Direct Line Group: They went short. We went long

Printed from WARC

Listen with Speechify

0:00 25:51

20 min read

Carl Bratton, Ann Constantine and Nic Pietersma

Institute of Practitioners in Advertising, Gold, IPA Eectiveness Awards, 2018

Summary

Direct Line Group (DLG), a British insurance company, measured the impact of marketing in both the short and long term to provide a holistic view

of how brand acquisition and investment inuence consumers.

A highly competitive market, the insurance sector faces severe budget restrictions with DLG's competitors responding by cutting brand advertising

and shifting into short-term acquisition marketing.

DLG questioned whether the industry's preferred short term approach was the most eective solution and it invested in mass reach, above-the-line,

brand-building media lines.

DLG's research indicated that a small nudge from brand preference can have a disproportionately large eect as this slight preference means that

thousands of marginal decisions go its way, ultimately delivering 37% of sales in the PCW environment.

As a result of brand advertisement two of DLG's brand are in the top three insurance brands in the market – an outcome that it argues could only be

achieved with a long-termist approach to brand measurement, management and investment.

Campaign details

Brand: Direct Line Group

Advertiser: Direct Line Group

Agency: Direct Line Group; Ebiquity

Summary

Direct Line Group (DLG) had to demonstrate the business case for marketing its multiple insurance brands:

Direct Line, Churchill and Privilege. The company analysed what factors drove sales at each brand, measuring

the contribution of brand and acquisition activity over the short term and the long term. It used the learnings to

set investment priorities across its portfolio, including more focus on brand-building TV, improving propositions

and customer service. Brand preference and consideration rose across the portfolio. Total customers increased,

led by Direct Line. This case estimates DLG brands contributed £46m prot to its home and motor insurance

businesses.

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

1/25

Editor's comment

The judges thought that this was an excellent case of an organisation adopting a systematic approach to

effectiveness, using this to help manage its portfolio of brands, model brand equity and communications spend

both in the short and long term. Something for everyone to learn from.

Client comment

This project was a huge undertaking for marketing, spearheaded by the marketing effectiveness team. It required

patience and perseverance. What we built is knotty in the extreme, but has become a key platform to cement the

condence, capability and credibility of marketing within the business.

Coincidentally at the time of writing we are responding to a cost challenge. However, we are not panicking since

we have the nance community saying that marketing 'is the last place we want to have to take from'. There is no

greater accolade for the team than moving us from the front of the 'cuts queue' three years ago to the back of the

queue today. Because we are able to articulate precisely the short- and long-term impacts of our marketing

investment decisions we have changed the tone of conversation with the business. This empowers us to do the

right things for our brands with a very explicit long-term perspective in mind.

This backdrop has also provided a context for genuine creativity in our communication as evidenced by bold

projects such as 'Fleetlights' and 'Smart crossing' which were unimaginable a few years ago. Implicit to this we

have been able to 'prove it' i.e. acceptance across the business that the art of long-term brand building is alive and

well. Seemingly the more things change, the more they stay the same!

We are proud that we went long when others went short. It was painful at times given that we were moving

against popular opinion. However, there is a restless ambition in the team so this journey represents how we

constantly aim higher to bolster our brands and drive towards a customer-rst business.

Mark Evans, Marketing Director, Direct Line Group

Introduction

Every marketing professional deals with them at some point in their working life. Cost challenges.

'The business needs £5m to pull out of 2016 ... can you get back to me by the end of the week with your suggestions.'

Cost challenges are a fact of life, but they have been the everyday norm in the insurance sector for the last ten

years. Insurance is ultra-competitive; it is as close to perfect competition as you can get. Consumers can enter

their details on one price comparison website and instantly get hundreds of quotes back from across the

marketplace. This is an unforgiving environment, where every pound spent on marketing needs to pay for itself.

Most direct insurers have responded to budget challenges by cutting brand advertising and shifting into short-

term acquisition marketing, trying against all odds to boost short-term efficiency.

At DLG, we chose a different path. We zigged when the rest of the market zagged; we continued to invest in

mass-reach above-the-line brand-building media lines when others did not. Why?

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

2/25

We subscribe to the philosophy that we have a duty to invest responsibly. At DLG we work with brands that have

been built up through long-term investment over the last 30 years; they are assets and we see ourselves as their

current guardians.

