ANNUAL REPORT

2021

deliveroo plc Annual Report 2021

CONTENTS

Strategic report

01 At a glance

02 Founder & Chief Executive

Ocer’s letter

08 Chair’s letter

10 Operational highlights 2021

12 Business model

18 Our investment proposition

20 Strategy

22 Key performance indicators

26 Stakeholder statement

35 Sustainability review

44 Operating and strategic review

54 Financial review

57 Risk report

64 Viability statement

65 Non-financial information statement

66 People

Governance report

70 Chair’s introduction

to governance

72 Board of Directors

75 Governance report

84 Nomination Committee report

86 Audit & Risk Committee report

93 Directors’ Remuneration report

131 Directors’ report

137 Directors’ responsibilities statement

Financial report

138 Independent Auditor’s report

146 Consolidated income

statement and statement

of comprehensive income

147 Consolidated statement

of financial position

148 Consolidated statement

of changes in equity

149 Consolidated statement

of cash flows

150 Notes to the consolidated

financial statements

182 Parent Company balance sheet

182 Parent Company statement

of changes in equity

183 Notes to the financial statements

188 4-Year financial summary

189 Glossary

191 Glossary – alternative

performance measures

IBC Company and shareholder

information

AT DELIVEROO OUR MISSION IS

TO BUILD THE DEFINITIVE ONLINE

FOOD COMPANY. WE WANT TO

BE THE PLATFORM THAT PEOPLE

TURN TO WHENEVER THEY

THINK ABOUT FOOD.

AT A GLANCE

HYPERLOCAL

THREESIDED ONLINE MARKETPLACE

OUR BUSINESS IS A

We manage our business on a geographic basis. Our eleven

markets are split into two geographic segments: the UK and

Ireland segment and the International segment, comprising

our business in Continental Europe, Asia Pacific and the

Middle East.

We work with restaurant partners across four key

restaurant segments: global quick service restaurants,

national casual dining chains, independent full-service

restaurants, and takeaways. We also partner with some

of the largest grocery retailers in the world.

WHERE WE DO IT

WHO WE PARTNER WITH

+++MM

UKI – 54%

UK

Ireland

International

1

– 46%

France

Italy

Belgium

Netherlands

Hong Kong

Singapore

Australia

UAE

Kuwait

Our business split by geography (% of GTV*)

WHAT WE DO

CONSUMERS

21 meal

occasions

We connect consumers, riders and restaurant and grocery

partners across local markets to bring people the food

they love.

We are a global online platform, yet a very local business. Our

consumers, riders and restaurant and grocery partners live

and operate within their local neighbourhoods.

RIDERS

RESTAURANTS

+ GROCERS

1 Exited Spain on 29 November 2021.

* To supplement performance assessment, Deliveroo uses Alternative Performance Measures (APMs), which are not defined

under IFRS. APMs are indicated in this document with an asterisk (*); definitions and further details are provided on page 191.

Strategic report Governance report Financial report

01Annual Report 2021 deliveroo plc

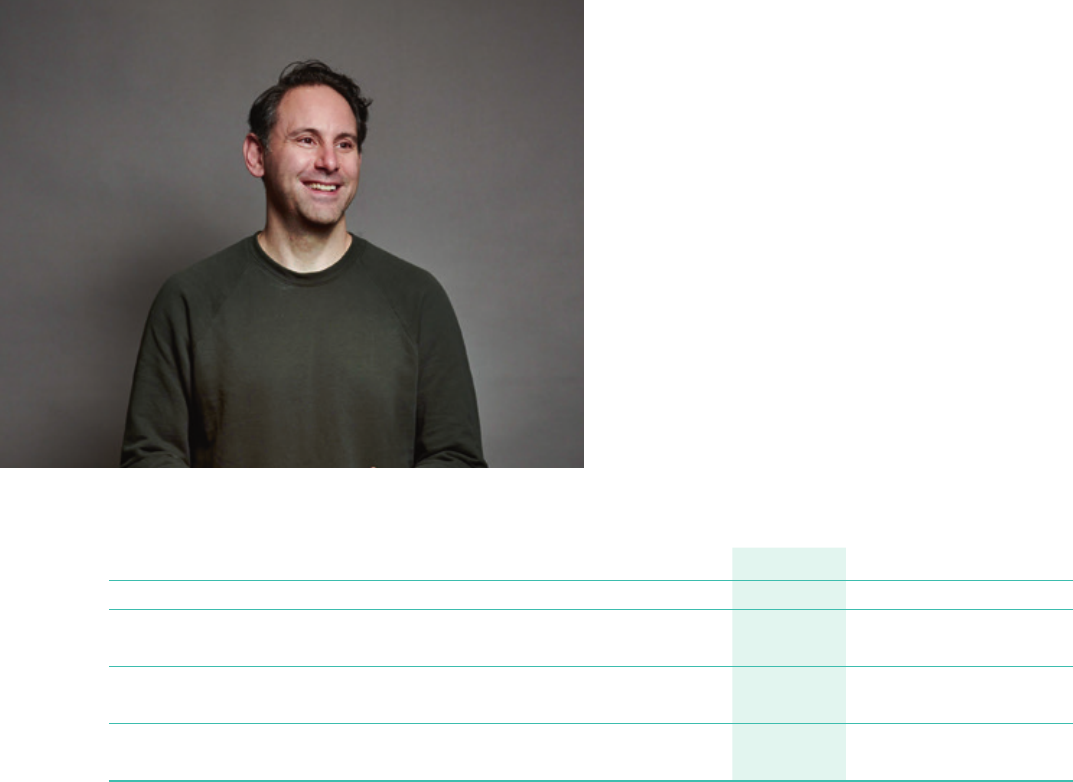

I’m Will, I’m the founder and CEO

of Deliveroo. I started Deliveroo

in 2013 because I wanted a

great delivery experience. I had

one and only one idea, and I was

and continue to be obsessed

about it. I am proudly a top 10

individual customer! My most

frequently ordered dish is the

Spicy Beef Soup from Gogi, a

Korean restaurant in Maida

Vale, London. I also continue to

do deliveries on my bicycle in

West London.

FOUNDER & CHIEF EXECUTIVE OFFICER’S LETTER

EVERYONE

WELCOME

Deliveroo’s business

Deliveroo is a complex three-sided marketplace, involving

consumers (an e-commerce destination), riders (an on-

demand logistics business), and restaurant and grocery

partners (a demand generation platform). Consumers

choose Deliveroo because we unlock a wealth of hyperlocal

choice, at the right price, with fast and reliable delivery.

At Deliveroo, we think about food as content in the same

emotional way that other online platforms think about film

or fashion – and we do so because that’s why consumers

come to the platform. Riders care about flexibility,

earnings and security, and often learning and development

opportunities too. For restaurant and grocery partners,

it’s all about demand and incremental profitability, great

service, and increasingly the ability to tell their story

emotionally – both organically and through paid channels.

Balancing the interests of all three sides of the marketplace

– as well as those of our other stakeholders – is critical to

Deliveroo’s success in the short, medium and long term.

Deliveroo is unusual because it is a global online platform,

yet it is also a very local business. Our consumers, riders

and restaurant and grocery partner live and operate

within local neighbourhoods. A consumer in Bristol doesn’t

care about restaurant selection or delivery speed in

Brighton; a rider in Milan doesn’t think about the earnings

opportunities in Naples; and a typical restaurant or grocery

partner in Marseille isn’t trying to tap into demand in Monza,

Manchester or Melbourne.

I think about our business through the lens of our consumer

value proposition (CVP) at all times. Focusing on developing

the right CVP, neighbourhood by neighbourhood, is our

obsession – and how we run the business. Let me briefly

explain the five pillars of our CVP.

1) Availability – Of course, this starts with whether we

operate in your neighbourhood, but it’s more than that.

Are we open late at night or for breakfast? Do we take

alternative payment methods like Alipay? Do we offer

pick-up as well as delivery?

Will Shu

Founder & Chief Executive Officer

Strategic report Governance report Financial report

02 deliveroo plc Annual Report 2021

2) Selection – This isn’t just the number of restaurants

and grocers we have in the neighbourhood. How many

different cuisine types do we have? How many of these

are outlier restaurants/grocers in terms of popularity?

