Earnings Release

Q2 FY21

1

Coursera Reports Second Quarter Fiscal 2021 Financial Results

● Revenue grows 38% year-over-year on global demand for reskilling

● Entry-level Professional Certificates drive strong Consumer performance

August 3, 2021

MOUNTAIN VIEW, Calif. (BUSINESS WIRE) – Coursera (NYSE: COUR) today announced

financial results for its second quarter of fiscal 2021, ended June 30, 2021.

“Our second-quarter result reflects the growing adoption and impact of our platform around the

world. Institutions are using Coursera to launch large-scale reskilling efforts, and learners are

coming to the platform to upskill for high-demand digital roles,” said Coursera CEO Jeff

Maggioncalda. “Working with global brands like Google, IBM and Facebook, we have

assembled a broad catalog of job-relevant content and credentials that are helping learners with

no college degree or industry experience learn the skills needed to start new digital careers.”

Financial Highlights for Second Quarter Fiscal 2021

● Total revenue was $102.1 million, up 38% from $73.7 million a year ago.

● Gross profit was $60.9 million or 59.7% of revenue, up 58% from $38.6 million a year

ago. Non-GAAP gross profit was $61.8 million or 60.6% of revenue, up 60% from $38.7

million a year ago.

● Net loss was $(46.4) million or (45.4)% of revenue, compared to $(13.9) million or

(18.9)% of revenue a year ago. Non-GAAP net loss was $(6.9) million or (6.8)% of

revenue, compared to $(10.3) million or (14.0)% of revenue a year ago.

● Adjusted EBITDA was $(2.9) million or (2.8)% of revenue, compared to $(7.9) million or

(10.6)% of revenue a year ago.

● Net cash used in operating activities was $(5.5) million, compared to $11.4 million

provided by operating activities a year ago. Free cash flow was $(8.5) million, compared

to $8.3 million a year ago.

For more information regarding the non-GAAP financial measures discussed in this press

release, please see "Non-GAAP Financial Measures" and "Reconciliation of GAAP to Non-

GAAP Financial Measures" below.

“In the second quarter, revenue grew 38% year-over-year with strong momentum across our

three-sided learning platform,” said Ken Hahn, Coursera’s CFO. “Following our pandemic-

related surge in 2020, we believe we are seeing sustained structural demand for online learning

as businesses, governments and individual learners seek the skills required to compete in

today’s economy.”

Earnings Release

Q2 FY21

2

Operating Segment Highlights

● Consumer revenue for the second quarter was $62.0 million, up 23% from a year ago

on sustained demand for our career-oriented Professional Certificates targeted at entry-

level digital jobs. Segment gross margin was $40.7 million, or 66% of Consumer

revenue, compared to 54% a year ago. The company added 5 million new registered

learners during the quarter for a total of 87 million.

● Enterprise revenue for the second quarter was $28.2 million, up 69% from a year ago

on a combination of strong renewals and growth in new customers. The total number of

Paid Enterprise Customers increased to 584, up 109% from a year ago. Segment gross

margin was $19.0 million, or 67% of Enterprise revenue, compared to 70% a year ago.

Our Net Retention Rate (NRR) for Paid Enterprise Customers was 114%.

● Degrees revenue for the second quarter was $11.9 million, up 78% from a year ago on

scaling of prior cohorts and newly launched programs. Segment gross margin was 100%

of Degrees revenue; there is no content cost attributable to the Degrees segment as

students pay tuition directly to the university, and the university pays us a fee based on

the amount of tuition. The total number of Degrees Students reached 14,630, up 81%

from a year ago.

All key business metrics are as of June 30, 2021. For more information regarding the metrics

discussed in this press release, please see "Key Business Metrics Definitions" below.

Content, Customer and Platform Highlights

● Content and Credentials:

○ Announced 6 new industry partners, including Intuit, Infosec and Tencent.

