Western Spaces, LLC Pagosa Springs Market Study 2022

TOWN OF CRESTED BUTTE MARKET ANALYSIS

OCTOBER 2022

PREPARED BY WESTERN SPACES FOR THE TOWN OF CRESTED BUTTE

Western Spaces, LLC Crested Butte Market Study October 2022

1

Table of Contents

Key Findings ................................................................................................................................... 3

Introduction ................................................................................................................................... 9

Methodology and Sources ............................................................................................................ 9

Area Covered ............................................................................................................................... 10

Gunnison County ..................................................................................................................... 11

North and South Valley ........................................................................................................... 12

Market Area Demographics .................................................................................................... 12

Economic Conditions ................................................................................................................... 13

Unemployment ........................................................................................................................ 13

Current and Projected Jobs..................................................................................................... 15

Jobs by Sector........................................................................................................................... 16

Commuting............................................................................................................................... 17

Employer Perceptions ............................................................................................................. 18

Deed Restricted Inventory .......................................................................................................... 19

Renter Market Size ...................................................................................................................... 21

Current and Projected Renter Households ........................................................................... 21

Renter Households by AMI ..................................................................................................... 22

Maximum Affordable Rents .................................................................................................... 23

HH Sizes and Incomes ............................................................................................................. 23

Renter Market Conditions ........................................................................................................... 24

Vacancy Rates .......................................................................................................................... 24

Market Rents ............................................................................................................................ 24

Rental Trends ........................................................................................................................... 25

Ownership Market Size ............................................................................................................... 26

Current and Projected Owner Households ........................................................................... 26

Owner Households by AMI ..................................................................................................... 27

Maximum Affordable Purchase Price .................................................................................... 27

Household Sizes and Incomes ................................................................................................ 28

Ownership Market Conditions ................................................................................................... 28

County Wide Sales Trends ...................................................................................................... 28

Transactions and Dollar Volume ............................................................................................ 29

Western Spaces, LLC Crested Butte Market Study October 2022

2

Affordability of Sales ............................................................................................................... 31

Occupancy ................................................................................................................................ 31

Availability of Market Housing ................................................................................................ 33

Sale of Deed Restricted Units ................................................................................................. 34

Residency Trends ..................................................................................................................... 35

Demand Estimates ...................................................................................................................... 36

Rental Estimate ........................................................................................................................ 37

Ownership Estimate ................................................................................................................ 38

Design and Development ........................................................................................................... 38

Number of Bedrooms ............................................................................................................. 39

Tradeoffs .................................................................................................................................. 39

Amenities.................................................................................................................................. 40

Lease Terms ............................................................................................................................. 40

Down Payment Availability ..................................................................................................... 41

Western Spaces, LLC Crested Butte Market Study October 2022

3

Key Findings

The purpose of this study is to determine demand for new ownership and rental housing in

the North Valley. The North Valley includes the Town’s of Crested Butte and Mt. Crested

Butte, as well as unincorporated areas north of, but not including, Almont.

Demand is calculated using estimates of existing households in the North Valley by income,

number of people in the household, and whether they own or rent. Additional data on

economic and demographic characteristics, trends in the rental and ownership market, as

well as housing preferences, help paint a picture of who might live in new housing and

what that housing could look like.

There is expressed consensus between residents and employers in the North Valley that

the availability of housing represents a major problem. When the market fails to respond to

a community need, it creates an environment where public and private sector cooperative

efforts can step in to provide solutions. An optimally located housing supply supports

resident and workforce mobility, productivity, and contributes to a higher quality of life.

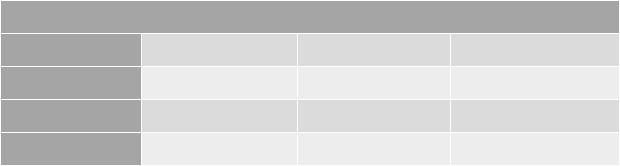

Income Distribution

Household incomes are typically expressed as a percentage of the Area Median Income

(AMI) to allow for applicability among various programs and across geographies. For the

purposes of this study, the market is defined as households between 60 and 180% AMI.

AMI

Income Range*

Renter HH

Owner HH

60% to 80%

$42,480 to $56,640

18%

18%

80.1% to 100%

$56,641 to $70,800

24%

22%

100.1% to 120%

$70,801 to $84,960

18%

16%

120.1% to 150%

$84,961 to $106,200

20%

31%

150.1% to 180%

$106,201 to $127,440

20%

13%

Total

-

503

658

Source: Ribbon Demographics, Western Spaces Calculations

*Income range varies by HH Size, ranges provided here are for a 2-person HH

Western Spaces, LLC Crested Butte Market Study October 2022

4

Population

The population and labor force in the North Valley is

aging, as is the trend in other Colorado mountain resort

communities. According to the American Community

Survey, the median age increased from 36 years in 2015

to 41 years in 2020. The largest increase occurred in

households between 50 and 54 years (5%). Most retiring

workers in the community will remain in their existing

housing, increasing the demand for housing to

accommodate new workers.

Unfilled Jobs

After a spike in unemployment in April 2020 (16%), labor shortages are once again a

challenge with unemployment down to 2.4% in May 2022. As reported by the QCEW, total

jobs in the County follow a similar pattern to unemployment with a net decrease in jobs

(over 2,000) occurring in March of 2020. At the end of 2021, total jobs were near pre-COVID

numbers.

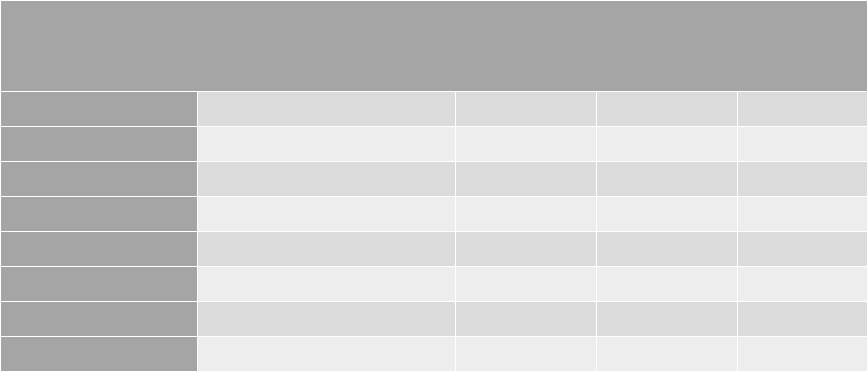

Gunnison County Jobs

Source: QCEW

Employers are both replacing employees lost between 2019 and 2020, as well as growing

and hiring for new positions. While low-wage and mid-wage jobs were the hardest hit by

COVID shutdowns, the ability of new hires to find housing is difficult for the entire

spectrum of income levels. Employers’ ability to recruit

and retain qualified employees has become harder, in

large part due to a lack of available housing. The North

Valley is seeing high demand for new talent, however,

the current housing supply is unable to accommodate

the influx.

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2019

8,748 8,784 8,765 8,095 7,992 9,060 9,389 9,330 8,907 8,447 8,072 8,976

2020

8,857 8,990 8,774 6,494 7,091 8,010 8,617 8,617 8,430 8,415 7,953 8,837

2021

8,752 8,834 8,861 8,533 8,349 9,202 9,389 9,245 8,762 8,767 8,336 9,111

6,000

6,500

7,000

7,500

8,000

8,500

9,000

9,500

Most retiring workers in

the community will remain

in their existing housing

increasing the demand for

housing to accommodate

new workers.

