

Absolute emissions

Greenhouse gas emissions attributed to a financial institution’s lending

and investing activity, expressed in metric tonnes of CO

2

equivalent

(tCO2e).

Asset class

A group of financial instruments that have similar financial

characteristics.

Attribution share or

attribution factor

The share of total greenhouse gas emissions of the borrower or investee

that are allocated to the loan or investments.

Avoided emissions

Emission reductions that the financed project produces versus what

would have been emitted in the absence of the project (the

counterfactual baseline emissions); avoided emissions are not included

in SBTs.

Biogenic CO

2

e

emissions

Emissions from a stationary source directly resulting from the

combustion or decomposition of biologically based materials other than

fossil fuels.

Business loan

On-balance sheet loans and lines of credit with unknown use of

proceeds to businesses, nonprofits, and any other structure of

organization. Revolving credit facilities and overdraft facilities as well as

business loans secured by real estate, such as commercial real estate–

secured lines of credit, are also included in the business loans asset class.

Carbon accounting of

financial portfolios

The annual accounting and disclosure of GHG emissions associated with

loans and investments at a fixed point in time in line with financial

accounting periods. This is also called “portfolio carbon accounting.”

Climate impact

In the context of this framework, climate impact refers to the GHG

emissions that occur as a result of financing of loans and investments.

Climate-related risks

Financial risk associated with climate-related investments and activities,

including carbon asset risk or transition risk, physical risk, and legal risk.

Financial Sector Science-Based Targets Guidance

11

CO

2

-equivalent (CO

2

e)

The amount of CO

2

that would cause the same integrated radiative

forcing (a measure for the strength of climate change drivers) over a

given time horizon as an emitted amount of another GHG or mixture of

GHGs. Conversion factors vary based on the underlying assumptions and

as the science advances.

Commercial real

estate loans

On-balance sheet loans for the purchase, refinance, construction, or

rehabilitation of commercial real estate (CRE). This definition implies

that the property is used for commercial purposes.

Consolidation

approach

Refers to how an organization sets boundaries for corporate GHG

accounting. Types include equity approach, financial control and

operational control as per the GHG Protocol Corporate Standard.

Consumer loan

A loan given to consumers to finance specific types of expenditures. A

consumer loan is any type of loan made to a consumer by a creditor. For

example, a mortgage or a motor vehicle loan.

Corporate debt

Money that is owed by companies rather than by governments or

individual people.

Debt

A financing instrument that requires repayment by the borrower.

Direct emissions

Emissions from sources that are owned or controlled by the reporting

entity and/or the borrower or investee.

Double counting

Occurs when a single GHG emission reduction or removal, achieved

through a mechanism issuing units, is counted more than once toward

attaining mitigation pledges or financial pledges for the purpose of

mitigating climate change within one or multiple organizations.

Emission intensity

metric

Emissions per a specific unit, for example: tCO

2

e/$million invested,

tCO

2

e/MWh, tCO

2

e/ton produced, tCO

2

e/$million company revenue.

Emission removal

The action of removing GHG emission from the atmosphere and storing

it through various means, such as in soils, trees, underground reservoirs,

rocks, the ocean, and even products like concrete and carbon fiber.

Financial Sector Science-Based Targets Guidance

12

Emission scopes

The GHG Protocol Corporate Standard classifies an organization’s GHG

emissions into three scopes. Scope 1 emissions are direct emissions from

owned or controlled sources. Scope 2 emissions are indirect emissions

from the generation of purchased energy. Scope 3 emissions are all

indirect emissions (not included in scope 2) that occur in the value chain

of the reporting organization, including both upstream and downstream

emissions.

Enterprise Value

Including Cash (EVIC)

The sum of the market capitalization of ordinary shares at fiscal year-

end, the market capitalization of preferred shares at fiscal year-end, and

the book values of total debt and minorities’ interests. To avoid the

possibility of negative enterprise values and considering that cash as an

important financing sources for many companies should carry its fair

share of emissions, no deductions of cash or cash equivalents are made.

Environmentally

extended input-

output (EEIO) data

EEIO data refer to EEIO emissions factors that can be used to estimate

cradle-to-gate (all upstream) GHG emissions for a given industry or

product category. EEIO data are particularly useful in screening

emissions sources when prioritizing data collection efforts.

Equity

Bank’s or investor’s ownership in a company or project. There are

various types of equity, but equity typically refers to shareholder equity,

which represents the amount of money that would be returned to a

company’s shareholders if all of the assets were liquidated and all of the

company's debt were paid off.

EXIOBASE

A global, detailed Multi-Regional Environmentally Extended Supply-Use

Table (MR-SUT) and Input-Output Table (MR-IOT). It was developed by

harmonizing and detailing supply-use tables for a large number of

countries, estimating emissions and resource extractions by industry.

Financed emissions

Absolute emissions that banks and investors finance through their loans

and investments. Financed emissions can be calculated and disclosed at

an asset class level.

Financial institutions

The SBTi defines financial institutions as companies whose business

involves the dealing of financial and monetary transactions, including

deposits, loans, investments, and currency exchange. If 5 percent or

more of a company’s revenue or assets comes from activities such as

those described above, they are considered to be financial institutions.

Development financial institutions are currently out of project scope.

Financial Sector Science-Based Targets Guidance

13

Greenhouse gas

(GHG) emissions

The seven gases covered by the United Nations Framework Convention

on Climate Change (UNFCCC)—carbon dioxide (CO

2

), methane (CH

4

),

nitrous oxide (N

2

O), hydrofluorocarbons (HFCs), perfluorocarbons

(PFCs), sulphur hexafluoride (SF

6

), and nitrogen trifluoride (NF

3

).

Greenhouse Gas

(GHG) Protocol

Comprehensive global standardized frameworks to measure and

manage greenhouse gas (GHG) emissions from private and public sector

operations, value chains, and mitigation actions. The GHG Protocol

supplies the world's most widely used greenhouse gas accounting

standards. The Corporate Accounting and Reporting Standard provides

the accounting platform for virtually every corporate GHG reporting

program in the world.

Greenhouse gas

(GHG) accounting

Greenhouse gas accounting techniques that include two primary

approaches to tracking GHG emissions resulting from a company’s

operations: corporate accounting through an annual GHG inventory,

which involves financed emissions as part of the accounting; and project

accounting through estimating net emission reductions or increases

from individual projects or activities relative to a baseline scenario.