○ Expanded our entry-level Professional Certificate catalog, including the Intuit

Bookkeeping Professional Certificate and Facebook Marketing Analyst

Professional Certificate.

○ Announced a new degree program with the Global Master’s in English

Language Teaching Leadership from Tomsk State University, which was in

addition to the 5 degrees announced at Coursera Conference in April.

● Enterprise Customers:

○ Expanded programs with Coursera for Business customers focused on

accelerating their digital transformation strategies, including PwC ProEdge

(U.S.), Pernod Ricard (France), and Go1 (U.K.).

○ Launched nationwide reskilling program with the Government of Barbados

National Transformation Initiative, ramped up statewide program with the U.S.

Tennessee Department of Labor and Workforce Development, and expanded our

partnership with the Commonwealth of Learning, serving 54 member nations

across Asia Pacific, Africa, Latin America, and the Caribbean.

○ Leading public and private universities adopted Coursera for Campus, including

the Universidad de Guadalajara (Mexico), L’Université Hassan II de Casablanca

(Morocco), UNext Learning (India), BAC Education (Malaysia), and Riphah

International University (Pakistan).

Earnings Release

Q2 FY21

3

● Learning Platform:

○ Expanded availability of Coursera Plus as a monthly subscription to all

learners, offering unlimited access to thousands of courses and all Guided

Projects for one all-inclusive price.

○ Announced general availability of our new LMS content ingestion solution,

enabling educators to quickly and seamlessly migrate large amounts of content

to Coursera from Learning Management Systems including edX, Canvas, Blackboard,

Moodle and others.

○ Announced general availability of Live2Coursera app for Zoom, helping to

address the digital divide facing universities with flexible download options and

mobile device compatibility.

Highlights reflect developments since March 31, 2021 through today’s announcement. For

additional information on these developments, see the Coursera Blog at blog.coursera.org.

Financial Outlook

● Third quarter fiscal 2021:

○ Revenue in the range of $105 to $109 million

○ Adjusted EBITDA in the range of $(7.5) to $(10.5) million

● Full-year fiscal 2021:

○ Revenue in the range of $402 to $410 million

○ Adjusted EBITDA in the range of $(38.0) to $(44.0) million

Actual results may differ materially from Coursera’s Financial Outlook as a result of, among

other things, the factors described under “Special Note on Forward-Looking Statements” below.

A reconciliation of our non-GAAP guidance measure (adjusted EBITDA) to corresponding

GAAP guidance measure is not available on a forward-looking basis without unreasonable effort

due to the uncertainty regarding, and the potential variability of, expenses that may be incurred

in the future. Stock-based compensation expense-related charges, including employer payroll

tax-related items on employee stock transactions, are impacted by the timing of employee stock

transactions, the future fair market value of our common stock, and our future hiring and

retention needs, all of which are difficult to predict and subject to constant change. We have

provided a reconciliation of GAAP to non-GAAP financial measures in the financial statement

tables for our historical non-GAAP financial results included in this press release.

Conference Call Details

As previously announced, Coursera will hold a conference call to discuss its second quarter

performance today, August 3, 2021 at 2:00 p.m. Pacific Time (5:00 p.m. Eastern Time).

A live, audio-only webcast of the conference call and earnings release materials will be

available to the public on the company’s Investor Relations page at investor.coursera.com. For

those unable to listen to the broadcast live, an archived replay will be accessible in the same

location for one year.

Earnings Release

Q2 FY21

4

Disclosure Information

In compliance with disclosure obligations under Regulation FD, Coursera announces material

information to the public through a variety of means, including filings with the Securities and

Exchange Commission, press releases, company blog posts, public conference calls and

webcasts, as well as the investor relations website.

