NBER WORKING PAPER SERIES

THE CHINA SHOCK:

LEARNING FROM LABOR MARKET ADJUSTMENT TO LARGE CHANGES IN TRADE

David H. Autor

David Dorn

Gordon H. Hanson

Working Paper 21906

http://www.nber.org/papers/w21906

NATIONAL BUREAU OF ECONOMIC RESEARCH

1050 Massachusetts Avenue

Cambridge, MA 02138

January 2016

The views expressed herein are those of the authors and do not necessarily reflect the views of the

National Bureau of Economic Research.

NBER working papers are circulated for discussion and comment purposes. They have not been peer-

reviewed or been subject to the review by the NBER Board of Directors that accompanies official

NBER publications.

© 2016 by David H. Autor, David Dorn, and Gordon H. Hanson. All rights reserved. Short sections

of text, not to exceed two paragraphs, may be quoted without explicit permission provided that full

credit, including © notice, is given to the source.

The China Shock: Learning from Labor Market Adjustment to Large Changes in Trade

David H. Autor, David Dorn, and Gordon H. Hanson

NBER Working Paper No. 21906

January 2016

JEL No. F14,J23,J31

ABSTRACT

China’s emergence as a great economic power has induced an epochal shift in patterns of world trade.

Simultaneously, it has challenged much of the received empirical wisdom about how labor markets

adjust to trade shocks. Alongside the heralded consumer benefits of expanded trade are substantial

adjustment costs and distributional consequences. These impacts are most visible in the local labor

markets in which the industries exposed to foreign competition are concentrated. Adjustment in local

labor markets is remarkably slow, with wages and labor-force participation rates remaining depressed

and unemployment rates remaining elevated for at least a full decade after the China trade shock commences.

Exposed workers experience greater job churning and reduced lifetime income. At the national level,

employment has fallen in U.S. industries more exposed to import competition, as expected, but offsetting

employment gains in other industries have yet to materialize. Better understanding when and where

trade is costly, and how and why it may be beneficial, are key items on the research agenda for trade

and labor economists.

David H. Autor

Department of Economics, E17-216

MIT

77 Massachusetts Avenue

Cambridge, MA 02139

and NBER

David Dorn

University of Zurich

Department of Economics

Schoenberggasse 1

CH-8001 Zurich - Switzerland

Gordon H. Hanson

IR/PS 0519

University of California, San Diego

9500 Gilman Drive

La Jolla, CA 92093-0519

and NBER

0.04 0.08 0.12 0.16 0.20 0.24 0.28 0.32 0.36 0.40

Manufacturing Share of Non-Farm Employment

1939 1944 1949 1954 1959 1964 1969 1974 1979 1984 1989 1994 1999 2004 2009 2014

0

5

10

15

20

25

percent

1990 1995 2000 2005 2010

Year

China share of world manufacturing value added

China share of world manufacturing exports

Source: World Development Indicators.

China's share of world manufacturing activity

-10

-5

0

5

10

15

percent of GDP

1985 1990 1995 2000 2005 2010

Year

Net exports of manufacturing

Net exports of food, fuels, ores and metals

Source: World Development Indicators.

Exports minus imports as share of GDP for China

-1.5

-1

-.5

0

.5

log RCA

1988 1992 1996 2000 2004 2008 2012

Year

China RCA in manufacturing

China RCA in food, fuels, ores and metals

Source: World Development Indicators.

Revealed comparative advantage for China

∆

-20 0 20 40 60 80 100

Growth Net Import Penetr. 1991-2007

.2 .4 .6 .8 1

Share of Production Workers 1991

food/tobacco textile/apparel/leather

wood/furniture paper/print

chemical/petroleum plastic/rubber/glass

metal/metal products machines/electrical

transportation toys/other

-5

0

5

10

percent of GDP

1985 1990 1995 2000 2005 2010

Year

China current account balance

U.S. current account balance

Source: World Development Indicators.

