Investor & Analyst Briefing

Welcome & Introduction

Stuart Crosby

President & Chief Executive Officer

21 March 2013

Investor & Analyst Briefing

Business Overview: United Kingdom, Channel

Islands, Ireland & Africa (UCIA)

Naz Sarkar

Head of UCIA

21 March 2013

Regional Overview: UCIA

Plan Managers

State of play

› Underlying Plans business performing well with very high client retention/renewal rates

in the year and significant new client wins.

› Transactional revenue remains strong and we have seen some early positive impact of

recovery in global equity markets.

› Only 1 ex-HBOS-EES client left to migrate which will complete in June.

› The Morgan Stanley Global Stock Plan Services EMEA business acquisition set to

complete in May and integration resources from EES will switch immediately over.

Challenges & opportunities

› Further cost synergies are expected later this calendar year.

› The growth in post-vest services is helping to build an underlying asset base that

underpins future revenue streams.

› The Plans business now offers a full range of share plans and is well positioned to meet

changing market requirements and develop new ancillary products.

3. Investor & Analyst Briefing - Computershare Limited.

Regional Overview: UCIA

Plan Managers

GSPS EMEA Acquisition

› Strong corporate client customer base that includes large UK and European issuers.

› GSPS compared to the EES acquisition*:

4. Investor & Analyst Briefing - Computershare Limited.

•9%

Employees

• 33%

Clients

• 74%

Annual Revenue

• 225%

Revenue per client

• 190%

Revenue per participant

• 198%

AUM per participant

*Comparison based on pre-acquisition data

Regional Overview: UCIA

Channel Islands

State of play

› Offshore business still performing strongly with good organic growth year on year.

› Offshore Registry in Jersey and Guernsey showing steady growth with high win rates on

tenders.

› The Vested Share Account product is proving popular with offshore Plans clients.

› The offshore Plans business provides highly complementary share warehousing services

to the overall CPU Global Plans, in particular the GESPP.

Challenges & opportunities

› We continue to track the heightened global and UK focus on tax and offshore financial

centres.

› Offshore IPO’s have remained relatively buoyant in comparison to overall global activity

and we expect to see early signs of any recovery here first.

› Offshore Trust structures continue to be an important component of the share plan offer

as we extend in to new global markets.

5. Investor & Analyst Briefing - Computershare Limited.

Regional Overview: UCIA

Registry UK

State of play

› Continue to enjoy high levels of customer approval. Rated number one in Capital

Analytics Survey overall and top in 6 of the 8 headline categories.

› Some major client contracts renewed with minimal client losses.

› Direct Line Group IPO now live.

› We continue to see net growth in Depositary Interest clients and our market share

remains strong.

Challenges & opportunities

› Recovery in the equity markets has resulted in up-turn in some of our dealing services

and we expect to see some growth.

› Potential for return of some corporate action and M&A activity in next 12-18 months.

› Market structure changes expected to be implemented in 2015.

› New regulatory regime comes in to force in April 2013 with introduction of the Financial

Conduct Authority (FCA).

6. Investor & Analyst Briefing - Computershare Limited.

Regional Overview: UCIA

Ireland

State of play

› Registry market remains very ‘sticky’.

› Increase in companies re-domiciling to Ireland and spin-offs listing in US.

› Now administering over 300 ETF funds – up from 240 last year and seeing growth in

underlying transaction volumes.

› Irish Share Plans business now managed as part of regional business bringing improved

know-how and efficiencies.

Challenges & opportunities

› Some early signs of opportunities for M&A in Ireland.

› Expect the ETF market to continue to recover and grow.

› Continue to work with other parts of the Computershare network including US, Germany

and Australia to identify and execute on cross border opportunities.

7. Investor & Analyst Briefing - Computershare Limited.

Regional Overview: UCIA

Communication Services

State of play

› Continued focus on providing high quality communication services for the internal

business units, plus ongoing development of commercial revenues.

› Continued focus on protecting existing revenue & profit, by renewing contracts with key

clients, without going to tender.

› Marketing of value propositions for wealth/investment management, insurance, B2B

transactional & water markets is gathering momentum, leading to growth of sales

pipeline.

Challenges & opportunities

› UK communications market continues to be highly competitive, underlining the

importance for differentiating value propositions, which leverage CPU brand, services &

technology.

› Currently assessing the opportunity presented by rolling out global products to the UK

market including inbound processing.

› Potential incremental revenue opportunity for CCS resulting from CPU acquisitions.

8. Investor & Analyst Briefing - Computershare Limited.

Regional Overview: UCIA

South Africa

9. Investor & Analyst Briefing - Computershare Limited.

State of play

› M&A activity remains subdued but we continue to pick up the majority of new listings in

the market.

› Corporate client relationships remain very strong with minimal impact from new registry

and CSDP market entrants.

› Management focused on delivering cost efficiencies and continuing to meet high service

quality benchmarks.

Challenges and opportunities

› Hoped for growth in the African JV, has not materialised and currently reviewing options.

› Reviewing the current Share Plans business in South Africa with a view to using Global

Share Plans expertise and systems to create new offers.

› Expecting opportunities to arise from the Assupol demutualisation and listing.

Regional Overview: UCIA

Georgeson – Corporate Proxy Solicitation

State of play

› Corporate Proxy now based on 30% recurring revenues related to Annual General

Meetings.

› One-off activity related to M&A continues to be subdued but shareholder activism

related activity continues to feature.

› Client loyalty remains high despite very competitive market place.

Challenges & opportunities

› UK market movement to make remuneration votes on future pay a binding vote in

2014, this will provide some opportunities for the coming meeting season.

› Changes in the Swiss market mean pay and annual director elections may be put to

shareholders at AGMs, increasing the overall market need for proxy solicitation.

› Changes in the German market relating to share-blocking may also create further

opportunity for proxy solicitors.

10. Investor & Analyst Briefing - Computershare Limited.

Regional Overview: UCIA

Computershare Voucher Services (CVS)

State of play

› CVS continues to be the market leader in a fragmented and highly competitive market.

› Government announced in its mid-term review that it intends to give working families

further support with their childcare costs.

› Operations now fully migrated to the UK operations centre in Bristol and benefiting from

wider group efficiencies.

Challenges and opportunities

› UK Government has now announced plans to launch a new Childcare Voucher Scheme in

late 2015.

