The 2019 New Jersey Elder Index Page 2

THE ELDER INDEX ™

The Elder Index

TM

(formerly, the Elder Economic Security Standard Index) is a tool for use

by policy makers, older adults, family caregivers, service providers, aging advocates and the

public at large. Developed by the Gerontology Institute at the University of Massachusetts

Boston and Wider Opportunities for Women (WOW), the Elder Index is a geographically

specific measure of income that older adults require to maintain their independence in the

community and meet their daily costs of living, including affordable and appropriate housing

and health care. Previous statewide reports for New Jersey were produced with the support

of the New Jersey Foundation for Aging and the State of New Jersey.

The information developed through the Elder Index helps us understand that many older

adults who are not poor, as defined by the official poverty level, still do not have enough

income to meet their basic needs. The Elder Index helps answer the following questions:

How much income—or combination of personal income and public programs—is needed by

older adults living on fixed incomes to cover today’s rising living costs? What is the impact

of public programs, such as Medicare, Medicaid, or housing assistance, on an older person’s

evolving ability to meet his or her shelter and health needs? How does the need for long-

term services and supports affect economic security?

Members of the Gerontology Institute primarily responsible for this report are Jan Mutchler

and Yang Li. We acknowledge the contributions of Laura Russell in developing the core

methodology used in the Elder Index, Ellen Bruce for her leadership and insights on

economic security, and Judith Conahan for her work developing the long-term care cost

component of the Elder Index. We also thank WOW and Gerontology Institute staff members

who participated in developing previous state-level reports on the Elder Index upon which

the current report is based, including Shawn McMahon, Alison Gottlieb, Jiyoung Lyu, Nidya

Velasco-Roldan, and Ping Xu. The authors are responsible for the contents of this report and

accept responsibility for any errors or omissions.

For more information about the Elder Index, see our website

(https://www.umb.edu/demographyofaging/elder_economic_security)

or contact us at CSDRA@umb.edu

The 2019 New Jersey Elder Index Page 3

Table of Contents

Executive Summary ............................................................................................................ 4

Introduction ......................................................................................................................... 7

The Statewide New Jersey Elder Index ............................................................................. 7

Calculating the Elder Index .............................................................................................. 14

The 2019 Elder Index for New Jersey .............................................................................. 18

Summary of Findings for Mercer County ............................................................................... 20

Summary of Findings for Essex County ................................................................................. 22

Summary of Findings for Ocean County ................................................................................. 24

The Impact of Home and Community-Based Long-Term Services and Supports ...... 25

The Changing Cost of Getting by in New Jersey ........................................................... 30

Conclusion ........................................................................................................................ 32

References......................................................................................................................... 33

Appendix B: Elder Index for New Jersey Counties and Selected Areas ...................... 35

The 2019 New Jersey Elder Index Page 4

The 2019 New Jersey Elder Index

TM

Executive Summary

Many New Jersey residents age 65 and older struggle to make ends meet. Living costs are

high, especially for housing and health care. In the face of rising expenses, many older people

receive at most a modest cost of living adjustment each year; thus, they are spending down

retirement savings or face growing debt. At the same time, older people strain to be prepared

for the present but face a challenging future if their life circumstances change due to illness,

loss of a spouse or partner, or growing needs for help with daily tasks.

The 2019 Elder Index for New Jersey was tabulated using a national methodology developed

by the University of Massachusetts Boston Gerontology Institute (GI) in collaboration with

Wider Opportunities for Women (WOW) and a national advisory board. The Elder Index

measures the living expense costs for older adults in today’s economy and helps us answer

key questions: What is an adequate income for older adults in New Jersey to “age in place”?

How do financial needs vary according to life circumstances—whether people live alone or

with a spouse or partner, rent or own their home? How do living expenses change as health

status and life circumstances change? What happens if an older person needs long-term care

to remain at home? In answering these questions, the Elder Index presented in this report

may be used to increase public awareness and inform public policies and programs meant

to support older adults as they age in their communities.

A Framework for Measuring Economic Security for Older People

The Elder Index is a measure of the cost of basic expenses of older households—those

exclusively including members age 65 or older—to age in place, continuing to live in the

community setting of their choice. The Elder Index defines economic security as the financial

status where an older person has sufficient income from Social Security, pension, retirement

savings, and other sources to cover basic and necessary living expenses. The Elder Index

estimates what it costs older people to meet their expenses without public support, such as

food assistance, energy assistance, subsidized housing, or property tax assistance, and it

illustrates how living expenses change when life circumstances change. The Elder Index also

can be used to demonstrate the interplay between New Jersey residents’ living expenses and

actual income.

This report presents the 2019 Elder Index for New Jersey to benchmark basic living expense

costs for older households. It illustrates how expenses vary both by specific New Jersey

geographic areas and by the circumstances of households, including household size,

homeowner or renter status, health status, and the need for long-term care. The expenses

are based on market costs and do not assume any public or private needs-based supports.

The 2019 New Jersey Elder Index Page 5

Key Findings for New Jersey

1. Older New Jersey residents cannot meet their basic living expenses whether they

live at the Federal Poverty Level or the level of the average Social Security benefit.

This is true of older people statewide, whether they rent or own a home.

Eight percent of New Jersey’s older adults live at or below the federal poverty

level.

Expenses vary widely across types of communities. For example, older

homeowners with no mortgage who live alone in Ocean County need $23,256 per

year to cover basic living expenses. In contrast, older homeowners with a

mortgage who live alone in Bergen County need as much as $47,184 to cover basic

expenses. The statewide average for single older adults is $28,056 for an owner

with no mortgage, $29,616 for a single renter, and $41,292 for an owner with a

mortgage.

Older couples who own a home with no mortgage and live in Ocean County need

$33,612 per year to cover basic living expenses. In contrast, couples who own a

home with a mortgage living in Bergen County need as much as $57,288 to cover

basic expenses. The statewide average for an older couple is $38,568 for owners

with no mortgage, $40,128 for couples who rent, and $51,804 for owners with a

mortgage.

2. Housing costs (mortgage or rent, taxes, utilities and insurance) put a heavy burden

on many older households, especially among renters and those with a mortgage.

The Elder Index reflects a wide variation in housing costs depending on whether

older adults own or rent, and by county. Older homeowners without a mortgage

typically have the lowest housing costs, while homeowners still paying a mortgage

typically have the highest housing costs.

The monthly housing costs for older homeowners without a mortgage range from

a low of $739 per month in Cumberland County to a high of $1,357 per month in

Essex County.

The monthly housing costs for older adults paying fair market rent for a one-

bedroom apartment range from a low of $936 per month in Cumberland County

to a high of $1,425 per month in Bergen and Passaic Counties.

The monthly housing costs for older homeowners with a mortgage range from a

low of $1,463 per month in Cumberland County to a high of $2,659 per month in

Bergen County.

The 2019 New Jersey Elder Index Page 6

3. The Elder Index shows the significance of health care costs for older New Jersey

residents, who must purchase supplemental health and prescription drug coverage in

addition to Medicare.

The Elder Index includes premium costs of supplemental health and prescription

drug coverage to Medicare, which provide critical protection against high medical

and prescription drug costs.

Older adults in New Jersey who are in good health face combined health care costs

(insurance premiums plus co-pays, deductibles, fees, and other out-of-pocket

expenses) of $396 per month to have protection against high medical and

prescription drug costs.

Retired couples are unable to purchase supplemental health insurance through a

“family plan”; rather, they must each buy coverage as an individual. Thus,

combined health care costs are doubled for older couples, totaling $792 per

month.

4. Even older people who are currently making ends meet face an uncertain future if

their life circumstances change, such as loss of a spouse/partner or a decline in health

status.

An older person paying market rate rent in New Jersey has expenses reduced by

only 26% when a spouse dies, yet his or her income mix of Social Security and/or

pension income may decrease substantially.

Older adults often face a rise in health care expenses when their health declines.

Although adding supplemental health and prescription drug coverage to Medicare

provides protection against unanticipated health care expenses, average out-of-

pocket expenses rise from $396/month for an individual in good health to

$602/month for an individual in poor health.

5. The need for home and community-based long-term care can more than double an

older person’s expenses, significantly increasing the income needed to meet basic needs.

The need for home and community-based long-term services and supports adds

substantially to an older person’s expenses. Purchasing a low level of care for one

person adds $9,660 per year to living costs for an older adult in northern New

Jersey. Requiring a medium level of care adds $25,323 and needing a high level of

care adds $42,683-$52,823.

As a comparison, national market surveys report an average annual rate of

$127,750 for nursing facility care (semi-private room) in New Jersey.

The 2019 New Jersey Elder Index Page 7

Introduction

This report addresses income adequacy for New Jersey’s older adults using the national

Elder Index methodology. The Elder Index benchmarks basic costs of living and illustrates

how those costs vary geographically and based on the characteristics of older households,

including household size, housing tenure, and health status. The costs are based on market

costs for basic needs of older households and do not assume any public or private supports.

The Elder Index presented in this report may be used to increase public awareness and

inform public policies and programs. The Elder Index offers:

Information to illustrate the basic expenses that older adults face and how changes in

their life circumstances affect their financial security. Common changes include the

need for long-term care services, which dramatically increases living expenses, or the

death of a spouse or partner, which often greatly reduces income without

substantially decreasing living expenses.

A framework for analyzing the effects of public policy and policy proposals in such

areas as retirement security, health and long-term care, taxes, and housing.

An educational tool to inform older people about actual and projected living costs to

support their financial, employment, and life decisions.

