Technical Document

Ingenico

MOVE 5000

Terminal

User Guide

Fiserv Condential

2 | Fiserv Condential

What Are You Looking For?

Get to Know Your Terminal ��������������������������� 04

Introduction �������������������������������������������������������������������� 04

Terminal Location and PIN Privacy ������������������������������������������������ 04

Terminal Ownership ������������������������������������������������������������ 04

Your Terminal Layout ������������������������������������������������������������ 05

Using the Keypad ��������������������������������������������������������������� 06

Basic Functions ���������������������������������������������������������������� 07

Integration With Your Point-of-Sale (POS) ����������������������������������������� 08

Transaction Processing Options �������������������������������������������������� 09

Loading Receipt Paper ���������������������������������������������������������� 10

Communication Set-Up ������������������������������ 11

Broadband Internet (Ethernet Set-Up) ��������������������������������������������� 12

Broadband Internet (Wi-Fi Set-Up) ������������������������������������������������ 13

Bluetooth Set-Up (Pair Base to Terminal) ������������������������������������������ 15

Switching Communication Options ����������������������������������������������� 17

Communication Status ���������������������������������������������������������� 18

Operating Your Eftpos Terminal ����������������������� 20

How to Complete a Sale ��������������������������������������������������������� 20

Cash Out Transaction ����������������������������������������������������������� 21

Cash Out Transaction With Purchase ������������������������������������������� 21

Cash Out Only Transaction ���������������������������������������������������� 22

Tipping ������������������������������������������������������������������������ 24

How to Process a Refund �������������������������������������������������������� 24

Void Last Transaction ����������������������������������������������������������� 26

Preauthorisation Processing ����������������������������������������������������� 28

Part One: Preauthorisation ���������������������������������������������������� 28

Part Two: Completion �������������������������������������������������������� 28

3 | Fiserv Condential

Processing a Preauthorisation Transaction �������������������������������������� 29

Processing a Preauthorisation Completion �������������������������������������� 31

Surcharge ��������������������������������������������������������������������� 33

Enabling/Disabling Surcharge �������������������������������������������������� 33

Surcharge Report ������������������������������������������������������������ 34

Mail Order Telephone Order (MOTO) ��������������������������������������������� 35

Dynamic Currency Conversion (DCC) ��������������������������������������������� 38

How to Print Last Receipt ������������������������������������������������������� 41

Reprint Specic Transaction Record (Invoice) �������������������������������������� 42

Settlement �������������������������������������������������������������������� 43

Manual Settlement ����������������������������������������������������������� 43

Print Settlement Totals (Pre-Settlement) ���������������������������������������� 44

Print Settlement Totals (Last Settlement) ��������������������������������������� 45

View Batch Details on the Screen ���������������������������������������������� 46

Batch Totals ����������������������������������������������������������������� 47

Transaction List �������������������������������������������������������������� 47

How to Enable Transaction List ������������������������������������������������ 48

How to Print The Transaction List ���������������������������������������������� 49

Ofine Transaction Processing ��������������������������������������������������� 50

Card Rules ������������������������������������������������������������������� 50

Electronic Fallback ������������������������������������������������������������ 50

Additional Terminal Functions ���������������������������������������������������� 51

Where to Get Help ����������������������������������� 52

Get to Know Your Terminal

4 | Fiserv Condential

Introduction

Your EFTPOS terminal from Fiserv allows to accept credit, debit and charge card transactions

electronically as a means of payment. Customers can access their cheque, savings or credit

accounts for purchases and refunds. Customers can also request cash out from cheque and

savings accounts.

Terminal Location and PIN Privacy

The physical location of an EFTPOS terminal is important in protecting a customer’s PIN privacy.

When your new terminal is installed or relocated within the premises, you must take care

toensure:

The EFTPOS terminal is in a position that allows the customer to enter their PIN so it cannot

be observed by employees or other customers

The EFTPOS PIN pad has an adequate length of terminal connection cord to allow customers

to enter their PIN privately

If in a xed position, the EFTPOS PIN pad has not been placed at an angle or height that

prevents customers from shielding their PIN entry

The placement of mirrors and other reective materials do not allow the customer’s PIN entry

to be observed through reection

Security cameras cannot make a visual record of a customer’s PIN entry

Communicate these guidelines to staff members who process EFTPOS transactions using the

terminal. It is also important to remind staff members that customers should never be asked to

disclose a PIN.

Terminal Ownership

All physical equipment provided to the merchant by Fiserv remains the property of Fiserv. This can

include but is not limited to EFTPOS terminals, PIN pads, power packs, phone line cables and any

additional hardware provided at the time of installation.