› New partnership arrangements established to promote white-labelled employee benefits

products alongside our childcare voucher scheme – enabling CVS to compete with key

competitors in the employee benefits space.

11. Investor & Analyst Briefing - Computershare Limited.

Regional Overview: UCIA

Business Services

State of play

› DPS continues to grow market share in line with growth in the private rented sector.

› From April DPS will be the only scheme to offer both custodial and insured options

following successful tender process.

› Scottish custodial scheme successfully launched in July 2012.

› The Northern Ireland Executive has granted approval to run both Custodial and

Insured schemes from April.

Challenges & opportunities

› Republic of Ireland likely to be tendering for deposit protection schemes in the next 12

months.

› Gilts contract is being re-tendered – will be awarded in December 2013 with

commencement January 2015.

12. Investor & Analyst Briefing - Computershare Limited.

Investor & Analyst Briefing

Question Time

Naz Sarkar

Head of UCIA

21 March 2013

Investor & Analyst Briefing

Business Overview: Continental Europe

Steffen Herfurth

Head of Computershare Continental Europe

21 March 2013

Regional Overview: Continental Europe

EU Regulatory and Infrastructure Developments

There are a raft of initiatives in play that may change the market dynamic in the near to mid-

term, including:

Infrastructure initiatives:

› Proposed introduction of

T2S

settlement system, by the European Central Bank

Regulatory initiatives:

›

CSD-R

codifying the role of central securities depositary entities, including T+2

settlement, expected from 2015, and mandatory dematerialisation.

›

Securities Law Legislation (SLL),

introducing changes to codify the relationship

between book-entry account providers and account owners, including specifying

rights of ownership and obligations regarding investor communications.

Some commercial dialogue starting to emerge. However, too early to tell what the final

shape of timing or change will be. We will continue to participate in discussions with

regulators and commercial players to explore near to mid-term opportunities.

15. Analyst Briefing of Computershare Limited.

Regional Overview: Continental Europe

Investor Services - Russia

State of play

› Two registrars owned by CPU in Russia cumulatively have the largest market share.

› Fund Administrator has been formed by adding specialised depository services into

the scope of services.

› Roll-out of brokerage and custody services; Online Registrar Services

Computershare 24/7.

› Implementation of the retail platform for small and mid cap companies.

Challenges & opportunities

› Merger of two registrars owned by CPU in Russia.

› Non-organic growth in the registrar and specialised registrar segments.

› National Settlement Depository (NSD), affiliated with Moscow Exchange, became

the Russian CSD in November 2012. NSD will have opened CSD accounts in the

registers of all major Russian issuers by the end of March 2013. Role of registrars in

corporate actions likely to stay unchanged.

16. Analyst Briefing of Computershare Limited.

Regional Overview: Continental Europe

Investor Services – Denmark & Sweden

17. Analyst Briefing of Computershare Limited.

State of play

› CPU well positioned with unique service portfolio and new products.

› Continuously high client satisfaction among registry clients.

› Growth in revenue for non-CSD registered share register solutions.

› Using global CPU products, e.g. Boardworks, to win new (non-registry) clients.

› Market for meeting services in Sweden is shared between Euroclear Sweden Issuer

Services and CPU.

Challenges & opportunities

› Overall market conditions are still weak and clients are focused on costs.

› Still intense competition with local CSD, VP Securities.

› Many IPOs have been postponed. If market conditions allow, then 4 to 8 IPOs are

expected in 2013 in the Danish market.

› Deployment of new interfaces to core market infrastructure creates new product

opportunities in 2013 and 2014.

Regional Overview: Continental Europe

Investor Services - Germany

State of play

› Increased market share for CPU due to significant wins: e.g. Siemens AGM (> 9k

attending), Osram and Telefonica Deutschland registry and meeting services (incl.

>500k mail packs for CCS Germany).

› Successfully offering full issuer services in mid cap market segment (Proxy, Registry,

Disclosure, Meeting and Tabulation Services, Dividend Payment).

› Re-organisation and positioning towards “One CIS” (incl. Proxy services, Shareholder

ID, disclosure services) underway.

Challenges & opportunities

› German court ruling on SRD may lead to share-blocking for issuers with registered

shares.

› Potential acquisition opportunities expected to lead to further consolidation.

› Roll-out of CPU products in Continental Europe (i.e. German technology for

shareholder meetings in Italy, Spain and vice versa).

18. Analyst Briefing of Computershare Limited.

Regional Overview: Continental Europe

Communication Services - Germany

State of play

› Focus remains on operational management and margin improvement.

› CIS integration proceeds through registry wins (meeting invitations) and bearer

share management (entrance tickets).

› Digital mail alliance with Deutsche Post implemented.

› Inbound service successfully implemented.

› Strong client retention.

Challenges & opportunities

› CCS became leading provider for the local insurance sector, which provides steady

output volumes and further potential.

› Colour printing is developing well and improving margins.

› CPU internal business <5%. To be improved through new client wins in Germany

and contribution to international CPU contracts.

19. Analyst Briefing of Computershare Limited.

State of play

› VEM has acquired a solid base of recurring revenue business, such as paying

agency, designated sponsoring, research, SME share option plans and listing

partner mandates.

› VEM was able to capture a number of SME corporate bond issues, placements of

which give us a revenue boost.

› Steady inflow of corporate action mandates (tender offers, rights issues,

prospectus admissions, etc.).

Challenges & opportunities

› Market conditions are still difficult in our core market, listed SME in Germany with

equities still on the downturn as opposed to SME corporate bonds, which are

seeing bubble-type investor appetite.

› ETF servicing may finally come through – discussions are at final stage.

› Collapse of some competitors allowed us to capture new business.

Regional Overview: Continental Europe

VEM - Germany

20. Analyst Briefing of Computershare Limited.

Regional Overview: Continental Europe

Servizio Titoli (ST) - Italy

State of play

› Market remains weak; no new floats very few small caps; last midcap (SEA airport

authority) has been pulled back by the market.

› SME’s bankruptcy rates at their highest for the last decade.

› De-listings are still “cheap” and attractive to SMEs.

› ST undisputed market leader with unique service portfolio.

Challenges & opportunities

› Interesting opportunities for inorganic growth.

