New Issue: Jubilee Place 4 B.V.

Primary Credit Analyst:

Sandra Fronteau, Paris +331.44.20.67.76; Sandra.F[email protected]

Secondary Contacts:

Florent Stiel, Paris + 33 14 420 6690; f[email protected]

Alastair Bigley, London + 44 20 7176 3245; Alastair[email protected]

Rory O'Faherty, Dublin +353 1 568 0619; rory[email protected]

Table Of Contents

Transaction Summary

The Credit Story

Environmental, Social, And Governance (ESG)

Originators

Operational Risk And Servicing

Collateral

Credit Analysis And Assumptions

Macroeconomic And Sector Outlook

Transaction Structure

Cash Flow Modeling And Analysis

Counterparty Risk

Sovereign Risk

WWW.SPGLOBAL.COM JUNE 23, 2022 1

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global

Ratings' permission. See Terms of Use/Disclaimer on the last page.

2857769

New Issue: Jubilee Place 4 B.V.

Ratings Detail

Ratings

Class Rating*

Class size

(mil. €)§

Credit enhancement

(%)† Interest

Step-up

margin Step-up date

Legal final

maturity

A loan AAA (sf) 302.3 14.93 3ME + 1.20% 3ME + 2.20% January 2027 July 2059

B-Dfrd AA- (sf) 21.2 8.93 3ME + 1.60% 3ME + 2.60% January 2027 July 2059

C-Dfrd A (sf) 9.7 6.18 3ME + 2.00% 3ME + 3.00% January 2027 July 2059

D-Dfrd BBB- (sf) 7.1 4.18 3ME + 2.50% 3ME + 3.50% January 2027 July 2059

E-Dfrd B- (sf) 8.8 1.68 3ME + 2.75% 3ME + 3.75% January 2027 July 2059

F-Dfrd CCC (sf) 4.4 0.43 3ME + 3.00% 3ME + 4.00% January 2027 July 2059

X-Dfrd NR 4.4 0.0 3ME + 6.50% N/A N/A July 2059

S1 NR N/A N/A S1 payment N/A N/A July 2059

S2 NR N/A N/A S2 payment N/A N/A July 2059

R NR N/A N/A N/A N/A N/A July 2059

*Our ratings address timely receipt of interest and ultimate repayment of principal on the class A loan, and the ultimate payment of interest (until

they become most senior when timely interest becomes due and payable) and principal on the rated notes. §As a percentage of 95% of the pool

for the class A to X-Dfrd debt. †This is the credit enhancement including the liquidity reserve fund, with any excess amount over the reserve

target being released to the principal priority of payment. 3ME--Three-month Euro Interbank Offered Rate. NR--Not rated. N/A--Not applicable.

Transaction Summary

• S&P Global Ratings has assigned credit ratings to Jubilee Place 4 B.V.'s class A loan and class B-Dfrd to X-Dfrd

interest deferrable notes. Jubilee Place 4 is a RMBS transaction that securitizes a portfolio of buy-to-let (BTL)

mortgage loans secured on properties located in the Netherlands. This is the fourth Jubilee Place transaction,

following Jubilee Place 2020-1, 2021-1, and 3, which were also rated by S&P Global Ratings.

• The loans in the pool were originated by DNL 1 B.V. (DNL; 20.9%; trading as Tulp), Dutch Mortgage Services B.V.

(DMS; 63.5%; trading as Nestr), and Community Hypotheken B.V. (Community; 15.7%; trading as Casarion).

• All three originators are new lenders in the Dutch BTL market, with a very limited track record. However, the key

characteristics and performance to date of their mortgage books are similar with peers. Moreover, Citibank N.A.,

London Branch, maintains significant oversight in operations, and due diligence is conducted by an external

company, Fortrum, which completes an underwriting audit of all the loans for each lender before a binding

mortgage offer can be issued.

• At closing, the issuer used the issuance proceeds to purchase the full beneficial interest in the mortgage loans from

the seller. The issuer granted security over all its assets in favor of the security trustee.

• Citibank retained an economic interest in the transaction in the form of a vertical risk retention (VRR) loan note

accounting for 5% of the pool balance at closing. The remaining 95% of the pool is funded through the proceeds of

the mortgage-backed rated notes and class A loan amount.

• We consider the collateral to be prime, based on the originators' prudent lending criteria, and the absence of loans

WWW.SPGLOBAL.COM JUNE 23, 2022 3

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

in arrears in the securitized pool.

• Credit enhancement for the rated debt consists of subordination from the closing date and the liquidity reserve fund,

with any excess amount over the target being released to the principal priority of payment.

• The class A loan benefits from liquidity support in the form of a liquidity reserve, and the class A loan and B-Dfrd

through F-Dfrd notes benefit from the ability of principal to be used to pay interest, provided that, in the case of the

class B-Dfrd to F-Dfrd notes, they are the most senior class outstanding.

• There are no rating constraints in the transaction under our counterparty, operational risk, or structured finance

sovereign risk criteria. We consider the issuer to be bankruptcy remote and the legal framework to be compliant

with our legal criteria.

Transaction Participants

Role Participant

Issuer Jubilee Place 4 B.V.

Shareholder Stichting Holding Jubilee Place 4

Seller Citibank, N.A., London Branch

Paying agent and agent bank Citibank, N.A., London Branch

Cash manager Citibank, N.A., London Branch

Arranger Citibank Europe PLC

Security trustee Stichting Security Trustee Jubilee Place 4

DNL servicer DNL 1 B.V.

DMS servicer Dutch Mortgage Services B.V.

Community servicer Community Hypotheken B.V.

DMS collection foundation Stichting Ontvangsten Dutch Mortgage Services

DNL collection foundation Stichting Ontvangsten DNL

Community collection foundation Stichting Community Hypotheken Ontvangsten

Back-up servicer facilitator Vistra Capital Markets (Netherlands) N.V.

Director of the security trustee Erevia B.V.

Director of the issuer Vistra Capital Markets (Netherlands) N.V.

Director of the shareholder Vistra Capital Markets (Netherlands) N.V.

Swap counterparty BNP Paribas S.A.

Issuer account bank Citibank Europe PLC

Collection foundation account provider ABN AMRO Bank N.V.

Original Class A lender and loan facility agent Citibank, N.A., London Branch

The Credit Story

WWW.SPGLOBAL.COM JUNE 23, 2022 4

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

The Credit Story

Strengths Concerns and mitigating factors

The underwriting criteria target prime, professional landlords

with no adverse credit history. Lending criteria were

tightened during the COVID-19 pandemic by reducing

leverage and maximum loan size. They returned to normal in

mid-2021. In 2022 the maximum original loan-to-value

(OLTV) ratio was increased to 85% from 80%. Citi maintains

significant oversight in operations and due diligence is

conducted by an external company, Fortrum, which

completes an underwriting audit of all the loans before a

binding mortgage offer can be issued.