Green financing

Financial flows (such as lending, equity positions, or underwriting and

advisory services) associated with zero- or low-carbon assets or

activities. This term is often used to reflect non-climate-specific “green”

activities as well, such as “green” bonds, which can support climate-

relevant activities or water, conservation, and other related activities.

Grey financing

Financial flows toward activities and technologies that contribute

significantly to GHG emissions.

Indirect emissions

Emissions that are a consequence of the activities of the reporting entity

but occur at sources owned or controlled by another entity.

Investment

The term investment is broadly defined as “putting money into activities

or organizations with the expectation of making a profit.” Most forms of

investment involve some form of risk taking, such as investment in

equities, debt, property, projects, and even fixed interest securities,

which are subject to inflation risk, among other risks.

Listed equity and

bonds

This asset class includes all corporate bonds without known use of

proceeds and all listed equity on the balance sheet and/or actively

managed by the financial institution.

Financial Sector Science-Based Targets Guidance

14

Mortgage

On-balance sheet loans used to purchase residential property, including

multifamily properties with no limit on the number of units. This

definition implies that the property is used for residential purposes.

Motor vehicle loan

On-balance sheet loans that are used to finance one or several motor

vehicles.

Non listed corporate

finance

Finance provided to companies that is not traded on a market such as

business loans or commercial real estate.

Paris Agreement

The Paris Agreement, adopted within the United Nations Framework

Convention on Climate Change (UNFCCC) in December 2015, commits

all participating countries to limit global temperature rise to well-below

2°C above preindustrial levels and pursue efforts to limit warming to

1.5°C, to adapt to changes already occurring, and to regularly increase

efforts over time.

Project finance

On-balance sheet loan or equity (private) with known use of proceeds

that are designated for a clearly defined activity or set of activities, such

as the construction of a gas-fired power plant, a wind or solar project, or

energy efficiency projects.

Scenario analysis

A process of analyzing future events by considering alternative possible

outcomes.

Science-based

reduction targets

(SBTs)

Targets adopted by companies to reduce GHG emissions are considered

“science-based” if they are in line with what the latest climate science

says is necessary to meet the goals of the Paris Agreement—to limit

global warming to well-below 2°C above preindustrial levels and pursue

efforts to limit warming to 1.5°C.

Scope 1 emissions

Emissions from operations that are owned or controlled by the reporting

company.

Scope 2 emissions

Emissions from the generation of purchased or acquired electricity,

steam, heating, or cooling consumed by the reporting company.

Scope 3 emissions

All indirect emissions (not included in scope 2) that occur in the value

chain of the reporting company, including both upstream and

downstream emissions.

Financial Sector Science-Based Targets Guidance

15

Scope 3, category 15

(investments)

emissions

This category includes scope 3 emissions associated with the reporting

company’s loans and investments in the reporting year, not already

included in scope 1 or scope 2.

For category 15, the Greenhouse Gas Protocol Scope 3 Standard only

requires the inclusion of corporate debt holdings with known use of

proceeds. The SBTi financial sector project goes beyond this

requirement and thus expands the minimum boundary of category 15.

Financial institutions shall follow the emissions measurement

requirements in the relevant asset class methods and measure

emissions of debt investments without known use of proceeds, where

applicable.

Sequestered

emissions

Refers to atmospheric carbon dioxide (CO

2

) emissions that are captured

and stored in solid or liquid form, thereby removing their harmful global

warming effect.

Sector-specific

metrics

Energy or carbon intensity metrics that use a physical unit denominator

and are applicable to a specific sector. Examples include kgCO

2

/MWh

(power), MWh/m

2

(real estate), etc.

Small and medium-

sized enterprises

(SMEs)

As the definition of SMEs can vary from region to region, financial

institutions may use their own definitions of SMEs to define this

category. For companies, the SBTi provides a streamlined target

validation route for SMEs, where an SME is defined as a non-subsidiary,

independent company with fewer than 500 employees. Financial

institutions interested in engaging SMEs to set SBTs and whose

threshold for SMEs is higher than 500 employees (e.g., 1,000

employees) may be required to direct their SME clients or investees to

the regular SBTi validation route.

Total balance sheet

value

A balance sheet is a financial statement that reports a company's assets,

liabilities, and shareholders' equity. The balance sheet value refers to

the value of total debt plus equity.

World Input-Output

Database (WIOD)

World Input-Output Tables and underlying data, covering 43 countries,

and a model for the rest of the world for the period 2000–2014. Data for

56 sectors are classified according to the International Standard

Industrial Classification revision 4 (ISIC Rev. 4).

Financial Sector Science-Based Targets Guidance

16

1. Introduction

The former governor of the Bank of England, Mark Carney, has warned that the global financial system is

backing carbon-producing projects that will raise the temperature of the planet by over 3°C—severely

overshooting what is required to stay well-below 2°C as agreed in the 2015 Paris Agreement.

3

At the

same time, extreme weather events and other climate impacts pose growing threats to financial

institutions’ (FIs) economic models. While many FIs are working on reducing their exposure to risks from

climate impacts, the Science Based Targets initiative’s (SBTi) finance sector guidance provides a

framework for financial institutions to reduce their impact on the climate. More specifically, it is

designed to clarify, improve, and accelerate financial institutions’ alignment with the goals of the Paris

Agreement.

To decarbonize the global economy in alignment with the goals established by the Paris Agreement, all

economic actors in the real economy need to reduce their greenhouse gas (GHG) emissions at a rate

sufficient to remain aligned with the emissions pathways established by climate science. Corporate

emissions do not occur in a vacuum, but rather within a broader economic and regulatory system that

creates a complex web of incentives and disincentives for economic actors to reduce emissions. In many

ways, all actors across a given value chain, namely the upstream and downstream activities associated

with each company’s operation, and those connected through policy and other incentives, share

influence over the direct emissions of each actor and, therefore, share responsibility for reducing them.

FIs have unique influence over other actors through their provision of investment and lending services.

To drive Paris-aligned systemic decarbonization, it is critical to leverage shared influence and

responsibility for aligning incentives as well as eliminating barriers to emission reductions.

1.1 Purpose of this Document

To date, more than 70 financial institutions have publicly committed to set emissions reduction targets

through the SBTi. The list of committed financial institutions as of March 2021 is included below in

alphabetical order:

1

ABN Amro Bank N.V.

25

E.SUN Financial Holding Co., Ltd.