Do we have a wide price range of restaurants? Do

we have exclusive, amazing content? Do we have the

beloved local Chinese restaurant, the halal butcher and

the most popular grocer in the neighbourhood?

3) Consumer experience – It’s not just about how fast the

delivery arrived; this covers the full customer journey.

How accurate was our timing? How easy was it to track

your order? How was the packaging? It’s also about the

quality of personalisation and merchandising in the app.

Do we know, before you do, what you are looking for? Can

restaurants and grocers tell their story effectively and

emotionally in our app? And occasionally, things can go

wrong. How quickly did we resolve the issue?

4) Price – In the end, this is about perception of value, but

a lot of factors influence that. How is our consumer

pricing in terms of delivery fees? What is the price of the

food itself on the platform – and is it marked up over the

restaurant prices? What is the prevalence and relevance of

promotions? Are you part of our subscription programme

Plus, which unlocks free delivery and other rewards?

5) Brand – To me, this is about what Deliveroo stands for

outside of the singular transaction. Does our brand

resonate with people? Are we seen as ethical?

Some of these pillars are easily quantifiable, others not. But

we try to measure them neighbourhood by neighbourhood,

on a standalone basis as well as against our competitors.

This is our scorecard, and it is how we manage the business

and make certain day-to-day operational decisions in a

decentralised manner. For example, general managers can

decide to encourage more riders to work in an area if rider

supply is too low. They can choose to offer a famous local pizza

restaurant an exclusive contract. They can push hyperlocal

in-app discounts, or build a hyperlocal consumer reactivation

campaign to get the flywheel spinning quickly again.

Guided by this report card, we improve over time by grinding

out daily gains, as well as making step-change advances

through long term innovation. Technology is key to both. We

are continuing to improve things we’ve been working on

for years: how long it will take a restaurant to prepare an

order, which rider to assign to collect it, what restaurants

to show to a customer first, how to match rider supply with

demand in real time, which consumer acquisition channels

are most effective. We are also focusing on questions that

have become priorities more recently: how should the user

interface differ for restaurant versus grocery orders, when

should we show upsell items, which orders can be batched,

how best to pick a grocery order, how to build a high quality

advertising platform that brings value to all sides.

These questions are all answered with technology, each

involving teams of data scientists, product designers and

software engineers, to name but a few. They are frequently

hard questions with complex answers. For example, in

the early days our rider assignment algorithm was a

simple ‘greedy solver’ where the closest available rider

would receive the order; now we use deep learning to

predict future network states and advanced optimisation

techniques to decide rider assignment, and we have vastly

more data on which to train our models. This illustrates why

Deliveroo is at its heart a technology company, and why

we’re continuing to invest in our technology team.

Our technology and our operational teams are key to

executing on a hyperlocal basis. This is how we gain market

share in each neighbourhood. This is critical to generating

attractive financial returns. As for any company, overall

scale helps to spread marketing costs and overheads.

But in our business, hyperlocal network effects are more

powerful than overall scale, and network effects come from

hyperlocal market share. Improving and winning local market

share positions yields outsized unit economics, and unit

economics is the key to overall profitability.

Profit pool potential is a function of population density,

affluence, restaurant and grocery partner supply, and our

local market share. Not every neighbourhood is created

equal in terms of potential, but we believe the vast majority

of neighbourhoods in the markets where we operate have

the fundamental demand and supply characteristics to be

profitable. Just how profitable depends in large part on the

strength of our local market position. In the UK, for example,

we believe over 70% of our Gross Transaction Value (GTV*) is

in neighbourhoods where we are number one in terms of

market share. We will aim to increase this percentage across

all our markets, and we will consider exiting neighbourhoods

where we cannot achieve this position.

We operate in a very competitive market, so how do we

maintain durable advantages? Part of it comes down to the

day-to-day execution that I already described – which is

becoming increasingly automated over time. Alongside this

is the combination of long-term vision with the curiosity to

innovate and the willingness to adapt. How do we decide

what new verticals or businesses to enter?

I start by looking through the lens of the three sides of

the marketplace. These are really three core assets in our

business: (1) monthly active consumer (MAC) base; (2) rider

base; and (3) restaurant and grocery partner base. New

verticals or businesses are best if they involve at least

two sides. For instance, Signature, our white label business,

makes sense because we can engage both the partner base

as well as the rider base. Grocery has allowed us to leverage

our MACs as well as our rider base. Editions has allowed us

to utilise all three! Initiatives that only involve one side of the

marketplace can be beneficial, but are less obvious.

Hopefully this provides an understanding of how I think

about the business, and how we make decisions to enter

new areas.

* To supplement performance assessment, Deliveroo uses Alternative

Performance Measures (APMs), which are not defined under IFRS. APMs are

indicated in this document with an asterisk (*); definitions and further

details are provided on page 191.

Strategic report Governance report Financial report

03Annual Report 2021 deliveroo plc

Share price performance

I’d like to take this opportunity to address our share price.

Our shares were listed on the London Stock Exchange on

7 April 2021. This was an important step for the Company,

as the capital we raised allows us to invest in our business

to create durable advantages that drive long term value

creation. Since the IPO, our share price performance

has been poor and that’s disappointing to me not just

because I’m the CEO, but because I’m the largest individual

shareholder. My interests are aligned with shareholders’ over

the long term and I will continue to do my best to improve

long-term shareholder value.

I acknowledge that it’s been a difficult time for shareholders.

In particular, I pushed very hard to ensure retail investors

would have access to the share offering because I believe

that IPOs should not be open to institutional investors only

and lock out ordinary people. There are a lot of reasons

for the disappointing performance, some related to the

business, some related to the industry, and some related to

the macro environment. Broadly speaking, I am focused on

the business, because that’s all I can control. But like you as

fellow shareholders, I am interested in creating long term

value. I am hiring, motivating and retaining the best team I

can to execute on our hyperlocal CVP and to innovate where

we think is appropriate, so that we drive the business to

profitability and deliver sustainable growth.

Business progress in 2021

From a business perspective, I am proud of our performance

in 2021. We grew very quickly, across all of our markets. Full

year GTV* was up 70% year-on-year in constant currency*.

This was at the top end of our guidance for 60-70% growth,

and we had actually increased that guidance twice

during the year. Particularly encouraging to me was our

performance in the UK, where we continued to grow our

market share in a competitive environment. This shows the

strength of our CVP, as well as great execution by our UK and

Ireland (UKI) team. Having expanded UK population coverage

to 77% at the end of 2021 compared to 53% at the end of

2020, we believe we are well placed for continued growth

and market share gains.

We were early to the on-demand grocery opportunity, and

in the last three years we have built a leading position in the

segment. In 2021, we continued to grow this business rapidly

and it reached 8% of Group GTV* in 2021. We had over 11,000

partner sites live globally at the end of 2021 (compared to

~7,000 at the end of 2020). In late Q3 we launched Deliveroo

Hop, a new rapid grocery delivery service operating from

delivery-only stores (often called ‘dark stores’). We’re in the

early stages of developing this model, and are currently

operating Hop with several different partners in the UK and

Italy as we continue to test and learn with this new model.

Since 2017, consumers have been able to unlock access

to unlimited free delivery for a fixed monthly fee through

our Plus subscription programme. Plus provides great value

for consumers, and because it drives higher retention and

frequency, it helps to increase customer lifetime value for

Deliveroo. In 2021, we made a big step forward in broadening

the programme. In Q1 2021, we launched a new ‘Silver’ tier of

the programme designed for families. Strong initial take-

up has been further boosted since September, when we

partnered with Amazon to allow all UK and Ireland Amazon

Prime members to sign up for free Deliveroo Plus Silver

membership for a year. Overall, I was really pleased to see

the strong traction of Plus with consumers in 2021, and by

December 2021 our total number of Plus subscribers in UKI

was up four-fold compared to the year before.

