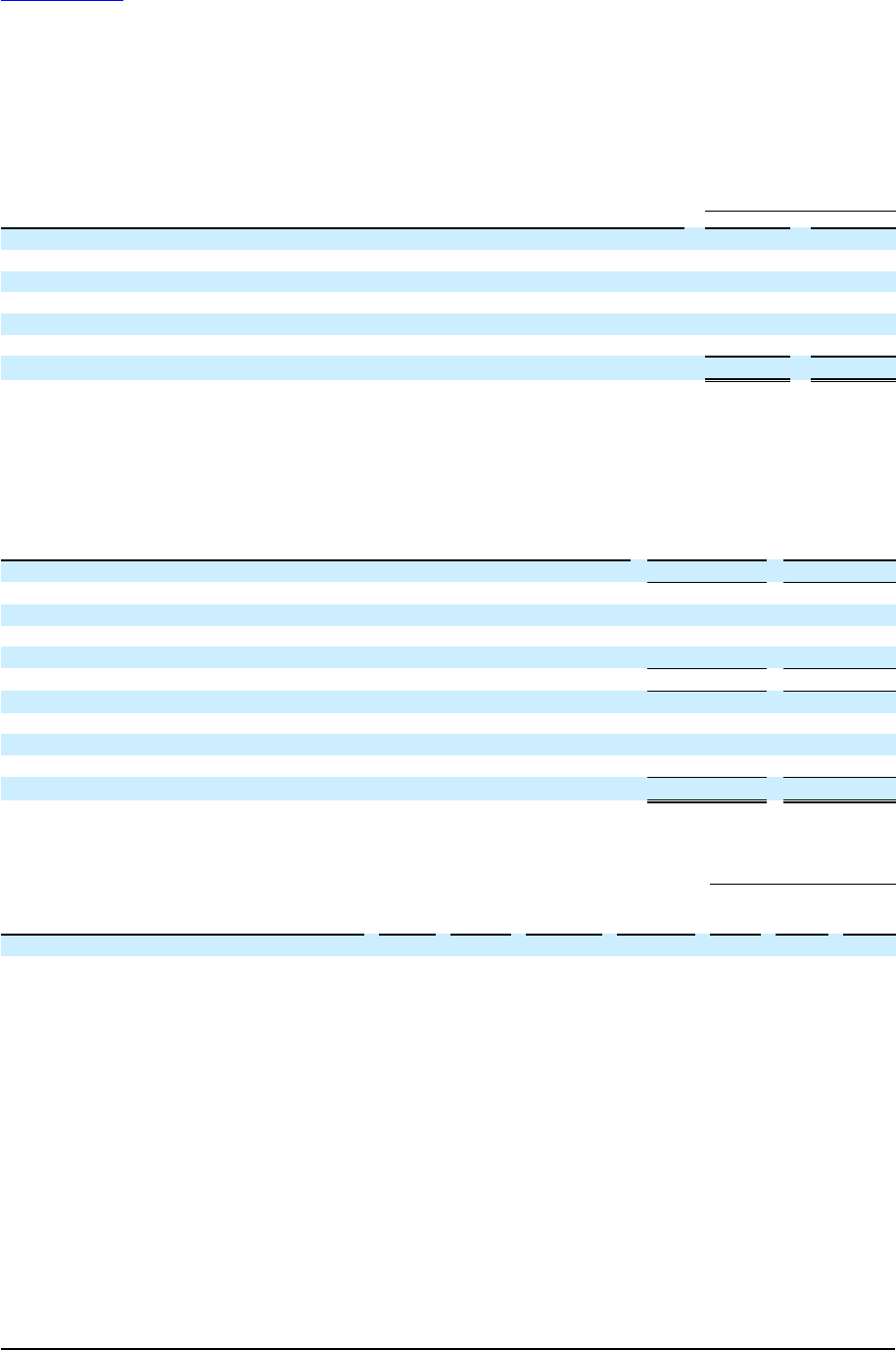

Table of Contents

d

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

☐☐

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☒☒

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2020

OR

☐☐

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

OR

☐☐

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Date of event requiring this shell company report

Commission file number: 001-38863

JUMIA TECHNOLOGIES AG

(Exact Name of Registrant as Specified in its Charter)

N/A

(Translation of registrant’s name into English)

Skalitzer Strasse 104

10997 Berlin, Germany

+49 (30) 398 20 34 54

(Address of registrant’s registered office)

Sacha Poignonnec

Skalitzer Strasse 104

10997 Berlin, Germany

+49 (30) 398 20 34 54

(Name, Telephone, E-Mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

Title of Each Class Trading Symbol(s) Name of Each Exchange On Which Registered

American Depositary Shares JMIA New York Stock Exchange

Ordinary Shares, no par value N/A New York Stock Exchange

1

Securities registered or to be registered pursuant to Section 12(g) of the Act:

None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act:

None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report.

179,259,246 ordinary shares, no par value.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes ◻ No ⌧

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934.

Yes ◻ No ⌧

Note—checking the box above will not relieve any registrant required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 from their obligations under those Sections.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that

the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ⌧ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding

12 months (or for such shorter period that the registrant was required to submit such files).

Yes ⌧ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definitions of “large accelerated filer,” “accelerated filer,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act:

Large accelerated filer ◻ Accelerated Filer ⌧ Non-accelerated filer ◻

Emerging Growth Company ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the

Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

U.S. GAAP ◻

International Financial Reporting Standards as issued

by the International Accounting Standards Board ⌧

Other ◻

If “Other” has been checked in response to the previous question indicate by check mark which financial statement item the registrant has elected to follow Item 17 ◻ Item 18 ◻

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ⌧

1 Not for trading, but only in connection with the listing on The New York Stock Exchange of American Depository Shares.

Table of Contents

TABLE OF CONTENTS

Page

Introduction i

Presentation of Certain Financial and Other Information i

Market and Industry Data i

Trademarks, Service Marks and Tradenames i

Information Regarding Forward-Looking Statements ii

Part I 1

Item 1. Identity of Directors, Senior Management and Advisers 1

Item 2. Offer Statistics and Expected Timetable 1

Item 3. Key Information 1

Item 4. Information on the Company 55

Item 4A. Unresolved Staff Comments 80

Item 5. Operating and Financial Review and Prospects 80

Item 6. Directors, Senior Management and Employees 99

Item 7. Major Shareholders and Related Party Transactions 116

Item 8. Financial Information 119

Item 9. The Offer and Listing 119

Item 10. Additional Information 120

Item 11. Quantitative and Qualitative Disclosures About Market Risk 132

Item 12. Description of Securities Other Than Equity Securities 135

Item 13. Defaults, Dividend Arrearages and Delinquencies 137

Item 14. Material Modifications to the Rights of Security Holders and Use of Proceeds 137

Item 15. Controls and Procedures 138

Item 16A. Audit Committee Financial Expert 139

Item 16B. Code of Ethics 139

Item 16C. Principal Accountant Fees and Services 139

Item 16D. Exemptions from the Listing Standards for Audit Committees 140

Item 16E. Purchases of Equity Securities by the Issuer and Affiliated Purchasers 140

Item 16F. Change in Registrant’s Certifying Accountant 140

Item 16G. Corporate Governance 140

Item 16H. Mine Safety Disclosure 141

PART II 141

Item 17. Financial Statements 141

Item 18. Financial Statements 142

Item 19. Exhibits 143

Table of Contents

i

INTRODUCTION

We conduct our business through Jumia Technologies AG, a German stock corporation (Aktiengesellschaft) and its

subsidiaries. Except where the context otherwise requires or where otherwise indicated, the terms “Jumia,” the “Company,” the

“Group,” “we,” “us,” “our,” “our company” and “our business” refer to Jumia Technologies AG together with its consolidated

subsidiaries as a consolidated entity.

PRESENTATION OF CERTAIN FINANCIAL AND OTHER INFORMATION

We report under International Financial Reporting Standards (“IFRS”) as issued by the International Accounting

Standards Board (the “IASB”), which differ in certain significant respects from U.S. generally accepted accounting principles

(“U.S. GAAP”).

Our consolidated financial statements are reported in euros, which are denoted “euros,” “EUR” or “€” throughout this

Annual Report on Form 20-F (“Annual Report”) and refer to the currency introduced at the start of the third stage of European

economic and monetary union pursuant to the treaty establishing the European Community, as amended. Also, throughout this

Annual Report, the terms “dollar,” “USD” or “$” refer to U.S. dollars. Unless otherwise noted, all translations of euro amounts

into dollar amounts were calculated at a rate of €1.00 = $1.2230, which equals the noon buying rate of the Federal Reserve Bank

of New York on December 31, 2020. You should not assume that, on that or any other date, one could have converted these

amounts of euros into dollars at this exchange rate.