To ensure that we continue to make the right decisions for the brand, for shareholders and for our business, we

set up a two-year joint marketing insight and effectiveness workstream called the Brand Equity Analysis

Programme. This programme has helped us identify c. £46m of previously unmeasured prot contribution per

year.

In this paper we present three case studies that together create a strong commercial argument for long-termism

in the management of brands in the nancial sector and beyond.

Case Study 1: The Brand Glide Path – Privilege Insurance

For our rst study we asked the question ... what happens when we 'turn off the tap' and completely stop brand

investment?

Privilege was launched in 1994 as a brand for higher-risk consumers, but soon evolved into a mass-market brand.

Between 2004 and 2006 Privilege enjoyed high levels of above-the-line marketing support, featuring the slogan

'you don't have to be posh to be privileged' made famous in the UK by Joanna Lumley.

Around 2006 the insurance market was disrupted by the growth of price comparison websites, or PCWs

(illustrated in Figure 1 using Google search volume ).

PCWs changed the existing commercial logic of insurance marketing by offering a commission-based model that

was cheaper than media acquisition. Media cost per sale climbed as the size of the direct market shrank.

Furthermore, on PCWs, brands that carry large marketing overheads are at a pricing disadvantage. After a

portfolio review, we identied that DLG needed a 'pure PCW' brand. Privilege was given a new strategic position

– it carries no marketing overhead and is priced as keenly as possible. The brand outcome of this natural

experiment is shown in Figure 2.

Figure 1: Growth of price comparison sites

Source: Indexed Google Trends for top four brands

Figure 2: Privilege Insurance the brand glide path

1

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

3/25

Case study 1: What did we learn?

First, when marketing investment is reduced, brand metrics such as spontaneous awareness do not decline

immediately. It took about three years for the brand to level off at c. 2-3%, where it stabilised. Second, in the

period between 2007 and 2009, although the level of investment was greatly reduced, even a little spend seemed

to provide some 'maintenance' support.

This case study gives us a measure of what 'glide path' we should expect as a consequence of reducing marketing

investment for any of our brands.

Case Study 2: Brand Advantage on Price Comparison Websites -Churchill Motor

Measurement of marketing effectiveness on direct channels (like phone or web) is relatively easy, but

understanding the inuence of brand marketing in a PCW environment is much more difficult. Churchill's

challenge is that it is both a direct brand as well as a PCW brand.

Above-the-line advertising relies on a small percentage of the audience responding via website or contact centre.

Measured this way, on a direct cost per sale basis, Churchill brand advertising is below breakeven and looks

unsustainable versus Direct Line (Figure 3).

Figure 3: Motor insurance direct cost per sale (indexed Churchill vs. Direct Line)

To understand the full picture though we need to know how brand equity inuences consumers in the PCW

environment. The consumer journey is fundamentally different on PCWs. When consumers start shopping they

may not have your brand in mind at all. Once they submit their details they will be confronted with numerous

options, mostly comparable in quality, and all bunched together around a similar price point.

2

3

4

5

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

4/25

What makes the consumer select one brand over the other? Competitiveness is tremendously important, but

contrary to popular belief consumers do not always choose the cheapest brand. For DLG, roughly half the sales

volume on PCWs come from quotes that were not in fact the cheapest result shown to the consumer (Figure 4).

Familiarity may provide a nudge that swings consumers towards one brand rather than the rest. This dynamic is

particularly apparent for insurance brands. Insurance is about trust. Consumers are anxious about poor claims

handling, refusal to pay out or nancial insecurity. Many will automatically exclude any unknown brand.

'I've never heard of these brands ... I don't want to make a mistake. I know legally an unknown brand would have to pay out, but

a known brand would provide me with more reassurance.'

Andrea, Manchester

Once the consideration set is narrowed, consumers will look for a 'better brand' and are willing to pay a small

price premium if necessary. Our survey data suggests that recognisable brands are also likelier to be trusted and

selected. This mechanism is subtle, but as we will show it's ultimately very effective (Figure 5).

Figure 4: PCW motor insurance sales by position in results (total DLG, Churchill and Privilege)

Figure 5: General insurance awareness drives trust

Measurement approach

6

7

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

5/25

We found that if a consumer is served an identical price for both brands, c. 83% of consumers chose Churchill. If

however, Churchill has a higher price we would still see a certain proportion of consumers selecting Churchill as

their preferred brand.