About Coursera

Coursera was launched in 2012 by two Stanford Computer Science professors, Andrew Ng and

Daphne Koller, with a mission to provide universal access to world-class learning. It is now one

of the largest online learning platforms in the world, with 87 million registered learners as of

June 30, 2021. Coursera partners with over 200 leading university and industry partners to offer

a broad catalog of content and credentials, including Guided Projects, courses, Specializations,

certificates, and bachelor’s and master’s degrees. Institutions around the world use Coursera to

upskill and reskill their employees, citizens, and students in many high-demand fields, including

data science, technology, and business.

Contacts:

For investors: Cam Carey, [email protected]

For media: Arunav Sinha, [email protected]

# # #

Key Business Metrics Definitions

Registered Learners

We count the total number of registered learners at the end of each period. For purposes of

determining our registered learner count, we treat each customer account that registers with a

unique email as a registered learner and adjust for any spam, test accounts, and cancellations.

Our registered learner count is not intended as a measure of active engagement. New

registered learners are individuals that register in a particular period.

Paid Enterprise Customers

We count the total number of Paid Enterprise Customers at the end of each period. For

purposes of determining our customer count, we treat each customer account that has a

corresponding contract as a unique customer, and a single organization with multiple divisions,

segments, or subsidiaries may be counted as multiple customers. We define a “Paid Enterprise

Customer” as a customer who purchases Coursera via our direct sales force. For purposes of

determining our Paid Enterprise Customer count, we exclude our Enterprise customers who do

not purchase Coursera via our direct sales force, which include organizations engaging on our

platform through our Coursera for Teams offering or through our channel partners.

Earnings Release

Q2 FY21

5

Net Retention Rate (NRR) for Paid Enterprise Customers

We calculate annual recurring revenue (“ARR”) by annualizing each customer’s monthly

recurring revenue (“MRR”) for the most recent month at period end. We calculate “Net Retention

Rate” as of a period end by starting with the ARR from all Paid Enterprise Customers as of the

twelve months prior to such period end, or Prior Period ARR. We then calculate the ARR from

these same Paid Enterprise Customers as of the current period end, or Current Period ARR.

Current Period ARR includes expansion within Paid Enterprise Customers and is net of

contraction or attrition over the trailing twelve months, but excludes revenue from new Paid

Customers in the current period. We then divide the total Current Period ARR by the total Prior

Period ARR to arrive at our Net Retention Rate.

Number of Degrees Students

We count the total number of Degrees students for each period. For purposes of determining

our Degrees student count, we include all the students that are matriculated in a degree

program and who are enrolled in one or more courses in such degree program during the

period. If a degree term spans across multiple quarters, said student is counted as active in all

quarters of the degree term. For purposes of determining our Degrees student count, we do not

include students who are matriculated in the degree but are not enrolled in a course in that

period.

Non-GAAP Financial Measures

In addition to financial information presented in accordance with GAAP, this press release

includes non-GAAP gross profit, non-GAAP net loss, adjusted EBITDA, adjusted EBITDA

margin and Free Cash Flow, each of which is a non-GAAP financial measure. These are key

measures used by our management to help us analyze our financial results, establish budgets

and operational goals for managing our business, evaluate our performance, and make

strategic decisions. Accordingly, we believe that these non-GAAP financial measures provide

useful information to investors and others in understanding and evaluating our operating results

in the same manner as our management and board of directors. In addition, we believe these

measures are useful for period-to-period comparisons of our business. We also believe that the

presentation of these non-GAAP financial measures provides an additional tool for investors to

use in comparing our core business and results of operations over multiple periods with other

companies in our industry, many of which present similar non-GAAP financial measures to

investors, and to analyze our cash performance. However, the non-GAAP financial measures

presented may not be comparable to similarly titled measures reported by other companies due

to differences in the way that these measures are calculated. These non-GAAP financial

measures are presented for supplemental informational purposes only and should not be

considered as a substitute for or in isolation from financial information presented in accordance

with GAAP. These non-GAAP metrics have limitations as analytical tools.