Financial information in thousands or millions, and percentage figures have been rounded. Rounded total and sub-total

figures in tables may differ marginally from unrounded figures indicated elsewhere in this Annual Report or in the consolidated

financial statements. Moreover, rounded individual figures and percentages may not produce the exact arithmetic totals and sub-

totals indicated elsewhere in this Annual Report.

MARKET AND INDUSTRY DATA

We obtained the industry, market and competitive position data from our own internal estimates, surveys, and research

as well as from publicly available information, industry and general publications and research, surveys and studies conducted by

third parties, including, but not limited to, the International Monetary Fund (“IMF”), the African Development Bank, the World

Bank, the Central Intelligence Agency (“CIA”), Statista, GSMA, Ovum, the Alliance for Affordable Internet, IDC, the United

Nations, and the United Nations Economic Commission for Africa. None of the independent industry publications used in this

Annual Report were prepared on our behalf.

Industry publications, research, surveys, studies and forecasts generally state that the information they contain has been

obtained from sources believed to be reliable, but that the accuracy and completeness of such information is not guaranteed.

Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and

uncertainties as the other forward-looking statements in this Annual Report. These forecasts and forward-looking information are

subject to uncertainty and risk due to a variety of factors, including those described under Item 3. “Key Information—D. Risk

Factors.” These and other factors could cause results to differ materially from those expressed in our forecasts or estimates or

those of independent third parties.

TRADEMARKS, SERVICE MARKS AND TRADENAMES

We have proprietary rights to trademarks used in this Annual Report that are important to our business, many of which

are registered under applicable intellectual property laws. Solely for convenience, the trademarks, service marks, logos and trade

names referred to are without the

®

and ™ symbols, but such references are not intended to indicate, in any way, that we will not

assert, to the fullest extent under applicable law, our rights or the rights of the applicable licensors to these trademarks, service

marks and trade names.

This Annual Report contains additional trademarks, service marks and trade names of others, which are the property of

their respective owners. All trademarks, service marks and trade names appearing in this Annual Report are, to our knowledge,

the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks,

copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Table of Contents

ii

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report contains forward-looking statements that relate to our current expectations and views of future

events. These statements relate to events that involve known and unknown risks, uncertainties and other factors, including those

listed under Item 3. “Key Information—D. Risk Factors,” which may cause our actual results, performance or achievements to be

materially different from any future results, performance or achievements expressed or implied by the forward-looking

statements.

In some cases, these forward-looking statements can be identified by words or phrases such as “believe,” “may,” “will,”

“expect,” “estimate,” “could,” “should,” “anticipate,” “aim,” “estimate,” “intend,” “plan,” “believe,” “potential,” “continue,”

“is/are likely to” or other similar expressions. Forward-looking statements contained in this Annual Report include, but are not

limited to, statements about:

● our future business and financial performance, including our revenue, operating expenses and our ability to maintain

profitability and our future business and operating results;

● our strategies, plan, objectives and goals; and

● our expectations regarding the development of our industry, internet penetration, market size and the competitive

environment in which we operate.

These forward-looking statements are subject to risks, uncertainties and assumptions, some of which are beyond our

control. In addition, these forward-looking statements reflect our current views with respect to future events and are not a

guarantee of future performance. Actual outcomes may differ materially from the information contained in the forward-looking

statements as a result of a number of factors, including, without limitation, the risk factors set forth in Item 3. “Key Information

—D. Risk Factors,” including the following:

● we have incurred significant losses since inception and there is no guarantee that we will achieve or sustain profitability

in the future;

● we rely on external financing and may not be able to raise necessary additional capital on economically acceptable

terms or at all;

● our markets pose significant operational challenges that require us to expend substantial financial resources;

● we face risks related to health epidemics and other outbreaks such as COVID-19, which could significantly disrupt our

supply chain and our operations, and could negatively affect our development;

● many of our countries of operation are, or have been, characterized by political instability or changes in regulatory or

other government policies;

● our business may be materially and adversely affected by an economic slowdown in any region of Africa;

● currency volatility and inflation may materially adversely affect our business;

● uncertainties with respect to the legal system in certain African markets could adversely affect us;

● our business may be materially and adversely affected by violent crime or terrorism in any region of Africa;

● growth of our business depends on an increase in internet penetration in Africa and other external factors, some of

which are beyond our control;

● we face competition, which may intensify;

Table of Contents

iii

● we may be unable to adapt to changes in our industry or successfully launch and monetize new and innovative

technologies, as a result of which our growth and profitability could be adversely affected;

● we may not be able to maintain our existing partnerships, strategic alliances or other business relationships or enter into

new ones. We may have limited control over such relationships, and these relationships may not provide the anticipated

benefits;

● we may fail to maintain or grow the size of our consumer base or the level of engagement of our consumers;

● sellers set their own prices and decide which goods they make available on our marketplace, which could affect our

ability to respond to consumer preferences and trends;

● we use third-party carriers as part of our fulfillment process, giving us limited control over the fulfillment process and

exposing us to challenges should we need to replace carriers;

● we may experience malfunctions or disruptions of our technology systems;

● we may experience security breaches and disruptions due to hacking, viruses, fraud, malicious attacks and other

circumstances;

● we conduct a substantial amount of our business in foreign currencies, which heightens our exposure to the risk of

exchange rate fluctuations.

The forward-looking statements made in this Annual Report relate only to events or information as of the date on which

the statements are made in this Annual Report. Except as required by law, we undertake no obligation to update or revise publicly

any forward-looking statements, whether as a result of new information, future events or otherwise, after the date on which the

statements are made or to reflect the occurrence of unanticipated events. You should read this Annual Report and the documents

that we have filed as exhibits to this Annual Report completely and with the understanding that our actual future results or

performance may be materially different from what we expect.

Table of Contents

1

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

A. Selected Financial Data

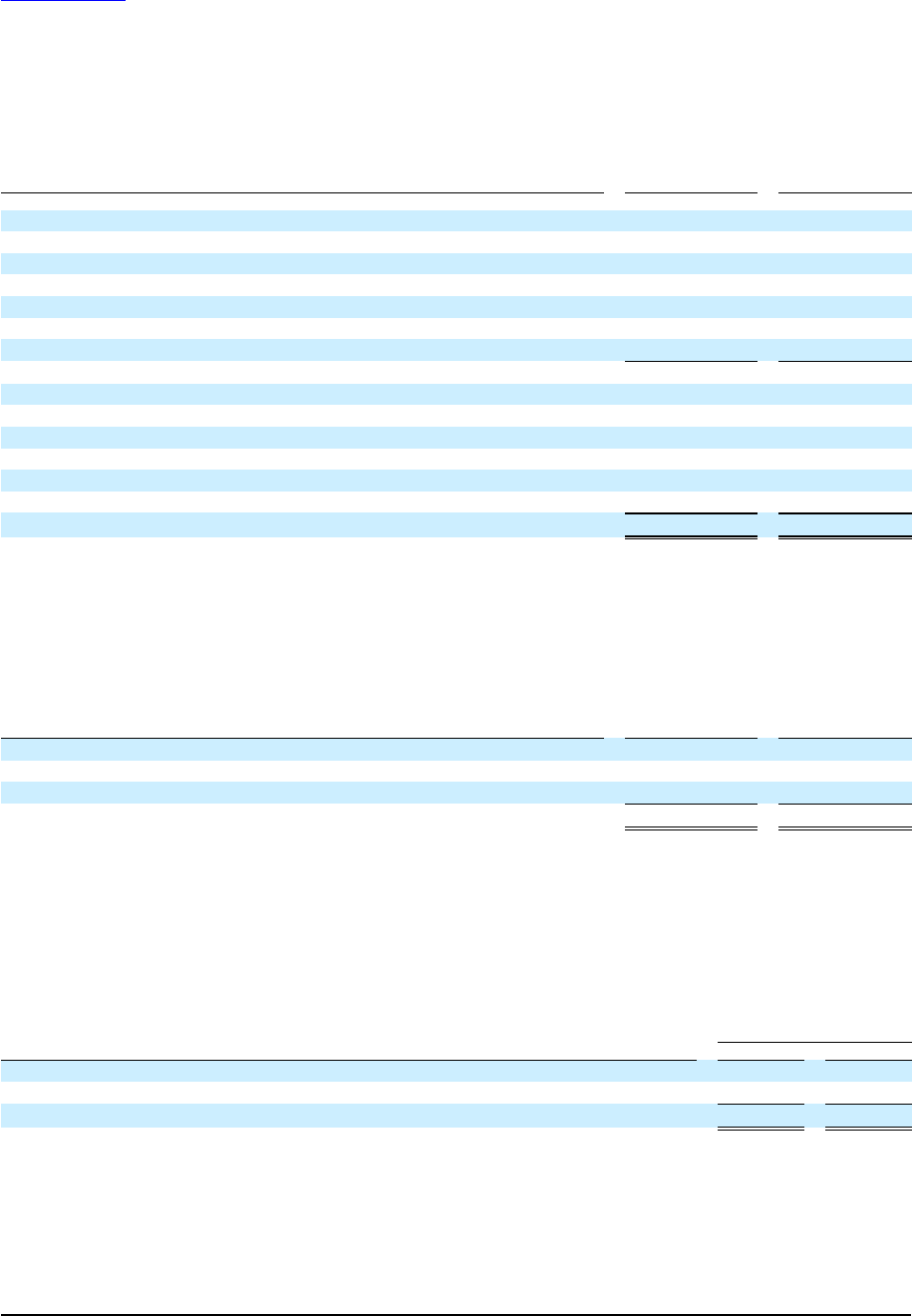

The following tables present the selected consolidated financial information for our company. The financial data as of

and for the years ended December 31, 2017, December 31, 2018, December 31, 2019 and December 31, 2020 have been derived

from our audited consolidated financial statements and the related notes, which are included for the years December 31, 2019 and

December 31, 2020 elsewhere in this Annual Report and which have been prepared in accordance with IFRS as issued by the

IASB. For fiscal years ended December 31, 2017 and 2018, refer to our previously filed annual reports on Form 20-F and 20 F/A.