We continued to scale other category innovations that

are driving long term differentiation of the CVP. Editions is

our delivery-only kitchens concept that allows restaurant

partners to bring their brands to new neighbourhoods

without needing to open a new dine-in location. From our

perspective it’s quite simple: how do we bring the best and

most relevant content to areas that lack it? Restaurants

also use Editions even in areas where they have an existing

restaurant: delivery-only kitchens allow them to separate

and optimise their dine-in and delivery operations, and their

P&L profile benefits from the lower-cost real estate footprint

and lack of front of house. I’m excited that we accelerated

the roll out of Editions during the course of 2021, adding

FOUNDER & CHIEF EXECUTIVE OFFICER’S LETTER CONTINUED

1. Compelling structural growth

Over £1 trillion global TAM; Low online

penetration; Favourable structural shift

in consumer demand

2. Winning competitive differentiators

Distinctive value propositions for

consumers, partners and riders; Investing

in innovation; Efficient logistics

3. Driving to profitability

Stable cohorts; Strong capital position;

aim to reach 4%+ adjusted EBITDA margin (as

% of GTV)* by 2026

4. Building sustainable futures

Reducing carbon and waste; Helping

partners to grow and thrive; Creating an

inclusive marketplace

Read more on page 18

OUR INVESTMENT PROPOSITION

* To supplement performance assessment, Deliveroo uses Alternative

Performance Measures (‘APMs’), which are not defined under IFRS. APMs

are indicated in this document with an asterisk (*); definitions and further

details are provided on page 191.

Strategic report Governance report Financial report

04 deliveroo plc Annual Report 2021

over 100 kitchens in the year with approximately half of

these opening in Q4 2021, and bringing brands like Dishoom,

Five Guys, Shake Shack and Pho to new neighbourhoods.

During the year, we took the difficult decision to end our

operations in Spain, reflecting our intention to focus

investment and resources on the Company’s other markets.

We had determined that achieving and sustaining a top-tier

market position in Spain would require a disproportionate

level of investment with highly uncertain long term potential

returns. The decision took effect in November 2021, and

I want to thank again all the riders and restaurants who

have worked with Deliveroo in Spain, as well as our fantastic

consumers and of course the Deliveroo team in Spain.

Back in 2013, I was the very first rider for Deliveroo and

worked doing deliveries full time for the first year of running

the business. I still complete deliveries regularly today, as do

many team members right across Deliveroo. This first hand

understanding of what riders care about most has helped

us develop an offer that prioritises the things they value:

flexible work, good earnings, and security.

Deliveroo has provided riders with free and automatic

accident and injury cover and third-party liability insurance

since 2018. During Q3 2021, we extended this free insurance

in several markets to provide riders with enhanced

protection. The new insurance coverage includes earnings

support for riders working regularly with the company who

are unwell and unable to work for more than seven days

(backdated to day one). In addition, this insurance now

entitles qualifying riders to a one-off lump sum payment

following the birth or adoption of a child. We are currently

exploring extending these enhanced entitlements to

additional markets.

To support the tremendous growth in our business, I was

really pleased to welcome many new colleagues to Deliveroo

this year. Amongst the new starters were two additions

to the Executive Team: Eric French joined in January 2021

as Chief Marketplace Officer and in September 2021 he

was followed by Devesh Mishra, our new Chief Product and

Technology Officer. Both Eric and Devesh have made a real

impact already. The whole team is excited about executing

on the opportunities we have ahead of us.

Focus areas for 2022

A key focus for the company this year and beyond is making

progress on our longer term path to profitability. Deliveroo

was profitable on an adjusted EBITDA* basis in H2 2020.

In 2021, our unit economics were impacted by two factors.

First, we experienced a reversal of the benefits seen from

higher basket sizes during COVID-related lockdowns. Second,

we increased investment in order to capture growth

opportunities. Investment had been lower in 2020 in part

due to capital constraints related to the CMA investigation

connected to our Series G funding round and also uncertainty

around COVID-19 in the first half of 2020. In late 2020, we

began to increase investment in acquisition and retention

of consumers and in brand-building marketing, as well as in

WE STILL SEE PLENTIFUL OPPORTUNITIES

TO FURTHER INCREASE OUR REVENUE

‘TAKE RATE’, TO CREATE AN EVEN MORE

EFFICIENT LOGISTICS NETWORK, AND TO

GENERATE TECHDRIVEN EFFICIENCIES

IN OWN OPERATIONS THAT WILL DRIVE

OPERATING LEVERAGE AS WE SCALE.”

headcount additions, especially in technology. As a result, in

2021 we grew GTV* by 70% (in constant currency*), while our

gross profit margin (as % of GTV)* fell by 120 bps and our

adjusted EBITDA margin (as % of GTV)* declined to (2.0)%.

Going forward, I am very focused on delivering on our path to

profitability. For 2022, our guidance is for an adjusted EBITDA

margin (as % of GTV)* in the range of (1.5)-(1.8)%. We aim to

reach breakeven at some point during H2 2023–H1 2024

on an adjusted EBITDA* basis. And by 2026, we aim to reach

a 4%+ adjusted EBITDA margin (as % of GTV)*, with further

upside potential beyond 2026.

This year we will make progress across a range of levers

underpinning our path to profitability.

The largest component of our revenue is commissions from

restaurant and grocery partners; and this is a function of

average order value (AOV)* and the percentage commission

rate. Before this year, we hadn’t really actively managed AOV*,

but we are working on managing minimum order values more

effectively, and upselling is a big opportunity where we can

also learn from other online businesses who already do this

very successfully. In addition, the AOV* for grocery is already

slightly higher than for restaurant delivery offering, and we

see scope to move into higher basket sizes here over time.

On commission rates, we don’t expect significant upwards

or downwards movement on segment-level commission, but

we may be impacted by mix shifts as, for example, grocery

becomes a bigger part of our business.

Consumer fees are another key revenue lever. These are

the amalgamation of delivery and other consumer fees (e.g.

service fee, small order fee) along with subscription revenue

from our Plus programme. Since we started in 2013, we have

modestly increased our consumer fees, but I’m the first

to admit that we didn’t always approach this in the most

structured way. In fact, we are still early in the process of

optimising pricing across all the elements of consumer fees.

But, as with most things, I always start from the perspective

of the consumer – how do we keep providing each individual

consumer with more relevant content that ultimately

increases their willingness to pay?

* To supplement performance assessment, Deliveroo uses Alternative

Performance Measures (‘APMs’), which are not defined under IFRS. APMs

are indicated in this document with an asterisk (*); definitions and further

details are provided on page 191..

Strategic report Governance report Financial report

05Annual Report 2021 deliveroo plc

FOUNDER & CHIEF EXECUTIVE OFFICER’S LETTER CONTINUED

Focus areas for 2022 continued

Advertising revenue is a small part of our current model but

a big opportunity. This comprises sponsored positioning for

our restaurant partners as well as partnerships with fast-

moving consumer goods (FMCG) companies on the grocery

side. This is a proven opportunity for online platforms

and already represents a meaningful part of revenues

for certain players. We see a lot of potential to grow this

revenue channel, but it’s super important to do this in the

right way. As I said before, consumers care a lot about the

quality of personalisation and merchandising in the app, and

restaurants and grocers want to tell their story effectively

and emotionally. If we get this right, we can both grow

this revenue stream and actually improve the consumer

experience in the app. This is something I spend a lot of time

thinking about.

On cost of sales – comprising delivery costs, credit card

fees, and other direct costs – we have consistently gained

efficiency in the past. On delivery, a key measure is the

rider experience time (‘RET’), which is the amount of time it

takes between a rider accepting an order and delivering it

to the consumer. We see plenty of opportunity to reduce

RET further – by cutting riders’ wait time at restaurants, for

example – allowing us to gain efficiency, riders to benefit

from being able to take on more orders and increase their

earnings, and consumers to receive their orders faster.

In the area of marketing and overheads*, we will continue

to make investments to support the growth of the

business. But I’m extremely conscious that as we do this,

these investments need to drive benefits across the P&L.

Technology is a good example. We think of investments

here as building assets that: (i) drive direct financial

benefits, through revenue generation (such as advertising

platforms) or cost reduction (like self-serve capabilities for

consumers, riders and restaurant and grocery partners); (ii)

provide the enabling technology for particular businesses

(an example is Deliveroo Hop delivery-only stores); and (iii)

provide supporting infrastructure for scaling the business

efficiently (such as platform stability, or forecasting models

for consumer demand and rider supply). The quality and

effectiveness of the solutions, products and machinery we

develop are a direct output of the quality and experience of

people we hire and develop.