Get to Know Your Terminal

5 | Fiserv Condential

Your Terminal Layout

Your mobile integrated EFTPOS terminal is supplied with:

Power pack

Contactless card reader

3G/4G modem

Docking/Base station

Integrated Contactless Reader

Magnetic Stripe Reader

Menu

Cancel

Clear

Enter

Chip Reader

Receipt Printer

Get to Know Your Terminal

6 | Fiserv Condential

Using the Keypad

The grey Menu key on the keypad accesses different application menus

The red Cancel key on the keypad cancels the procedure in process

The yellow Clear key on the keypad cancels the last character

The green Enter key on the keypad validates input and powers on

the terminal

The Function button on the keypad is used to perform advanced functions

on the terminal

F2 on the touchscreen scrolls down menu options

F3 on the touchscreen scrolls up menu options

F2

F3

Get to Know Your Terminal

7 | Fiserv Condential

Basic Functions

Press the green Enter key on the keypad

Remove the terminal from its base and any power source

Press and hold the Func and yellow Clear keys together

Press the red Cancel button on the keypad

The terminal will return to the home screen if there is no activity for

60 seconds

Power on

Power off

Cancel an

action

Idle state

Get to Know Your Terminal

8 | Fiserv Condential

Integration With Your Point-of-Sale (POS)

The EFTPOS terminal can integrate with your POS to process credit, debit and charge card

transactions. When the card payment option is selected, the POS integration software provided by

Linkly (formerly PC EFTPOS), interacts with the EFTPOS terminal to process the transaction. The

outcome of the transaction is then automatically updated in your POS solution, making it easy for

you to reconcile the payments and shorten payment processing time.

EFTPOS terminals are designed to work with your Linkly (formerly PC EFTPOS)-certied POS

system. The POS system sends the total amount to the EFTPOS terminal to nalise the payment.

For all transaction types, the merchant initiates the transaction on the POS system and follows the

system prompts displayed on the POS screen. The customer follows the prompts displayed on the

terminal to process the payment.

Your EFTPOS terminal and base are paired through Bluetooth. This enables the terminal to continue

to operate normally when it is separated from the base.

You can also choose to have all transaction receipts printed directly from your POS system or have

the terminal print the transaction receipt.

Get to Know Your Terminal

9 | Fiserv Condential

Chip Card Reader

All chip cards must be inserted into the chip card reader located in

front of the terminal, below the keyboard.

Insert the credit card into the card reader with the gold

contact pad facing upward

Leave the chip card in the reader until the transaction

is completed

Remove the card when prompted by the terminal

The terminal screen prompts will guide you through the

transaction process

Contactless Reader

The contactless reader is located on top of the receipt roll around

the display.

If the card is capable of performing a contactless transaction,

place the card over the contactless reader

When the terminal is powered on, the rst LED willblink on

and off while the terminal is in Idle/Ready state

All four status LEDs will be illuminated from the time the

card reader is activated until completion of the contactless

transaction

Magnetic Stripe Reader

The magnetic stripe card reader is located on the right hand side

of the terminal.

If the card does not have a chip or contactless capability, you can

process transactions by swiping themagnetic stripe through the

terminal. The magnetic stripe should face down and against the

side of theterminal.

Transaction Processing Options

The EFTPOS terminal has a chip card reader, a magnetic stripe reader and an integrated

contactless reader for processing transactions.

Get to Know Your Terminal

10 | Fiserv Condential

Loading Receipt Paper

Open the printer cover by gently pulling the

printercover’s latch, then lift the cover away from

the printer.

Load a roll of thermal paper into the printer

Pull the paper up to the top of the terminal

Maintain the paper and close the cover

Press simultaneously on both upper corners of

the paper compartment until it clips into position

Use the serrated bar to tear off any excess paper

Correct paper position

Lift latch up

Pull cover open

Important

Always store thermal paper for your terminal in a dry, dark area.

Handle thermal paper carefully. Impact, friction, temperature, humidity and oils can affect

the colour and storage characteristics of the paper.

Never load a roll of paper that has folds, wrinkles, tears or holes at the edges of the

printarea.

Please call our Merchant help desk 1800-234-444 for stationery orders.

Communication Set-Up

11 | Fiserv Condential

Terminal communication conguration will be completed during the installation process.

Allcommunication options are available on new terminals and it is possible to switch

communication congurations.

If required, please contact the Merchant help desk on 1800-243-444 if you need assistance.

The EFTPOS terminal has the following communication options available:

Broadband internet (Ethernet Set-Up)

Broadband internet (Wi-Fi Set-Up)

Mobile 4G/3G

Integrated – Linkly (formerly PC EFTPOS) (USB and Rs232 connectivity with 4G/3G backup)

Bluetooth (pair base to terminal)

Communication Set-Up

12 | Fiserv Condential

Broadband Internet (Ethernet Set-Up)

Please ensure you have broadband internet available at your merchant site and have an Ethernet

cable supplied by Fiserv. Please contact your internet service provider to help set up broadband

internet if not available. Please ensure the terminal and base have been paired for Bluetooth (refer

section Bluetooth Set-Up (pair base to terminal) page 19).

Step 1

Plug the Ethernet cable

into the back of the

base.

Step 2

Press the Menu key.

Step 5

Select ETH to switch

the communications

option to Ethernet.

Step 3

Press 4 to select

Terminal.

Step 4

Press 4 to select

Host Comms.

