MOTOR VEHICLE

REGISTRATION MANUAL

i

Contact information

MOTOR VEHICLE DIVISION (Central Oce)

NORTH DAKOTA DEPARTMENT OF TRANSPORTATION

608 East Boulevard Avenue

Bismarck, North Dakota 58505-0780

Telephone: 701-328-2725 • Fax: 701-328-1487

for Motor Vehicle Branch sites hours and locations go to:

https://www.dot.nd.gov/dotnet2/view/mvsites.aspx

Registration Manual Disclosure

This manual provides information on how certain activities are performed and is designed to

guide and assist individuals in performing registration and titling functions. When appropriate,

there may be deviations from these written procedures due to changes in policies, interpretation,

law, or evolution of vehicle types. This manual may be changed at any time.

ii

Rev. 09/14/23

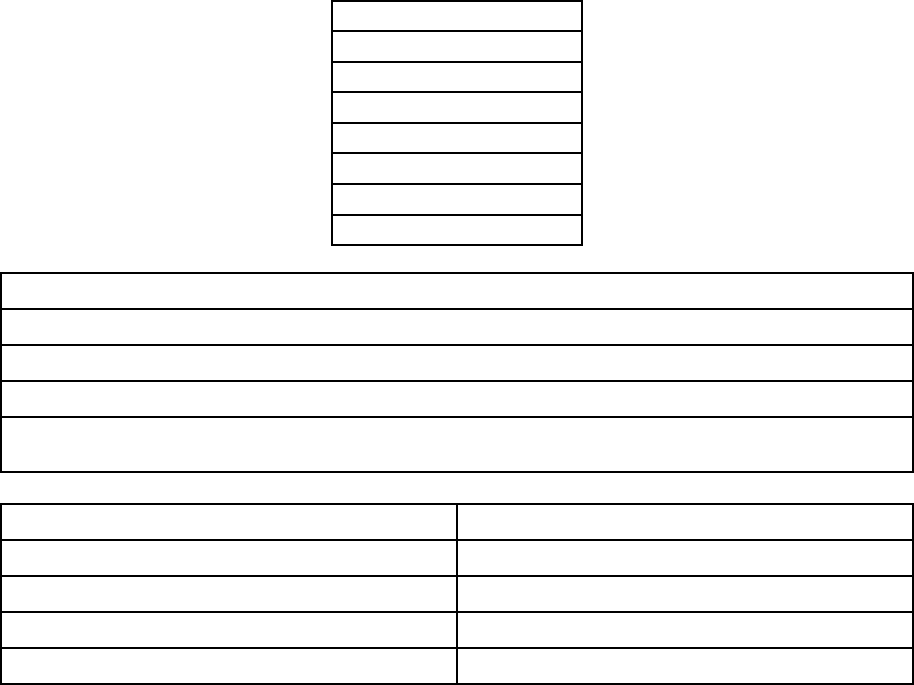

Where do my vehicle registration fees go?

Cities

Counties

Department of

Transportation

14 %

23%

63%

Highway Distribution Fund

iii

TABLE OF CONTENTS

Section I: Certicate of Title and Registration ..................................................................................... 1

Abandoned Motor Vehicle Disposal Fee: 23.1-15-11 (NDCC) ..................................................................................2

Air Bags: ....................................................................................................................................................................2

Amateur Radio Operator: 39-04-10 (NDCC) .............................................................................................................2

Ambulance: 39-04-19 Subsection 2(a), 39-10-26 (NDCC) ........................................................................................2

Antique: 39-04-10.4 (NDCC) .....................................................................................................................................3

Boat License: ............................................................................................................................................................3

Buses: 39-01-01 Subsection 4 (NDCC).....................................................................................................................3

Collector Vehicle: 39-04-10.6 (NDCC).......................................................................................................................6

Damage Disclosure: 39-05-17.2 (NDCC) (See Damaged Vehicle and Salvage Certicate of Title) .........................6

Damaged Vehicle: 39-05-17.2, 39-05-20.1, 39-05-20.2 (NDCC) .............................................................................8

Defacement: 39-05-09.1, 39-15-11 (NDCC) ..............................................................................................................8

Disabled American Veteran (DAV): 39-01-15 (NDCC), 39-04-18 Subsection 2(j) (NDCC)

and 57-40-3-04(1) (NDCC) ....................................................................................................................................9

Driver Education Vehicle: 39-04-18 Subsection 2(b) (NDCC) ................................................................................... 9

Duplicate Decal: 39-04-13 (NDCC) ...........................................................................................................................9

Duplicate Plate: 39-04-13 (NDCC) ............................................................................................................................9

Duplicate Registration Card: 39-04-13 (NDCC) ......................................................................................................10

Duplicate Certicate of Title: 39-05-09.1 (NDCC)....................................................................................................10

Electric and Plug-in Hybrid Vehicle Road Use Fee: 39-04-19.2 (NDCC) ................................................................10

Estate: 30.1-23-01 (NDCC) .....................................................................................................................................10

Farm Truck: 39-04-19 Subsection 5, 39-04-26 (NDCC) .......................................................................................... 11

FFA Foundation Number Plate: 39-04-10.12 (NDCC) ............................................................................................. 11

Fireghter’s Association License Plate: 39-04-10.11 (NDCC) ................................................................................. 11

Fleet Registration: 39-04-12 Subsection 2 (NDCC) (See Trailers) ..........................................................................12

Gold Star Number Plate: 39-04-10.14 (NDCC) ......................................................................................................12

Government: 39-04-18 Subsection 2(d) (NDCC) ....................................................................................................12

Hearse: 39-04-19 Subsection 2(a) (NDCC).............................................................................................................13

Heavy Vehicle Use Tax: 39-04-05 Subsection 8 (NDCC) ........................................................................................13

House Mover: 39-04-18 Subsection 2(l) (NDCC) .................................................................................................... 14

Imported Vehicle: .....................................................................................................................................................14

Insurance Requirements: ........................................................................................................................................14

Leased Motor Vehicle: 39-04-19, 57-40.3 (NDCC)..................................................................................................15

Legal Name: 39-04-02 Subsection 1, 39-05-05 Subsection 1(f) (NDCC)................................................................16

Lemon Law: 51-07-16, 51-07-17, 51-07-18, 51-07-18.1, 51-07-19, 51-07-20, 51-07-21,

and 51-07-22 (NDCC) .........................................................................................................................................16

Low-Speed Vehicle: 39-29.1 (NDCC) ......................................................................................................................17

Manufactured Home: 39-05-35 (NDCC) ..................................................................................................................17

Mobile Home: 39-01-01 Subsection 45, 39-05-01, 39-18-03 (NDCC).....................................................................18

Mobility-Impaired License Plate and Parking Permit: 39-01-15, 39-04-10.2 (NDCC) .............................................18

Moped: 39-01-01 Subsection 48, 39-10.2 (NDCC) .................................................................................................19

Motor Home: 39-01-01 Subsection 31, 39-04-19 Subsection 2(a) (NDCC) ............................................................20

Motorcycle: 39-01-01 Subsection 48, 39-04-14.4, 39-04-10.3, 39-04-19 (NDCC) .................................................. 20

National Guard Plate: 39-04-10.8 (NDCC) .............................................................................................................. 21

New Vehicle: 39-04-02 Subsection 3, 39-05-05 Subsection 3 and 4 (NDCC) .......................................................21

Odometer Disclosure: 39-05-05 Subsection 1(g) (NDCC) ......................................................................................22

O-Highway: 39-29-01, 39-29-03, 39-29-09, 39-29-09.1 (NDCC) ..........................................................................22

Organizational Plate: 39-04-10.13 (NDCC) ............................................................................................................. 24

iv

Out-of-State Vehicle: 39-04-18 Subsection 2(c)(e), 39-04-21 (NDCC) ...................................................................24

Park Model Trailer: 39-18-03.2, 57-55-10 Subsection 2 (NDCC) ............................................................................ 25

Passenger: 39-01-01 Subsection 59, 39-04-15, 39-04-18 Subsection 2(c)(e) (NDCC) ..........................................25

Patriotic Plate: NDCC 39-04-10.15..........................................................................................................................25

Permits: 39-04-18.2, 39-04-18 Subsection 2(f), 39-04-21, 39-04-36 (NDCC) .........................................................26

Personalized Plate: 39-04-10.3 (NDCC) .................................................................................................................29

Plate With Owner: 39-04-36 (NDCC) ......................................................................................................................30

Power of Attorney (POA) .........................................................................................................................................31

Prisoner of War (POW): 39-04-10.5, 39-04-18 Subsection 2(o) (NDCC) ................................................................ 31

Purple Heart Plate: 39-04-18 Subsection 2 (NDCC) ...............................................................................................31