The ability of new hires to find

housing is difficult for the

entire spectrum of income

levels.

Western Spaces, LLC Crested Butte Market Study October 2022

5

Availability of Housing

Vacancy rates are below 1%, which is far below a

functional market vacancy level. Typically, vacancy

rates around 5% suggest some equilibrium in the

market, meaning there is sufficient supply to

provide renters with a choice of product. Vacancy

rates below this threshold indicate under-supply,

whereas rates above this level suggest over-supply

of housing.

The distribution of sales across the North Valley that are affordable to households making

between 80 and 180% AMI has been decreasing. As of early August, there were no market

rate units for sale in the North Valley at prices affordable to households making up to180%

AMI.

Rental Trends

Properties listed during a three-month inventory of rental listings revealed primarily large

homes that are fully furnished with high end finishes, or condos with amenities targeted to

second homeowners, and many do not allow pets – all contrary to what most locals want,

which is pet-friendly studio and one-bedroom units.

Interviews with multiple stakeholders, including property managers, real estate agents, and

other community members, indicate that rental rates and lack of availability have been

rising.

North Valley Average Market Rent

Studio

1BR

2BR

3BR

2016

-

$890

$1,175

$1,883

2020

$892

$1,104

$1,534

$2,100

2022

$1,150

$1,300

$2,295

$3,400

2022 Income Required

$46,000

$52,000

$91,800

$136,000

2022 AMI Required

74% AMI

73% AMI

115% AMI

154% AMI

Source: 2016 Housing Needs Assessment, Property Manager interviews, CHAFA

As of early August, rental vacancy

rates were below 1% and there

were no market rate units for sale

in the North Valley at prices

affordable to households making

180% AMI or less.

Western Spaces, LLC Crested Butte Market Study October 2022

6

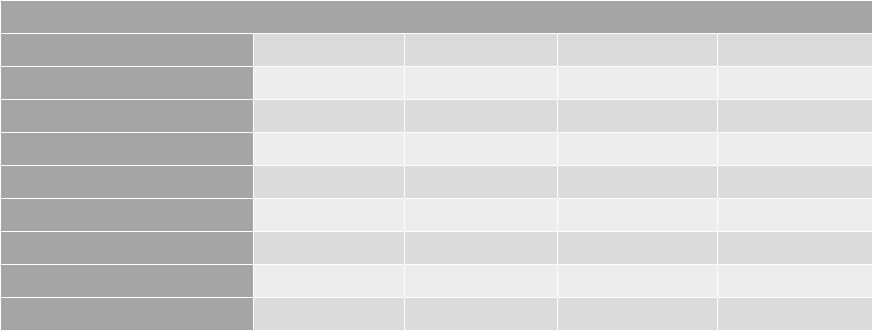

Ownership Trends

Overall dollar volume of residential sales

in the North Valley remained fairly

steady through 2019 and then jumped

quickly in 2020. This increase can partly

be attributed to COVID migrations

coming with the arrival of summer,

strong demand fueled by the ability to

work remotely, and the motivation to get

out of urban areas. County Wide, the

median sales price for residential units

rose steadily between 2019 and 2021,

with an increase of 15% from 2019 to

2020 and another 17% from 2020 to

2021.

However, data indicate that the COVID frenzy has slowed and data show an overall

decrease in transactions compared to last year. Countywide, the number of transactions

decreased by 39%. North Valley followed a similar trend, with 37% fewer transactions.

Changes in the Use of Existing Units

Data indicate that the proportion of units occupied by long-term rentals has remained

constant within the Town limits (34%). A long-term rental is typically categorized as a lease

of 30 days or more. The trend observed in the last two years indicating an influx of

“zoomers” does not preclude those rented for a month or more, that effectively have

resulted in a loss of units available to the local workforce.

Additionally, as reported in the Mountain Migration report, families were moving into their

second home residences as a result of COVID shutdowns. This transition does not

necessarily indicate a loss of second homes, as many maintained their primary residence

elsewhere. While the ratio of second homeownership has not changed, the use may have.

This trend can attribute to the general increase in busyness around the area and around

town.

North Valley Transactions and Dollar Volume

0

100

200

300

400

$0

$100,000,000

$200,000,000

$300,000,000

$400,000,000

$500,000,000

2018 2019 2020 2021

Dollar Volume Number of Transactions

The trend observed in the last two years indicating an influx of “zoomers” does not preclude

those rented for a month or more, that effectively have resulted in a loss of units available to

the local workforce.

Western Spaces, LLC Crested Butte Market Study October 2022

7

Design and Development

Decisions about the provision of rental and homeownership opportunities – number of

units, location, unit type, amenities, and pricing, will depend on policy and developer

decisions as to which segments of the potential market for each should be the focus.

Units for rent could include one, two, and three

bedrooms but the primary emphasis should be on one

and two-bedroom units. Owners are most often in need

of two and three-bedroom homes. Homes of 1,200 to

1,800 square feet were reported as the “sweet spot” by

property managers and realtors, consistent with modest

two- and three-bedroom homes.

For renters and owners in the North Valley market, choosing where to live inevitably

involves tradeoffs. While many are willing to make tradeoffs to live in their preferred

location, the lack of available housing choice has resulted in renters simply getting by with

anything that is available and for would-be homebuyers staying in the rental market.

Demand Estimates

The estimate of demand quantifies the size of the market and the capture rates for the

proposed units taking into consideration the number of households residing within the

market area by income and household size and in-migration of households from outside

the market area.

This demand calculation uses a conservative method, considering only existing households.

It is assumed that with growth, demographics and preferences will remain much the same.

In market analysis it is not necessary to consider households that might move in unless

major events, like a large tech company moving into a community, are planned.

For new rental units, there is potential demand for between 40 and 82 units generated by

households with incomes between 60 and 120% AMI. The less served renter population is

between 60 and 80% AMI which is above LIHTC and generally still below market rate.

The lack of available housing

choice has resulted in

renters simply getting by

with anything that is

available and for would-be

homebuyers staying in the

rental market.

Western Spaces, LLC Crested Butte Market Study October 2022

8

North Valley Capture Rates – For Rent

60 to 80%

80 to 100%

100 to 120%

Max Affordable Monthly Payment

2-person HH

$1,000 -

$1,300

$1,300 - $1,600

$1,600 - $2,000

Total Eligible Households

116

134

60

Capture Rate - Conservative

20%

10%

5%

Number of potential units at

conservative Capture Rate

23

13

3

Capture Rate - Mid

30%

15%

10%

Number of potential units at mid

Capture Rate

35

20

6

Capture Rate - Aggressive

40%

20%

15%

Number of potential units at

aggressive Capture Rate

46

27

9

For ownership units, there is total potential demand for between 50 and 81 units

generated by households with incomes between 100 and 180% AMI. The majority of

purchasers will be first-time homebuyers. For households in the North Valley, 100 to 120%

AMI is a transitional range where renter households become more capable to purchase.

North Valley Capture Rates – For Sale

100 to 120%

120 to 150%

150 to 180%

Max Affordable Purchase Price

2-person HH

$360,000

$440,000

$540,000

Total Eligible Households

38

102

109

Capture Rate - Conservative

10%

20%

15%

Number of potential units at

conservative Capture Rate

4

30

16

Capture Rate - Mid

15%

30%

20%

Number of potential units at mid

Capture Rate

6

31

22

Capture Rate - Aggressive

20%

40%

30%

Number of potential units at

aggressive Capture Rate

8

41

33

Max Purchase Price assumes 30-yr fixed, 5.875% interest, 30% of income towards payment

Western Spaces, LLC Crested Butte Market Study October 2022

9

Introduction

The Town of Crested Butte commissioned Western Spaces, LLC, to complete a market

study to inform the development of workforce housing. The goal of this study is to

determine the spectrum of demand for workforce housing in the North Valley and to help

design a development program for targeting portions of that demand.

