Employee Dental Plans

Member Guidebook

Pensions & Benefits

HD-0379-0124

The Dental Plan Organizations and The Dental Expense Plan

For the State Health Benets Program and the School Employees’ Health Benets Program

Employee Dental Plans — Member Guidebook January 2024 Page 2

State Health Benets Program School Employees’ Health Benets Program

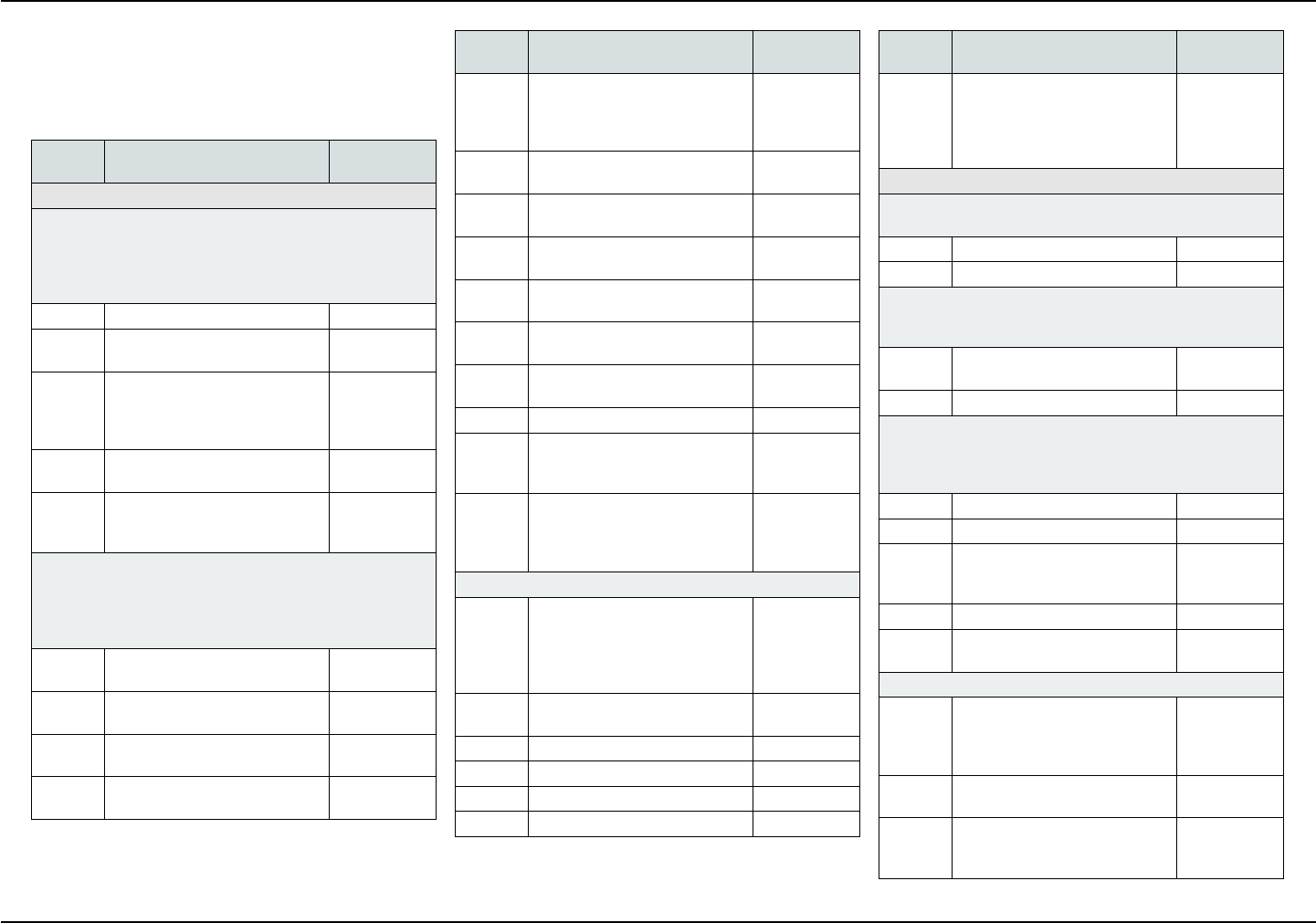

TABLE OF CONTENTS

Introduction ................................4

Employee Dental Plans Eligibility .............4

State Employees .........................4

Local Employees .........................4

Eligible Dependents .......................5

Retirees ................................5

COBRA Coverage ..........................5

Employee Dental Plans ......................5

General Conditions of the Dental Plans ........5

Enrollment ..............................5

Limitation On Changing Dental Plans .........5

Dual Dental Enrollment Is Prohibited ..........5

Other Enrollment Information ................5

Dental Plan Choices ........................6

Levels of Coverage .........................6

Dental Plan Premiums. . . . . . . . . . . . . . . . . . . . . . . 6

State Employees .........................6

Local Government and

Local Education Employees .................6

Extension of Coverage Provisions ............6

If Eligibility Ends While Undergoing

Treatment ...............................6

For Children Over the Age of

26 With Disabilities ........................6

Transition of Care .........................6

Orthodontics Takeovers —

From Previous Insurance Carrier .............6

Special Provisions of the

Employee Dental Plans ......................7

Coordination of Benets With

Other Insurance Plans .....................7

Third Party Liability .........................7

Repayment Agreement .....................7

Recovery Right ...........................7

HIPAA Privacy .............................8

Audit of Dependent Coverage ................8

Health Care Fraud ..........................8

The Dental Plan Organizations ................8

Considerations in Choosing a DPO ............8

Covered Services ..........................9

Orthodontics ............................17

More Expensive Services ..................17

Emergency Services — Out of Area ..........18

Services Not Covered by the DPO ............18

The Dental Expense Plan ...................18

Annual Deductible. . . . . . . . . . . . . . . . . . . . . . . . 18

Reasonable and Customary Charges. . . . . . . . . 18

Dental Expense Plan Benets (Chart) ........19

Covered Services .........................19

Annual and Lifetime Benet Maximums .......19

In-Network and Out-of-Network Integration ....19

In-Network Claims (Chart) ..................20

Out-of-Network Claims (Chart) ..............20

Additional Provisions of the DEP ............20

How Payments Are Made ..................20

Filing Deadline — Proof of Loss .............20

Itemized Bills Are Necessary ...............20

Predetermination of Benets ...............20

Alternative Procedures ....................21

Services Eligible For Reimbursement .........21

Orthodontic Services

Eligible For Reimbursement .................21

Orthodontic Benets .......................22

Services Not Eligible

for Reimbursement ........................22

Orthodontic Charges Not

Eligible Under the DEP .....................22

Appendix I

Claim Appeal Procedures ...................23

Appendix II

Glossary .................................24

Appendix III

Available Dental Plans (Chart) ...............25

Appendix IV

Tax$ave ..................................26

Appendix V

Notice of Privacy Practices to Enrollees .......26

Protected Health Information ...............26

Uses and Disclosures of PHI ...............26

Restricted Uses .........................27

Member Rights ..........................27

Questions and Concerns ..................28

Page 3 January 2024 Employee Dental Plans — Member Guidebook

School Employees’ Health Benets Program State Health Benets Program

Health Benets Contact Information ..........29

Addresses .............................29

Telephone Numbers ......................29

Health Benets Publications ................29

General Publications .....................29

Health Benet Fact Sheets ................29

Health Plan Member Guidebooks ...........29

Employee Dental Plans — Member Guidebook January 2024 Page 4

State Health Benets Program School Employees’ Health Benets Program

INTRODUCTION

The State Health Benets Program (SHBP) was es-

tablished in 1961. It oers medical, prescription drug,

and dental coverage to qualied State and local gov-

ernment public employees, retirees, and eligible de-

pendents. Local employers must adopt a resolution to

participate in the SHBP.

The State Health Benets Commission (SHBC) is

the executive organization responsible for overseeing

the SHBP.

The State Health Benets Program Act is found in the

New Jersey Statutes Annotated, Title 52, Article 14-

17.25 et seq. Rules governing the operation and admin-

istration of the program are found in Title 17, Chapter 9

of the New Jersey Administrative Code.

The School Employees’ Health Benets Program

(SEHBP) was established in 2007. It oers medical,

prescription drug, and dental coverage to qualied lo-

cal education public employees, retirees, and eligible

dependents. Local education employers must adopt a

resolution to participate in the SEHBP.

The School Employees’ Health Benets Commis-

sion (SEHBC) is the executive organization responsi-

ble for overseeing the SEHBP.

The School Employees’ Health Benets Program Act is

found in the New Jersey Statutes Annotated, Title 52,

Article 14-17.46 et seq. Rules governing the operation

and administration of the program are found in Title 17,

Chapter 9 of the New Jersey Administrative Code.