› Increasing capital requirements for banks will lead to disposal of service units that might

be interesting to us.

› Strategic development of Monte Titoli (CSD) might reshape the industry.

› Client renegotiation/pressure on pricing of contracts is common practice.

› AGM concentration and technological requirements increase entry barriers.

21. Analyst Briefing of Computershare Limited.

Regional Overview: Continental Europe

Corporate Proxy – Southern Europe

State of play

› Georgeson involved in all material proxy fights in 2012/2013. Market activity after

summer break is down.

› Focus on additional consulting services incl. Corporate Governance Services –

assisting Italian & Spanish issuers to better manage their international investors’

requirements.

› Continuing to increase client base in both Italy and Spain.

› EU legislation and transparency initiatives will remain a strong driver of short and

midterm revenues growth.

Challenges & opportunities

› Consulting on “Board Remuneration” expected to grow significantly over the next

couple of years.

› Strong and positive perception of the Georgeson brand as a recognised player in

Corporate Governance Consultancy.

› Pressure on prices by local competitors.

22. Analyst Briefing of Computershare Limited.

Investor & Analyst Briefing

Question Time

Steffen Herfurth

Head of Computershare Continental Europe

21 March 2013

Investor & Analyst Briefing

Business Overview: Shareowner Services

Mark Davis & Stuart Irving

Joint Heads of Shareowner Services

21 March 2013

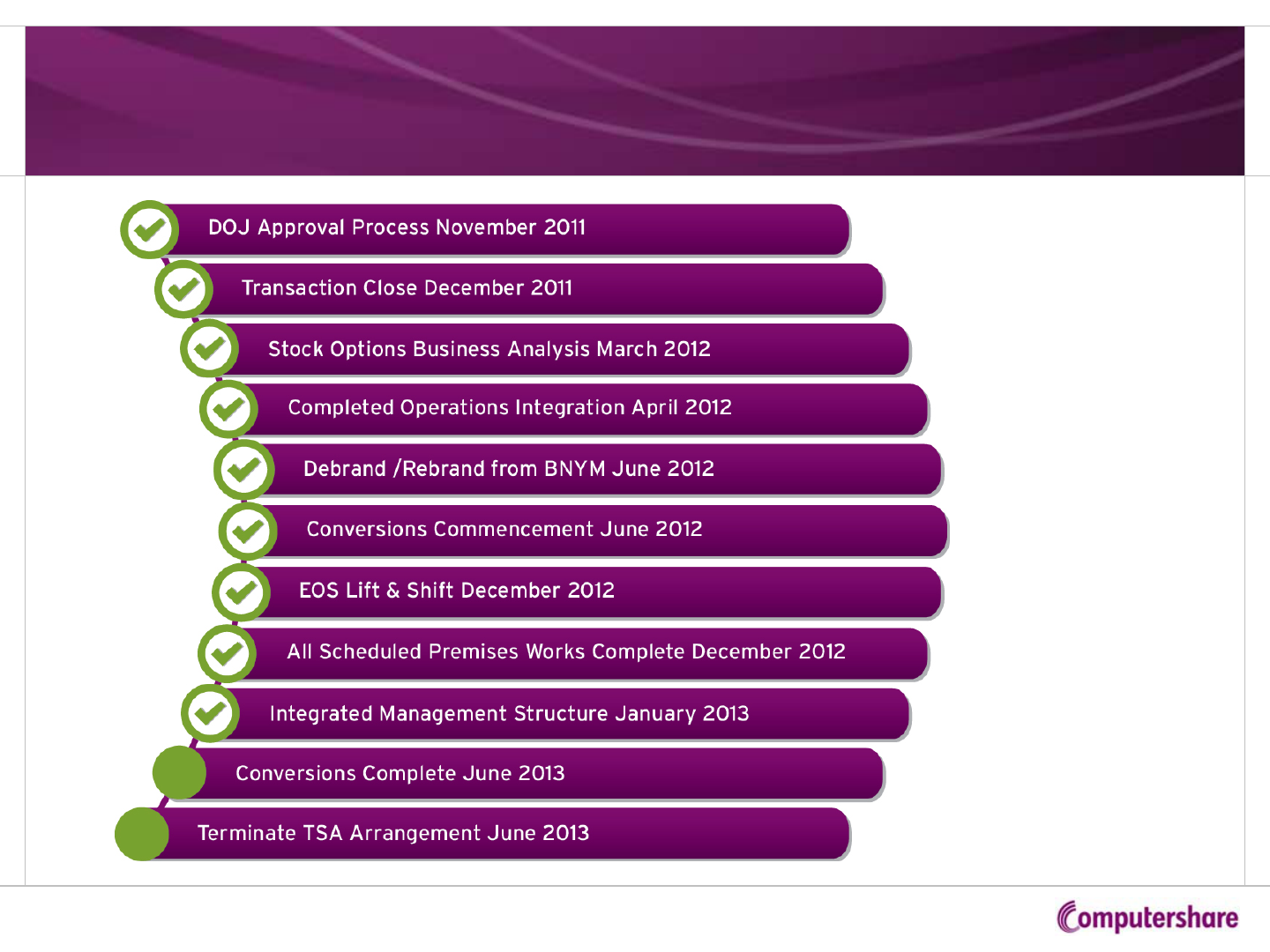

Shareowner Services Integration

Transaction Recap

Recap of the transaction

› Cost $550m.

› Clearance received on 4 November 2011.

› Transaction close achieved 31 December 2011.

› 18-month period to complete data migrations; overall, 2-3 year integration program.

› We are almost 15 months in...

Recap of the opportunity

› Large-scale cost synergies (initially $72.5m, now believe $77.8m).

› In-sourcing.

› Offshoring opportunities for US and broader Computershare group.

› Cross selling.

25. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Key Integration Program Objectives

26. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Integration Program Approach

27. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Integration Risk Management

Key risks all being effectively managed

› Client retention.

› Synergies achievement.

› Staff retention and engagement.

› Service quality.

› Capacity to continue the benefits of offshoring arrangements.

› Client data migrations to Computershare systems.

› Change management – managing significant levels of concurrent change.

28. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Synergies

How we are achieving transaction synergies

› Technology.

› Operations rationalisation.

› Facilities rationalisation.

› Staff.

› In-sourcing and offshoring.

› Vendor management.

29. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Synergies

Costs to realise synergies

› We anticipate one off costs of about $53.5m to realise these synergies (up from the

original market disclosed number of $50m) of which we had spent $23.5m by 31

December with $32.0m to come predominantly in FY13 and FY14. These costs include: IT

and IT capex, facilities build-out and rationalisation, and staff severance costs.

Anticipated Timing FY12 FY13 FY14 FY15

Delivered 9.3m 11.0m

Incremental expected synergies 15.7m 36.8m 5.0m

Cumulative expected synergies 36.0m 72.8m 77.8m

Synergies progress

30. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Operations Integration – Facilities

Facilities consolidation

› At close of transaction, Operations

were being conducted in a combined

total of 13 different locations.

› By June 2013, Operations will have

been consolidated into 6 locations

(including 2 offshore locations).

31. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Operations Integration – Call Centres

› At close of transaction there were six separate call centres. Two sites, previously

announced, are closing in May 2013. Expansion in College Station, TX and Manila.

› All remaining call centres, including outsourcer in Manila, are on the same Automated Call

Distributing Switch – allows for a consolidated view and ability to route traffic dynamically.

› Real-time BCP environment.

› All four sites running on the same platform, infrastructure, business practices, metrics and

measurements. Goals unified and consistent across all four sites.

32. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Operations Integration – Call Centers

33. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Operations Integration – Offshoring

› Shareowner Services conducted work with offshore partners in Manila, Philippines and in

Noida, India. Previously we discussed exploring these capabilities for the broader group.

› Strategic review of vendors completed and embarked on program to ready Computershare

platforms and processes as we started the conversion process.

› Program also laid out the foundation for other parts of Computershare to benefit from

these arrangements and work has commenced both for existing US clients as well as other

regions to move to this successful model.

34. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Operations Integration - Offshoring

Offshoring process

› Distributed processing.

› Work routed based on employee skillset.

› Consistency of process and scalability.

35. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

New Organisational Structure

36. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Data Migration Progress Update

Project consists of two main streams

› Shareholder and employee records of clients across 21 tranches.

› Image, conversion records from multiple legacy storage systems to CPU platform.

16 of 21 tranche weekends successfully completed

› 16.6 million shareholder accounts converted so far.

› More than 85% of clients converted.

› 45 million images converted.

37. Analyst Briefing of Computershare Limited.

Shareowner Services Integration

Our Approach to Migration

› System conversions are well advanced and will complete in May 2013

› 21 tranches, grouped according to client complexity

› 16 tranches completed successfully

38. Analyst Briefing of Computershare Limited.

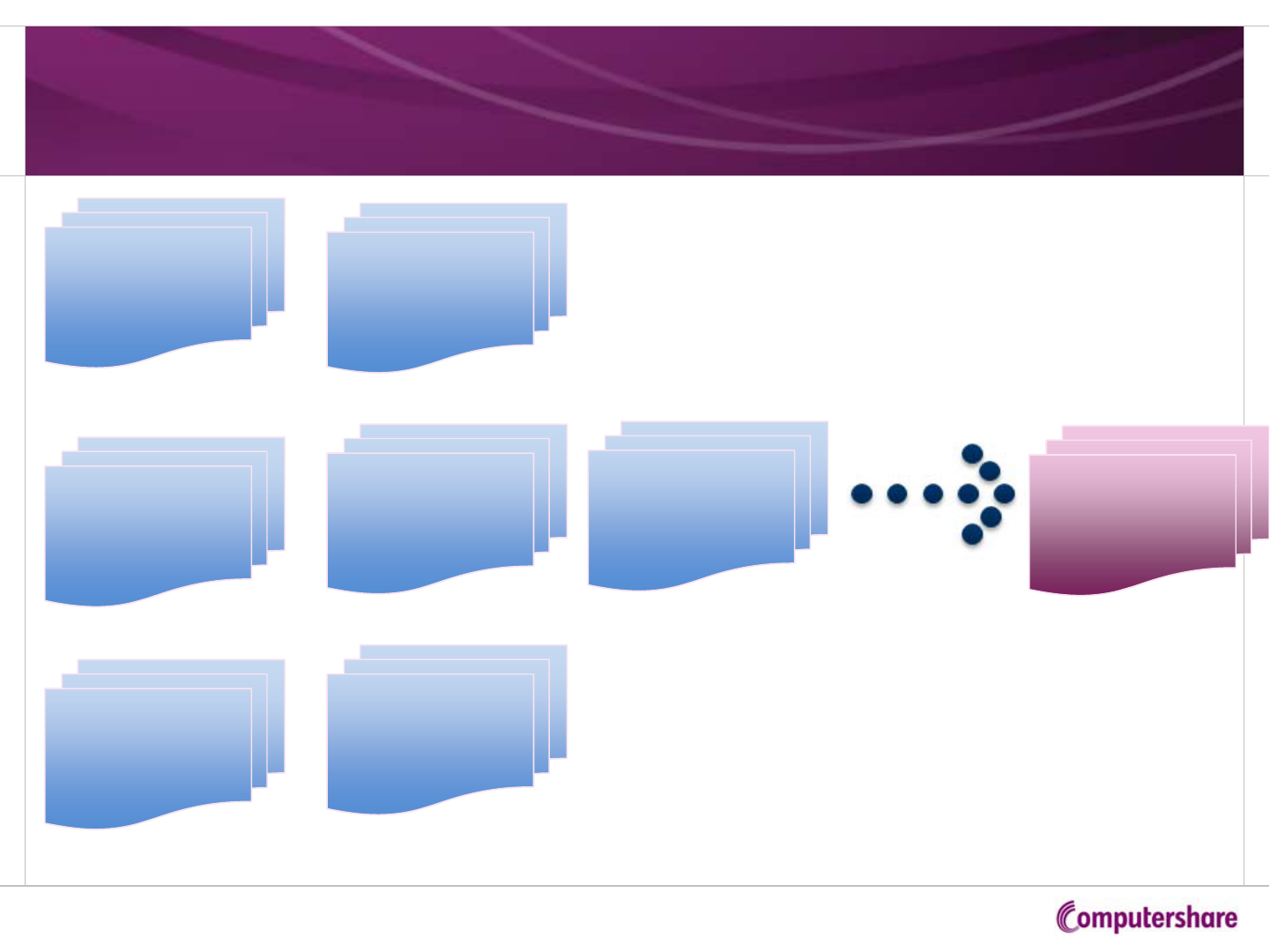

Shareowner Services Integration

Image Data – Seven Platforms into One

Current

Proxy Scans

Current

Corres

Legacy

Mellon

Legacy BNY

Content Mgr

Legacy

Mellon

Platter

Legacy BNY

Optical

Platter

3

rd

Party

CPU DSS

45 million images of 60

million converted

39. Analyst Briefing of Computershare Limited.

Investor & Analyst Briefing

Question Time

Mark Davis & Stuart Irving

Joint Heads of Shareowner Services

21 March 2013

Investor & Analyst Briefing

Business Overview: Asia

James Wong

Head of Computershare Asia

21 March 2013

Regional Overview: Asia

Hong Kong

State of play

› Fundraising and other corporate actions remain quiet as investors remain cautious, but