According to the U.S. Census Bureau’s population estimates for 2018, 15.5% of New Jersey

residents were 65 years or older, and 13.4% were between the ages of 55-64, poised to

dramatically increase the number of older residents as the “baby boomers” age.

1

The

individual circumstances of New Jersey residents vary from the most fortunate, who are

healthy and economically secure, to the least fortunate, who are poor, ill, or living with

disability. Situations vary greatly in terms of family support, neighborhood networks, and

community and social connections. New Jersey older people also differ according to their

housing situation, health status, and need for long-term services and supports. Many of these

characteristics change over a person’s lifetime. The Elder Index shows how older people may

be prepared for the present, yet face a precarious future as living expenses rise markedly

because of situational changes.

The Statewide New Jersey Elder Index

1. For older people living alone and in good health, the statewide New Jersey Elder Index

for 2019 is $28,056 for homeowners without a mortgage, $29,616 for renters, and

$41,292 for homeowners with a mortgage (see Table 1). This represents the living

expense costs (housing, health care, transportation, food and miscellaneous) for

people age 65 and older in New Jersey. The Elder Index is much higher than other

commonly used income benchmarks.

The federal poverty guideline, which is a formula measuring income inadequacy

that is based solely on food costs, is $12,490 per year for an individual. This is

1

Source: 2018 Population Estimates of the U.S. Census Bureau. See

https://data.census.gov/cedsci/table?g=0400000US34&tid=ACSST5Y2018.S0101&y=2018&t=Populations%20and%20P

eople&vintage=2018&hidePreview=false&cid=S0101_C01_001E

The 2019 New Jersey Elder Index Page 8

only 45% of the statewide Elder Index for homeowners with no mortgage, 42% of

the statewide Elder Index for renters, and 30% of the statewide Elder Index for

homeowners who have a mortgage.

The average Social Security benefit in New Jersey is $19,402 per year for an

individual retired worker. This represents only 69% of the statewide Elder Index

for homeowners with no mortgage, 66% of the statewide Elder Index for renters,

and 47% of the statewide Elder Index for homeowners who have a mortgage.

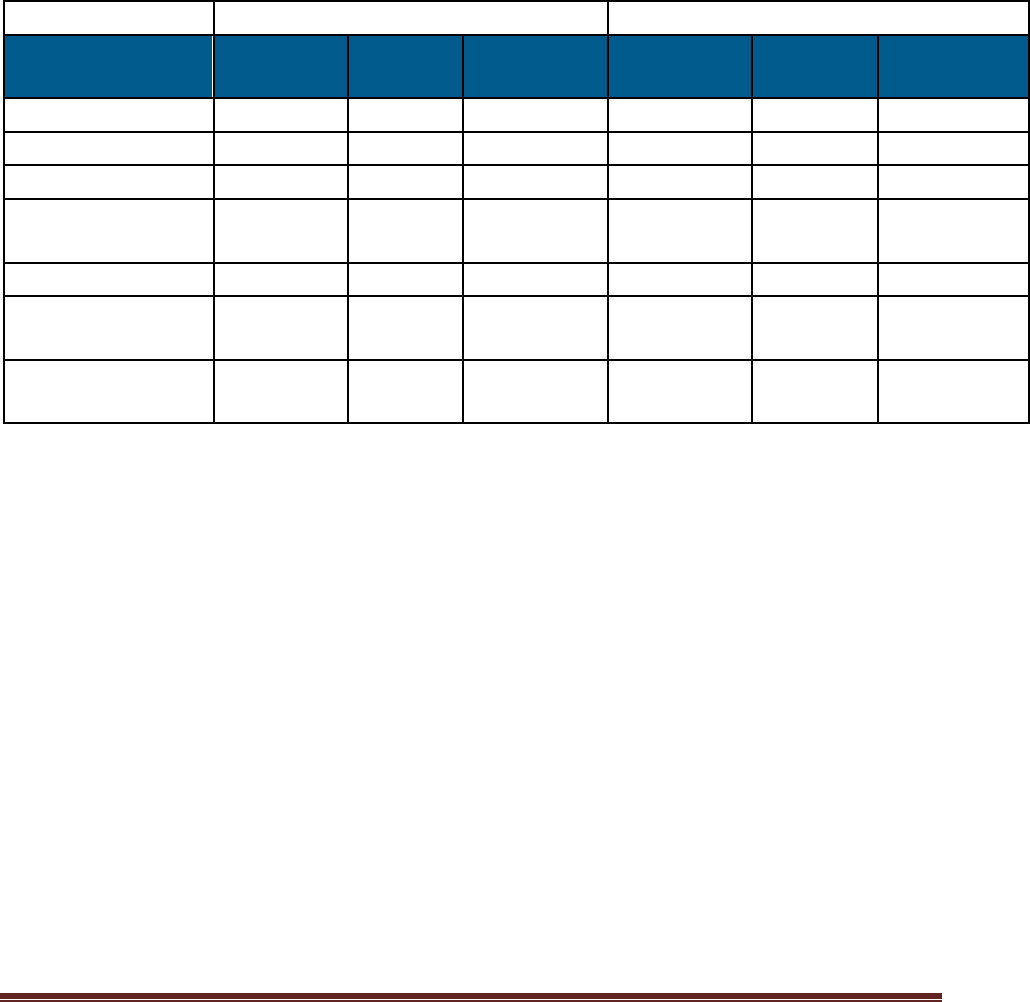

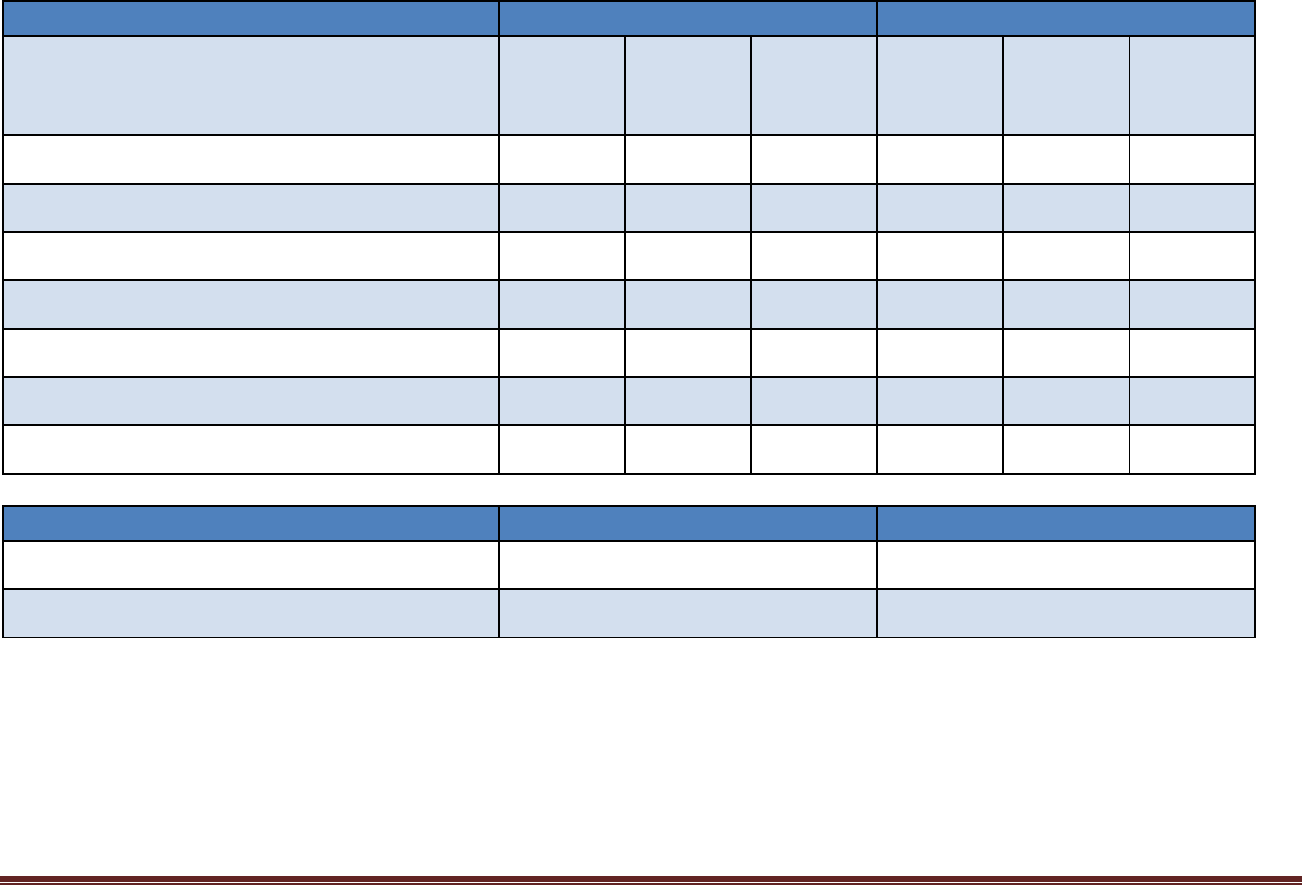

Table 1

The Statewide Elder Index for New Jersey, 2019

Older Person Living Alone

Two-person Older Household

Monthly Expenses

Owner, w/o

Mortgage

Renter

Owner, with

Mortgage

Owner, w/o

Mortgage

Renter

Owner, with

Mortgage

Housing

$1,071

$1,201

$2,174

$1,071

$1,201

$2,174

Food

$257

$257

$257

$471

$471

$471

Transportation

$224

$224

$224

$344

$344

$344

Health Care (Good

Health)

$396

$396

$396

$792

$792

$792

Miscellaneous

$390

$390

$390

$536

$536

$536

Total Monthly

(Index) Expenses

$2,338

$2,468

$3,441

$3,214

$3,344

$4,317

Total Annual

(Index) Expenses

$28,056

$29,616

$41,292

$38,568

$40,128

$51,804

2. For two people living together and in good health, the statewide New Jersey Elder

Index is $38,568 for homeowners without a mortgage, $40,128 for renters, and

$51,804 for homeowners with a mortgage. This represents the living expense costs

(housing, health care, transportation, food and miscellaneous) for households

including two people age 65 and older in New Jersey. The Elder Index is much higher

than other commonly used income benchmarks.

