1) Broad assessment of insurance industry cybersecurity loss events over

the past decade (20 minutes)

(CIPR)

2) Discuss insurance industry loss events in wider context as well as

ongoing NAIC initiatives and best practices aimed at curbing the

frequency and impact of such cybersecurity loss events (30 minutes)

(Jim Blinn, Zywave)

(Cynthia Amann, Missouri Department of Commerce & Insurance)

3) Cyber modeling landscape and application (30 minutes)

(Rebecca Bole, CyberCube)

(Shaveta Gupta, NAIC CAT COE)

AGENDA

4

Arthur J. Gallagher targeted in class action lawsuit based on 2020 ransomware attack

Chubb hit by a Maze ransomware attack in March 2020

Geico reported in April 2021, customer stolen license numbers possibly used to apply

for fraudulent unemployment benefits

CNA paid $40 million in late March 2021 to hackers

(Source: Insurance Journal, Jan. 5, 2022, https://www.insurancejournal.com/news/2022/01/05/647530.htm)

Alleged Funeral Insurance Services Robocalls Gets Allstate Affiliate National General

Into TCPA Hot Water

(Source: https://www.natlawreview.com/article/tcpaworld-after-dark-alleged-funeral-insurance-services-robocalls-gets-allstate)

Health Insurance Associates agreed to pay $990,000 to resolve claims that it violated

the Telephone Consumer Protection Act (TCPA) with unsolicited telemarketing calls.

(Source: https://topclassactions.com/lawsuit-settlements/closed-settlements/health-insurance-associates-telemarketing-calls-990k-class-action-settlement/

CYBER HEADLINES

5

The long list of companies hit by the global MOVEit hack has grown further with

the addition of insurance provider Genworth

, whose millions of customers and

agents combined are affected – up to 2.7 million individuals affected.

https://www.insurancebusinessmag.com/us/news/cyber/genworth-outlines-massive-hit-from-global-moveit-hack-450435.aspx

Other 2023 high profile incidents:

Managed Care of North America (MCNA) Dental – March data breach that compromised data of almost nine million

patients;

Progressive – May, one of its third-party vendors has fallen victim to a data breach that impacted about 347,000

customers;

CareSource – May, more than three million customers to have their personal data compromised;

Prudential & New York Life – May, more than 345,000 customer accounts were impacted by MOVEit hack;

American Family – October cyberattack shutting down IT systems;

MORE CYBER HEADLINES

https://www.insurancebusinessmag.com/us/guides/the-insurance-industry-cyber-crime-report-recent-attacks-on-insurance-businesses-

448429.aspx#:~:text=In%20a%20notification%20letter%20dated,personal%20information%20accessed%20by%20hackers

.

6

But what do we know about the objective cybersecurity

risk across the entire insurance industry over time

?

Access and analyze industry recognized proprietary cyber loss

dataset

Merging NAIC data points and survey information to create a

unique modeling set for descriptive and statistical analysis

Share and leverage findings with NAIC regulators

7

RESEARCH OBJECTIVE

MAIN RESULTS

• Between 2012 and 2022, over 541 insurance companies

suffered a known cyber loss event, with an average of 233

cyber loss events transpiring each year.

• Cyber events potentially impact both market conduct and

financial solvency areas of regulation.

• The likelihood of experiencing a malicious cyber

event increases as firm visibility increases.

• The likelihood of experiencing a malicious cyber

event increases as firm performance decreases.

[RESULTS ARE PRELIMINARY]

8

• Data source: Zywave Data Set (f/k/a Advisen)

• Cyber loss events accessed from a variety of sources

Government: SEC, FTC, FCC, Homeland Security, State FOIA requests, Int'l sources

Litigation: Official court records, plaintiff attorney websites, litigation sources