49

Piraeus Bank SA

2

Actiam NV

26

EQT AB

50

Principal Financial Group, Inc.

3

Albaraka Türk Participation

Bank

27

Eurazeo

51

Raiffeisen Bank International

AG

4

Allianz Investment

Management SE

28

Fubon Financial Holdings

52

Schroders

5

Amalgamated Bank

29

FullCycle

53

Shinhan Financial Group

6

ASN Bank

30

Grupo Financiero Banorte SAB de

CV

54

SK Securities, Co., Ltd

3

For more information on Mark Carney’s statement, please see https://www.theguardian.com/business/2019/oct/15/bank-of-

england-boss-warns-global-finance-it-is-funding-climate-crisis?CMP=share_btn_link.

Financial Sector Science-Based Targets Guidance

17

7

Australian Ethical Investment

31

Hannon Armstrong

55

Societe Generale

8

Aviva PLC

32

Hitachi Capital Corporation

56

Sompo Holdings, Inc.

9

AXA Group

33

HSBC Holdings plc

57

Standard Chartered Bank

10

Banco do Brasil S.A.

34

ING Group

58

Storebrand ASA

11

BanColombia SA

35

KLP

59

Swedbank AB

12

Bank Australia

36

La Banque Postale

60

Swiss Re

13

Bank J. Safra Sarasin AG

37

Legal & General Group PLC

61

Turkiye Garanti Bankasi A

14

BBVA

38

Lloyd Fonds AG

62

Teachers Mutual Bank

15

BNP Paribas

39

63

Tokio Marine Holdings, Inc.

16

Caixa Geral de Depósitos

40

Mahindra & Mahindra Financial

Services Limited

64

Tribe Impact Capital LLP

17

Capitas Finance Limited

41

MetLife, Inc.

65

TSB Bank

18

Chambers Federation

42

MP Pension

66

TSKB

19

Commercial International

Bank Egypt (SAE) CIB

43

MS&AD Insurance Group

Holdings, Inc.

67

Türkiye İş Bankası

20

Commerzbank AG

44

NatWest Group plc

68

Vakifbank

21

Credit Agricole

45

Novo Banco, SA

69

Westpac Banking Corporation

22

Credit Suisse Group

46

OXI-ZEN Solutions SA

70

YES Bank

23

DGB FINANCIAL GROUP

47

PensionDanmark

71

Yuanta Financial Holding Co

Ltd

24

Direct Line Insurance Group

plc

48

Phoenix Group Holdings plc

72

Zurich Insurance Group Ltd

An additional 80 institutions in the financial sector reported to CDP in 2019 that they intend to set a

science-based target within the next two years.

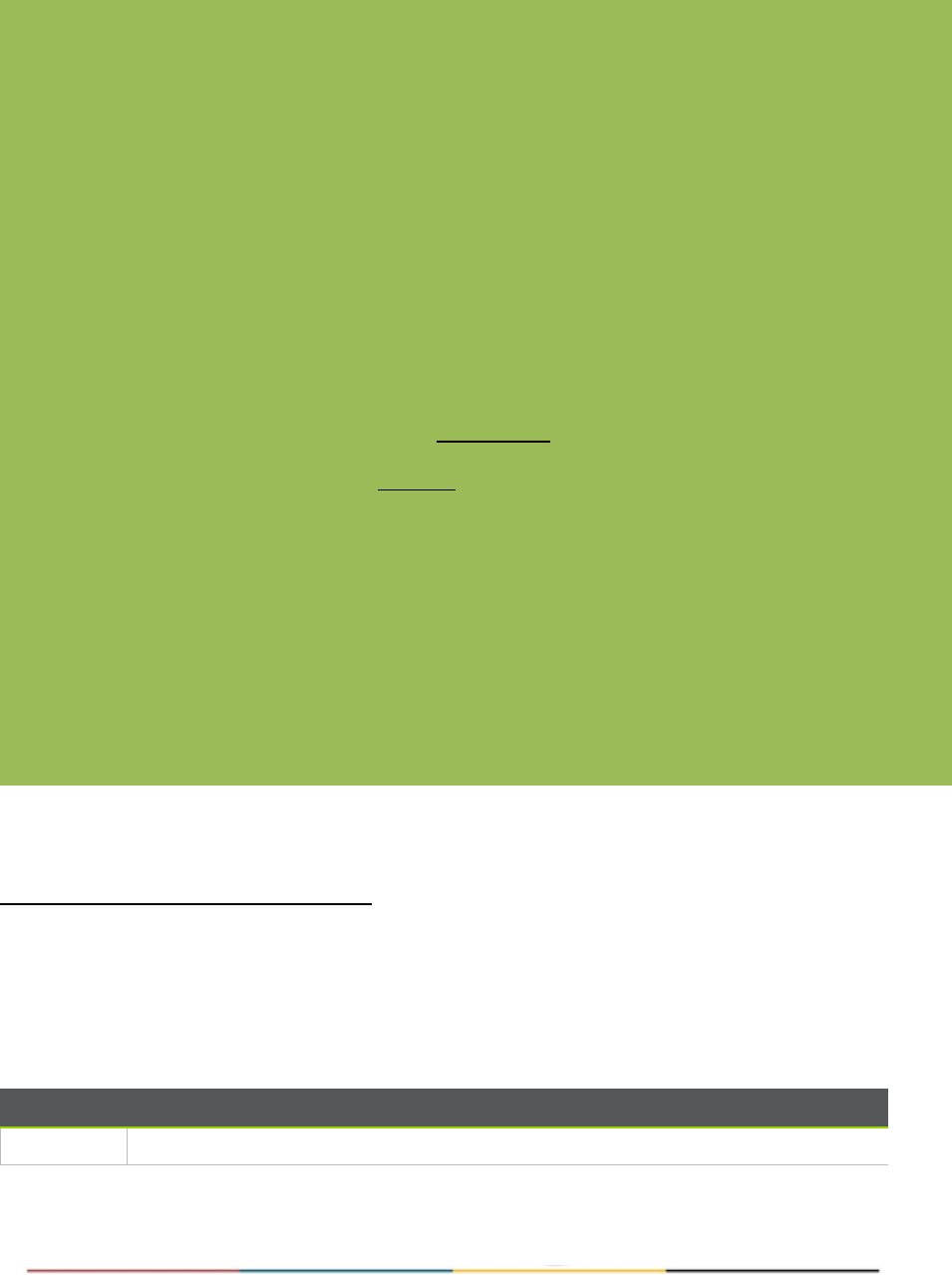

Recognizing the pressing need for a tailored, yet standardized approach for financial institutions, the

SBTi launched a project in 2018 to develop target setting methods, target validation criteria and

recommendations, a target setting tool, and a guidance for financial institutions to align their lending

and investment portfolios with the ambitions of the Paris Agreement (see Figure 1.1).