Non-GAAP Gross Profit and Non-GAAP Net Loss

We define non-GAAP gross profit and non-GAAP net loss as GAAP gross profit and GAAP net

loss excluding the impact of stock-based compensation, and payroll tax expense related to

Earnings Release

Q2 FY21

6

stock-based activities. We believe the presentation of operating results that exclude these non-

cash or non-recurring items provides useful supplemental information to investors and facilitates

the analysis of our operating results and comparison of operating results across reporting

periods.

Adjusted EBITDA and Adjusted EBITDA Margin

We define Adjusted EBITDA as our net loss excluding: (1) depreciation and amortization; (2)

interest income, net; (3) stock-based compensation; (4) income tax expense; and (5) payroll tax

expense related to stock-based activities. We define Adjusted EBITDA Margin as Adjusted

EBITDA divided by revenue.

Free Cash Flow

Free Cash Flow is a non-GAAP financial measure that we calculate as net cash used in

operating activities, less cash used for purchases of property, equipment, and software, and

capitalized internal-use software costs. We exclude purchases of property, equipment and

software, and capitalized internal-use software costs as we consider these capital expenditures

to be a necessary component of our ongoing operations.

Reconciliations of the non-GAAP measures to the most directly comparable GAAP financial

measures are included in the Appendix.

Special Note on Forward-Looking Statements

This press release contains forward-looking statements that involve substantial risks and

uncertainties. Any statements contained in this press release that are not statements of

historical facts may be deemed to be forward-looking statements. In some cases, you can

identify forward-looking statements by the words “may,” “might,” “will,” “can,” “could,” “would,”

“should,” “expect,” “intend,” “plan,” “objective,” “target,” “anticipate,” “believe,” “estimate,”

“predict,” “project,” “potential,” “continue,” and “ongoing,” or the negative of these terms, or other

comparable terminology intended to identify statements about the future. These forward-looking

statements include statements regarding: the growing adoption and impact of our platform

around the world; trends in the online learning market, including with respect to institutions using

online learning for skilling at scale; trends in the higher education market, including learner

interest in online credentials as a pathway into digital roles; our ability to assemble a broad

catalog of content and credentials; our ability to differentiate from our competitors; demand for

online learning, including for skills to compete in today’s economy, and our ability to meet the

needs of learners and institutions; anticipated features and benefits of our content and platform

offerings, including partner adoption of and satisfaction with content ingestion, pricing and

access to our content and platform offerings, and mobile device compatibility and download

options; our ability to scale our business; and our financial outlook, future financial performance,

and expectations, among others. These forward-looking statements involve known and

unknown risks, uncertainties, and other factors that may cause our actual results, levels of

activity, performance, or achievements to be materially different from the information expressed

or implied by these forward-looking statements. These risks and uncertainties include, but are

Earnings Release

Q2 FY21

7

not limited to, the following: our ability to manage our growth; our limited operating history; the

nascency of online learning solutions and risks related to market adoption of online learning; our

ability to maintain and expand our partnerships with our university and industry partners; our

ability to attract and retain learners; our ability to increase sales of our Enterprise offering; our

ability to compete effectively; the COVID-19 pandemic’s impact on our business and our

industry; regulatory matters impacting us or our partners; risks related to intellectual property;

cyber security and privacy risks and regulations; potential disruptions to our platform; and our

status as a B Corp, as well as the risks discussed in our Quarterly Report on Form 10-Q for the

quarter ended June 30, 2021 and as detailed from time to time in our SEC filings. You should

not rely upon forward-looking statements as predictions of future events. Although we believe

that the expectations reflected in the forward-looking statements are reasonable, we cannot

guarantee that the future results, levels of activity, performance, or events and circumstances

reflected in the forward-looking statements will be achieved or occur. Moreover, neither we nor

any other person assumes responsibility for the accuracy and completeness of the forward-

looking statements. Such forward-looking statements relate only to events as of the date of this

press release. We undertake no obligation to update any forward-looking statements except to

the extent required by law.