News: Key-word based alerts

Company: S&P, D&B

• Timeframe

Events range from 1953 – 2022

Analysis range from 2012 – 2022

Lag time from event creation and case updates can be considerable

9

OUR DATA UNIVERSE - SOURCE

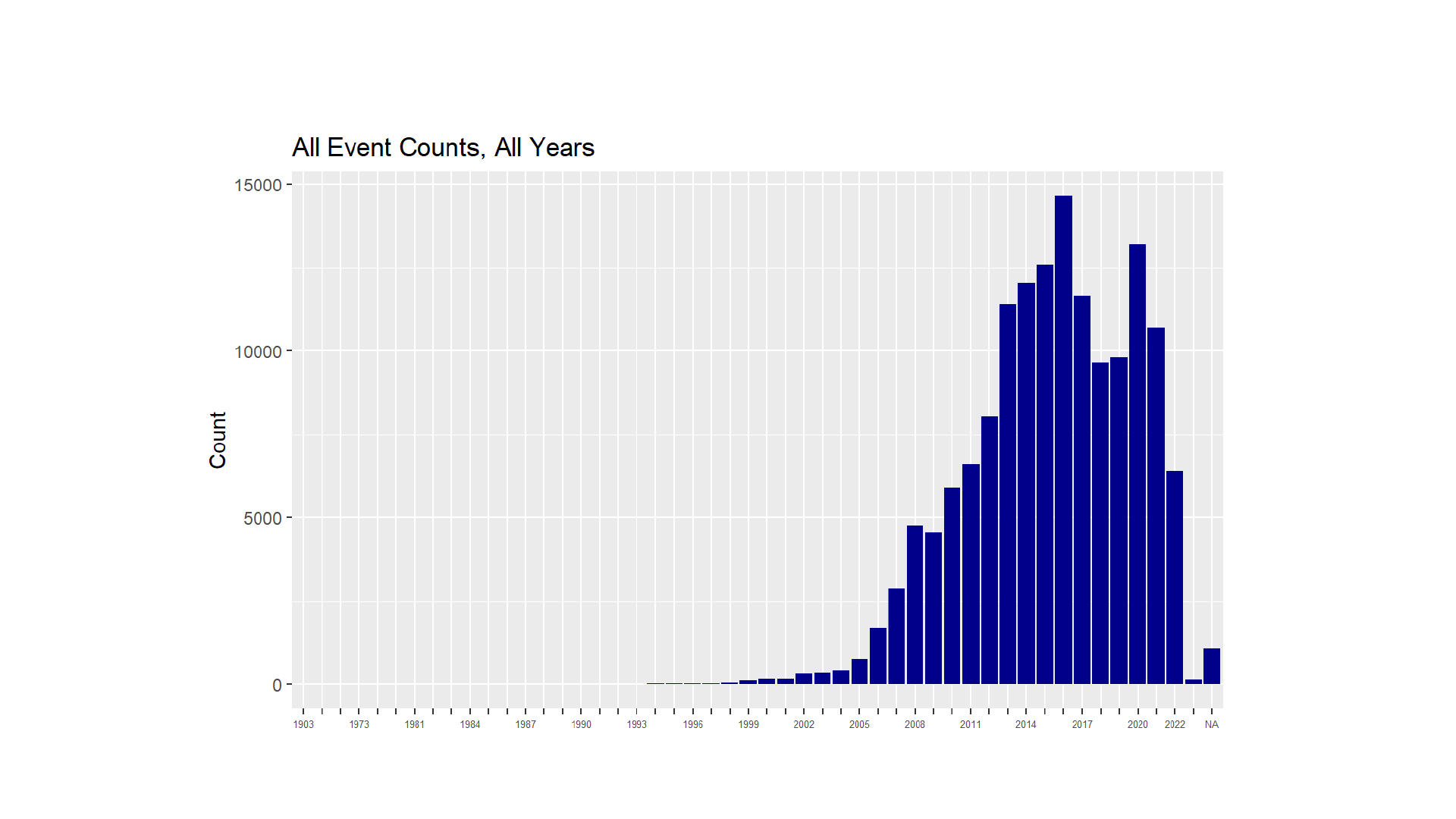

HISTORICAL VIEW OF EVENTS - ALL GLOBAL COMPANIES

Total Number of Events: 150,341

Source: Zywave Data Set, 01/26/2023

EVENT YEAR

10

110010

101010

110011

What is being tracked?

Events –An event is any risk of financial or physical loss, disruption of services, privacy

violation, or damage to the assets or reputation of an organization through either

a failure

of its information or technology systems, or a malicious act affecting their information or

technology systems

.

Events may result in significant financial loss to or judgments against corporate entities.

Data--

Unintentional

Disclosure

Data–

Malicious

Breach

Data–

Physically

Lost or

Stolen

IT Configuration,

Implementation

Errors

Privacy

Unauthorized

Contact or

Disclosure

Phishing,

Spoofing,

Social

Engineering

11

OUR DATA UNIVERSE – LOSS EVENTS

ISOLATING U.S. INSURANCE COMPANIES

Source: Zywave data set, Jan 26, 2023

NAIC FDR

All U.S.

Insurance

Related*

4,475

events

NAIC

Matched

Insurers

All U.S.

Insurance

Related*

2,050

Zywave

companies

NAIC

Matched

Insurers

541

NAIC

companies

2,566

events

All

U.S.

124,589

events

TIME PERIOD:

2012 - 2022

Zywave ID

FEIN / Name /

Event Description

/State of Domicile

COCODE

*SIC Codes 63 & 64

12

INSURANCE EVENTS OVER TIME (2012-2022)

Source: Zywave data set, Jan. 26, 2023; NAIC FDR; SICCODE.com

n Events= 9,129

n Firms =107,281

n Events= 2,566

n Firms = 7,602

Annual Rate Per Firm:

0.007736

Annual Rate Per Firm:

0.030686

Roughly,

insurance

companies

are 4x more

likely than a

depository

institution to

experience a

cyber event.