The financial data presented below are not necessarily indicative of the financial results to be expected for any future

periods. The financial data below do not contain all the information included in our financial statements. You should read this

information in conjunction with Item 5. “Operating and Financial Review and Prospects,” and our consolidated financial

statements and related notes, each included elsewhere in this Annual Report.

Table of Contents

2

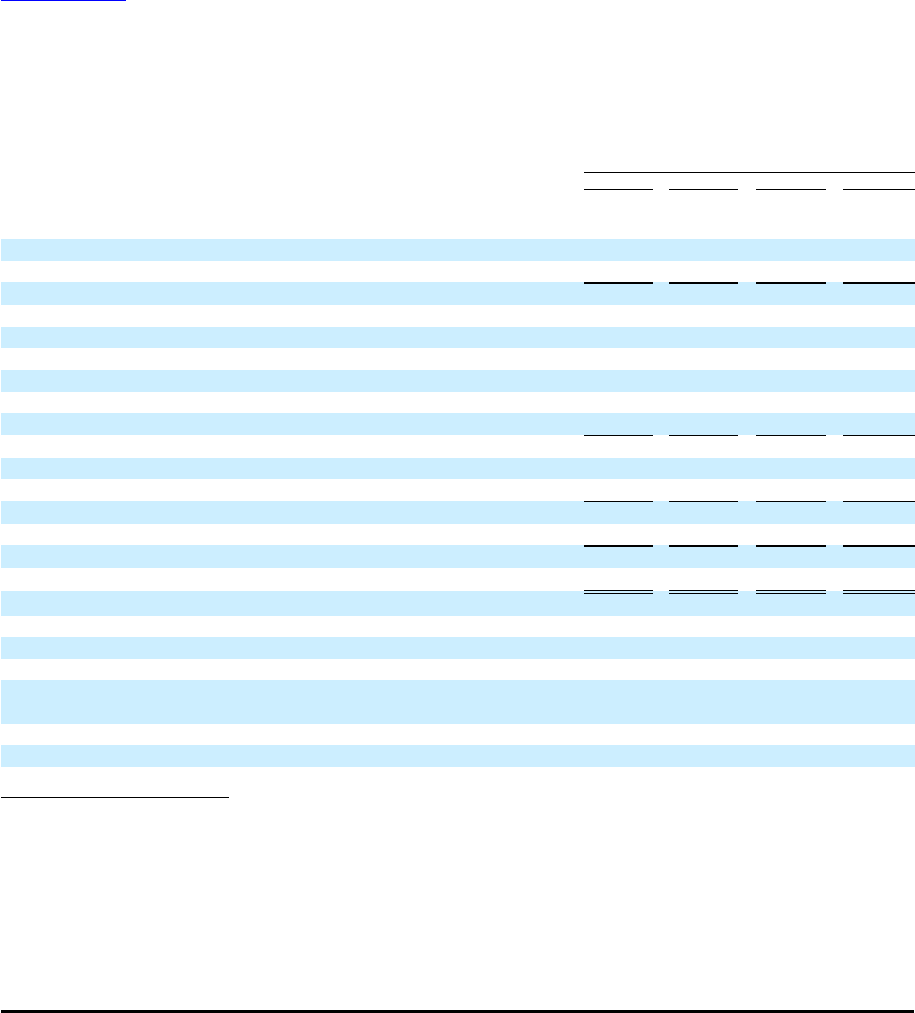

Consolidated Statement of Operations

For the year ended December 31,

2017 2018 2019 2020

EUR EUR EUR EUR

(in millions, except for per share data)

Revenue 93.1 129.1 160.4 139.6

Cost of revenue (65.8) (84.8) (84.5) (46.8)

Gross profit

27.2 44.2 75.9 92.8

Fulfillment expense (34.4) (50.5) (77.4) (69.3)

Sales and advertising expense (36.9) (46.0) (56.0) (32.5)

Technology and content expense (20.6) (22.4) (27.3) (27.8)

General and administrative expense

(1)

(89.1) (94.9) (144.5) (115.7)

Other operating income 1.3 0.2 1.9 3.3

Other operating expense (2.2) (0.3) (0.5) (0.1)

Operating loss

(154.7) (169.7) (227.9) (149.2)

Finance income 2.3 1.6 4.0 4.9

Finance costs (1.5) (1.3) (2.6) (14.0)

Loss before income tax

(153.9) (169.5) (226.5) (158.3)

Income tax expense (11.5) (0.9) (0.6) (2.6)

Net Loss

(165.4) (170.4) (227.1) (161.0)

Net Loss attributable to equity holders of the Company (161.6) (170.1) (226.7) (160.9)

Net Loss per share

Basic and diluted (1.70) (1.79) (1.61) (1.00)

Shares used in loss per share computation

Basic and diluted 95.0 95.0 140.7 160.7

Loss per American Depositary Share ("ADS", each ADS representing two

ordinary shares)

Basic and diluted (3.40) (3.58) (3.22) (2.00)

ADSs used in loss per ADS computation

Basic and diluted 47.5 47.5 70.3 80.3

(1) Includes share-based compensation of €26.3 million in 2017, €17.4 million in 2018, €37.3 million in 2019 and €21.6 million

in 2020.

Table of Contents

3

Consolidated Statement of Financial Position Data

As of December 31,

2017 2018 2019 2020

EUR EUR EUR EUR

(in millions)

Non-current assets 5.0 6.6 19.1 18.5

Current assets 66.5 135.4 278.1 337.4

Total assets 71.5 142.0 297.2 355.9

Share capital 0.1 0.1 156.8 179.3

Share premium 629.8 845.8 1,018.3 1,205.3

Other reserves 50.9 66.1 104.1 108.6

Accumulated losses (677.7) (862.0) (1,096.1) (1,268.7)

Equity attributable to the equity holders of the Company 3.2 50.0 183.1 224.5

Total equity (12.6) 49.8 182.6 224.2

Non-current liabilities - 0.4 7.6 9.2

Current liabilities 84.1 91.8 107.1 122.6

Total liabilities 84.1 92.2 114.6 131.8

Total equity and liabilities 71.5 142.0 297.2 355.9

Consolidated Statement of Cash Flows

For the year ended December 31,

2017 2018 2019 2020

EUR EUR EUR EUR

(in millions)

Net cash flows used in operating activities (117.0) (139.0) (182.6) (98.5)

Net cash flows (used in) / from investing activities (2.6) (3.6) (67.7) 60.0

Net cash flows from financing activities 121.6 213.2 316.8 187.1

Net increase in cash and cash equivalents 2.0 70.6 66.5 148.7

Cash and cash equivalents at the beginning of the year 29.8 29.7 100.6 170.0

Cash and cash equivalents at the end of the year 29.7 100.6 170.0 304.9

Selected Other Data

(1)

For the year ended December 31,

2017 2018 2019 2020

(in millions)

Annual Active Consumers 2.7 4.0 6.1 6.8

Orders n/a 14.4 26.5 27.9

GMV

(2)

€ 507.1 € 828.2 € 1,097.6 € 836.5

TPV n/a 54.8 € 124.3 € 196.4

JumiaPay Transactions n/a 2.0 7.6 9.6

Adjusted EBITDA € (126.8)€ (150.2) € (182.7) € (119.5)

(1) See “Non-IFRS and Other Financial and Operating Metrics” below.

(2) For information on our GMV as adjusted for perimeter changes as a result of the portfolio optimization undertaken during

the fourth quarter of 2019 as further described under Item 4. “Information on the Company—A. History and Development of

the Company—Corporate History and Recent Transactions” as well as improper sales practices as further described under

Item 4. “Information on the Company—A. History and Development of the Company—Sales Practices Review”, see Item 5.