Current account balance (percent of GDP)

i

X

i

=

X

k

A

ik

τ

−θ

ik

Φ

k

E

k

X

i

i A

ik

i k τ

ik

i

k θ E

k

i i

k Φ

k

k Φ

k

≡

P

i

0

A

i

0

k

τ

i

0

k

−θ

i

ˆx ≡ dx/x

i

ˆ

X

i

=

X

k

φ

ik

ˆ

E

k

− θ ˆw

i

+

X

k

φ

ik

ˆ

A

k

−

X

k

φ

ik

X

i

0

6=c

ρ

i

0

k

ˆ

A

i

0

k

−

X

k

φ

ik

ρ

ck

ˆ

A

ck

φ

ik

≡ X

ik

/X

i

k i ρ

ik

≡

X

ik

/E

k

i k c

ˆ

A

ik

=

ˆ

A

k

− θ ˆw

i

i

X

k

φ

ik

ρ

ck

ˆ

A

ck

=

X

k

φ

ik

"

X

ck

ˆ

A

ck

E

k

#

i

φ

ik

i

A

ik

k i k i

i k

k

ˆ

A

k

i ˆw

i

P

k

φ

ik

ˆ

E

k

United States Japan Germany Spain Australia

∆ Chinese Imports (Bil$)

303.8 108.1 64.3 23.2 21.5

No. Industries with Import Growth

385 368 371 377 378

Correlation w/ U.S.-China Imports

1.00 0.86 0.91 0.68 0.96

Finland Denmark New Zealand Switzerland

∆ Chinese Imports (Bil$)

234.7 5.7 4.7 3.8 3.3

No. Industries with Import Growth

383 356 362 379 343

Correlation w/ U.S.-China Imports

0.92 0.58 0.62 0.92 0.55

First stage regressions (using import penetration variables as in ADHS QJE)

Japan Germany Spain Australia

coeff 1.918 3.897 9.203 13.646

se 0.112 0.136 0.551 0.495

t-stat 17.075 28.674 16.705 27.550

8 Non-U.S. Finland Denmark New Zealand Switzerland

coeff 1.169 16.041 24.541 61.478 40.995

se 0.046 1.368 2.250 2.866 3.408

t-stat 25.281 11.725 10.907 21.450 12.028

Correlations of imports across 397 4-digit industries are weighted using 1991 industry employment from the NBER Manufacturing database.

8 Non-US

Countries

Table 1. Imports from China in the U.S. and Other Developed Economies 1991 - 2007 (in Billions of 2007$),

and their Correlations with U.S.-China Imports

θ ˆw

i

i

i

P

k

φ

ik

ˆ

A

k

i

P

k

φ

ik

P

i

0

6=c

ρ

i

0

k

ˆ

A

i

0

k

∆L

jτ

= α

τ

+ β

1

∆IP

jτ

+ γX

j0

+ e

jτ

.

∆L

jτ

j τ

∆IP

jτ

j τ β

1

X

j0

α

τ

e

jτ

∆IP

jτ

= ∆M

UC

j,τ

/ (Y

j,91

+ M

j,91

− E

j,91

) Y

j

M

j

E

j

∆M

UC

j,τ

1991-1999 1999-2011 1999-2007 2007-2011

Mean/SD Median Mean/SD Mean/SD Mean/SD Mean/SD

0.50 0.14 0.27 0.66 0.84 0.30

(0.94) (0.75) (1.33) (1.61) (1.68)

-2.71 -2.05 -0.30 -4.32 -3.62 -5.73

(3.07) (3.49) (3.85) (4.15) (5.02)

Based&on&AADHP&Tab&1.

Based&on&AADHP&Tab&1.

Table 2. Industry-Level Changes in Chinese Import Exposure and U.S. Manufacturing Employment.

Statistics are based on 392 4-digit manufacturing industries. The change in U.S. exposure to Chinese imports is computed by dividing 100 x the annualized

increase in the value of U.S. imports over the indicated period by 1991 U.S. market volume in that industry. Employment changes are computed in the

County Business Patterns. All observations are weighted by 1991 industry employment.

1991-2011

100 x Annual ∆ in U.S.

Exposure to Chinese Imports

100 x Annual Log ∆ in Emp.