The New Jersey Division of Pensions and Benets

(NJDPB), specically the Health Benets Bureau and

the Bureau of Policy and Planning, are responsible for

the daily administrative activities of the SHBP and the

SEHBP.

The Employee Dental Plans consist of the Dental

Plan Organizations (DPOs) and the Dental Expense

Plan (DEP). The Employee Dental Plans are available

to full-time employees of the State of New Jersey, State

colleges and universities, certain independent State

agencies, and adopting local government and local

education employers. Before making any enrollment

decision, you should carefully review the standards

of eligibility and the conditions, limitations, and exclu-

sions of the benet coverage oered under each plan.

The complete terms of Employee Dental Plans cover-

age are described in the DPO and DEP contracts with

amendments.

Every eort has been made to ensure the accuracy

of the Employee Dental Plans Member Guidebook.

However, State law and the New Jersey Administrative

Code govern the SHBP and SEHBP. If there are dis-

crepancies between the information presented in this

guidebook and/or plan documents and the law, regula-

tions, or contracts, the law, regulations, and contracts

will govern. Furthermore, if you are unsure whether a

dental service or procedure is covered, contact your

dental plan before you receive services to avoid any

denial of coverage issues that could result.

If, after reading this guidebook, you have any questions,

comments, or suggestions regarding the information

presented, please write to the New Jersey Division of

Pensions & Benets, P.O. Box 295, Trenton, NJ 08625-

0295, call us at (609) 292-7524, or send email to:

pensions.nj@treas.nj.gov

EMPLOYEE DENTAL PLANS ELIGIBILITY

Eligibility for coverage is determined under the provi-

sions of the SHBP. Enrollments, terminations, chang-

es to coverage, etc. must be presented through your

employer to the Health Benets Bureau of the NJDPB.

If you have any questions concerning eligibility pro-

visions, you should see your employer’s benets ad-

ministrator. You can also contact the NJDPB Oce

of Client Services at (609) 292-7524 or by email at:

pensions.nj@treas.nj.gov

State Employees

To be eligible for State Employee coverage, you must

work full-time for the State of New Jersey or be an ap-

pointed or an elected ocial of the State of New Jersey

(this includes employees of a State agency or authori-

ty and employees of a State college or university). For

State employees, full-time requires 35 hours per week

or more if required by contract or resolution.

State part-time employees covered under P.L. 2003,

c. 172 (Chapter 172), and State intermittent employees

covered by negotiated agreements between the State

of New Jersey and the Communications Workers of

America (CWA) are not eligible for coverage under the

Employee Dental Plans.

Local Employees

To be eligible for Employee Dental Plans local employ-

er coverage, you must be a full-time employee or an

appointed or elected ocial receiving a salary from a

local government/education employer (county, munic-

ipality, county or municipal authority, board of educa-

tion, etc.) that participates in the SHBP or the SEHBP

and has adopted a resolution to provide dental benets

under the Employee Dental Plans.

Each participating local employer denes, in its reso-

lution, the minimum hours required to be considered a

full-time employee, but it can be no less than 25 hours

per week or more if required by contract. Employment

must also be for 12 months per year except for employ-

ees whose usual work schedule is 10 months per year

(the standard school year).

Local part-time employees covered under Chapter 172

are not eligible for coverage under the Employee Den-

tal Plans.

Page 5 January 2024 Employee Dental Plans — Member Guidebook

School Employees’ Health Benets Program State Health Benets Program

Eligible Dependents

Your eligible dependents are your spouse, civil union

partner, or eligible same-sex domestic partner and/or

your eligible children. See the NJDPB website for de-

nitions of eligible dependents and required documenta-

tion: www.nj.gov/treasury/pensions

Note: There is no provision for dental coverage under

P.L. 2005, c. 375 (Chapter 375), which provides medi-

cal and/or prescription drug coverage to over age chil-

dren until age 31.

Retirees

The Employee Dental Plans are not available to retir-

ees. At retirement, retirees who are eligible for enroll-

ment into the Retired Group of the SHBP or SEHBP

may elect to enroll for coverage in the Retiree Dental

Plans.

Note: Employees who, at retirement, are eligible to en-

roll in the Retired Group of the SHBP or SEHBP can-

not continue Employee Dental Plan coverage under

COBRA. See the “COBRA Coverage” section.

For more information about the Retiree Dental Plans,

see the Dental Plans – Retirees Fact Sheet, or the Re-

tiree Dental Plans Member Guidebook. See the “Health

Benets Publications” section.

COBRA COVERAGE

Continuing Coverage When it Would Normally End

The Consolidated Omnibus Budget Reconciliation Act

of 1985 (COBRA) is a federally regulated law that gives

employees and their eligible dependents the opportuni-

ty to remain in their employer’s group coverage when

they would otherwise lose coverage. COBRA coverage

is available for limited time periods, and the member

must pay the full cost of the coverage plus an adminis-

trative fee.

Under COBRA, you may elect to continue in any or

all of the coverages you had as an active employee or

dependent (health, prescription drug, dental, and vi-

sion). You may also change your health or dental plan

when enrolling in COBRA. You may elect to cover the

same dependents that you covered while an active

employee, or delete dependents from coverage. How-

ever, you cannot add dependents who were not covered

while an employee, except during the annual Open En-

rollment period or unless a qualifying event (marriage,

birth or adoption of a child, etc.) occurs within 60 days

of the COBRA event.

The rules and plan provisions that govern COBRA cov-

erage for the Employee Dental Plans are the same as

those for the SHBP/SEHBP medical plans. Please re-

fer to the Summary Program Description for additional

information about your rights and responsibilities under

COBRA. See the “Health Benets Publications” sec-

tion for information on how to obtain this publication.

EMPLOYEE DENTAL PLANS

All benets listed in this guidebook may be subject to

limitations and exclusions as described in subsequent

sections. Services or supplies not listed in this guide-

book may still be eligible under this plan.

GENERAL CONDITIONS OF THE DENTAL PLANS

Enrollment

Enrollment in a dental plan is optional. If you do not

enroll when rst eligible, you will have the option to en-

roll each year during the annual SHBP/SEHBP Open

Enrollment Period.

In deciding whether to enroll and which plan to choose,

you should consider the dierences in out-of-pocket

costs, the covered services between a Dental Plan Or-

ganization (DPO) and the Dental Expense Plan (DEP),

and the degree of exibility that you may want in select-

ing a dentist.

Eligibility for coverage is determined under the provi-

sions of the SHBP/SEHBP. Enrollments, terminations,

changes to coverage, etc. must be presented through

your employer to the Health Benets Bureau of the

NJDPB.

Limitation on Changing Dental Plans

If you choose to enroll in a dental plan, you must remain

in the dental plan you select for at least 12 months.

Dual Dental Enrollment is Prohibited

SHBP/SEHBP regulations prohibit two members who

are married to each other, civil union partners, or eli-

gible same-sex domestic partners, and who are both

enrolled in the SHBP or SEHBP, from enrolling under

more than one of the dental plans. An individual may

belong to a dental plan as an employee or as a depen-

dent but not as both. Furthermore, two SHBP and/or

SEHBP members cannot both cover the same children

as dependents under their dental plan coverage.

In cases of divorce or single parent coverage of depen-

dents, there is no coordination of benets under two

dental plans. That is, once a claim has been submitted

for payment under one plan it is not eligible for addition-

al payment under another dental plan.

Other Enrollment Information

Except as indicated above, the rules for enrollment and

information on maintaining coverage in the Employee

Dental Plans are the same as those for the SHBP/SE-

HBP medical plans. Please refer to the Summary Pro-

gram Description for additional information about enroll-

ment, dates of coverage, and other coverage provisions

under the SHBP and SEHBP.

Employee Dental Plans — Member Guidebook January 2024 Page 6

State Health Benets Program School Employees’ Health Benets Program

DENTAL PLAN CHOICES

You may choose to enroll in one of two dierent types

of dental plans:

• The Dental Plan Organizations (DPOs) are com-

panies that contract with a network of providers for

dental services. There are several DPOs participat-

ing in the Employee Dental Plans from which you

may choose. You must use providers participating

with the DPO you select to receive coverage. Be

sure you conrm that the dentist or dental facility

you select is taking new patients and participates

with the Employee Dental Plans, since DPOs also

service other organizations.

• The Dental Expense Plan (DEP) is a traditional

indemnity plan that allows you to obtain services

from any dentist. After you satisfy the $50 annual

deductible (the deductible applies to non-preven-

tive services only), you are reimbursed a percent-

age of the reasonable and customary charges for

the services that are covered under the DEP. This

plan is administered under a contract between the

SHBC and Aetna Life Insurance Company (Aetna).

LEVELS OF COVERAGE

There are four levels of coverage:

• Single: covers the employee only;

• Member and Spouse/Partner: covers the employ-

ee and spouse, civil union partner, or eligible do-

mestic partner;

• Parent and Child(ren): covers the employee and

all enrolled eligible children; or

• Family: covers employee, spouse or partner, and

all enrolled eligible children.