“Operating and Financial Review and Prospects—Operating Results—Comparison of Fiscal Years Ended December 31,

2018, December 31, 2019 and December 31, 2020—Consolidated Statement of Operations—Quarterly Data.”

Table of Contents

4

Non-IFRS and Other Financial and Operating Metrics

We have included in this Annual Report certain financial measures and metrics not based on IFRS, including Adjusted

EBITDA, Adjusted EBITDA Margin as well as operating metrics, including GMV, Annual Active Consumers, Orders, TPV and

JumiaPay Transactions.

Adjusted EBITDA

We define Adjusted EBITDA as loss for the year adjusted for income tax expense (benefit), finance income, finance

costs, depreciation and amortization and further adjusted by share-based payment expense.

Adjusted EBITDA is a supplemental non-IFRS measure of our operating performance that is not required by, or

presented in accordance with, IFRS. Adjusted EBITDA is not a measurement of our financial performance under IFRS and

should not be considered as an alternative to loss for the year, loss before income tax or any other performance measure derived

in accordance with IFRS. We caution investors that amounts presented in accordance with our definition of Adjusted EBITDA

may not be comparable to similar measures disclosed by other companies, because not all companies and analysts calculate

Adjusted EBITDA in the same manner. We present Adjusted EBITDA because we consider it to be an important supplemental

measure of our operating performance. Management believes that investors’ understanding of our performance is enhanced by

including non-IFRS financial measures as a reasonable basis for understanding our ongoing results of operations. By providing

this non-IFRS financial measure, together with a reconciliation to the nearest IFRS financial measure, we believe we are

enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how

well we are executing our strategic initiatives.

Management uses Adjusted EBITDA:

● as a measurement of operating performance because it assists us in comparing our operating performance on a

consistent basis, as it removes the impact of items not directly resulting from our core operations.

● for planning purposes, including the preparation of our internal annual operating budget and financial projections.

● to evaluate the performance and effectiveness of our strategic initiatives; and

● to evaluate our capacity to expand our business.

Items excluded from this non-IFRS measure are significant components in understanding and assessing financial

performance. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation, or as an

alternative to, or a substitute for analysis of our results reported in accordance with IFRS, including loss for the year. Some of the

limitations are:

● Adjusted EBITDA does not reflect our share-based payments, income tax expense (benefit) or the amounts necessary to

pay our taxes.

● although depreciation and amortization are eliminated in the calculation of Adjusted EBITDA, the assets being

depreciated and amortized will often have to be replaced in the future and such measures do not reflect any costs for

such replacements; and

● other companies may calculate Adjusted EBITDA differently than we do, limiting its usefulness as a comparative

measure.

Due to these limitations, Adjusted EBITDA should not be considered as a measure of discretionary cash available to us

to invest in the growth of our business. We compensate for these and other limitations by providing a reconciliation of Adjusted

EBITDA to the most directly comparable IFRS financial measure, loss for the year.

Table of Contents

5

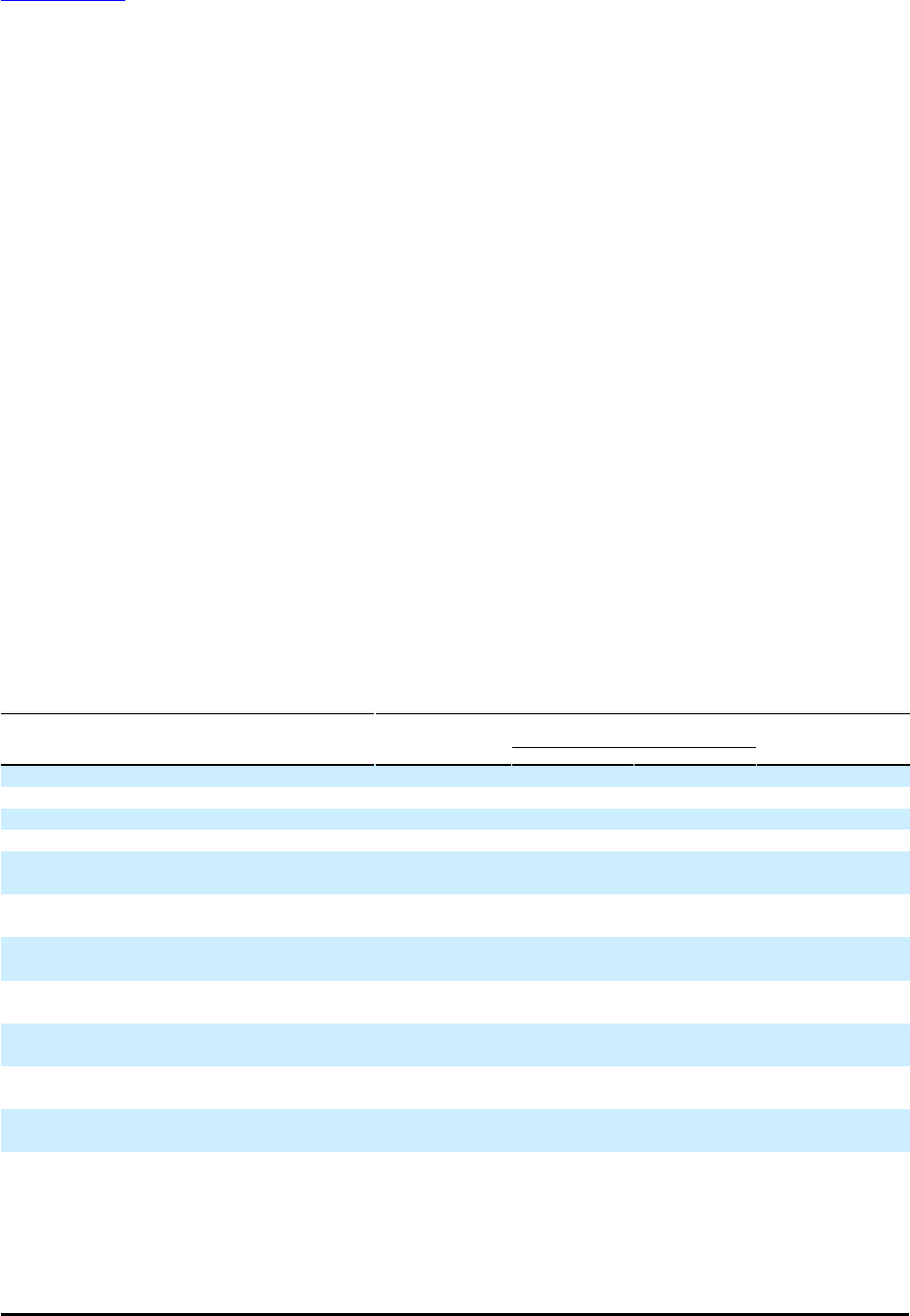

The following tables provide a reconciliation of loss for the year to Adjusted EBITDA for the periods indicated:

For the year ended December 31,

2017 2018 2019 2020

EUR EUR EUR EUR

(in millions)

Loss for the year (165.4) (170.4) (227.1) (161.0)

Income tax expense 11.5 0.9 0.6 2.6

Net Finance costs / (income) (0.8) (0.3) (1.4) 9.1

Depreciation and amortization 1.6 2.2 7.9 8.1

Share-based compensation 26.3 17.4 37.3 21.6

Adjusted EBITDA

(1)

(126.8) (150.2) (182.7) (119.5)

(1) Unaudited.

2017

(1)

First Quarter Second Quarter Third Quarter Fourth Quarter

EUR EUR EUR EUR

(unaudited, in millions)

Loss for the period (24.8) (30.1) (49.9) (60.6)

Income tax expense 0.0 0.3 0.2 10.9

Net Finance costs / (income) (0.2) 0.7 (0.1) (1.2)

Depreciation and amortization 0.5 0.4 0.5 0.3

Share-based compensation 0.4 (0.1) 20.7 5.2

Adjusted EBITDA

(1)

(24.1) (28.7) (28.6) (45.4)

(1) Due to rounding, the sum of quarterly amounts may not equal the amounts reported for the relevant full-year period.

2018

(1)

First Quarter Second Quarter Third Quarter Fourth Quarter

EUR EUR EUR EUR

(unaudited, in millions)

Loss for the period (34.1) (42.3) (40.9) (53.1)

Income tax expense 0.1 0.2 0.2 0.4

Net Finance costs / (income) (0.3) 0.1 0.1 (0.3)

Depreciation and amortization 0.5 0.5 0.6 0.6

Share-based compensation 3.6 5.8 4.3 3.7

Adjusted EBITDA

(1)

(30.2) (35.6) (35.8) (48.6)

(1) Due to rounding, the sum of quarterly amounts may not equal the amounts reported for the relevant full-year period.