Rebuilt or Reconstructed Vehicle: 39-01-01 Subsection 70, 39-04-02 Subsection 2, 39-05-05

Subsection 1(e), 39-05-20.2 Subsection 2, 39-21-45.1 (NDCC) ......................................................................... 32

Registration Renewal: 39-04-14, 39-04-14.1, 39-04-18 Subsection 1, 39-04-19 Subsection 2 (NDCC) ................32

Repairman’s Lien: 35-13, 39-05-19, 39-05-20 (NDCC) ........................................................................................... 33

Repossession: 39-05-19, 39-05-20.3 Subsection 3 (NDCC)...................................................................................34

Salvage Certicate of Title: 39-04-44, 39-05-20.1, 39-05-20.2 (NDCC) ..................................................................34

Snowmobile: 39-24 (NDCC) .................................................................................................................................... 35

Soil Conservation: 39-04-19.1 (NDCC) ...................................................................................................................35

Special Mobile Equipment: 39-01-01(84), 39-04-18 Subsection 2(a) (NDCC) ........................................................36

Stack Mover: 39-12-04 Subsection 1(d) (NDCC) ....................................................................................................36

Staggered Registration: 39-04-14.2 (NDCC)...........................................................................................................36

Tax: Vehicle Excise 57-40.3 (NDCC) .......................................................................................................................36

Title Transfer: (North Dakota Certicate of Title) 39-04-06 Subsection 9, 39-04-36, 39-05-16.1,

39-05-17 (NDCC) ................................................................................................................................................39

Trailers: 39-01-01 Subsection 97, 39-04-11, 39-04-19 Subsection 4 and 5,

39-04-26 (NDCC) ................................................................................................................................................40

Truck: 39 -01-01 Subsection 81 and 99, 39-04-19 Subsection 2(b), 39-04-26, 39-12-05,

39-04-23 (NDCC) ................................................................................................................................................44

Trust: (North Dakota Certicate of Title) 39-05-17, 57-40.3-04 Subsection 5 (NDCC) ............................................47

Unconventional Vehicle: 39-29.2-01, 39-29.2-03, 39-05-05 (NDCC) ......................................................................47

Untitled Vehicle: ND Admin. Rule Ch. 37-12-04-01 ................................................................................................. 47

Untitled O-Highway & Low-Speed Vehicle: ND Admin. Code 37-12-04-01 ........................................................... 49

Veterans’ Number Plate: 39-04-10.10 (NDCC) .......................................................................................................50

Volunteer Emergency Responder: 39-04-10.16 (NDCC) ........................................................................................50

Well Driller: 39-04-18 Subsection 2 (L) (NDCC) ...................................................................................................... 51

Title & Registration Forms ................................................................................................................... 53

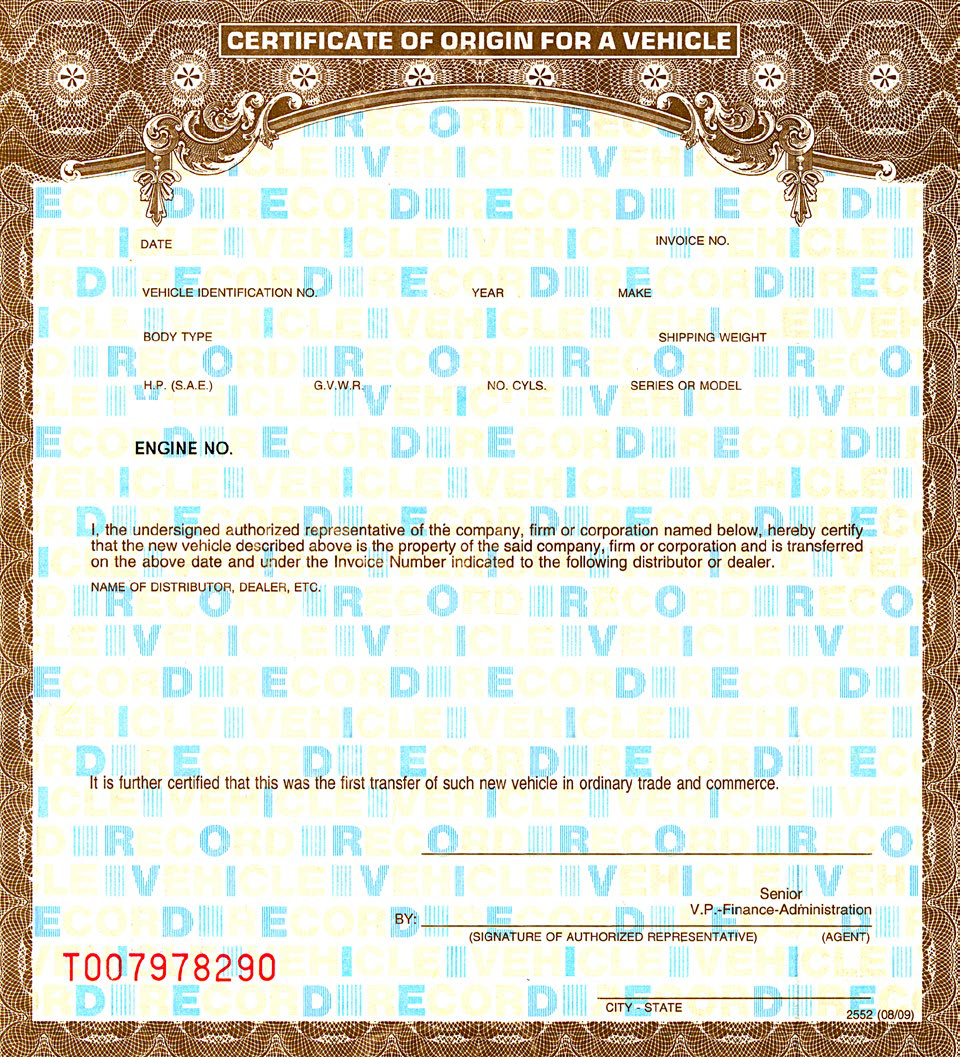

Certicate of Origin for a Vehicle (page 1)...............................................................................................................54

Certicate of Origin for a Vehicle (page 2)...............................................................................................................55

Section II: Compliance & Dealer Services.......................................................................................... 57

Dealer’s License Requirements ..............................................................................................................................59

Dealer Plate Usage: 39-22-17 (NDCC) ...................................................................................................................60

Manufacturer’s Plate: 39-04-10.1 (NDCC) ..............................................................................................................61

Rental Motor Vehicle ...............................................................................................................................................61

Sale of a Motor Vehicle............................................................................................................................................62

Section III: Motor Carrier Services ...................................................................................................... 65

Motor Carrier Vehicle ..............................................................................................................................................67

Transporter Certicate: 39-04-44.1 (NDCC) ............................................................................................................68

Forms List ............................................................................................................................................. 69

1

SECTION I

CERTIFICATE OF TITLE

AND REGISTRATION

2

Abandoned Motor Vehicle Disposal Fee: 23.1-15-11 (NDCC)

A. Fee of $1.50 applies to all new and out-of-state vehicles except mobile homes, motorcycles, snowmobiles, o-

highway vehicles, travel trailers, and all other trailers.

B. Fee applies only upon initial application for North Dakota Certicate of Title for a Vehicle.

NOTE: For more information contact the North Dakota Department of Environmental Quality, 918 E.Divde Ave,

4th Floor, Bismarck, North Dakota 58501; phone: 701-328-5150.

Air Bags:

Contact the following administration for rules on air bags:

Attention: Air Bag Switch Requests

National Highway Trac Safety Administration

400 7th Street, Southwest

Washington, DC 20590-1000

Amateur Radio Operator: 39-04-10 (NDCC)

A. License as a passenger vehicle using passenger fee schedule or as a truck using the truck fee schedule.

B. Certicate of title fee is $5.

C. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of

title.

D. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

E. Amateur radio plates bearing the owner’s call letters are issued.

F. Copy of current FCC card must be submitted or on le with the Motor Vehicle Division.

G. No service charge rst time plates are issued; however, a service charge of $5 is due each time plates are

transferred to another vehicle.

H. Amateur radio license plates must be transferred to a replacement vehicle upon selling or trading the vehicle.

I. Duplicate amateur radio plates are $5.

Ambulance: 39-04-19 Subsection 2(a), 39-10-26 (NDCC)

A. GOVERNMENT OWNED: 39-04-18 Subsection 2(d) (NDCC)

1. License fee is $5.

3. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate

of title.

4. Motor vehicle excise tax is NOT due.

5. Government plates are issued.

6. Current year plates can be transferred to replacement vehicle at no additional cost. Plate number being

transferred must be listed on the application.

B. PRIVATELY OWNED:

1. License as passenger vehicle using the passenger fee schedule.

2. Certicate of title fee is $5.

3. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate

of title.