13

EVENT FREQUENCY BY STATEMENT TYPE

Source: Zywave data set, Jan 26, 2023

Matched

NAIC

Insurers

n Events=2,566

19%

44%

36%

14

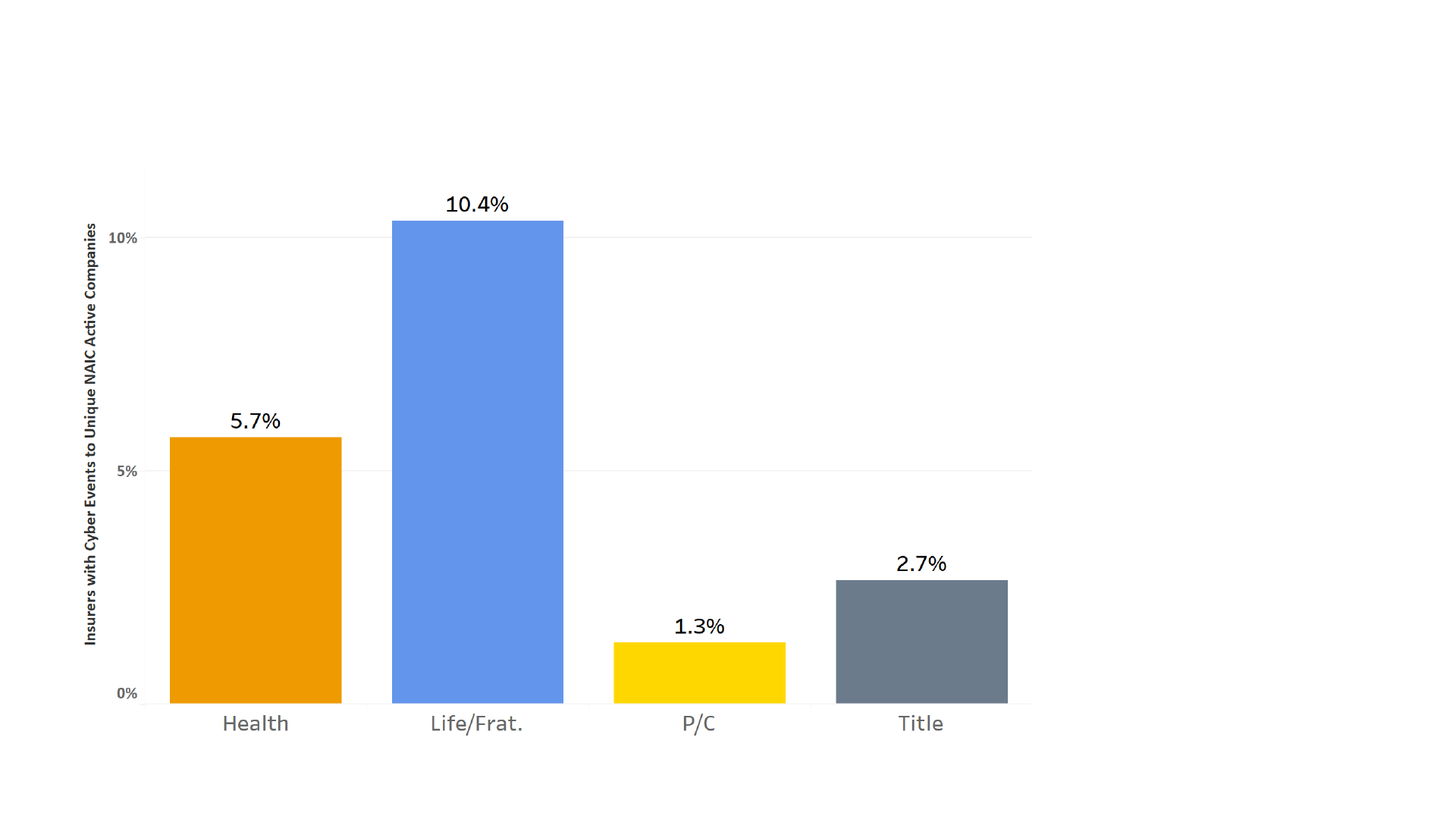

INSURER SECTOR INFLUENCE

Source: Zywave data set, Jan. 26, 2023; NAIC FDR

All Cyber Events n = 2566

Companies w/ Cyber Event n = 526

Total Distinct Companies with Filings

Requested 2012 - 2022 n = 5876

TIME PERIOD:

2012 – 2022

Proportion of Companies with Cyber Event to Financial Filings Received

15

THIRD-PARTY FINANCIAL IMPACT

Source: Zywave data set, Jan 26, 2023

[140]

[180]

[284]

[207]

[76]

[371]

[317]

[319]

[266]

[211]

[195]

• Settlement Amounts

• Other Fines & Penalties

• Plaintiff’s Legal Expenses

16

INSURER TOP 4 EVENT TYPES OVER TIME

Source: Zywave data set, Jan 26, 2023

17

EVENT TYPES: NAIC MATCHED INSURERS

Source: Zywave data set, Jan. 26, 2023

Unintentional Disclosure

Example:

A policyholder ran a

report that should have

only shown their policy

info, but instead included

additional policyholders’

info. Customer sent copy

of report. Impacted over

1,000 policyholders.