2019

(1)

First Quarter Second Quarter Third Quarter Fourth Quarter

EUR EUR EUR EUR

(unaudited, in millions)

Loss for the period (45.8) (67.8) (49.9) (63.6)

Income tax expense / (benefit) 0.1 0.2 (0.2) 0.5

Net Finance costs / (income) 0.2 0.9 (4.3) 2.0

Depreciation and amortization 1.7 1.8 2.1 2.3

Share-based compensation 4.3 20.5 7.1 5.3

Adjusted EBITDA

(1)

(39.5) (44.4) (45.4) (53.4)

(1) Due to rounding, the sum of quarterly amounts may not equal the amounts reported for the relevant full-year period.

Table of Contents

6

2020

(1)

First Quarter Second Quarter Third Quarter Fourth Quarter

EUR EUR EUR EUR

(unaudited, in millions)

Loss for the period (42.3) (39.4) (32.4) (46.9)

Income tax expense 0.1 0.5 0.8 1.2

Net Finance costs / (income) (1.6) 1.3 3.6 5.7

Finance costs —

Depreciation and amortization 2.1 2.1 1.9 2.0

Share-based compensation 6.0 2.6 3.4 9.6

Adjusted EBITDA

(1)

(35.6) (32.9) (22.7) (28.3)

(1) Due to rounding, the sum of quarterly amounts may not equal the amounts reported for the relevant full-year period.

Annual Active Consumers

“Annual Active Consumers” means unique consumers who placed an order for a product or a service on our platform,

within the 12-month period preceding the relevant date, irrespective of cancellations or returns.

We believe that Annual Active Consumers is a useful indicator for adoption of our offering by consumers in our

markets.

Orders

“Orders” corresponds to the total number of orders for products and services on our platform, irrespective of

cancellations or returns, for the relevant period.

We believe that the number of orders is a useful indicator to measure the total usage of our platform, irrespective of the

monetary value of the individual transactions.

GMV

“Gross Merchandise Value” (“GMV”) corresponds to the total value of orders for products and services, including

shipping fees, value added tax, and before deductions of any discounts or vouchers, irrespective of cancellations or returns for the

relevant period.

We believe that GMV is a useful indicator for the usage of our platform that is not influenced by shifts in our sales

between first-party and third-party sales or the method of payment.

We use Annual Active Consumers, Orders and GMV as some of many indicators to monitor usage of our platform.

Total Payment Volume

“Total Payment Volume” (“TPV”) corresponds to the total value of orders for products and services for which JumiaPay

was used including shipping fees, value-added tax, and before deductions of any discounts or vouchers, irrespective of

cancellations or returns, for the relevant period.

We believe that TPV, which corresponds to the share of GMV for which JumiaPay was used, provides a useful indicator

of the development, and adoption by consumers, of the payment services offerings we make available, directly and indirectly,

through JumiaPay.

Table of Contents

7

JumiaPay Transactions

“JumiaPay Transactions” corresponds to the total number of orders for products and services on our marketplace for

which JumiaPay was used, irrespective of cancellations or returns, for the relevant period.

We believe that JumiaPay Transactions provides a useful indicator of the development, and adoption by consumers, of

the cashless payment services offerings we make available for orders on our platform irrespective of the monetary value of the

individual transactions.

We use TPV and the number of JumiaPay Transactions to measure the development of our payment services and the

progressive conversion of cash on delivery orders into prepaid orders.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

The following risks may have material adverse effects on our business, financial condition and results of operations.

Additional risks and uncertainties of which we are not presently aware or that we currently deem immaterial could also

materially affect our business operations and financial condition.

Summary Risk Factors

Our business is subject to numerous risks. We may be unable, for many reasons, including those that are beyond our

control, to implement our business strategy. In particular, risks associated with our business include, but are not limited to, the

following:

● we have incurred significant losses since inception and there is no guarantee that we will achieve or sustain

profitability in the future;

● we rely on external financing and may not be able to raise necessary additional capital on economically acceptable

terms or at all;

● our markets pose significant operational challenges that require us to expend substantial financial resources;

● we face risks related to health epidemics and other outbreaks such as COVID-19, which could significantly disrupt

our supply chain and our operations, and could negatively affect our development;

● many of our countries of operation are, or have been, characterized by political instability or changes in regulatory

or other government policies;

● our business may be materially and adversely affected by an economic slowdown in any region of Africa;

● currency volatility and inflation may materially adversely affect our business;

● uncertainties with respect to the legal system in certain African markets could adversely affect us;

Table of Contents

8

● our business may be materially and adversely affected by violent crime or terrorism in any region of Africa;

● growth of our business depends on an increase in internet penetration in Africa and other external factors, some of

which are beyond our control;

● we face competition, which may intensify;

● we may be unable to adapt to changes in our industry or successfully launch and monetize new and innovative

technologies, as a result of which our growth and profitability could be adversely affected;

● we may not be able to maintain our existing partnerships, strategic alliances or other business relationships or enter

into new ones. We may have limited control over such relationships, and these relationships may not provide the

anticipated benefits;

● we may fail to maintain or grow the size of our consumer base or the level of engagement of our consumers;

● sellers set their own prices and decide which goods they make available on our marketplace, which could affect our

ability to respond to consumer preferences and trends;

● we use third-party carriers as part of our fulfillment process, giving us limited control over the fulfillment process

and exposing us to challenges should we need to replace carriers;

● we may experience malfunctions or disruptions of our technology systems;

● we may experience security breaches and disruptions due to hacking, viruses, fraud, malicious attacks and other

circumstances;

● we conduct a substantial amount of our business in foreign currencies, which heightens our exposure to the risk of

exchange rate fluctuations.

Risks Related to Our Business, Operations and Financial Position

Detailed Risks Associated with our Business, Operations and Financial Position

We have incurred significant losses since inception and there is no guarantee that we will achieve or sustain

profitability in the future.

Jumia operates a pan-African e-commerce platform. Our platform primarily consists of our marketplace, which connects

businesses with consumers, our logistics service, which enables the shipping and delivery of packages, and our payment service,

JumiaPay, which, together with its network of licensed payment service providers and other partners, facilitates transactions

among participants active on our platform. We primarily generate revenue from commissions, where third-party sellers pay us

fees based on the goods and services they sell, and from the sale of goods where we act directly as seller. Our revenue is,

however, not sufficient to cover our operating expenses. Accordingly, since we were founded in 2012, we have not been

profitable on a consolidated basis. We incurred a loss for the year of €170.4 million in 2018, a loss for the year of €227.1 million

in 2019 and a loss for the year of €161.0 million in 2020. As of December 31, 2020, we had accumulated losses of €1.3 billion.

There is no guarantee that we will generate sufficient revenue in the future to offset the cost of maintaining our platform

and maintaining and growing our business. Furthermore, even if we achieve profitability in certain of our more mature markets,

where e-commerce is growing rapidly, there is no guarantee that we will be able to break even and achieve profitability in other

markets, where e-commerce adoption is slower. We expect that our operating expenses will

Table of Contents

9

continue to increase as we intend to expend substantial financial and other resources on acquiring and retaining sellers and

consumers, growing and maintaining our technology infrastructure and sales and marketing efforts and conducting general

administrative tasks associated with our business, including expenses related to being a public company. These investments may

not result in increased revenue growth. If we cannot successfully generate revenue at a rate that exceeds the costs associated with

our business, we will not be able to achieve or sustain profitability or generate positive cash flow on a sustained basis and our

revenue growth rate may decline.

If we fail to become and remain profitable, this could have a material adverse effect on our business, financial condition,

results of operations and prospects.

We rely on external financing and may not be able to raise necessary additional capital on economically acceptable

terms or at all.

Since our inception, we have had negative operating cash flows and have relied on external financing. While we

received net proceeds of $280.2 million from our April 2019 initial public offering, a concurrent private placement with

Mastercard Europe SA (“Mastercard”) and the issuance of shares to existing shareholders to protect them from dilution, and net

proceeds of $231.4 million from our December 2020 equity offering, we will require additional capital to finance our operations

and/or growth of our platform in the future. If we are not able to raise the required capital on economically acceptable terms, or at

all, or if we fail to project and anticipate our capital needs, we may be forced to limit or scale back our operations, which may

adversely affect our growth, business and market share and could ultimately lead to insolvency.

If we choose to raise capital by issuing new shares, our ability to place such shares at attractive prices, or at all, depends

on the condition of equity capital markets in general, the performance of our business and the price of our ADSs in particular, and

the price of our ADSs may be subject to considerable fluctuation.

Currently, debt financing from independent third parties is unlikely to be available to us due to our loss making history,

negative operating cash flows and lack of significant physical assets and collateral. If debt financing were available, such

financing may require us to post collateral in favor of the relevant lenders or impose other restrictions on our business and

financial position. Such restrictions may adversely affect our operations and ability to grow our business as intended. A breach of

the relevant covenants or other contractual obligations contained in any of our current or future external financing agreements

may trigger immediate prepayment obligations or may allow the relevant lenders to seize collateral posted by us, all of which

may adversely affect our business. In addition, if we raise capital through debt financing on unfavorable terms, this could

adversely affect our operational flexibility and profitability.