4. Eective for purchases made on or after April 18, 2007, motor vehicle excise tax is NOT due provided the

motor vehicle was originally manufactured for use as an ambulance when purchased by the operator of an

emergency medical services operation.

3

Antique: 39-04-10.4 (NDCC)

A. Vehicle must be 40 years old or older. (Cars, trucks, motorcycles, and motor homes.)

B. License fee is $10. Antique plates are issued.

C. Certicate of title fee is $5.

D. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of

title.

E. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

F. Seller’s Certicate and Vehicle Bill of Sale (SFN 2888) and Certicate of Vehicle Inspection (SFN 2486) may

be used as proof of ownership if no certicate of title is available.

G. License is valid for life of vehicle.

H. Personalized plates may be purchased for a one-time fee of $100.

I. License plates from the year of manufacture of the vehicle or in the case of military vehicles, military

identication numbers may be displayed in lieu of the antique plates issued by the division. The license plates

from the year of manufacture or military identication numbers must be clean and legible and must be restored

and approved by the division.

J. The plate number from the year of manufacture or military identication numbers may not be used in lieu of a

distinctive number plate when it would create a duplication of a number in the record keeping system of the

department.

K. A vehicle registered as an antique may not be used in the routine functions of a business or farming

operations.

Boat License:

Obtained from the North Dakota Game and Fish Department, 100 North Bismarck Expressway, Bismarck, North

Dakota 58501-5095; phone: (701) 328-6300; Web site: http://gf.nd.gov (See Trailers, Boat Trailer)

Buses: 39-01-01 Subsection 4 (NDCC)

A. BUS CONVERTED TO A MOTOR HOME. (See Motor Home)

B. GOVERNMENT BUS: 39-04-19 Subsection 2(a) (NDCC)

1. Out of state Registered Bus coming into North Dakota. Each bus should have a sticker from the

manufacturer located on the bus that lists the VIN number and the Gross Vehicle Weight Rating (GVWR).

We will accept a photo of the sticker to obtain the Gross Vehicle Weight.

a. If the sticker is illegible, the process would be to require a weight ticket, and add the weight of the

passengers (adults: 175 lbs, children: 150 lbs.) multiplied by the number of passengers (we would have

to ask for this information) rounded o to the next ton.

2. Certicate of title fee is $5.

3. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate

of title.

4. Motor vehicle excise tax is NOT due.

5. Government plates are issued.

C. INTERSTATE BUS: Multi-State Use, 39-04-19 Subsection 2(b) (NDCC)

1. Interstate bus pays a percentage of license fees to each state in which they operate.

2. License fees are computed and collected ONLY by the Motor Carrier Section of the Motor Vehicle Division,

North Dakota Department of Transportation, Bismarck, North Dakota 58505. Phone: (701) 328-2725.

4

D. INTRASTATE BUS: 39-04-19 Subsection 2(b) (NDCC)

1. License fees are based on the Gross Vehicle Weight Rating (GVWR). The truck fee schedule is used.

2. Out of state Registered Bus coming into North Dakota. Each bus should have a sticker from the

manufacturer located on the bus that lists the VIN number and the Gross Vehicle Weight Rating (GVWR).

We will accept a photo of the sticker to obtain the Gross Vehicle Weight.

a. If the sticker is illegible, the process would be to require a weight ticket, and add the weight of the

passengers (adults: 175 lbs, children: 150 lbs.) multiplied by the number of passengers (we would have

to ask for this information) rounded o to the next ton.

3. Certicate of title fee is $5.

4. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate

of title.

5. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

E. MOBILITY IMPAIRED AND SENIOR CITIZENS BUS: 39-04-19 Subsection 2(b) (NDCC)

1. License fees are based on the Gross Vehicle Weight Rating (GVWR). The truck fee schedule is used.

2. Out of state Registered Bus coming into North Dakota. Each bus should have a sticker from the

manufacturer located on the bus that lists the VIN number and the Gross Vehicle Weight Rating (GVWR).

We will accept a photo of the sticker to obtain the Gross Vehicle Weight.

a. If the sticker is illegible, the process would be to require a weight ticket, and add the weight of the

passengers (adults: 175 lbs, children: 150 lbs.) multiplied by the number of passengers (we would have

to ask for this information) rounded o to the next ton.

3. Certicate of title fee is $5.

4. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate

of title.

5. Motor vehicle excise tax is NOT due.

F. NONPROFIT ORGANIZATION BUS: (Religious, Charitable, or Fraternal) 39-04-19 Subsection 2(b) (NDCC)

1. License fees are based on the Gross Vehicle Weight Rating (GVWR). The truck fee schedule is used.

Vehicle may not be used for commercial activity.

2. Out of state Registered Bus coming into North Dakota. Each bus should have a sticker from the

manufacturer located on the bus that lists the VIN number and the Gross Vehicle Weight Rating (GVWR).

We will accept a photo of the sticker to obtain the Gross Vehicle Weight.

a. If the sticker is illegible, the process would be to require a weight ticket, and add the weight of the

passengers (adults: 175 lbs, children: 150 lbs.) multiplied by the number of passengers (we would have

to ask for this information) rounded o to the next ton.

3. Certicate of title fee is $5.

4. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate

of title.

5. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

G. SCHOOL BUS: 39-04-19 Subsection 2(b) (NDCC)

1. GOVERNMENT SCHOOL BUS: 39-04-18 Subsection 2(b) (NDCC)

a. License fee is $5, plus.

b. Certicate of title fee is $5.

c. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota

certicate of title.

d. Motor vehicle excise tax is NOT due.

e. Government plates are issued.

5

f. Current year plates can be transferred to a replacement vehicle at no additional cost. Plate number

being transferred must be listed on the application.

2. PRIVATELY-OWNED SCHOOL BUS: 39-04-19 Subsection 2(b) (NDCC)

a. License fees are based on the Gross Vehicle Weight Rating (GVWR). The truck fee schedule is used.

b. An out of state registered bus coming into North Dakota. Each bus should have a sticker from

the manufacturer located on the bus that lists the VIN number and the Gross Vehicle Weight Rating

(GVWR). We will accept a photo of the sticker to obtain the Gross Vehicle Weight.

(1) If the sticker is illegible, the process would be to require a weight ticket, and add the weight of the

passengers (adults: 175 lbs, children: 150 lbs.) multiplied by the number of passengers (we would

have to ask for this information) rounded o to the next ton.

c. Certicate of title fee is $5.

d. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota

certicate of title.

e. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

f. Bus may not be used for purposes other than transporting school children to school-related activities.

3. PAROCHIAL OR PRIVATE NONPROFIT SCHOOL BUS: 39-04-19 Subsection 2(b) (NDCC)

a. License fees are based on the Gross Vehicle Weight Rating (GVWR). The truck fee schedule is used.

b. Out of state Registered Bus coming into North Dakota. Each bus should have a sticker from

the manufacturer located on the bus that lists the VIN number and the Gross Vehicle Weight Rating

(GVWR). We will accept a photo of the sticker to obtain the Gross Vehicle Weight.

(1) If the sticker is illegible, the process would be to require a weight ticket, and add the weight of the

passengers (adults: 175 lbs, children: 150 lbs.) multiplied by the number of passengers (we would

have to ask for this information) rounded o to the next ton.

c. Certicate of title fee is $5.

d. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota

certicate of title.

e. Motor vehicle excise tax is NOT due.

f. Bus may not be used for purposes other than transporting school children to school-related activities.

6

Collector Vehicle: 39-04-10.6 (NDCC)

A. Vehicle must be 25 years old or older. A collector vehicle can only be operated on public streets and highways

for the purpose of driving the vehicle to and from active entry and participation in parades, car shows, car

rallies, other public gatherings held for the purpose of displaying or selling the vehicle, and to and from service

or storage facilities.

B. License fee is $60. (See Personalized Plate). A set of personalized plates is available for a one-time fee of

$160. A set of collector plates is issued.

C. Certicate of title fee is $5.

D. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of

title. (See Abandoned Motor Vehicle Disposal Fee)

E. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

F. When registering a collector vehicle the applicant shall le an Adavit of Use for a Collector Motor Vehicle

(SFN 16783) with the division which stating the owner’s name and address, the make, year, and the

manufacturer’s identication number of the vehicle, and a statement that the vehicle is owned and operated

solely as a collector’s item and not for general transportation purposes.

G. License plates from the year of manufacture of the vehicle may be displayed in lieu of the collector plates

issued by the division. The license plates from the year of manufacture must be clean and legible and must be

restored and approved by the division. The plate number may not be duplicated.

H. PENALTY: Any person violating this section or a department rule regarding this section forfeits the right to the

registration provided in this section and any registration fees that have been paid.