Earnings Release

Q2 FY21

8

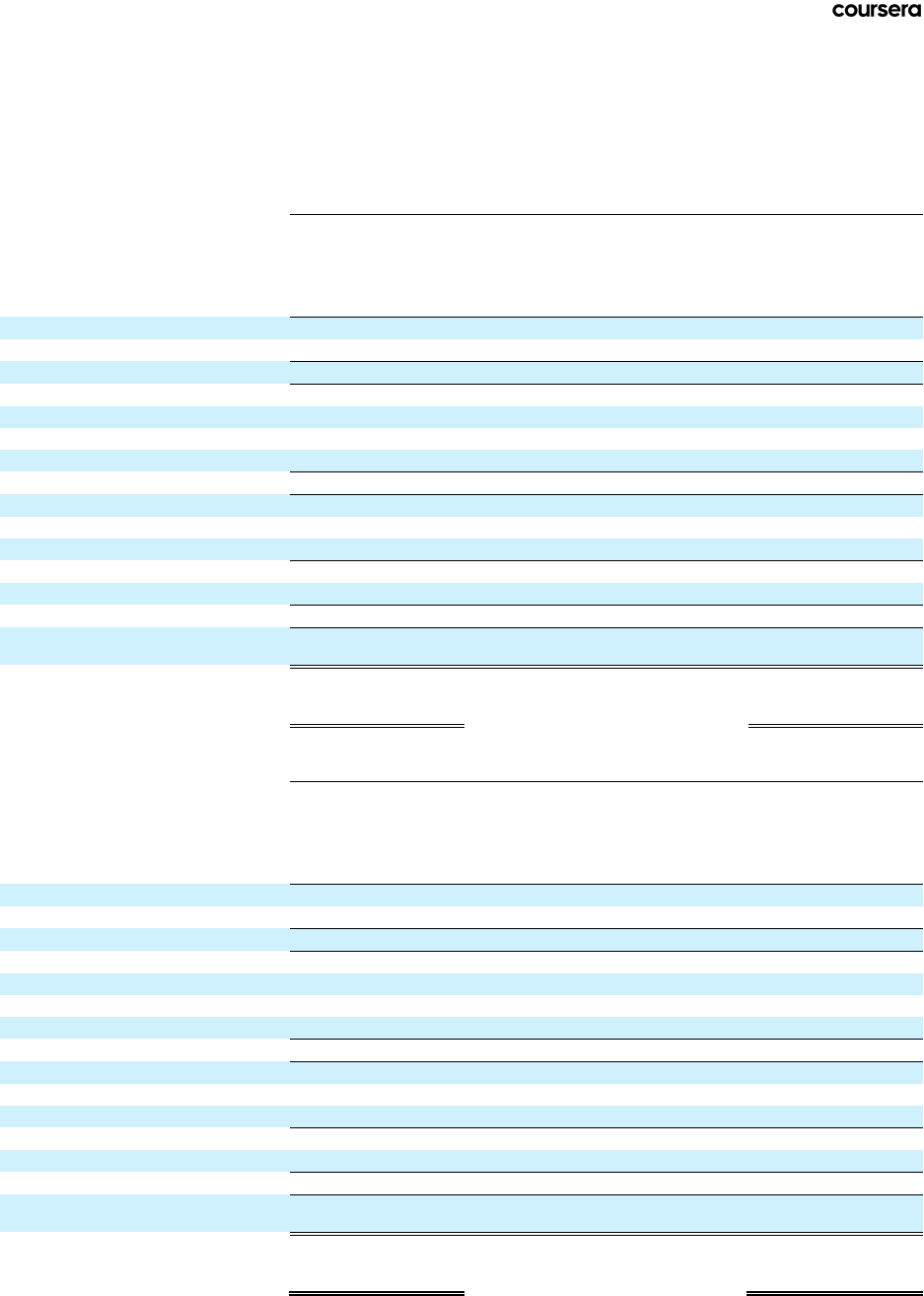

Coursera Inc.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited)