The federal poverty guideline is $16,910 per year for older two-person

households. This is only 44% of the statewide Elder Index for homeowners with

no mortgage, 42% of the statewide Elder Index for renters, and 33% of the

statewide Elder Index for homeowners who have a mortgage.

The average Social Security benefit for New Jersey couples is estimated to be

$32,509 per year. This represents only 84% of the Elder Index for homeowners

with no mortgage, 81% of the Elder Index for renters, and 63% of the statewide

Elder Index for homeowners who have a mortgage.

The 2019 New Jersey Elder Index Page 9

Comparison to Other Benchmarks of Income

One-Person Household

Federal Poverty Guidelines: As illustrated in Figure 1, the average after-tax income

required by an older person living alone in New Jersey is 2.2 to 3.3 times as high as the official

poverty guideline. In 2019, under the federal poverty guideline a single adult household is

“poor” only if he or she has a monthly income of $1,041 ($12,490 per year) or less. The

federal poverty guideline (not the federal poverty threshold) is used as the basis for most

income eligibility guidelines for public support programs.

Average Social Security Benefit: The average Social Security benefit for a retired worker

in New Jersey, at $1,617 per month ($19,402 per year), is higher than the poverty guideline,

but well below the Elder Index for owners without a mortgage, further below the Elder Index

for older adults paying market rate rents, and even further below (less than half) the Elder

Index for owners who have a mortgage. While Social Security was never intended to be the

sole source of income, in reality it is the only income source for a sizable share of older New

Jersey residents.

2

Figure 1

The Elder Index Compared to Other Benchmarks, 2019

Elder Index for One-Person Older Households in New Jersey

2

Source: AARP. (2014). Social Security: 2014 New Jersey Quick Facts. Retrieved from

http://www.aarp.org/content/dam/aarp/research/surveys_statistics/general/2014/ssqf/Social-Security-2014-New-

Jersey-Quick-Facts-AARP-res-gen.pdf

$12,490

$19,402

$28,056

$29,616

$41,292

Federal Poverty

Guideline

Avg. Social Security

Benefit for retired

worker, NJ

Estimated Statewide

Index (owner w/o

mortgage, good

health)

Estimated Statewide

Index (renter, good

health)

Estimated Statewide

Index (owner with

mortgage, good

health)

The 2019 New Jersey Elder Index Page 10

Two-Person Households

Federal Poverty Guidelines: As illustrated in Figure 2, the average after-tax income

required by a two-person older household in New Jersey is 2.3 to 3.1 times the official

poverty guideline. In 2019, under the federal poverty guideline a two-adult household is

poor if it has a monthly income of $1,409 ($16,910 per year).

Average Social Security Benefit: The estimated average Social Security benefit for an older

couple in New Jersey in 2019, at $2,709 per month ($32,509 per year), is below the Elder

Index for homeowner couples without a mortgage, further below the Elder Index for older

couples renting at market rates, and just 63% of the value of the Elder Index for owners who

have a mortgage.

Figure 2

The Elder Index Compared to Other Benchmarks, 2019

Elder Index for Two-Person Households in New Jersey

Income Patterns among New Jersey’s Households

Household income levels vary by age and life circumstance. Typically, median income levels

rise with age until mid-life and then decline with advancing age, as indicated in Figure 3. In

New Jersey, median household income for householders 65 years and older

3

, at $51,492 in

$16,910

$32,509

$38,568

$40,128

$51,804

Federal Poverty

Guideline

Avg. Social Security

Benefit for retired

couple, NJ

Estimated Statewide

Index (owner w/o

mortgage, good

health)

Estimated Statewide

Index (renter, good

health)

Estimated Statewide

Index (owner with

mortgage, good

health)

The 2019 New Jersey Elder Index Page 11

2018, was just over half the median household income of householders in their “peak

earning” years of 45-64, at $97,649.

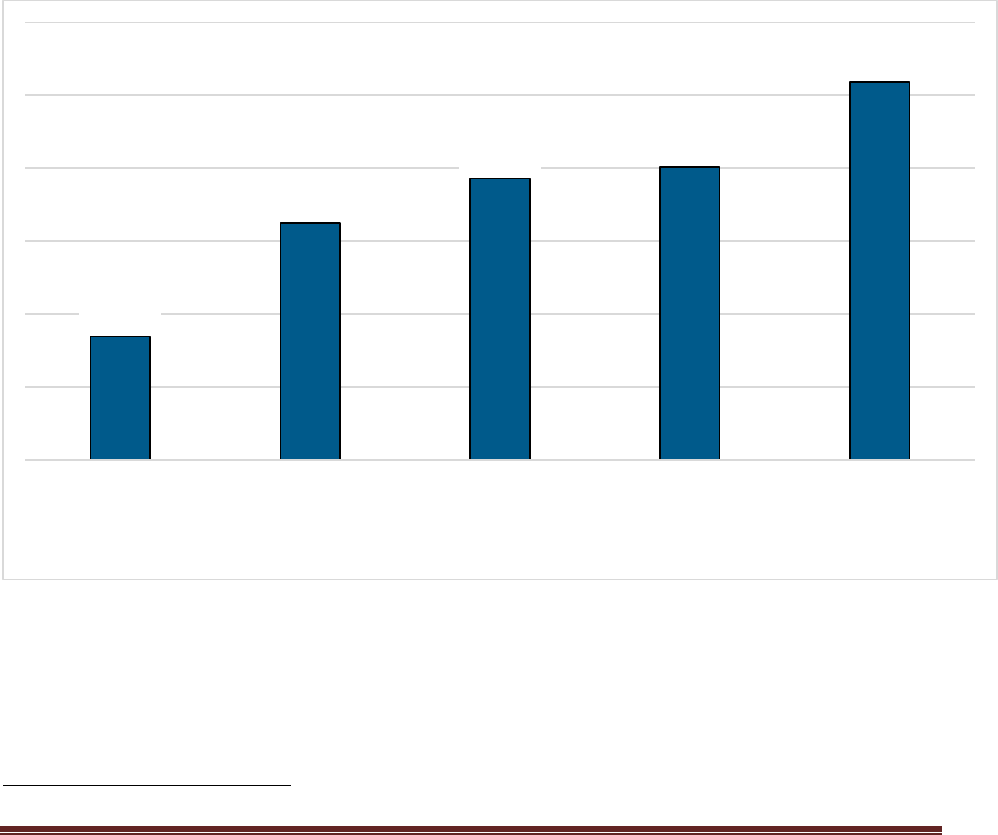

Figure 3

New Jersey Median Household Income

By Age of Householder, 2018

Source: U.S. Census Bureau, American Community Survey 2014-2018, Table B19049

According to the federal poverty threshold and the most current American Community

Survey data, an estimated 8% of older New Jersey residents were considered “poor” in 2018,

and a similar share was just above the poverty threshold. A full 15% were estimated to have

incomes at or below 150% of the poverty threshold.

4

Poverty rates for older women are

considerably higher than for older men, at 9% (women) versus 6% (men). Moreover, poor

older households are disproportionately headed by women. In 2018, 63% of older

households in New Jersey with incomes below the poverty level were headed by a widowed

or non-married woman.

5

Reasons for higher poverty rates among women include lower

wages, lower lifetime earnings, and less time in the workforce. Women also have longer life

expectancies but more chronic illness, and are more likely than men to experience loss of

income when widowed.

This report focuses on the challenges of meeting expenses for low- and moderate-income

older adults. Figure 4 shows that in 2018, 25% of New Jersey households headed by adults

aged 65 or older had incomes under $25,000; half had incomes under $50,000 (representing

the two lower income categories combined). In contrast, only 25% of households headed by

3

A “householder” is the person in whose name the home is owned or rented. Household income includes the income of

the householder plus all other individuals living in the same home.

4

Estimated from Tables B17001 and B17024, 2014-2018 American Community Survey 5-year estimates.

5

Estimated using table B17017, 2014-2018 American Community Survey 5-year estimates.

$37,186

$85,767

$97,649

$51,492

Householder under 25

years

Householder 25-44 years Householder 45-64 years Householder 65+ years

The 2019 New Jersey Elder Index Page 12

an individual age 45-64 had incomes below $50,000, highlighting substantial income

disparities between older and middle-aged households. Households headed by those 65 and

older have substantially lower income due in large part to less employment income; older

households also include fewer members on average.

Figure 4

New Jersey Household Income Distribution by Age, 2018

Source: U.S. Census Bureau, American Community Survey 2014-2018, Table B19037

The Federal Poverty Threshold

The poverty thresholds are drawn from the original version of the federal poverty measure.

6

The poverty thresholds were first calculated in the 1960’s by estimating the cost of food

needed to meet the minimum nutritional needs of people of different ages, and multiplying

this by three. This figure was then used as the reference point for the amount of income

needed to live at a basic level. This calculation was based on consumption surveys conducted

in the late 1950s showing that U.S. families spent about one-third of their incomes on food.