For example, as shown below, at a price premium in the £10—£19 range, we would still see c. 33% of consumers

choose Churchill.

This is a well-behaved relationship that is predictable and consistent in the data -the greater the price premium,

the greater the switching rate (Figure 6).

Figure 6: Motor insurance preference Churchill vs. Privilege by price comparison

This analysis can be extended. We were able to quantify Churchill's brand advantage by matching PCW data to

internal data on clicks, quotes, sales and customer demographics; then we used Privilege as a 'low brand equity'

reference point.

To understand the volume advantage conferred by Churchill's stronger brand equity we need to look at the click-

through rate, an important metric in the PCW environment.

On a PCW, a click-through is intermediate between a quote and a sale. If a quote is more competitive it will gain

a better rank position, which will improve the click-through rate.

However, because competitiveness is so important, we cannot compare click-through rate directly between

Churchill and Privilege without rst banding into rank. What this shows is that Churchill enjoys better click-

through rates for any given rank (Figures 7 and 8).

Figure 7: Click-through rate by brand and rank

8

9

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

6/25

Figure 8: Click-through rate advantage Churchill vs. Privilege

Why do consumers seem to have a preference for Churchill? More to the point, why are some consumers willing

to pay a premium to be covered by Churchill? It is not service levels. Churchill and Privilege are supported by the

same contact centres and claims handlers and have similar satisfaction and complaint rates.

The explanation is that Churchill has enjoyed much higher brand advertising investment over the last ten years

which has driven its advantage. Regardless of metric, it is clear that Churchill is ahead of Privilege (Figure 9 and

10).

Figure 9: Ad spend 2008-2016

Figure 10: Brand metrics 2016

10

11

12

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

7/25

The dependent variable in our models is click-through rate for each age band and rank. Robust quantication of

the size of the brand effect requires further controls which are implemented in a time-series multiple regression

framework. Specically:

Age banding: splitting the data into age bands helps control for composition effects. Three groups were

used: 16-34, 35-54, 55 + ;

Price point: beyond grouping data by rank we also control for price competitiveness in both absolute and

relative terms;

Propositions: there were periods when either Privilege or Churchill benetted from special offers such as

free breakdown, free toys or telematics;

Media: time-series analysis is required to quantify the short-term benet of marketing investment, which

is a signicant factor even if it is much smaller than the long-term benets.

Our model is set up within a system that includes both Churchill and Privilege data. Any difference that cannot

be explained by the factors above are absorbed by differences in brand equity.

This modelling approach helped us establish under what circumstances Churchill's enhanced brand equity

delivers the greatest benet. We found that brand equity gives us a bigger advantage if our price is within an

acceptable range (ideally in rank 2-4) and that we are more likely to 'swing the vote' of older consumers (Figure

11).

Figure 11: Standardised impact on click-through rate Churchill brand advantage (by age and position

in results)

13

14

15

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

8/25

A fascinating result! But what is this worth in commercial terms?

Case study 2: What did we learn?

Of Churchill's PCW sales, 37% can be attributed to our brand advantage and a further 5% can be attributed to

short-term impact of above-the-line marketing (Figure 12).

A small nudge from brand preference can have a disproportionately large effect. Our analysis suggests that if a

consumer is willing to pay a premium for a brand, the most they will tolerate is typically in the £10-£20 range.

But even if the consumer's attachment to our brand is slight, thousands of marginal decisions go our way,

ultimately delivering 37% of Churchill's sales in the PCW environment.

By isolating this impact we quantied c. £5.5m of previously unmeasured prot contribution (Figure 13).

Figure 12: Churchill weekly sales decomposition

Figure 13: Churchill motor media ROI (52 weeks to March 2017)

16

17

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

9/25

Over the same period the short-term prot contribution from brand media lines was c. £2.9m at an ROI of

£0.45. If we made budget decisions on a pure short-term basis we would have disinvested at this point. Having

measured the long-term contribution on PCWs we get an additional ROI of £0.63.

This takes us to an ROI £1.08, which we consider commercially sustainable to continue supporting the brand.

Strategically, we could not replicate this outcome by reducing our marketing overhead and lowering our price

point; our competitive set can (and do) respond to price changes almost instantly. The Churchill brand legacy is

based on long-term investment and a tremendous creative asset; this builds a consumer affinity that acts as a kind

of soft 'barrier to entry' that low-cost insurers cannot match.