An inability to obtain capital on economically acceptable terms, or at all, could have a material adverse effect on our

business, financial condition, results of operations and prospects.

Our markets pose significant operational challenges that require us to expend substantial financial resources.

We operate in emerging markets in Africa. While we believe that our markets offer opportunities for an e-commerce

company, they are also characterized by fragmented and largely underdeveloped logistics, delivery, and digital payment

landscapes, which can differ significantly in the consumer markets in which we operate. This underdeveloped infrastructure

restricts and complicates the movement of people and goods, which may make our delivery service too expensive or our delivery

times too long to effectively compete with offline stores, in particular outside of main urban centers. Underdeveloped

infrastructure may also limit our growth prospects by obstructing access to potential consumers. Lack of an established, secure

and convenient cashless payment system in many markets also poses significant challenges for sellers. From our experience, we

believe that a large percentage of our consumers either do not have a bank account or do not trust online payments, which is why

cash on delivery is still a payment method used by many of our consumers.

In order to overcome the challenges posed by our markets, we have had to develop significant logistics, delivery and

payment infrastructures, which include, for example, the operation of warehouses and drop-off centers, the

Table of Contents

10

integration of third-party logistics providers, the establishment of our own delivery and last-mile delivery fleet in certain cities,

the design of our independent technology platform and the provision of unconventional payment options. These factors make our

operations more complex than those of similar businesses in more developed markets and may place a higher risk on us, for

example, due to a higher number of failed orders, the risk of fraud or otherwise. The costs incurred by us to meet these challenges

have, and may continue to, put a strain on our financial resources, may be unjustified in light of the benefits they bring us and

may make it challenging for us to reach profitability. In particular, there is no guarantee that the markets in which we currently

operate will prove to be as attractive as we currently believe them to be, which could have a material adverse effect on our

business, financial condition, results of operations and prospects.

We face risks related to health epidemics and other outbreaks such as COVID-19, which could significantly disrupt

our supply chain, disrupt our operations and negatively affect our development.

Our business could be adversely impacted by epidemics or pandemics, such as COVID-19. The COVID-19 pandemic

has significantly negatively impacted our business in many ways:

● As part of our cross-border business, we facilitate orders into Africa from international sellers. The COVID-19

pandemic has disrupted, and may continue to disrupt, the operations of these international sellers. For example, some of

these sellers have been forced to temporarily halt production, close their offices or suspend their services.

● Many of our local sellers depend on imported products. The reactions to the COVID-19 pandemic have posed

challenges for our sellers to source products and raw materials.

● Certain of our sellers and restaurant venders on our platform have been forced to reduce their hours of operations or

shut down for periods of time and some have gone out of business, and this may continue, which may negatively impact

our results.

● The COVID-19 pandemic has negatively impacted consumer sentiment in many of our countries of operation, which

has led to a reduction in discretionary spending. While we may benefit from a shift from offline to online trade, there

can be no assurance that the effects of this shift will outweigh the negative impact caused by a change in consumer

sentiment.

● Any fears among consumers that COVID-19 could be transmitted through goods shipped by us, reduced consumer

spending on discretionary items or the economic consequences of administrative measures to limit the spreading of

COVID-19 may significantly negatively affect our sales.

● We may incur increased operating costs as we adapt to new demands of operating during the term of the pandemic and

we may experience disruptions to our operations including to implement enhanced employee safety procedures.

● In South Africa, our fulfilment center was shut down due to very strict lockdown restrictions during April 2020. These

restrictions were eased from May 2020 onwards and e-commerce businesses have been allowed to operate since then.

Any further forced or voluntary shut downs of business operations, or other intervention in our business by police and

government authorities, in any of the geographies in which we have operations may negatively affect our ability to do

business, operate our fulfilment centers, serve our customers and fulfill our administrative tasks.

As a result, the effects of the COVID-19 pandemic have adversely affected, and may continue to adversely affect our

business, financial condition, results of operations and prospects. We may be required, or may decide, to reduce our expenses,

including through a review of our size of operations and of the remuneration of our work force. Any decision to reduce expenses

may negatively impact our operations and reputation. Further, COVID-19 may lead to unrest, instability and crisis in our

countries of operation, which may further impact negatively our business. COVID-19 may also negatively affect our ability to

raise additional capital, as our business results may be negatively affected and as

Table of Contents

11

markets and investors may not be willing to invest in companies such as us. Protracted negative effects on investor confidence

may require us to significantly cut our spending, which may lead to a decline in our usage indicators and revenue.

Many of our countries of operation are, or have been, characterized by political instability or changes in regulatory

or other government policies.

Frequent and intense periods of political instability make it difficult to predict future trends in governmental policies.

For example, in periods of intense political turmoil, governments in certain of our markets have restricted access to the internet.

Most recently, this occurred in Uganda in advance of the presidential election in January 2021. Any similar shut-down in the

future will negatively affect our business and results of operations. In addition, if government or regulatory policies in a market in

which we operate were to change or become less business-friendly, our business could be adversely affected.

Governments in Africa frequently intervene in the economies of their respective countries and occasionally make

significant changes in policy and regulations. Governmental actions have often involved, among other measures, nationalizations

and expropriations, price controls, currency devaluations, mandatory increases on wages and employee benefits, capital controls

and limits on imports. Our business, financial condition and results of operations may be adversely affected by changes in

government policies or regulations, including such factors as exchange rates and exchange control policies, inflation control

policies, price control policies, consumer protection policies, import duties and restrictions, liquidity of domestic capital and

lending markets, electricity rationing, tax policies, including tax increases and retroactive tax claims, and other political,

diplomatic, social and economic developments in or affecting the countries where we operate. For example, the Central Bank of

Nigeria requires foreign investors to obtain a certificate of capital importation (“CCI”) to be able to repatriate imported funds and

related proceeds via the Nigerian foreign exchange market. Jumia has transferred about €125 million into Nigeria as of December

31, 2019. While Jumia has obtained valid CCIs for approximately €95.2 million, Jumia currently does not hold CCIs for the

remaining amount. Jumia currently does not anticipate any need to repatriate funds from Nigeria in the medium term. In the

meantime, Jumia has started working with the Nigerian authorities to obtain the additional CCIs that would allow Jumia to

repatriate these funds and related proceeds. As of January 31, 2021, Jumia was awaiting feedback for €0.6 million requested in

2020. However, there can be no assurance that Jumia will be successful in obtaining these certificates. Any failure to obtain the

required certificates could impact Jumia’s ability to repatriate these funds and related proceeds or the exchange rate at which a

repatriation could be effected.

In the future, the level of intervention by African governments may continue to increase. The COVID-19 pandemic may

serve as a catalyst for increasing government intervention. These or other measures could have a material adverse effect on the

economy of the countries in which we operate and, consequently, could have a material adverse effect on our business, financial

condition, results of operations and prospects.

Our business may be materially and adversely affected by an economic slowdown in any region of Africa.

The success of our business depends on consumer spending. While we believe that economic conditions in Africa will

improve, poverty in Africa will decline and the purchasing power of African consumers will increase in the long term, there can

be no assurance that these expected developments will actually materialize. In addition, the COVID-19 pandemic could further

negatively impact levels of economic activity and depress consumer demand. The development of African economies, markets

and levels of consumer spending are influenced by many factors beyond our control, including consumer perception of current

and future economic conditions, political uncertainty, employment levels, inflation or deflation, real disposable income, poverty

rates, wealth distribution, interest rates, taxation, currency exchange rates, weather conditions and the COVID-19 pandemic. As

our operations in Nigeria and Egypt generate a larger portion of our orders and revenue than any other country in which we

currently operate, adverse economic developments in Nigeria or Egypt could have a greater impact on our results than a similar

downturn in other countries.

Furthermore, in some of the countries in which we operate, local banks have faced liquidity and funding issues and may

face such issues in the future, which could lead to bank failures or systemic collapse potentially resulting in an economic

slowdown in the particular region.

Table of Contents

12

An economic downturn, whether actual or perceived, currency volatility, a decrease in economic growth rates or an

otherwise uncertain economic outlook in Nigeria, Egypt or any region of Africa could have a material adverse effect on our

business, financial condition, results of operations and prospects.

Currency volatility and inflation may materially adversely affect our business.

Third-party sellers and consumers transact on our marketplace in local currency. The economies of a number of the

African countries in which we operate are affected by high currency exchange rate volatility due to, among other things, inflation,

selective tariff barriers, raw material prices, current account balances and widespread corruption and political uncertainty.

Currency volatility and high inflation in any of the countries in which we operate could increase the cost of goods to our third-

party sellers while decreasing the purchasing power of our consumers. If sellers are unable to pass along price increases to

consumers, we could lose sellers from our marketplace. Similarly, if consumers are unwilling to pay higher prices, we could lose

consumers.

The occurrence of any of these risks could have a material adverse effect on our business, financial condition, results of

operations and prospects.