Financial Sector Science-Based Targets Guidance

18

Figure 1.1. Four Components of the SBTi's Framework for Financial Institutions

Source: Authors 2020.

This guidance document is a part of the science-based target setting framework for financial institutions

that ties the three other components together, namely the target validation criteria and

recommendations, target setting methods, and description of an open-source tool for target setting

methods. Financial institutions are invited to use the criteria and recommendations (Chapter 3) and

methods (Chapters 4 and 5) described in this document to formulate their targets.

The criteria and recommendations will also be used by the SBTi Target Validation Team (TVT) to assess

financial institutions’ target submissions. The SBTi Finance Tool described here is freely available

through the project website

4

along with all other project resources to facilitate target setting. Finally,

the case studies and other information included in this guidance document are intended to further

inform financial institutions’ target development, submission, and implementation processes.

In addition, this document provides recommendations to financial institutions on how to set science-

based targets for scope 1, 2, and 3 emissions (Chapters 4 and 5), informed suggestions on

communicating targets and actions (Chapter 6), examples of actions FIs can take to achieve their targets

(Chapter 7), and instructions on committing to the SBTi and submitting targets for validation (Chapter 8).

The document finishes by outlining areas for discussion and further research (Chapter 9).

4

Please find the project website here: https://sciencebasedtargets.org/financial-institutions/.

Financial Sector Science-Based Targets Guidance

19

1.2 The SBTi’s Financial Sector Project Audience

The SBTi defines a financial institution as a company whose business involves the arrangement and

execution of financial and monetary transactions, including deposits, loans, investments, and currency

exchange. More specifically, the SBTi deems a company a financial institution if 5 percent or more of its

revenue or assets comes from the activities described above.

In practice (and for the first phase of the project from 2018 to 2020), the primary audience includes

universal banks, asset managers (mutual funds), asset owners (pension funds, closed-end funds,

insurance companies), and mortgage real estate investment trusts (REITs). The framework is also

relevant for other financial institutions that have holdings in the following asset classes where methods

are currently available:

- Real estate

- Mortgages

- Electricity generation project finance

- Corporate and consumer loans, bonds, and equity

Asset classes beyond this list are currently out of scope. Bilateral and multilateral development financial

institutions (e.g., the World Bank) are not the primary audience of the project. Equity REITs, namely real

estate companies that own or manage income-generating properties and lease them to tenants, are not

a target audience of this project and shall pursue the regular target validation route for companies.

Additional audiences and asset classes are expected to be included in Phase II of the project.

1.3 The SBTi’s Financial Sector Project Context

Financial institutions differ from other economic sectors: they provide finance and other services to the

companies that are responsible for reducing GHG emissions, rather than exercise direct control over

GHG emission reductions. The central enabling role of finance is recognized in the Paris Agreement,

which contains Article 2.1(c) on “making finance flows consistent with a pathway towards low

greenhouse gas emissions and climate-resilient development.”

As reflected by Article 2.1(c), financial institutions require an approach within the SBTi that is tailored to

their role and recognizes that climate target setting is one of numerous activities needed for systemic

transformation. Due to the lack of complete understanding and evidence regarding the climate impacts

of financial institutions' investment and lending portfolios, the SBTi’s finance sector project focuses on

trackable activities. Activities that connect financial flows with GHG emission reductions in the real

economy include physical and transition risk assessment, emissions measurement and disclosure, target

setting, tracking of mitigation actions, and performance and disclosure. Thus, the SBTi framework for

finance contributes to the wider portfolio transition framework through its transparent and robust

Financial Sector Science-Based Targets Guidance

20

target setting platform and disclosure requirement regarding actions taken by financial institutions to

achieve targets.

1.4 What Are Science-Based Targets (SBTs)?

1.4.1 SBTs for Companies

Targets adopted by companies to reduce GHG emissions are considered “science-based” if they are in

line with what the latest climate science says is necessary to meet the goals of the Paris Agreement—to

limit global warming to well-below 2°C above preindustrial levels and pursue efforts to limit warming to

1.5°C.

Among companies globally, there is a growing momentum for science-based target setting through the

SBTi. As of September 2020, 989 companies and 58 financial institutions have publicly joined the SBTi,

among which 467 companies have had their targets officially approved (see Figure 1.2).

5

The pace at which companies join the SBTi doubled between April 2018 and October 2019 compared to

the previous 36 months. When the SBTi was launched in 2015, science-based target setting emerged as

a novel corporate sustainability practice. The onset of the global COVID pandemic in 2020 has not

slowed the pace of company commitments such that SBTi remains on track to hit its “1,000 committed

companies by end of 2020” goal. Today, SBTs have become a shared language for ambitious corporate

climate ambition.

The SBTi has made substantial progress against its goal of making science-based target setting a

standard business practice for companies seeking to play a leading role in driving down global GHG

emissions.

5

For more information on committed and approved companies, please visit https://sciencebasedtargets.org/companies-taking-

action/.

Financial Sector Science-Based Targets Guidance

21

Figure 1.2. Company Activity in the SBTi since June 2015

Source: SBTi.

1.4.2 Overview of the Science Based Targets initiative

The SBTi mobilizes companies to set science-based targets and boosts their competitive advantage in

the transition to a low-carbon economy. It is a collaboration between CDP, the United Nations Global

Compact, World Resources Institute (WRI), and the World Wide Fund for Nature (WWF), and is one of

the We Mean Business coalition commitments.

6

The finance project is one of the SBTi’s ongoing sector

development projects.

The initiative:

● Showcases companies that have set SBTs through case studies, events, and media to highlight

the increased innovation, reduced regulatory uncertainty, strengthened investor confidence,

and improved profitability and competitiveness generated by setting SBTs;

● Defines and promotes best practice in setting SBTs with the support of a Technical Advisory

Group and a Scientific Advisory Group;

● Offers resources, workshops, and guidance to reduce barriers to adoption; and

● Independently assesses and approves companies’ targets through a Call to Action campaign that

calls on companies to demonstrate their leadership on climate action by publicly committing to

set SBTs. Companies then have two years to get their targets approved and published through

the SBTi.