Case Study 3: Pathways to Consideration – Direct Line Insurance

Our third case study is about nding the balance between brand and acquisition media lines.

It is worth recapping some of Direct Line's achievements. In 2014, after four years of decline, we rebooted the

brand with the 'Fixer' campaign led by Harvey Keitel. The use of a character from a Tarantino lm to represent

our brand was a bold choice, but we were condent that the humour and the promise of straightforward

convenient insurance would resonate with our target market. Initial results were excellent. In 2016 we submitted

an IPA paper that showcased early signs of success from the reboot.

The IPA Advertising Works editor commented that '... this case documented an extremely well-considered comeback that

transformed the business from inside out'. Since then, we have indeed gone from strength to strength. We know that

market trends and improved short-term media ROI is part of this success story, but we also believed that there

was a brand element that we were failing to capture (Figure 14).

Figure 14: Direct Line motor and home quotes

18

19

20

21

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

10/25

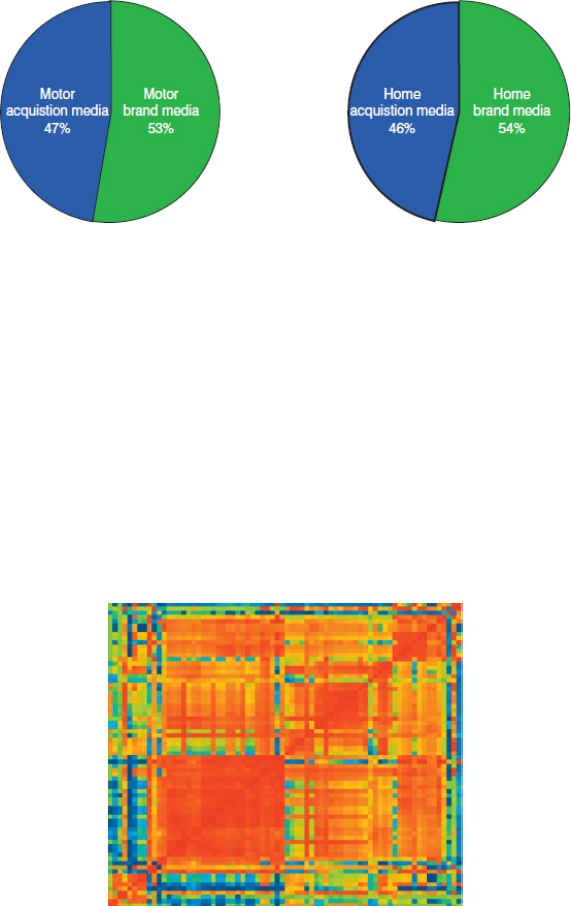

Understanding the true drivers of our growth is critical for our commercial planning. Our challenge is that,

despite our growth since reboot, the short-term acquisition costs of brand media lines are still much higher

than we see for acquisition media lines (PPC, affiliates or DM). The cost per sale of brand media is shown

indexed versus acquisition media in Figures 15 and 16.

Figure 15: Direct Line cost per sale - motor and home

It is a fair challenge to ask whether putting c. 45-50% of our Direct Line marketing budget into what apparently

looks like a less-efficient media line is the right decision for DLG. To address this we created a new measurement

approach that allows us to better understand the impact of our marketing investments on long-term dynamics

(Figure 16).

Figure 16: Direct Line motor spend percentage - motor and home (52 weeks to October 2017)

22

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

11/25

Measurement approach

The dening problem of modern commercial analysis is not that there is not enough information, but that there

is too much. Brand survey data gives us an abundance of information - hundreds of metrics that can be split

hundreds of ways. This creates an analytic challenge; how can we identify what element drives commercial

growth? Individually, many brand measures are statistically noisy making it hard to draw meaningful conclusions

about what individual factor is driving success.

The correlation heat map shown in Figure 17 represents a subset of 72 brand metrics available for Direct Line.

Red data points indicate highly correlated metrics, blue data points represent negatively correlated metrics.

Figure 17: Direct Line brand metrics correlation

This graphic illustrates two things: a) there are large red blocks of metrics that all move together and seem to be

measuring some underlying factor and b) there is too much data for meaningful interpretation.