Although we view the lending standards of all three originators positively, all three

are new lenders in the Dutch BTL market, with a very limited track record given

the low seasoning of the loans that have been originated to date. However, the

key characteristics of their mortgage books are aligned with peers in terms of

OLTV ratio distribution (most of the loans are in the 70%-80% bucket); DSCR

distribution; loan purpose distribution; geographic distribution; and concentration

on professional landlords. Overall performance has been good since the inception

of all three lenders, with limited arrears and no losses recorded. We received a

clean audit on the pool, performed by Deloitte. We have considered these factors

in our analysis through an appropriate originator adjustment, and we used proxy

data from comparable lenders in the Dutch market to supplement our analysis.

The weighted-average OLTV ratio of 74.1% is in line with

peers operating in the Dutch BTL market. The pool has a

relatively low current indexed LTV ratio of 74.0%, which

makes it more likely to incur lower loss severities if the

borrowers default.

Of the remortgage loans within the portfolio, a significant portion were

remortgaged or mortgaged for the first time to withdraw equity. They account for

47.3% of the pool. We consider loans for this purpose--rather than to purchase a

property--to be higher risk. This is reflected in our credit analysis.

Of the pool, 20.0% are remortgage loans from other lenders,

and all remortgages are subject to an underwriting audit. The

remortgage loans would not have been accepted by all three

originators if they had been in arrears in the past three years.

The transaction contains some loans advanced to limited liability companies

rather than directly to individuals. However, all of these loans benefit from

personal guarantees and a first-ranking charge on the security property.

All valuations are full external and internal inspections on

every property conducted selected from a certified valuer's

panel. For all three originators, a periodic sample verification

of valuations performed by these selected valuers is carried

out.

All the loans revert to a floating rate at the end of their fixed-rate periods. This is

somewhat unusual in the Dutch market, and the borrowers are at risk of payment

shock if interest rates rise. Most loans in the pool will switch to a floating rate in

2026 or 2027. We have considered this in our analysis.

The transaction does not allow for any further advances or

automatic product switches.

Some of the loans may switch from an amortized to an interest-only repayment

should the LTV ratio of the loan fall below 80%. The switch is not automatic and

depends on a valuation to be carried at the expense of the borrower. So far, the

originators registered a limited number of loans in which this provision was

applied. Given the strict conditions for the switch to be performed and the few

cases observed, we have not applied any stress in our cash flow analysis.

The performance of loans by all three originators has been

relatively robust during the COVID-19 pandemic. No losses

were incurred on the books of the originators since they

started lending and very few arrears were recorded. In the

pool to be securitized, no loan is on payment holiday and

there are no arrears.

The pool has a few exception mortgage loans, meaning that their characteristics

diverge from the underwriting criteria of the originators. They account for 4.8% of

the pool balance. We have been provided with the list of those exception

mortgage loans. In our view, the variations from underwriting criteria are minor.

Given the small share of the pool and the minor nature of variations, we have not

applied any stress to those loans.

Servicing is outsourced to BCMGlobal Netherlands B.V.

BCMGlobal is one of the largest mortgage service providers

in the Netherlands and has the requisite staffing and systems

in place to carry out its role as required under the transaction

documentation.

Credit enhancement for the junior notes is mostly provided through excess spread

rather than subordination. We have considered this in our cash flow analysis by

applying prepayment stresses to assess the impact of a reduction in excess

spread.

A liquidity reserve fund is available to meet interest shortfalls

on the class A loan. Any excess in the liquidity reserve over

the required amount will be released to the principal priority

of payments.

If the notes are not redeemed on the optional redemption date (January 2027), the

weighted-average cost of the notes will increase, reducing the excess spread

available, which we also considered in our cash flow analysis. We assume the

notes are not redeemed and we have incorporated this into our analysis of the

long-term transaction cash flows.

The transaction can also use principal receipts to pay for

interest shortfalls on the most senior class of debt.

Commingling risk might arise if the collection foundation account bank defaults.

However, a pledge contract applies to the three collection accounts for the benefit

of the security trustee. If the account bank defaults, the security trustee is entitled

to recover the collected amounts held on the collection accounts.

The capital structure is fully sequential regarding the

application of principal proceeds. Credit enhancement can

therefore build up over time for the rated debt, enabling the

capital structure to withstand performance shocks.

Our credit and cash flow analysis and related assumptions consider the

transaction's ability to withstand higher defaults, longer recovery timing, and

additional liquidity stresses. Considering these factors, we believe that the

available credit enhancement is commensurate with the ratings assigned.

WWW.SPGLOBAL.COM JUNE 23, 2022 5

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

The Credit Story (cont.)

Strengths Concerns and mitigating factors

An interest rate swap mechanism hedges the mismatch

between the fixed rate received from the mortgage loans and

three-month European Interbank Offered Rate (EURIBOR)

plus a margin paid under the debt. We have considered this

hedge in our cash flow analysis.

The transaction has no general reserve fund. Subordination provides credit

support for the rated debt. Liquidity support for the class A loan is provided by the

liquidity reserve fund, which is initially funded from principal receipts. Hence, for

the other rated debt where deferred interest payments are allowed, there is no

liquidity support available. However, a mitigant is that deferred interest is due at

maturity.

The seller is not a deposit-taking institution and--under the

underwriting criteria--no loan is granted to an employee of

the originators. In the case of construction loans (renovation

loans with a deposit generally not exceeding 20% of the

current balance), if the originator is insolvent and cannot

disburse the construction deposits to borrowers, as the

monies of deposits are held in the account of the collection

foundation and there is a pledge mechanism in place, the

cash will still be available to transfer the drawdown amount

to borrowers. Therefore, the transaction is not exposed to

setoff risk.

The weighted-average interest rate on the loans is 3.31%. Nevertheless, excess

spread is low, at 0.35% after having considered the weighted-average margin on

debt (1.40%), fees (0.22%), and the swap rate (1.35%). However, most loans are

fixed-to-floating rate loans. The post-reversion weighted-average interest rate is

3.99%, which partly mitigates the low excess spread.

Environmental, Social, And Governance (ESG)

Our analysis considers a transaction's potential exposure to ESG credit factors. For RMBS, we view the exposure to

environmental credit factors as average, social credit factors as above average, and governance credit factors as below

average (see "ESG Industry Report Card: Residential Mortgage-Backed Securities," published on March 31, 2021).