(Manufacturing Industries)

1991-2007

(1) (2) (3)

-0.81*** -1.30*** -1.24***

(0.16) (0.41) (0.37)

1{1991-1999} -0.08 0.05 0.04

(0.36) (0.36) (0.36)

1{1999-2011} -3.79*** -3.46***

(0.33) (0.33)

1{1999-2007} -2.58***

(0.38)

Estimation Method OLS 2SLS 2SLS

Based&on&AADHP&Tab&2.

Table 3. Effect of Import Exposure on Log Employment Change in U.S.

Manufacturing Industries: OLS and 2SLS Estimates.

N = 784 (392 4-digit manufacturing industries x 2 periods 1991-1999 and 1999-2011 or 1999-2007).

Employment changes are computed in the County Business Patterns and are expressed as 100 x

annual log changes. Observations are weighted by 1991 employment. Standard errors in parentheses

are clustered on 135 3-digit industries. * p < 0.10, ** p < 0.05, *** p < 0.01.

Stacked First Differences

1991-2011

100 x Annual ∆ in U.S.

Exposure to Chinese Imports

(1) (2) (3) (4)

-0.60*** -0.18 0.22*** 0.55***

(0.10) (0.14) (0.06) (0.15)

(5) (6) (7) (8)

-0.05 -0.76*** -549.3*** 57.7***

(0.75) (0.25) (169.4) (18.4)

Based&on&ADH&Tab&5/6/8/9.

With an average annual wage of about $40k per employee, the employment loss by 0.78%pt lowers annual income by about $312 (0.0078*40000).