DENTAL PLAN PREMIUMS

The cost for participation in a dental plan is shared by

the State or local employer and dental plan participants.

For a current list of premium rates and payroll deduction

schedules, please see your benets administrator.

State Employees

For State employees paid through the State’s Central-

ized Payroll Unit, premium payments are made through

biweekly payroll deductions.

For all other State employees, premium payments are

made through a deduction schedule determined by your

employer.

State employee premiums can be paid on a pre-tax

basis through participation in the Premium Option Plan

(POP) of the State’s IRC Section 125 Program, Tax-

$ave. Participation in POP is automatic unless you spe-

cically decline enrollment. See the “Tax$ave” section

for more information.

Local Government and Local Education Employees

For local employees, premium payments are made

through a deduction schedule determined by your em-

ployer.

Note: The State Tax$ave program is not available to lo-

cal employees. Contact your employer to nd out if you

are eligible to pay premiums on a pre-tax basis through

an IRC Section 125 Program oered by your employer.

EXTENSION OF COVERAGE PROVISIONS

If Eligibility Ends While Undergoing Treatment

If your coverage is terminated voluntarily or due to

non-payment of premiums, there is no extension of on-

going treatment for you or your dependents.

Once coverage is terminated for you or any of your

dependents, there is no eligibility for continuation of the

Employee Dental Plans under the provisions of CO-

BRA. There is also no conversion to an individual policy

authorized under this plan.

If you die, and your dependent does not elect to con-

tinue Employee Dental Plans coverage under their own

account and is undergoing treatment, your dependent’s

coverage will be extended to cover the following proce-

dures for up to 30 days following the end of their cov-

erage:

• Production of an appliance or modication of an

appliance for which the impression was taken while

the person was covered;

• Preparation of a crown or restoration for which a

tooth was prepared while the person was covered;

and

• Root canal therapy for which the pulp chamber was

opened while the person was covered.

For Children Over the Age of 26 With Disabilities

In certain circumstances, coverage can be continued

for a dependent child over the age of 26. See the

NJDPB website at: www.nj.gov/treasury/pensions for

more information about extending coverage for children

with disabilities.

Transition of Care

The dental plan shall ensure that all members currently

undergoing dental treatment for any condition be transi-

tioned into the new plan without any disruption in cover-

age or access to providers.

ORTHODONTICS TAKEOVERS

FROM PREVIOUS INSURANCE CARRIER

When a member chooses to elect the SHBP/SEHBP

Dental Plan, the following items need to occur for or-

thodontics procedures to be considered eligible under

the plan:

• The member must have been covered by an insur-

ance carrier;

• The treatment is only eligible for consideration

Page 7 January 2024 Employee Dental Plans — Member Guidebook

School Employees’ Health Benets Program State Health Benets Program

under the SHBP/SEHBP Plan if the prior carrier

covered and considered the member’s orthodontic

treatment plan;

• The treatment must have started prior to the SHBP/

SEHBP Plan eective date;

• The member must provide the new carrier with the

banding date, treatment plan, and length of treat-

ment;

• The member must provide the new carrier with the

amount the prior carrier paid to date by submitting

the necessary documentation;

• Bands need to be placed on the patient’s teeth be-

fore reaching the plan’s specied age limit; and

• Any amounts paid by the prior carrier will be up-

dated to the SHBP/SEHBP orthodontic maximums.

The entire amount paid out will be subject to the

SHBP/SEHBP plan maximum rather than the prior

carrier’s maximum.

Note: If the new plan does not cover orthodontia, no

benets will be paid.

SPECIAL PROVISIONS OF THE

EMPLOYEE DENTAL PLANS

Coordination of Benets

With Other Insurance Plans

There is no coordination of benets between two SHBP/

SEHBP dental plans because no individual is eligible for

coverage in more than one dental plan.

If you and your dependents are also covered for dental

expenses by other plans, certain rules apply that de-

termine which plan provides the primary coverage and

how much each plan will reimburse you. The purpose

of these rules is to prevent a combined reimbursement

from both plans that exceeds the expenses that you ac-

tually incur. Although there may be special cases not

described here, the usual determination of which plan

provides primary coverage is as follows:

• The employee’s primary dental coverage is provid-

ed by the DEP or the DPO;

• If your spouse/partner is enrolled as your depen-

dent and is also covered by a dental plan through

his or her employer, your spouse/partner’s primary

coverage is through the dental plan oered by his

or her employer;

• If your children are enrolled as dependents in your

plan and your spouse/partner’s plan, their primary

coverage is provided by the dental plan of the par-

ent whose birthday falls earlier in the year. If your

spouse/partner’s plan does not follow this rule, then

the rule in the other program will determine the or-

der of benets; or

• In the case of a separation, divorce, dissolution of a

civil union or domestic partnership, or parents who

are not married, the primary coverage for a child

is provided in this order: by the plan of the parent

who is legally responsible for the dental expenses

of the child; by the plan of the parent with custody

of the child; by the plan of the spouse/partner of the

parent with custody of the child; or by the plan of

the non-custodial parent.

THIRD PARTY LIABILITY

Repayment Agreement

If you have received benets from your dental plan for

services that are related to either an automobile acci-

dent or your work, the Employee Dental Plans have the

right to recover those payments. This means that if your

dental expenses are also reimbursed by a third party

through a settlement, satised by a judgment, or oth-

er means, you are required to return any benets paid

for illness or injury to the Employee Dental Plans. The

repayment will only be equal to the amount paid by the

Employee Dental Plans.

This provision is binding whether the payment received

from the third party is the result of a legal judgment,

an arbitration award, a compromise settlement, or any

other arrangement, whether or not the third party has

admitted liability for the payment.

Recovery Right

You are required to cooperate with the Employee Den-

tal Plans in recovering any benets paid by the plan that

may also be payable by a third party. The Employee

Dental Plans may:

• Assume your right to receive payment for benets

from the third party;

• Require you to provide all information and sign and

return all documents necessary to exercise the Em-

ployee Dental Plans’ rights under this provision, be-

fore any benets are provided under your group’s

policy; or

• Require you to give testimony, answer interrogato-

ries, attend depositions, and comply with all legal

actions which the Employee Dental Plans may nd

necessary to recover money from all sources when

a third party may be responsible for damages or

injuries.

Employee Dental Plans — Member Guidebook January 2024 Page 8

State Health Benets Program School Employees’ Health Benets Program

HIPAA PRIVACY

The SHBP and SEHBP make every eort to safeguard

the health information of their members and comply with

the privacy provisions of the federal Health Insurance

Portability and Accountability Act (HIPAA) of 1996. HI-

PAA requires medical and dental plans to maintain the

privacy of any personal information relating to its mem-

bers’ physical or mental health. the “Notice of Privacy

Practices” section for further information.

AUDIT OF DEPENDENT COVERAGE

Periodically the NJDPB performs an audit using a ran-

dom sample of members to determine if enrolled de-

pendents are eligible under plan provisions. Proof of

dependency such as a marriage, civil union, birth certif-

icates, or tax returns are required and coverage for inel-

igible dependents will be terminated. Failure to respond

to the audit will result in the termination of all coverage

and may include nancial restitution for claims paid.

Members who are found to have intentionally enrolled

an ineligible person for coverage will be prosecuted to

the fullest extent of the law.

HEALTH CARE FRAUD

Health care fraud is an intentional deception or misrep-

resentation that results in an unauthorized benet to a

member or to some other person. Any individual who

willfully and knowingly engages in an activity intended

to defraud the SHBP or SEHBP will face disciplinary

action that could include termination of employment

and may result in prosecution. Any member who re-

ceives monies fraudulently from a health plan will be

required to fully reimburse the plan.

THE DENTAL PLAN ORGANIZATIONS

A Dental Plan Organization (DPO) is similar to a medi-

cal Health Maintenance Organization (HMO) program.

The full cost for most services is prepaid to your dentist,

but certain services require an additional copayment

from you. Also, if you choose a more expensive treat-

ment than deemed appropriate by your dental provider,

you must pay the extra cost. Further, you will not be

covered for services if you go to a dentist who is not a

member of your DPO, unless you are referred by your

DPO dentist. There are several DPOs included among

the Employee Dental Plans. Among these organiza-

tions, there are two types of plans – Dental Center and

Individual Practice Associations (IPA).

• Dental Centers employ a group of dentists and

technicians who are located at a central oce. In a

Dental Center Plan, you do not have the option to

select a particular dentist unless permitted by the

Dental Center. However, some DPOs oer both a

Dental Center and a list of participating dentists,

thereby giving you the option of selecting a center

or a particular dentist.

• Individual Practice Associations (IPA) consist

of a network of participating dentists who work in

their own oces. If you choose an IPA, you must

select a specic dentist in the IPA who will treat

you and your dependents.