Since that time, the thresholds are updated each year by the change in the consumer price

index (CPI).

Despite this historical calculation’s reliance on an outdated connection to households’ food

costs alone, the poverty thresholds continue to be used as the basis to estimate the number

of Americans living in poverty each year. In addition, the U.S. Department of Agriculture

calculations assume that older adults have lower caloric requirements than younger adults.

6

The federal poverty thresholds were developed by Mollie Orshansky of the Social Security Administration in 1963-64

and are updated each year by the U.S. Census Bureau. For more information on the federal poverty measures, see

https://aspe.hhs.gov/history-poverty-thresholds

12%

25%

13%

24%

26%

27%

49%

24%

Householder age 45-64 Householder age 65+

Under $25,000 $25,000-$49,999 $50,000-$99,999 $100,000 or more

The 2019 New Jersey Elder Index Page 13

As a result, the official U.S. poverty thresholds are lower for adults 65 and older than for

younger adults. The federal poverty thresholds do not consider age variability in any other

costs – e.g., housing, health care, transportation or long-term care. Figure 5 compares the US

poverty thresholds by age for one- and two-person households. The poverty cutoff for older

people living alone is $1,039 per year less than the cutoff for younger adults, and the poverty

cutoff for older two-person households is $1,666 less than the cutoff for younger couples.

7

Figure 5

Comparison of U.S. Poverty Thresholds by Age, 2019

Source: U.S. Census Bureau, https://www.census.gov/data/tables/time-series/demo/income-

poverty/historical-poverty-thresholds.html

As indicated, the federal poverty measure’s methodology is based on outdated spending

patterns and assumes households spend a fixed ratio of one-third of their incomes on food.

In addition, it does not allow for different rates of inflation for different living expenses; for

example, health care and housing costs have risen much more than food costs. Finally, it does

not reflect regional variations in living costs.

8

Defining the Elder Index: A Framework for Economic Security in Later Life

In contrast to the poverty threshold, the Elder Index is a measure of the living expenses for

basic needs, for households to “age in place” in their homes or the community setting of their

choice.

7

The poverty guidelines are a second version of the federal poverty measure. Issued each year in the Federal Register by

the Department of Health and Human Services, they are a simplification of the poverty thresholds for administrative uses,

such as determining eligibility for certain federal programs. The federal poverty guidelines for 2019 are $12,490 for one-

person households and $16,910 for two-person households, and do not differ by age of householder. They are the same in

48 states and adjusted for living costs only in Alaska and Hawaii.

8

For discussion of the limitations of the federal poverty measures and information on the Supplemental Poverty Measure

developed in recent years by the U.S. Census Bureau, which addresses some of these shortcomings, see Short (2015).

$13,300

$17,120

$12,261

$15,453

1-Person Household 2-Person Household

Poverty Thresholds:<65

Poverty Thresholds:≥65

The 2019 New Jersey Elder Index Page 14

The cost components and methodology for the Elder Index were developed by researchers

at the University of Massachusetts in collaboration with Wider Opportunities for Women,

and with input and guidance from the Advisory Board for the national Elder Economic

Security Initiative. The Elder Index methodology is based on the characteristics and spending

patterns of older households, reflecting a realistic measure of income adequacy as opposed

to the original intent of the federal poverty measure, which was to illustrate income

inadequacy. Economic security requires that people have sufficient income (from Social

Security, pensions, retirement savings, and other income) to cover living costs. Using the

Elder Index we can illustrate the basic costs that older people face, and the interplay between

living costs and income adequacy. For more information about features of the Elder Index,

see Mutchler, Shih, Lyu, Bruce & Gottlieb (2015) and Center for Social and Demographic

Research on Aging (2017).

Calculating the Elder Index

The Elder Index uses data from public sources that are comparable, geographically specific,

easily accessible, and widely accepted. In areas where existing public data sources are not

currently available, the Elder Index uses a consistent methodology to derive comparable

measures for costs within and across states.

The following represent some of the assumptions that are built into the Elder Index’s

methodology. The Elder Index:

measures basic living expenses for older people living in the community (i.e., not in

nursing homes or assisted living facilities);

measures costs for households to live independently (vs. living in intergenerational

households);

measures living expenses for people ages 65 and older to reflect the age at which

Medicare begins;

includes Medicare because people qualify for and receive it based on age and without

regard to income and assets, making Medicare nearly a universal program;

9

and

models costs for retired people, who no longer have work-related expenses such as

payroll taxes and commuting to work.

The Elder Index is tabulated separately for people living alone in one-person households,

and for two-person households, including just two members, both of whom are age 65 or

older. A large majority, but not all, of two-person older households are married couples.

9

Eligibility for Medicare based on age requires that a person is age 65 or older and has accumulated a sufficient amount of

covered employment, or have a spouse who has accumulated sufficient employment credit (see

https://www.cms.gov/medicare/eligibility-and-enrollment/origmedicarepartabeligenrol/index.html). Some individuals,

such as recent immigrants, may not qualify for Social Security or Medicare.

The 2019 New Jersey Elder Index Page 15

The Big Picture: Spending among Older Households Compared to All Households

Figure 6 compares the spending between households headed by a person age 65 or older

and all households, based on data from the Consumer Expenditure Survey. For the Northeast

region as a whole, older households spend a similar percentage of their budgets on housing,

food, and transportation as do all households, but substantially more on health care. All

other expenditures account for 23% of household spending by the average older household,

less than the percentage for all households in the Northeast (30%).

Figure 6

Household Spending as a Percentage of Total Budget:

Older vs. All Households in Northeast, 2017-2018

Sources: U.S. Department of Labor, Bureau of Labor Statistics, Consumer Expenditure Survey 2017-2018, Tables 3104 and

3850.

Introduction to Cost Components of the Elder Index

The basic cost components developed for the Elder Index include the following:

10

Housing – includes housing (rent or mortgage payment, if any), and related costs (heat,

utilities, insurance, and property taxes) for older renters and owners, based on U.S. Census-

reported housing costs for homeowners age 65 and older, and U.S. Department of Housing

and Urban Development (HUD) Fair Market Rents. As illustrated in Figure 7, 46% of older

10

All Elder Index values presented here are in 2019 dollars.

38%

36%

13%

8%

14%

13%

12%

14%

23%

30%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

65+ All

Housing Health Food Transport Other

The 2019 New Jersey Elder Index Page 16

New Jersey households own their homes without a mortgage, 25% are renters, and 29% are

homeowners with a mortgage.

Figure 7

Owner and Renter Status of Householders Age 65 and Older in

New Jersey, 2014-2018

Source: U.S. Census Bureau, American Community Survey 2014-2018, Tables B25007 and B25027.

Food – represents costs of food prepared at home, based on USDA Low-Cost Food Plan for

older adults, using the average of low-cost food plan budgets for women and men.

11

Health Care – includes premium costs for comprehensive supplemental coverage to

Medicare. As embedded in the Elder Index national methodology, health care costs include

Medicare Part B and either Medicare Advantage, including prescription drug coverage, or

Medicare Supplemental Insurance (Medigap) plus Medicare Part D for prescription drug

coverage. Calculations also include out-of-pocket costs including co-pays, deductibles, and

fees for uncovered expenses, and are based on data from the Medicare Options Compare

website.

In calculating New Jersey health care costs, we assume coverage through Medicare

Advantage for all counties. This is consistent with the national methodology, which uses

Medicare Advantage costs for any county in which Medicare Advantage enrollment rates are

20% or more for Medicare recipients. Although in previous years many New Jersey counties

had enrollment rates lower than 20%, with the result being that Medigap purchase was

assumed, in 2019 all counties surpassed that 20% threshold. Because Medicare Advantage

costs are lower than costs assuming Medigap when a person is in good health, declines in the

11

Although food expenses likely vary somewhat across geographic localities in New Jersey, data to adequately reflect this

variability are not available.

24%

28%

48%

Renter

Owner with mortgage

Owner without mortgage

The 2019 New Jersey Elder Index Page 17

cost of health care are estimated for virtually every New Jersey county in 2019. The

implications of this important change are described elsewhere in the report. As in previous

years, health care costs are estimated for people in good, poor, and excellent health.

To simplify presentation, in this report the Elder Index is presented for people in good health,

which is the most common health status as self-reported by older people in the U.S. In New

Jersey, the statewide average monthly health care cost for older adults in good health is $396

(or $4,752 per year). The estimated out-of-pocket health care expenses for all three levels of

health are presented in Table 2.

Table 2

Estimated Out-of-Pocket Health Care Expenses, for Three Levels of Health (Statewide

average)

Per Person:

Excellent Health

Good Health

Poor Health

Cost Per Month

$293

$396

$602

Cost Per Year

$3,516

$4,752

$7,224

Source: Calculated by the authors based on data from the Medicare Options Compare Website.

Transportation – uses automobile owner and operating costs from Internal Revenue

Service (IRS) mileage reimbursement rates, and auto usage patterns estimated from the

most recent National Household Travel Survey (NHTS), which was conducted in 2017.

Miscellaneous – represents all other goods, such as clothing, personal and household needs,

and any additional expenses not captured elsewhere. Based on an analysis of the detailed

spending patterns from consumer spending data, the Elder Index estimates miscellaneous

expenses at 20% of all other costs (excluding long-term care) in each county for older owners

without a mortgage.

12

This amount is calculated separately for older individuals and older

couples, and applied to each of the three housing scenarios.

13

Living expenses in each of the above components are summed to determine budgets for each

of the respective household scenarios. This yields the Elder Index, the after-tax income

required to cover older people’s living expenses based on where they live and the

characteristics of their households.