Uncertainties with respect to the legal system in certain African markets could adversely affect us.

Legal systems in Africa vary significantly from jurisdiction to jurisdiction. Many countries in Africa have not yet

developed a fully integrated legal system, and recently-enacted laws and regulations may not sufficiently cover all aspects of

economic activities in such markets. In particular, the interpretation and enforcement of these laws and regulations involve

uncertainties. Since local administrative and court authorities have significant discretion in interpreting and implementing

statutory provisions and contractual terms, it may be difficult to predict the outcome of administrative and court proceedings and

our level of legal protection in many of our markets. Moreover, local courts may have broad discretion to reject enforcement of

foreign awards. These uncertainties may affect our ability to enforce our contractual rights or other claims. Uncertainty regarding

inconsistent regulatory and legal systems may also embolden plaintiffs to exploit such uncertainties through unmerited or

frivolous legal actions or threats in attempts to extract payments or benefits from us.

Many African legal systems are based in part on government policies and internal rules, some of which are not

published on a timely basis, or at all, and may have retroactive effect. There are other circumstances where key regulatory

definitions are unclear, imprecise or missing, or where interpretations that are adopted by regulators are inconsistent with

interpretations adopted by a court in analogous cases. As a result, we may not be aware of our violation of certain policies and

rules until after the violation. In addition, any administrative and court proceedings in Africa may be protracted, resulting in

substantial costs and the diversion of resources and management attention.

It is possible that a number of laws and regulations may be adopted or construed to apply to us in Africa and elsewhere

that could restrict our business. Scrutiny and regulation of the industries in which we operate may further increase, and we may

be required to devote additional legal and other resources to addressing such regulation. Changes in current laws or regulations or

the imposition of new laws and regulations in our markets or elsewhere regarding e-commerce may slow our growth and could

have a material adverse effect on our business, financial position, results of operations and prospects.

Our business may be materially and adversely affected by violent crime or terrorism in any region of Africa.

Many of the markets in which we operate suffer from a high incidence in violent crime and terrorism, which may harm

our business. Violent crime has the potential to interfere with our delivery and fulfillment operations, in particular, given the fact

that a high proportion of transactions on our marketplace are settled in cash. Our warehouses may also be targets of criminal acts.

For example, in late 2018, we experienced an isolated incident in which our warehouse in Kenya was robbed, and merchandise

with a value of approximately €500,000 was stolen. Violent crimes may increase as a result of the ongoing COVID-19 pandemic.

Table of Contents

13

Further, the terrorist attacks of Boko Haram have created considerable economic instability in northeastern Nigeria for

nearly a decade. Although it is difficult to quantify the economic effect of Boko Haram’s terrorist activities, countless markets,

shops, and schools have been temporarily or permanently closed over the years out of fear of coordinated attacks. In some of the

areas most devastated by terrorism, commercial banks have chosen to remain open for only three hours per day. Many Nigerians

have also chosen to migrate from the north to the south, or out of the country altogether. If Boko Haram’s terrorist activities were

to spread throughout Nigeria, the increasing violence could have material adverse effects on the Nigerian economy. A terrorist

attack in Nairobi in January 2019 by Somalia-based militant group al-Shabab drew increased attention to the risks of

destabilization in Kenya. An increase in violent crime or terrorism in any region of Africa may interfere with deliveries,

discourage economic activity, weaken consumer confidence, diminish consumer purchasing power or cause harm to our sellers

and consumers in other ways, any of which could have a material adverse effect on our business, financial position, results of

operations and prospects.

Growth of our business depends on an increase in internet penetration in Africa and other external factors, some of

which are beyond our control.

Our business model relies on an increase in internet penetration and digital literacy in Africa. Even though the main

urban centers of Africa typically offer reliable wired internet service, a substantial portion of the population are inhabitants of

rural areas, which largely depend on mobile networks. Internet penetration in the markets in which we operate may not reach the

levels seen in more developed countries for reasons that are beyond our control, including the lack of necessary network

infrastructure or delayed implementation of performance improvements or security measures. The internet infrastructure in the

markets in which we operate may not be able to support continued growth in the number of users, their frequency of use or their

bandwidth requirements. Delays in telecommunication and infrastructure development or other technology shortfalls may also

impede improvements in internet reliability. If telecommunications services are not sufficiently available to support the growth of

the internet, response times could be slower, which would reduce internet usage and harm our platform. Internet penetration may

decline if providers become insolvent or decide to exit a specific country. The price of personal computers, mobile devices and

internet access, particularly with respect to mobile data rates, may also limit the growth of internet penetration in the markets in

which we operate. Accordingly, there is no guarantee that internet penetration rates, and in particular, mobile internet penetration

rates, will continue to grow as we anticipate. Internet penetration in our target markets may even stagnate or decline. Digital

illiteracy among many consumers and vendors in Africa presents obstacles to e-commerce growth.

If internet penetration and digital literacy do not increase in our markets of operation, it could have a material adverse

effect on our business, financial condition, results of operations and prospects.

The continued growth of our business and e-commerce will depend on a number of other factors, some of which are

beyond our control, including, the trust and confidence level of e-commerce sellers and consumers, changes in demographics and

consumer tastes and preferences. Even if internet penetration rates increase, physical retail or face-to-face transactions may

remain the predominant form of commerce in our markets due to, among other factors, a lack of trust and confidence in e-

commerce offerings. There is no guarantee that consumers will adapt to the use of the internet for consumer transactions on the

scale we anticipate.

A failure of e-commerce to continue to grow as we anticipate in the markets in which we operate could have a material

adverse effect on our business, financial condition, results of operations and prospects.

We face competition, which may intensify.

As the e-commerce business model is relatively new in the markets in which we operate, competition for market share

may intensify significantly. Current competitors, such as Souq.com (a company affiliated with Amazon) and noon in Egypt,

Konga in Nigeria or Takealot and Superbalist, which are both part of the Naspers group, in South Africa, may seek to intensify

their investments in those markets and also expand their businesses in new markets. We also face competition for on-demand

services from companies such as Glovo and UberEast, while in digital services we face competition from companies such as

OPay and PalmPay. Some of our competitors currently copy our marketing campaigns, and such competitors may undertake

more far reaching marketing events or adopt more aggressive pricing policies, all of which could adversely impact our

competitive position. We also compete with a large and fragmented

Table of Contents

14

group of offline retailers, such as traditional brick-and-mortar retailers and market traders, in each of the markets in which we

operate. In addition, new competitors may emerge, or global e-commerce companies, such as Amazon, Asos or Alibaba, which

already offer shipping services to certain African countries for a selection of products, may expand across our markets, and such

competitors may have greater access to financial, technological and marketing resources than we do. We also face competition

from transactions taking place through other platforms, including via social media sites such as Instagram or Facebook.

Competitive pressure from current or future competitors or our failure to quickly and effectively adapt to a changing

competitive landscape could adversely affect demand for the goods available on our marketplace and could thereby adversely

affect our growth. Given the early stage of the e-commerce industry in the markets in which we operate, the share of goods sold

and purchased via e-commerce may be small and loyalty of sellers and consumers may therefore be low. Current or future

competitors may offer lower commissions to sellers than we do, and we may be forced to lower commissions in order to maintain

our market share.

With respect to JumiaPay, we face competition from financial institutions with payment processing offerings, credit,

debit and prepaid card service providers, other offline payment options and other electronic payment system operators, in each of

the markets in which we operate. We expect competition to intensify in the future as existing and new competitors may introduce

new services or enhance existing services. New entrants tied to established brands may engender greater user confidence in the

safety and efficacy of their services.

If we fail to compete effectively, we may lose existing sellers or consumers and fail to attract new sellers or consumers,

which could have a material adverse effect on our business, financial condition, results of operations and prospects.

If we are unable to adapt to changes in our industry or successfully launch and monetize new and innovative

technologies, our growth and profitability could be adversely affected.

The internet and e-commerce industry is characterized by rapidly changing technology, evolving industry standards,

new product and service introductions and changing consumer demand. Despite our investment of significant resources in

developing our infrastructure, such as our logistics service, changes and developments in our industry may require us to re-

evaluate our business model and significantly modify our long-term strategies and business plan.

We constantly seek to develop new and innovative technologies, such as our payment service, JumiaPay. Our ability to

monetize these technologies and other new business lines in a timely manner and operate them profitably depends on a number of

factors, many of which are beyond our control, including:

● our ability to manage the financial and operational aspects of developing and launching new technologies, including

making appropriate investments in our software systems, information technologies and operational infrastructure;

● our ability to secure required governmental permits and approvals and implement appropriate compliance procedures;

● the level of commitment and interest from our current and potential third-party innovators;

● our competitors developing and implementing similar or better technology;

● our ability to effectively manage any third-party challenges to the intellectual property behind our technology;

● our ability to collect, combine and leverage data about our consumers collected online and through our new technology

in compliance with data protection laws; and

Table of Contents

15

● general economic and business conditions affecting consumer confidence and spending and the overall strength of our

business.