Damage Disclosure: 39-05-17.2 (NDCC) (See Damaged Vehicle and Salvage Certicate of

Title)

A. The damage disclosure law includes passenger cars, trucks, pickup trucks, motorcycles, motor homes and

unconventional vehicles that are less than nine years old. It EXCLUDES all trailers, o-highway vehicles, and

snowmobiles. A Damage/Salvage Disclosure Statement (SFN 18609) must be completed.

B. Motor vehicle body damage disclosure requirements apply only to the transfer of certicate of title on vehicles

of a model year released in the current calendar year and those vehicles of a model year manufactured in

the seven years before the current calendar year. When a motor vehicle has been subject to this disclosure

requirement and more than eight years have elapsed since the date of manufacture, the holder of the

certicate of title with the damage disclosure may have the disclosure removed and a new certicate of title

issued for a fee of $5. The disclosure can only be removed if the vehicle has no prior “SALVAGE” history.

C. As used in this section, “motor vehicle body damage” means a change in the body or structure of a motor

vehicle, generally resulting from a vehicular crash or accident, including loss by re, vandalism, weather, or

submersion in water, resulting in damage to the motor vehicle which equals or exceeds the greater of $10,000

or 25 percent of the pre-damage retail value of the motor vehicle as determined by the National Automobile

Dealers Association Ocial Used Car Guide. The term does not include body or structural modications,

normal wear and tear, glass damage, hail damage, or items of normal maintenance and repair.

D. A person repairing, replacing parts, or performing body work on a motor vehicle that is less than nine years

old shall provide a statement to the owner of the motor vehicle when the motor vehicle has sustained motor

vehicle body damage requiring disclosure under this section. The owner shall disclose this damage when

ownership of the motor vehicle is transferred. When a vehicle is damaged in excess of 75 percent of its retail

value, as determined by the National Automobile Dealers Association Ocial Used Car Guide, the person

repairing, replacing parts, or performing body work on the motor vehicle that is less than nine (9) years old

shall also advise the owner of the motor vehicle that the owner of the vehicle must comply with section

39-05-20.2.

E. The amount of damage to a motor vehicle is determined by adding the retail value of all labor, parts, and

material used in repairing the damage. When the retail value of labor has not been determined by a purchase

in the ordinary course of business, for example, when the labor is performed by the owner of the vehicle, the

retail value of the labor is presumed to be the product of the repair time, as provided in a generally accepted

auto body repair at rate manual, multiplied by $35.

7

F. DAMAGE DISCLOSURE will not be required on the following transactions:

1. Certicate of title transfer into North Dakota from out-of-state if there is no ownership change.

2. Certicate of title transfer when one existing owner is retained.

3. Repossession if the ownership is being transferred to the lien holder.

4. Change of a name by marriage.

G. A person who violates this section or rules adopted pursuant to this section is guilty of a Class A misdemeanor.

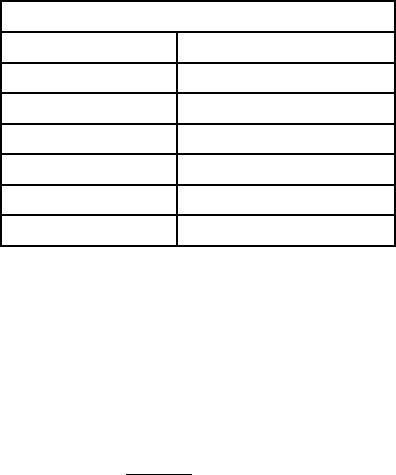

DAMAGE DISCLOSURE

YEAR YEAR MODEL

2022 2015 and newer

2023 2016 and newer

2024 2017 and newer

2025 2018 and newer

2026 2019 and newer

2027 2020 and newer

DAMAGE DISCLOSURE FORMULA

1. Calculate 25% of the retail value of the vehicle at the time the vehicle was damaged.

2. Which is the higher amount - 25% of the retail value of the vehicle or $10,000?

3. What is the amount of the assessed damage?

4. The assessed damage amount must be greater than the higher amount from step 2 to be

damaged vehicle.

EXAMPLE 1 EXAMPLE 2

1. $15,000 (retail value) * 25% = $3,750 1. $50,000 (retail value) * 25% = $12,500

2. $3,750 OR $10,000 = $10,000 is higher 2. $12,500 OR $10,000 = $12,500 is higher

3. Assessed damage is $7,000 3. Assessed damage is $13,000

4. Check NO on damage disclosure form 4. Check YES on damage disclosure form

8

Damaged Vehicle: 39-05-17.2, 39-05-20.1, 39-05-20.2 (NDCC)

A. A vehicle being transferred into North Dakota with a branded certicate of title will be issued a branded North

Dakota certicate of title.

B. North Dakota will not accept a certicate of title for a vehicle from any other state or foreign country that is

branded “CERTIFICATE OF DESTRUCTION,” “DISMANTLED,” “JUNK,” “NON-REBUILDABLE,” “PARTS

ONLY,” “UNREPAIRABLE,” or any other similar notation.

C. A certicate of title branded as salvage will be accepted.

D. A certicate of title issued for a damaged vehicle will have one of the following brands:

1. THIS VEHICLE HAS BEEN PREVIOUSLY DAMAGED. IF YOU REQUIRE FURTHER INFORMATION,

PLEASE CONTACT THE DOT.

2. SALVAGE VEHICLE - VEHICLE INSPECTION REQUIRED PRIOR TO REGISTRATION.

3. PREVIOUSLY SALVAGED - THIS VEHICLE HAS BEEN PREVIOUSLY DAMAGED. IF YOU REQUIRE

FURTHER INFORMATION, PLEASE CONTACT THE DOT.

Defacement: 39-05-09.1, 39-15-11 (NDCC)

A. When a part of a certicate of title or application for a certicate of title has been defaced or altered, a

notarized adavit must be submitted. The adavit must state a reason for the defacement or alteration.

Statement of Error, Correction, or Alteration (SFN 2964) must be completed.

9

Disabled American Veteran (DAV): 39-01-15 (NDCC), 39-04-18 Subsection 2(j) (NDCC)

and 57-40-3-04(1) (NDCC)

A. Letter from the Veterans Aairs oce attesting eligibility under Public Law 663 of the 79th Congress, as

amended, or a 100 percent service-connected disability, or having an extra-schedular rating to include

unemployability to a rating of 100 percent service-connected disability, as veried by the Department of

Veterans Aairs, is required when rst applying for DAV license.

B. A qualied veteran is eligible for no more than two vehicles at any one time. A passenger, truck, motorcycle,

or any motor home not exceeding 26,000 pounds [11793.40 kilograms] registered gross weight may be

registered with DAV plates.

C. No license fee is required. License is renewed January 1 each year.

D. Certicate of title fee is $5.

E. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of

title.

F. Motor vehicle excise tax is NOT due. A qualied veteran may lease a vehicle and remain exempt from motor

vehicle excise tax.

G. DAV plates are issued. A vehicle with DAV plates may park in a mobility-impaired zone; in addition, mobility-

impaired DAV license plates are also available. Plates must be transferred to the replacement vehicle. No

plate transfer fee is assessed.

H. When a DAV vehicle is resold, applicable registration fees are due from date of sale.

I. A surviving spouse may apply or retain retain the DAV excise tax exemption and registration exemption for

one vehicle. The surviving spouse can apply or retain the DAV, standard, vanity, or any other distinctive plate

purchased from the department. A letter from the Veterans Aairs oce attesting eligibility is required.

J. A Disabled American Veteran may choose to receive standard, vanity, or any other distinctive plates instead of

DAV plates. They receive the DAV tax and registration exemptions.

Driver Education Vehicle: 39-04-18 Subsection 2(b) (NDCC)

A. Vehicle is to be used for Drivers’ Education and training program only and must be titled in the name of the

school district. Government license plates are issued.

B. License fee is $5.

C. Certicate of title fee is $5.

D. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of

title.

E. Motor vehicle excise tax is NOT due.

F. Current year plates must be transferred to replacement vehicle. Plate number being transferred must be on

the application.

G. Any violations are a Class B misdemeanor.

Duplicate Decal: 39-04-13 (NDCC)

A. Fee is $3.

B. Application for Certicate of Title and Registration of a Vehicle (SFN 2872) must indicate appropriate duplicate,

the reason for the duplicate, and must be signed by the registered owner.

C. Decals and a registration card will be issued.

Duplicate Plate: 39-04-13 (NDCC)

A. Fee is $5.

B. Application for Certicate of Title and Registration of a Vehicle (SFN 2872) must indicate appropriate duplicate,

the reason for the duplicate, and must be signed by the registered owner.