Costs of home and community-based long-term services and supports, for those who require

them to remain in their home, are presented for three service packages along the continuum

of care. Because home and community-based long-term services and supports are not

needed by all people, these cost estimates are provided as an add-on component to the basic

Elder Index.

12

See U.S. BLS Consumer Expenditure Survey (http://www.bls.gov/cex/), and Social Security Administration,

Expenditures of the Aged Chartbook, 2015, for related data.

13

Note that 20% of all other costs equal 16.67% of total expenses. Miscellaneous expenses include all expenditures other

than those specified elsewhere in the Elder Index. Within household size category, miscellaneous expenses are estimated

based on the value of all other expenses for homeowners without a mortgage (the largest single segment of the older

householder population). This strategy is used because miscellaneous expenses are not likely to vary dramatically across

housing types. Note that the Elder Index budget does not include funds for savings, large purchases, or home repairs.

The 2019 New Jersey Elder Index Page 18

Local property taxes are included in the housing cost component for homeowners, and New

Jersey sales tax (6.625%) is included in the miscellaneous category.

14

A significant portion of Social Security income is exempt from federal income tax when

combined incomes are under certain limits. Income tax treatment and rates vary by source

of income; older people typically rely on a combination of Social Security, pension, and

savings. Because most of the Elder Index household basic budgets are near the no-tax

limits

15

, and because tax rates vary by income source, calculations do not include income

taxes in the basic model.

The 2019 Elder Index for New Jersey

The four components—housing, food, health care, and transportation, plus miscellaneous

expenses—are added together to calculate the Elder Index for New Jersey counties. These

costs vary according to household size (living alone or living with another adult age 65 or

older) and housing tenure (whether the person is renting a home, owns a home and is still

paying a mortgage, or owns a home outright). Information is also presented on the budget

impact of health status.

A Note on Geographic Areas

Data are tabulated for each of the 21 counties in New Jersey. The Elder Index is also

tabulated for Newark City, for Jersey City, for the Camden metropolitan area (which includes

Burlington, Camden and Gloucester counties), and for the Jersey Shore region (including

Atlantic, Cape May, Middlesex, Monmouth, and Ocean counties). Tables 3, 4, and 5 on the

following pages illustrate the Elder Index for selected household scenarios in three counties:

Mercer County, Essex County, and Ocean County.

The Elder Index values for all New Jersey counties plus the areas specified above are

presented in Appendix B.

14

State of New Jersey, Department of the Treasury (https://www.state.nj.us/treasury/taxation/pdf/pubs/sales/su4.pdf)

15

For a single person, Social Security benefits will not be taxable unless modified adjusted gross income, plus one-half of

Social Security benefits, exceeds $25,000. For a couple, the no-tax limit is $32,000. (https://www.irs.gov/newsroom/are-

social-security-benefits-taxable)

The 2019 New Jersey Elder Index Page 19

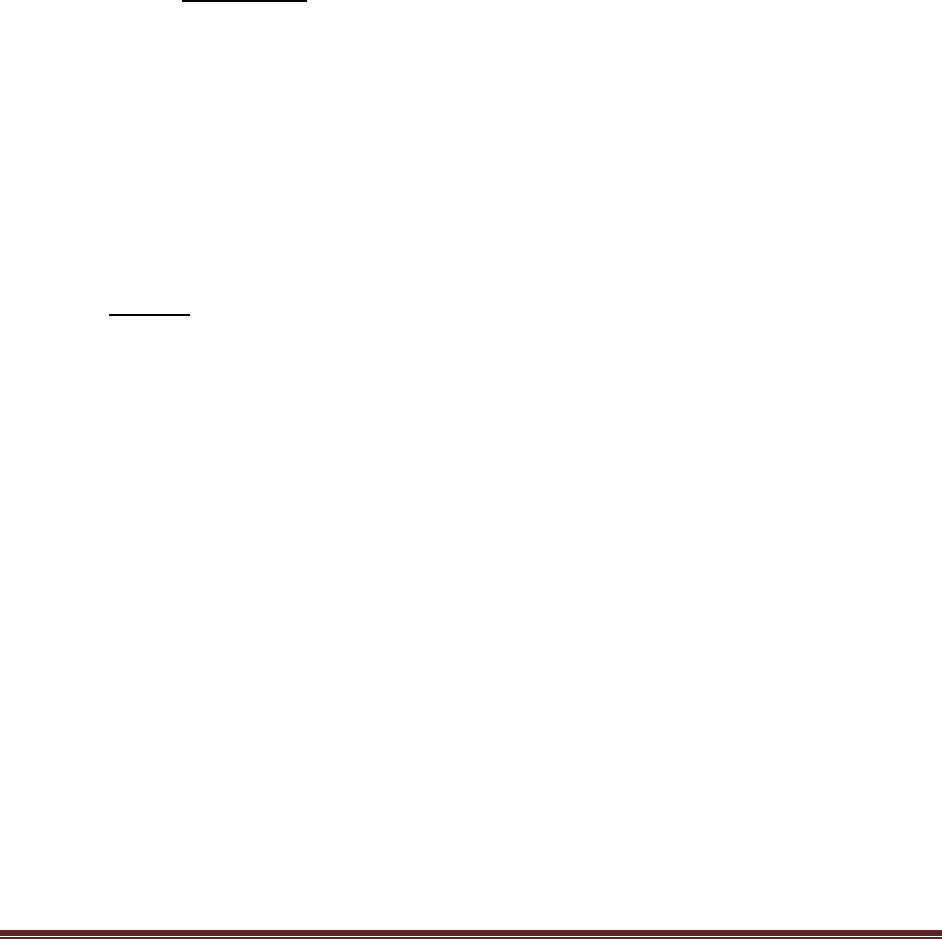

Table 3

The Elder Index for Mercer County, 2019

Expenses for Selected Household Types

Older Person Living Alone

Two-person Older Household

Monthly Expenses

Owner,

w/o

Mortgage

Renter

Owner,

with

Mortgage

Owner,

w/o

Mortgage

Renter

Owner,

with

Mortgage

Housing

$1,024

$1,082

$2,078

$1,024

$1,082

$2,078

Food

$257

$257

$257

$471

$471

$471

Transportation

$210

$210

$210

$323

$323

$323

Health Care (Good

Health)

$369

$369

$369

$738

$738

$738

Miscellaneous

$372

$372

$372

$511

$511

$511

Total Monthly

(Index) Expenses

$2,232

$2,290

$3,286

$3,067

$3,125

$4,121

Total Annual

(Index) Expenses

$26,784

$27,480

$39,432

$36,804

$37,500

$49,452

Comparative Income Benchmarks

Federal Poverty

Guideline (2019

DHHS)

$12,490

$12,490

$12,490

$16,910

$16,910

$16,910

Average Social

Security Benefit for

Mercer County,

2019

$19,937

$19,937

$19,937

$33,405

$33,405

$33,405

Federal Poverty

Guideline as a

Percent of Index

47%

45%

32%

46%

45%

34%

Average Social

Security Benefit as

a Percent of Index

74%

73%

51%

91%

89%

68%

Older people in Mercer County with incomes at the federal poverty level, or even if living on

the average Social Security benefit in 2019, cannot afford living expenses without public

or private supports for housing and health care.

Impact of Change in Health Status on Estimated Health Care Expenses

(change from estimated expenses for good health)

Per Person:

Poor Health

Increase of:

Excellent Health

Decrease of:

Change in Cost Per Month

$202

-$90

Change in Cost Per Year

$2,424

-$1,080

The 2019 New Jersey Elder Index Page 20

Summary of Findings for Mercer County

1. Older people in Mercer County at the poverty level or with the average Social Security

benefit cannot make ends meet.

The average Social Security benefit provides an older person living alone in Mercer

County 51%-74% of the amount needed to cover basic expenses.

In Mercer County, older people living alone on an income equivalent to the federal

poverty guideline can cover only 32%-47% of their basic living expenses.

The average Social Security benefit provides an older couple living in Mercer County

68%-91% of the amount needed to cover basic expenses.

In Mercer County, two older people living on an income equivalent to the federal

poverty guideline can cover only 34%-46% of their basic living expenses.

2. Older people living alone in Mercer County need $26,784-$39,432 to cover their basic

annual living costs.

Older people living alone in Mercer County who own their home without a mortgage

need $26,784 a year to cover their basic living expenses.

If older people rent an apartment in Mercer County, their basic living expenses

increase to $27,480.

Older people still paying a mortgage face housing costs more than double those for

homeowners without a mortgage, increasing annual living expenses to $39,432.

Older people with lower incomes need rent subsidies and/or affordable housing

units, as well as financial assistance to cover supplemental health plan costs.

3. Older couples in Mercer County need $36,804-$49,452 to cover their basic annual

living costs.

Older couples in Mercer County who own their home without a mortgage need

$36,804 a year to cover their basic living expenses.

If older couples rent an apartment in Mercer County, their basic living expenses

increase to $37,500.

Older couples still paying a mortgage face housing costs more than double those for

homeowners without a mortgage, increasing annual living expenses to $49,452.

Older couples with lower incomes need rent subsidies and/or affordable housing

units, as well as financial assistance to cover supplemental health plan costs.

4. Some older people who are currently making ends meet face a precarious future if

their life circumstances change, such as losing a spouse/partner or experiencing a

decline in health status.

A member of an older couple paying market rate rent in Mercer County has expenses

reduced by only 27% when a spouse or partner dies, from $37,500 to $27,480, yet his

or her income may decrease substantially based on the mix of Social Security and/or

pension income.