some signs of activity picking up since December.

› Launched first B Shares to H Shares conversion and working on others.

› Drafting of Scripless legislation slipped. New target date 2016.

› Significantly increasing cross-selling of Plans, Shareholder ID, Proxy and other services

to Registry client base, recognising the fact that our client resources are our biggest

asset.

› Healthy growth in Plans business with dealing activities.

Challenges & opportunities

› Scripless project slippage adds to uncertainty.

› Cross-selling increases ‘stickiness’ of our relationships, beginning to attract others to

look at us as a conduit.

42. Investor & Analyst Briefing - Computershare Limited.

Regional Overview: Asia

China

State of play

› Effectively utilised our presence in China to stay close to our important customers.

› Slowly building a sales presence in Shanghai.

› Conducted a series of Plans seminars and generated good interest.

› CSRC lowered hurdle of Chinese companies to list in HK. Introduced RQFII product for

HK and Taiwan, and now considering QFII-2 / QDII-2.

› Stronger line-up between HK-China exchanges in terms of development.

› ID/Proxy and meeting business seeing healthy growth and increasing our stickiness.

Challenges & opportunities

› International Board still off the radar.

› Market waiting for dust to settle after change of leadership, including changes in the

heads of regulatory bodies.

43. Investor & Analyst Briefing - Computershare Limited.

Regional Overview: Asia

India

State of play

› New IPOs emerging but take up remains slow.

› SEBI making efforts in improving the funds industry environment and encouraging more

activities beyond the big cities.

› Expanding into new areas such as e-governance leveraging on BPO expertise.

Challenges & opportunities

› Volatile market and regulatory environment.

44. Investor & Analyst Briefing - Computershare Limited.

Regional Overview: Asia

Japan

State of play

› Corporate activities remain low.

› Acquired small book of ID business from a local competitor.

› Fast Yen depreciation may tip the balance to break out of the deflationary cycle.

Challenges & opportunities

› Product integration and relationship now a big factor in client retention for MUTB so we

see increased level of referral.

› When business grows servicing capacity could be an issue.

45. Investor & Analyst Briefing - Computershare Limited.

Investor & Analyst Briefing

Question Time

James Wong

Head of Computershare Asia

March 2013

Investor & Analyst Briefing

Business Overview: Australia & New Zealand

Scott Cameron

Head of Computershare Australia & New Zealand

21 March 2013

Regional Overview: Australia and New Zealand

Investor Services - Australia

State of play

› Rated #1 in 2013 Australian Registry Services Provider Survey.

› Continue to lead market (62% of ASX50; 59% of ASX200).

› Continue to win the large and/or complex corporate actions that arise

› Woolworths demerger (Shopping Centres Australia).

› Appointed to upcoming Newscorp demerger.

› IOOF takeover of Plan B.

› Virgin takeover of Skywest.

› Leveraging strong global positioning to win dual-listing mandates e.g. Resmed.

Challenges & opportunities

› Ensure we maximise any uptick in corporate actions and IPO activity.

› Continue to drive savings and efficiencies that benefit CPU and Issuers e.g.

Intermediary Online, straight through processing, Digital Post Australia.

› Demonstration of our market differentiators.

48. Analyst Briefing of Computershare Limited.

Regional Overview: Australia and New Zealand

Investor Services – New Zealand

State of play

› Market leader with around 66% of market.

› Successfully managed the Fonterra listing.

› Mighty River Power IPO main focus over coming months.

Challenges & opportunities

› The remaining assets from MOM (Mixed Ownership Model) sale.

› Taking advantage of any uptick in market.

› Identifying new revenue streams

›Maori Trusts.

› Tenancy Bonds.

49. Analyst Briefing of Computershare Limited.

Regional Overview: Australia and New Zealand

Communication Services

State of play

› A leading provider of specialised inbound and outbound communication services that

integrate print, mail and electronic solutions.

› Continuous inkjet printer now in Brisbane to add to Melbourne and Sydney capability.

› Strong growth in inbound Capturepoint offering and partnerships with leading banks

to offer locked box receivable processing and digital mailroom solutions.

› Continue to implement Superpartners inbound and outbound work.

› Won and implemented Bank of Queensland work.

Challenges & opportunities

› Traditional print and mail volumes and margins stabilising.

› Maximising inbound solutions pipeline.

50. Analyst Briefing of Computershare Limited.

Regional Overview: Australia and New Zealand

Plan Managers

51. Analyst Briefing of Computershare Limited.

State of play

› Continues to be the market leader in Australia.

› Reputation for ability to roll-out global plans.

› Production of 200,000 tax statements within 9 business days as part of end of

financial year reporting requirements.

› Trading volumes up.

› Growth in SME’s outsourcing plan administration.

Challenges & opportunities

› Conversion of Global Plans opportunities into client wins.

› Continued focus on process improvement and efficiencies including leveraging our

global best practices.

› Promoting/driving self-service channels for participants.

Regional Overview: Australia and New Zealand

Proxy Solicitation

52. Analyst Briefing of Computershare Limited.

State of play

› Market leader in Australia.

› Engaged in most major recent corporate actions e.g. Consolidated Media’s

acquisition by News, Woolworths spin-off and EGM.

Challenges & opportunities

› Although M&A activity continues to be subdued the market seems to be becoming

optimistic.

› Shareholder activism on the rise.