The DPO dentist is responsible for providing all of the

services that are listed as covered in this guidebook.

If the participating dentist that you have selected does

not provide a specic service, then the DPO must refer

you to another participating dentist located within 10

miles of your dentist’s oce (or 20 miles for orthodontic

service). If you agree, the DPO may also refer you to a

dentist located beyond these limits.

If the DPO has no participating dentist who can provide

the service in your geographical area, the DPO must

refer you to a nonparticipating dentist within the 10- or

20-mile limit. If there is no dentist within this area, you

must be referred to the dentist closest to your dentist’s

oce.

If the DPO dentist refers you to another dentist and that

referral is approved by the DPO, you will have the same

coverage for the service as if you had been treated by

your dentist. However, if you select an outside dentist

on your own, the service will not be covered.

CONSIDERATIONS IN CHOOSING A DPO

• Obtain information about the DPOs and participat-

ing dentists from your benets administrator or the

NJDPB website. If you choose a dentist rather than

a Dental Center, check with the DPO and the den-

tist to be sure that the dentist: is a member of the

DPO; services members of the Employee Dental

Plans; and will accept you as a new patient.

• If you choose a dentist, you should check with the

dentist to make sure that he or she plans to stay

in the DPO. If the dentist leaves, you will have to

select another dentist who participates with that

DPO.

• You should check to determine that the DPO den-

tist or center can serve the needs of your entire

family and whether the days and hours of opera-

tion are convenient for you and your family.

• If your dentist leaves the DPO, and there are no

other dentists in the DPO within 30 miles of your

home, you may switch to another dental plan (ei-

ther another DPO or the DEP).

Page 9 January 2024 Employee Dental Plans — Member Guidebook

School Employees’ Health Benets Program State Health Benets Program

COVERED SERVICES

The following is a list of covered services and, if ap-

plicable, required copayments. Copayments are your

portion of the cost for the service.

Codes

Description of

Covered Services Copayments

D0100-D0999 I. Diagnostic

Clinical Oral Evaluations

Oral evaluations are limited to two in a calendar year.

Emergency or limited oral evaluations are covered, limited

to one evaluation per patient, per dentist, per calendar

year. There are no copayments for diagnostic services.

D0120 Periodic Oral Evaluation $0

D0140 Limited Oral Evaluation —

Problem Focused

$0

D0145 Oral Evaluation for Patient

Under Three Years of Age

and Counseling With Primary

Caregiver

$0

D0150 Comprehensive Oral Evaluation

— New or Established Patient

$0

D0160 Detailed and Extensive Oral

Evaluation — Problem Fo-

cused, by Report

$0

Radiographs

Bitewing X-rays are limited to two series of up to four lms

in a calendar year; set of full mouth X-rays are limited to

once per 36 month interval; no more than 18 lms per set

of mouth X-rays.

D0210 Intraoral — Complete Series of

Radiographic Images

$0

D0220 Intraoral — Periapical — First

Radiographic Image

$0

D0230 Intraoral — Peripical — Each

Additional Radiographic Image

$0

D0240 Intraoral — Occlusal Radio-

graphic Image

$0

Codes

Description of

Covered Services Copayments

D0250 Extraoral — 2D Projection Ra-

diographic Image created using

a Stationary Radiation Source,

and Detector

$0

D0251 Extraoral — Posterior Dental

Radiographic Image

$0

D0270 Bitewings — Single Radio-

graphic Image

$0

D0272 Bitewings — Two Radiographic

Images

$0

D0273 Bitewings — Three Radio-

graphic Images

$0

D0274 Bitewings — Four Radiographic

Images

$0

D0277 Vertical Bitewings — Seven to

Eight Radiographic Images

$0

D0330 Panoramic Radiographic Image $0

D0340 2D Cephalometric Radio-

graphic Image — Acquisition,

Measurement and Analysis

$0

D0391 Interpretation of Diagnostic

Image by a Practitioner Not

Associated With the Capture of

the Image, Including Report

$0

Test and Laboratory Examinations

D0414 Laboratory Processing of

Microbial Specimen to Include

Culture and Sensitivity Studies,

and Preparation and Transmis-

sion of Written Report

$0

D0415 Collection of Microorganisms

for Culture and Sensitivity

$0

D0416 Viral Culture $0

D0425 Caries Susceptibility Tests $0

D0460 Pulp Vitality Tests $0

D0470 Diagnostic Casts $0

Codes

Description of

Covered Services Copayments

D0600 Non-ionizing Diagnostic Pro-

cedure Capable of Quantifying,

Monitoring, and Recording

Changes in Structure of Enam-

el, Dentin, and Cementum

$0

D1000-D1999 II. Preventive

Dental Prophylaxis

Limited to two in a calendar year

D1110 Prophylaxis — Adult $0

D1120 Prophylaxis — Child $0

Topical Fluoride Treatment (Oce Procedure)

Limited to two in a calendar year, and only for eligible

dependent children under the age of 19 years.

D1206 Topical Application of Fluoride

Varnish

$0

D1208 Topical Application of Fluoride $0

Other Preventive Services

Sealants are limited to once per lifetime for permanent

molars of eligible dependent children under the age of 19

years.

D1330 Oral Hygiene Instruction $0

D1351 Sealant — Per Tooth $0

D1352 Preventive Resin Restoration in

a Moderate to High Caries Risk

Patient - Permanent Tooth

$0

D1353 Sealant Repair — Per Tooth $0

D1354 Interim Caries Arresting

Medicament Application

$0

Space Maintenance (Passive Appliances)

D1510 Space Maintainer — Fixed —

Unilateral Excludes a Distal

Shoe Space Maintainer - Per

Quadrant

$0

D1515 Space Maintainer — Fixed —

Bilateral

$0

D1520 Space Maintainer —

Removable — Unilateral - Per

Quadrant

$0

Employee Dental Plans — Member Guidebook January 2024 Page 10

State Health Benets Program School Employees’ Health Benets Program

Codes

Description of

Covered Services Copayments

D1525 Space Maintainer —

Removable — Bilateral

$0

D1551 Re-Cement or Re-Bond Bilater-

al Space Maintainer - Maxillary

$0

D1552 Re-Cement or Re-Bond

Bilateral Space Maintainer -

Mandibular

$0

D1553 Re-Cement or Re-Bond Bilat-

eral Space Maintainer - Per

Quadrant

$0

D1556 Removal of Fixed Unilateral

Space Maintainer - Per Quad-

rant

$0

D1557 Removal of Fixed Unilateral

Space Maintainer - Maxillary

$0

D1558 Removal of Fixed Unilateral

Space Maintainer - Mandibular

$0

D1575 Distal Shoe Space Maintain-

er — Fixed — Unilateral - Per

Quadrant

$0

D2000-D2999 III. Restorative

The replacement of a crown is covered only after a ve-year

period measured from the date on which the crown was pre-

viously placed.

Amalgam Restorations (Including Polishing)

D2140 Amalgam — One Surface —

Primary or Permanent

$0

D2150 Amalgam — Two Surfaces —

Primary or Permanent

$0

D2160 Amalgam — Three Surfaces —

Primary or Permanent

$0

D2161 Amalgam — Four or More Sur-

faces — Primary or Permanent

$0

Resin Restorations

D2330 Resin-Based Composite —

One Surface — Anterior

$0

D2331 Resin-Based Composite —

Two Surfaces — Anterior

$0

Codes

Description of

Covered Services Copayments

D2332 Resin-Based Composite —

Three Surfaces — Anterior

$0

D2335 Resin-Based Composite —

Four or More Surfaces or In-

volving Incisal Angle — Anterior

$0

D2390 Resin-Based Composite Crown

— Anterior

$35

D2391 Resin-Based Composite —

One Surface — Posterior

$15

D2392 Resin-Based Composite —

Two Surfaces — Posterior

$25

D2393 Resin-Based Composite —

Three Surfaces — Posterior

$35

D2394 Resin-Based Composite

— Four or More Surfaces —

Posterior

$45

Inlay/Onlay Restorations

D2510 Inlay — Metallic —

One Surface

$100

D2520 Inlay — Metallic —

Two Surfaces

$100

D2530 Inlay — Metallic —

Three or More Surfaces

$100

D2542 Onlay — Metallic —

Two Surfaces

$100

D2543 Onlay — Metallic — Three

Surfaces

$100

D2544 Onlay — Metallic — Four or

More Surfaces

$100

D2610 Inlay — Porcelain/Ceramic —

One Surface

$115

D2620 Inlay — Porcelain/Ceramic —

Two Surfaces

$115

D2630 Inlay — Porcelain/Ceramic —

Three or More Surfaces

$115

D2642 Onlay — Porcelain/Ceramic —

Two Surfaces

$115

Codes

Description of

Covered Services Copayments

D2643 Onlay — Porcelain/Ceramic —

Three Surfaces

$115

D2644 Onlay — Porcelain/Ceramic —

Four or More Surfaces

$115

D2650 Inlay — Resin-Based

Composite — One Surface

$115

D2651 Inlay — Resin-Based

Composite — Two Surfaces

$115

D2652 Inlay — Resin-Based

Composite — Three or More

Surfaces

$115

D2662 Onlay — Resin-Based Com-

posite — Two Surfaces

$115

D2663 Onlay — Resin-Based

Composite — Three Surfaces

$115

D2664 Onlay — Resin-Based

Composite — Four or More

Surfaces

$115

Crowns — Single Restorations Only

D2710 Crown — Resin-Based

Composite (Indirect)