This analysis is different than a Needs Assessment in that it represents the households

from which a proposed housing development will draw its residents. It is used to determine

if projects are feasible and to gauge risk.

After quantifying the total number of households that comprise the market of potential

project residents, this report segments the market by income, household type and size,

and housing and location preferences to inform decisions about unit type, bedroom mix,

pricing, and amenities.

The market area is defined as the North Valley, including the towns of Crested Butte and

Mount Crested Butte, as well as Crested Butte South and unincorporated subdivisions

south to, but not including, Almont.

Methodology and Sources

Western Spaces, LLC reviewed all relevant data, conducted personal interviews with local

apartment managers, government officials, local real estate professionals, and service

providers, and independently established the conclusions for this report. This preliminary

market analysis is intended to inform initial decisions on the design and pricing of potential

new units.

This study references the most up-to-date information available from:

• Colorado State Demographer;

• Colorado Department of Labor and Employment;

• U.S. Bureau of Labor Statistics;

• Gunnison County MLS ;

• Ribbon Demographics;

• Interviews of property managers, municipal and county planners, and

representatives of the Gunnison Valley Regional Housing Authority;

• For-rent listings in the Crested Butte News, Gunnison Country Times, Craigslist

and Zillow;

• 2016 Gunnison Valley Regional Needs Assessment by Rees Consulting, Inc., WSW

Consulting and Williford LLC;

• 2021 Gunnison Valley Housing Market Update by Williford LLC, Rees Consulting

and the Urban Rural Continuum;

Western Spaces, LLC Crested Butte Market Study October 2022

10

• 2021 North Gunnison Valley Rental Market by Williford LLC and Karen Bauer.

• Stakeholder interviews.

Area Covered

This report uses the same methodology for defining market areas as the 2021 Gunnison

Valley Housing Market Update. The North Valley is the primary market and the focus of this

report. For data collection purposes, the North Valley includes census tract 9638. South

Valley is the secondary market and includes census tracts 9636 and 9637.

Market Area

Source: ESRI, US Census

Western Spaces, LLC Crested Butte Market Study October 2022

11

Gunnison County

Gunnison County is the fifth-largest county by area in Colorado with 3,260 square miles.

According to the National Community Survey, residents rate the County as an excellent

(46%) or good (43%) place to live. This is an indicator of the overall health of the County.

Place to Live

2018 Gunnison National Community Survey (NCS)

Per the Colorado Department of Local Affairs State Demography Office, the 2020

population of Gunnison County is estimated to be 16,944. The largest age category is the

25 to 44 age group (28%).

Population by Age Group 2020 Gunnison County

Source: Data Visualization by the Colorado State Demography Office

The County is projected to grow to 18,149 by 2030, about 7%. During that time,

countywide, the largest growth is projected to occur in the 45 to 54 age group, while the 25

to 44 age group is projected to decrease.

Western Spaces, LLC Crested Butte Market Study October 2022

12

Projected Population Change by Age Group, 2020 to 2030 Gunnison County

Source: Data Visualization by the Colorado State Demography Office

North and South Valley

Overall, 34% of households in the County are located in the North Valley and a slightly

higher 36% of owner households are located in the North Valley. The distribution of owner

and renter households varies, with the South Valley having a higher ratio of renters (43%)

compared to the North Valley (37%).

Households by Tenure

South Valley

North Valley

#

%

#

%

Rent

2,088

43%

913

37%

Own

2,740

57%

1,533

63%

Total

4,828

100%

2,446

100%

Source: Ribbon Demographics

Market Area Demographics

As of 2020, Gunnison County had a population of around 17,000 persons residing in 12,131

households. Of these, 2,256 households or 32% of the total were within the North Valley

market area.

In the North Valley, the housing occupancy rate was only 52% in 2020, up slightly from 2010

which was estimated at 49% occupancy. As classified by the US Decennial Census, a

housing unit is vacant if no one is living in it at the time of the interview, unless its

occupants are only temporarily absent. In addition, a vacant unit may be one which is

entirely occupied by persons who have a usual residence elsewhere. These primarily

consist of those used for seasonal, recreational, or occasional use. The estimate also

includes vacant units listed for rent or sale at the time of the survey.

Western Spaces, LLC Crested Butte Market Study October 2022

13

The homes that are not occupied by members of the workforce typically create demand for

workforce housing through cleaning, repair, snow removal, landscaping, and similar jobs

involved in the operation and maintenance of the units.

2020 Population and Housing Occupancy

North

Valley

Gunnison

County

Population

5,116

16,918

Housing units

4,355

12,131

Households

2,256

7,135

Housing occupancy rate

52%

59%

Source: 2020 Decennial Census

The population and labor force in the North Valley is aging, as is the trend in other

Colorado mountain resort communities. According to the American Community Survey,

the median age increased from 36 years in 2015 to 41 years in 2020. The largest increase

occurred in households between 50 and 54 years (5%).

Economic Conditions

This section of the report covers jobs, wages and the distribution of jobs in Gunnison

County. It also quantifies impacts as a result of COVID-19 closures and reviews the

quarterly survey conducted by the Gunnison County Recovery Team and the One Valley

Leadership Council for employer perceptions on housing.

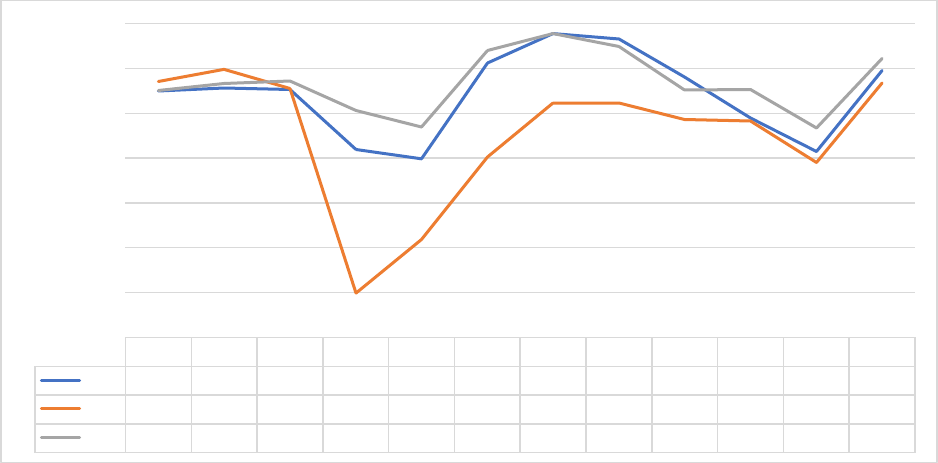

Unemployment

Unemployment is estimated differently depending on the source. The Bureau of Labor

Statistics, which is the source used for this report, classifies people as unemployed if they

do not have a job, have actively looked for work in the prior four weeks, and are currently

available for work. Workers expecting to be recalled from temporary layoff are counted as

unemployed whether or not they have engaged in a specific job seeking activity.

When the 2016 assessment was released, the County’s economy was growing quickly.