C. A set of license plates, decals, and registration card will be issued.

10

Duplicate Registration Card: 39-04-13 (NDCC)

A. Fee is $2.

B. Application for Certicate of Title and Registration of a Vehicle (SFN 2872) must indicate appropriate duplicate,

the reason for the duplicate, and must be signed by the registered owner.

C. Registration card will be issued.

Duplicate Certicate of Title: 39-05-09.1 (NDCC)

A. Fee is $5.

B. Application for Certicate of Title and Registration of a Vehicle (SFN 2872) must indicate appropriate duplicate,

the reason for the duplicate, and must be signed by the registered owner or legal owner.

C. A duplicate certicate of title will contain the following legend: “This is a duplicate certicate and may be

subject to the rights of a person under the original certicate.”

D. A duplicate certicate of title will be mailed to the lien holder named. If there is no lien holder, a duplicate

certicate of title will be mailed to the owner.

E. If the Motor Vehicle Division record shows a lien, the certicate of title must be mailed to the lien holder unless

a lien release is provided, Release of Lien by Legal Owner (SFN 2876).

Electric and Plug-in Hybrid Vehicle Road Use Fee: 39-04-19.2 (NDCC)

A. An electric vehicle road use fee is $120 for each electric vehicle registered will be in addition to the annual

registration fee. “Electric vehicle” means a vehicle propelled by an electric motor powered by a battery or other

electric device incorporated into the vehicle and not propelled by an engine powered by the combustion of a

hydrocarbon fuel, including gasoline, diesel, propane, or liquid natural gas.

B. A plug-in hybrid vehicle road use fee is $50 for each plug-in hybrid vehicle registered. “Plug-in hybrid vehicle”

means a vehicle drawing propulsion energy from an internal combustion engine, an energy storage device,

and a receptacle to accept grid electricity.

C. An electric motorcycle road use fee is $20 for each electric motorcycle registered. “Electric motorcycle”

means a motor vehicle that has a seat or saddle for the use of the rider, is designed to travel on not more than

three wheels in contact with the ground, and is propelled by an electric motor powered by a battery or other

electric device incorporated into the vehicle and not propelled by an engine powered by the combustion of a

hydrocarbon fuel, including gasoline, diesel, propane, or liquid natural gas.

D. The road use fees will be collected at the beginning of each annual registration period, non-transferrable, and

deposited into the highway tax distribution fund.

Estate: 30.1-23-01 (NDCC)

A. An estate under $50,000 may require an Adavit for Collection of Personal Property of the Decedent (SFN

2916).

B. If certicate of title is in Joint Tenants with Right of Survivorship (JTWROS), the survivor must present a copy

of the death certicate along with the certicate of title for transfer.

C. If A or B do not apply, a copy of the letter of administration, letter of testamentary, or an order of the court must

accompany the certicate of title for transfer.

D. A last will and testament cannot be accepted for certicate of title transfer.

11

Farm Truck: 39-04-19 Subsection 5, 39-04-26 (NDCC)

A. A truck with a gross weight of 22,000 pounds through 105,500 pounds, owned or leased by a resident farmer

to transport their own property, is eligible for a farm license. If the vehicle is leased, it must be leased for one

year or longer.

B. If the truck is used commercially, the unused portion of the farm fee will be credited toward any additional fee

to be collected. New plates and decals will be issued.

C. License as farm truck using farm truck fee schedule. A set of personalized license plates cannot be issued.

D. Certicate of title fee is $5.

E. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of

title.

F. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

G. A resident beekeeper qualies for a farm license.

FFA Foundation Number Plate: 39-04-10.12 (NDCC)

A. There are no restrictions on who may apply for or display FFA license plates.

B. Plates cannot be issued to an owner of a passenger vehicle or truck when the registered gross weight

exceeds 20,000 pounds [9071.84 kilograms].

C. License fees are based on the type of vehicle being registered, plus a one time fee of $10 for the FFA license

plates.

D. Personalized plates may be issued. An annual fee of $25 is due. (See Personalized Plates)

E. Certicate of title fee is $5.

F. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of

title.

G. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

Fireghter’s Association License Plate: 39-04-10.11 (NDCC)

A. Eligibility: A registrant is eligible for distinctive number plates under this section if the registrant is a member of

the North Dakota Fireghter’s Association. Application for North Dakota Fireghter’s Plate (SFN 52908) must

be completed.

B. Plates cannot be issued to an owner of a passenger motor vehicle or truck when the registered gross weight

exceeds 20,000 pounds [9071.84 kilograms].

C. License fees are based on the type of vehicle being registered, plus additional annual fee of $15 for the

Fireghter’s license plate.

D. Personalized plates may be issued. An annual fee of $25 is due. (See Personalized Plates)

E. Certicate of title fee is $5.

F. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of title.

G. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

H. On termination of the registrant’s eligibility, the registrant shall return the decals and plates to the director, who

shall reissue for a fee of not more than $5 another number plate to which the registrant is entitled under this

chapter.

12

Fleet Registration: 39-04-12 Subsection 2 (NDCC) (See Trailers)

A. Fleet registration is available to an owner of 100 or more vehicles (includes passenger, truck, and trailers). The

registrant shall le with the division a corporate surety bond in the amount of $10,000.

B. License fees apply. Fleet plates are issued.

C. Registration for all vehicles expires in December of the current year.

D. Certicate of title fee is $5.

E. Abandoned motor vehicle disposal fee of $1.50 applies upon application for North Dakota certicate of title.

F. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title. Plates must be

transferred to a replacement vehicle. Registration fees will be prorated from the date of sale for the balance of

the current year.

Gold Star Number Plate: 39-04-10.14 (NDCC)

A. A Gold Star Number plate is issued to a surviving spouse, parent, including stepmother, stepfather, parent

through adoption, and foster parent who stands or stood in loco parentis, grandparents, child, including

stepchild and child through adoption, and sibling, including half-brother and half-sister, of a member of the

armed forces of the United States who died while serving on active duty during a time of military conict.

B. Application for North Dakota Gold Star Plate (SFN 59183) must be completed by the North Dakota State

Veteran Aairs oce. www.nd.gov/veterans.

C. Gold Star Number plates are issued with a distinctive gold star insignia symbolizing Honor and Courage. The

lettering GS precedes the plate number. Qualied applicants are eligible for one set of plates.

D. Once a plate number is issued to an eligible family member, the department may not assign the plate to

another eligible person.

E. Plates cannot be issued to an owner of a passenger motor vehicle or truck when the registered gross weight

exceeds 20,000 pounds [9071.74 kilograms].

F. License fees are due upon initial plate request and thereafter.

G. Personalized plates with up to ve characters may be issued. (See Personalized Plates)

H. Certicate of title fee is $5.

I. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of title.

J. Motor Vehicle excise tax (5%) must be remitted when applying for a certicate of title.

Government: 39-04-18 Subsection 2(d) (NDCC)

A. DRIVER EDUCATION VEHICLE: (See Driver Education Vehicle)

B. GOVERNMENT AMBULANCE: (See Ambulance)

C. GOVERNMENT BUSES: (See Buses; School Bus)

D. POLICE: 39-04-10.9 (NDCC)

1. Plates with the word “POLICE” will be issued upon request for vehicles used and owned by a city’s

police department. A vehicle that displays a plate under this section must have a clearly visible distinctive

identication number on the rear of the vehicle assigned by the appropriate law enforcement agency.

2. License fees are $5. Plates may be transferred to a replacement vehicle at no additional cost.

3. Certicate of title fee is $5.

4. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate

of title.

5. Motor vehicle excise tax is NOT due.

E. SHERIFF: 39-04-10.9 (NDCC)

1. Plates with the word “SHERIFF” will be issued upon request for vehicles used and owned by a sheri’s

department. A vehicle that displays a plate under this section must have a clearly visible distinctive

identication number on the rear of the vehicle assigned by the appropriate law enforcement agency.

2. License fees are $5. Plates may be transferred to a replacement vehicle at no additional cost.

13

3. Certicate of title fee is $5.

4. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of title.

5. Motor Vehicle excise tax is NOT due.

F. STATE AGENCY OR POLITICAL SUBDIVISION: 39-04-18 Subsection 2(d) (NDCC)

1. Government plates will be issued to vehicles used, owned, or leased by a state agency or political

subdivision.

2. License fee is $5. Plates may be transferred to a replacement vehicle at no additional cost.

3. Certicate of title fee is $5.

4. Abandoned motor vehicle disposal fee of $1.50 applies upon initial applications for North Dakota certicate of title.

5. Motor vehicle excise tax is NOT due.

6. See Buses (Government Bus) and Driver Education Vehicle.

Hearse: 39-04-19 Subsection 2(a) (NDCC)

A. License as a passenger vehicle using the passenger fee schedule.

B. Certicate of title fee is $5.

C. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of title.

D. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

Heavy Vehicle Use Tax: 39-04-05 Subsection 8 (NDCC)

A. An owner of a truck with a gross weight of 55,000 pounds or more must le each year with the Internal

Revenue Service a Form 2290 Schedule 1.

B. FORM 2290 SCHEDULE 1, stamped by the Internal Revenue Service or the printed electronically led receipt,

must be sent in with the application for registration before the division will issue a license.

C. Upon purchasing a truck, registered with a gross weight of 55,000 pounds or more, the Form 2290 Schedule 1

is not required if certicate of title and registration are applied for within 60 days from the date of purchase.

D. The Motor Vehicle Division is not responsible for the collection of the Heavy Vehicle Use Tax. Contact the

Internal Revenue Service for the forms and any further information. Telephone 1-866-699-4096.

E. A vehicle owned by state agency or political subdivision and tribal government are exempt from the IRS 2290

requirements.

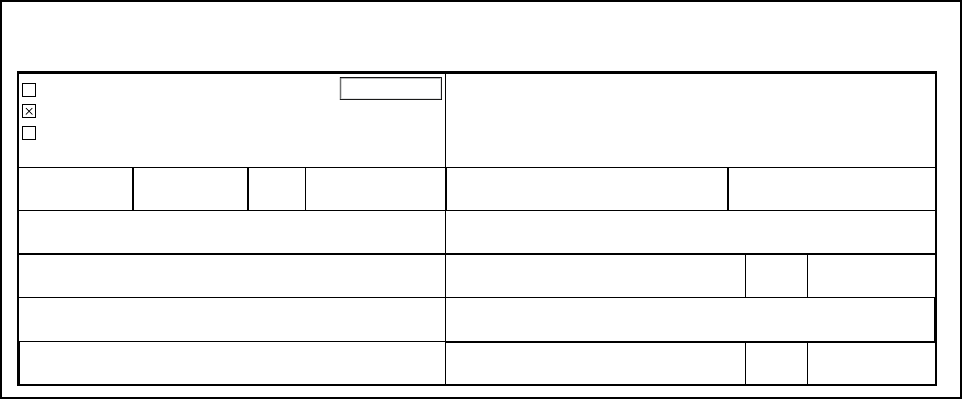

INTERNAL REVENUE SERVICE OFFICES

City Street Address Days/Hours of Service Telephone*

Bismarck

4503 N Coleman St,

Ste 101

Bismarck ND 50503

Monday-Friday - 8:30 am - 4:30 pm

(Closed for lunch 11:00 am - 12:00 noon)

701-221-5834

Fargo

657 2nd Ave N

Fargo ND 58102

Monday-Friday - 8:30 am - 4:30 pm 701-232-4710

Grand Forks

102 N 4th St

Grand Forks ND 58203

Monday-Friday - 8:30 am - 4:30 pm

(Closed for lunch 11:00 am - 12:00 noon)

701-746-5283

Minot

315 S Main St, Ste 316

Minot ND 58701

Monday-Friday - 8:30 am - 4:30 pm

(Closed for lunch 11:00 am - 12:00 noon)

701-839-7741

* These phone lines are answered by a recorded business message with information about oce hours and locations. Leave a

message to schedule an Everyday Tax Solutions appointment or to reschedule an existing IRS appointment.

14

House Mover: 39-04-18 Subsection 2(l) (NDCC)

A. Vehicle may be used only for moving buildings or building moving equipment.

B. The following fees are charged:

1. $25 for single axle truck. (25,000 pounds is printed on registration card.)

2. $50 for single axle tractor and tandem axle truck. (50,000 pounds is printed on registration card.)

3. $75 for tandem axle tractor. (75,000 pounds is printed on registration card.)

C. Certicate of title fee is $5.

D. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of title.

E. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

Imported Vehicle:

A. The following documents are required to title and register imported vehicles:

1. The original registration, a copy of the registration, or a letter of verication from the foreign government

agency.

2. Proper chain of ownership from the registered owner to the purchaser. A Bill of Sale that transfers

ownership from each seller to the next buyer must be provided.

3. US Customs documentation is required to meet Federal Government Regulations covering the vehicle

being imported. Acceptable forms include: 368, 7523, 3299, 3311, 7501, 7533, 6059B or 3461. If documents

are written in a language other than English, documents translated to English must be included.

4. If the odometer has been converted from kilometers to miles, certication is required from the business and

from the individual responsible for the change.

5. Secure Odometer Disclosure form, if applicable.

6. An Indemnifying Adavit (SFN 60662) must be completed by the owner releasing the State of North

Dakota and its agencies from any and all liability.

7. If you need to know if a document is acceptable, please call the Motor Vehicle Division.

Insurance Requirements:

https://www.insurance.nd.gov/consumers/insurance/auto

A. LIABILITY INSURANCE: 26.1-41-02, 39-08-20, 39-16.1-11 (NDCC)

1. Insurance protection for a third-party claim resulting from bodily injury or property damage you may cause

to someone else.

2. State law requires each motor vehicle to carry a minimum of $25,000 per person, $50,000 per accident for

bodily injury, and $25,000 per accident for property damage.

3. MOTORCYCLE AND MOPED

a. A motorcycle and a moped is required to have liability insurance. A motorcycles does not meet the no-

fault denition of a motor vehicle and; therefore, is not required to carry no-fault insurance.

4. OFF-HIGHWAY VEHICLE

a. An o-highway vehicle is required to have liability insurance when the vehicle leaves the owner’s

property and is operated on the highway shoulder or right of way. Please contact your insurance agent

for further information.

5. SNOWMOBILE: 39-24-09 Subsection 11 (NDCC)

a. A person may not operate a snowmobile on any state snowmobile trails without liability insurance.

The liability insurance insures the snowmobile owner named on the policy and any operator of that

snowmobile, with permission of the owner. Upon request of a law enforcement ocer, a person

operating a snowmobile shall provide proof of liability insurance to that ocer within 20 days.

6. LOW SPEED VEHICLE

a. A low-speed vehicles is required to have liability insurance when the vehicle leaves the owner’s

property and is operated on a highway on which the designated speed limit does not exceed 35 mph.

15

NOTE: When using the term “LIABILITY INSURANCE,” it is common practice to automatically include all

mandatory coverage as listed below in its meaning.

B. UNINSURED MOTORIST: 26.1-40-15.2, 39-16.1-11 (NDCC)

1. Insurance that provides bodily injury protection for you if the other party causing the injury has no insurance.

2. State law requires each motor vehicle to carry a minimum of $25,000 per person for bodily injury and

$50,000 per accident for bodily injury.

C. UNDERINSURED MOTORIST: 26.1-40-15.3 (NDCC)

1. Insurance that provides bodily injury protection for you if the other party causing the injury had bodily injury

liability coverage less than the amount of your uninsured motorist coverage.

2. State law requires each motor vehicle to carry underinsured limits equal to the uninsured motorist limit.

D. BASIC NO-FAULT (PERSONAL INJURY PROTECTION): 26.1-40-16 (NDCC)

1. Insurance that provides protection for economic loss as a result of accidental injury regardless of fault.

2. Basic limit required by state law is $30,000.

3. Payment for medical expenses and rehabilitation expenses plus: work loss not to exceed $150 per week;

survivor income loss not to exceed $150 per week; funeral, cremation, and burial expense of $3,500.

Replacement service loss not to exceed $15 per day.

Leased Motor Vehicle: 39-04-19, 57-40.3 (NDCC)

A. A lease is subject to the following:

1. Motor vehicle excise tax (5%) is imposed on the lease price of a vehicle which is operated and required to

be registered in North Dakota.

2. A qualifying vehicle (including a trailer) must have an actual weight of 10,000 pounds or less.

3. A lease must be for a period of 12 months or more.

4. SFN 60399, Lease Tax Worksheet, must be submitted to show the calculation of tax due.

Note to Dealers: Additional Charges: Tax will apply on additional charges that may apply after the

inception of the leases, such as excess mileage charges, excess wear charges, damage or repair charges,

lease cancellation charges, option to renew charges, and end-of-the lease payments. The additional tax

must be computed and paid directly to the North Dakota State Tax Commissioner.

5. If a vehicle is leased and later sold to the lessee (buyout), the motor vehicle excise tax will be due on the

purchase price at the time the lessee registers the vehicle.

6. A leased vehicle entering North Dakota from another state is subject to tax on the remaining lease period

from the date the vehicle enters North Dakota.

B. Credit for tax paid to another state will be allowed if one of the following conditions exist:

1. Tax was paid to another state for the lease period remaining after the vehicle entered North Dakota, up to 5

percent. (If less than 5 percent, the remaining lease periods are taxed based on the dierence in tax rates.)