In order to make sense of the information it is necessary to reduce the number of factors we look at. This can be

done using techniques such as factor analysis, principal components analysis or cluster analysis (as shown in

dendrogram in Figure 18).

Reducing the dimensions of the brand dataset gives us a more natural way of thinking about human attitudes so

we can identify the pathways that drive commercial growth; either directly or indirectly.

For DLG brands, the exact aggregation differs for new and existing customers, for home and motor and by

period. However, the factor groupings shown in Table 1 highlight common themes that were found to be most

representative across the portfolio.

The extended brand health dataset could not be tested in an econometric framework. The reduced factor set,

however, can then be tested.

23 24

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

12/25

The rst stage of the analysis is a 'traditional' econometric model which we use to strip out drivers like PPC, DM

and the short-term impact of above-the-line media. For Direct Line motor insurance this accounts for about 41%

of sales. For home insurance this accounts for 48%.

But what about the remainder? Typically this is described as 'base' sales and it would include factors such as the

market, the regulatory environment and brand equity (which we believe would determine market share in the

absence of price and short-term marketing).

The mechanism through which brand investment drives base evolution is not straightforward, but rather relies on

both direct and indirect pathways. One fundamental nding is that consideration is directly linked to base sales,

which conrms a rather classical view of how the marketing funnel works (Figures 19 and 20).

Figure 18: Dendrogram cluster analysis of brand values

Table 1: Factor groupings

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

13/25

Figure 19: Pathways of inuence - motor

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

14/25

Figure 20: Pathways of inuence - home

These diagrams illustrate how these pathways of direct and indirect effects drive consideration and ultimately

help us explain base evolution.

Top-of-mind factors are shown with the pink arrows. For motor insurance we found that the 'Guaranteed hire

car' campaign drove awareness which in turn drove consideration and base sales. Similarly we found that buzz

drives awareness.

Brand-perception factors are shown in blue. The 'Guaranteed hire car' campaign directly improved perceptions of

straightforwardness, trustworthiness, and customer service. These in turn helped improve the net promotor score

(NPS), either directly or indirectly, which feeds into consideration. Similarly, reliability and non-customer

service perceptions are positively associated with awareness.

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

15/25

For the 'Emergency plumber' home insurance campaign shown in Figure 22 we saw similar patterns emerge. The

campaign drove positive brand perceptions on customer service, honesty and 'doing the right thing' as well as

top-of-mind factors such as buzz and awareness. All of which ultimately improved base sales via consideration ...

the value of which is quantied in the next section.

Case study 3: What did we learn?

First, as a result of this work we now know with much greater rigour that consideration and awareness are key

drivers of our base, but more importantly we have identied the levers we need to pull to move them and we

know which media channels can inuence our base evolution.

Second, we have identied specic long-term multipliers for Direct Line of 1.60 for motor and 1.70 for home.

These are not nebulous 'industry norms' but are derived by linking our tracking data to our own commercial

performance. After factoring these into our commercial planning we see that the effective cost per sale of

acquisition and brand media is much more evenly balanced (Figure 21).

Figure 21: Direct Line cost per sale - motor and home (econometrics 52 weeks to October 2017)

Finally, our analysis allowed us to further decompose the base and identify the contribution of brand equity. We

already knew that on a short-term basis, marketing delivers around 40-50% of our sales (see below). What we

now know is that brand equity accounts for c. 20-25%.

Before even considering the long-term contribution, our marketing ROI on Direct Line is excellent. We

delivered a short-term return of £2.39 in the 52 weeks to March 2017 across home and motor (Figure 22).

Figure 22: Short-term vs. brand equity share

25

26

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

16/25

But what we found truly stunning was that the previously unmeasured prot contribution is worth c. £40.5m on

a ve-year NPV basis. To put this in perspective, that number alone represents about 9% of DLG's average

annual prot.

Implications: What We Did Differently

Taking the three case studies as a whole, here are four things we did differently as a result of our cumulative

learnings.

We doubled down on brand-led TV marketing

As PCWs became the primary shopping channel, most insurance brands reduced investment in TV advertising.

DLG didn't follow the trend. We kept TV at the heart of our media plan because we knew that it is an effective

driver of brand equity in general and awareness, buzz and consideration in particular. As of 2017 our share of TV

spend was twice our market share for motor, and three times for home (Figure 23).