(See Note)

$115

D2720 Crown — Resin With High

Noble Metal

$150

D2721 Crown — Resin With

Predominantly Base Metal

$150

D2722 Crown — Resin With Noble

Metal

$150

D2740 Crown — Porcelain/Ceramic

Substrate

$200

D2750 Crown — Porcelain Fused to

High Noble Metal

$225

D2751 Crown — Porcelain Fused to

Predominantly Base Metal

$200

D2752 Crown — Porcelain Fused to

Noble Metal

$200

D2753 Crown - Porcelain Fused to

Titanium and Titanium Alloys

$200

Page 11 January 2024 Employee Dental Plans — Member Guidebook

School Employees’ Health Benets Program State Health Benets Program

Codes

Description of

Covered Services Copayments

D2780 Crown — 3/4 Cast High Noble

Metal

$225

D2781 Crown — 3/4 Cast

Predominantly Base Metal

$200

D2790 Crown — Full Cast High Noble

Metal

$225

D2791 Crown — Full Cast

Predominantly Base Metal

$200

D2792 Crown — Full Cast Noble Metal $200

D2794 Crown — Titanium and

Titanium Alloys

$225

Note: There is no copayment for procedure D2710 when

performed in conjunction with a permanent crown on the

same tooth.

Codes

Description of

Covered Services Copayments

Other Restorative Services

D2910 Recement Inlay, Onlay, or

Partial Coverage Restoration

$0

D2915 Recement Cast or

Prefabricated Post and Core

$0

D2920 Recement Crown $0

D2921 Reattachment of Tooth

Fragment Incisal Edge or Cusp

$0

D2929 Prefabricated Porcelain/

Ceramic Crown —

Primary Tooth

$49

D2930 Prefabricated Stainless Steel

Crown — Primary Tooth

$35

D2931 Prefabricated Stainless Steel

Crown — Permanent Tooth

$35

D2932 Prefabricated Resin Crown $35

D2933 Prefabricated Stainless Steel

Crown With Resin Window

$35

D2934 Prefabricated Esthetic Coated

Stainless Steel Crown —

Primary Tooth

$35

D2940 Protective Restoration $0

D2941 Interim Therapeutic Restoration

— Primary Dentition

$0

D2950 Core Buildup, Including any

Pins

$0

D2951 Pin Retention — Per Tooth in

Addition to Restoration

$0

D2952 Cast Post and Core in Addition

to Crown

$40

D2954 Prefabricated Post and Core in

Addition to Crown

$40

D2955 Post Removal $0

D2971 Additional Procedures to

Construct New Crown under

Existing Partial Denture

Framework

$0

Codes

Description of

Covered Services Copayments

D2980 Crown Repair Necessitated by

Restorative Material Failure

$0

D2981 Inlay Repair Necessitated by

Restorative Material Failure

$0

D2982 Onlay Repair Necessitated by

Restorative Material Failure

$0

D2983 Veneer Repair Necessitated by

Restorative Material Failure

$0

D2990 Resin Inltration of Incipient

Smooth Surface Lesions

$0

D3000-D3999 IV. Endodontics

Pulp Capping

D3110 Pulp Capping — Direct —

Excluding Final Restoration

$0

D3120 Pulp Capping — Indirect —

Excluding Final Restoration

$0

Pulpotomy

D3220 Therapeutic Pulpotomy —

Excluding Final Restoration

$25

D3222 Partial Pulpotomy for

Apexogenesis — Permanent

Tooth With Incomplete Root

Development

$25

Endodontic Therapy on Primary Teeth

D3230 Pulpal Therapy (Resorbable

Filling) — Anterior-Primary

Tooth — Excluding Final Res-

toration

$20

D3240 Pulpal Therapy (Resorbable

Filling) — Posterior-Primary

Tooth — Excluding Final Res-

toration

$20

Endodontic Therapy

D3310 Anterior (Excluding Final

Restoration)

$100

D3320 Bicuspid (Excluding Final

Restoration)

$125

D3330 Molar (Excluding Final Resto-

ration)

$150

Employee Dental Plans — Member Guidebook January 2024 Page 12

State Health Benets Program School Employees’ Health Benets Program

Codes

Description of

Covered Services Copayments

Endodontic Retreatment

D3346 Retreatment of Previous Root

Canal Therapy — Anterior

$125

D3347 Retreatment of Previous Root

Canal Therapy — Bicuspid

$150

D3348 Retreatment of Previous Root

Canal Therapy — Molar

$175

Apexication/Recalcication Procedures

D3351 Apexication/Recalcication —

Initial Visit

$35

D3352 Apexication/Recalcication —

Interim Medication

Replacement

$35

D3353 Apexication/Recalcication —

Final Visit

$35

Apicoectomy/Periapical Services

D3410 Apicoectomy/Periradicular

Surgical — Anterior

$90

D3421 Apicoectomy/Periradicular

Surgical — Bicuspid First Root

$90

D3425 Apicoectomy/Periradicular

Surgical — Molar First Root

$90

D3426 Apicoectomy/Periradicular

Surgical — Each Additional

Root

$40

D3427 Periradicular Surgical —

Without Apicoectomy

$90

D3430 Retrograde Filling — Per Root $20

D3450 Root Amputation — Per Root $40

Other Endodontic Procedures

D3910 Surgical Procedure for Isolation

of Tooth With Rubber Dam

$0

D3920 Hemisection (Including any

Root Removal) — Not Including

Root Canal Therapy

$60

Codes

Description of

Covered Services Copayments

D4000-D4999 V. Periodontics

Coverage for surgical periodontal procedures, excluding

scaling and root planing, is limited to one surgical periodon-

tal treatment per quadrant every 36 months; coverage for

scaling and root planing is limited to one nonsurgical peri-

odontal treatment per quadrant every 12 months.

Surgical Services

D4210 Gingivectomy or

Gingivoplasty — Four or more

Contiguous Teeth or Tooth

Bounded Spaces per Quadrant

$85

D4211 Gingivectomy or Gingivoplasty

— One to Three Contiguous

Teeth or Tooth Bounded

Spaces per Quadrant

$30

D4212 Gingivectomy or Gingivoplasty

to Allow Access for Restorative

Procedure — Per Tooth

$12

D4240 Gingival Flap Procedure

Including Root Planing — Four

or more Contiguous Teeth or

Tooth Bounded Spaces per

Quadrant

$90

D4241 Gingival Flap Procedure

including Root Planing — One

to Three Contiguous Teeth or

Tooth Bounded Spaces per

Quadrant

$60

D4245 Apically Positioned Flap $90

D4249 Clinical Crown Lengthening —

Hard Tissue

$90

D4260 Osseous Surgery (Including

Flap Entry and Closure) — Four

or more Contiguous Teeth or

Tooth Bounded Spaces per

Quadrant

$175

D4261 Osseous Surgery (Including

Flap Entry and Closure) — One

to Three Contiguous Teeth or

Tooth Bounded Spaces per

Quadrant

$100

Codes

Description of

Covered Services Copayments

D4263 Bone Replacement Graft —

Retained Natural Tooth — First

Site in Quadrant Site

$100

D4264 Bone Replacement Graft —

Retained Natural Tooth — Each

Additional Site in Quadrant

$50

D4266 Guided Tissue Regeneration —

Resorbable Barrier per Site

$90

D4267 Guided Tissue Regeneration —

Non-resorbable Barrier per Site

(Includes Membrane Removal)

$90

D4270 Pedicle Soft Tissue Graft

Procedure

$175

D4273 Autogenous Connective Tissue

Graft Procedures (Including

Donor and Recipient Surgical

Sites) — First Tooth, Implant,

or Edentulous Tooth Position

in Graft

$175

D4274 Mesial/Distal Procedure —

Single Tooth (When not Per-

formed in Conjunction With

Surgical Procedures in the

same Anatomical Area)