7

6

Please refer to the SBTi’s website for further details on its governance: https://sciencebasedtargets.org/governance/.

7

For more information, see http://sciencebasedtargets.org/.

Financial Sector Science-Based Targets Guidance

22

1.5 How is the Financial Sector Addressing Climate?

Financial institutions are increasingly attuned to climate, both in terms of adaptation to warming and

reducing climate impacts of investment and lending portfolios. Actions in this latter mitigation category

can be categorized into six rubrics: high-level commitments to act, measurement of financed

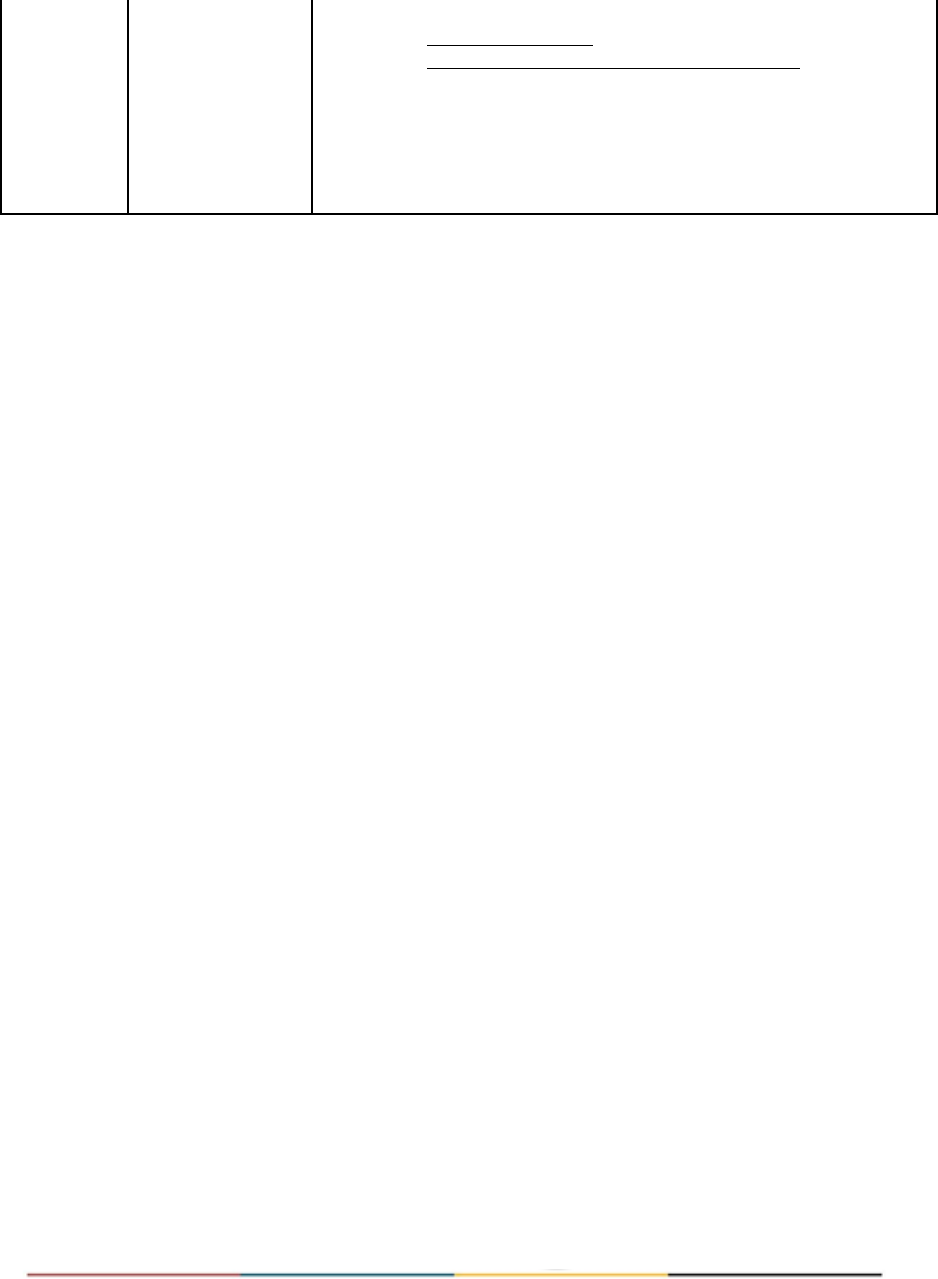

emissions/disclosure, scenario analysis, target setting, implementation actions, and reporting. Table 1.1

below summarizes 15 related financial sector initiatives alongside these six rubrics.

Table 1.1. Relevant Initiatives That Support Financial Institutions' Climate Actions

Notes: UNEP = United Nations Environment Program; IIGCC = Institutional Investors Group on Climate Change; CDP = Carbon

Disclosure Project.

Source: Authors.

The SBTi’s financial sector project is focused on the target setting component in the broader portfolio

transition process. The first climate mitigation step for many financial institutions is a high-level

commitment to act through an international initiative such as the UN-convened Net-Zero Asset Owners

Financial Sector Science-Based Targets Guidance

23

Alliance, Principles for Responsible Banking, the Investor Agenda, or a commitment to Task Force on

Climate-related Financial Disclosures (TCFD) reporting. To develop emissions metrics, the Partnership for

Carbon Accounting Financials (PCAF) provides asset class methods and data resources for quantification

of financed emissions. The Institutional Investors Group on Climate Change (IIGCC) Paris Aligned

Investment Initiative builds from a high-level commitment to set out a range of actions investors should

take to align their portfolios. Target setting with the SBTi is intended to provide specific, shorter-term

components of the high-level commitments and build on the financed emissions and scenario analysis.

After the targets are set and published, the SBTi seeks to harmonize with action and reporting–focused

initiatives to facilitate implementation, accountability, and compilation of evidence.

Outside of the areas described in Table 1.1 above, financial institutions are also mitigating their climate

impact by measuring emissions intensity of their portfolios, distinguishing green versus grey financing,

and divesting from fossil fuels. The emissions intensity approach calculates emissions per economic unit,

often grams CO

2

equivalent(gCO

2

e)/$ assets under management, to quantify sector differences and

track changes over time. Green versus grey metrics are exemplified by WRI’s Green Targets tool, which

illustrates the distribution of banks’ sustainable finance commitments relative to their fossil fuel

finance.