Note: If Ethernet was not setup during technician visit at time of install, please contact Merchant

Services at 1800-243-444 and select terminal support for guidance on steps to setup Ethernet.

Communication Set-Up

13 | Fiserv Condential

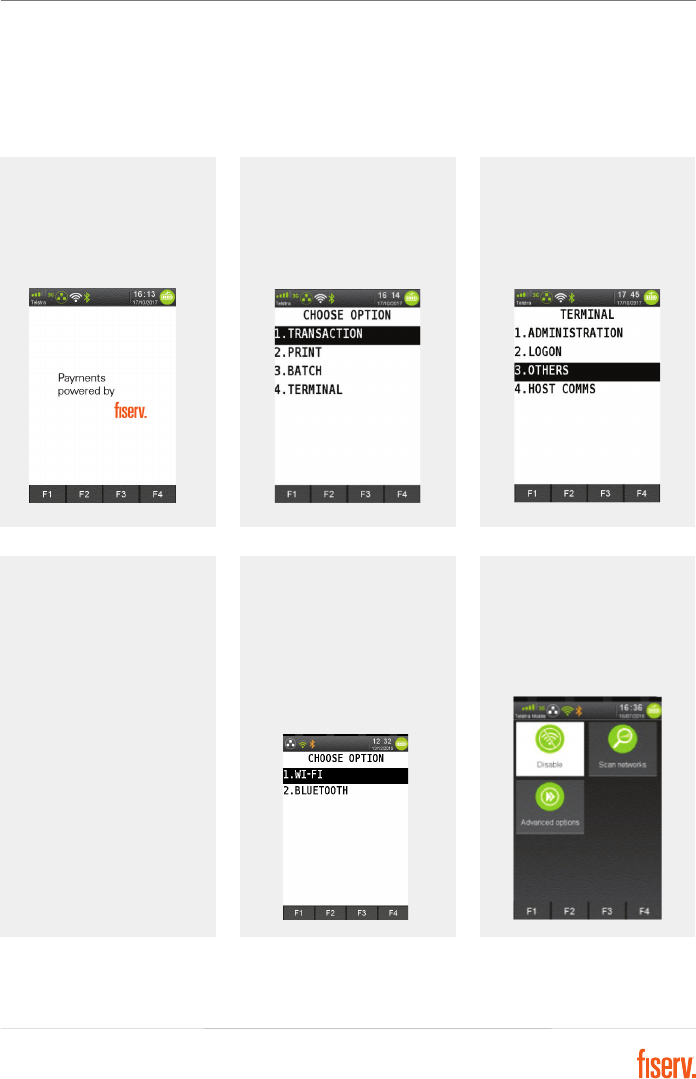

Broadband Internet (Wi-Fi Set-Up)

Please ensure you have access to a Wi-Fi network. Please contact your internet service provider

to help Set-Up if not available.

Step 1

Press the Menu key.

Step 4

Press 4 to select

4. Settings.

Step 5

Choose Option

1. Wi-Fi

2. Bluetooth

Press 1 for Wi-Fi.

Step 2

Press 4 to select

Terminal.

Step 3

Press 3 to select

Others.

Step 7

Select Scan

networks to nd

available hotspots.

Communication Set-Up

14 | Fiserv Condential

Step 8

Select the required

network.

Step 9

Use the keypad to

enter the Password

for the selected Wi-Fi

hotspot, then tap the

green button to Enter.

Step 10

When the Password is

entered correctly, the

message “New Prole

OK” displays. The Wi-Fi

symbol in the status

header of the terminal

will turn green.

Communication Set-Up

15 | Fiserv Condential

Bluetooth Set-Up (Pair Base to Terminal)

Step 1

Press the Menu key.

Step 4

Press 4 to select 4.

Settings.

Step 5

Choose Option

1. Wi-Fi

2. Bluetooth

Press 2 for Bluetooth.

Step 2

Press 4 to select

Terminal.

Step 3

Press 3 to select

Others.

Note: Your password will be set up at the time of terminal installation. If you’re unsure of your

password, please contact the Merchant help desk at 1800-243-444.

Step 8

Select Base.

Communication Set-Up

16 | Fiserv Condential

Step 12

The idle screen

re-displays with the

Bluetooth symbol in

the status header of

the terminal.

Step 10

Select New base.

Step 11

A message displays on

the terminal to warn that

the terminal will reboot.

Step 9

Select Association.

Communication Set-Up

17 | Fiserv Condential

Switching Communication Options

Step 1

Press the Menu key.

Step 2

Press 4 to select

Terminal.

Step 3

Press 4 to select

Host Comms.

Note: There will be a slight delay while the terminal connects to the new communication network.

Step 4

Use the F2 and F3

buttons to scroll to the

communication option

and press Enter.

Communication Set-Up

18 | Fiserv Condential

Communication Status

Header Bar

When the terminal is powered on, the screen displays a status header bar consisting

offoursegments:

Segment 1: Indicates status of 4G/3G connectivity and signal strength, if enabled

Segment 2: Displays Ethernet status

Segment 3: Shows status of Bluetooth or Wi-Fi connectivity and signal strength, if enabled

Segment 4: Provides terminal information such as System Date and Time, Power and

Batteryconditions

Is displayed when the terminal is powered on to indicate 4G/3G

communications is supported.