Unemployment was extremely low at 1.9% and jobs were projected to grow at a rate of 2%

per year on average through 2020.

As reported in the May 2021 Gunnison Valley Housing Market Update, County job growth

between 2016 and 2020 ended up being even higher than estimated in the 2016 Needs

assessment (2% per year) at 2.6% per year on average according to the Colorado

Demography Office. Valley employers struggled with labor shortages in 2019 into early

2020.

Western Spaces, LLC Crested Butte Market Study October 2022

14

Coming into 2020, unemployment remained low up until March 2020 (2.2%). By Mid-March

the ski area was shut down, visitors were asked to go home, second-home owners were

asked to stay at their primary residence (essentially closing County boarders) and COVID-19

was determined a global pandemic.

The unemployment rate across the State spiked in April. The spike in Gunnison County

reached 16.0%, higher than the State of Colorado at 12.2%, but took a rapid decline over

the next few months to 3.9% in October. As of May 2022, the unemployment was down to

2.4%, lower than the State overall at 3.5%.

Unemployment Rate Gunnison and State of Colorado Compared

Western Spaces, LLC Crested Butte Market Study October 2022

15

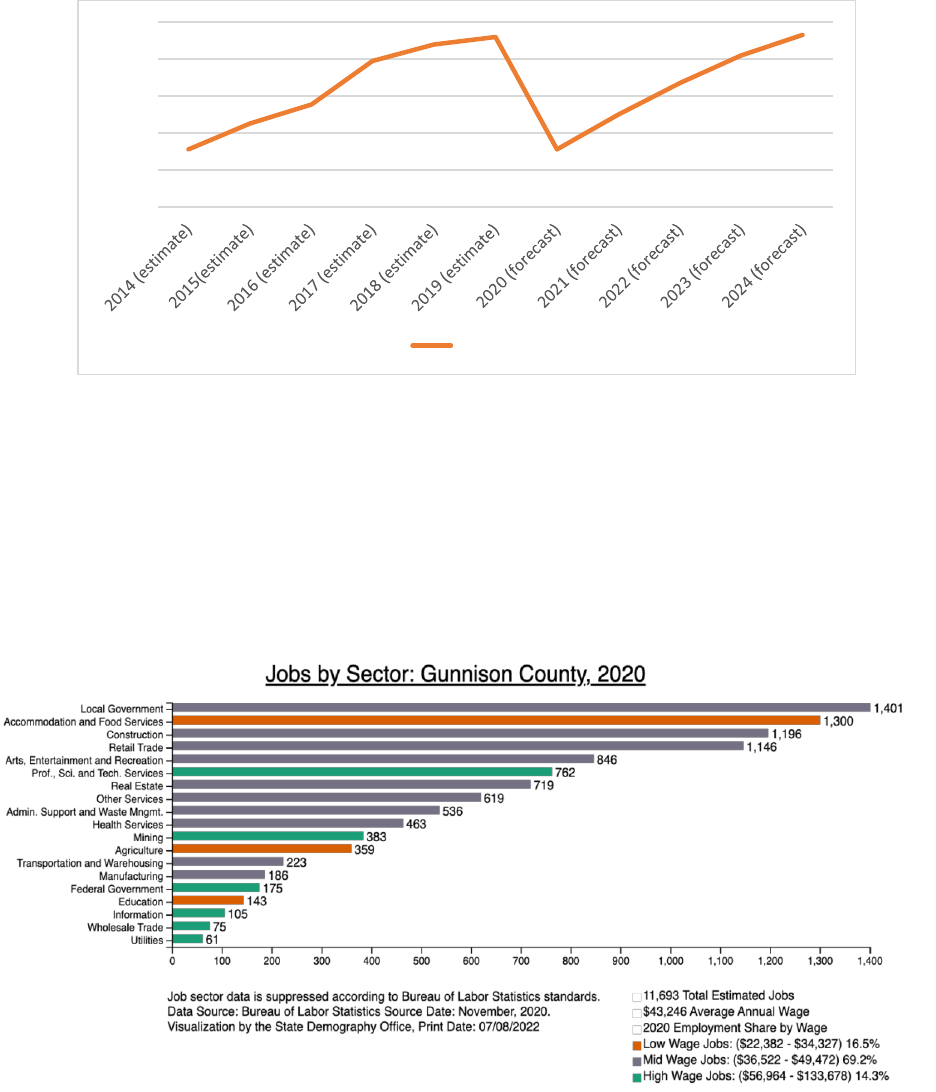

Current and Projected Jobs

The estimation of jobs, as with unemployment, varies by source. The Quarterly Census of

Employment and Wages (QCEW) is used in this report. QCEW monthly employment data

represent the number of covered workers who worked during, or received pay for, the pay

period that included the 12th day of the month.

As reported by the QCEW, total jobs in the County follow a similar pattern to

unemployment with a net decrease in jobs (over 2,000) occurring in March of 2020. At the

end of 2021, total jobs were near pre-COVID numbers. The seasonal fluctuation of jobs in

the County follows a typical mountain tourist economy with drops during the shoulder

seasons in the Spring (April and May) and Fall (September and October).

Gunnison County Jobs

Source: QCEW

*2021 number are noted as preliminary

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2019

8,748 8,784 8,765 8,095 7,992 9,060 9,389 9,330 8,907 8,447 8,072 8,976

2020

8,857 8,990 8,774 6,494 7,091 8,010 8,617 8,617 8,430 8,415 7,953 8,837

2021

8,752 8,834 8,861 8,533 8,349 9,202 9,389 9,245 8,762 8,767 8,336 9,111

6,000

6,500

7,000

7,500

8,000

8,500

9,000

9,500

Western Spaces, LLC Crested Butte Market Study October 2022

16

Recent Colorado Demography Office projections indicate strong annual job growth for the

next few years with a full recovery to pre-COVID total jobs around 2024.

Gunnison County Job Projections

Source: DOLA

Jobs by Sector

In Gunnison County, the largest sector is local government providing 1,401 jobs (12%). The

second largest sector is accommodation and food services providing 1,300 jobs in 2020

(11%). This group on average makes the lowest annual wage, between $22,382 and

$34,327. Construction, retail trade and arts, entertainment and recreation are the next

three largest sectors.

10,778

12,295

10,778

12,324

10,000

10,500

11,000

11,500

12,000

12,500

Total Jobs

Western Spaces, LLC Crested Butte Market Study October 2022

17

Taking a closer look at the effects of COVID on jobs in the County, data indicate that

between 2019 and 2020, an estimated 662 jobs were lost. The largest sector,

accommodation and food services, lost an estimated 296 jobs, followed by arts,

entertainment and recreation (151). These job categories are classified at low-wage

($22,382 - $34,327) and mid-wage ($36,522 - $49,472). The sectors that gained the most

jobs during this time period were transportation and warehousing and construction.

Change in Jobs by Sector 2019 to 2020

Sector

Change

2019 to

2020

Accommodation and Food Services

-296

Arts, Entertainment and Recreation

-151

Other Services

-82

Retail Trade

-48

Mining

-37

Prof., Sci. and Tech. Services

-17

Real Estate

-12

Wholesale Trade

-11

Information

-7

Local Government

-1

Manufacturing

0

Utilities

1

Agriculture

2

Health Services

2

Education

3

Federal Government

7

Admin. Support and Waste Mngmt.

15

Construction

23

Transportation and Warehousing

37

Source: QCEW

Commuting

The relationship between where households live and where they work in the region is

central to understanding current housing demand patterns and to planning for future

housing development.