2. The owner of the vehicle paid sales, use, or motor vehicle excise tax to another state on the purchase

price of the vehicle.

3. A vehicle leased by a non-resident military personnel transferring into North Dakota may be titled and

registered without the payment of any motor vehicle excise tax. This exemption applies only to a vehicle

that is titled outside of North Dakota by the applicant in the name of the lease company, but is now being

titled in North Dakota.

C. License fees are based on type of vehicle being leased. Use proper fee schedule.

D. Certicate of title fee is $5.

E. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of

title.

16

F. Motor vehicle excise tax (5%) must be remitted or proof of tax paid on an out-of-state vehicle entering North

Dakota.

1. Exemptions

a. A motor vehicle leased to the following is not subject to tax:

(1) Federal or state government and political subdivisions. (See Government)

(2) A disabled veteran (maximum – two vehicles).

(3) A prisoner of war (maximum – two vehicles).

(4) A nonprot senior citizen or mobility-impaired person’s corporation.

(5) A parochial or private nonprot school (for use in transporting students).

G. Miscellaneous:

1. New motor vehicle leases: A licensed motor vehicle dealer who leases a vehicle they do not have a

franchise for will continue to be subject to the motor vehicle excise tax on the purchase price and must also

collect the tax on the total consideration of a qualifying lease agreement.

2. Re-lease: Where a lease ends and the owner of the vehicle initiates a second lease agreement for a period

of 12 months or more, the tax must again be computed at the inception of the second lease. Tax must be

paid directly to the North Dakota Tax Department.

3. Sale of Lease: When the owner (lessor) sells a vehicle currently being leased, the transfer of ownership

will not be taxable if the lessee remains the same and the conditions of the lease do not change.

H. Tax credit on a stolen or totally destroyed leased vehicle may not exceed the total amount of motor vehicle

excise tax paid.

Legal Name: 39-04-02 Subsection 1, 39-05-05 Subsection 1(f) (NDCC)

A. An application for certicate of title must be made by the owner using their legal name evidenced by a valid

state-issued driver’s license, non-driver identication card, or any other document conrming the true identity

of the owner.

B. Non-residents and military personnel must provide a paper copy of their current driver’s license card or non-

driver identication card with their certicate of title application.

C. A business, trust, partnership, or corporation must provide a paper copy document conrming the legal name.

Lemon Law: 51-07-16, 51-07-17, 51-07-18, 51-07-18.1, 51-07-19, 51-07-20, 51-07-21, and

51-07-22 (NDCC)

A. If a new passenger vehicle or truck with a registered gross weight of 10,000 pounds or less does not conform

to all applicable warranties, the manufacturer or dealer shall make the necessary repairs to conform the

vehicle to the express warranties.

B. If the manufacturer or dealer is unable to repair or correct the defects after a reasonable number of attempts,

they shall replace the vehicle or refund the consumer the full purchase price less a reasonable allowance for

the consumer’s use of the vehicle not exceeding ten cents per mile driven or ten percent of the purchase price,

whichever is less.

C. If a leased vehicle does not conform to all applicable warranties, the manufacturer shall provide to the lessee

the sum of all payments previously paid to the lessor. Payments include all cash payments, security deposits,

and trade-in allowance, if any. The lease agreement is terminated and no penalty for early termination may be

assessed.

17

Low-Speed Vehicle: 39-29.1 (NDCC)

A. “Low-speed vehicle” means a four-wheeled vehicle that is able to attain a speed, upon a paved surface, of

more than 20 mph (32 kilometers) in one mile (1.6 kilometers) and not more than 25 mph (40 kilometers) in

one mile (1.6 kilometers) and may not exceed 3,000 pounds (1361 kilograms) in weight when fully loaded with

passengers and any cargo.

B. A low-speed vehicle must be equipped with head lamps, front and rear turn signal lamps, tail lamps, stop

lamps, red reex reectors on each side as far to the rear of the vehicle as practicable and one red reector on

the rear, brakes, a parking brake, a windshield, a vehicle identication number, a safety belt installed at each

designated seating position, an exterior mirror mounted on the operator’s side of the vehicle, and either an

exterior mirror mounted on the passenger’s side of the vehicle or an interior rear view mirror.

C. A person may not operate a low-speed vehicle on a highway on which the speed limit exceeds 35 mph (56.33

kilometers). The operator of a low-speed vehicle may make a direct crossing of a highway on which the speed

limit exceeds 35 mph (56.33 kilometers) if the crossing is made so the operator can continue on the highway

on which the speed limit doesn’t exceed 35 mph (56.33 kilometers).

D. License fee is $20 for a two-year period ending March 31 of each odd numbered year.

E. Certicate of title fee is $5.

F. Abandoned motor vehicle disposal fee is NOT due.

G. Motor vehicle excise tax (5%) must be remitted when applying for certicate of title.

H. No odometer or damage disclosure required.

I. Liability insurance required. (See Insurance Requirements)

Manufactured Home: 39-05-35 (NDCC)

A. A manufactured home is a home that is sold as real property and can qualify for Federal Home Loan Mortgage

Corporation (FHLMC) nancing.

B. The Application for Certicate of Title and Registration of a Vehicle (SFN 2872) must be submitted along with a

fee of $5.

C. Adavit of Use for a Manufactured Home (SFN 53658) must be completed by the applicant certifying the

manufactured home is real property.

D. A copy of the Adavit of Axation, as recorded with the county recorder’s oce in the county where the real

property is axed, must be submitted with the certicate of title application. This adavit is not provided by the

Motor Vehicle Division. The following can assist with this adavit:

1. If nanced, it is likely the form is available through the creditor.

2. If no nancing, it is the owner’s responsibility to make certain the form is completed and sent to the county

recorder’s oce.

3. One can be prepared by an attorney. A fee is likely associated with this assistance.

E. The Motor Vehicle Division will process the application and create a record. NO CERTIFICATE OF TITLE

WILL BE ISSUED. Eective August 1, 2017, a Manufactured Home Conversion Conrmation will be issued.

F. The only time NDDOT will be required to complete these requests is when the owner has a manufacturer’s

certicate of origin or title and the manufactured home is axed to real property for the rst time.

G. The online title search is also available to check the status of a record at:

https://apps.nd.gov/dot/mv/mvrenewal/titleStatus.htm

18

Mobile Home: 39-01-01 Subsection 45, 39-05-01, 39-18-03 (NDCC)

A. A mobile home MUST be titled. Certicate of title fee is $5.

B. Tax on a mobile home is as follows:

1. A new mobile home purchased from a North Dakota or out-of-state dealer is 3 percent.

2. A used mobile home purchased from a North Dakota or out-of-state dealer—no tax.

3. A used mobile home purchased from private individuals in North Dakota or out-of-state—no tax.

C. Tax collected by a dealer on a mobile home sale must be remitted on the sales tax report to the North Dakota

Tax Department, 600 East Boulevard Avenue, Bismarck, ND 58505.

D. North Dakota State Board of Equalization Statement of Mobile Home Full Consideration (SFN 3004) must be

submitted with the certicate of title application when the transfer of ownership involves a sale.

E. No license is required unless the mobile home is being moved on a public street or highway.

F. Landlord’s Mobile Home Lien: Section 35-20-17 (NDCC)

1. Complete Request for Vehicle Information (SFN 51269) processing fee is $3 to determine/verify current

registered owner’s name, address, and lien holder information (if applicable).

2. A notice of lien must be posted on the primary entrance of the mobile home. Notice of lien must state/

include the following information.

a. The name and last-known address of the owner of the mobile home.

b. The name and post-oce address of the lien claimant.

c. The amount of the lien.

d. A description of the location and type of mobile home.

e. A recitation of the penalty provisions of NDCC 35-20-17.

3. A copy of the notice of lien must be mailed, by certied mail, to registered owner and lien holder on record

with the Motor Vehicle Division.

4. Contact the lien holder on record to obtain a lien release (SFN 2876) Release of Lien by Legal owner.

5. 30 days from the date the notice of lien was mailed and posted must have elapsed before title work can be

submitted to the Motor Vehicle Division for the title. The follow documents would be required:

a. A copy of the results from the completed Request for Vehicle Information (SFN 51269).

b. Indemnifying Adavit (SFN 60662) completed and signed by the mobile home park releasing the State

of North Dakota and its agencies from any and all liability.

c. A copy of the notice of lien, the original certied mail form (to verify mail date) and the original certied

mail return receipt. If the notice of lien is returned as undeliverable submit the entire letter / envelope

with the title work.

d. Lien release (if applicable).

e. Application for Certicate of Title & Registration of a Vehicle (SFN 2872) completed in full, signed, and

dated.

f. North Dakota State Board of Equalization form (SFN 3004) completed in full, signed and dated.

g. Proof of legal name for the mobile home park as required by NDCC 39-05-05 Subsection 1(f).

h. $5 title fee

Mobility-Impaired License Plate and Parking Permit: 39-01-15, 39-04-10.2 (NDCC)

A. Application for Mobility-Impaired Parking Permit (SFN 2886), either written or electronic must be completed

and contain a certication by a qualied physician, physician assistant, chiropractor, or advanced practice

registered nurse or physical therapist.