Delivery-only grocery stores, or dark stores, are an example

of how we think about both the consumer value proposition

and the path to profitability at the same time. During 2021,

we witnessed an unprecedented amount of capital enter

the dark store grocery space — with $18 billion raised

across over 100 deals, according to one study. We’ve

watched this space closely for quite some time, and we

have begun building our own delivery-only stores.

We are well positioned in this segment, and actually all

three sides of our existing marketplace contribute to that.

We have eight million monthly active consumers already

on our platform. We have an existing logistics network of

over 180,000 riders. And we have strong relationships with

grocers, who recognise our record on innovation and want

to work with us to help them figure out this fast-moving

landscape. We understand the consumer proposition of

delivery-only stores is very good, both in terms of stock

accuracy and delivery speed. But it’s not crystal clear

to me that this is a profitable product at scale and on a

fully-allocated basis, so we are monitoring this closely

and being prudent about our rollout plans. Ultimately, we

expect the on-demand grocery space to be served by a

mix of delivery-only stores and store-picked approaches,

and we’re excited about how well positioned we are to be

successful with both models.

I’ve always thought of Deliveroo as an online food platform,

but as our grocery business scaled, I noticed consumers

were purchasing a lot of non-food items, such as household

essentials. I was previously a bit doubtful that consumers

would want something non-perishable very quickly, and be

willing to pay a premium for that service. The evidence would

indicate that I was wrong. As I have already noted, building

and maintaining durable competitive advantages depends

in part on the curiosity to innovate and the willingness to

* To supplement performance assessment, Deliveroo uses Alternative Performance Measures (‘APMs’), which are not defined under IFRS.

APMs are indicated in this document with an asterisk (*); definitions and further details are provided on page 191.

1 Spain discontinued operations are excluded in 2020-2021 but included for 2018-2019.

2026

4%+

(1.5)–(1.8)%

2022

Reach

breakeven

during

period

H2 2023 –

H1 2024

Further

upside

potential

Beyond 2026

(12.3)%

2018

(9.0)%

2019

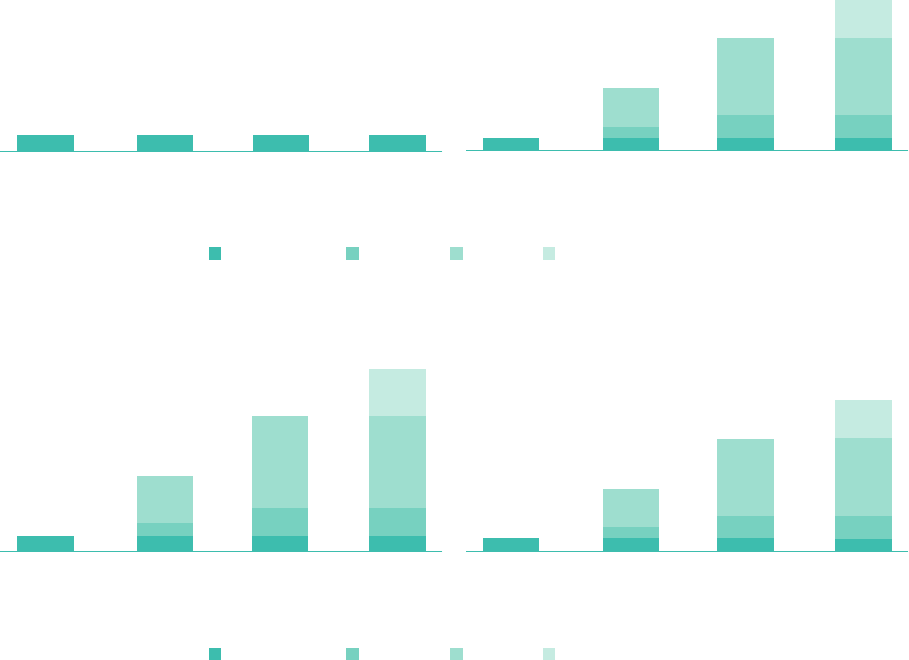

Adjusted EBITDA margin (% of GTV)*

1

2018-2021: actuals

2022 onwards: guidance

(0.3)%

(2.0)%

(3.2)%

2021

(0.8)%

0.7%

2020

(1.6)%

Strategic report Governance report Financial report

06 deliveroo plc Annual Report 2021

adapt. So in 2021 we launched a partnership with Boots,

the UK’s leading pharmacy, offering 800 health and beauty

products from 14 pilot stores. The results so far have been

very encouraging.

I don’t have a good sense yet of how large the non-food

opportunity is, but in line with the new vertical framework

I laid out earlier in the letter, I expect to launch some exciting

non-food partnerships in 2022. I would note, however, that

we have dedicated nine years to merchandising food – an

emotional product – well online. Doing this in a completely

different category will be exactly that: completely different.

So just as with delivery-only stores, we will monitor progress

closely and take a prudent approach to expanding in

this space.

Challenges in 2022 and beyond

As I just laid out, we have a lot of opportunities to focus on

in 2022. At the same time, there are some areas of concern

I have looking out over the next 12-18 months. In 2022 and

beyond, the European consumer will face some headwinds.

Consumer price indices look set to be high for some period

of time. Inflationary pressures had been building in recent

months; this has been exacerbated by the conflict in

Ukraine, and the broader geopolitical and economic impacts

of this crisis are only just beginning to be felt. Coupled with

interest rate rises, consumers will be operating under a

different spending environment in the quarters ahead. How

this impacts consumer staples and discretionary categories,

and where delivery of restaurant food and groceries fits into

that environment is not clear yet. This is something we will

follow closely.

After operating against the backdrop of COVID-19 for an

extended period, many markets have been out of full COVID

restrictions for about a year. Our view is that COVID-19 was a

catalyst to accelerate the existing trend of adoption in the

online food delivery category and it is encouraging that our

consumer base has remained engaged after the widespread

removal of restrictions. For example, average order

frequency across our UKI cohorts in Q4 2021 was higher than

in Q4 2020. Despite these recent datapoints, we will wait and

see how cohorts acquired over COVID-19 behave over the

long term. We also expect new user acquisition to be more

difficult and costly than during COVID times.

An inflationary environment will also impact the other sides

of our marketplace. Restaurant and grocery partners will

face challenges from rising costs across a range of inputs,

including food, fuel and labour. Higher fuel prices will affect

many of our riders, despite the vast majority of orders being

delivered on two-wheel vehicles. We will need to monitor all

of these impacts closely and ensure that consumer pricing

adequately reflects this reality.

Most critical to achieving both the neighbourhood-

by-neighbourhood improvements as well as long term

innovation is the team we have and continue to build at

Deliveroo. Internally, we are very focused on our hiring plan

especially for developers, product managers and data

scientists. The market for tech talent is very competitive

– I believe demand is at an all-time high. Hiring the right

people at the right cost is critical for executing well. For us

to reach our ambitions, we will have to make good progress

along this front. Likewise, as we automate more and more

of our business, we have to ensure that our organisational

structure continues to evolve. Given the experience of

the last two years, scaling our business in an uncertain

environment is not new, but it is still a challenge.

While I am cautious about the rapidly changing consumer

environment, overall I am very excited about working with

our leadership team and the whole Deliveroo organisation

to navigate these challenges and capture the opportunities

over the next 12-18 months.

EU Directive on platform work

There has been a lot of attention on European Union

proposals for regulation of platform work, published in

December 2021. The on-demand work Deliveroo offers is still

relatively new and has changed labour markets. Regulation

is in many ways catching up. Our starting point in the debate

on the future of work has always been that we should

give riders what they want, which is flexibility. That’s why

Deliveroo riders are self-employed, and this status has been

confirmed by courts across many of our markets. I welcome

the EU’s objective of providing legal clarity over how self-

employed platform workers should work. Our model is

broadly in line with the direction of travel of the proposals,

which remain subject to further consultation between the

three central institutions of the EU. As this debate develops

in the EU and elsewhere, we will continue to advocate for

changes to the law to enable platforms such as ours to be

able to provide greater security to self-employed workers

free from legal risk.