Data and anecdotal evidence suggest that the ski and tourism industry in the North Valley

has contributed to local workers being priced out of the area. This is a trend seen in many

resort communities. To sustain a living, workers live further away, where housing is

available and more attainable.

Western Spaces, LLC Crested Butte Market Study October 2022

18

As noted in GVRHA Housing Market update, commuting up and down valley for work

dropped off sharply when businesses closed and/or employees worked from home, but as

employees returned to work on site, commuting returned.

Based on April 2021 responses to Gunnison County’s monthly business survey question

asking where employees live and where they work, 34% of employees that work in the

North Valley (Crested Butte, Mount Crested Butte, or Crested Butte South) commute in

from the South Valley. This finding is consistent with data from 2016. Comparing 2016 to

2020 employer survey data suggests that the dominant commuting pattern has not

changed – many South Valley residents still commute north for work.

In contrast, almost all (93%) employees that work in the South Valley (Gunnison, Almont

and the Unincorporated County) also live in the South Valley, a figure that is higher than in

2016 (82%). This indicates that workers in the South Valley are also increasingly living in the

South Valley.

A trend that was noted prior to COVID, but accelerated as a result, is the increasing number

of remote workers in many resort communities. This is a hard trend to measure, however,

Census data from the American Community Survey 5-year estimates indicate that the

percent of workers 16 years and over working from home in the North Valley almost

doubled between 2017 and 2020, going from 5% to 10%. This estimate does not represent

jobs in the North Valley, but employed persons living in the North Valley.

Employer Perceptions

The Gunnison County Recovery Team and

the One Valley Leadership Council conduct

regularly recurring surveys to ask

community members about their

experiences during COVID-19 and how the

regions’ economic situation is impacting

them. As noted, the participation rate has

declined in the last two quarters but still

provides valuable information regarding

perceptions on housing.

Responses in the last quarter of 2021 indicate that labor shortages are once again a

challenge, one that is likely to get worse. In the last quarter of 2021, 56% of business survey

respondents indicated that they have unfilled jobs. This is a 6% increase from April 2021.

Additionally, the percentage of employers who responded that it has gotten harder to

recruit and retain qualified employees has increased from 46% to 67%. Long-term

workforce challenges continue in the County and appear to be getting more severe.

Employer Comments:

“Create more affordable housing to be

able to support our workforce.”

“Actual affordable housing and a living

wage for this area.”

“Anything that can be done to provide

workforce housing for the people who are

already here!”

Western Spaces, LLC Crested Butte Market Study October 2022

19

Employers interviewed for this study noted difficulty for new hires across the board to find

housing. In particular, while the North Valley is seeing high demand for new talent, the

current housing supply is unable to accommodate the influx.

Deed Restricted Inventory

In the North Valley, the Town of Created Butte has been investing in affordable housing

options for over 30 years. The Town has enabled a wide variety of affordable housing

including rentals and home ownership units that are dispersed throughout. There are

currently 314 deed-restricted units within Town limits, including 16 employee housing units

owned by the Town of Crested Butte, 6 of which are dormitory style.

In addition to the 314 deed restricted units in the Town of Crested Butte, there are 95 units

spread between Mt. Crested Butte and the balance of the North Valley in unincorporated

Gunnison County.

Data recorded by the Gunnison County Assessor’s office for the North Valley were used to

assist in compiling this inventory. Assessor records were compared to the inventory kept by

the Town of Crested Butte, as well as the inventory kept by the Gunnison Valley Regional

Housing Authority. In the Assessor data, it was discovered that properties within the Town

of Crested Butte classified as residential in-commercial, dorm room, multi-family six-plex

and three-plex and four mobile homes were excluded. These have been added to

reconcile the tally.

North Valley Deed-Restricted Units

Units

Town of Crested Butte

314

Remainder of North Valley

95

Total

409

Source: Town of Crested Butte, Gunnison County Assessor, GVRHA,

2016 Needs Assessment, 2021 Needs Update

The largest category of deed restricted properties in the North Valley (40%) are two-

bedroom units. An additional 27% are one-bedroom units, followed by a similar 25% 3-

bedroom units. Very few, 8%, have four or more bedrooms.

Western Spaces, LLC Crested Butte Market Study October 2022

20

Bedroom Mix

Source: Gunnison County Assessor

Of the 409 deed workforce housing units in the North Valley, 150 are deed restricted or

used as rentals. The Gunnison Valley Regional Housing Authority (GVRHA) manages two

income-restricted workforce housing buildings in the North Valley: Anthracite Place and Elk

Creek Townhomes.

• Anthracite Place is a 30-unit LIHTC development consisting of one and two-bedroom

units. Construction was completed and it took about four months to fully lease up

(7.5 units/month.) The income restriction includes 13 units at 50% AMI and 17 units

at 60% AMI.

• Elk Creek Townhomes has eight units. Gunnison County owns seven and Gunnison

Hospital owns one.

Scattered throughout Town are 96 privately owned, deed-restricted accessory dwelling

units (ADUs) that are required to be rented via a long-term lease. Additionally, the Town of

Crested Butte owns ten units that are used as long-term rentals for Town employees as

well as a six-unit dorm-style property that provides housing for seasonal workers with

priority leasing given to Town employees.

Studio/One-

bedroom, 27%

2-bedroom,

40%

3-bedroom,

25%

4 or more

bedrooms, 8%

Western Spaces, LLC Crested Butte Market Study October 2022

21

Renter Market Size

Market size represents the market from which new development would draw its renters

and helps determine feasibility and risk. After quantifying the total number of renter

households that comprise the market, the market is segmented by income and household

size to inform decisions about unit size and pricing.

This section focuses on the North Valley and provides overall figures for Gunnison County

and the South Valley for insight into regional differences and similarities.

Current and Projected Renter Households

The potential market for rental housing in the North Gunnison Valley consists of

approximately 913 renter households who now reside in the market area year-round. They

represent the market from which apartment properties must draw residents. Design and

rent decisions should be based upon the characteristics and preferences of renters

currently living in the area since no significant in-migration from outside of Gunnison

County is anticipated.

Roommate households are the most common (40%), followed by those with only one

member living alone (32%). Families are in the minority (28%). About 18% of renter

households are families with children and 10% are families (both couples and singles)

without children.

2020 Renter Households by Type: North Valley

Source: 2020 ACS

Family, no

children,

10%

Family, with

children, 18%

Living alone,

32%

Roommates,

40%

Western Spaces, LLC Crested Butte Market Study October 2022

22

Renter households in the North Valley are projected to grow by 6% overall between 2022

and 2027, adding a total of 51 renter households. A similar growth rate is projected for the

South Valley (5%), adding around 118 rental households in the next five years. The largest

projected increase by household size is three- and four-person households (11% change

each). These estimates could be impacted by the construction of additional rental units in

the valley through projects not yet on the ground.

Projected Growth in North Valley Renter Households

1-person

2-person

3-person

4+ person

Total

2022

251

343

169

150

913

2027

258

353

187

166

964

# Change

7

10

18

16

51

% Change

3%

3%

11%

11%

6%

Source: Ribbon Demographics

Renter Households by AMI

Household incomes are typically expressed as a percentage of the Area Median Income

(AMI) to allow for applicability among various programs and across geographies. These

incomes are tied to household size and are published annually by the Department of

Housing and Urban Development (HUD).