As the terminal attempts to register with the mobile communications

provider, this icon is displayed.

When the terminal registers with the network provider, it will display

this icon. A 4G/3G signal strength indicator is also displayed.

Other 4G/3G conditions that may be displayed: SIM card not detected;

SIM card locked and entry of code is required.

4G/3G

When GPRS communications is enabled, the status of the modem is displayed in Segment1:

Communication Set-Up

19 | Fiserv Condential

Ethernet is congured but not enabled.

Ethernet communications enabled.

Ethernet

The status of ‘Ethernet’ communications is displayed in Segment 3:

Bluetooth

The EFTPOS terminal supports Bluetooth communications to pass and receive data with the

base/docking station.

The status of the Bluetooth will be displayed in the statusheader:

If the terminal exceeds the maximum operating range from its base,

this icon will be displayed to indicate the Bluetooth link is broken.

When the terminal is within range of its base and the Bluetooth link

has been interrupted, this icon will be displayed until the connection is

reestablished.

When the terminal has established a Bluetooth link with its base, this

icon will be displayed.

Note: Bluetooth Connectivity complies with Bluetooth v2.1 EDR (Enhanced Data Rate) – Class.

Operating range is subject to site location and prevailing conditions: Indoor, up to 70m typically;

Outdoor, up to 250m with clear line of sight.

Operating Your EFTPOS Terminal

20 | Fiserv Condential

How to Complete a Sale

Step 1

Enter the sale amount

from idle/home screen

and press Enter. If cash

out on a sale is enabled,

a CASH button will

appear. If TIP is enabled,

a TIP button will appear.

Step 4

If prompted, allow

customer to enter their

PIN and press Enter.

Note: Contactless

transactions do not

require a PIN or

signature for amounts

under $100

*

.

Step 2

Ask customer to

Tap, Insert or Swipe

theircard.

Step 5

Once approved,

remove card if inserted

and press Yes to print

a customer receipt,

if requested.

Step 3

If prompted ask

customer to select

their account type:

Cheque, Savings

or Credit.

Operating Your EFTPOS Terminal

21 | Fiserv Condential

Sale and Cash Out Transactions

Customers may choose to get cash out by using your terminal to debit their cheque or savings

account, with or without making a purchase. Cash out is not allowed on a credit card account or

contactless transaction.

A sale with cash out transaction is shown as one total item in the settlement report and on the

monthly merchant statement.

Cash out is an optional feature. You may enable or disable this feature by contacting Merchant

Services at 1800-243-444.

Step 1

To include Cash Out

with a Purchase, enter

the sale amount from

idle/home screen and

press Enter. If cash out

on a sale is enabled,

a CASH button will

appear. Press the

CASH button.

Operating Your EFTPOS Terminal

22 | Fiserv Condential

Cash Out Only Transaction

Step 1

Press the Menu key.

Step 4

Enter the cash amount

and press Enter.

Step 2

Press 1 to select

Transaction.

Step 5

Ask customer to insert

or swipe their card.

Step 6

Ask customer to select

an account.

Step 3

Press 2 to select

Cash Out.

Operating Your EFTPOS Terminal

23 | Fiserv Condential

Step 7

Ask customer to enter

their PIN and press

Enter.

Step 10

Press Yes to print the

customer receipt, if

required.

Step 8

An Approved

acknowledgement

displays once the sale

has been successfully

processed and the

merchant receipt will be

printed automatically.

Step 9

Ask customer to

remove their card.

Operating Your EFTPOS Terminal

24 | Fiserv Condential

Tipping

Tipping is an optional feature. You may enable and disable this feature by contacting Merchant

Services at 1800-243-444.

How to Process a Refund

A refund transaction can be used for any of the following instances:

Returned goods purchased that is accepted under your returns policy

Services that are terminated or cancelled

Incorrect amount charged

Step 1

Press Menu key on

the home screen, and

press 1 for Transaction.

Step 2

Press 3 for Refund.

Step 3

Enter refund amount

and press Enter.

Operating Your EFTPOS Terminal

25 | Fiserv Condential

Step 4

Enter your refund

password and

pressEnter.

Step 5

Ask customer to insert

orswipe their card.

Step 6

Ask customer to select

their account type: Cheque,

Savings or Credit.

Note: Your password will be set up at the time of terminal installation. If you are unsure of your

password, please contact the Merchant help desk at 1800-243-444.

Step 7

Ask customer to

entertheir PIN and

press Enter.

Step 8

An Approved

acknowledgement

displays once the sale

has been successfully

processed and the

merchant receipt will be

printed automatically.

Note: Even if a PIN is entered, a signed receipt will still be required.