$40

D4275 Non-Autogenous Connective

Tissue Graft (Including

Recipient Site and Donor Ma-

terial) — First Tooth, Implant,

or Edentulous Tooth Position

in Graft

$175

D4276 Combined Connective Tissue

and Double Pedicle Graft —

Per Tooth

$175

D4277 Free Soft Tissue Graft Proce-

dure (Including Recipient and

Donor Surgical Sites) — First

Tooth, Implant, or Edentulous

Tooth Position in a Graft

$70

Page 13 January 2024 Employee Dental Plans — Member Guidebook

School Employees’ Health Benets Program State Health Benets Program

Codes

Description of

Covered Services Copayments

D4278 Free Soft Tissue Graft

Procedure (Including Recipient

and Donor Surgical Sites) —

Each additional Contiguous

Tooth, Implant, or Edentulous

Tooth Position in same Graft

Site

$35

D4283 Autogenous Connective Tissue

Graft Procedure (Including

Donor and Recipient Surgi-

cal Sites) — Each additional

Contiguous Tooth, Implant, or

Edentulous Tooth Position in

same Graft Site

$96

D4285 Non-Autogenous Connective

Tissue Graft Procedure (In-

cluding Recipient Surgical Site

and Donor Material) — Each

Additional Contiguous Tooth,

Implant, or Edentulous Tooth

Position in same Graft Site

$96

Non-Surgical Periodontal Services

D4320 Provisional Splinting —

Intracoronal

$0

D4321 Provisional Splinting —

Extracoronal

$0

D4341 Periodontal Scaling and Root

Planing — Four or More Teeth

per Quadrant

$55

D4342 Periodontal Scaling or Root

Planing — One to Three Teeth

per Quadrant

$40

D4346 Scaling in Presence of Gen-

eralized Moderate or Severe

Gingival Inammation — Full

Mouth, after Oral Evaluation

$28

D4355 Full Mouth Debridement to En-

able Comprehensive Periodon-

tal Evaluation and Diagnosis

$55

Other Periodontal Services

Codes

Description of

Covered Services Copayments

D4910 Periodontal Maintenance $30

D4920 Unscheduled Dressing Change

(By someone other than Treat-

ing Dentist)

$0

D5000-D5999 VI. Prosthodontics (Removable)

The replacement of an existing removable prosthetic appli-

ance is covered only after a ve-year period measured from

the date on which the appliance was previously placed.

Complete Dentures

Including Routine Post Delivery Care

D5110 Complete Denture — Maxillary $250

D5120 Complete Denture —

Mandibular

$250

D5130 Immediate Denture — Maxillary $275

D5140 Immediate Denture —

Mandibular

$275

Partial Dentures Including Routine Post Delivery Care

D5211 Maxillary Partial Denture —

Resin Base (Including any

Conventional Clasps, Rests,

and Teeth)

$250

D5212 Mandibular Partial Denture

— Resin Base (Including any

Conventional Clasps, Rests,

and Teeth)

$250

D5213 Maxillary Partial Denture —

Cast Metal Framework w/

Resin Denture Bases (Including

Retentive/Clasping Materials,)

$275

D5214 Mandibular Partial Denture —

Cast Metal Framework With

Resin Denture Bases (Including

Retentive/Clasping Materials)

$275

D5221 Immediate Maxillary Partial

Denture — Resin Base

(Including Retentive/Clasping

Materials)

$288

Codes

Description of

Covered Services Copayments

D5222 Immediate Mandibular Partial

Denture — Resin Base

(Including Retentive/Clasping

Materials)

$288

D5223 Immediate Maxillary Partial

Denture — Cast Metal

Framework With Resin Denture

Bases (Including Retentive/

Clasping Materials, Rests,

and Teeth) Includes limited

Follow-up Care Only; Does not

Include Future Rebasing

$316

D5224 Immediate Mandibular Partial

Denture — Cast Metal Frame-

work With Resin Denture Bases

(Including Retentive/Clasping

Materials, Rests, and Teeth)

$316

D5225 Maxillary Partial Denture —

Flexible Base (Including any

Clasps, Rests, and Teeth)

$300

D5226 Mandibular Partial Denture —

Flexible Base (Including any

Clasps, Rests, and Teeth)

$300

D5281 Removable Unilateral Partial

Denture — One Piece Cast

Metal (Including Clasps and

Teeth)

$125

D5284 Removable Unilateral Partial

Denture - One Piece Flexible

Base (Including Clasps and

teeth) - Per Quadrant

$150

D5286 Removable Unilateral Partial

Denture - One Piece Resin

(Including Clasps and teeth) -

Per Quadrant

$125

Adjustments to Removable Prostheses

D5 410 Adjust Complete Denture —

Maxillary

$0

Employee Dental Plans — Member Guidebook January 2024 Page 14

State Health Benets Program School Employees’ Health Benets Program

Codes

Description of

Covered Services Copayments

D5411 Adjust Complete Denture —

Mandibular

$0

D5421 Adjust Partial Denture —

Maxillary

$0

D5422 Adjust Partial Denture —

Mandibular

$0

Repairs to Complete Dentures

D5510 Repair Broken Complete

Denture Base

$35

D5520 Replace Missing or Broken

Teeth — Complete Denture —

Each Tooth

$35

Repairs to Partial Dentures

D5610 Repair Resin Denture Base $35

D5620 Repair Cast Framework $35

D5630 Repair or Replace Broken

Clasp — Per Tooth

$35

D5640 Replace Broken Teeth — Per

Tooth

$35

D5650 Add Tooth to Existing Partial

Denture

$35

D5660 Add Clasp to Existing Partial

Denture — Per Tooth

$35

Denture Rebase Procedures

D5710 Rebase Complete Maxillary

Denture

$85

D5711 Rebase Complete Mandibular

Denture

$85

D5720 Rebase Maxillary Partial

Denture

$85

D5721 Rebase Mandibular Partial

Denture

$85

Denture Reline Procedures

D5730 Reline Complete Maxillary

Denture — Chairside

$40

Codes

Description of

Covered Services Copayments

D5731 Reline Complete Mandibular

Denture — Chairside

$40

D5740 Reline Maxillary Partial Denture

— Chairside

$40

D5741 Reline Mandibular Partial Den-

ture — Chairside

$40

D5750 Reline Complete Maxillary

Denture — (Lab Process)

$40

D5751 Reline Complete Mandibular

Denture — (Lab Process)

$40

D5760 Reline Maxillary Partial Denture

— (Lab Process)

$40

D5761 Reline Mandibular Partial Den-

ture — (Lab Process)

$40

Other Removable Prosthetic Services

D5810 Interim Complete Denture

(Maxillary)

$40

D5811 Interim Complete Denture

(Mandibular)

$40

D5820 Interim Partial Denture

(Maxillary)

$40

D5821 Interim Partial Denture

(Mandibular)

$40

D5850 Tissue Conditioning (Maxillary) $40

D5851 Tissue Conditioning

(Mandibular)