We may not be able to grow our new technologies or operate them profitably, and these new and innovative technology

initiatives may never generate material revenue. In addition, our technology development requires substantial management time

and resources, which may result in disruptions to our existing business operations and adversely affect our financial condition,

which may decrease our profitability and growth.

We may not be able to maintain our existing partnerships, strategic alliances or other business relationships or

enter into new ones. We may have limited control over such relationships, and these relationships may not provide

the anticipated benefits.

We partner with numerous third parties. For example, more than 100 logistics providers are integrated into our logistics

service and help us and our sellers deliver goods to consumers. Additionally, we may enter into new strategic relationships in the

future. Such relationships involve risks, including but not limited to: maintaining good working relationships with the other party,

any economic or business interests of the other party that are inconsistent with ours, the other party’s failure to fund its share of

capital for operations or to fulfill its other commitments, including providing accurate and timely accounting and financial

information to us, which could negatively impact our operating results, loss of key personnel, actions taken by our strategic

partners that may not be compliant with applicable rules, regulations and laws, reputational concerns regarding our partners or

our leadership that may be imputed to us, bankruptcy, requiring us to assume all risks and capital requirements related to the

relationship, and the related bankruptcy proceedings could have an adverse impact on the relationship, and any actions arising out

of the relationship that may result in reputational harm or legal exposure to us. Further, these relationships may not deliver the

benefits that were originally anticipated.

Any of these factors may have a material adverse effect on our business, financial condition, results of operations and

prospects.

We may fail to maintain or grow the size of our consumer base or the level of engagement of our consumers.

The size and engagement level of our consumer base are critical to our success. Our business and financial performance

have been and will continue to be significantly determined by our success in adding, retaining, and engaging Annual Active

Consumers. We continue to invest significant resources to grow our consumer base and increase participant engagement, whether

through innovation, providing new or improved goods or services, marketing efforts or other means. While our consumer base

has expanded significantly, we cannot assure you that our consumer base and engagement levels will continue growing at

satisfactory rates, or at all. Our consumer growth and engagement could be adversely affected if, among other things:

● we are unable to maintain the quality of our existing goods and services;

● we are unsuccessful in innovating or introducing new goods and services;

● we fail to adapt to changes in participant preferences, market trends or advancements in technology;

● technical or other problems prevent us from delivering our goods or services in a timely and reliable manner or

otherwise affect the participant experience;

● there are participant concerns related to privacy, safety, security or reputational factors;

● there are adverse changes to our platform that are mandated by, or that we elect to make in response to, legislation,

regulation, or litigation, including settlements or consent decrees;

● we fail to maintain the brand image of our platform or our reputation is damaged; or

Table of Contents

16

● there are unexpected changes to the demographic trends or economic development of the markets in which we operate.

Our efforts to avoid or address any of these events could require us to make substantial expenditures to modify or adapt

our services or platform. If we fail to retain or grow our participant base, or if our users reduce their engagement with our

platform, our business, financial condition, results of operations and prospects could be materially and adversely affected.

Sellers set their own prices and decide which goods they make available on our marketplace, which could affect

our ability to respond to consumer preferences and trends.

We do not control the portfolio or pricing strategies of our sellers, which could affect our ability to effectively compete

on the breadth of our product assortment or on price with the other distribution channels. Our sellers may be unaware of

consumer preferences and trends and fail to offer the products our consumers prefer. Additionally, our sellers may employ

different pricing strategies based on the geographical location of consumers, which could lead consumers to look for more

competitively priced products on other distribution channels. Our sellers may also engage in fictitious pricing, an advertising

tactic wherein sellers exaggerate the level of discounts provided on certain products by comparing the discount price to a prior-

reference price at which the product was never really offered for sale. Such tactics, if perpetrated by our sellers, may alienate

consumers from our marketplace and harm our reputation. Moreover, sellers that are prevented from engaging in fictitious pricing

on our marketplace may choose to list their goods on other channels instead of our marketplace, which could also result in a loss

of consumers.

If consumers are unable to purchase their preferred products at competitive prices on our marketplace, they may choose

to purchase products elsewhere, which could have a material adverse effect on our business, financial condition, results of

operations and prospects.

We depend on third-party carriers as part of our fulfillment process.

We depend on the services of third-party carriers for the delivery of a large number of goods to our warehouses and

subsequently to the distribution centers of third-party carriers and from there to our consumers. Even where goods do not enter

our warehouses, these goods are handled by third-party carriers who directly receive them from sellers.

Consequently, we have only limited control over the timing of deliveries and the security and quality of the goods while

they are being transported. Consumers may experience shipping delays due to inclement weather, natural disasters, employment

strikes or terrorism, and/or goods may be damaged or lost in transit. If goods are of a poor quality or damaged or lost in transit,

not delivered in a timely manner, or if we are not able to provide adequate consumer support, our consumers may become

dissatisfied and cease buying their goods through our marketplace.

It may be difficult to replace any of our current third-party carriers due to a lack of alternative offerings at comparable

prices and/or service quality in the relevant geographic area. Given the infrastructure deficiencies in the markets in which we

currently operate, experienced and highly qualified third-party carriers are in increasing demand and accordingly, have only

limited capacities. As a result, competition for delivery capacities may intensify even further. In addition, our carriers may

increase their prices, which would adversely affect our results. Furthermore, as we continue to grow, our existing carriers may be

unable to keep up with such growth, and we may have to contract additional carriers. There is no guarantee that their services and

prices will be satisfactory to us or our consumers. An inability to maintain and expand a network of high-quality third-party

carriers at attractive costs could have a material adverse effect on our business, financial condition, results of operations and

prospects.

We may experience malfunctions or disruptions of our technology systems.

We rely on a complex technology platform and technology systems to operate our websites and apps. While we analyze

our technology systems regularly, we may not be able to correctly assess their susceptibility to errors, hacking or viruses. For

example, certain software we use for our business is based on open source software, which may expose our business to systemic

problems if errors in the open source code are not detected in a timely manner.

Table of Contents

17

Our systems may experience service interruptions or degradation because of hardware and software defects or

malfunctions, computer denial-of-service and other cyberattacks, human error, earthquakes, hurricanes, floods, fires, natural

disasters, power losses, disruptions in telecommunications services, fraud, military or political conflicts, terrorist attacks,

computer viruses, or other events. Our systems are also subject to break-ins, sabotage and intentional acts of vandalism. Some of

our systems are not fully redundant, and our disaster recovery planning is not sufficient for all eventualities. In particular, as we

have not yet completed a full disaster recovery check, we may not be aware of any material weaknesses in our disaster recovery

systems. Any failure of or disruptions to our technology systems may lead to significant malfunctions and downtimes of our

websites and apps. If our algorithms suffer from programing failures or our technology systems experience disruptions, we may

be unable to deliver goods on time or misallocate goods, either of which could adversely affect our business. Furthermore, we do

not have an adequate business continuity infrastructure, and any failure of a key piece of infrastructure may lead to extended

outages and generally affect our business continuity. In addition, we may not adequately manage malfunctions. If we cannot fix

any malfunction ourselves, we may have to pay third parties to fix the malfunction or to license functioning software, which may

be costly.

We have experienced and will likely continue to experience system failures, denial-of-service attacks and other events

or conditions from time to time that interrupt the availability or reduce the speed or functionality of our websites and mobile

applications. Reliability is particularly critical for us because the full-time availability of our payment services is critical to our

goal of gaining widespread acceptance among consumers and sellers, in particular with respect to digital and mobile payments.

Frequent or persistent interruptions in our services could cause current or potential consumers to believe that our systems are

unreliable, leading them to switch to our competitors or to avoid our sites, which could irreparably harm our reputation and

brands. To the extent that any system failure or similar event results in damages to our consumers or their businesses, these

consumers could seek significant compensation from us for their losses and such claims, even if unsuccessful, would likely be

time consuming and costly to address.

In addition, we depend on certain third-party service providers to operate and maintain certain of our technology

systems, such as cloud services. If such service providers experience malfunctions or disruptions of their technology or increase

their prices, it could adversely affect our business. Furthermore, if we need to switch service providers, for example if certain

software is no longer fully compatible with our technology platform or no longer available in any country in which we currently

operate (e.g., due to sanctions), there is no guarantee that alternative service providers will be available to us or that we would

manage the transition successfully.

As we continue to grow our business, we may be required to further scale our technology platform and technology

systems, including by adding and migrating to new systems and proprietary software, replacing outdated hardware and increasing

the integration of our technology systems. Such changes may, however, be delayed or fail due to malfunctions or an inability to

integrate new software and functions with our existing technology platform, resulting in disruptions to our operations and

insufficient scale to support our future growth. In addition, as a provider of payments solutions, we are subject to increased