For the purposes of this study, the market is defined as households between 60 and 180%

AMI. Applying AMI by household size to income estimates for households in the North

Valley, the largest category of households falls between 80 and 100% AMI (24%). The

maximum annual income for an average two-person household in this range is $70,800.

North Valley Renter Household Distribution 2022

AMI

Income Range

(avg. 2-person HH)

Renter

HH

Renter HH

60 to 180%

% Renter HH

60 to 180%

Under 60%

Under $42,480

328

-

-

60% to 80%

$42,480 to $56,640

93

93

18%

80% to 100%

$56,641 to $70,800

120

120

24%

100% to 120%

$70,801 to $84,960

89

89

18%

120% to 150%

$84,961 to $106,200

98

98

20%

150% to 180%

$106,201 to $127,440

103

103

20%

Over 180%

Over $127,440

82

-

-

Total

-

913

503

100%

Source: Ribbon Demographics, Western Spaces Calculations

Western Spaces, LLC Crested Butte Market Study October 2022

23

Maximum Affordable Rents

AMI’s are used to determine eligibility to rent most of the apartment complexes in the

County. Rents are calculated to be affordable at different AMI levels by the Colorado

Housing and Finance Authority (CHFA) and are often expressed by the AMI at which the

corresponding rental unit is income restricted, for example 80% AMI rents.

Maximum Affordable Rents by AMI and Bedrooms

Gunnison County 2022

AMI

Studio

1 bed

2 beds

3 beds

4 beds

60%

$930

$996

$1,195

$1,380

$1,540

80%

$1,240

$1,328

$1,594

$1,841

$2,054

100%

$1,550

$1,660

$1,992

$2,301

$2,567

120%

$1,860

$1,992

$2,391

$2,761

$3,081

150%

$2,325

$2,490

$2,988

$3,450

$3,849

180%

$2,790

$2,988

$3,586

$4,140

$4,619

Source: CHFA

HH Sizes and Incomes

The following table is provided to help inform potential unit mix, focusing on households

between 60 and 180% AMI. The majority of renter households in the North Valley include

one or two people.

North Valley Renter Households 2022

60% to 180% AMI

1-person

2-person

3-person

4+ people

Total

% of Total

60 to 80%

29

38

15

10

93

18%

80 to 100%

40

65

13

2

120

24%

100 to 120%

44

23

8

13

89

18%

120 to 150%

1

29

0

69

98

20%

150 to 180%

12

18

34

39

103

20%

Total

126

173

70

133

503

100%

% of Total

25%

34%

14%

26%

100%

Source: Ribbon Demographics, CHFA, Western Spaces Calculations

Western Spaces, LLC Crested Butte Market Study October 2022

24

Renter Market Conditions

This section provides an overview of the renter market. It includes an evaluation of current

conditions and past trends including occupancy, average rents, and renter preferences.

Vacancy Rates

Vacancy rates are below 1%, which is far below a functional market vacancy level. Typically,

vacancy rates around 5% suggest some equilibrium in the market, meaning there is

sufficient supply to provide renters with a choice of product. Vacancy rates below this

threshold indicate under-supply, whereas rates above this level suggest over-supply of

housing.

Focus groups and interviews with property managers and realtors support this data, noting

that in the rare instance when they have a vacancy, they can fill it within a week. Many

managers maintain a waist list, and one indicated that they do not bother because there

are always people looking for housing. Many properties report having historical occupancy

rates of 100%.

A three-month inventory of rental listings in the Crested Butte News Classifieds, Craigslist,

Zillow, property manager websites, and multiple Facebook groups resulted in just over 30

listings. Asking rents are captured below; however, because there are so few vacancies to

evaluate, the sample sizes are too small for meaningful analysis.

Market Rents

Rents and occupancy levels that drive rent adjustments tend to be more volatile in resort

communities than in more diversified urban areas. Rents are generally lowest in the South

Valley. Rents in the northern end of the valley have historically been the highest in the

region. Of the 31 units listed for rent in the North Valley over the summer, 40% are fully

furnished units.

For Rent Listings – Average Price by Bedroom Size

Bedrooms

June

July

August

0

-

-

$1,150

1

-

$1,267

$1,320

2

$2,238

$1,999

$2,650

3

$3,100

$3,500

$3,733

Source: Crested Butte News, Craigslist

Interviews with multiple stakeholders, including property managers, real estate agents, and

other community members, indicate that rental rates and scarcity have been increasing.

Concurrently, the quality of available rental housing has also declined. The rents below are

Western Spaces, LLC Crested Butte Market Study October 2022

25

based on property manager interviews and secondary data. They vary broadly and are

estimates.

North Valley Average Market Rent (excludes ADUs and Affordable Rentals)

Studio

1BR

2BR

3BR

2016

-

$890

$1,175

$1,883

2020

$892

$1,104

$1,534

$2,100

2022

$1,150

$1,300

$2,295

$3,400

Change

2022 Income Required

$46,000

$52,000

$91,800

$136,000

2022 AMI Required*

74% AMI

73% AMI

115% AMI

154% AMI

Source: 2016 Housing Needs Assessment, Property Manager interviews, CHAFA

*Adjusted for household size by bedroom(s)

Market rents have increased to levels where mortgage payments could be competitive,

depending upon how units are priced. To be affordable for households with incomes

ranging from 60% AMI to 180% AMI, monthly payments would need to range from about

$1,000 to $4,000, resulting in an overall average below $2,500 per month. Rents now

average about $2,300 for two-bedroom condos/townhomes and $3,400 or three

bedrooms.

Rental Trends

Properties listed during a three-month inventory of rental listings revealed primarily large

homes that are fully furnished with high end finishes, or condos with amenities targeted to

second homeowners, and many do not allow pets – all contrary to what most locals want,

which is pet-friendly studio and one-bedroom units.

Renters are seeking assurance that they will be able to renew their lease. North Valley

realtors and property managers report that in the last couple of years, renters are more

frequently forced to move when owners decide to sell or convert to short term rental use.

Managers of properties in the South Valley have seen some pressure from buyers coming

from the north end of the valley. Given the extreme for-sale prices in the North Valley, long

time owners are choosing to cash in and purchase in the South Valley where the prices are

more affordable. This trend results in some rental units being converted into ownership.

The decreased availability of rental units combined with rising rents will cause some

renters who want to live in the North Valley to consider buying, especially households that

have been residing in the area for some time. Employees moving into the area will be more

likely than longer term residents to live with multiple roommates, allowing them to share

the cost of higher rents with others and crowd into the available units.

Western Spaces, LLC Crested Butte Market Study October 2022

26

As senior employees retire, jurisdictions and quasi-governmental entities are struggling to

hire because of the limited rentals even in the higher rental ranges, so many positions go

unfilled. Landing pad rentals for these positions would go a long way in helping recruiting

efforts.

Ownership Market Size

This section focuses on the North Valley and provides overall figures for Gunnison County

and the South Valley to provide insight into regional differences and similarities.

Market size represents the market from which new development would draw homeowners

and helps determine feasibility and risk. After quantifying the total number of owner

households that comprise the market, the market is segmented by income and household

size to inform decisions about unit size and pricing.

Current and Projected Owner Households

Ribbon Demographics estimates there are about 1,533 owner occupied households in the

North Valley. These are households that are considered to be full-time residents.

Owner households in the North Valley are projected to grow by 6% overall between 2022

and 2027, adding a total of 86 households. This projected growth rate is consistent for both

owner and renter households; however, the majority of the growth in owner households is

projected to occur among those with one and two-people and the majority of growth in

rental households is projected to occur among those with three-four people.