Operating Your EFTPOS Terminal

26 | Fiserv Condential

Void Transaction

A void can only be performed on a credit card transaction. A refund is the equivalent process

for debit transactions. You can only void a transaction prior to performing a settlement on your

terminal (this includes forced settlement). There will be no record of the transaction and it is void

in your customer’s bank account. This is because the transaction is deleted before the bank can

complete it, and no funds are removed from your customer’s account. The transaction and void

will also not appear on your terminal settlement summary for the same reason. A record of the

voided transaction will only appear on your transaction list report. If you have already settled your

terminal, the incorrect transaction must be refunded and re-processed.

Note: Please refer to your POS Vendor POS manual on how to initiate this transaction at the POS,

if in integrated mode.

Step 1

Press Menu key.

Step 2

Press 3 for Batch.

Step 3

Press 5 to select Void.

Operating Your EFTPOS Terminal

27 | Fiserv Condential

Step 4

Void

Enter INV No.

and press Enter.

Merchant to enter the

invoice number from the

receipt for the transaction

they want to void.

Step 6

An acknowledgement

will be displayed.

Step 5

Enter Void password.

Your Void password will be set-up at the time of terminal installation. If you are unsure of your

password, please contact the Merchant help desk at 1800-243-444.

Step 7

Press Yes to print

the customer receipt,

ifrequired.

Operating Your EFTPOS Terminal

28 | Fiserv Condential

Preauthorisation Processing

The preauthorisation function allows you to authorise and hold funds on a customer’s credit card

for a period of up to seven days. A preauthorisation will not debit a customer’s account until a

completion transaction is processed at a later date. Each “transaction” consists of two parts: the

preauthorisation and the completion. This facility is only available for use in certain industries,

suchas hotels or lodgings.

It is important to retain the preauthorisation merchant receipt as the preauthorisation completion

cannot be completed without the Approval Code from the receipt.

Part One: Preauthorisation

A preauthorisation transaction requests verication from a customer’s card-issuing bank for the

full value of the purchase. The customer’s bank will issue a successful preauthorisation request

with a six-digit authorisation number.

Part Two: Completion

The Completion transaction is used to process the customer’s nal payment where a

preauthorisation was processed earlier. When processing the completion request, use the

following data to retrieve the preauthorisation transaction:

The six-digit authorisation number

The invoice number and amount

The card number or date

The amount of the completion request may not exceed the preauthorisation request by more

than 15 percent. If it does, the transaction will be declined. When a completion transaction is

successful, the value will be included in the end-of-day settlement to your merchant account.

Preauthorisation is an optional feature. You may enable and disable this feature by contacting

Merchant Services at 1800-243-444.

Note: Please refer to your POS Vendor POS manual on how to initiate this transaction at the POS,

if in integrated mode.

Operating Your EFTPOS Terminal

29 | Fiserv Condential

Processing a Preauthorisation Transaction

Step 1

Press Menu key.

Step 2

Press 1 for Transaction.

Step 3

Press 3 to select

Pre-Auth.

Step 5

Enter the preauthorisation

amount and press Enter.

Step 4

In the Pre-Auth/

Completion submenu,

Press 1 for Pre-Auth.

Step 6

Ask the customer to

insert, tap or swipe

their card.

Operating Your EFTPOS Terminal

30 | Fiserv Condential

Step 7

Ask customer to enter

their PIN and Enter, or

press Enter to sign.

Step 8

An Approved

acknowledgement

displays once the sale

has been successfully

processed and the

merchant receipt

will be printed

automatically.

Step 9

Ask the customer to sign

the receipt if required.

You will need to verify

your customers’

signature.

Press Yes , if the

signature matches.

Step 10

Press Yes to print

the customer receipt,

if required.

Operating Your EFTPOS Terminal

31 | Fiserv Condential

Processing a Preauthorisation Completion

Step 1

Press Menu key.

Step 2

Press 1 for Transaction.

Step 3

Press 3 for Pre-Auth.

Step 5

Enter the completion

amount and press Enter.

Step 4

Press 2 to select

Completion.

Step 6

Enter the six, digit

Approval Code from

the merchant receipt

and press Enter.

Note: Your password will be set-up at the time of terminal installation. If you are unsure of your

password, please contact the Merchant help desk at 1800-243-444.

Operating Your EFTPOS Terminal

32 | Fiserv Condential

If the preauthorisation transaction is not found in the terminal, the customer’s credit card will

berequired.

a. Ask the customer to insert or swipe their card

b. Enter the last eight digits of the RRN from the merchant receipt and press Enter

c. Enter the preauthorisation date from the receipt in DD/MM format and press Enter

Step 7

Enter the terminal

password.

Step 8

Press Enter to conrm

key and the merchant

receipt will be printed

automatically.

Step 9

Ask the customer to sign

the receipt, if required

You will need to verify

your customers’

signature.

Press Yes , if the

signature matches.

Step 10

Press Yes to print

the customer receipt,

if required.

Operating Your EFTPOS Terminal

33 | Fiserv Condential

Surcharge

The EFTPOS terminal can add a surcharge to every contact and contactless transaction

processed. The surcharge can be either a xed dollar amount ($1.00 per transaction, for example)

or it can be a percentage of the total transaction (two percent, for example).