In our view, the exposure to social credit factors is in line with the sector benchmark. Social credit factors are generally

considered above average because housing is viewed as one of the most basic human needs. Conduct risk presents a

direct social exposure for lenders and servicers, particularly as regulators are increasingly focused on ensuring fair

treatment of borrowers. For RMBS, social risk is generally factored into our base-case assumptions.

The transaction's exposure to environmental credit factors is also in line with the sector benchmark. Physical climate

risks could severely damage properties and reduce their value, decreasing recoveries if borrowers default. We believe

that well-diversified portfolios reduce exposure to extreme weather events.

In 2021, all three originators started to grant mortgages that they define as "green". There are 34.4% "green" mortgages

in the securitized pool. "Green" mortgages are mortgages with a five basis points (bps) to 10 bps discount on the

interest rate if the property has an environmental label of A or B, and a 10 bps to 15 bps discount for a label of C or D

with evidence of an improvement of the label. The discount is applied from the origination of the loan or within six

months from origination if the property has a label of C or D and the borrower commits to renovate to improve the

label by at least one notch. In that case, the borrower must provide proof of the new label for the discount to be

applied. After the six-month period, if no proof has been presented, the discount will never be applied. We have not yet

seen enough evidence to draw any conclusions on whether the green home loans will exhibit fundamentally better or

worse credit performance than traditional mortgage loan collateral. As a result, we have not made any adjustments to

our foreclosure frequency or loss severity assumptions for the green home loans included in the securitized pool. We

have considered the lower yield resulting from discounted interest rates, when effective, in our cash flow analysis.

In our view, the exposure to governance credit factors is in line with the sector benchmark. There are very tight

WWW.SPGLOBAL.COM JUNE 23, 2022 6

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

restrictions on what activities the special-purpose entity (SPE) can undertake compared to other entities. Given that

this transaction securitizes a static pool with no reinvestment or prefunding features, the originator's role becomes less

active over the transaction's life, mitigating the risk of loosening underwriting standards or potential adverse selection.

Moreover, an additional audit on underwriting and post-completion loan files compared to data in the system of the

originators is performed by a third party, Fortrum, which we view as positive.

Originators

The pool comprises loans that were originated by three lenders specializing in the Dutch residential BTL sector: DNL,

DMS, and Community.

• DNL commenced lending in January 2020 and concentrates on the specialist BTL sector. DNL is part of the Tulp

Group, which placed its first public securitization in November 2019.

• DMS was founded in 2016 and focuses on origination and servicing of BTL mortgages. DMS entered the

non-consumer BTL space in November 2019, when it launched its Nestr Smart Finance brand.

• Community was set up in 2015 and in 2017 launched its own mortgage platform, closing a funding agreement with

Citi in December 2019. It also focuses on the specialist BTL sector.

Overall, we consider the control frameworks of the origination process to be appropriate for the three lenders, with

significant relevant experience at key stages of the process. In addition, the origination process is subject to regular

pre- and post-completion scrutiny (100% of all loans are subject to an underwriting audit by an external party,

Fortrum, at the pre-offer stage), checking, and oversight.

Key factors of the origination process include the following:

• In response to COVID-19, all three originators, for a time, tightened their lending criteria (e.g., the maximum LTV

ratio at origination was reduced to 75%). Then, lending criteria reverted back to what it was before the pandemic.

• In 2022, the lending criteria were slightly loosened. In particular, the maximum LTV ratio has been increased to

85% from 80%. We believe that the lending criteria are still prudent.

• There is limited tolerance to adverse credit. The lending criteria outline that no applicant with a negative credit

record in the last five years is accepted.

• The overall lending policy is owned by the company's credit committee, which meets frequently and is responsible

for considering changes to the policy. All three originators' policies are similar with oversight provided by Citi as

warehouse provider.

• All valuations are full external and internal inspections on every property selected from a certified valuer's panel.

For all three originators, a periodic sample verification of valuations performed by these selected valuers is carried

out.

• There are only a small number of criteria exemptions within the pool (4.8%). These exceptions required additional

levels of approval during origination. We have been provided with the list of those exception mortgage loans. In our

view, the variations from underwriting criteria are minor. Given the small share of the pool and the minor nature of

variations, we have not applied any stress to those loans.

WWW.SPGLOBAL.COM JUNE 23, 2022 7

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

• The interest coverage ratio (ICR) and debt-service coverage ratio (DSCR) are stressed at a five-year mortgage rate

or a higher rate for longer tenors.

• No self-certified loans are allowed.

• All the borrowers in the pool are confirmed to be a professional landlord either as an individual or as a company. As

part of the know your customer (KYC) process, each lender performs a check on the borrower to assess its

professionalism in the letting market.

Operational Risk And Servicing

DNL, DMS, and Community act as the servicers in this transaction. They sub-delegate the portfolio's day-to-day

servicing to BCMGlobal Netherlands B.V.

Our operational risk criteria focus on key transaction parties (KTPs) and the potential effect of a disruption in the KTPs'

services on the issuer's cash flows, as well as the ease with which the KTPs could be replaced if needed (see "Global

Framework For Assessing Operational Risk In Structured Finance Transactions," published on Oct. 9, 2014). For this

transaction, the delegate servicer, BCMGlobal Netherlands B.V., is the main KTP we have assessed under this

framework. BCMGlobal is one of the largest mortgage service providers in the Netherlands and has the requisite

staffing and systems in place to carry out its role as required under the transaction documentation. The three

originators are the actual contracted servicers, and they have also been considered in our analysis. We believe that the

underwriting, servicing, and risk management policies and procedures of all three originators are in line with market

standards and adequate to support the ratings assigned to the transaction. In addition, the origination process is

subject to regular pre- and post-completion scrutiny, checking, and oversight.

Based on our analysis, we believe that our operational risk criteria do not constrain the maximum potential rating on

the transaction's notes.

As a starting point for the rating analysis of RMBS transactions, we typically seek performance data (e.g., default,

delinquency, and recovery/loss severity) spanning a minimum of three years, ideally including a period of economic

stress that demonstrates performance that is consistent with our expectations of similar assets in the relevant asset

class. Since for this transaction the availability of data was less than three years, we used alternative analytical

considerations during our operational review (see "How Much Is Enough? Information Quality Standards For The

EMEA RMBS And ABS Rating Process," published Jan. 8, 2019). Following this analysis, we were satisfied that there

was no requirement for a cap on the ratings.

Collateral

Asset description

As of the April 30, 2022, pool cutoff date, the pool of €372.2 million comprised 1,112 first-lien BTL mortgage loans

(consisting of 1,352 loan parts) secured on Dutch properties. The pool is newly originated with low seasoning, all loans

having been originated between March 2021 and April 2022.