Internal -

Organization

Printed Records

Personal

Financial

Identity

Personal

Identity

Information

n = 862

External Other

Internal - TTP

Email

Unknown/Other

Internal -

Employee

Server

Personal Health

Information

Unknown/Other

18

FREQUENCY BY COMPANY: 2012 - 2022

UNINTENTIONAL DISCLOSURE

Source: Zywave data set, Jan 26, 2023

n = 862

19

SEVERITY: 2012 - 2022

UNINTENTIONAL DISCLOSURE

Source: Zywave data set, Jan 26, 2023

% of Class Action Lawsuits: .35%

0% 1

10% 1

25% 1

50% 2

90% 1,563

75% 103

100% 15,000,000

Event Persons

Percentile

Affected

n = 862

Estimated

20

EVENT TYPES: NAIC MATCHED INSURERS

Source: Zywave data set, Jan. 26, 2023

Malicious Breach

Example:

A former employee took

personal information from

company records and sent

it to their laptop to obtain

OTC products from

pharmacy. [54,000+

members potentially

affected. ]

External - Other

Server

Personal

Financial

Identify

Personal

Identity

Information

n = 980

Employee

Criminal Org.

Email

Website

Personal Health

Info

21

FREQUENCY BY COMPANY: 2012 - 2022

MALICIOUS BREACH

Source: Zywave data set, Jan 26, 2023

n = 980

22

SEVERITY: 2012 - 2022

MALICOUS BREACH

Source: Zywave data set, Jan 26, 2023

0% 1

10% 1

25% 2

50% 42

90% 26,179

75% 1,324

100% 11,000,000

Event Persons

Percentile

Affected

% of Class Action Lawsuits: 3.6%

n = 980

23

EVENT TYPES: 2012 - 2022

NAIC INSURERS COMPARED TO FINANCIAL INSTITUTIONS

Source: Zywave data set, Jan. 26, 2023

U.S. Insurers

Depository Institutions

U.S. Insurer n = 2,566,

98% of Case Types Shown

Depository Institution n = 9,129

99.5% of Case Types Shown

24

Harder to Breach

- Larger IT Budget

& Security

Bigger Payoff

- Larger

quantity of

desirable

information

Relatively Larger Insurer

Lower Payoff –

Smaller

quantity of

desirable

information

Easier to

Breach –

Smaller IT

Budget &

Security

Relatively Smaller Insurer

25

TYPE OF INSURER TO EXPERIENCE

MALICIOUS CYBER LOSS EVENT

Research question

What types of insurers are more likely to experience a cyber loss

event?

• Firm visibility

• Age, Size (Total assets), Advertisement expense, Number of states

• Performance

• Return on Assets (ROA) = Net income / Total assets

• Financial health

• Leverage = Capital surplus / Total assets

• IT budget

• Intangible assets (Personal information)

• Net premiums written

26

STATISTICAL ANALYSIS – DETERMINANTS

OF MALICIOUS CYBER EVENTS

Sample

Includes all insurers that reported total assets greater than

0 in the annual statement from years 2012-2022

• 49,694 observations

• 7,219 insurers

Methodology

Malicious cyber event

t

= f(firm characteristics

t-1

)

Malicious cyber event equals 1 if an insurer experienced a

malicious cyber event in year t, and equals 0 otherwise

27

STATISTICAL ANALYSIS – DETERMINANTS

OF MALICIOUS CYBER EVENTS

Key findings

Insurers are more likely to experience a cyber event when:

• Greater firm visibility (Size, Age, Advertisement expense,

Number of states)

• Lower ROA

• Health insurer (3% > P&C, Life)

• Previous malicious cyber event (0.7%)

• Mutual insurers edge out non-mutual (0.3%)