8

University endowment and other financial institutions’ commitments to divest from fossil fuels

represent another type of action. The SBTi finance sector project complements and augments these

approaches with its focus on target setting.

1.5.1 Framework Development Process

Science-based target setting resource for financial institutions has been developed through a two-year

inclusive multi-stakeholder process, including consultation with an Expert Advisory Group (EAG)

representing financial institutions, consultants, nongovernmental organizations (NGOs), and academic

institutions; financial institutions participating in method road testing; and a broad, inclusive

Stakeholder Advisory Group (SAG), which provides input at key milestones in the framework

development process.

Below are highlights and milestones from the development process:

● September 2018: First EAG meeting;

● December 2018: EAG meeting to introduce the draft methods and solicit initial feedback;

● February 2019: EAG meeting to obtain feedback on the road-testing process;

● April 2019: Launch of draft methods for road-testing process;

● April–September 2019: Gathered feedback from financial institutions and other stakeholders

on draft asset class–based methods through road-testing process and an open stakeholder

consultation;

8

For more information on WRI’s Green Targets tool for banks, see https://www.wri.org/finance/banks-sustainable-finance-

commitments/.

Financial Sector Science-Based Targets Guidance

24

● October 2019: Hosted a webinar to share a summary of feedback received from companies

participating in the road-testing process;

● November 2019: Cohosted a webinar with Global Compact Network Australia and WWF to

share progress on methodologies with financial institutions in Oceania and Asia Pacific;

● February 2020: Hosted workshops in London and Tokyo to gather feedback from stakeholders

on draft target validation criteria;

● April 2020: Hosted a webinar to initiate public call for feedback on development of a new

temperature rating draft methodology for companies and investment portfolios;

● April–May 2020: Conducted public consultation to gather input from stakeholders on draft

target validation criteria and tool development process that will serve as central components

of the SBTi’s framework for financial institutions;

● May 2020: Hosted a webinar to share a summary of stakeholder feedback on draft target

validation criteria;

● May 2020: Participated in a webinar hosted by the Institute of International Finance to share

a project overview and update;

● April–May 2020: Hosted a webinar to launch the consultation process for the temperature

rating methodology;

● July 2020: Hosted a webinar to launch the Temperature Rating and SBT Portfolio Coverage

tool beta-testing process and provided an overview of the Financial Sector Science Based

Targets Guidance and the feedback process;

● August 2020: Shared the first draft of the Financial Sector Science Based Targets Guidance for

public comments;

● August 2020: Public consultation on the first draft of the Financial Sector Science Based

Targets Guidance took place from August 6 to 27, 2020;

● July–August 2020: Beta testing of an open-source tool, which covers the Temperature Rating

and SBT Portfolio Coverage methods, target setting tool launched on July 23. Two webinars

were hosted for beta testers: Beta Tester Technical Deep Dive: Setting Up and Integrating the

Tool in Your Workflow (August 6) ; Beta Tester Workshop: How To Run the Tool and Use

Cases (August 7). The tool is based on a new open-source Temperature Rating

methodology developed by CDP and WWF. The methodology and tool are suitable for setting

targets for unlisted and listed equity and corporate debt portfolios;

● August–October 2020: Revised the first draft of the guidance based on feedback received in

the survey and other engaged stakeholders; revised the Temperature Rating and SBT Portfolio

Coverage tool and tool documentation based on feedback received in the beta-testing

process.

9

9

More documentation of the framework development process can be found on the project website:

https://sciencebasedtargets.org/financial-institutions/.

Financial Sector Science-Based Targets Guidance

25

1. Business Case for Financial Institutions to Set Science-

Based Targets

Financial institutions are uniquely positioned to influence other actors through their investment and

lending activities. To drive Paris-aligned systemic decarbonization, it is critical to leverage shared

influence and responsibility for aligning incentives as well as eliminating barriers to emissions

reductions.

Financial institutions that set science-based targets commit to align their lending and investment

portfolios with the level of ambition required to achieve the goals of the Paris Agreement. This

commitment, along with the strategy and actions that will be taken to achieve the targets not only

contribute to the transition to a net-zero economy but also bring substantial benefits to the financial

institution. Key benefits include the following:

● Build business resilience and increase competitiveness: Performing scenario analysis and

applying methods to set SBTs enable financial institutions to align with the zero-carbon

economy, to identify and capitalize on a range of opportunities, and to mitigate climate risks and

increase competitiveness by gaining insights into the transformations faced by the economic

sectors they lend to and invest in.

● Drive innovation: As SBTs include a long-term vision, financial institutions can plan future

financing options that prioritize the low-carbon transition. Engaging with their clients, financial

institutions can develop innovative financial products and services that enable customers to

reduce emissions in the real economy.

● Build credibility and reputation: As compared to targets initiated solely by financial institutions,

SBTs have higher credibility with stakeholders since they are based on the latest available

science and validated against a set of robust criteria developed through a multi-stakeholder

consultative process. Financial institutions with SBTs can serve as lower-risk options for long-

term shareholders and investors that are seeking to hedge climate-related risks. In addition,

financial institutions with SBTs demonstrate leadership in sustainability, which improves a

financial institution's reputation with all stakeholders.

● Influence and prepare for shifts in public policy: SBTs help financial institutions adapt to

changing policies and send a stronger signal to policymakers, allowing the industry to better

influence policy decisions. Financial institutions with SBTs are much better positioned to

respond to future regulatory adjustments as governments ramp up their climate action.

● Demonstrate leadership: While metrics and methods to set SBTs targets for financial

institutions are new and best practice is still evolving, this is no reason to delay action. Financial

institutions that undertake the target setting process lead the way and push the market toward

the most credible and practical solutions.

Financial Sector Science-Based Targets Guidance

26

2. SBTi Target Validation Criteria and Recommendations for

Financial Institutions

This chapter presents Version 1.0 of the SBTi target validation criteria and recommendations for

financial institutions. These sector-specific criteria supersede the general SBTi criteria for companies.

Sections 1 to 4 and 7 of the criteria (Section 3.1, 3.2, 3.3, 3.4 and 3.7) focus on GHG inventory, scope 1

and 2 targets, and target validity and recalculations. Version 4.1 of the SBTi general criteria for

companies serves as the basis for these sections, with slight deviations for financial institutions.