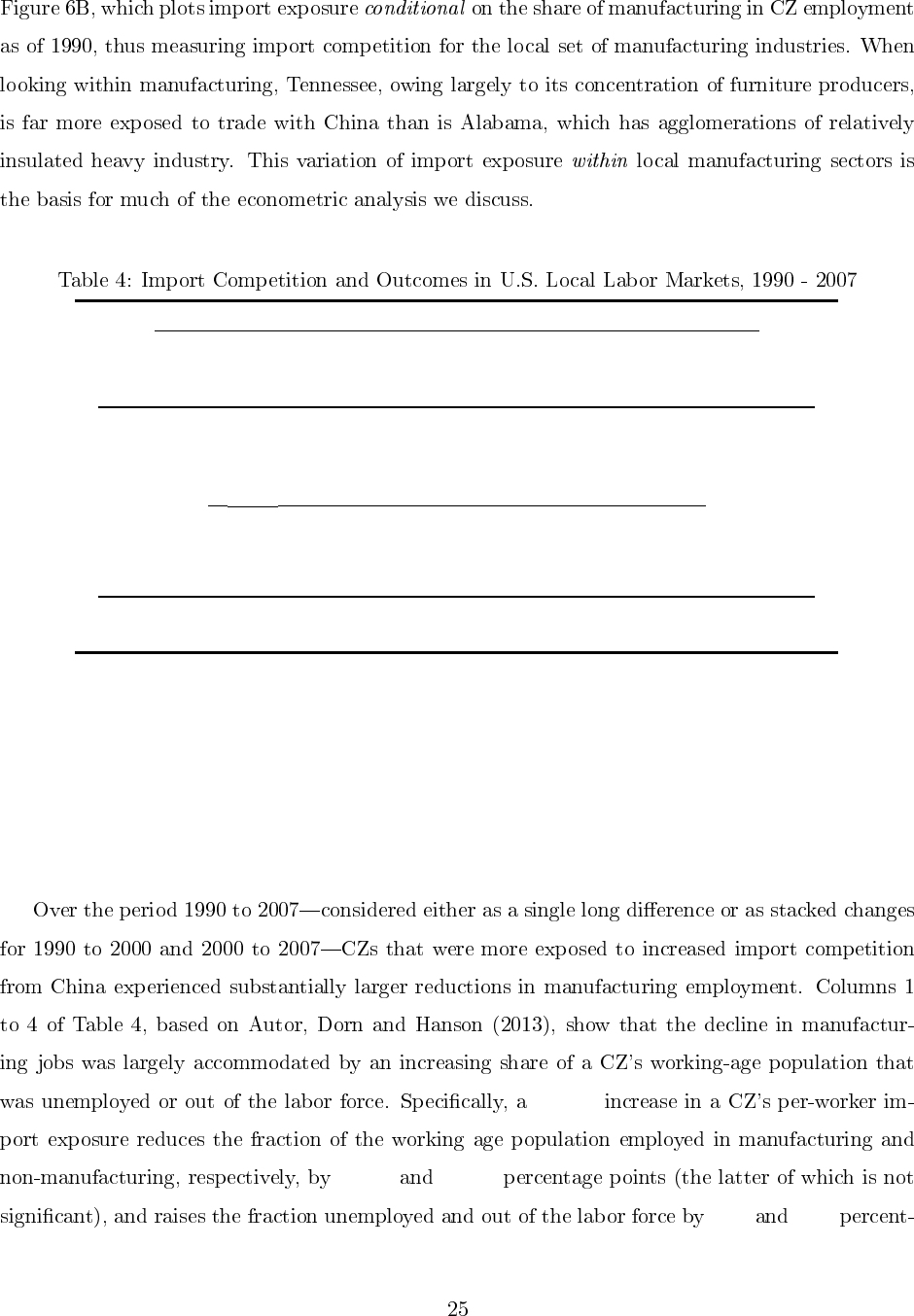

Table 4. Estimated Impact of a $1K per Worker Increase on Chinese Import Exposure on Outcomes in

U.S. Local Labor Markets, 1990-2007: 2SLS Estimates

N=1444 (722 commuting zones x 2 time periods 1990-2000 and 2000-2007). Employment, population and income data is

based on U.S. Census and American Community Survey data, while transfer payments are based on BEA Regional

Economic Accounts. All regressions control for the start of period percentage of employment in manufacturing, college-

educated population, foreign-born population, employment among women, employment in routine occupations, average

offshorability index of occupations, and Census division and time dummies. Models are weighted by start of period

commuting zone share of national population. Robust standard errors in parentheses are clustered on state. * p < 0.10, ** p

< 0.05, *** p < 0.01.

A. ∆ Fraction of Working Age Population in Manufacturing, Unemployment, NILF

B. ∆ Log Population, Log Wages, Annual Wage and Transfer Income

Employed in

Manufacturing

Employed in Non-

Manufacturing

Unemployed

Not in Labor Force

∆ Log CZ Population

(log pts)

∆ Avg Log Weekly

Wage (log pts)

∆ Annual Wage/Salary

Inc per Adult (US$)

∆ Transfers per Capita

(US$)

$1, 000

−0.60 −0.18

0.22 0.55

φ

ik

E

k

0.0078 × 40, 000

0.0076 × 0.7 × 40, 000

!"#$%&

!'#()&

!*)#))&

!*%#)(&

!*'#+,&

!%,#,"&

!)&

!*)&

!+)&

!")&

!()&

!%)&

!$)&

!,)&

-./012340/.5&

6.7&899&:/./;5<&

==9&>?<6@?2?54&

:/./;5<&

==9&A/BC/0/.5&

:/./;5<&

D5E/C&F3G/C.0/.5&

H.I30/&9<<?<56.I/&

F3G5&J/7?I62&

:/./;5<&

83562&:/./;5<&

>3226C&KE6.L/&&

H013C5<&MC30&KE?.6&6.7&KE6.L/&3M&F3G/C.0/.5&8C6.<M/C&A/I/?15<&?.&

K300NB.L&O3./<&P*QQ)R+)),S&&

&

Effect&of&an&$1000&Per&Worker&Increase&in&Imports&from&China&during&

1990=2007&on&Dollar&Change&of&Annual&Transfer&Receipts&per&Capita&

1

1.0

0.43

0.17

60

0 .2 .4 .6 .8 1 1.2

Coefficient

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

Conditional correlation in trade exposure between 1991 firm and firm in indicated year

Counterfactual with zero trade exposure in all firms except 1991 firm

2 × 16

0