Older people in good health in Mercer County face health care costs of $369 per

month – more than they spend on food. A decline in health status results in a $202

monthly increase in health care costs, adding $2,424 annually to expenses.

The 2019 New Jersey Elder Index Page 21

Table 4

The Elder Index for Essex County, 2019

Expenses for Selected Household Types

Older People Living Alone

Two-person Older Household

Monthly

Expenses

Owner,

w/o

Mortgage

Renter

Owner,

with

Mortgage

Owner,

w/o

Mortgage

Renter

Owner, with

Mortgage

Housing

$1,357

$1,188

$2,434

$1,357

$1,188

$2,434

Food

$257

$257

$257

$471

$471

$471

Transportation

$223

$223

$223

$342

$342

$342

Health Care (Good

Health)

$360

$360

$360

$720

$720

$720

Miscellaneous

$439

$439

$439

$578

$578

$578

Total Monthly

(Index) Expenses

$2,636

$2,467

$3,713

$3,468

$3,299

$4,545

Total Annual

(Index) Expenses

$31,632

$29,604

$44,556

$41,616

$39,588

$54,540

Comparative Income Benchmarks

Federal Poverty

Guideline (2019

DHHS)

$12,490

$12,490

$12,490

$16,910

$16,910

$16,910

Average Social

Security Benefit

for Essex County,

2019

$18,670

$18,670

$18,670

$31,283

$31,283

$31,283

Federal Poverty

Guideline as a

Percent of Index

39%

42%

28%

41%

43%

31%

Average Social

Security Benefit

as a Percent of

Index

59%

63%

42%

75%

79%

57%

Older people in Essex County, with incomes at the federal poverty level, or even if living on

the average Social Security benefit in 2019, cannot afford basic living expenses without

public or private supports for housing and health care.

Impact of Change in Health Status on Estimated Health Care

Expenses (change from estimated expenses for good health)

Per Person:

Poor Health

Increase of:

Excellent Health

Decrease of:

Change in Cost Per Month

$196

-$92

Change in Cost Per Year

$2,352

-$1,104

The 2019 New Jersey Elder Index Page 22

Summary of Findings for Essex County

1. Older people in Essex County at the poverty level or with the average Social Security

benefit cannot make ends meet.

The average Social Security benefit provides an older person living alone in Essex

County 42%-63% of the amount needed to cover basic expenses.

In Essex County, older people living alone on an income equivalent to the federal

poverty guideline can cover only 28%-42% of their basic living expenses.

The average Social Security benefit in Essex County provides an older couple 57%-

79% of the amount needed to cover basic expenses.

In Essex County, two older people living on an income equivalent to the federal

poverty guideline can cover only 31%-43% of their basic living expenses.

2. Older people living alone in Essex County need $29,604 -$44,556 to cover their basic

annual living costs.

Older people living alone in Essex County who own their home without a mortgage

need $31,632 a year to cover their basic living expenses.

If older people rent an apartment in Essex County, their basic living expenses are

slightly less, at $29,604.

Older people still paying a mortgage face housing costs 80% higher than those for

homeowners without a mortgage, increasing annual living expenses to $44,556.

Older people with lower incomes need rent subsidies and/or affordable housing

units, as well as financial assistance to cover supplemental health plan costs.

3. Older couples in Essex County need $41,616-$54,540 to cover their basic annual

living costs.

Older couples in Essex County who own their home without a mortgage need $41,616

a year to cover their basic living expenses.

If older couples rent an apartment in Essex County, their basic living expenses are

slightly less, at $39,588.

Older couples still paying a mortgage face housing costs 80% higher than those for

homeowners without a mortgage, increasing annual living expenses to $54,540.

Older couples with lower incomes need rent subsidies and/or affordable housing

units, as well as financial assistance to cover supplemental health plan costs.

4. Some older people who are currently making ends meet face a precarious future if

their life circumstances change, such as losing a spouse/partner or experiencing a

decline in health status.

A member of an older couple paying market rate rent in Essex County has expenses

reduced by only 25% when a spouse or partner dies, from $39,588 to $29,604, yet his

or her income may decrease substantially based on the mix of Social Security and/or

pension income.

Older people in Essex County face health care costs of $360 per month – more than

they spend on food. A decline in health status results in a $196 monthly increase in

health care costs, adding $2,352 annually to expenses.

The 2019 New Jersey Elder Index Page 23

Table 5

The Elder Index for Ocean County, 2019

Expenses for Selected Household Types

Older Person Living Alone

Two-person Older Household

Monthly

Expenses

Owner,

w/o

Mortgage

Renter

Owner,

with

Mortgage

Owner,

w/o

Mortgage

Renter

Owner,

with

Mortgage

Housing

$749

$1,137

$1,624

$749

$1,137

$1,624

Food

$257

$257

$257

$471

$471

$471

Transportation

$223

$223

$223

$342

$342

$342

Health Care (Good

Health)

$386

$386

$386

$772

$772

$772

Miscellaneous

$323

$323

$323

$467

$467

$467

Total Monthly

(Index) Expenses

$1,938

$2,326

$2,813

$2,801

$3,189

$3,676

Total Annual

(Index) Expenses

$23,256

$27,912

$33,756

$33,612

$38,268

$44,112

Comparative Income Benchmarks

Federal Poverty

Guideline (2019

DHHS)

$12,490

$12,490

$12,490

$16,910

$16,910

$16,910

Average Social

Security Benefit

for Ocean

County, 2019

$19,300

$19,300

$19,300

$32,339

$32,339

$32,339

Federal Poverty

Guideline as a

Percent of Index

54%

45%

37%

50%

44%

38%

Average Social

Security Benefit

as a Percent of

Index

83%

69%

57%

96%

85%

73%

Older people in Ocean County with incomes at the federal poverty level, or even if living on

the average Social Security benefit in 2019, cannot afford living expenses without public or

private supports for housing and health care.

Impact of Change in Health Status on Estimated Health Care

Expenses (change from estimated expenses for Good Health)

Per Person:

Poor Health

Increase of:

Excellent Health

Decrease of:

Change in Cost Per Month

$223

-$112

Change in Cost Per Year

$2,676

-$1,344

The 2019 New Jersey Elder Index Page 24

Summary of Findings for Ocean County

Older people in Ocean County at the poverty level or with the average Social Security

benefit cannot make ends meet.

The average Social Security benefit provides an older person living alone in Ocean

County 57%-83% of the amount needed to cover basic expenses.

In Ocean County, older people living alone on an income equivalent to the federal

poverty guideline can cover only 37%-54% of their basic living expenses.

The average Social Security benefit provides an older couple living in Ocean County

73%-96% of the amount needed to cover basic expenses.

In Ocean County, two older people living on an income equivalent to the federal

poverty guideline can cover only 38%-50% of their basic living expenses.

Older people living alone in Ocean County need $23,256-$33,756 to cover their basic

annual living costs.

Older people living alone in Ocean County who own their home without a mortgage

need $23,256 a year to cover their basic living expenses.

If older people rent an apartment in Ocean County, their basic living expenses

increase to $27,912.

Older people still paying a mortgage face housing costs more than double those for

homeowners without a mortgage, increasing annual living expenses to $33,756.

Older people with lower incomes need rent subsidies and/or affordable housing

units, as well as financial assistance to cover supplemental health plan costs.

Older couples in Ocean County need $33,612-$44,112 to cover their basic annual

living costs.

Older couples in Ocean County who own their home without a mortgage need $33,612

a year to cover their basic living expenses.

If older couples rent an apartment in Ocean County, their basic living expenses

increase to $38,268.

Older couples still paying a mortgage face housing costs more than double those for

homeowners without a mortgage, increasing annual living expenses to $44,112.

Older couples with lower incomes need rent subsidies and/or affordable housing

units, as well as financial assistance to cover supplemental health plan costs.

Some older people who are currently making ends meet face a precarious future if

their life circumstances change, such as losing a spouse/partner or experiencing a

decline in health status.

A member of an older couple paying market rate rent in Ocean County has expenses

reduced by only 27% when a spouse or partner dies, from $38,268 to $27,912, yet his

or her income may decrease substantially based on the mix of Social Security and/or

pension income.

Older people in Ocean County face health care costs of $386 per month – more than

they spend on food. A decline in health status results in a $223 monthly increase in

health care costs, adding $2,676 annually to expenses.

The 2019 New Jersey Elder Index Page 25

The Impact of Home and Community-Based Long-Term Services and

Supports

Home and community-based long-term services and supports occur along a continuum

ranging from a few hours of care per week to 24/7, year-round care. Not all people require

long-term support, and the Elder Index shows it as an add-on component to the basic Elder

Index. However, an estimated 70% of older people will need long-term services at some

point in their later years; 16% will incur as much as $100,000 in long-term care expenses

and 5% will incur at least $250,000 in expenses over their lifetime (Doty & Shipley, 2012).

Using national long-term care utilization data, the Elder Index constructed three packages of

home- and community-based long-term services: “low,” “medium,” and “high.” The selected

packages are representative of a possible continuum. The packages assume that the care is

formal, paid care, since the Elder Index measures the market costs of goods and services. The

high package has two variations, one with Adult Day Health Care (ADH) and one with all

services provided at home.