WWW.SPGLOBAL.COM JUNE 23, 2022 8

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

The originators grant loans to buy-to-let professional borrowers. The transaction contains some loans advanced to

limited liability companies rather than directly to individuals. However, all of these loans benefit from personal

guarantees and a first-ranking charge on the security property. No loans in the pool were granted to borrowers with

credit adversity (BKR record) within the past three years. No bankruptcy or secured loan defaults in the last 60 months

are accepted under any circumstance.

Of the pool, 31.7% comprises borrowers that have more than one property, and the borrower with the maximum

number of properties holds 44 properties. We consider this to be expected given the type of borrowers that all three

originators target.

Of the pool, the top five borrowers by current balance account for 5.6%, and each of the top two represent more than

1.0% of the total pool. Borrower concentration is in line with what we usually observe in other BTL transactions.

The properties are primarily concentrated in Zuid-Holland (24.4%) and Noord-Holland (25.2%). None of the

concentrations in each of the regions exceeds the threshold defined in our criteria, therefore we have not applied any

adjustment for concentration.

WWW.SPGLOBAL.COM JUNE 23, 2022 9

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Partially commercial-use properties represent around 4.2% of the pool. The lending criteria state that the residential

component must comprise at least 50% of the value. We have applied an adjustment multiple of 1.15 to the RMVD

(repossession market value decline) to calculate the WALS (weighted-average loss severity).

All the loans in the pool have an original LTV ratio below or equal to 85% (see chart 3), with the weighted-average

original LTV ratio being 74.1%. The maximum OLTV allowed as per the underwriting criteria of the three originators is

85%. The OLTV ratios in this pool are, on average, below our archetypal assumptions for the Netherlands.

Because of the collateral's marginal seasoning, the pool's weighted-average current LTV ratio of 74.0% is closely

WWW.SPGLOBAL.COM JUNE 23, 2022 10

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

aligned to the weighted-average original LTV ratio.

Chart 2

WWW.SPGLOBAL.COM JUNE 23, 2022 11

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Chart 3

Of the loans, 20.0% are remortgage loans and 47.3% are considered cash-out loans. All remortgages are subject to

complete an underwriting audit. The remortgage loans would not have been accepted by all three originators if they

had been in arrears in the past three years. For the cash-out loans, based on the information provided by the

originator, we assumed that the purpose was equity release in our analysis and applied an adjustment (see chart 2).

The pool also comprises 4.1% of construction loans for which we apply an adjustment of either 1.2 or 1.5 depending

on the size of their construction deposit. Those deposits are related to renovation rather than construction. They are

restricted to the lower of 20% of the purchase price or market value prior renovation, and €75,000.

WWW.SPGLOBAL.COM JUNE 23, 2022 12

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Chart 4

Of the portfolio, 30.3% comprises repayment mortgage loans, and 69.7% comprises interest-only loans (aggregated at

main loan level) with the vast majority having a maturity of more than 10 years. Given that interest-only loans are

standard mortgage products in the BTL market, we have not applied any additional adjustment.

WWW.SPGLOBAL.COM JUNE 23, 2022 13

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Chart 5

Of the pool, 100% of loans pay a fixed rate of interest, with periodic resets ranging from one year to 10 years, with the

most common being a five-year reset (59.4% of the pool; see chart 6). At the end of the fixed period, they revert to a

floating rate set at EURIBOR plus a fixed margin, which is set at origination. This is unlike loans from other originators

in this market, which typically revert to another fixed rate.

WWW.SPGLOBAL.COM JUNE 23, 2022 14

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Chart 6

There are 1.1% expatriate loans in the pool (seven loans). They have been originated by Nestr, which started to grant

loans to expatriates in 2021. Borrowers are Dutch citizens that live in Germany or Belgium, at the border with the

Netherlands. Properties linked to the loans are located in the Netherlands.

Given the non-material share of expat loans in this pool we do not apply any stress. We believe that our originator

adjustment is sufficient to cover the risk stemming from expatriate loans.

Table 1

Collateral Key Features

Jubilee Place

4 B.V.

Jubilee Place

3 B.V.

Jubilee Place

2021-1 B.V.

Jubilee Place

2020-1 B.V.

Domi 2022-1

B.V.

Domi 2021-1

B.V. Domi 2020-2

Pool cutoff date April 30, 2022 Nov. 30, 2021 Feb. 28, 2021 Sept. 30, 2020 Jan 31, 2021 April 30, 2021 Sep. 30, 2020

Jurisdiction The

Netherlands

The

Netherlands

The

Netherlands

The

Netherlands

The

Netherlands

The

Netherlands

The

Netherlands

Principal

outstanding of the

pool (mil. €)

372.2 345.1 304.3 212.9 350.9 352.2 258.6

Number of loans 1,112 1,174 962 669 1,085 1,851 897

Number of

properties

1,506 1,536 1,489 1,136 1,851 897

WWW.SPGLOBAL.COM JUNE 23, 2022 15

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Table 1

Collateral Key Features (cont.)

Jubilee Place

4 B.V.

Jubilee Place

3 B.V.

Jubilee Place

2021-1 B.V.

Jubilee Place

2020-1 B.V.

Domi 2022-1

B.V.

Domi 2021-1

B.V. Domi 2020-2

Weighted-average

interest rate (%)

3.31 3.49 3.63 3.67 3.39 3.58

Average loan

balance (€)

334,728 224,679 316,371 318,260 213,415 310,843 288,365

Weighted-average

indexed current

LTV ratio (%)

74.0 70.7 71.7 71.2 72.4 72.1 68.8

Weighted-average

effective LTV ratio

(%)

74.1 72.4 72.0 72.1 72.4 69.7

Weighted-average

seasoning

(months)

3 4 3 4 4 3.4 4

Top two regional

concentration (by

balance)

Noord-Holland

(25.2%) and

Zuid-Holland

(24.4%)

Noord-Holland

(23.2%) and

Zuid-Holland

(30.2%)

Noord-Holland

(25.8%) and

Zuid-Holland

(28.6%)

Noord-Holland

(28.8%) and

Zuid-Holland

(30.3%)

Noord-Holland

(37.6%) and

Zuid-Holland

(26.1%)

Noord-Holland

(33.5%) and

Zuid-Holland

(23.8)

Noord-Holland

(41.4%) and

Zuid-Holland

(23.8%)

Interest-only loans

(%)

69.7 66.8 23.4 19.8 96.4 93.5 15.6

Cash-out loans (%) 47.3 50.2 32.5 45.9 13.7 12.7 26.3

Buy-to-let (%) 100.0 100.0 100.0 100.0 100.0 100.0 100.0

BKRs >= one (%) 0.0 0.0 0.0 0.0 0.0 0.0 0.0

Construction loans

(%)

4.1 2.9 2.4 1.8 0.0 0.0 0.0

Mixed-use

properties (%)

4.2 4.9 4.8 1.7 3.4 9.0 9.0

Jumbo valuations

(%)

29.4 22.5 24.6 24.08 51.2 50.00 49.5

'AAA' RMVD (%) 57.3 57.2 52.4 52.4 57.3 52.4 52.4

Current arrears >

one month (%)

0.0 0.0 0.00 0.00 0.00 0.00 0.00

'AAA' WAFF (%) 22.98 22.45 22.54 23.04 18.16 18.99 20.11

'AAA' WALS (%) 49.43 46.0 40.43 40.14 50.42 44.76 41.35

Calculations are according to S&P Global Ratings' methodology. LTV--Loan-to-value. BKR--Bankruptcy. RMVD--Repossession market value

declines. WAFF--Weighted-average foreclosure frequency. WALS--Weighted-average loss severity.