Projected Growth in North Valley Owner Households

1-person

2-person

3-person

4+ person

Total

2022

482

615

225

211

1,533

2027

521

649

233

216

1,619

# Change

39

34

8

5

86

% Change

8%

6%

4%

2%

6%

Source: Ribbon Demographics

Western Spaces, LLC Crested Butte Market Study October 2022

27

Owner Households by AMI

Applying AMI by household size to income estimates for owner households in the North

Valley, the largest category falls between 120 and 150% AMI (31%). The maximum annual

income for an average two-person household making up to 150% AMI is $106,200.

North Valley Owner Household Distribution 2022

AMI

Income Range

(avg. 2-person HH)

All HH

HH in AMI

Range

% HH in

AMI

Range

Under 60%

Under $42,480

200

-

-

60% to 80%

$42,480 to $56,640

122

118

18%

80.1% to 100%

$56,641 to $70,800

142

142

22%

100.1% to 120%

$70,801 to $84,960

108

108

16%

120.1% to 150%

$84,961 to $106,200

205

205

31%

150.1% to 180%

$106,201 to $127,440

85

85

13%

Over 180%

Over $127,440

671

-

-

Total

-

1,533

658

100%

Source: Ribbon Demographics, Western Spaces Calculations

Maximum Affordable Purchase Price

The table below shows estimates for the maximum affordable purchase price by income

and household size. Housing is generally considered to be affordable when the monthly

mortgage or rent payment plus utilities does not exceed 30% of a household’s gross

income. Households paying more than 30% are considered to be cost burdened by their

housing payment, which makes it difficult from them to afford other necessities. While this

is a standardized measure, it should be noted that the cost of living, HOA dues, commuting,

availability of assets, and other factors also play into affordability.

Affordable purchase prices were calculated based on an interest rate of 5.875%, which is

about the prevailing rate for 30-year fixed rate mortgages. However, interest rates have

been rising and have a profound impact on housing affordability. Rates at the beginning of

the year were closer to 3.22%. This is a huge change for households looking to purchase a

home.

Western Spaces, LLC Crested Butte Market Study October 2022

28

Maximum Affordable Purchase Price by AMI and HH Size 2022

AMI

1-person

2-person

3-person

4-person

60 to 80%

$210,000

$240,000

$270,000

$300,000

80.1 to 100%

$270,000

$300,000

$330,000

$370,000

100.1 to 120%

$320,000

$360,000

$400,000

$440,000

120.1% to 150%

$400,000

$440,000

$500,000

$560,000

150.1% to 180%

$470,000

$540,000

$600,000

$660,000

Source: CHFA, mortgageloan.com (assume 30-yr fixed, 5.875% interest, 30% of income towards

payment)

Household Sizes and Incomes

The following table is provided to help inform potential unit mix, focusing on households

between 60 and 180% AMI.

North Valley Owner Households 2022

60% AMI to 180% AMI

1-

person

2-

person

3-

person

4+

people

Total

% of

Total

60 to 80%

48

34

28

12

122

18%

80 to 100%

34

67

21

20

142

22%

100 to 120%

20

64

11

13

108

16%

120 to 150%

52

84

36

33

205

31%

150 to 180%

6

42

12

24

85

13%

Total

159

291

109

103

661

100%

% of Total

24%

44%

16%

16%

100%

Source: Ribbon Demographics, CHFA, Western Spaces Calculations

Ownership Market Conditions

This section provides an overview of the ownership market for both market rate and deed

restricted housing. It evaluates current conditions and past trends, including the number of

sales, sales prices, and inventory of units listed for sale. The information was gleaned from

realtor interviews and analysis of MLS data for homes sold between 2019 and July 2022.

Current listings were pulled from the MLS on August 5

th

, 2022.

County Wide Sales Trends

County Wide, the median sales price for residential units rose steadily between 2019 and

2021, with an increase of 15% from 2019 to 2020 and another 17% from 2020 to 2021.

However, sales data pulled through July 2022 indicates a leveling of the market with similar

numbers to 2021.

Western Spaces, LLC Crested Butte Market Study October 2022

29

Price patterns vary by community, with Crested Butte having the largest swings by year. As

reported, the number of sales in Crested Butte currently total 25% (13) of the sales volume

experienced the last two years (average around 53 per year).

Gunnison County MLS Median Sales

2019

2020

2021

2022 YTD*

Crested Butte Rural

$1,010,000

$1,250,000

$1,337,500

$1,812,500

Crested Butte South

$547,000

$602,500

$872,500

$992,500

Mt. Crested Butte

$495,000

$500,000

$601,000

$565,000

Crested Butte

$1,042,500

$1,250,750

$1,002,500

$1,680,000

Gunnison City

$312,500

$343,500

$410,000

$456,500

Gunnison Rural

$376,250

$438,250

$575,000

$565,000

Totals

$434,500

$500,000

$582,500

$575,000

Source: Gunnison County MLS

Almont excluded due to low number of sales.

*YTD Pulled through July 2022

Transactions and Dollar Volume

The number of sales in the North Valley increased by almost 60% from 2019 to 2020. This

increase corroborates findings from the May 2021 GVRHA Market Update report that

indicated while COVID stalled listings and sales in spring 2020, the market quickly

rebounded when summer arrived with strong demand.

While this trend continued through the end of 2021, data from sales through July of this

year show an overall decrease in transactions compared to last year. Countywide, the

number of transactions decreased by 39%. North Valley followed a similar trend, with 37%

fewer transactions.

Western Spaces, LLC Crested Butte Market Study October 2022

30

Number of Transactions

2021

Jan thru

July

2022

Jan thru

July

% Change

North Valley

Crested Butte Rural

48

24

-50%

Crested Butte

South

18

16

-11%

Mt. Crested Butte

109

76

-30%

Crested Butte

90

52

-42%

South Valley

Gunnison City

79

68

-14%

Gunnison Rural

50

24

-52%

Countywide

Totals

353

216

-39%

Source: Gunnison County MLS

*YTD Pulled through July 2022

Almont excluded due to low number of sales.

Overall dollar volume in the North Valley remained fairly steady through 2019 and then

jumped quickly in 2020. This increase can partly be attributed to COVID migrations coming

with the arrival of summer, strong demand fueled by the ability to work remotely, and the

motivation to get out of urban areas. The number of sales also increased in 2020 but

experienced more of a leveling off coming into 2021. The increase in transactions in 2020

can primarily be attributed to single-family sales (77% increase).

North Valley Transactions and Dollar Volume

Source: Gunnison County MLS

0

50

100

150

200

250

300

350

400

$0

$50,000,000

$100,000,000

$150,000,000

$200,000,000

$250,000,000

$300,000,000

$350,000,000

$400,000,000

$450,000,000

$500,000,000

2018 2019 2020 2021

Dollar Volume Number of Transactions

Western Spaces, LLC Crested Butte Market Study October 2022

31

Affordability of Sales

The distribution of sales across the North Valley that are affordable to households making

between 80 and 180% AMI has been decreasing. In 2018, an estimated 31% of sales fell in

this category, steadily decreasing to 13% in 2021. This year, through July, only 7% of sales

were affordable to these households. It should be noted that the calculation of affordability

does not include additional homeowner’s association fees (HOA). In many cases, HOA fees

significantly decrease the affordability of units.