• Grows over sample time frame

28

STATISTICAL ANALYSIS – DETERMINANTS

OF MALICIOUS CYBER EVENTS

29

Zywave Loss Data Insights

Jim Blinn

Zywave

12/1/2023

Losses: Linking Disparate Sources

Loss

Data

News

Articles

Court

Records

Plaintiff

Lawyers

Government

Websites

FOIA

Requests

Federal Trade

Commission

Office of

Civil Rights

Company

Data

SEC

DoJ

Financial

Records

Cyber

D&O

EPLI

Fiduciary

Liability

Excess

Casualty

Comparison of Loss Types

December 1, 2023

32

Loss Type Insurer Non-Insurer FI All Others Total

Data - Malicious Breach 35.90% 38.46% 42.87% 41.88%

Privacy - Unauthorized Contact or Disclosure 13.63% 38.60% 22.67% 25.26%

Data - Unintentional Disclosure 28.87% 8.21% 14.27% 13.61%

Data - Physically Lost or Stolen 11.91% 4.64% 6.24% 6.11%

Network/Website Disruption 0.84% 2.04% 6.23% 5.32%

Phishing, Spoofing, Social Engineering 4.09% 2.78% 3.23% 3.18%

Privacy - Unauthorized Data Collection 0.49% 0.37% 1.22% 1.05%

IT - Configuration/Implementation Errors 1.15% 0.58% 0.92% 0.87%

Skimming, Physical Tampering 0.00% 2.26% 0.77% 1.01%

IT - Processing Errors 1.21% 0.68% 0.59% 0.62%

Identity - Fraudulent Use/Account Access 1.31% 1.04% 0.58% 0.68%

Undetermined/Other 0.59% 0.35% 0.30% 0.31%

Industrial Controls & Operations 0.02% 0.00% 0.11% 0.09%

Comparison of Actor Types

December 1, 2023

33

Actor Type Insurer Non-Insurer FI All Others Total

External

- Other 40.96% 38.88% 41.03% 40.64%

Internal

- Organization 33.49% 44.87% 33.50% 35.54%

External

- Criminal Organization 5.25% 6.36% 10.80% 9.84%

Internal

- Employee 11.57% 5.44% 8.22% 7.82%

External

- Hacktivist 0.27% 0.86% 2.51% 2.15%

Internal

- Trusted Third Party (TTP) 3.05% 1.07% 0.89% 0.98%

External

- Vendor 3.09% 0.80% 0.66% 0.76%

External

- Nation State 0.12% 0.22% 0.77% 0.65%

External

- Former Employee 1.09% 0.60% 0.60% 0.62%

Internal

- Other 0.54% 0.39% 0.47% 0.45%

External

- Criminal Individual 0.21% 0.33% 0.21% 0.23%

External

- Terrorist 0.04% 0.05% 0.12% 0.11%

Other

0.33% 0.14% 0.21% 0.20%

Comparison of Loss Types

December 1, 2023

34

Cyber Incident Insurer Non-Insurer FI All Others Total

MOVEit Cl0p Ransomware Attack, 2023 56 144 823 1023

Blackbaud Inc. Ransomware Attack, 2020 5 887 892

Heartland Payment Systems, Hacking, 2008 3 657 10 670

Ukraine-Russia Crisis Cyber Warfare, 2022 21 138 159

Insurance Technologies Data Breach, 2021 1 147 2 150

WannaCry Ransomware Attack, 2017 7 134 141

Sabre, Payment Card Data Breach, 2016 5 14 110 129

Connexin Software, Inc Data Breach, 2022 120 120

Luxottica Data Hacking Incident, 2020 106 106

Kronos Private Cloud Ransomware, 2021 4 92 96

Horizon Actuarial Services, Hacking 2021 42 52 94

AmeriCommerce, Data Hacking 2021 87 87

Accellion Unauthorized Access, 2020 3 8 58 69

35

www.cybcube.com

Cyber risk modeling - an insurance industry view

December 2023

www.cybcube.com

Market Position

● > 100 (re)insurance clients

○ 20/30 top cyber carriers

○ 9/20 top global reinsurers

● > 95% client retention rate

● > 66% of global cyber insurance premiums

Mission

Deliver the world’s leading analytics and services to quantify

cyber risk

About CyberCube

37

History

● Founded in 2018

● Focused solely on cyber risk quantification and analytics

● Largest

○ single investment in cyber risk data and analytics

○ dedicated multi-functional team (>115)

Regulatory Engagement

● Maintain active dialogues with regulators in key markets,

and regularly engage on projects to develop cyber risk

governance frameworks and risk management structures

● Partner with rating agencies to develop approaches to

underwriting and rating cyber risk

CyberCube Solutions leveraged

● Portfolio Manager

○ SPoF scenario-class based cyber cat model

○ Quantify attritional and tail risk

● Account Manager

○ Predictive security score and risk factors

www.cybcube.com

Insurance Industry loss modeling analysis: Carrier Count by Type

38

# of Carriers by Type

● Total 4155

● Excluded 679

● Subtotal 3476

● P&C 1960

● Health 867

● Life 601

● Title 48

www.cybcube.com

Insurance Industry loss modeling analysis: 2022 Direct Written Premium by Type

39

Premiums by Carrier Type*

● P&C

$1,055B

● Life

$967B

● Health

$848B

● Title

$21B

*excluding N/A, Zero, Negatives

www.cybcube.com

What questions did we tackle?