Asset performance

The pool contains no loans in arrears. There are no borrowers on payment holidays. Although we have received the

historical performance data on the originators' book, and the originations' performance has been very good--with no

defaults and very few arrears recorded--the data is limited. Due to the lack of three years of historical performance

data, we followed alternative analytical considerations to assess the quality of the assets. As such, we have considered

the performance of the past Jubilee transactions, the origination criteria relative to peers, and the data of other BTL

lenders in the market, as we expect the performance of this pool to be broadly similar.

WWW.SPGLOBAL.COM JUNE 23, 2022 16

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Audit and Fortrum reports

We received a clean pool audit report performed by Deloitte. We also received reports by Fortrum, a third-party

company that reviews underwriting and post-completion loan files compared to data in the system of the originators.

All loans reviewed are considered to be acceptable for prudent lenders as per Fortrum's criteria, with no material

errors. Given the clean pool audit and positive conclusion of the Fortrum reports, we have not applied any pool-level

adjustment to our weighted-average foreclosure frequency (WAFF).

Credit Analysis And Assumptions

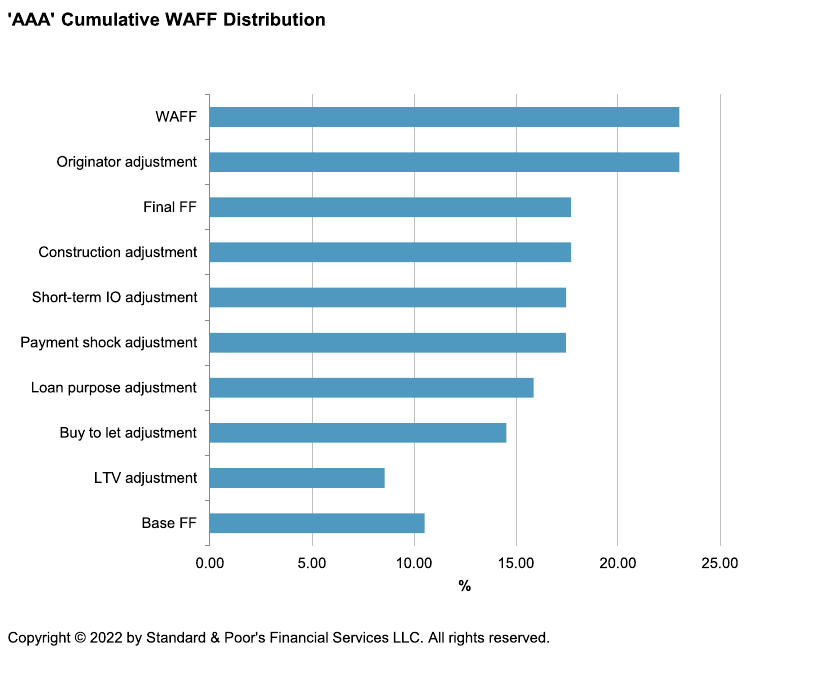

We applied our global residential loans criteria to the pool to derive the WAFF and the WALS at each rating level (see

table 2).

The WAFF and WALS assumptions increase at each rating level because notes with a higher rating should be able to

withstand a higher level of mortgage defaults and loss severity. Our credit analysis reflects the characteristics of loans,

properties, and associated borrowers.

Table 2

Portfolio WAFF And WALS

Rating level WAFF (%) WALS (%) Credit coverage (%)

AAA 22.98 49.43 11.36

AA 15.54 43.41 6.75

A 11.60 32.92 3.82

BBB 8.10 26.48 2.14

BB 4.16 21.69 0.90

B 3.28 17.20 0.56

WAFF--Weighted-average foreclosure frequency. WALS--Weighted-average loss severity.

WWW.SPGLOBAL.COM JUNE 23, 2022 17

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Chart 7

Macroeconomic And Sector Outlook

S&P Global Ratings acknowledges a high degree of uncertainty about the extent, outcome, and consequences of the

military conflict between Russia and Ukraine. Irrespective of the duration of military hostilities, sanctions and related

political risks are likely to remain in place for some time. The potential effects could include dislocated commodities

markets (notably for oil and gas) supply chain disruptions, inflationary pressures, weaker growth, and capital market

volatility. As the situation evolves, we will update our assumptions and estimates accordingly (see "Global Macro

Update: Growth Forecasts Lowered On Longer Russia-Ukraine Conflict And Rising Inflation," published on May 17,

2022).

We expect Dutch inflation to reach 5.0% in 2022. Although elevated inflation is overall credit negative for all

borrowers, inevitably some borrowers will be more negatively affected than others and to the extent inflationary

pressures materialize more quickly or more severely than currently expected, risks may emerge.

WWW.SPGLOBAL.COM JUNE 23, 2022 18

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Table 3

Dutch Housing Market Statistics

2020 2021 2022f 2023f 2024f

CPI inflation, % change y/y 1.1 2.8 5.0 2.6 2.2

Real GDP, % change (3.8) 5.0 3.2 2.1 2.0

Unemployment rate 3.8 4.2 3.7 3.6 3.4

CPI--Consumer Price Index. Y/Y--Year on year. f--Forecast. Sources: S&P Global Ratings, Eurostat, Kadaster, OECD, CBS Statistics Netherlands.

Transaction Structure

Chart 8

The issuer is a Dutch special-purpose entity. We consider the issuer to be bankruptcy remote and the legal framework

WWW.SPGLOBAL.COM JUNE 23, 2022 19

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

is compliant with our legal criteria.

Interest is paid quarterly on the interest payment dates in April, July, October, and January. The rated debt pay

interest equal to EURIBOR plus a class-specific margin with a further step up in margin following the optional call date

in January 2027. All the notes will reach legal final maturity in July 2059.