If required, the method of calculation and the surcharge amount can be different for different card

types. The surcharge amount is always displayed on the customer and merchant receipts.

Customers should be informed of the surcharge before the transaction is entered.

Note:Surcharge must be added to the total amount for refund transactions.

Note: Please refer to your POS Vendor Point-of-Sale manual on how to initiate this transaction at

the POS if in integrated mode.

Enabling/Disabling Surcharge

Surcharging is an optional feature. You may enable and disable this feature by contacting Merchant

Services at 1800-243-444.

Operating Your EFTPOS Terminal

34 | Fiserv Condential

Surcharge Report

Step 1

Press Menu key.

Step 4

Press OK.

Step 2

Press 4 for Terminal.

Step 3

Press 5 for

Surcharging.

Step 5

Press OK to print

surcharge summary

receipt or Cancel toexit.

Operating Your EFTPOS Terminal

35 | Fiserv Condential

Mail Order Telephone Order (MOTO)

This function is for use when processing card payments for orders received by mail or telephone

(card not present).

Mail Order and Telephone Order (MOTO) merchants are authorised to manually key credit card

transactions. The terminal will automatically default to “Credit” as the account type whenever

you manually enter card numbers. Should you attempt to manually key a debit card number,

the terminal will reject the transaction. The MOTO process is similar to a normal purchase (or

refund) that involves manually entering card details.

MOTO is an optional feature. You may enable and disable this feature by contacting Merchant

Services at 1800-243-444.

Note: Please refer to your POS Vendor POS manual on how to initiate this transaction at the POS,

if in integrated mode.

Step 1

Press Menu key.

Step 2

Press 1 for Transaction.

Step 3

Press 4 for MOTO.

Operating Your EFTPOS Terminal

36 | Fiserv Condential

Step 4

Enter the sale amount

and press Enter.

Step 5

Commence entering the

customer’s card number.

Step 6

Complete entering the

customer’s card number

and press Enter.

Step 7

Enter the card expiry

date receipt in the MMYY

format and press Enter.

Step 9

Select MOTO type and

press Enter to conrm.

Step 8

Key Entry Password?

Merchant will be prompted

for this if it has been set-up

on the TMS for their terminal.

Operating Your EFTPOS Terminal

37 | Fiserv Condential

Step 11

An acknowledgement

displays once the sale

has been approved and

the merchant receipt

will be printed.

Step 12

Press Yes to print

thecustomer receipt,

ifrequired.

Step 10

Select whether the MOTO

is a One-Off (Single),

Recurring or Instalment type.

Operating Your EFTPOS Terminal

38 | Fiserv Condential

Dynamic Currency Conversion (DCC)

Dynamic Currency Conversion (DCC) allows you to offer a customer the option to pay in their

“home” currency (for Visa and Mastercard

®

credit transactions only).

When the card is presented to the terminal, the terminal will determine whether it is eligible

for DCC and if so, will automatically prompt the merchant by loading the DCC particulars onto

thescreen.

A Typical DCC Transaction Process:

International cardholder presents a Visa or Mastercard for payment

The EFTPOS terminal determines whether the card presented for payment is an

internationalcard

If it is, determine whether the card falls into one of the eligible currencies for DCC

Obtain an exchange rate

Display the pertinent details on the screen as per below:

The AUD amount

The exchange rate

Any fees/margins/commissions being applied

The equivalent amount in the cardholder’s home currency

Merchant and cardholder receipts will be generated as usual. However, additional information will

be printed on the receipt in accordance with the scheme requirements. It is therefore mandatory

to provide the cardholder their copy of the receipt for a DCC transaction.

DCC is an optional feature. You may enable and disable this feature by contacting Merchant

Services at 1800-243-444.

Operating Your EFTPOS Terminal

39 | Fiserv Condential

Step 1

Enter sale amount from

idle/home screen and

press Enter. If cash

out on a sale is

enabled, a CASH

button will appear.

Step 4

Ask Customer to select

between AUD or

Home currency.

Step 2

Ask the customer to

tap, insert or swipe

their card.

Step 5

Ask customer to enter

their PIN or press Enter.

Step 3

Ask customer to

selecttheir account

type: Cheque, Savings

or Credit.

Step 6

An Approved

acknowledgement

displays once the sale

has been successfully

processed.

Operating Your EFTPOS Terminal

40 | Fiserv Condential

Step 7

If the PIN was

bypassed, ask the

customer to sign

the receipt. You will

need to verify your

customers’ signature.

Press Yes , if the

signature matches.

Your Merchant Solutions EFTPOS terminal

DCC receipt will look like this.

Operating Your EFTPOS Terminal

41 | Fiserv Condential

How to Print Last Receipt

This function allows a duplicate receipt to be printed for the last transaction (either approved

ordeclined).

Step 1

Press Menu key on the

home screen.

Step 4

Press 1 for Last to

reprint receipt for the

last transaction.

Step 2

Press 2 for Print.

Step 3

Press 1 for Transaction.