$40

D6200-D6999 IX. Prosthodontics, Fixed

Fixed Partial Denture Pontics

D6097

Abutment Supported Crown

- Porcelain Fused to Titani-

um and Titanium Alloys

$200

D6210 Pontic — Cast High Noble

Metal

$225

Codes

Description of

Covered Services Copayments

D6211 Pontic — Cast Predominantly

Base Metal

$200

D6212 Pontic — Cast Noble Metal $200

D6214 Pontic — Titanium $225

D6240 Pontic — Porcelain Fused to

High Noble Metal

$225

D6241 Pontic — Porcelain Fused to

Predominantly Base Metal

$200

D6242 Pontic — Porcelain Fused to

Noble Metal

$200

D6243 Pontic - Porcelain Fused to

Titanium and Titanium Alloys

$200

D6245 Pontic — Porcelain/Ceramic $200

D6250 Pontic — Resin With High

Noble Metal

$150

D6251 Pontic — Resin With

Predominantly Base Metal

$150

D6252 Pontic — Resin With Noble

Metal

$150

Fixed Partial Denture Retainers — Inlays/Onlays

D6545 Retainer — Cast Metal for Res-

in Bonded Fixed Prosthesis

$100

D6549 Resin Retainer — For Resin

Bonded Fixed Prosthesis

$75

D6602 Inlay — Cast High Noble Metal

— Two Surfaces

$75

D6603 Inlay — Cast High Noble Metal

— Three or More Surfaces

$175

D6604 Inlay — Cast Predominantly

Base Metal — Two Surfaces

$100

D6605 Inlay — Cast Predominantly

Base Metal — Three or More

Surfaces

$100

D6606 Inlay — Cast Noble Metal —

Two Surfaces

$155

Page 15 January 2024 Employee Dental Plans — Member Guidebook

School Employees’ Health Benets Program State Health Benets Program

Codes

Description of

Covered Services Copayments

D6607 Retainer Inlay — Cast Noble

Metal — Three or More

Surfaces

$155

D6610 Retainer Onlay — Cast High

Noble Metal — Two Surfaces

$185

D6611 Retainer Onlay — Cast High

Noble Metal — Three or More

Surfaces

$185

D6612 Retainer Onlay — Cast Pre-

dominantly Base Metal — Two

Surfaces

$100

D6613 Retainer Onlay — Cast

Predominantly Base Metal —

Three or More Surfaces

$100

D6614 Retainer Onlay — Cast Noble

Metal — Two Surfaces

$175

D6615 Retainer Onlay — Cast Noble

Metal — Three or More

Surfaces

$175

D6624 Retainer Inlay — Titanium $175

D6634 Retainer Onlay — Titanium $185

Fixed Partial Denture Retainers — Crown

D6720 Retainer Crown — Resin With

High Noble Metal

$150

D6721 Retainer Crown — Resin With

Predominantly Base Metal

$150

D6722 Retainer Crown — Resin With

Noble Metal

$150

D6740 Retainer Crown — Porcelain/

Ceramic

$200

D6750 Retainer Crown — Porcelain

Fused to High Noble Metal

$225

D6751 Retainer Crown — Porcelain

Fused to Predominantly Base

Metal

$200

D6752 Retainer Crown — Porcelain

Fused to Noble Metal

$200

Codes

Description of

Covered Services Copayments

D6753 Retainer Crown - Porcelain

Fused to Titanium and Titanium

Alloys

$200

D6780 Retainer Crown — 3/4 Cast

High Noble Metal

$225

D6781 Retainer Crown — 3/4 Cast

Predominantly Base Metal

$200

D6782 Retainer Crown — 3/4 Cast

Noble Metal

$200

D6783 Retainer Crown — 3/4

Porcelain/Ceramic

$200

D6784 Retainer Crown 3/4- Titanium

and Titanium Alloys

$200

D6790 Retainer Crown — Full Cast

High Noble Metal

$225

D6791 Retainer Crown — Full Cast

Predominantly Base Metal

$200

D6792 Retainer Crown — Full Cast

Noble Metal

$200

D6794 Retainer Crown — Titanium $225

Other Fixed Partial Denture Services

D6930 Recement Fixed Partial

Denture

$15

D6980 Fixed Partial Denture Repair

Necessitated by Restorative

Material Failure

$25

D7000-D7999 X. Oral and Maxillofacial Surgery

Extractions Includes local anesthesia, suturing, if needed,

and routine post-operative care.

D7111 Extraction — Coronal

Remnants — Deciduous Tooth

$10

Codes

Description of

Covered Services Copayments

D7140 Extraction — Erupted Tooth or

Exposed Root (Elevation and/

or Forceps Removal) Includes

Removal of Tooth Structure,

Minor Smoothing of Socket

Bone, and Closure, as

Necessary

$20

Surgical Extractions Includes local anesthesia, suturing, if

needed, and routine post-operative care.

D7210 Extraction — Erupted Tooth

Requiring Removal of Bone

and/or Sectioning of Tooth,

and Including Elevation of

Mucoperiosteal Flap if Indicated

$30

D7220 Removal of Impacted Tooth —

Soft Tissue

$55

D7230 Removal of Impacted Tooth —

Partially Bony

$55

D7240 Removal of Impacted Tooth —

Completely Bony

$65

D7241 Removal of Impacted Tooth —

Completely Bony With

Complications

$65

D7250 Removal of Residual Tooth

Roots — Cutting Procedure

$30

D7251 Coronectomy — Intentional

Partial Tooth Removal

$33

Other Surgical Procedures

D7260 Oroantral Fistula Closure $100

D7261 Primary Closure of a Sinus

Perforation

$100

D7270 Tooth Reimplantation/

Stabilization

$60

D7280 Exposure of an Unerupted

Tooth

$60

Employee Dental Plans — Member Guidebook January 2024 Page 16

State Health Benets Program School Employees’ Health Benets Program

Codes

Description of

Covered Services Copayments

D7282 Mobilization of Erupted or

Malpositioned Tooth to Aid

Eruption

$60

D7283 Placement of Device to

Facilitate Eruption of Impacted

Tooth

$0

D7285 Biopsy of Oral Tissue — Hard

(Bone, Tooth)

$60

D7286 Biopsy of Oral Tissue — Soft $25

D7287 Exfoliative Cytology — Sample

Collection

$13

D7291 Transseptal Fiberotomy Supra

Crestal Fiberotomy — By

Report

$20

Codes

Description of

Covered Services Copayments

Alveoloplasty — Surgical Preparation of the Ridge for

Dentures

D7310 Alveoloplasty in Conjunction

With Extractions — Four or

More Teeth or Tooth Spaces,

per Quadrant.

The Alveoloplasty is Distinct

(Separate Procedure) from

Extractions. Usually in

Preparation for a Prosthesis

or Other Treatments Such as

Radiation Therapy and

Transplant Surgery

$30

D7311 Alveoloplasty in Conjunction

With Extractions — One to

Three Teeth or Tooth Spaces,

per Quadrant.

The Alveoloplasty is Distinct

(Separate Procedure) from

Extractions. Usually in

Preparation for a Prosthesis or

Other Treatments Such as

Radiation Therapy and Trans-

plant Surgery

$15

D7320 Alveoloplasty not in

Conjunction With Extractions

— Per Quadrant

$35

D7321 Alveoloplasty not in Conjunc-

tion With Extractions — One to

Three Teeth or Tooth Spaces

per Quadrant

$20

Removal of Cysts, Tumors, and Neoplasms

D7450 Removal of Benign Odontogen-

ic Cyst or Tumor — Lesion up

to 1.25 cm Diameter

$60

D7451 Removal of Benign Odonto-

genic Cyst or Tumor — Lesion

Greater than 1.25 cm Diameter

$60

D7460 Removal of Benign Non-Odon-

togenic Cyst or Tumor — Le-

sion up to 1.25 cm Diameter

$60

Codes

Description of

Covered Services Copayments

D7461 Removal of Benign Non-Odon-

togenic Cyst or Tumor —

Lesion Greater than 1.25 cm

Diameter

$60

Excision of Bone Tissue

D7471 Removal of Lateral Exostosis

— Maxilla or Mandible

$90

D7472 Removal Torus Palatinus $90

D7473 Removal Torus Mandibularis $90

D7485 Reduction of Osseous

Tuberosity

$90

Surgical Incision

D7510 Incision and Drainage of

Abscess — Intraoral — Soft

Tissue

$25

D7511 Incision and Drainage of

Abscess — Intraoral — Soft

Tissue — Complicated

(Includes Drainage of Multiple

Facial Spaces)

$30

D7520 Incision and Drainage of

Abscess — Extraoral — Soft

Tissue

$35

D7521 Incision and Drainage of

Abscess — Extraoral — Soft

Tissue — Complicated

(Includes Drainage of Multiple

Facial Spaces)

$40

Other Repair Procedures

D7922 Placement of Intra-Socket

Bilolgical Dressing to Aid In

Hemostasis or Clot Stabiliza-

tion, Per Site

$0

D7953 Bone Replacement Graft for

Ridge Preservation — Per Site

$75

Page 17 January 2024 Employee Dental Plans — Member Guidebook

School Employees’ Health Benets Program State Health Benets Program

Codes

Description of

Covered Services Copayments

D7960 Frenulectomy — Also Known

as Frenectomy or Frenotomy

— Separate Procedure not

Incidental to Another Proce-

dure. Removal or Release of

Mucosal and Muscle Elements

of a Buccal, Labial, or Lingual

Frenum that is Associated

with a Pathological Condition,

or Interferes with Proper Oral

Development or Treatment

$60

D7963 Frenuloplasty $65

D7970 Excision of Hyperplastic Tissue

— Per Arch

$60

D7971 Excision of Pericoronal Gingiva

Removal of Inammatory or

Hypertrophied Tissues

Surrounding Partially Erupted/

Impacted Teeth

$30

D7972 Surgical Reduction of Fibrous

Tuberosity

$60

Miscellaneous Services

D9110 Palliative (Emergency) Treat-

ment of Dental Pain — Minor

Procedure

$0

D9211 Regional Block Anesthesia $0

D9212 Trigeminal Division Block

Anesthesia

$0

D9215 Local Anesthesia $0

D9219 Evaluation for Deep Sedation

or General Anesthesia

$0

D9223 Deep Sedation/General An-

esthesia — Each 15-Minute

Increment

$20

D9230 Analgesia, Anxiolysis,

Inhalation of Nitrous Oxide

$0

D9243 Intravenous Moderate (Con-

scious) Sedation/Analgesia —

Each 15-Minute Increment

$20

Codes

Description of

Covered Services Copayments

D9310 Consultation (Diagnostic

Service Provided by a Dentist

or Physician other than

Practitioner Providing

Treatment)

$0

D9311 Treating Dentist Consults with

a Medical Health Care

Professional Concerning

Medical Issues that May Aect

Patient’s Planned Dental

Treatment

$0

D9430 Oce Visit Observation $0

D9440 Oce Visit After Hours $0

D9610 Therapeutic Drug Injection —

By Report

$0

D9612 Therapeutic Paternal Drug,

Two or more Administrations

Dierent Medications

$0

D9630 Drugs or Medicaments

Dispensed in the Oce for

Home Use

$0

D9910 Application of Desensitizing

Medication

$0

D9930 Treat Complications — By

Report

$0

D9932 Cleaning and Inspection of

Removable Complete Denture,

Maxillary

$0

D9933 Cleaning and Inspection of

Removable Complete Denture,

Mandibular

$0

D9934 Cleaning and Inspection of

Removable Partial Denture,

Maxillary

$0

D9935 Cleaning and Inspection of

Removable Partial Denture,

Mandibular

$0

D9940 Occlusal Guard — By Report $40

Codes

Description of

Covered Services Copayments

D9942 Repair and/or Reline of

Occlusal Guard

$20

D9943 Occlusal Guard Adjustment $5

D9951 Occlusal Adjustment — Limited $0

D9952 Occlusal Adjustment —

Complete

$60

D9997 Dental Case Management -

Patients With Special Health

Care Needs

$0

Orthodontics

Treatment plan maximum of 24 months.