40

1. Which companies are most vulnerable from a security perspective?

2. Which of the insurer’s technology dependencies are the vector for loss?

3. What types of events are most likely to cause losses across the insurance industry?

4. What is the financial cost of cyber attacks on the US insurance industry?

5. Which companies present the largest risks?

www.cybcube.com

Executive Summary

41

1. Which companies are most vulnerable from a security perspective?

a. Micro-sized insurers (<$10mn premium), on average, have the weakest cyber security postures and are most

vulnerable to loss

b. Large companies, on average, have the best cyber security among insurers

c. The Insurance sector, on average, is below the Financial industry average on cyber security

2. Which of the insurer’s technology dependencies are the vector for loss?

a. Cyber attackers are most likely to access systems via shared technology dependencies such as certificate authorities,

cloud service providers and content management systems

3. What types of events are most likely to cause losses across the insurance industry?

a. Ransomware and Data Theft are the sources of largest loss to the insurance industry

4. What is the financial cost of cyber attacks on the US insurance industry?

a. In any given year, the insurance industry will suffer $434mn in losses. At the 1-in-250 return period, the insurance

industry could suffer losses of $8.3bn

5. Which companies present the largest risks?

a. In a breakdown of individual companies that drive the industry loss, larger insurers contribute most to the loss quantum

www.cybcube.com

P&C

1a. Which companies are the most

vulnerable

from a security perspective?

42

Life

● American Mut Life Assn

● Alliance Of Transylvanian Saxons

● KJZT Family Life

● American Farmers & Ranchers Life

● Assurity Life Ins Co of NY

● Foundation Life Ins Co Of AR

● National Family Care Life Ins Co

● Western Amer Life Ins Co

● Portuguese Fraternal Soc. of Amer

● Dakota Capital Life Ins Co

● Superior Specialty Ins Co

● Farmers & Mechanics Mut

● New Mexico Business Ins

● United Frontier Mut Ins Co

● California Cas Ins Co

● Wisconsin Lawyers Mut Ins

● Midwest Family Advantage

● Peninsula Ind Co

● Jet Ins Co

● Consumer Specialties Ins

Health

● Magna Ins Co

● United Hlthcare of AR Inc

● ProTec Ins Co

● Dignity Care Corp

● Optilegra Inc

● Ryder Hlth Plan Inc

● Solstice Health Ins Co

● Momentum Ins Plans Inc

● Eon Hlth Inc

● Central Mass Hlth LLC

Title

● American Eagle Title Ins Co

● National Consumer Title Ins Co

● Southwest Land Title Ins Co

● California Members Title Ins Co

● Apex Underwriters Inc

● Title Guar & Trust Co

● AHP Title Direct Inc

● ARIS Title Ins Co

● Dakota Homestead Title Ins Co

● Conestoga Title Ins Co

- CyberCube’s security scores consider 45 security risk factors, including Open Ports, End-of-Life products, Unpatched

software

- These top-10 vulnerable* companies are all Micro size (<$10mn GwP). Company names obscured below, because…

- ‘Vulnerable’ does not equal ‘Negligent’. Cybersecurity is fast moving and requires resource. The likelihood of being

attacked is a function of cybersecurity, the company’s value as a target and the volume of data/assets to be stolen

* lowest CyberCube security scores

www.cybcube.com

1b. Which segment is the most

vulnerable

from a security perspective?

43

˃ CyberCube Security Score averages show all Financial industry companies

˃ For all insurers, the averages by segment range from 42-48, therefore slightly below average Financial companies

˃ For P&C and Health insurers, two-thirds are below average for all Financials

˃ Life and Title insurers sit around the Financial industry average

˃ Overlaying company size, Large and Medium companies have above average scores. Small are average and Micro are below average

(Least)

100

75

50

25

(Most) 0

LifeP&C Health TitleIndustry-size

Averages

61

56

46

37

46

47

87

2

86

48

6

42

2

84

63% below average

35% above average

57% below average

42% above average

63% below average

36% above average

50% below average

50% above average

87

4

Large

Medium

Small

Micro

Financial Industry

average security

score

www.cybcube.com

2. Which of the insurer’s technology dependencies are main vectors for loss?

44

˃ Cloud Service Provider (Omni)