Measuring Costs of Home and Community-Based Long-Term Services and Supports

The services and supports packages modeled here include hourly in-home services

(homemakers/personal care aides and home health aides), care management, supplies, and

a personal emergency response system. At the high level of care, there is also an option in

which one-half of the care is provided through Adult Day Health Care. The long-term services

package options are illustrated in Table 6. For example, a “low” level of service use assumes

6 hours of care per week, all of which are in the form of homemaker services. A modest

amount of care management is assumed, and fees for a personal emergency response system

are also included. In contrast, a “high” in-home service package assumes 36 hours per week

of support, half of which are in the form of homemaker services and half in the form of home

health assistance. A higher level of care management is assumed, and funds for health care

supplies (e.g., incontinence supplies) are included as well as fees for a personal emergency

response system. Table 7 presents private pay rates for each element of the long-term

services package.

The 2019 New Jersey Elder Index Page 26

Table 6

New Jersey Elder Index

Home and Community-Based Long-Term Supports Package

Long-Term Services and Supports at 6, 16, and 36 Hours/Week

Level of Need for Long-Term

Care

Low

Medium

High with

Adult Day

Health

High without

Adult Day

Health

Hours Per Week

6 hours

16 hours

36 hours

36 hours

Total care hours per month

26

69

156

156

Distribution of Care Hours:

Homemaker

100%

100%

33%

50%

Home Health Aide

Not used

Not used

17%

50%

Adult Day Health (3 days/week)

Not used

Not used

50%

Not used

Case Management

Routine

More

Intensive

Intensive

Supplies

None

Yes

Yes

Yes

Personal emergency response

system

Yes

Yes

Yes

Yes

Table 7

New Jersey Elder Index

Long-Term Services and Supports Private Pay Rates, 2019

Northern

New

Jersey

1

Atlantic

County

Cape May

County

Mercer

County

Cumberland

County

New

Jersey

statewide

Homemaker/Personal care

(per hour)

$25

$25

$20

$25

$19

$25

Home Health Aide (per hour)

$25

$25

$21

$26

$22

$25

Adult Day Health (daily rate)

$85

$96

$93

$85

$77

$85

Case Management (per hour)

$125

$100

$100

$100

$100

$100

Supplies (per month)

$97

$97

$97

$97

$97

$97

Personal Emergency Response

System (per month)

$30

$30

$30

$30

$30

$30

Sources:

Homemaker, Home Health Aide, & Adult Day Health pay rates from Genworth Financial 2019 Cost of Care Survey

Care management rates based on web searches.

Supplies is incontinence supplies—4.5 briefs/day, online purchase at $51 for package of 72.

PERS is medical alert system—Philips Lifeline, priced online

1

The Northern New Jersey area includes the following counties: Bergen, Essex, Hudson, Hunterdon, Middlesex, Monmouth, Morris,

Ocean, Passaic, Somerset, Sussex, and Union. These values are also used for Newark City calculations.

The 2019 New Jersey Elder Index Page 27

The Impact of Home and Community-Based Long-Term Care Costs on the Elder Index

Table 8 illustrates the annual cost of home and community-based long-term services and

supports in New Jersey based on private pay rates. Each component in the service package

uses the rate per hour (as shown in Table 7) and number of hours (Table 6) to determine the

annual cost of obtaining supports to enable people to remain in their homes when they

require ongoing, long-term services and support. The cost of home and community-based

long-term services and supports can add substantially to the costs of all other items in the

Elder Index, creating a severe financial crisis. Long-term service needs can vary considerably

over time and tend to increase with age.

Table 8

Home and Community-Based Long-Term Services and Supports Costs

for the Elder Index, 2019

At Private Pay Rates in New Jersey

Level of Need for Long-

Term Care

Low

Medium

High with

Adult Day

Health*

High without

Adult Day

Health

Hours Per Week

6 hours

16 hours

36 hours

36 hours

Northern New Jersey

1

$9,660

$25,323

$42,683

$52,823

Atlantic County

$9,204

$24,307

$43,031

$50,987

Cape May County

$7,800

$20,563

$38,723

$43,677

Mercer County

$9,204

$24,307

$41,783

$52,391

Cumberland County

$7,488

$19,731

$35,855

$43,499

New Jersey (statewide)

$9,360

$24,723

$41,783

$51,923

* 3 days at 6 hours/day = 18 hours/week in Adult Day Health Program (= 1/2 total hours)

Source: Authors' calculations from applying private rates for NJ to the long-term care services package at three levels.

1

The Northern New Jersey area includes the following counties: Bergen, Essex, Hudson, Hunterdon, Middlesex, Monmouth,

Morris, Ocean, Passaic, Somerset, Sussex, and Union. These values are also used for Newark City calculations.

The need for long-term services and supports markedly raises costs, multiplying the Elder

Index. In the 12-county Northern New Jersey area, the “low” home and community-based

long-term services package adds $9,660 per year to living expenses. The “medium” home

and community-based long-term services package adds $25,323 per year. The “high” home

and community-based long-term services package with Adult Day Health Care adds $42,683

per year to living expenses, and the high home and community-based long-term services

package with all in-home care adds $52,823 per year to living expenses. Typically, estimated

costs of home and community-based long-term services and supports are slightly lower

outside the Northern New Jersey area.

To illustrate the overall impact of purchasing home and community-based long-term

services and supports, Table 9 outlines the financial implications at different levels of need

The 2019 New Jersey Elder Index Page 28

and for selected household scenarios in Mercer County. Figure 8 illustrates the impact of

adding these costs for an older renter in Mercer County. The impact of long-term care costs

on estimated living costs in each county is included in Appendix B. Note that the Elder Index

values in Table 9 and Figure 8 have been adjusted to reflect an older person in poor health,

given that only individuals with poor health are likely to need long-term care.

Overview of Impact of Home and Community-Based Long-Term Care Findings for

Mercer County

The need for home and community-based long-term care can more than double a person’s

expenses, substantially increasing the income required to meet basic needs:

For the Mercer County household scenarios described in this report, the Elder

Index ranges from $29,208 to $51,876 (without purchasing home and

community-based long-term services, but assuming poor health for the older

person or for one member of the older couple).

Adding home and community-based long-term supports adds substantially to

living expense costs - $9,204 for “low” levels of care, $24,307 “medium” levels of

care, and $41,783-$52,391 for “high” levels of care.

Surveys suggest that people prefer home and community-based long-term

supports over nursing facility care, which is considerably more expensive.

National market surveys report an average annual cost of $127,750 for nursing

facility care (semi-private room) in New Jersey.

16

When older people become frail and are in poor health, they may need community-based

long-term services to remain at home. Using the example of an older renter living alone in

Mercer County, Figure 8 illustrates the dramatic increase in annual expenses experienced

when low (6 hours/week), medium (16 hours/week), or high (36 hours/week) levels of

home and community-based long-term services are required. For example, compared to the

older renter in poor health who purchases no long-term services (with estimated annual

living expenses of $29,904), annual expenses are more than two and a half times higher if

high levels of home-based care are required ($82,295).

16

https://www.genworth.com/about-us/industry-expertise/cost-of-care.html

The 2019 New Jersey Elder Index Page 29

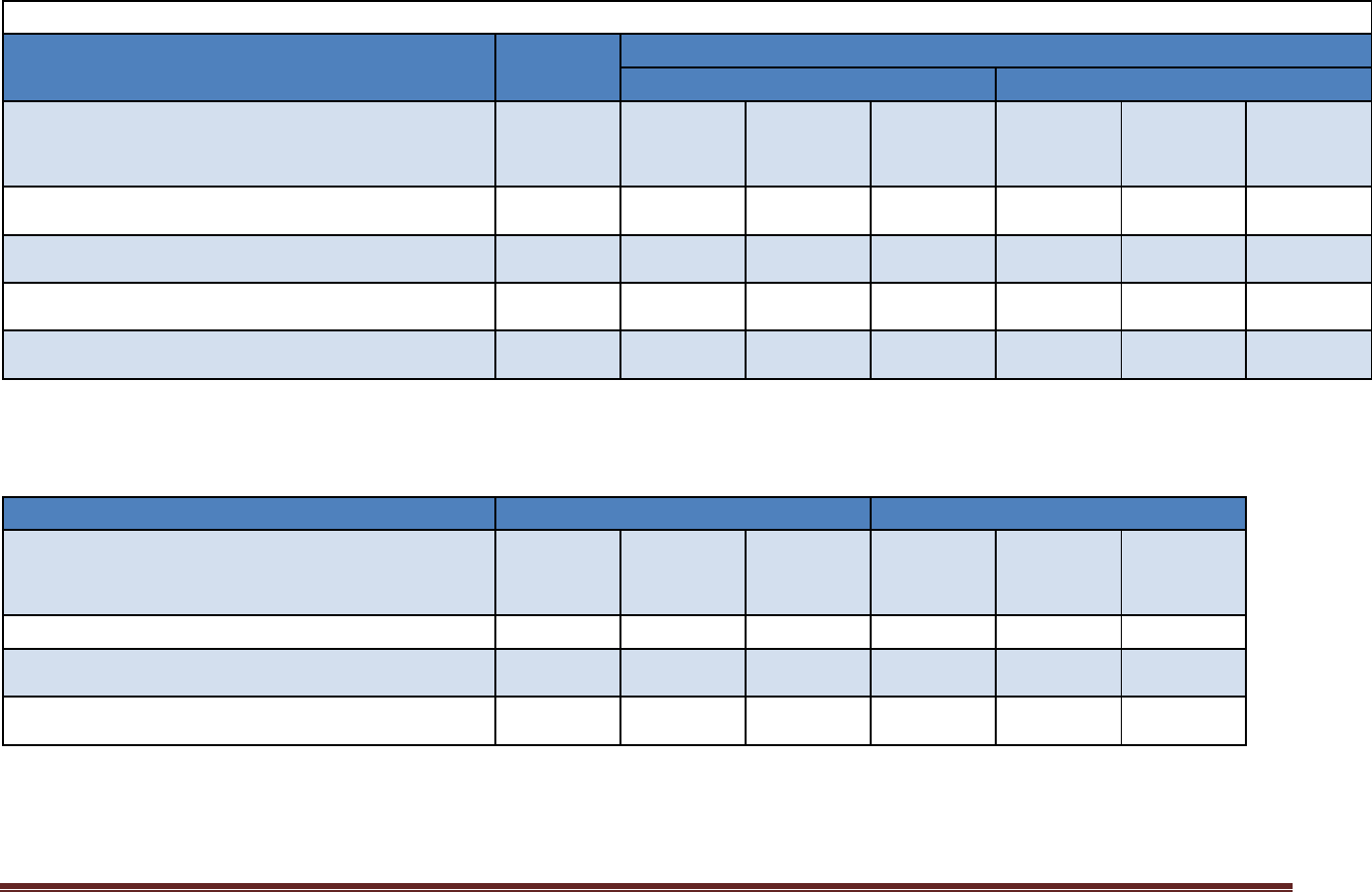

Table 9

The Elder Index for Mercer County, 2019

Addition of Home and Community-Based Long-Term Services and

Supports Costs*

Older Person Living Alone

Two-Person Older Household

Expenses

Owner

w/o

Mortgage

Renter

Owner

with

Mortgage

Owner

w/o

Mortgage

Renter

Owner

with

Mortgage

Index Per Year

(assuming poor health)