10

Where relevant, these criteria are subject to the SBTi’s annual update of corporate criteria.

Developed through extensive stakeholder consultation, Sections 5 and 6 (Section 3.5 and 3.6) of

the criteria are designed specifically for financial institutions’ target setting, progress-tracking, and

action reporting related to their investment and lending activities. In 2022, the SBTi plans to update

this initial set of criteria based on lessons learned in the target validation pilot phase for financial

institutions (see Chapter 8 for more information on committing and submitting targets to SBTi).

The SBTi also reserves the right to make adjustments to the criteria, as needed, to reflect the

most recent emissions scenarios, partner organization policies, greenhouse gas accounting

approaches, and evolving understanding of best practice in science-based target setting.

All the criteria presented here must be met for financial institutions' targets to be recognized by the

SBTi. In addition, financial institutions shall follow the GHG Protocol Corporate Standard, Scope 2

Guidance, and Corporate Value Chain (Scope 3) Accounting and Reporting Standard for their emissions

accounting and reporting.

11

In the context of the criteria and this guidance, the term “shall” is used to

describe requirements related to relevant criteria and accounting guidance, whereas the term “should”

is used to describe recommendations. The SBTi recommendations are important for transparency and

best practices, but are not required. Unless otherwise noted (including specific sections), all criteria

apply to scopes 1, 2, and 3.

A select group of criteria and recommendations most relevant to FIs are expanded on in further sections

throughout this document, which include additional information on successfully fulfilling these

requirements.

12

The SBTi strongly recommends that financial institutions thoroughly review the

guidance before target development.

10

Please see Version 4.1 of the SBTi general criteria for corporates here: https://sciencebasedtargets.org/wp-

content/uploads/2019/03/SBTi-criteria.pdf.

11

Limited deviations from the scope 3 standard in this framework are described in Section 4.1 Compiling a GHG Inventory.

12

For more information on criteria not expanded further in this guidance, please refer to the SBTi Target Validation Protocol

that describes the underlying principles, process, and criteria followed to assess targets and to determine conformance with the

SBTi criteria.

Financial Sector Science-Based Targets Guidance

27

The initiative also reserves the right to withdraw a target approval decision if it becomes apparent that

the FI provided incorrect information during the target validation process that results in any of the

criteria existing during the assessment not being met, or if requirements following the approval of the

target are not respected (i.e., target progress-reporting and recalculations).

3.1 GHG Emissions Inventory and Target Boundary

Criteria

FI-C1 – Scopes: Financial institutions (FIs) must set a target(s) that covers institution-wide scope 1 and

scope 2 emissions, as defined by the GHG Protocol Corporate Standard, and scope 3 investment and

lending activities as per FI-C15 and FI-C16. FIs may set targets for remaining scope 3 emissions

categories as per FI-R9.

FI-C2 – Significance Thresholds: Financial institutions may exclude up to 5 percent of scope 1 and scope

2 emissions combined in the boundary of the inventory and target.

13

FI-C3 – Greenhouse Gases: Scope 1 and 2 targets must cover all relevant GHGs as required per the GHG

Protocol Corporate Standard. If optional targets on scope 3, categories 1–14 are set, they shall also

cover all relevant GHGs. Coverage of all relevant GHGs are recommended, where possible, for FIs’ scope

3 portfolio targets. If financial institutions are unable to cover all GHGs for scope 3 portfolio targets,

they shall cover CO

2

emissions at a minimum.

FI-C4 – Bioenergy Accounting: Direct emissions from the combustion of biomass and biofuels for

Institution-wide operational use, as well as GHG removals associated with bioenergy feedstock,

14

must

be included alongside the financial Institution’s inventory and must be included in the target boundary

when setting a science-based target and when reporting progress against that target. If biogenic

emissions from biomass and biofuels are considered climate neutral, the financial institution must

provide justification of the underlying assumptions. Financial institutions must report emissions from

N

2

O and CH

4

from bioenergy use under scope 1, 2, or 3, as required by the GHG Protocol, and must

apply the same requirements on inventory inclusion and target boundary as for biogenic carbon.

FI-C5 – Subsidiaries: It is recommended that financial institutions submit targets only at the parent- or

group-level, not the subsidiary level. Parent companies must include the emissions of all subsidiaries in

their target submission, in accordance with boundary criteria above. In cases where both parent

13

Where financial institutions’ scope 1 or 2 emissions are deemed immaterial (i.e., under 5 percent of total combined scope 1

and 2 emissions), FIs may set their SBT solely on the scope (either scope 1 or scope 2) that covers more than 95 percent of the

total scope 1 and 2 emissions. Financial institutions must continue to report on both scopes and adjust their targets as needed,

in accordance with the GHG Protocol’s principle of completeness and as per FI-C21-Mandatory target recalculation.

14

Non-bioenergy–related biogenic emissions must be reported alongside the inventory and included in the target boundary.

GHG removals that are not associated with bioenergy feedstock are currently not accepted to count as progress toward SBTs or

toward net emissions in the inventory.

Financial Sector Science-Based Targets Guidance

28

companies and subsidiaries submit targets,

15

the parent company’s target must also include the

emissions of the subsidiary if it falls within the parent company’s emissions boundary, given the chosen

inventory consolidation approach.

16

Recommendations and Additional Guidance

FI-R1 – Direct Land Use Change Emissions: When relevant, financial institutions are encouraged to

account for direct land use change emissions and include them in their target boundary. Financial

institutions seeking to implement mitigation actions aimed at reducing land use change as part of their

SBTs (e.g., through preventing deforestation from their supply chains) should include land use change

emissions in their base year inventory. Since methods to calculate land use change can differ widely, and

there is currently no standardized method recognized under the GHG Protocol, companies should

disclose the method used to calculate these impacts in their GHG inventory.

17

Financial institutions with

indirect land use emissions can report these separately alongside the inventory and similarly disclose the

method used to calculate these impacts.

FI-R2 – Bioenergy Accounting: Assumptions of neutrality for bioenergy tend to overlook that there is a

significant time lag between the bio-based resource removal (wood/crop) and later regeneration. They

also overlook possible differences in productivity among forest/crop systems used as bioenergy

feedstock and the effects of long-term carbon storage in bio-based products and/or disposal. For these

reasons, until a standardized method for bioenergy GHG accounting is developed under the GHG

Protocol, the SBTi strongly recommends financial institutions take into account the time of emissions

(i.e., wood/crop removal) and sequestration (i.e., forest/crop regrowth) in their accounting

methodologies.