˃ AWS, Azure, Salesforce

˃ Content Delivery Network Provider

˃ Cloudflare, Akamai, Amazon CloudFront

˃ Certificate Authority

˃ DigiCert, Let’s Encrypt, GoDaddy

˃ Cloud-based Enterprise File Sharing Provider

˃ MS OneDrive/Azure, Google Drive, Apple iCloud

˃ Email Services Provider

˃ MS Exchange, Gmail for Business, Zoho Mail

˃ DNS Provider

˃ Route53, Cloudflare, GoDaddy

˃ Operating System - Server

˃ Ubuntu, Unix, Linux

˃ Content Management System Provider

˃ WordPress. Adobe Experience Manager, HubSpot CMS

˃ E-Commerce Platform

˃ Shopify, Magento, Amazon

Insurer technology dependency groups

- CyberCube loss modeling is

based on Single Points of

Failure (SPoF) technology

dependencies that act as vectors

to cause loss

- We show here the top SPoF

groups for the insurance industry

- Research highlights 4 main

SPoF types as vulnerabilities for

attack: Certificate Authority, File

sharing providers, Email

services providers and Content

Management Systems

www.cybcube.com

3. What type of event(s) can cause the largest losses to the Insurance Industry?

45

Five highest loss scenario classes

Loss type SPoF exploited

Ransomware File Sharing Provider

Data Theft Fund Administrator

Destructive Malware Cloud Services Provider

Ransomware Endpoint Operating System

Data Theft Enterprise Payroll Provider

Five lowest loss scenario classes

Loss type SPoF exploited

Cash Theft Financial Transaction Provider

Data Theft E-Commerce Platform

Ransomware Medical Device Manufacturer

Data Theft Mobile Point of Sale Vendor

Extortion Point of Sale Vendor

www.cybcube.com

168

4. What is the financial cost of cyber attacks on the US insurance industry?

46

Average

Annual

Loss

2.0% or 1-

in-50yr

1.0% or

1-in100yr

0.4% or 1-

in-250yr

0.2% or 1-

in-500yr

120

142 4

1,7381,167 1,387 35

2,4581,585 1,896 54

3,6422,077 2,735 87

4,9173,101 3,876 122

434

LifeP&C Health TitleUS Insurance Industry

Annual

Probability

4,267

5,782

8,284

11,501

Losses shown in $millions.

Individual Life & Health company

contribution to loss is higher

www.cybcube.com

P&C

5. Which companies drive the most losses – on average vs in a cyber catastrophe?

47

Average Annual Loss

● State Farm Mut Auto Ins Co

● United Specialty Ins Co

● State Farm Fire & Cas Co

● Nations Ins Co

● Federal Ins Co

1-in-250yr cat

● State Farm Mut Auto Ins Co

● United Specialty Ins Co

● State Farm Fire & Cas Co

● Nations Ins Co

● United Serv Automobile Assn

Life

Average Annual Loss

● Health Net Life Ins Co

● American Nat Life Ins Co of NY

● Globe Life Ins Co of NY

● Wysh Life & Hlth Ins Co

● Reliance Standard Life Ins Co

1-in-250yr cat

● Health Net Life Ins Co

● American Nat Life Ins Co of NY

● Wysh Life & Hlth Ins Co

● Reliance Standard Life Ins Co

● Globe Life Ins Co of NY

Health

Average Annual Loss

● Pacificare Life & Hlth Ins Co

● Clover Ins Co

● Golden Security Ins Co

● Anthem Ins Co Inc

● Cigna Dental Hlth of NC Inc

1-in-250yr cat

● Pacificare Life & Hlth Ins Co

● Clover Ins Co

● Golden Security Ins Co

● Anthem Ins Co Inc

● Cigna Dental Hlth of NC Inc

Title

Average Annual Loss

● Conestoga Title Ins Co

● Attorneys Title Guaranty Fund Inc

● National Title Ins Of NY Inc

● Alliant Natl Title Ins Co Inc

● Real Advantage Title Ins Co

1-in-250yr cat

● Conestoga Title Ins Co

● Alliant Natl Title Ins Co Inc

● Attorneys Title Guaranty Fund Inc

● National Title Ins Of NY Inc

● Real Advantage Title Ins Co

www.cybcube.com

Executive Summary

48

1. Which companies are most vulnerable from a security perspective?

a. Micro-sized insurers (<$10mn premium), on average, have the weakest cyber security postures and are most

vulnerable to loss

b. Large companies, on average, have the best cyber security among insurers

c. The Insurance sector, on average, is below the Financial industry average on cyber security

2. Which of the insurer’s technology dependencies are the vector for loss?

a. Cyber attackers are most likely to access systems via shared technology dependencies such as certificate authorities,

cloud service providers and content management systems

3. What types of events are most likely to cause losses across the insurance industry?

a. Ransomware and Data Theft are the sources of largest loss to the insurance industry

4. What is the financial cost of cyber attacks on the US insurance industry?

a. In any given year, the insurance industry will suffer $434mn in losses. At the 1-in-250 return period, the insurance

industry could suffer losses of $8.3bn

5. Which companies present the largest risks?

a. In a breakdown of individual companies that drive the industry loss, larger insurers contribute most to the loss quantum

www.cybcube.com

Confidential and subject to NDA

49

This document is for general information purpose only and is not and shall not under any

circumstance be construed as legal advice. It is not intended to address all or any specific area of the

topic in this document. Unless otherwise expressly set out to the contrary, the views and opinions

expressed in this document are those of CyberCube’s and are correct as at the date of publication.