Regional Overview: Australia and New Zealand

Fund Services

53. Analyst Briefing of Computershare Limited.

State of play

› Focus has been on service delivery for new business onboarded in 2012.

› CFS operations have moved under centralised model better enabling leverage of

broader CPU learnings and processes.

Challenges & opportunities

› Further process improvements and efficiencies.

› Demand for service is there but needs to be at right pricing model.

State of play

› CPU ownership now 18 months - integration largely complete.

› Some good new client and project wins. Revenue growth and pipeline remains

strong.

› Focus on cost management and operational efficiencies continues.

Challenges & opportunities

› Learnings from CPU’s self service journey and work force planning should assist to

drive and accelerate operational efficiencies.

› Maximisation of ConnectNow and Switchwise as feeders of customers.

› International opportunities

› Texas, USA.

› ConnectNow/SLS.

Regional Overview: Australia and New Zealand

Serviceworks

54. Analyst Briefing of Computershare Limited.

State of play

› 80% CPU/20% Zumbox JV – CPU acquired Fuji Xerox interest in Dec 2012.

› First digital mail service in Australia running live and able to deliver

› Private launch held in 2012 for employees of CPU and other strategic partners

› Consumer launch expected in 1H13.

› Australia Post appeal due to be heard in May 2013.

Challenges & opportunities

› Senders love concept – however, need to sign up.

› Australia Post trying to launch a competitor product.

Regional Overview: Australia and New Zealand

Digital Post Australia

55. Analyst Briefing of Computershare Limited.

Investor & Analyst Briefing

Question Time

Scott Cameron

Head of Computershare Australia and New Zealand

21 March 2013

Investor & Analyst Briefing

LUNCH

Investor & Analyst Briefing

Business Overview: Specialized Loan Servicing (SLS)

John Beggins & Toby Wells

Specialized Loan Servicing Management

21 March 2013

59. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

US Strategic Perspective

Objective

› Identify a new business line where our skills, infrastructure and client relationships can

add significant value and that can grow to be a material contributor to the Group.

› Learn lessons (good and bad) from earlier business services acquisitions (e.g. vouchers

and bankruptcy admin):

› Good execution on identifying businesses where we can leverage skills,

infrastructure and client-base.

› Good execution on obtaining those benefits.

› Poor qualification of growth potential.

60. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

US Strategic Perspective

Integration into Computershare

› Stage 1: begin migration of shared services such as legal, compliance, finance, HR,

marketing, IT infrastructure, etc.

› Stage 2: determine where cost efficiencies and productivity gains can be achieved

through greater integration of core operations and call-centre infrastructure.

› Some examples

› Moving certain processing operations to Canton.

› Introducing Computershare technology applications – e.g., Capturepoint

inbound processing and imaging.

› Leveraging SLS’s Arizona service centre for other business lines.

› Moving print/mail functions in-house.

› Rapid growth in the market has resulted in a need to prioritise integration in certain key

areas such as IT and Risk.

› Other less immediately impactful changes, such as operational integration, have

been slowed as a consequence.

Business Overview: Specialized Loan Servicing

What is Mortgage Servicing?

› Mortgage Servicing is the management and administration of mortgage loans and

adherence with loan documents and various regulatory requirements. Mortgage

Servicing includes:

› Billing, collection and processing of loan payments.

› Management of customer enquiries and written communications.

› Monitoring of tax, property insurance and mortgage insurance to ensure

compliance with the loan documents.

› Management of custodial accounts holding principal and interest, as well as

escrow held funds for tax and property insurance payments.

› Counseling delinquent mortgagors about alternatives to foreclosure.

› Supervising foreclosure, bankruptcy and property dispositions.

61. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

History of Mortgage Servicing

› US mortgage industry started in small community banks that originated and

serviced loans.

› As banking consolidated and ownership of loans expanded to national banks,

mortgage servicing operations were formed to provide nationwide servicing of loan

portfolios.

› With the development of quasi-government agencies, such as Fannie Mae in 1938

and Freddie Mac in 1970, and a growing secondary loan market, non-depository

lenders and servicers were formed to originate and service conventional and

government-insured mortgage loans.

› In the late 1990s, with increased demand, Wall Street participants began to play a

bigger role in the financing and funding of mortgage loans.

› More diverse loan products became available to consumers.

› Requiring professional and specialised loan servicers to support enhanced

servicing and reporting requirements.

62. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

History of Mortgage Servicing, Cont’d.

› In an effort to maximise values, many of these loan products were directed to large

low-cost service providers that were ill-equipped to deal with the large volume of

defaulted loans.

› Consequently, post-2008, the industry migrated from low-cost service providers to

specialised servicers better equipped to manage defaulted loans during the

mortgage crisis in a new regulatory environment.

63. Analyst Briefing of Computershare Limited.

64. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

Three Primary Types of Servicers

›Captive Servicers:

› Generally bank-owned and service loans that are either originator owned or sold

to third parties with servicing retained by the captive servicer.

› Customer retention.

› Cross-selling bank services.

› Low-Cost Servicers and Subservicers:

› Generally service conventional and government-insured loans with a low risk of

default requiring fewer resources.

› Maximise value of performing loans by providing low cost to service.

› Specialty Servicers:

› Service and subservice a variety of loan products, which generally have a higher

risk of default and require high touch servicing.

› Improve performance of high risk servicing portfolios.

› Minimise losses incurred from defaulted loans creating value for clients.

65. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

Servicing Types

› Agency Servicing (Fannie Mae, Freddie Mac and Ginnie Mae) - Generally higher

credit quality and conventional/conforming loans.

› Low risk of default.

› Low cost to service and minimal servicing advance requirements.

› Low servicing and subservicing fees, which require higher volume of loans

serviced.

› Acquisition of mortgage servicing rights (MSRs) have a higher value or

multiples of servicing fees, due to more reliable cash flows over a longer life

of loan.

› Results in less risk or discount rate or return requirements.

› Origination representations and warranties risk transfers with servicing, which

requires financially strong counterparties and high net worth requirements.

› Servicing advances are difficult to finance with third-party lenders due to

agency-retained offset rights, which provide agencies with the right to

reimbursement from the top of the waterfall.

Business Overview: Specialized Loan Servicing

Servicing Types, Cont’d.

› Private Securitizations – generally lower credit quality and/or higher loan-to-value

non-conventional/non-conforming loans.