15

This criterion applies only to subsidiaries. Brands, licensees, and/or specific regions or business divisions (with the exception

of banks’ asset management divisions) of a financial institution will not be accepted as separate targets unless they fall outside

of a parent company’s chosen consolidation approach.

16

Under this version of the criteria, it is optional for banks to include their asset management divisions in their scope 1, 2, and 3

target boundaries. If such exclusion is made, it shall be disclosed clearly in the target language. See Section 5.3 for more

information.

17

At the moment, the GHG protocol provides only limited guidance on agriculture, forestry, and other land-use (AFOLU)

emissions accounting, and there are no sector-specific SBT-setting methodologies available for companies in land-intensive

sectors that include AFOLU emissions. The Science Based Targets initiative is undertaking a sector development project, the

SBTi Forest, Land and Agriculture project (“SBTi FLAG”), led by WWF, to address this methodology gap. The effort will focus on

the development of methods and guidance to enable the food, agriculture, and forest sectors to set science-based targets

(SBTs) that include deforestation, and possibly other land-related impacts. In parallel to this effort, WRI and World Business

Council for Sustainable Development (WBCSD) are leading the development of three new GHG Protocol Standards on how

companies should account for GHG emissions and removals in their annual inventories. The three standards will cover: Carbon

Removals and Sequestration; Land Sector Emissions and Removals; and Bioenergy. For more information on this work and how

to participate, see here. The FLAG project and the new GHG Protocol Standards are complementary workstreams that will

provide the infrastructure needed for corporate target setting, accounting, and reporting of AFOLU-related emissions.

Financial Sector Science-Based Targets Guidance

29

3.2 Scope 1 and 2 Target Time Frame

Criteria

FI-C6 – Base and Target Years: Targets must cover a minimum of 5 years and a maximum of 15 years

from the date the target is submitted to the SBTi for an official validation.

18

FI-C7 – Progress to Date: Targets that have already been achieved by the date they are submitted to the

SBTi are not acceptable. The SBTi uses the year the target is submitted to the initiative (or the most

recent completed GHG inventory) to assess forward-looking ambition. The most recent completed GHG

inventory must not be earlier than two years prior to the year of submission.

Recommendations and Additional Guidance

FI-R3 – Base Year: The SBTi recommends choosing the most recent year for which data are available as

the target base year.

FI-R4 – Target Year: Targets that cover more than 15 years from the date of submission are considered

long-term targets. Financial institutions are encouraged to develop such long-term targets up to 2050 in

addition to midterm targets required by C6. At a minimum, long-term targets must be consistent with

the level of decarbonization required to keep global temperature increase to well-below 2°C compared

to preindustrial temperatures to be validated and recognized by the SBTi.

FI-R5 – Consistency: It is recommended that financial institutions use the same base and target years for

all targets within the midterm time frame and all targets within the long-term time frame.

3.3 Scope 1 and 2 Target Ambition

Criteria

FI-C8 – Level of Ambition: At a minimum, scope 1 and scope 2 targets will be consistent with the level of

decarbonization required to keep global temperature increase to well-below 2°C compared to

preindustrial temperatures, though financial institutions are encouraged to pursue greater efforts

toward a 1.5°C trajectory. Both the target time frame ambition (base year to target year) and the

forward-looking ambition (most recent year to target year) must meet this ambition criteria.

19

18

For targets submitted for an official validation in the first half of 2020, the valid target years are 2024–2034 inclusive. For

targets submitted in the second half of 2020, the valid target years are between 2025 and 2035 inclusive.

19

For targets submitted for an official validation in 2020, the most recent inventory data submitted must be for 2018 at the

earliest.

Financial Sector Science-Based Targets Guidance

30

FI-C9 – Absolute vs. Intensity: Intensity targets for scope 1 and scope 2 emissions are only eligible when

they lead to absolute emissions reduction targets in line with climate scenarios for keeping global

warming to well-below 2°C or when they are modeled using an approved sector pathway. Absolute

reductions must be at least as ambitious as the minimum of the range of emissions scenarios consistent

with the well-below 2°C goal or aligned with the relevant sector reduction pathway within the Sectoral

Decarbonization Approach.

FI-C10 – Method Validity: Targets must be modeled using the latest version of methods and tools

approved by the initiative. Targets modeled using previous versions of the tools or methods can only be

submitted to the SBTi for an official validation within six months of the publication of the revised

method or the publication of relevant sector-specific tools.

FI-C11 – Offsets: The use of offsets is not counted as emissions reduction toward the progress of

financial institutions’ science-based targets. The SBTi requires that financial institutions set targets

based on emission reductions through direct action within their own operations or their investment and

lending portfolios. Offsets are only considered to be an option for financial institutions seeking to

support additional emission reductions beyond their science-based targets.

FI-C12 – Avoided Emissions: Avoided emissions fall under a separate accounting system from corporate

and financial institutions’ inventories and do not count toward science-based targets.

Recommendations and Additional Guidance

FI-R6 – Choosing an approach: The SBTi recommends using the most ambitious decarbonization

scenarios that lead to the earliest reductions and the least cumulative emissions.

3.4 Scope 2

Criteria

FI-C13 – Approaches: Financial Institutions shall disclose whether they are using a location- or market-

based approach per the GHG Protocol Scope 2 Guidance to calculate base year emissions and to track

performance against a science-based target. Financial Institutions shall use a single, specified scope 2

accounting approach (“location-based” or “market-based”) for setting and tracking progress toward

their SBTs.

FI-C14 – Renewable Electricity Procurement: Targets to actively source renewable electricity at a rate

that is consistent with well-below 2°C scenarios are an acceptable alternative to scope 2 emissions

reduction targets. The SBTi has identified 80 percent renewable electricity procurement by 2025 and

100 percent by 2030 as thresholds (portion of renewable energy over total energy use) for this approach

Financial Sector Science-Based Targets Guidance

31

in line with the recommendations of RE100. Financial Institutions that already source electricity at or

above these thresholds shall maintain or increase their use share of renewable electricity to qualify.

Recommendations and Additional Guidance

FI-R7 – Purchased Heat and Steam: For science-based target modeling purposes using the sectoral

decarbonization approach (SDA), it is recommended that financial institutions model purchased heat

and steam–related emissions as if they were part of their direct (i.e., scope 1) emissions.