Final thoughts

As I’ve said before, I never set out to be a founder or CEO

of a public company. But having become both, one of

the most rewarding parts of my role is engaging with the

diverse stakeholders we have at Deliveroo. This includes

consumers, riders and restaurant and grocery partners;

investors, analysts and the media; public bodies and local

communities; and of course, my colleagues in the amazing

team we have here.

I hope that Deliveroo’s first Annual Report as a public

company provides all of our stakeholders with more insight

into what we have delivered in 2021 and where we are

heading next. Despite all we have been through, especially in

the last two years, it still feels to me like we are right at the

beginning of our journey, and I look forward with optimism

and enthusiasm to 2022 and beyond.

Yours sincerely,

Will Shu

Founder & CEO

24 March 2022

Strategic report Governance report Financial report

07Annual Report 2021 deliveroo plc

Hello, I became Chair of Deliveroo in November 2020 and I am

delighted to be writing to you today. It has been a busy year

for the Company and I hope that this, our first Annual Report,

will give you a good understanding of what we have been

doing to grow and develop the business. We have tried to

give you a clear picture of what has gone well, as well as the

areas that we need to work harder on and the opportunities

and risks that we see in the future.

I was a very early customer of Deliveroo when the business

was just starting out, and my family and I have been regular

users ever since. I was delighted to have the opportunity

to meet Will and his senior team in 2020 and I joined the

business because I genuinely believe in their vision as well

as their commitment to all our stakeholders. Deliveroo is

a fascinating and complex business and, as Will explains

in his letter, it’s a tough balancing act to manage a three-

sided marketplace for the benefit of our consumers,

riders and restaurant and grocery partners. We are a

global online technology company but we work on a

neighbourhood by neighbourhood basis. We are growing

quickly in a competitive and fast-changing sector which

requires constant innovation to flourish. Most importantly,

CHAIR’S LETTER

Claudia Arney

Chair

PROGRESS

MAKING GOOD

our business connects us to people in a very personal way

as food is about more than just sustenance. It provides us

with pleasure, special times with family and friends, and the

celebration of different cultures. At Deliveroo we feel a real

connection to the communities in which we operate and we

are focused on how we can support them in ways that are

important to them. As a Board we have spent time since IPO

thinking about these matters and I will explain more about

that below, but would first like to focus on how the business

performed during FY2021.

Our performance during FY2021

One big milestone this year was becoming a publicly

listed company on 7 April 2021, which was a significant

undertaking. I would like to thank our internal teams

and advisers for their hard work in making this happen

particularly, while having to navigate the business through

the unprecedented challenges brought on by COVID-19.

From an operational and strategic perspective, the business

performed well in 2021, delivering an excellent year of

growth, making further UK market share gains, strengthening

our leading position in on-demand grocery and continuing

to scale our differentiated offerings, Plus and Editions.

This has translated into strong financial performance with

full year gross transaction value (GTV*) up 70% year-on-

year in constant currency*. Adjusted EBITDA* was a loss of

£(131) million compared to £(11) million in 2020, reflecting

the reversal of benefits from higher basket sizes during

COVID-related lockdowns, as well as increased investments

in marketing and technology to support future growth. Net

proceeds from the IPO bolstered our financial resources

as we ended the year with no borrowings and £1.3 billion in

cash and cash equivalents.

Governance and Board focus

When we embarked on the IPO process, we believed that

it was important to ensure that Will could continue to

execute on his vision for how Deliveroo should evolve and

grow, while also allowing others to share in that growth

* To supplement performance assessment, Deliveroo uses Alternative Performance Measures (‘APMs’), which are not defined under IFRS. APMs are indicated in this

document with an asterisk (*); definitions and further details are provided on page 191.

Strategic report Governance report Financial report

08 deliveroo plc Annual Report 2021

Strategic report Governance report Financial report

and to have confidence in the governance of the Company.

As a consequence we adopted a time-limited dual class

structure for three years to provide the stability and

flexibility to allow Will and his team to focus on and execute

on their vision and strategy. At the time of the IPO we also

committed to strong governance. In particular, that we

would voluntarily comply with certain aspects of the UK

Corporate Governance Code (the Code) that the Board

considers appropriate in light of the nature of our business.

We confirmed that we would actively recruit additional

independent Non-Executive Directors to ensure that the

composition of the Board and its Committees was fully

compliant with the Code. We have achieved this, with the

appointment of additional independent Non-Executive

Directors Karen Jones CBE and Dominique Reiniche during

the year, and Peter Jackson joined the Board in 2022.

All three are making a very valuable contribution to the

development of our business and I would like to thank them

as well as our other Non-Executive Directors Rick Medlock,

Lord Simon Wolfson and Tom Stafford for their hard work,

insights and advice.

I am pleased with how the Board has been working to

establish the routines and oversight necessary for a PLC

Board and to assist the Company in its transition to public

company life. The Non-Executive Directors have brought

their varied experience and relevant skill sets to the fore to

constructively challenge the business and to support the

management team as they seek to grow and strengthen

the Company. I discuss in detail in our Governance Report

(page 70) the work of our Board during the year. We have

particularly focused on the consideration of our strategy

and growth plans and how to ensure we have the right

people to execute on our plans, especially in the areas

of engineering, product and data science. We know that

having a strong team in these areas will yield a competitive

advantage in both our day-to-day operations as well as our

longer term investments.

Our Remuneration Committee has worked hard to develop

a Remuneration Policy which will support the recruitment,

motivation and retention of the talent that we need to

deliver on our strategy, and our shareholders will be

considering our Remuneration Policy at our upcoming AGM.

This has been the subject of recent engagement between

Karen Jones, our Remuneration Committee Chair, and our

significant shareholders. We have sought to ensure that our

remuneration framework is flexible and competitive with

the pay models offered by many of our competitors, whilst

still ensuring that our overall incentive levels are capped

and consistent with UK PLC pay models. More detail on this is

provided in the Directors’ Remuneration Report on page 93.

Supporting our communities and sustainability

I know we all hope that we have begun to move beyond

the COVID pandemic which brought such unprecedented

challenges for us all. I would like to thank our leadership

teams across Deliveroo for their efforts during these

difficult times to maintain our culture and operations,

and to support our employees and wider marketplace to

ensure we could operate safely. This included ensuring that

our consumers could receive their orders with no direct

contact, extending our range to offer more grocery which

was vital to so many people who were unable to go out

during this time, and offering riders support if they had to

isolate and couldn’t work. I am particularly proud of our

delivery of free meals during the crisis to those in need in

the UK and to NHS workers, and our similar efforts in some of

our other communities. We hope that these difficult times

are truly behind us and we are pleased to see many of our

innovations continuing to resonate with our consumers,

riders and grocery and restaurant partners.

We know we need to make our platform deliver real value

for all participants in our three-sided marketplace for us

to be successful in our mission to be the definitive online

food company. We also know how much environmental,

social and governance issues (ESG) matter to each of the

communities of our marketplace, as well as our employees

and other stakeholders. These issues are also very important

to Will and the entire Board, and we are very conscious of

the leadership role that we must play. We are committed

to taking action to drive sustainability in our operations

particularly in reducing plastic and food waste and carbon

emissions, and to supporting positive change in our

sector. We are at the beginning of our journey to build a

comprehensive sustainability strategy and we have set out

in our Sustainability Review on page 35, the key pillars we will

focus on as well as some initial actions. As we continue to

evolve our ESG strategy during the coming year, we plan to

establish clear commitments in these areas which we will

share with you on an ongoing basis.

Looking ahead

The coming year will be focused on continuing to execute on

our strategy and investing to drive forward our key growth

initiatives as well as moving towards breakeven and long

term profitability. I am confident we have the opportunity,

and the talented and committed teams that we need across

the business who can make this happen.

It was a significant milestone listing on the London Stock

Exchange and we are very pleased to welcome our new

investors. We are also really appreciative of the efforts of all

our teams across the world and to our partners, riders and

others who work with us, for their hard work and support

during the year. Thank you for your belief in Deliveroo and for

coming on our journey with us.