› High risk of default.

› High cost to service and high advance requirements.

› High servicing and subservicing fees with lower volumes of loans serviced.

› Acquisitions of MSRs have a lower value or multiples of servicing due to less

reliable cash flows over a shorter life of loan.

› Requires higher discount rate or return requirements.

› Servicers are indemnified for origination representations and warranties,

which requires a lower net worth.

› Servicing advances are relatively easy to finance with third-party lenders due

to top of the waterfall reimbursement from the cash flows from the entire

pool of loans.

66. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

Servicing Types, Cont’d.

› Whole Loans – generally not securitised, and owned by a single investor, which

tends to be a hedge fund or financial institution that does not have captive or

affiliated servicers.

› Whole loan portfolios can be composed of a many types of loans

(e.g. performing, nonperforming, 30-year fixed and option arms).

› Servicing fees are generally fee-for-service based on the status of the loan

and the servicers are often entitled to incentive fees for loss mitigation

activity.

› Loan owner owns the MSRs.

› Servicers are indemnified for origination representations and warranties.

› There is generally no net worth requirement since the agreement is

negotiated directly with the servicer.

› No long-term advance requirements for the servicer.

› Any advance would be reimbursed on a monthly basis.

67. Analyst Briefing of Computershare Limited.

› Financial institutions continue to re-evaluate their business models.

› Heightened regulatory landscape.

› National Servicing Standards, Consumer Finance Protection Bureau, Basel III

Rules and Dodd-Frank Act.

› Servicing market consolidation with approximately $1 trillion unpaid principal balances

(‘UPB’) in servicing sold in past year.

› Special servicers are leading the consolidation with another $1-2 trillion UPB in

servicing transfers expected in next few years.

› Current market players include:

› Nationstar Mortgage - acquired MSRs of more than $300 billion UPB in the past

year alone (e.g. Aurora Bank, Bank of America, Met Life and JPMorgan).

› Ocwen Financial - acquired more than $400 billion UPB in MSRs

(e.g. Res Cap, Homeward and Litton).

› Walter Investment (aka Green Tree Servicing) - acquired more than $100 billion

UPB (e.g. Res Cap, Bank of America and Met Life).

68. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

Current State of the U.S. Mortgage Servicing Market

› The U.S. mortgage market has always been highly-regulated, but with the

mortgage crisis of 2007, the industry is experiencing unprecedented regulatory

changes.

› Formation of a new federal regulator, Consumer Finance Protection Bureau

(CFPB).

› Consent orders, which created new national servicing standards.

› Adoption of Basel III Rules and Dodd-Frank Act.

› The implementation and management of these new regulations are a costly

investment for mortgage servicers.

› SLS’ ability to leverage Computershare’s resources provides an advantage

over competitors.

› Ability to navigate regulatory changes faster and more efficiently.

› The upfront and ongoing investment to comply and compete with regulatory

changes has created a significant barrier to entry for new market participants.

69. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

Regulatory Environment

› SLS servicing operations structure:

› Servicing operations: loan boarding, loan administration, customer service,

collections, loss mitigation, bankruptcy and foreclosure.

› Finance and business development: accounting, investor reporting, cash

management, analytics and credit facility management.

› Information Technology: Application Development and Management, Corporate

Support and Managed Services.

› Four profit centres:

› Real estate disposition and valuation services: manages the marketing and sale of

client owned real estate and provides property valuation products to client.

› Title services: provide title abstract products to attorneys and clients, title curative

and closing services to clients.

› Debt collections: provides collection services for loans with insufficient equity (i.e.,

charged-off subordinated lien assets).

› Insurance agency: brokers mortgage insurance products to customers and clients.

70. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

SLS Structure

› SLS is a well-known, high-quality special servicer with a proven track record of

improving the performance of challenged portfolios.

› The majority of our business comes from:

› Owners of credit risk in private residential mortgage-backed securities (RMBS)

seeking to minimise losses.

› Owners of whole loan portfolios seeking to achieve optimal performance of

their servicing portfolios.

› New business is primarily sourced from our existing clients.

71. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

Current State of SLS

› Continue to pursue direct subservicing and strategic MSR opportunities.

› Continue to develop and expand capital partner relationships to assist in the

acquisition of MSRs and enhance subservicing relationships.

› Expand into other product loan types such as Fannie Mae, Freddie Mac and Ginnie

Mae.

› Work with new loan originators to support their loan retention efforts.

› Work with large prime servicers to develop delinquent loan flow subservicing.

› Develop additional services to support existing and new clients (e.g. expansion of

valuation services and debt collection business).

72. Analyst Briefing of Computershare Limited.

Business Overview: Specialized Loan Servicing

Growth Opportunities for SLS

Investor & Analyst Briefing

Question Time

John Beggins & Toby Wells

Specialized Loan Servicing Management

21 March 2013

Investor & Analyst Briefing

Business Overview: Canada

Wayne Newling

Head of Computershare Canada

21 March 2013

Regional Overview: Canada

Investor Services

State of play

› Focus remains on client retention, new business, margin income opportunities and

cost control across the Transfer Agent and Corporate Actions business lines.

› Continue to negotiate and re-sign major clients.

› Corporate actions activity is slow, we have benefited from some corporate actions

in the commodity sector.

› Client satisfaction remains very high.

Challenges & opportunities

› Low interest rates continue to impact margin income.

› Regional competitors attempting to establish growing footprint.

› Pricing pressure continues due to clients actively pressuring their suppliers for

discounts and competition from new market entrants.

› Working with major participants in continued market structure debate.

75. Analyst Briefing of Computershare Limited.

Regional Overview: Canada

Corporate Trust

State of play

› Steady activity in residential mortgage backed securities. This includes new covered

bond initiatives.

› Debt activity has been consistent with new and existing issuances.

› Broker Registered Product holding up.

› Default levels stable (debt restructuring, etc.).

› Focus continues to be on client retention, new business, cost control and margin

enhancement across all areas of this business.

Challenges & opportunities

› Structured finance and other traditional issuances (e.g. warrants) remain slower due

to market conditions.

› Ongoing low interest rate environment adversely affecting earnings.

› Pricing pressures exist from global and regional competitors.

› Growth of balances remains an opportunity.