Operating Your EFTPOS Terminal

42 | Fiserv Condential

Reprint Specic Transaction Record (Invoice)

This function allows a duplicate receipt to be printed for a specic approved transaction from

the current batch.

Step 1

Press Menu key on the

home screen.

Step 4

Press 2 for Invoice.

Step 2

Press 2 for Print.

Step 5

Enter Invoice Number

from receipt.

Step 3

Press 1 for Transactions.

Step 6

The receipt will

be printed.

Operating Your EFTPOS Terminal

43 | Fiserv Condential

Settlement

Settlement can be initiated manually or automatically, and the net total amount for the settlement

day will be credited to the nominated bank account you have provided Fiserv.

Fiserv automatically settles transactions daily at 21:00 (AEST/AEDT). If you request for an earlier

settlement cutover time (allowed settlement cutover time is between 03:00 AEST/AEDT and

21:00 AEST/AEDT), an Automatic Settlement will occur at the nominated time.

If you want to tailor your settlement terminal cut-off time to allow for longer trading hours, please

contact the call centre at 1800-243-444.

The EFTPOS Terminal Offers the Following Settlement Functions:

1) Manual Settlement

2) Last Settlement

3) View Batch Details

4) Batch Totals

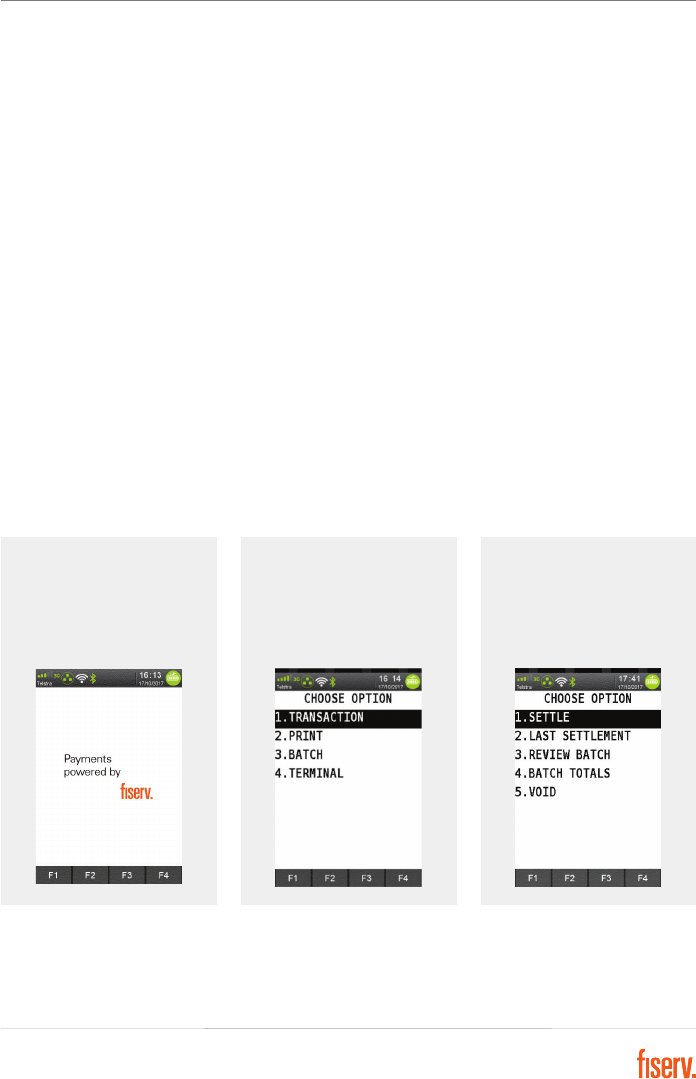

Manual Settlement

Step 1

Press Menu key.

Step 2

Press 3 for Batch.

Step 3

Press 1 to select Settle.

The settlement receipt will

be printed.

Operating Your EFTPOS Terminal

44 | Fiserv Condential

Print Settlement Totals (Pre-Settlement)

This function prints a listing of all transactions performed after the last settlement time until the

current time. A Pre-Settlement does not settle the terminal.

Note: This function is only supported in Standalone mode.

Step 1

Press Menu key.

Step 2

Press 3 for Batch.

Step 3

Press 4 to select

Batch Totals.

Operating Your EFTPOS Terminal

45 | Fiserv Condential

Print Settlement Totals (Last Settlement)

The Last Settlement function will print the total value of transactions in the last settlement period.

Note: This function is only supported in Standalone mode.

Step 1

Press Menu key.

Step 2

Press 3 for Batch.

Step 3

Press 2 for Last

Settlement.

Operating Your EFTPOS Terminal

46 | Fiserv Condential

View Batch Details on the Screen

The Review Batch function allows you to review transactions in the current batch.

Note: This function is only supported in Standalone mode.

Step 1

Press Menu key.

Step 2

Press 3 for Batch.

Step 3

Press 3 to select

Review Batch.

Step 4

Press F3 under

“INFO” to view these

three screens.

Step 5

Press F2 to go to next

transaction.

Press F1 to go back to

the previous transaction.