Yours sincerely,

Claudia Arney

Chair

24 March 2022

Strategic report Governance report Financial report

09Annual Report 2021 deliveroo plc

* To supplement performance assessment,

Deliveroo uses Alternative Performance

Measures (APMs), which are not defined

under IFRS. APMs are indicated in this

document with an asterisk (*); definitions

and further details are provided on page 191.

Strategic report Governance report Financial report

10 deliveroo plc Annual Report 2021

OPERATIONAL HIGHLIGHTS 2021

DELIVER

CONTINUING TO

1. Grew our monthly active consumer base to 8 million

We ended the year with an average of 8.0 million monthly active

consumers (MACs) in Q4 2021 across our 11 markets. This is more

than double the number at the start of 2020 (Q1 2020: 3.6 million),

reflecting both strong acquisition and retention. This increase in

MACs was the primary driver of GTV* growth in 2021.

8.0M MACs

2. Expanded our restaurant selection

We further increased our restaurant selection to over

148,000 partner sites live on the platform globally (Q4 2020: 102,000).

We also added over 100 delivery-only Editions kitchens, taking the

overall number to more than 300 globally.

148,000+

RESTAURANT PARTNER SITES

3. Strengthened our on-demand

grocery offering

Our existing and fast-growing

on-demand grocery service now

delivers from over 11,000 partner

grocery sites globally (Q4 2020: ~7,000).

To complement this, in September

2021, we launched Deliveroo Hop, a

new rapid grocery delivery service,

operating from delivery-only stores.

8%

OF TOTAL GTV* IN GROCERY

IN 2021

Strategic report Governance report Financial report

11Annual Report 2021 deliveroo plc

FINANCIAL HIGHLIGHTS 2021

Orders

1,3

301M

+73% VS. 2020

Gross transaction value (GTV)*

1

£6.6BN

+70%

2

VS. 2020

Gross profit*

1

£497M

7.5% AS % OF GTV*

Adjusted EBITDA*

1

£131M

2.0% AS % OF GTV*

Loss before income tax

1

£298M

VS. £213M IN 2020

Cash and cash equivalents

£1.3BN

VS. £0.4BN AT END OF 2020

4. Further developed our rider proposition

with enhanced protections

Riders enjoy free and automatic accident and injury cover and third-

party liability insurance. In 2021, we extended this to provide cover for

riders who are unwell and cannot work, as well as providing one-off

payments for new parents. This is currently available in several markets

and we aim to roll this out to more of our markets in the future.

85%

GLOBAL RIDER SATISFACTION

Figure based on Q4 2021 monthly survey results. During the reported period, 40,000 riders

completed the survey globally, representing 22% of riders who delivered an order across

the quarter.

5. Grew Deliveroo Plus subscription programme

Deliveroo Plus is our consumer subscription programme that unlocks

access to unlimited free delivery for a fixed monthly fee. In February

2021, we launched a new Silver tier designed for families, and in

September 2021 we announced a new offering with Amazon Prime,

allowing all UK and Ireland Amazon Prime members to sign up for free to

Deliveroo Plus Silver for a year. After strong growth in the year, the total

number of Deliveroo Plus subscribers globally in December 2021 was

three times higher than in December 2020.

3X

INCREASE IN PLUS SUBSCRIBERS

6. Listed on the London Stock Exchange

On 7 April 2021, we were Admitted to the London Stock Exchange

having completed the initial public offering (IPO) of Class A shares

in the capital of the Company, raising £1.0 billion of net proceeds.

£1.0BN

NET PROCEEDS

1 From continuing operations.

2 GTV* growth rate shown in constant currency*.

3 Full discussion of statutory financials on pages 54 to 56.

* To supplement performance assessment,

Deliveroo uses Alternative Performance

Measures (APMs), which are not defined under

IFRS. APMs are indicated in this document with

an asterisk (*); definitions and further details are

provided on page 191.

Getting food right online is hard. Food is inherently

perishable and as a result, delivery needs to be fast

and flawless. And food is emotional. How do you express

the creativity of a restaurateur or the passion of a

consumer online?

Establishing and operating a three-sided marketplace is

complex. Our platform connects local consumers, riders and

restaurant and grocery partners – all of whom we see as our

customers. We must provide a compelling customer value

proposition to all three sides.

We must develop the technology and logistics that make the

marketplace work seamlessly. We must also create demand

and balance supply to drive network density.

Doing all of these things together is challenging. But

by doing them successfully, we bring ever-increasing

platform utility to our customers, and support the

growth flywheel and economies of scale that drive value

for Deliveroo’s shareholders and wider stakeholders.

BUSINESS MODEL

MARKETPLACE

OUR THREESIDED

OUR OPPORTUNITY

CONSUMERS

RESTAURANTS

+ GROCERS

Logistics technology

Our growth businesses The local network effect

21 meal

occasions

RIDERS

Strategic report Governance report Financial report

12 deliveroo plc Annual Report 2021

DELIVERING VALUE

Consumers

We unlock a wealth of choice for consumers, providing

fast, reliable delivery of restaurant food, groceries,

and more. Our Plus subscription programme further

enhances consumer value with free delivery (above a

minimum order value) and other benefits.

301M

orders delivered in 2021

See page 14 for our consumer value proposition

Riders

We provide riders with attractive earnings opportunities

combined with full flexibility over when and where

to work. Our free insurance provides security, with

accident and third-party liability cover globally and

additional cover in many markets.

85%

Global rider satisfaction score in Q4 2021

1

See page 15 for our rider value proposition

Employees

We offer an inclusive environment where individuals

can evolve their skills and experience and leave their

mark, in step with the rapid scaling of our business. Our

people have the opportunity to be part of something

bigger through the impact we make in our marketplace

and communities.

8.1

out of 10 employee engagement score in December 2021

See page 66 for more detail in our People section

Restaurants and grocers

Access to Deliveroo’s logistics, innovations and more

than eight million consumers provides restaurant and

grocery partners with new ways to grow revenues,

increase brand value and maximise the profit potential

from online delivery.

£6.6BN GTV*

enabled through our platform in 2021

See page 14 for our restaurant and grocer value proposition

Communities and environment

We support communities through charity partnerships

and employee volunteering. We are also focusing on

reducing plastic waste, food waste and the carbon

emissions created by our operations, and supporting

the wider supply chain to implement more sustainable

practices.

>1M

meals delivered to families in need

See page 35 for our Sustainability Review

Shareholders

We aim to balance continued strong growth with

progress to profitability, and have set out our path to

reach our aim of an adjusted EBITDA margin (as % of GTV)*

of 4%+ by 2026. Capturing growth opportunities and

driving towards our target margins will create substantial

shareholder value.

4%+

adjusted EBITDA margin (as % of GTV)* by 2026

See page 26 for more detail on our Shareholder and wider

Stakeholder Engagement

1 Figure based on Q4 2021 monthly survey results. During the reported period, 40,000 riders completed the survey globally, representing 22%

of riders who delivered an order across the quarter.

* To supplement performance assessment, Deliveroo uses Alternative Performance Measures (APMs), which are not defined under IFRS. APMs

are indicated in this document with an asterisk (*); definitions and further details are provided on page 191.

Strategic report Governance report Financial report

13Annual Report 2021 deliveroo plc

We unlock a wealth of choice for consumers, providing fast, reliable

delivery of their most loved restaurant food and groceries, and

helping them to discover new favourites. Our ever-increasing selection

covers a wide range of cuisines and price options, with access to

>148,000 restaurant partner sites globally and >11,000 grocery partner

sites. We are focused on improving the full range of the consumer

experience: in-app search and discovery, ordering and tracking, fast

reliable delivery, and responsive customer care. Our Plus subscription

programme further enhances the value for consumers with free

delivery and additional rewards.

BUSINESS MODEL CONTINUED

MARKETPLACE

THE THREE SIDES OF THE

Deliveroo provides restaurants and grocers with new ways to achieve

long-term profitable growth through access to over eight million

consumers. We offer delivery capabilities through our tech and

operations, and provide dedicated, proactive support. We also bring

innovations and provide bespoke solutions to help partners grow their

businesses, from self-serve marketing tools to data-driven insights

to inform them on how to maximise the potential from online delivery.