Figure 23: TV share of voice vs. share of market - motor and home

Within TV planning our strategy also changed. Historically, about half of the budget was brand (BRTV) which

predominantly airs in more premium peak programming. The other half was direct response (DRTV), which is

typically aired during the daytime. With a renewed focus on brand building, the balance has shifted towards

BRTV As of 2017 almost 80% of our TV budget is brand focused (Figure 24).

Figure 24: DLG TV shore by brand vs. direct response TV

27

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

17/25

We are digital conservatives

Until very recently, the marketing orthodoxy has been that more targeting (and more digital media) is always and

unambiguously a good thing, not with us! Between 2013 and 2017 we substantially reduced investment in digital

display and programmatic online video, both compared to previous years and compared to our competitor peer

group.

What informed our divergent thinking? We devised a geotesting programme to understand the incremental

impact of digital. A series of tests gave us evidence of poor performance (despite excellent efficiencies being

reported on a post-impression basis).

These results put us ahead of the curve. The world of marketing was shaken in 2017 when Marc Pritchard of

P&G shone a light on the lack of transparency and poor efficiency of many programmatic media lines - but this

was not new news at DLG.

We call ourselves digital conservatives but we are not anti-digital. We favour new, innovative and targetable media

if it is cost-effective. Whatever the media line, cost-effective reach has become our imperative for all marketing

investment decisions across the brand portfolio.

We could nd compelling evidence for both the long-term and short-term effectiveness of media lines such as TV

and radio. By contrast, our research did not support continued investment in a number of programmatic digital

media lines even on a short-term basis.

The line chart in Figure 25 shows the non-response of our home and motor quote volume during an aggressive

upweight of display spend across half the UK while the other half was 'dark'. Blue bars represent delivered

impressions.

Figure 25: DLG digital display test number 1

28

29

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

18/25

On the back of this test we reduced our display spend across the portfolio from approx. £3.5m in 2013 to no

BAU display spend in 2017. These savings have contributed the most to our post-IPO budget challenges and

helped us defend brand budgets.

We improved our propositions and customer experience

The Brand Equity Analysis Programme demonstrated to us that our complaints, customer service perceptions

and net promoter scores are all important pathways on the way to consideration.

If customers have a sub-par experience with our brands, we know that this will put our brand equity at risk,

regardless of how much we invest in advertising. To protect our brand assets, we put together a programme that

improved the customer experience and our propositions across the portfolio. What kind of improvements were

implemented?

We reduced our reliance on discount-led advertising and strengthened our execution of the 'Fixer' positioning

with a string of market-leading propositions (Figure 26).

Figure 26: Direct Line 'Fixer' campaign

Against conventional thinking for an insurer we cancelled policy-amendment fees for Direct Line despite the

commercial risks (and an annual cost of c. £7m ). We improved car repair turnaround time through a

partnership programme with garages. The proof is in the numbers: our complaints rate fell by 48% between 2014

and 2017 (Figure 27).

We saved the dog! We continue to support a portfolio of brands

30

31

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

19/25

We have evidence that we should continue to support investment in the Churchill brand (Figure 28). From a

short-term perspective, this investment decision would previously have been indefensible. More broadly, we

understand that while there may be cost advantages to reducing the number of brands we support, we would lose

out on the benets of a 'diversied portfolio'. Our portfolio strategy is underpinned by a needs-based behavioural

segmentation model.

Figure 27: Personal lines complaints rate (Direct Line, Churchill, Privilege)

Figure 28: The Churchill bulldog and Green Flag

This has helped us reach consumers with different values and needs: we are able to reach customers who just

want the best possible price point (Privilege); consumers who are willing to pay a premium for a brand they know

and trust (Churchill); as well as consumers who simply want the best possible product and who value

straightforward convenience.

Conclusion: Performance of Our Brand Portfolio (2013-2017)

Was it successful? Unequivocally yes!

Because we have played the long game and sustained brand investment over the years, Direct Line and Churchill

enjoy some of the strongest spontaneous consideration scores in the marketplace. We own two of the top three

insurance brands in the market - an outcome that could only be achieved with a long-termist approach to brand

measurement, management and investment (Figure 29).