Class A loan

The class A loan is issued as a loan under the class A loan agreement. The terms in the loan agreement are consistent

with the transaction's terms and conditions. The class A lender agrees that its recourse is limited to the assets backing

the rated debt and agree not to initiate insolvency proceedings against the issuer and not to join any such proceedings.

We have reviewed the legal opinions for the purpose of assigning ratings and the class A loan structure does not affect

the issuer's tax status.

Deferral of interest

Under the transaction documents, interest payments on the class B-Dfrd, C-Dfrd, D-Dfrd, E-Dfrd, F-Dfrd, and X-Dfrd

notes can be deferred until they are the most senior outstanding. Consequently, any deferral of interest on these

classes would not constitute an event of default, until the notes become the most-senior outstanding. Unpaid interest

will accrue at the note-specific coupons and be due at the notes' legal final maturity.

Our ratings address the timely payment of interest and the ultimate payment of principal on the class A loan, and the

ultimate payment of interest, except when the notes are the most senior outstanding, and principal on the rated notes.

Any deferral of interest on the class A and S debt, as well as on the other rated notes after they become the most

senior outstanding, will constitute an event of default, and thus we have considered this in our cash flow analysis.

Liquidity reserve

The transaction features a liquidity reserve that is available to cover shortfalls on the senior fees, the issuer profit, the

swap outflows, the interest payment on the S1 and S2 certificates, and the interest payment on the class A loan.

The required liquidity reserve amount will evolve throughout the life of the transaction as follows:

• At closing: 0.50% (i.e., at 0.50% x 100/95, to include the VRR notes) of the class A loan;

• Until the step-up date (inclusive): the maximum of 1.00% (i.e. at 1.00% x 100/95 to include VRR notes) of the class

A loan at each interest payment date (IPD; prior to running the waterfall), and 0.50% (i.e., at 0.50% x 100/95, to

include the VRR notes) of the initial balance of the class A loan; and

• From the step-up date (exclusive): 1.00% of the class A loan at each IPD (prior to running the waterfall).

Excess amounts will be released down the principal priority of payments without resulting in a principal deficiency

ledger (PDL) credit. The release of excess amounts to the principal waterfall will create credit enhancement for the

rated debt.

Principal to pay interest

Principal can be used to pay senior fees, S notes, and interest on the most senior class of debt outstanding if there is a

shortfall in the revenue priority of payments. The use of principal to pay interest would result in the registering of a

WWW.SPGLOBAL.COM JUNE 23, 2022 20

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

debit in the PDL and may reduce the credit enhancement available to the debt.

Principal deficiency ledgers

The PDL comprises six subledgers, one for each of the rated mortgage-backed class of debt, and one for the VRR loan.

The PDL is loss based; it will also record where principal is used to cover shortfalls.

Payment priority

Table 4

Simplified Priority Of Payments

Revenue priority of payments Principal priority of payments

Senior fees To pay shortfalls on senior fees, the swap outflows, S1 and S2 notes, the interest on the

class A loan, and the class B-F notes' interest when most senior (see principal to pay

interest)

Issuer profit Top up liquidity reserve to target

Swap outflow (if any) Class A loan' principal

S1 payment (before call date) Class B-Dfrd notes' principal

S2 payment (post call date) Class C-Dfrd notes' principal

Interest to A loan Class D-Dfrd notes' principal

A PDL Class E-Dfrd notes' principal

Interest to B-Dfrd Class F-Dfrd notes' principal

B-Dfrd PDL Excess amounts to the revenue waterfall

Interest to C-Dfrd

C-Dfrd PDL

Interest to D-Dfrd

D-Dfrd PDL

Interest to E-Dfrd

E-Dfrd PDL

Interest to F-Dfrd

F-Dfrd PDL

Junior servicing fees

Interest to X-Dfrd

Principal to X-Dfrd

Excess to R notes. After the step up date, excess is

diverted to the principal waterfall

PDL--Principal deficiency ledger.

Interest rate risk

In the pool, 100% of the loans pay interest based on a fixed rate. To address the interest mismatch between the

mortgage loans and the rated debt, the transaction features a fixed-to-floating interest rate swap, where the issuer pays

a fixed rate (1.35%) and receive EURIBOR to mirror the index paid on the debt. The balance of the swap is a fixed

amortization schedule, assuming 0% prepayments on the fixed-rate loans for twelve months from origination, followed

by 10% until reversion.

WWW.SPGLOBAL.COM JUNE 23, 2022 21

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Cash Flow Modeling And Analysis

We stress the transaction's cash flows to test the credit and liquidity support that the assets, subordinated tranches,

and reserve provide.

We apply these stresses to the cash flows at all relevant rating levels. Our ratings are based on:

• The class A loan must pay full timely interest and principal.

• The S notes must pay full timely interest.

• The class B-Dfrd through X-Dfrd notes address the ultimate payment of principal and interest until the note

becomes the most senior, at which point timely interest becomes due.

In addition to our standard cash flow analysis, we have also considered the sensitivity to reductions in excess spread

caused by prepayments, potential increased exposure to tail-end risk, spread compression due to a potential 15 bps

discount applied to "green" mortgages, and relative positions of tranches in the fully sequential capital structure to

determine the ratings on the class A loan and B-Dfrd to D-Dfrd notes.

The class E-Dfrd notes do not pass at the 'B' rating level in any run except in the steady state run, where we consider

actual servicing fees, the expected level of prepayment, and do not apply the commingling stress. In our view, the

repayment of class E-Dfrd notes is not dependent upon favorable economic, financial, and business conditions and

therefore, based on our methodology for assigning 'B-' and 'CCC' ratings, we have assigned a 'B- (sf)' rating to class

E-Dfrd notes (see "Criteria For Assigning 'CCC+', 'CCC', 'CCC-', And 'CC' Ratings," published on Oct. 1, 2012).

The class F-Dfrd notes do not pass at the 'B' rating level in any run, even in the steady state run. In the steady state

run, they miss only two scenarios out of the eight we run. They fail in the scenarios where interest rates are going

down, which we consider to be less relevant in a rising interest rate environment. We believe that the repayment of the

class F-Dfrd notes is dependent upon favorable economic, financial, and business conditions, and therefore, based on

our methodology for assigning 'B-' and 'CCC' ratings, we have assigned a 'CCC (sf)' rating to class F-Dfrd notes.

The class X-Dfrd notes do not pass at the 'B' rating level in any run and in any scenarios, therefore we have not

assigned a rating to this class of notes.

Commingling risk

Borrowers pay into a collection foundation account held with ABN AMRO Bank N.V. On a monthly basis, collections

are then swept to the transaction account with Citibank Europe PLC, Netherlands Branch.