76. Analyst Briefing of Computershare Limited.

Regional Overview: Canada

Communication Services

State of play

› Continued steady growth in core commercial transactional revenues.

› Strong quality and service management driving high satisfaction and retention.

› Good cost control continues to balance pricing pressures.

Challenges & opportunities

› Notice and Access regulatory changes pressuring margins.

› Increasing trend to electronic communications supporting sales prospecting.

› Continuing to leverage existing Computershare relationships.

77. Analyst Briefing of Computershare Limited.

78. Analyst Briefing of Computershare Limited.

State of play

› Improved margins being driven by growing transactional activity combined with

strong economies of scale.

› Continue to lead marketplace in ESP recordkeeping and equity plan related

trusteeships.

› Focus continues on revenue growth via complementary product offerings

(Restricted Stock/Stock Options Plan) while maintaining quality and cost control

through automation and process improvement.

› Recently sold our stake in Solium Capital Inc.

Challenges & opportunities

› Pre-launch sales pipeline for Options is going well with strong interest from large

issuers.

› Pricing pressure continues due to clients actively pressuring their suppliers for

discounts and competition from new market entrants.

› Activity from US investors is driving higher FX transaction turnover.

Regional Overview: Canada

Plan Managers

79. Analyst Briefing of Computershare Limited.

Regional Overview: Canada

Corporate Proxy

State of play

› M&A deal flow remains very low, as market activity is soft and sporadic.

› Continued pricing pressures as issuers seek bids from multiple competitors.

› Regulatory changes (majority voting, slate ballots, say on pay) heightening issuer

awareness to shareholder engagement.

Challenges & opportunities

› Marketplace remains highly competitive.

› Focus on enterprise sales within CPU relationships.

› Potential increase in hostile proxy activity driven by increase in shareholder

activism.

Investor & Analyst Briefing

Question Time

Wayne Newling

Head of Computershare Canada

21 March 2013

Investor & Analyst Briefing

Business Overview: United States of America

Steven Rothbloom

Head of Computershare USA

21 March 2013

82. Analyst Briefing of Computershare Limited.

Regional Overview: United States of America

Investor Services

State of play

› Strong client satisfaction (93%), recommendation rate (90%), and retention: over 200

contracts renewed/extended FYTD and <1% competitive losses.

› Increase in dividend activity (special, accelerated, new, shift from annual to quarterly)

driving small amounts of additional revenue.

› Winning some business - 79 new TA relationships FYTD including most IPOs.

Challenges & opportunities

› Continued low interest rate environment eroding margin income.

› M&A activity low, comprising mostly smaller, lower revenue, cash jobs.

› Competitive pressure (banking relationships, below-market pricing) remains, but limited.

› Completing integration and delivering on acquisition synergies while continuing to provide

consistent service delivery.

› New global service model will provide industry-best service hours.

› Exploring opportunities to leverage expanded size to deliver new products and services to

issuers and shareholders.

83. Analyst Briefing of Computershare Limited.

Regional Overview: United States of America

Plan Managers

State of play

› Made a strategic decision to re-enter the options space, continuing to grow both options

and ESPP.

› Since that decision, retention OK - lost a large client, offset by solid new business

pipeline.

› Client satisfaction continues to be strong (over 90%) for both legacy Computershare and

Shareowner Services Plan Managers clients.

Challenges & opportunities

› Competition with brokers’ lower cost solution, which they offer as a trade-off for asset

capture.

› Brokers’ single solution for financial reporting.

› Computershare embracing open architecture for asset management and financial

reporting.

› Additional penetration of channels such as 401K providers.

84. Analyst Briefing of Computershare Limited.

Regional Overview: United States of America

Communication Services

State of play

› Realising major surge of FY13 growth from integration of new business.

› Redirect of BNY Mellon Shareowner Services outsourced work to CCS US.

› Redirect of Specialized Loan Servicing work to CCS US in progress.

› Commercial implementations: BMOHarris, Connecticut-on-line-Computing.

› Continued to grow both core and non-core work through our three US facilities in the

East, Midwest, and West.

› Continued focus on quality, with the California facility receiving ISO certification and the

New Jersey and Illinois facilities renewing their certifications.

Challenges & opportunities

› Maintaining Six Sigma level quality during period of major growth.

› Implementing Capturepoint (digital classification and workflow system) for SLS and

broader US commercial market deployment.

Regional Overview: United States of America

KCC Bankruptcy & Class Action

State of play

› Bankruptcy activity very low.

› Within limited market, # 1 in overall market share (34%) and in “mega” market (50%),

including Hostess Brands, Kodak & ResCap.

› Class Action proposal activity and revenue opportunity continues upward trend with

strong year-over-year growth and improved win rate of 45%, including Anthem, Hertz

and AT&T.

Challenges & opportunities

› Wall of debt continues to be pushed out: record-low interest rates enable distressed

companies to access capital and to refinance debt.

› Potential market share loss due to recent departures of sales team members.

› Limited brand awareness among class action attorneys challenges ability to win mega

deals despite expertise and capacity to handle large cases.

› FDIC insurance for qualified settlement funds offers escrow opportunities.

› Banks remain #1 target for class action opportunities; leveraging Computershare banking

and TA relationships.

85. Analyst Briefing of Computershare Limited.

86. Analyst Briefing of Computershare Limited.

Regional Overview: United States of America

Corporate Proxy Solicitation & Fund Services

State of play

› Overall Georgeson proxy business – annual meeting, proxy fights, and M&A – relatively flat

year over year – slight uptick in corporate governance consulting.

› M&A activity – won Sprint Nextel/Softbank; but continued lower activity levels for deals

over $100M.

› Mutual fund market continues at record lows, volume over the next ten years expected to

be only slightly less than the last ten years.

› CFS winning its share of small to medium size projects, some larger RFPs currently in play,

although very few over USD $5M anticipated in the near term.

Challenges & opportunities

› Weak M&A volume at top of the market; continued competition in proxy fights.

› Growth opportunity cross-selling Georgeson proxy services to Shareowner Services clients.

› Continue to grow assignments in compensation/governance consulting.

› Some pent-up demand in MFD market based on distraction of Dodd Frank and other

regulatory discussions.

Investor & Analyst Briefing

Question Time

Steven Rothbloom

Head of Computershare USA

21 March 2013

Investor & Analyst Briefing

Close