(In thousands, except number of shares and per share amounts)

Three Months Ended June 30,

Six Months Ended June 30,

2020

2021

2020

2021

(in thousands)

(in thousands)

Revenue

$

73,728

$

102,089

$

127,575

$

190,451

Cost of revenue

(1)

35,161

41,162

60,112

79,987

Gross profit

38,567

60,927

67,463

110,464

Operating expenses:

Research and

development

(1)

18,046

41,004

33,829

63,144

Sales and marketing

(1)

25,414

43,862

46,110

76,475

General and

administrative

(1)

8,943

21,846

16,029

34,991

Total operating expenses

52,403

106,712

95,968

174,610

Loss from operations

(13,836)

(45,785)

(28,505)

(64,146)

Interest income

265

85

961

165

Interest expense

(12)

—

(12)

—

Other income (expense),

net

34

42

(218)

35

Loss before income taxes

(13,549)

(45,658)

(27,774)

(63,946)

Income tax expense

367

705

456

1,080

Net loss

$

(13,916)

$

(46,363)

$

(28,230)

$

(65,026)

Net loss per share attributable

to common stockholders—

basic and diluted

$

(0.38)

$

(0.35)

$

(0.79)

$

(0.75)

Weighted-average shares used

in computing net loss per share

attributable to

common stockholders—basic

and diluted

36,185,155

131,804,121

35,925,639

86,761,169

(1) Includes stock-based compensation expense as follows:

Three Months Ended June 30,

Six Months Ended June 30,

2020

2021

2020

2021

(in thousands)

(in thousands)

Cost of revenue

$

115

$

903

$

225

$

1,010

Research and development

1,492

18,363

2,769

20,391

Sales and marketing

833

11,310

1,542

12,658

General and administrative

1,123

8,599

2,041

10,400

Total stock-based compensation

expense

$

3,563

$

39,175

$

6,577

$

44,459

Earnings Release

Q2 FY21

9

Coursera Inc.

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited)

(In thousands)

December 31, 2020

June 30, 2021

Assets:

Current assets:

Cash and cash equivalents

$

79,878

$

749,649

Marketable securities

205,402

51,088

Accounts receivable, net of allowance for doubtful accounts of

$48 and $153

40,721

51,757

Deferred costs

14,077

17,881

Prepaid expenses and other current assets

14,993

17,983

Total current assets

355,071

888,358

Property, equipment and software, net

18,644

23,049

Operating lease right-of-use assets

21,622

18,906

Intangible assets, net

10,570

10,336

Restricted cash

2,548

2,548

Other assets

9,169

10,383

Total assets

$

417,624

$

953,580

Liabilities, Redeemable Convertible Preferred Stock, and Stockholders’ Equity (Deficit):

Current liabilities:

Educator partners payable

$

39,005

$

41,666

Other accounts payable

12,897

9,260

Accrued compensation and benefits

12,997

15,469

Operating lease liabilities, current

7,926

7,970

Deferred revenue, current

76,080

95,917

Other current liabilities

4,739

6,861

Total current liabilities

153,644

177,143

Operating lease liabilities, non-current

18,305

15,071

Other liabilities

644

593

Deferred revenue, non-current

4,562

5,364

Total liabilities

177,155

198,171

Redeemable convertible preferred stock

462,293

—

Stockholders’ equity (deficit):

Common stock

—

1

Additional paid-in capital

126,408

1,168,681

Treasury stock

(4,701)

(4,701)

Accumulated other comprehensive income

20

5

Accumulated deficit

(343,551)

(408,577)

Total stockholders’ equity (deficit)

(221,824)

755,409

Total liabilities, redeemable convertible preferred stock,

and stockholders’ equity (deficit)

$

417,624

$

953,580

Earnings Release

Q2 FY21

10

Coursera Inc.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

(In thousands)

Six Months Ended June 30,

2020

2021

Cash flows from operating activities:

Net loss

$

(28,230)