Figure 29: Spontaneous brand consideration

32

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

20/25

We also enjoy excellent preference scores across general insurance. Again, this is the long-term payoff for

ongoing brand investment and our focus on improving the customer experience (Figure 30).

Figure 30: Preference home and motor

33

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

21/25

Figure 31: Total DLG in-force policies

We have also seen gains in the DLG share price since our IPO - signicantly ahead oftheFTSE 100 (Figure 32).

Figure 32: DLG share price vs. FTSE 100 (indexed October 2012)

Three years ago we set out on a journey to understand whether our brand-led strategy was right for DLG when it

seemed that so many of our competitors were travelling in the opposite direction.

The results are phenomenal! This paper has outlined how improved measurement has enabled us to quantify

£46m previously unmeasured prot contribution on home and motor alone .

Proper measurement of the contribution of brand equity has fundamentally altered the strategic thinking of the

business.

Through this piece of work we have been able to educate the organisation and we now have a better appreciation

of the value of our brands.

When the inevitable costs challenges do come around we can explicitly quantify the long-term impact of our

short-term decisions.

To put it simply, what we learned has allowed us to play the long game when others could not.

35

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

22/25

Notes

1. Source: Google Trends, 2004-2016.

2. Source: Spontaneous awareness data is based on survey based brand tracking from a number of providers.

TNS 2004-2017, Nunwood 2008-2013, Hall & Partners 2013-2016.

3. Source: Spend based on internal records.

4. By 'direct' we mean that the customers gets a quote either with the contact centre over the phone, or directly

on the website. Churchill's motor sales split is c. 40% direct to 60% PCW

5. Source: Ebiquity short-term econometrics. Media lines include TV, radio, press, OOH, social, display and

cinema. Period: 52 weeks to October 2017.

6. Source: Internal data and a leading PCW Period March 2014 to September 2016.

7. Source: Box-Clever. Survey Date: March 2017. Sample Size: 3036.

8. The PCW data used was sourced from one of our PCW partners and has a number of limitations in place.

Information was only provided on the top ve positions of each query and both brand and consumer were

anonymised. Exact quoted premium were provided for each position. Period: July 2014 to June 2016.

9. An implicit assumption here is that Privilege is a kind of 'non-brand' with zero equity. Clearly this is false as

many of us lovingly remember the Joanna Lumley adverts that ran in the early 2000s. This is a valid

criticism, but it should be noted that this will bias the results of our analysis downwards, not upwards.

10. Source: Internal data.

11. Source: Advertising spend from Ebiquity Portfolio 2008 to 2017. Media lines include estimated spend for

TV, Radio, Press, Cinema and Outdoor.

12. Source: Hall & Partners. 2016.

13. Black-box devices that measure driving characteristics and feed into (hopefully) cheaper insurance

premiums. Our model suggests consumers see Telematics as a 'slight negative' after adjusting for its pricing

benets.

14. Specically we used an ordinary least squares xed-effects panel model.

15. Technical note: the brand equity variable shares a common coefficient across Churchill and Privilege.

16. This £10-£20 gure can be derived from the hanging-bars analysis and has been corroborate by conjoint

analysis conducted in 2014 by Hall & Partners.

17. Based on the last 52 weeks of the model to June 2016.

18. Including TV, radio, sponsorship and VOD.

19. You could argue that this is a false dichotomy but for the purposes of this paper we are treating brand

building media lines such as TV, radio, cinema, OOH and press as 'brand' and demand- harvesting media

lines such as DM, door drops, PPC and SEO as 'acquisition'.

20. IPA Advertising Works Volume 23, 2016.

21. Source: Internal data. Period: December 2012 to September 2017.

22. Source: Based on econometric measurement of short-term advertising effects 52 weeks to September 2017.

23. Customer Net Promotor score and complaints data sourced from DLG. Positive Buzz sourced from

YouGov. All other survey data for this study was provided by Hall & Partners. Period: Jan 2013- March 2017.

Sample: n = 1000.