$29,208

$29,904

$41,856

$39,228

$39,924

$51,876

Add Impact of Changes in Long-Term Care status:

Low Long-Term Need: 6 hours per

week

Cost Per Year

$9,204

$9,204

$9,204

$9,204

$9,204

$9,204

Index Per Year

$38,412

$39,108

$51,060

$48,432

$49,128

$61,080

Medium Long-Term Need:

16 hours per week

Cost Per Year

$24,307

$24,307

$24,307

$24,307

$24,307

$24,307

Index Per Year

$53,515

$54,211

$66,163

$63,535

$64,231

$76,183

High Long-Term Need with Adult Day

Health: 36 hours per week

Cost Per Year

$41,783

$41,783

$41,783

$41,783

$41,783

$41,783

Index Per Year

$70,991

$71,687

$83,639

$81,011

$81,707

$93,659

High Long-Term Need all in-home

Support: 36 hours per week

Cost Per Year

$52,391

$52,391

$52,391

$52,391

$52,391

$52,391

Index Per Year

$81,599

$82,295

$94,247

$91,619

$92,315

$104,267

*Older people needing home and community-based long-term services and supports are presumed to be in

poor health. LTSS costs are added to the Elder Index for an older person in poor health, and to an older

couple, one in poor and one in good health.

The 2019 New Jersey Elder Index Page 30

Figure 8

Adding Home and Community-Based Long-Term Services and Supports Costs

to the Elder Index for Mercer County, 2019

Example of a Single Renter

The Changing Cost of Getting by in New Jersey

Table 10 presents a comparison between the Elder Index values generated for 2016 and

those generated for 2019. For older New Jersey residents, the cost of getting by, as reflected

by the Elder Index values, were relatively stable over this time period. Using statewide

average values, the Elder Index increased slightly during this time period for older singles,

and decreased slightly for older couples. This finding reflects a mix of increasing and

declining costs, primarily in housing, health care, and transportation, as well as patterns of

change across counties within New Jersey.

Housing continues to be the most sizable expense for older households in most scenarios,

although for couples the expense of health care exceeds that of housing (for example, see

Ocean County, where the cost of health care for two people in good health <$772> exceeds

the cost of owning a home without a mortgage <$749>). For every county, the cost of

$29,904 $29,904 $29,904 $29,904

$9,204

$24,307

$52,391

$0

$10,000

$20,000

$30,000

$40,000

$50,000

$60,000

$70,000

$80,000

$90,000

No LTC With Low LTC (6 HPW) With Medium LTC (16

HPW)

With High LTC (36

HPW)

Elder Index (single renter poor health) Long-Term Care Costs

The 2019 New Jersey Elder Index Page 31

homeownership among those with no mortgage increased between 2016 and 2019, largely

reflecting changes in home values and property taxes. Housing costs associated with renting

increased in all except for two counties. In comparison, the estimated housing costs for

owners with a mortgage declined slightly in several counties. On balance, therefore, trends

in housing costs served to push Elder Index values up over this time period.

Transportation costs increased for both singles and couples, and for nearly every county in

New Jersey. The increase in cost resulted from updated mileage estimates based on a new

survey of transportation patterns (the 2017 National Household Transportation Survey), as

well as per-mile costs that were higher in 2019 than in 2016 (based on IRS reimbursement

rates). On balance, trends in transportation costs also served to push Elder Index values up

over this time period.

As noted above, significant changes in health care expenses were estimated for New Jersey

in 2019. In calculating health care expenses, the Elder Index national methodology assumes

coverage by a Medicare Advantage plan for counties in which at least 20% of Medicare

enrollees have purchased such a plan; for counties falling short of that threshold, the cost is

estimated assuming Medigap coverage. Between 2016 and 2019, take-up of Medicare

Advantage plans increased and currently, every county in New Jersey surpasses the 20%

enrollment threshold. As a result, health care expenses for the 2019 Elder Index are

calculated assuming Medicare Advantage coverage in every county, whereas in the 2016

Elder Index calculations Medicare Advantage coverage was assumed in only two counties.

Because Medicare Advantage costs are typically lower than costs assuming Medigap when a

person is in good health, declines in the cost of health care are estimated for virtually every

New Jersey county in 2019. In some counties, declines were substantial enough to offset

rising housing costs, resulting in a decline in the value of the Elder Index between 2016 and

2019.

17

As shown in the lower panel of Table 10, if the Elder Index calculations had been

based on Medigap coverage in every county, we would have estimated increasing Elder Index

values for New Jersey, ranging from 6%-7% for owners with a mortgage to 9%-10% for

renters.

17

It is recognized that individual subscribers may prefer a Medigap over a Medicare Advantage plan due to health

conditions, access to specific providers, or other reasons. In addition, note that estimated costs assuming Medigap

coverage compares more favorably to Medicare Advantage in New Jersey when poor health is assumed.

The 2019 New Jersey Elder Index Page 32

Table 10

Elder Index Comparison for New Jersey: 2016 vs. 2019*

Older Person Living Alone

Two-person Older Household

Owner

without

mortgage

Renter,

one

bedroom

Owner

with

mortgage

Owner

without

mortgage

Renter,

one

bedroom

Owner

with

mortgage

2019 Elder Index values assuming Medicare Advantage Coverage

2016

$27,696

$29,016

$41,016

$38,952

$40,272

$52,272

2019

$28,056

$29,616

$41,292

$38,568

$40,128

$51,804

Change 2016 to

2019

1.3%

2.1%

0.7%

-1.0%

-0.4%

-0.9%

2019 Elder Index values assuming Medigap Coverage

2019 (assuming

Medigap)

$30,084

$31,644

$43,320

$42,624

$44,184

$55,860

Change 2016 to

2019 (with

Medigap)

8.6%

9.1%

5.6%

9.4%

9.7%

6.9%

*All calculations assume good health. Figures assuming Medigap coverage are for comparison only.

Conclusion

The Elder Index, with its modeled scenarios for older adults living in different circumstances,

shows the difficulties low- and moderate-income older people confront in meeting their

living expenses. In every county in the state, older people who live at the federal poverty

level, or who are totally dependent on the average Social Security payment in 2019, need

housing and health care supports to make ends meet. Expenses for long-term services and

supports, for those who need them to stay at home, add substantially to an older person’s

budget.

The Elder Index is a tool to help guide public, private, and personal decisions that can directly

shape the well-being of today’s and tomorrow’s older adults. Additionally, it provides

information for decisions that aging Baby Boomers will need to make for themselves and for

the older family members for whom they often care. The information contained in the Elder

Index may be used to develop and advocate for strategies that promote economic security to

meet the goals of independence, choice and dignity for older adults.

The 2019 New Jersey Elder Index Page 33

References

Center for Social and Demographic Research on Aging, University of Massachusetts Boston

and Gerontology Institute, University of Massachusetts Boston, "The National Elder

Economic Security Standard™ Index: Methodology Overview" (2017). Center for

Social and Demographic Research on Aging Publications, 16. Available online:

https://scholarworks.umb.edu/demographyofaging/16

Doty, P & Shipley, S (2012). Long-term care insurance research brief. Office of the Assistant

Secretary for Planning and Evaluation, U.S. Department of Health and Human

Services. Available online: https://aspe.hhs.gov/pdf-report/long-term-care-

insurance-research-brief

Genworth Financial (2019). Available online:

https://www.genworth.com/about-us/industry-expertise/cost-of-care.html

Mutchler, J., Shih, Y-C., Lyu, J., Bruce, E., & Gottlieb, A. (2015). The Elder Economic Security

Standard Index: A new indicator for evaluating economic security in later life. Social

Indicators Research, 120, 97-116. DOI: 10.1007/s11205-014-0577-y

Short, Kathleen (2015). The Supplemental Poverty Measure: 2014. Current Population

Reports, P60-254. Washington DC: U.S. Census Bureau. Available online:

https://www.census.gov/content/dam/Census/library/publications/2015/demo/

p60-254.pdf

Social Security Administration (2018). Expenditures of the Aged Chartbook, 2015. Available

online:

https://www.ssa.gov/policy/docs/chartbooks/expenditures_aged/index.html

The 2019 New Jersey Elder Index Page 34