Whilst all reasonable care has been taken in the preparation of this document including in ensuring

the accuracy of the content of this document, no liability is accepted by CyberCube and its affiliates

for any loss or damage suffered as a result of reliance on any statement or opinion, or for any error or

omission, or deficiency contained in the document. CyberCube and its affiliates shall not be liable for

any action or decisions made on the basis of the content of this document and accordingly, you are

advised to seek professional and legal advice before you do so. This document and the information

contained herein are CyberCube’s proprietary information and may not be reproduced without

CyberCube’s prior written consent. Nothing herein shall be construed as conferring on you by

implication or otherwise any license or right to use CyberCube’s intellectual property. All CyberCube’s

rights are reserved.

CyberCube Analytics, Inc., 58 Maiden Lane, 3

rd

Floor, San Francisco, 94108

Copyright © 2023 CyberCube Analytics, Inc. All rights reserved

Questions?

Email rebeccab@cybcube.com

www.cybcube.com

Confidential and subject to NDA

Cyber Catastrophe Modeling: Q&A

Rebecca Bole, Shaveta Gupta

50

51

www.cybcube.com

Confidential and subject to NDA

Digital Supply Chain - Single Point of Failure (SPOF) Overview

Single Point of Failure (SPoF)

• Signifies the company, service, etc.

within each scenario class that caused

the system failure.

• SPoF Intelligence provides information

to better understand your insurance

portfolio and connections by

understanding which single points of

failure an insured relies on

• Understand which accounts are

dependent upon a Single Point of

Failure

Dependent

Companies

Single Point of

Failure Technology

Amazon

Web

Services

Abercromb

ie & Fitch

Co.

Pacific

Gas and

Electric

Company

…

USAA

Real

Estate

Company

SPOF to Company Relationships

Technology

Dependencies

Company

Walmart

Amazon

Web

Services

Shopify

…

Woo

Commerce

Company to SPOFs Relationships

www.cybcube.com

Scenario Generation: CUBE Framework

52

Our multi-disciplinary expert teams leverage our

proprietary CUBE Framework to quantify the

impacts of cyber attacks across the six

dimensions of an attack:

● Attackers

● Targets

● Objectives

● Vulnerabilities

● Impact

● Consequences

This framework:

● Breaks down the technical complexity of a

cyber attack into meaningful and complete

narratives easily understood by both

experts and non-experts.

● Provides a consistent methodology to

create representative scenarios with the

greatest combined probability, impact, and

reach which would cause catastrophic loss

accumulation for (re)insurers.

www.cybcube.com

Confidential and subject to NDA

5353

CyberCube Exposure Data

Internal Security Data Expert IntelligenceDigital Supply Chain Historical DataEnterprise Data External Network Data

Catastrophe Model

Bottom-up loss modeling of

systemic events caused by

cascading impacts from single

point of failure technologies

www.cybcube.com

As with Property, 3 factors must be present to create Cyber insurance risk

54

Property Cyber

1. Exposure

Creates aggregation potential

2. Peril

Frequency & severity of events

3. Vulnerability

Susceptibility to peril

www.cybcube.com

Cyber risk shares many qualities with other P&C lines

55

TerrorismCasualty

Property

> Short tail

> Catastrophe-exposed line

> Embrace of catastrophe modeling &

exposure management

> Focus on risk tolerance at the

extreme tail: 1-in-100, 1-in-250

> Social science, not natural science

> Managed within Specialty /

Professional Liability / E&O

> Concern about systemic risk

(theoretically cannot be diversified)

> Pricing volatility & underwriting cycle

> Mean vs median vs mode loss ratio

> Man-made peril

> Sensitive to political environment

> Dynamic & rapidly evolving threat

How cyber risk is like…

56

www.cybcube.com

Confidential and subject to NDA

s

56

www.cybcube.com

Confidential and subject to NDA

57

This document is for general information purpose only and is not and shall not under any

circumstance be construed as legal advice. It is not intended to address all or any specific area of the

topic in this document. Unless otherwise expressly set out to the contrary, the views and opinions

expressed in this document are those of CyberCube’s and are correct as at the date of publication.

Whilst all reasonable care has been taken in the preparation of this document including in ensuring

the accuracy of the content of this document, no liability is accepted by CyberCube and its affiliates

for any loss or damage suffered as a result of reliance on any statement or opinion, or for any error or

omission, or deficiency contained in the document. CyberCube and its affiliates shall not be liable for

any action or decisions made on the basis of the content of this document and accordingly, you are

advised to seek professional and legal advice before you do so. This document and the information

contained herein are CyberCube’s proprietary information and may not be reproduced without

CyberCube’s prior written consent. Nothing herein shall be construed as conferring on you by

implication or otherwise any license or right to use CyberCube’s intellectual property. All CyberCube’s

rights are reserved.

CyberCube Analytics, Inc., 58 Maiden Lane, 3

rd

Floor, San Francisco, 94108

Copyright © 2023 CyberCube Analytics, Inc. All rights reserved

Questions?

Email rebeccab@cybcube.com

58