The collection foundation is set up as a SPE, which we believe includes characteristics that support the concept of

bankruptcy remoteness as per our legal criteria. Because of this and the fact that the issuer is the beneficiary of that

account, we consider the risk of commingling loss to be mitigated (see "Legal Criteria: Structured Finance: Asset

Isolation And Special-Purpose Entity Methodology," published on March 29, 2017).

Although we believe the risk of commingling loss is mitigated, the collections could be delayed in the event of an

insolvency. In our analysis, we therefore applied a liquidity stress equal to two months of collections.

WWW.SPGLOBAL.COM JUNE 23, 2022 22

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Spread compression

The asset yield on the pool can decrease if higher-paying assets default or prepay. Our cash flow analysis accounts for

this by assuming that the weighted-average yield on the portfolio drops by 0.12% at the 'AAA' level.

Fees

Contractually, the issuer is obliged to pay periodic fees to various parties providing services to the transaction such as

servicers, trustees, and cash managers, among others. In our analysis, we applied a stressed servicing fee of 0.26% (the

higher of 1.5x actual fees and 0.25% of the pool balance) to account for the potential increase in costs to attract a

replacement servicer, based on our global RMBS criteria.

Setoff risk

The seller is not a deposit-taking institution and under the underwriting criteria no loan is granted to an employee of

the originators. In the case of construction loans (renovation loans with a deposit generally not exceeding 20% of the

current balance), if the originator is insolvent and cannot disburse the construction deposits to borrowers, as the

deposit amounts are held in the collection foundation account and there is a pledge mechanism in place, the cash will

still be available to transfer the drawdown amount to the borrowers. Therefore, the transaction is not exposed to setoff

risk.

Default and recovery timings

We have used the WAFF and WALS derived under our credit analysis as inputs in our cash flow analysis. At each

rating level, the WAFF specifies the total balance of the mortgage loans we assume to default over the transaction's

life. We apply defaults on the outstanding balance of the assets as of the closing date. We simulate defaults following

two paths (i.e., one front-loaded and one back-loaded) over a three-year recession (see table 5).

Table 5

Default Timings For Front-Loaded And Back-Loaded Default Curves

Year after closing

Front-loaded defaults (percentage of WAFF per

year)

Back-loaded defaults (percentage of WAFF per

year)

1 25.0 5.0

2 25.0 10.0

3 25.0 10.0

4 10.0 25.0

5 10.0 25.0

6 5.0 25.0

We assume recoveries on defaulted assets to be received 18 months after default for both owner-occupied and BTL

properties. Foreclosure costs are estimated at 3% of the repossession value and €5,000.

Our loss severities are based on loan principal and do not give any credit to the recovery of interest accrued on the

loan during the foreclosure process.

Delinquencies

To simulate the effect of delinquencies on liquidity, we model a proportion of scheduled collections equal to one-third

of the WAFF (in addition to assumed foreclosures reflected in the WAFF) to be delayed. We apply this in each of the

first 18 months of the recession and assume a full recovery of these delinquencies will occur 36 months after they

WWW.SPGLOBAL.COM JUNE 23, 2022 23

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

arise.

Prepayments

To assess the impact on excess spread and the absolute level of defaults in a transaction we model two prepayment

scenarios: high and low (see table 6).

Table 6

Prepayment Assumptions

High Low

Pre-recession 24.0 1.0

During recession 1.0 1.0

Post-recession 24.0 1.0

We also run a sensitivity with 30% CPR pre-recession and post-recession. This accounts for the risk of a rise in

prepayment in the coming years due to a high share of loans that will switch to a floating rate in 2025 and 2027, and

also considers the high level of prepayment observed for comparable prime and buy-to-let Dutch transactions.

Interest rates

We modeled two interest rate scenarios in our analysis: up and down.

Summary

Combined, the default timings, interest rates, and prepayment rates described above give rise to eight different

scenarios at each rating level (see table 7).

Table 7

RMBS Stress Scenarios

Total number of scenarios Prepayment rate Interest rate Default timing

8 High and low Up and down Front-loaded and back-loaded

Scenario analysis

Various factors could lead us to lower our ratings on the debt, such as increasing foreclosure rates in the underlying

pool and changes in the pool composition.

We analyzed the effect of a moderate stress on our WAFF assumptions and its ultimate effect on our ratings on the

debt. We ran two stress scenarios to demonstrate the rating transition of a note, and the results are in line with our

credit stability criteria.

We also conducted additional sensitivity analysis to assess the impact of, all else being equal, increased WAFF and

WALS on our ratings on the debt. For this purpose, we ran eight scenarios by either increasing stressed defaults

and/or reducing expected recoveries as shown in the tables below.

Table 8

Sensitivity Stresses

WALS

WAFF 0 1.1x 1.3x

0 Base Case Scenario 3 Scenario 4

WWW.SPGLOBAL.COM JUNE 23, 2022 24

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Table 8

Sensitivity Stresses (cont.)

WALS

WAFF 0 1.1x 1.3x

1.1x Scenario 1 Scenario 5 Scenario 7

1.3x Scenario 2 Scenario 6 Scenario 8

WAFF--Weighted-average foreclosure frequency. WALS--Weighted-average loss severity.

The results of the above sensitivity analysis indicate a deterioration of no more than three notches on the debt (see

table 9).

Table 9

Sensitivity Scenarios

Class

Base

case 1 2 3 4 5 6 7 8

A AAA AA+ AA+ AAA AA+ AA+ AA AA AA

B-Dfrd AA- AA- A AA- A+ A+ A A A

C-Dfrd A A- BBB A- BBB+ BBB+ BBB BBB BBB

D-Dfrd BBB- BB+ BB BB+ BB BB+ BB BB BB

E-Dfrd NR 'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

F-Dfrd NR 'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

X-Dfrd NR 'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

'CCC' or

lower

Counterparty Risk

The issuer is exposed to Citibank Europe PLC, Netherlands branch, as the transaction's account provider; ABN AMRO

Bank N.V. as the servicer's collection account; and BNP Paribas S.A. as swap counterparty (see table 10). The

documented replacement mechanisms adequately mitigate the transaction's exposure to counterparty risk in line with

our current counterparty criteria.

Table 10

Supporting Ratings

Institution/role

Current counterparty

rating

Minimum eligible

counterparty rating

Remedy period (calendar

days)

Maximum

supported rating

ABN AMRO Bank N.V. as collection

account provider

A/Stable/A-1 BBB/A-2 30 AAA

Citibank Europe PLC, Netherlands

branch as transaction account

provider*

A+/Stable/A-1* A/A-1 60 AAA

BNP Paribas S.A. as swap

counterparty

AA-/Stable/A-1+§ A+ 10 business days to post

collateral and 90 calendar days

to find a replacement

AAA

*Rating derived from the rating on the parent entity. §Resolution counterparty rating.