$

(65,026)

Adjustments to reconcile net loss to net cash (used in) provided by operating

activities:

Depreciation and amortization

4,364

6,371

Stock-based compensation

6,577

44,459

Amortization or accretion of marketable securities

(187)

319

Other

25

105

Changes in operating assets and liabilities:

Accounts receivable, net

(11,497)

(11,141)

Prepaid expenses and other assets

(7,691)

(4,124)

Operating lease right-of-use assets

2,543

2,716

Educator partners and other accounts payable

13,202

(5,274)

Accrued and other liabilities

(431)

4,347

Operating lease liabilities

(2,822)

(3,191)

Deferred revenue

27,992

20,639

Net cash (used in) provided by operating activities

3,845

(9,800)

Cash flows from investing activities:

Purchases of marketable securities

(35,633)

—

Proceeds from maturities of marketable securities

98,434

153,981

Purchases of property, equipment and software

(1,737)

(739)

Capitalized internal-use software costs

(3,669)

(6,598)

Purchases of content assets

—

(531)

Net cash provided by investing activities

57,395

146,113

Cash flows from financing activities:

Proceeds from exercise of stock options and warrants

2,073

14,284

Proceeds from initial public offering, net of offering costs

—

525,284

Payment of deferred offering costs

—

(6,110)

Net cash provided by financing activities

2,073

533,458

Net increase in cash, cash equivalents, and restricted cash

63,313

669,771

Cash, cash equivalents, and restricted cash—Beginning of period

59,845

82,426

Cash, cash equivalents, and restricted cash—End of period

$

123,158

$

752,197

Reconciliation of cash, cash equivalents and restricted cash:

Cash and cash equivalents

$

119,354

$

749,649

Restricted cash

3,035

2,548

Restricted cash in prepaid expenses and other current assets

769

—

Total cash, cash equivalents, and restricted cash

$

123,158

$

752,197

Earnings Release

Q2 FY21

11

Coursera Inc.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES (Unaudited)

(In thousands, except number of shares and per share amounts)

Three Months Ended June 30, 2021

GAAP

Stock-based

compensation

Payroll tax

expense related

to stock-based

activities

Non-GAAP

Revenue

$

102,089

-

-

$

102,089

Cost of revenue

41,162

(903)

(15)

40,244

Gross profit

60,927

903

15

61,845

Operating expenses:

Research and development

41,004

(18,363)

(101)

22,540

Sales and marketing

43,862

(11,310)

(34)

32,518

General and administrative

21,846

(8,599)

(106)

13,141

Total operating expenses

106,712

(38,272)

(241)

68,199

Loss from operations

(45,785)

39,175

256

(6,354)

Interest income

85

-

-

85

Other income, net

42

-

-

42

Loss before income taxes

(45,658)

39,175

256

(6,227)

Income tax expense

705

-

-

705

Net loss

(46,363)

39,175

256

(6,932)

Net loss per share attributable to common

stockholders—basic and diluted

$

(0.35)

$

(0.05)

Weighted-average shares used in

computing net loss per share attributable to

common stockholders—basic and diluted

131,804,121

131,804,121

Six Months Ended June 30, 2021

GAAP

Stock-based

compensation

Payroll tax

expense related

to stock-based

activities

Non-GAAP

Revenue

$

190,451

-

-

$

190,451

Cost of revenue

79,987

(1,010)

(16)

78,961

Gross profit

110,464

1,010

16

111,490

Operating expenses:

Research and development

63,144

(20,391)

(124)

42,629

Sales and marketing

76,475

(12,658)

(35)

63,782

General and administrative

34,991

(10,400)

(109)

24,482

Total operating expenses

174,610

(43,449)

(268)

130,893

Loss from operations

(64,146)

44,459

284

(19,403)

Interest income

165

-

-

165

Other income, net

35

-

-

35

Loss before income taxes

(63,946)

44,459

284

(19,203)