The vast majority of our restaurants and grocery partners never offered

on-demand deliveries before, and we allow them to boost growth, increase

brand value and maximise the profit potential from online delivery. Throughout

the pandemic Deliveroo has campaigned for support for the restaurant and

hospitality sector, and we will continue to do so.

1. AVAILABILITY

4. PRICE

2. SELECTION

5. BRAND LOVE

3. EXPERIENCE

1. COMMERCE

PLATFORM

2. PARTNER

GROWTH

3. CUSTOMER

EXPERIENCE

4. PARTNER

EXPERIENCE

5. VALUE BASED

PARTNERSHIPS

RESTAURANTS

AND GROCERS

CONSUMERS

Strategic report Governance report Financial report

14 deliveroo plc Annual Report 2021

We provide riders with attractive earnings

opportunities combined with full flexibility. Rider

satisfaction was 85% in Q4 2021. During the

reported period, 40,000 riders completed the

survey globally, representing 22% of the riders

who worked across the quarter. Riders tell us

that flexibility is the main reason they work

with Deliveroo, valuing the total control

over when and where to work and what

orders to accept. Riders benefit from free

accident insurance and in many markets

the insurance also provides cover for

periods of short-term illness, and a one-

off pay-out on the birth of a child. Many

riders expect to work with Deliveroo for

years, but others see this as a stepping

stone in their career paths. We have

been proud to set up the Rider Academy

to support the learning aspirations of our

riders. Thousands of riders have taken part in

courses since the programme began.

1. FLEXIBILITY

2. EARNINGS

3. SECURITY

4. OPPORTUNITY

5. BRAND TRUST

RIDERS

Strategic report Governance report Financial report

15Annual Report 2021 deliveroo plc

THE LOCAL

NETWORK

EFFECT

LOGISTICS

TECHNOLOGY

A growing platform

As more consumers join our platform we receive

more orders. Greater consumer demand attracts

restaurants and grocery partners, who benefit

from increased volume. Greater volume and

network density provides greater earnings

opportunities for riders, who work with Deliveroo

more frequently and in greater numbers, which

in turn drives more efficient, high performance

logistics. This provides an enhanced service

for consumers, who have more selection and

availability in terms of both cuisine and price as

well as a faster, more reliable service.

Innovation at our core

Underpinning our entire offering is our logistics technology.

Our machine learning algorithms enable our network to

improve the experience of all three sides of the marketplace

on an ongoing basis. We use our technology to develop an ever-

expanding understanding of the nuances of delivering in each

neighbourhood we operate in, allowing us to improve quality

of service while gaining efficiency at the same time.

BUSINESS MODEL CONTINUED

ENABLERS

OUR

Strategic report Governance report Financial report

16 deliveroo plc Annual Report 2021

OUR GROWTH

BUSINESSES

Serving consumer demand

Our growth businesses – Editions, Plus and Grocery – each

contribute to our core food marketplace by strengthening

our network effects and accelerating the virtuous circle of

our three-sided marketplace.

Editions

Editions is Deliveroo’s delivery-only

kitchens concept that provides additional

value to all three sides of the marketplace.

Restaurant partners use Editions to bring their brands to

new neighbourhoods without needing to open a new dine-in

location; they also use Editions even in areas where they

have a restaurant to separate and optimise their dine-in

and delivery operations. Consumers enjoy the increased

availability in their area of most-loved brands – Editions can

account for 10-15% of total orders within the zone of their

delivery radius. And riders benefit from increased earnings

opportunities, including the fact that the efficiency of

the delivery-only kitchens means reduced wait-time at

restaurants, increasing earnings potential.

Plus

Deliveroo Plus is our subscription

programme that drives greater value for

consumers. For a fixed monthly fee, subscribers unlock free

delivery from all restaurant and grocery partners on orders

that meet the minimum spend requirements. Plus removes

delivery fees as a barrier to ordering, increasing order

frequency and improving retention. Plus was launched more

than three years ago, and in 2021 we added a plan designed

for families called Plus Silver.

Grocery

In the last three years, Deliveroo has built a leading position

in on-demand grocery, which represented 8% of Group GTV*

in 2021. We now offer delivery from over 11,000 partner

grocery sites globally, ranging from some of the largest

grocery retailers in our markets to small independent

convenience stores. For Deliveroo, Grocery offers powerful

synergies with the core platform, representing incremental

demand to the restaurant offering and providing an

effective customer acquisition channel. To complement

our leading network of partner store-picked grocery sites,

in 2021 Deliveroo launched a new rapid grocery delivery

service called ‘Deliveroo Hop’. Hop operates from delivery-

only grocery stores run by Deliveroo, working in partnership

with established grocers. Hop enables deliveries in as little

as 10 minutes with greater inventory accuracy than the

store-picked model.

300+

Number of Editions kitchens

On-demand grocery GTV*

% of total

H1 20 H2 20 H1 21 H2 21

7%

6%

5%

8%

H1 20 H2 20 H1 21 H2 21

* To supplement performance assessment, Deliveroo uses Alternative

Performance Measures (APMs), which are not defined under IFRS. APMs are

indicated in this document with an asterisk (*); definitions and further

details are provided on page 191.

Strategic report Governance report Financial report

17Annual Report 2021 deliveroo plc

Large global TAM

Opportunity to access a more than £1 trillion

total addressable market (TAM) in restaurant

and grocery food delivery across our existing

11 markets. Additional potential in adjacent

non-food categories.

Low online penetration

Online ordering of food is early in its maturity,

with online penetration of ~4% in restaurant

and ~3% in grocery food – far behind the level

in many other online categories.

Structural tailwinds

Consumer demand

continues to shift to

online and on-demand,

and pandemic effects

have accelerated

the trend.

Compelling structural growth

Distinctive value propositions

Focused on developing the best value

propositions for consumers, riders and

restaurant and grocery partners in

each neighbourhood to make Deliveroo

their #1 choice.

Investing in innovation

Scaling existing category innovations such

as Plus subscription model and Editions

delivery-only kitchens, and growing our

product, data and technology teams

to drive the innovations of the future.

Efficient logistics

Hyperlocal focus creates powerful network

effects, and use of big data and machine

learning helps to reduce delivery times

– benefiting riders and consumers.

Winning competitive dierentiators

OUR INVESTMENT PROPOSITION

DELIVEROO’S

DIFFERENCE

* Defined terms can be found in the Glossary on page 189.

Strategic report Governance report Financial report

18 deliveroo plc Annual Report 2021

Reaching net zero and reducing waste

Building a net zero carbon plan to reduce our

own direct emissions while supporting partners

and consumers to reduce their emissions

and food and packaging waste.

A KEY FOCUS FOR THE COMPANY

THIS YEAR AND BEYOND IS MAKING

PROGRESS ON OUR LONGER TERM

PATH TO PROFITABILITY.”

Will Shu

Founder & Chief Executive Officer

Building sustainable futures

Stable cohorts

Behaviour of our consumer cohorts has been

very consistent historically, with annual GTV*

retention well above 100% and increasing order

frequency, even coming out of COVID-19-related

lockdowns.

Path to profitability

Aim to reach adjusted EBITDA* breakeven during

H2 2023-H1 2024 and an adjusted EBITDA margin

(as % of GTV)* of 4%+ by 2026, with upside

potential beyond, supported by multiple levers

to drive unit economics and operating leverage.

Driving to profitability

* To supplement performance assessment, Deliveroo uses Alternative Performance Measures (APMs), which are not defined under IFRS. APMs are indicated in this

document with an asterisk (*); definitions and further details are provided on page 191.

Helping partners to grow and thrive

For riders, offering flexible work, attractive

earnings, security and learning opportunities.

For restaurants and grocery partners,

providing logistics technology and operations

plus continuous innovation to support

profitable growth.

Creating an inclusive marketplace

Attracting and developing a team of diverse

talents within Deliveroo that in turn supports

diversity and inclusion across all three sides

of our marketplace.