WWW.SPGLOBAL.COM JUNE 23, 2022 25

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Sovereign Risk

Our long-term unsolicited credit rating on the Netherlands is 'AAA'. Therefore, our ratings in this transaction are not

constrained by our structured finance ratings above the sovereign criteria.

Surveillance

We will maintain surveillance on the transaction until the debt mature or are otherwise retired. To do this, we will

analyze regular servicer reports detailing the performance of the underlying collateral, monitor supporting ratings, and

make regular contact with the servicer to ensure that it maintains minimum servicing standards and that any material

changes in the servicer's operations are communicated and assessed.

Related Criteria

• General Criteria: Environmental, Social, And Governance Principles In Credit Ratings, Oct. 10, 2021

• Criteria | Structured Finance | General: Global Framework For Payment Structure And Cash Flow Analysis Of

Structured Finance Securities, Dec. 22, 2020

• Criteria | Structured Finance | General: Methodology To Derive Stressed Interest Rates In Structured Finance, Oct.

18, 2019

• Criteria | Structured Finance | General: Counterparty Risk Framework: Methodology And Assumptions, March 8,

2019

• Criteria | Structured Finance | General: Incorporating Sovereign Risk In Rating Structured Finance Securities:

Methodology And Assumptions, Jan. 30, 2019

• Criteria | Structured Finance | RMBS: Global Methodology And Assumptions: Assessing Pools Of Residential

Loans, Jan. 25, 2019

• Legal Criteria: Structured Finance: Asset Isolation And Special-Purpose Entity Methodology, March 29, 2017

• Criteria | Structured Finance | General: Global Framework For Assessing Operational Risk In Structured Finance

Transactions, Oct. 9, 2014

• General Criteria: Methodology Applied To Bank Branch-Supported Transactions, Oct. 14, 2013

• Criteria | Structured Finance | General: Global Derivative Agreement Criteria, June 24, 2013

• General Criteria: Criteria For Assigning 'CCC+', 'CCC', 'CCC-', And 'CC' Ratings, Oct. 1, 2012

• General Criteria: Global Investment Criteria For Temporary Investments In Transaction Accounts, May 31, 2012

• General Criteria: Principles Of Credit Ratings, Feb. 16, 2011

• Criteria | Structured Finance | General: Methodology For Servicer Risk Assessment, May 28, 2009

WWW.SPGLOBAL.COM JUNE 23, 2022 26

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

Related Research

• Global Macro Update: Growth Forecasts Lowered On Longer Russia-Ukraine Conflict And Rising Inflation, May 17,

2022

• Inflation, War, And COVID Drag On, May 17, 2022

• European RMBS Index Report Q1 2022, May 16, 2022

• State of The Netherlands, April 26, 2022

• Economic Outlook Eurozone Q2 2022: Healthy But Facing Another Adverse Shock, March 28, 2022

• S&P Global Ratings Expects The Russia-Ukraine Conflict To Have Limited Direct Impact On Global Structured

Finance, March 4, 2022

• New Issue: Jubilee Place 3 B.V., Jan. 21, 2022

• European Economic Snapshots: From Fast-Paced Recovery To Robust Expansion, Dec. 6, 2021

• European RMBS Market Update Q3 2021, Nov. 24, 2021

• European Housing Market Inflation Is Here To Stay, Nov. 2, 2021

• ESG Industry Report Card: Residential Mortgage-Backed Securities, March 31, 2021

• How Much Is Enough? Information Quality Standards For The EMEA RMBS And ABS Rating Process, Jan. 8, 2019

• 2017 EMEA RMBS Scenario And Sensitivity Analysis, July 6, 2017

• Global Structured Finance Scenario And Sensitivity Analysis 2016: The Effects Of The Top Five Macroeconomic

Factors, Dec. 16, 2016

• European Structured Finance Scenario And Sensitivity Analysis 2016: The Effects Of The Top Five Macroeconomic

Factors, Dec. 16, 2016

WWW.SPGLOBAL.COM JUNE 23, 2022 27

© S&P Global Ratings. All rights reserved. No reprint or dissemination without S&P Global Ratings' permission. See Terms of Use/Disclaimer on the

last page.

2857769

New Issue: Jubilee Place 4 B.V.

S&P may receive compensation for its ratings and certain credit-related analyses, normally from issuers or underwriters of securities or from

obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites,

www.spglobal.com/ratings (free of charge), and www.ratingsdirect.com (subscription), and may be distributed through other means, including via

S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.spglobal.com/usratingsfees.

S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective

activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established

policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process.

Credit-related and other analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and

not statements of fact. S&P's opinions, analyses and rating acknowledgment decisions (described below) are not recommendations to purchase,

hold, or sell any securities or to make any investment decisions, and do not address the suitability of any security. S&P assumes no obligation to

update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment

and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P does

not act as a fiduciary or an investment advisor except where registered as such. While S&P has obtained information from sources it believes to be

reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. Rating-

related publications may be published for a variety of reasons that are not necessarily dependent on action by rating committees, including, but not

limited to, the publication of a periodic update on a credit rating and related analyses.

To the extent that regulatory authorities allow a rating agency to acknowledge in one jurisdiction a rating issued in another jurisdiction for certain

regulatory purposes, S&P reserves the right to assign, withdraw or suspend such acknowledgment at any time and in its sole discretion. S&P Parties

disclaim any duty whatsoever arising out of the assignment, withdrawal or suspension of an acknowledgment as well as any liability for any damage

alleged to have been suffered on account thereof.

Copyright © 2022 Standard & Poor's Financial Services LLC. All rights reserved.

No content (including ratings, credit-related analyses and data, valuations, model, software or other application or output therefrom) or any part

thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval

system, without the prior written permission of Standard & Poor's Financial Services LLC or its affiliates (collectively, S&P). The Content shall not be

used for any unlawful or unauthorized purposes. S&P and any third-party providers, as well as their directors, officers, shareholders, employees or

agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not

responsible for any errors or omissions (negligent or otherwise), regardless of the cause, for the results obtained from the use of the Content, or for

the security or maintenance of any data input by the user. The Content is provided on an “as is” basis. S&P PARTIES DISCLAIM ANY AND ALL

EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR

A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING

WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no

event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential

damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs or losses caused by

negligence) in connection with any use of the Content even if advised of the possibility of such damages.

Standard & Poor’s | Research | June 23, 2022 28

2857769