Income tax expense

1,080

-

-

1,080

Net loss

(65,026)

44,459

284

(20,283)

Net loss per share attributable to common

stockholders—basic and diluted

$

(0.75)

$

(0.23)

Weighted-average shares used in

computing net loss per share attributable to

common stockholders—basic and diluted

86,761,169

86,761,169

Earnings Release

Q2 FY21

12

Three Months Ended June 30, 2020

GAAP

Stock-based

compensation

Payroll tax

expense related

to stock-based

activities

Non-GAAP

Revenue

$

73,728

-

-

$

73,728

Cost of revenue

35,161

(115)

-

35,046

Gross profit

38,567

115

-

38,682

Operating expenses:

-

Research and development

18,046

(1,492)

(3)

16,551

Sales and marketing

25,414

(833)

(12)

24,569

General and administrative

8,943

(1,123)

-

7,820

Total operating expenses

52,403

(3,448)

(15)

48,940

Loss from operations

(13,836)

3,563

15

(10,258)

Interest income

265

-

-

265

Interest expense

(12)

-

-

(12)

Other income, net

34

-

-

34

Loss before income taxes

(13,549)

3,563

15

(9,971)

Income tax expense

367

-

-

367

Net loss

(13,916)

3,563

15

(10,338)

Net loss per share attributable to common

stockholders—basic and diluted

$

(0.38)

$

(0.29)

Weighted-average shares used in

computing net loss per share attributable to

common stockholders—basic and diluted

36,185,155

36,185,155

Six Months Ended June 30, 2020

GAAP

Stock-based

compensation

Payroll tax

expense related

to stock-based

activities

Non-GAAP

Revenue

$

127,575

-

-

$

127,575

Cost of revenue

60,112

(225)

-

59,887

Gross profit

67,463

225

-

67,688

Operating expenses:

-

Research and development

33,829

(2,769)

(3)

31,057

Sales and marketing

46,110

(1,542)

(12)

44,556

General and administrative

16,029

(2,041)

-

13,988

Total operating expenses

95,968

(6,352)

(15)

89,601

Loss from operations

(28,505)

6,577

15

(21,913)

Interest income

961

-

-

961

Interest expense

(12)

-

-

(12)

Other income (expense), net

(218)

-

-

(218)

Loss before income taxes

(27,774)

6,577

15

(21,182)

Income tax expense

456

-

-

456

Net loss

(28,230)

6,577

15

(21,638)

Net loss per share attributable to common

stockholders—basic and diluted

$

(0.79)

$

(0.60)

Weighted-average shares used in

computing net loss per share attributable to

common stockholders—basic and diluted

35,925,639

35,925,639

Earnings Release

Q2 FY21

13

Three Months Ended June 30,

Six Months Ended June 30,

2020

2021

2020

2021

(in thousands)

(in thousands)

Net loss

$

(13,916)

$

(46,363)

$

(28,230)

$

(65,026)

Depreciation and

amortization

2,371

3,440

4,364

6,371

Interest income, net

(253)

(85)

(949)

(165)

Stock-based compensation

3,563

39,175

6,577

44,459

Income tax expense

367

705

456

1,080

Payroll tax expense related

to stock-based activities

15

256

15

284

Adjusted EBITDA

$

(7,853)

$

(2,872)

$

(17,767)

$

(12,997)

Adjusted EBITDA margin

(11)%

(3)%

(14)%

(7)%

Three Months Ended June 30,

Six Months Ended June 30,

2020

2021

2020

2021

(in thousands)

(in thousands)

Net cash (used in) provided by

operating activities

$

11,381

$

(5,453)

$

3,845

$

(9,800)

Less: Purchases of property,

equipment and software

(1,155)

(432)

(1,737)

(739)

Less: Capitalized internal-use

software costs

(1,895)

(2,613)

(3,669)

(6,598)

Free Cash Flow

$

8,331

$

(8,498)

$

(1,561)

$

(17,137)