Strong capital position

Well-capitalised balance sheet supports

investment in growth opportunities, with

£1.3 billion cash and cash equivalents

at 31 December 2021.

Strategic report Governance report Financial report

19Annual Report 2021 deliveroo plc

1

STRATEGY

PROFITABILITY

GROWTH AND

Deliveroo’s mission is

to be the definitive

online food company –

providing consumers

with access to the

food they love for each

of the 21 weekly meal

occasions. We aim

to achieve this by our

focus on oering the

best value proposition

to all three sides of

the marketplace:

consumers, riders

and restaurant and

grocery partners.

• Deliver a seamless order experience for all and

transition from transactional to emotional

• Consumers: enable access to extensive selection and

experience for all food occasions

• Partners: provide demand, insights and innovations

that drive sustainable growth

• Riders: offer attractive earnings with flexibility,

security and opportunities for personal development

• Employees: create an inclusive environment where

our

people have growth opportunities and can leave

their mark;

continue to grow our technology team

• Increased number of restaurant partner sites to

>148k and grocery partner sites to >11k globally

• Extended rider insurance in many markets to cover

sickness and maternity/paternity

• Significant investment in the technology organisation

to innovate and build efficiencies

• Created Diversity, Equity and Inclusion (DE&I) team

under leadership of new Director of DE&I

• MACs*: 8.0 million in Q4 2021 (+37% YoY)

• Total partner sites: ~160k in Dec 2021 (+47% YoY)

• Rider satisfaction: 85% in Q4 2021**

• Employee engagement score: 8.1 in December 2021

(+0.6 YoY)***

Invest in dierentiated

value propositions

Goals

Progress

in 2021

Performance

measures

* Defined terms can be found in the Glossary on

page 189.

** Figure based on Q4 2021 monthly survey results.

During the reported period, 40,000 riders

completed the survey globally, representing

22% of riders who delivered an order across

the quarter.

*** Overall engagement score in December 2021,

compared to the same period last year.

This signifies improved sentiment across

four engagement areas: ‘Belief (in product)’,

‘Satisfaction (in job)’, ‘Loyalty (to Deliveroo)’

and ‘employee NPS’.

Strategic report Governance report Financial report

20 deliveroo plc Annual Report 2021

3

2

• Add new high-margin revenue streams, such

as advertising

• Create the most efficient logistics network built on

hyperlocal network density

• Generate tech-driven efficiencies in the marketplace

and our own operations

• Drive operating leverage with scale

• Took initial steps to develop advertising

revenue stream

• Reduced Rider Experience Time (RET) by >2%

• Launched several automation workstreams following

hiring of new Chief Product and Technology Officer

• Gross profit margin (as % of GTV)*: 7.5% in 2021

(8.7% in 2020)

• Adjusted EBITDA margin (as % of GTV)*: (2.0)% in 2021

((0.3)% in 2020)

• Cash and cash equivalents: £1.3 billion in 2021

(£0.4 billion in 2020)

Drive sustainable growth Strengthen levers of profitability

• Orders: 300.6 million in 2021 (+73% YoY)

• GTV*: £6.6 billion in 2021 (+70% YoY in

constant currency*)

• Revenue: £1,824.4 million in 2021 (+57% YoY)

• Expanded coverage across our markets and reached

77% population coverage in UK

• Added major new grocery partners, launched Hop and

increased grocery to 8% of GTV* in H2 2021

• Added more than 100 Editions kitchens, taking the

total to over 300 globally

• Increased Plus subscribers globally by 3X year-on-

year in Dec 2021

• Build leading market positions (#1 or strong #2) based

on hyperlocal market share

• Expand coverage and increase penetration by

growing category awareness and market share

• Accelerate grocery offering and scale category-

defining innovations such as Editions and Plus

• Support thriving incomes for restaurant and grocery

partners and riders

* To supplement performance assessment, Deliveroo uses Alternative Performance Measures (APMs), which are not defined under IFRS. APMs are indicated in this

document with an asterisk (*); definitions and further details are provided on page 191.

Strategic report Governance report Financial report

21Annual Report 2021 deliveroo plc

Description

Revenue is primarily generated from restaurant and

grocer commissions, from consumer fees, and from

restaurant and grocer sign-up fees. Revenue take rate*

is revenue divided by GTV*. It is a widely used measure

for understanding the proportion of total value spent

by consumers on our marketplace that is captured

by Deliveroo.

Performance 2021

Revenue reached £1,824.4 million, a year-on-year

increase of 57% in reported currency, mainly driven by

the growth in GTV*. The revenue take rate* was 27.5%

compared to 29.2% in 2020, with the year-on-year

movement attributable primarily to investments to drive

consumer acquisition (such as the New User Experience

programme) and retention (via the Plus subscription

offering); and investments to create differentiated

content for consumers through Deliveroo’s restaurant

and grocery selection.

Description

Gross profit* is calculated as revenue less costs of

sales, which primarily comprises rider costs and credit

card fees. Gross profit margin (as % of GTV)* is gross

profit* divided by gross transaction value (GTV)*. Gross

profit margin (as % of GTV)* is considered a good

measure of profitability at a transactional level.

Performance 2021

Gross profit* reached £497.3 million compared to

£347.7 million in 2020, an increase of 43% in reported

currency. Gross profit margin (as % of GTV)* was 7.5%

compared to 8.7% in 2020, with the year-on-year

movement attributable primarily to the reversal of

benefits from higher basket sizes during COVID-19-

related lockdowns and to initiatives to support future

growth, including investments to drive consumer

acquisition and retention, and to create differentiated

content for consumers through Deliveroo’s restaurant

and grocery selection.

Revenue (£m)

£1,824M

+57%

Revenue take rate* (%)

27.5%

170 BPS

Gross profit* (£m)

£497M

+43%

Gross profit margin* (%)

7.5%

120 BPS

KEY PERFORMANCE INDICATORS

FINANCIAL KPIs

27.5

21

29.2

20

30.6

19

29.6

18

7.5

21

8.7

20

7.5

19

5.7

18

Revenue and revenue take rate* Gross profit* and gross profit

margin* (as % of GTV)

1,824

21

1,163

20

772

1918

476

497

21

348

20

189

1918

91

* To supplement performance assessment, Deliveroo uses Alternative

Performance Measures (APMs), which are not defined under IFRS. APMs are

indicated in this document with an asterisk (*); definitions and further

details are provided on page 191.

Strategic report Governance report Financial report

22 deliveroo plc Annual Report 2021

Description

Adjusted EBITDA* is calculated as gross profit* less

marketing and overhead* expenses. It excludes inter

alia depreciation and amortisation, exceptional costs*,

exceptional income*, and share-based payments

charge. Adjusted EBITDA* is considered to be a measure

of the underlying trading performance of the Group

and is used, amongst other measures, to evaluate

operations from a profitability perspective.

Performance 2021

Adjusted EBITDA* was £(131.4) million, compared to

£(10.8) million in 2020, as higher aggregate gross profit*

was offset by increased investments to support

future growth, particularly in the second half of the

year. These increased investments include marketing

spend to drive consumer brand awareness, and adding

technology talent to further develop the Deliveroo

platform. Adjusted EBITDA margin (as % of GTV)* was

(2.0)%, with a margin of (0.8)% in H1 2021 and (3.2)%

in H2 2021.

Description

Cash and cash equivalents are a good measure of the

assets that the business has available to invest in its

operations and fund growth.

Performance 2021

Cash and cash equivalents were £1,290.9 million at

31 December 2021, compared to £379.1 million at

31 December 2020. Deliveroo had a strong cash inflow

from the successful completion of fundraising activities

in H1 2021, with £1,011.7 million net proceeds (after

costs) from the IPO in April 2021, as well as £135.3 million

net proceeds (after costs) from the Series H fundraising

round in January 2021.

Adjusted EBITDA* (£m)

£131M

N.M.**

Adjusted EBITDA margin* (%)

2.0%

170 BPS

Cash and cash equivalents (£m)

£1,291M

+241%

Adjusted EBITDA* and adjusted

EBITDA margin* (as % of GTV)

Cash and cash equivalents

(131)

2120

(227)

19

(198)

18

(11)

1,291

2118

185

19

230

20