Step 6

Press INFO/F3 to

view each transaction

in detail.

Operating Your EFTPOS Terminal

47 | Fiserv Condential

Batch Totals

The Batch Totals function prints the total value of transactions that have occurred since the

lastsettlement.

Step 1

Press Menu key.

Step 2

Press 3 for Batch.

Step 3

Press 4 for

Batch Totals.

Transaction List

By default, the Transaction Listing does not print automatically at the time of settlement. This

applies to automatic and manual settlement. This function enables you to display a prompt atthe

time of settlement to print the Transaction Listing.

Note: When the Transaction Listing printout prompt is turned on, if you are not there at the

timeofsettlement to select Ye s or No to print, the Transaction Listing will automatically be

printed afterone to two minutes.

Note: This function is not available on your EFTPOS terminal when your terminal is integrated

with your POS.

Operating Your EFTPOS Terminal

48 | Fiserv Condential

How to Enable Transaction List

Step 1

Press the Func key.

Step 4

The prompt is turned

on. Press Cancel

toexit.

Step 2

Enter 14 using the PIN

pad and press Enter.

Step 3

Press Enter to turn on

the prompt to print the

Transaction Listing.

Operating Your EFTPOS Terminal

49 | Fiserv Condential

How to Print the Transaction List

Step 1

Press Menu key on the

home screen.

Step 4

Press 1 for Audit.

Step 2

Press 2 for Print.

Step 3

Press 2 for Reports.

Operating Your EFTPOS Terminal

50 | Fiserv Condential

Ofine Transaction Processing

Ofine transactions are those your terminal approves without contacting the card issuer. The

approved transactions are forwarded to the issuer at a later stage. Ofine transactions are

allowed for a number of reasons outlined below.

Card Rules

Certain transactions are considered low risk and do not need to be authorised online.

Transactions in this category are known as off-host transactions. Below is a list of off-host

transaction responses:

Y1 = Ofine approved

Z1 = Ofine declined

Y3 = Unable to go online approved ofine

Z3 = Unable to go online and declined ofine

Electronic Fallback

If approved by Fiserv, your EFTPOS terminal can be congured for electronic fallback mode.

The EFTPOS terminal will enter electronic fallback mode if there is a problem transmitting the

transaction to the card issuer. This could be due to a communications error or dueto the issuer

being unavailable.

These transactions are known as electronic fallback (EFB) transactions. All EFB transactions

require signature conrmation and will be approved with a response code of “08 Approved

withsignature”.

Transactions above the oor limit will prompt the user to enter an authorisation number. You can

obtain an authorisation for EFB transactions by contacting the help desk at 1800-243-444. Please

note that in EFB mode, the terminal may prompt the customer to enter their PIN and provide

theirsignature. In all cases, please follow the prompts on your terminal.

Electronic fallback is an optional feature. You may enable and disable this feature by contacting

Merchant Services at 1800-243-444.

Operating Your EFTPOS Terminal

51 | Fiserv Condential

Additional Terminal Functions

Below are the additional functions you can complete on your EFTPOS terminal.

Note: These are only available on the terminal in Standalone mode.

Step 1

Press the Func key.

Step 2

Press corresponding

function number from

table below.

Step 3

Press Enter.

Function

Number

Function Name Description

1 View Batch

5 Display Transaction Totals

Allows you to display the “Number” and “Total

Amount” of Sales, Refunds, Tips and Cash-out

transactions performed in the current settlement

batch period

8 View Batch Number Allows you to view the current Batch Number

21

View Transaction By

InvoiceNumber

Allows you to view a specic transaction in the

current batch by entering the invoice number

58 Print Tip Report

Print the tip report for any tipped transactions

processed since the last report was produced

70 Reprint Last Settlement Print the last settlement report

71

Reprint Last Settlement

From Host

Print the last settlement report from the Host

(requires settlement password)

72

Reprint Last Transaction

Record

Print a duplicate of the last transaction that was

either approved or declined

73

Reprint Specic

TransactionRecord

Print a duplicate of the last approved transaction

from the current batch

74 View Host Totals

Provides details of transaction totals grouped by

transaction type and card type

75 View Transaction List

Provides details of transactions performed in the

current settlement period

120 Display Auto Settlement Time Displays the next auto settlement date and time

Fiserv, Inc.

30th Floor,100 Mount Street,

North Sydney

NSW 2060, Australia

Connect With Us

Fiserv is driving innovation in Payments,

Processing Services, Risk & Compliance,

Customer & Channel Management and

Insights & Optimization. Our solutions

help clients deliver nancial services at the

speed of life to enhance the way people

live and work today.

Visit serv.com to learn more.

For more information about

Ingenico Move 5000 Terminal:

1800-243-444/1800-372-838

merchantservicesAU@

rstdata.com

merchants.serv.com/en_au

© 2021 Fiserv, Inc. or its afliates. Fiserv is a trademark of

Fiserv, Inc., registered or used in the United States and foreign

countries, and may or may not be registered in your country. All

trademarks, service marks, and trade names referenced in this

material are the property of their respective owners. 711844 03/21