1. Applicant uses portable oxygen; or

2. Applicant has an orthopedic, neurological, or other medical condition that makes it impossible to walk 200

feet without assistance or rest; or

19

3. Applicant is restricted by cardiac, pulmonary, or vascular disease from walking 200 feet without rest; or

4. Applicant has a forced expiratory volume of less than one liter for one second or an arterial oxygen tension

of less than 60 millimeter of mercury on room air while at rest and is classied III or IV by standards for

cardiac disease set by the American Heart Association.

B. A mobility-impaired parking permit will be issued to a qualifying applicant. This permit must be hung from the

inside rearview mirror of the motor vehicle whenever the vehicle is occupying a space reserved for the mobility

impaired. The permit may be transferred from vehicle to vehicle. A permanent permit is free; a temporary

permit is $3 each; a duplicate permanent or a temporary permit is $3 each.

C. The applicant may obtain one set of mobility-impaired license plates, provided they do not possess more

than one parking permit. License plates bearing the wheelchair emblem will be issued to a mobility-impaired

applicant. One set of plates per mobility-impaired individual may be issued to a vehicle where the mobility-

impaired individual is not listed as the owner and if the vehicle is designated for the exclusive use of

transporting that mobility-impaired individual. A mobility-impaired DAV license plate is available; however, a

personalized license plates is not. The fee for replacing regular license plates with mobility-impaired license

plates is $5.

D. License as a passenger vehicle, a truck, or a motorcycle using the appropriate fee schedule.

E. Certicate of title fee is $5.

F. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of title.

G. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

H. Mobility impaired parking permits may be issued for a vehicle owned and operated by care providers licensed

by the state, veterans-related organizations, and other entities that regularly transport mobility impaired

individuals. An application for Care Providers Mobility-Impaired Parking Permit(s) (SFN 54306) must be

completed.

I. Mobility-impaired license plates must be transferred to a replacement vehicle upon selling or trading the

vehicle.

NOTE: If the mobility-impaired individual is a minor, please contact the Motor Vehicle Division for further

information.

Moped: 39-01-01 Subsection 48, 39-10.2 (NDCC)

A. A moped is dened as a vehicle equipped with two or three wheels, foot pedals to permit muscular propulsion

or footrests for use by the operator, a power source providing up to a maximum of two brake horsepower

having a maximum piston or rotor displacement of 3.05 cubic inches (49.98 milliliters) if a combustion engine

is used, which will propel the vehicle, unassisted, at a speed not to exceed 30 mph (48.28 kilometers) on

a level road surface, and a power drive system that functions directly or automatically only, not requiring

clutching or shifting by the operator after the drive system is engaged, and the vehicle may not have a width

greater than 32 inches (81.28 centimeters).

B. License fee is $25. An electric motorcycle road fee is $20 for each electric motorcycle registered.

C. Certicate of title fee is $5.

D. A personalized plate may be issued. An annual fee of $25 is due. (See Personalized Plate)

E. Abandoned motor vehicle disposal fee is NOT due.

F. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

G. Odometer certication is required; damage disclosure certication is not required.

H. Liability insurance is required on a registered moped. (See Insurance Requirements)

20

Motor Home: 39-01-01 Subsection 31, 39-04-19 Subsection 2(a) (NDCC)

A. “Motor Home” or “House Car” means a motor vehicle which has been reconstructed or manufactured primarily

for private use as a temporary or recreational dwelling and having at least four of the following permanently

installed systems:

1. Cooking facility.

2. Icebox or mechanical refrigerator.

3. Potable water supply including plumbing and a sink with faucet either self-contained or with connections for

an external source, or both.

4. Self-contained toilet or a toilet connected to a plumbing system with connection for external water disposal,

or both.

5. Heating or air conditioning system or both, separate from the vehicle engine or the vehicle engine electrical

system.

6. A 110-115 volt alternating current electrical system separate from the vehicle engine electrical system

either within its own power supply or with a connection for an external source, or both, or a liqueed

petroleum system and supply.

B. The license fee is based on 40 percent of the actual weight of the motor home, but not less than 4,000

pounds. The passenger fee schedule is used.

C. Certicate of title fee is $5.

D. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for North Dakota certicate of

title.

E. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

F. If a school bus is converted to a motor home, the purchaser must change the color of the vehicle and

deactivate or remove the warning signal lights and the stop sign on the control arm.

NOTE: The Vehicle Identication Number (VIN) identifying the completed vehicle, after a multi-stage

manufacture, shall be the VIN on the incomplete chassis.

Motorcycle: 39-01-01 Subsection 48, 39-04-14.4, 39-04-10.3, 39-04-19 (NDCC)

A. A motorcycle must comply with provisions of Chapter 39-27 of the North Dakota Century Code (NDCC)

relating to motorcycle equipment. If a motorcycle does not meet the equipment requirements, it cannot be

titled or licensed and the dealer must collect sales tax and submit the tax to North Dakota Tax Department,

600 East Boulevard Avenue, Bismarck, North Dakota 58505.

B. When a motorcycle has been modied, rebuilt, or homemade, an inspection is required. A Certicate of

Vehicle Inspection (SFN 2486) must be completed by a business that is registered with the Secretary of State,

is in good standing, and oers motor vehicle repair to the public. Submit (SFN 2486) with an Application for

Certicate of Title and Registration of a Vehicle (SFN 2872).

C. License fee is $25. Motorcycle plates are issued. An electric motorcycle road fee is $20 for each electric

motorcycle registered.

D. Personalized plates may be issued. An annual fee of $25 is due. (See Personalized Plate)

E. Certicate of title fee is $5.

F. Abandoned motor vehicle disposal fee is NOT due.

G. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

H. Odometer certication and damage disclosure certication are required.

I. Liability insurance is required on a registered motorcycle. (See Insurance Requirements)

21

National Guard Plate: 39-04-10.8 (NDCC)

A. Eligibility:

1. A registrant is eligible for a distinctive number plate under this section if the registrant is a member of the

National Guard or if the registrant has retired from the National Guard after 20 years or more of service.

2. Registrant must contact the Adjutant General Oce to obtain a National Guard license plate approval

letter. A memorandum stating the individual is eligible will be issued.

3. A one-time fee of $5 is due to obtain a set of National Guard plates. Personalized plates may be issued as

assigned by the Adjutant General. (See Personalized Plate)

B. A set of National Guard plates may be issued to the owner of a passenger motor vehicle, a motorcycle, or a

truck in which the registered gross weight does not exceed 20,000 pounds [9071.84 kilograms]. License fees

are based on the type of vehicle being registered.

C. Certicate of title fee is $5.

D. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for certicate of title.

E. Motor vehicle excise tax (5%) must be remitted when applying for a certicate of title.

F. On termination of the registrant’s eligibility, the registrant shall return the distinctive number plates to the

director who shall re-issue, for a fee of not more than $5, another number plate to which the registrant is

entitled under this chapter.

New Vehicle: 39-04-02 Subsection 3, 39-05-05 Subsection 3 and 4 (NDCC)

A. Manufacturer’s Certicate of Origin (MCO) must be completed on the reverse side in addition to the odometer

disclosure for retail sale. Application for Certicate of Title and Registration of a Vehicle (SFN 2872) must be

completed in full and signed on the reverse side.

B. License fees are based on the type of vehicle being registered. Use proper fee schedule.

C. Certicate of title fee is $5.

D. Abandoned motor vehicle disposal fee of $1.50 applies upon initial application for certicate of title.

E. Motor vehicle excise tax (5%) must be remitted. The tax is computed on the full purchase price less any trade-

in allowance. The vehicle traded must be identied by year, make, and vehicle identication number.

F. Odometer certication and damage disclosure certication are required.

NOTE: See Passenger or Truck section(s) to determine the proper license type.

22

Odometer Disclosure: 39-05-05 Subsection 1(g) (NDCC)

A. The Truth in Mileage Act (TIMA) is a federal law requiring the seller of a motor vehicle to make an odometer

disclosure to the buyer at the time of sale or transfer of ownership. Under the federal law, the Motor Vehicle

Division is required to refuse to transfer ownership of a motor vehicle unless the odometer disclosure is

completed.

B. TIMA covers passenger vehicles, motor homes, motorcycles, pickup trucks, trucks, and unconventional

vehicles if they are less than 10 years old. A truck with a manufacturer’s Gross Vehicle Weight Rating (GVWR)