1. Patient under 18 years of age at the start of treat-

ment — Class I, II, and III malocclusion (copay-

ment required of $1,000 or 50 percent of reason-

able and customary charges, whichever is less).

2. Patient 18 years of age or over at the start of treat-

ment — Class I, II, and III malocclusion (copay-

ment required of $1,750 or 50 percent of reason-

able and customary charges, whichever is less).

Includes Invisalign as an optional treatment pro-

cedure — this procedure may fall under the “More

Expensive Services” option and as such, the mem-

ber choosing this option would be responsible for

the dierence between Invisalign charges and the

standard adult orthodontic charge.

More Expensive Services

A covered individual may elect a more expensive pro-

cedure than an appropriate procedure recommended

by the dentist. The covered individual shall pay any

copayment required for the less expensive procedure,

plus the dierence in cost between the two procedures,

on the basis of the reasonable and customary dental

charges for the procedures.

Employee Dental Plans — Member Guidebook January 2024 Page 18

State Health Benets Program School Employees’ Health Benets Program

Emergency Services — Out-of-Area

Emergency Treatment is dened as when a covered

SHBP (or SEHBP) member or dependent is at least 50

miles from home, any necessary service or procedure

which is rendered as the direct result of an unforeseen

occurrence and requires immediate, urgent action or

remedy. Examples are: acute pain, bleeding, fractured

tooth, broken lling, broken front tooth, broken denture,

and lost or loose crown. The reimbursement shall be at

the full amount of the charge, up to a maximum of $100

per episode.

SERVICES NOT COVERED BY THE DPO

• A service started before the person became a cov-

ered individual under the plan.

• Replacement of lost, stolen, or damaged prostho-

dontic devices within two years of the date of initial

installation.

• A service not reasonably necessary for the dental

care of a covered individual or provided solely for

cosmetic purposes.

• Providing supplies of a type normally intended

for home use, such as toothpaste, toothbrushes,

waterpicks, and mouthwash.

• A service required because of war or an act of war.

• A service made available to a covered individual

or nanced by the federal, State, or local govern-

ment. This includes the federal Medicare program

and any similar federal program, any Workers’

Compensation law or similar law, any automobile

no-fault law, or any other program or law under

which the covered individual is, or could be, cov-

ered. The exclusion is applicable whether or not

the covered individual receives the service, makes

a claim or receives compensation for the service,

or receives a recovery from a third party for dam-

ages.

• A service not furnished by a dentist or physician

licensed to provide the dental service, except for

a service performed by a licensed dental hygienist

under the direction of a dentist.

• General anesthesia, except when medically

necessary in connection with covered oral and

periodontal surgery procedures.

• Hospitalization.

• Any dental implant including any crowns, prosthe-

ses, devices, or appliances attached to implants.

• Experimental procedures.

• Appliances, restorations, and procedures to alter

vertical dimension and/or restore occlusion, in-

cluding temporomandibular joint dysfunction, ex-

cept oral splints.

• Procedures that are not listed.

• A service covered under any medical, surgical,

or major medical plan (including a Health Mainte-

nance Organization — HMO) provided by the em-

ployer.

• Services and supplies provided in connection with

treatment or care that is not covered under the

plan.

THE DENTAL EXPENSE PLAN

The Dental Expense Plan (DEP) is an indemnity plan

that reimburses for a portion of the expenses incurred

for dental care provided by dentists or physicians li-

censed to perform dental services in the state in which

they are practicing. Not all dental services are eligible

for reimbursement, and some services are eligible only

up to a limited amount (for example, orthodontic ser-

vices are reimbursed dierently than other services)

Diagnostic/preventive and orthodontic services are not

subject to an annual deductible. For all other services

an annual deductible amount must be met before bene-

ts are payable. You are responsible for making the full

payment of all charges to your dentist.

The DEP has been established by the State as a

self-funded plan. The State currently contracts with

Aetna Dental to act as the administrative agent for the

Dental Expense Plan.

As a DEP member, you may be able to take advan-

tage of a special Aetna network of participating dental

providers. In this network, participating dental provid-

ers contract with Aetna for a discounted fee sched-

ule. When using a participating dental provider, you

only pay the provider any applicable deductible and

the appropriate coinsurance based on the discounted

fee, thereby reducing your out-of-pocket cost. In many

cases the participating dental provider will submit the

claims directly to Aetna, eliminating the necessity of l-

ing claim forms.

To nd out if your provider participates in the

discounted network, call Aetna at 1-877-STATENJ

(1-877-782-8365) or visit Aetna’s website at:

www.aetna.com

Annual Deductible

Diagnostic/preventive and orthodontic services are not

subject to a deductible amount.

For other services, the rst $50 of covered expenses

that you or your dependent(s) incur in a calendar year

is not eligible for reimbursement. However, if there are

four or more members of your family in the DEP, no ad-

ditional deductibles are charged after any three mem-

bers have each met their $50 deductible.

Reasonable and Customary Charges

The DEP covers only that part of a provider’s charge for

a service or supply that is reasonable and customary.

Generally speaking, a charge by your dentist, or by any

other provider of services or supplies, is considered

reasonable and customary if it doesn’t exceed the pre-

vailing charge for the same service or supply made by

similar providers in the same geographic area; it may

Page 19 January 2024 Employee Dental Plans — Member Guidebook

School Employees’ Health Benets Program State Health Benets Program

dier from the actual amount that your dentist charges.

You are responsible for the amount the dentist charges

above the reasonable and customary allowances.

Dental Expense Plan Benets

In-Network Out-of-Network

Deductible /

Calendar Year

$50 / Individual

$100 / Family

Waived for

Preventive Care

$75 / Individual

$150 / Family

Waived for

Preventive Care

Coinsurance

(as percentage

of reasonable

and customary

charges)

100% Preventive

80% Basic

Restorative

65% Major

Restorative

50%

Periodontics &

Prosthodontics

90% Preventive

70% Basic

Restorative

55% Major

Restorative

40%

Periodontics &

Prosthodontics

Maximum

Annual Benet /

Individual

$3,000 $2,000;

maximum of

$3,000 combined

in- and

out-of-network

Orthodontic

Services Under

Age 19

50% to $1,000

lifetime maxi-

mum; not subject

to deductible;

maximum not

combined with

Annual

Maximum

40% to $750

lifetime;

maximum of

$1,000 combined

in- and

out-of-network;

not subject to

deductible;

maximum not

combined with

Annual

Maximum

COVERED SERVICES

A general description of each category of service is

provided below. Refer to the “Services Eligible for Re-

imbursement” section for any limitations that may apply

to these services.

Diagnostic and Preventive Services are precautionary

services, and are intended to maintain oral health and

reduce the eects of tooth decay or gum disease which

could lead to an increased need for more costly restor-

ative services. They include the following:

• Oral Evaluations (includes comprehensive,

periodic, limited, and specialist oral evaluations);

• Prophylaxis (cleaning of the teeth, including

scaling and polishing procedures);

• Fluoride Treatments (topical application of uoride

for children under age 19);

• X-rays (limitations may apply); and

• Laboratory and other diagnostic tests.

Basic Services include:

• Emergency Treatment (Palliative only);

• Space Maintainers (i.e., passive appliances —

xed or removable);

• Simple Extractions;

• Surgical Extractions;

• Oral Surgery;

• Anesthesia Services;

• Basic Restorations (i.e., amalgam restorations

and resin restorations);

• Endodontics (i.e., treatment of diseases of the

dental pulp, including root canal and associated

therapy); and

• Repairs to removable dentures.

Major Restorative Services include those services

that restore existing teeth. These services are utilized

only if a tooth cannot be restored with an amalgam,

acrylic, synthetic porcelain, or composite lling resto-

ration. Inlays, onlays, and crowns are typical examples

of major restorative services.

Periodontal Services include those services involv-

ing the maintenance, reconstruction, regeneration,

and treatment of the supporting structures surrounding

teeth, including bone, gum tissue, and root surfaces.