24. To do so would be committing the crime of 'over-tting' the data.

25. Based on econometric analysis.

26. ROI calculated using a ve-year net present value for each acquisition. Breakeven ROI is c. £1.00.

27. Source: DLG Annual Report 2017. Average declared prot before tax 2016 and 2017.

28. This includes prospecting and retargeting.

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

23/25

Related Content

Monday May 13th 2024 -

WARC Awards for

Eectiveness

(http://www.warc.com//Search?

sc=WARC%20Awards%20for%2

0Eectiveness)

Anusol: Bum's

the word: How

Anusol smashed

taboos and

unlocked record

growth

(http://www.warc.com//content/ar

ticle/warc-awards-

eectiveness/anusol-bums-the-

word-how-anusol-smashed-

Monday October 10th

2022 - IPA (UK)

(http://www.warc.com//Search?

sc=IPA%20(UK))

Cushelle: How a

koala took on the

top dog

(http://www.warc.com//content/ar

ticle/cushelle-how-a-koala-took-

on-the-top-dog/147282)

Cushelle, the UK loo roll

brand, targeted key brand

metrics in a paid media ad

campaign that delivered

an extra 4% of market

share.

Thursday June 24th 2021

- WARC Awards for

Eectiveness

(http://www.warc.com//Search?

sc=WARC%20Awards%20for%2

0Eectiveness)

McDonald's:

Return of the

Mac(ca's)

(http://www.warc.com//content/ar

ticle/warc-awards-

eectiveness/mcdonalds-return-

of-the-maccas/137280)

McDonald's, the fast-food

chain, managed to regain

and sustain sales within

Wednesday June 23rd

2021 - Cannes Creative

Lions

(http://www.warc.com//Search?

sc=Cannes%20Creative%20Lion

s)

Aldi: Like brands

2011-2020

(http://www.warc.com//content/ar

ticle/cannes/aldi-like-brands-

2011-2020/136966)

Aldi, a supermarket chain,

increased brand love and

penetration in the UK by

launching a campaign

spanning several years

that applauded its

29. Implemented in partnership with Ebiquity.

30. Digital display spend is currently conned to our media testing budget (based on 2017 and 2018 plans).

31. Source: Internal data. Period: January 2014 to January 2018.

32. Our brand tracking was recently moved to a new provider and as such we cannot offer a multi- year time

series view. Period: Monthly average for the period July 2017 to February 2018. Source: Kantar Millward

Brown. Sample size: 1000. Question: 'Thinking about the next time you need to renew your motor! home insurance

policy, which providers would you consider?'

33. Source: Kantar Millward Brown. Period: Monthly average for the period July 2017 to February 2018. Sample

size: 1000. Question: Tf price was equal, which home and/or car insurance provider would you prefer to use?'

34. Based on consumer panel data provided by insurance specialist Consumer Intelligence.

35. On an annual basis. This is £5.5m on Churchill motor and £40.5m on Direct Line motor and home. This is

a conservative estimate as it does not include many of our other lines such as Churchill Home, Direct Line

for Business, Green Flag or Privilege.

About the authors

Carl Bratton

Direct Line Group

Ann Constantine

Direct Line Group

Nic Pietersma

Ebiquity

Topics

Insurance (http://www.warc.com//search/Financial-services?l3=Insurance) United Kingdom (http://www.warc.com//search/Europe?l3=United%20Kingdom)

Strategy (http://www.warc.com//search/strategy-pillar?l3=Strategy)

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

24/25

taboos-and-unlocked-record-

growth/154789)

Anusol, a brand of

haemorrhoid treatments,

created a TV

advertisement challenging

the taboos surrounding

haemorrhoids in the UK to

encourage suerers to

seek treatment with its

products to grow sales.

four weeks of a national

lockdown in New Zealand.

competition rather than

knocking them.

© Copyright IPA, Institute of Practitioners in Advertising, London 2018

Institute of Practitioners in Advertising

44 Belgrave Square, London SW1X 8QS, UK

Tel: +44 (0)207 235 7020, Fax: +44 (0)207 245 9904

www.warc.com (https://www.warc.com)

All rights reserved including database rights. This electronic le is for the personal use of authorised users based at the subscribing company's Authorised Oce (as dened by

the WARC Copyright Policy (https://www.warc.com/copyright-policy)). It may not be reproduced, posted on intranets, extranets or the internet, e-mailed, archived or shared electronically

either within the purchaser's organisation or externally, save as permitted by the WARC Copyright Policy (https://www.warc.com/copyright-policy).

6/25/24, 4:19 PM

Direct Line Group: They went short. We went long | WARC

https://www.warc.com/content/article/ipa/direct-line-group-they-went-short-we-went-long/en-gb/122384

25/25