In looking closer at sales affordable to incomes between 80 and 180% AMI, the large

majority between 2018 and 2021 have been condo units (around 94%). The average size of

these condo units is between 800 and 900 sqft. with an average of 1.5 bedrooms. The

majority of these sales were in the Mt. Crested Butte area (54% in 2021) and Crested Butte

Rural (24%).

North Valley Sales by AMI

AMI

Income Range

2-person HH

2018

2019

2020

2021

2022

YTD

Under 60%

Under $42,480

0%

0%

0%

0%

0%

60 to 80%

$42,480 to $56,640

0%

1%

2%

0%

1%

80 to 100%

$56,641 to $70,800

2%

2%

2%

1%

1%

100 to 120%

$70,801 to $84,960

4%

4%

3%

2%

2%

120 to 150%

$84,961 to $106,200

14%

8%

7%

5%

3%

150 to 180%

$106,201 to $127,440

10%

8%

6%

6%

1%

Over 180%

Over $127,440

68%

76%

79%

86%

93%

Total %

-

100%

100%

100%

100%

100%

Total #

-

248

205

324

343

112

Source: CHFA, mortgageloan.com

*AMI for the average 2-person HH

Occupancy

Occupancy can be a hard measure to pin down and invariably only captures a point in time,

as measured by the Decennial Census. The Department of Local Affairs provides estimates

and projections at the County level that are based off of the Decennial Census, which is

used here. The occupancy rate across the county decreased slightly between 2010 and

2020 from 59% to 57%. The North Valley also experienced a slight decrease from 52% to

49%. Within the North Valley, however, the Town of Crested Butte increased the ratio of

units occupied from 65% to 68%.

Western Spaces, LLC Crested Butte Market Study October 2022

32

Housing Unit Occupancy

% Occupied

2010

% Occupied

2020

Gunnison County

59%

57%

North Valley

52%

49%

Town of Crested Butte

65%

68%

Mount Crested Butte

33%

26%

Source: Decennial Census 2010 and 2020

While the American Community Survey (ACS) only provides estimates from a sampling of

households, it can shed some light on patterns in the reasons for homes to be classified as

vacant. The 2020 ACS indicates the most prevalent reason for vacancy is use for seasonal,

recreational, or occasional purposes.

Reason for Vacancy – 2020 American Community Survey

North

Valley

Crested

Butte

Mt. Crested

Butte

Total Vacant Units

2,229

520

1,208

For rent

27%

26%

36%

Rented, not occupied

0%

0%

1%

For sale only

2%

2%

2%

Sold, not occupied

1%

3%

0%

For seasonal, recreational, or occasional use

65%

59%

58%

For migrant workers

0%

0%

0%

Other vacant

6%

11%

3%

100%

100%

100%

Source: 2020 ACS

Interestingly, units that are classified as vacant because they are listed as ‘for rent’ is the

second largest category. While the ACS does not further classify why the unit is for rent, it

can be assumed this category captures both long-term and short-term rentals. As noted

previously, there are very few long-term rentals available in the North Valley.

Western Spaces, LLC Crested Butte Market Study October 2022

33

Percent of Vacant Units Categorized as ‘For Rent’

North Valley

Crested Butte

Mt. Crested Butte

2010

13%

11%

18%

2020

27%

26%

36%

Source: 2010 and 2020 ACS

Units listed with the MLS include a category for occupancy at the time of listing. This last

year, the largest category of units sold were owner occupied (35%), followed by vacant or

second home (32%), short-term rental (21%) and long-term rental (11%). Data from sales

since 2019 indicate a similar distribution over time, with little variation.

2021 North Valley Occupancy at Time of Listing

Source: MLS

Availability of Market Housing

As of early August, there were no market rate units for sale in the North Valley at prices

affordable to households making 180% AMI or less. A total of 103 units were listed for sale,

with an average listing price of $2,100,000. Overall, 81% of listings are over $1 million.

With the exception of one unit, the remaining seven units listed below $800,000 were built

between 1974 and 1980, with an average age of 44 yrs old. As noted previously, HOA fees

are not included in the calculation of affordable purchase price and can significantly effect

affordability.

Long-

Term

Rental

11%

Owner

Occupied

35%

Short-Term

Rental

21%

Vacant

32%

Western Spaces, LLC Crested Butte Market Study October 2022

34

Current Listings North Valley August 5

th

, 2022

Listing Price

Count

Percent

$500,000 to $600,000

3

3%

$600,000 to $700,000

1

1%

$700,000 to $800,000

4

4%

$800,000 to $900,000

7

7%

$900,000 to $1 million

5

5%

$1 to $2 million

30

29%

$2 to $3 million

27

26%

Over $3 million

26

25%

Grand Total

103

100%

Source: MLS

Sale of Deed Restricted Units

The Gunnison County Assessor maintains sales records for deed-restricted properties in

the County. There are five categories of deed restricted sales recorded; income restricted,

price cap, residency requirement and long-term rental. For these purposes, long-term

rental properties are excluded.

County Assessor records indicate 62 deed restricted housing units sold in the North Valley

from 2017 through August 2022.

Improved Deed Restricted Sales 2017 thru August 2022

Bedrooms

Median Sales

Average

PPSF

Count

1

$190,900

$281

12

2

$276,757

$309

33

3+

$660,000

$473

17

Overall

$289,000

$353

62

Source: Gunnison County Assessor

Over the last 5 years, 25 vacant deed restricted lot sales have been recorded. In 2019, the

inventory for vacant sales was large due to the sale of lots by the Town of Mt. Crested Butte

and Prospect Development Company to Homestead Housing. The 20 recorded vacant lots

are now newly constructed 2 and 3-bedroom units deed restricted with price caps. In June

2020, the GVRHA held a lottery for pre-qualified applicants and the available 20 units were

claimed and purchased.

Considering the affordability of deed restricted sales over the last 5 years, the largest

percentage of sales were affordable to households between 80 and 100% AMI (24%);

however, this income segment only represents 13% of current renter households that

Western Spaces, LLC Crested Butte Market Study October 2022

35

would most likely be prospective buyers. In comparison, only 7% of sales were to

households between 100% and 120% AMI, yet this group makes up 10% of the market .

This distinction helps identify the income ranges that have fewer purchase options in the

deed restricted market. As you reach upwards of 120% AMI, many of these households are

renters by choice, are newer to the area, or are temporarily in the North Valley.

Deed Restricted Sales by AMI Affordability

AMI

Sales

(5 yrs)

% Current

Renter HH

Under 60%

16%

36%

60 to 80%

12%

10%

80.1 to 100%

24%

13%

100.1 to 120%

7%

10%

120.1 to 150%

9%

11%

150.1 to 180%

2%

11%

Over 180%

30%

9%

Total

100%

100%

Source: Gunnison County Assessor, HUD, Ribbon Demographics,

Western Spaces, LLC Calculations

Residency Trends

The most recent 2021 Town of Crested Butte housing census shows a small proportional

gain in both long-term rentals and short-term rentals between 2018 and 2021; however,

the ratio of long-term rentals (32%) and vacation rentals (16%) remained constant during

this time.

Community perception is that there has been an accelerated loss of long-term rentals as a

result of owners taking advantage of high sales prices. However, the data presents a

different narrative. In 2021, 11% of sales were existing long-term rentals, a percentage that

has remained constant over the last few years. The Town of Crested Butte 2021 Housing

Census also indicates that the proportion of units occupied by long-term rentals has

remained constant within the Town limits (34%).

It is important to note that the Town census does not account for the demographics of

renters as well as the length of time rented. A long-term rental is typically categorized as a

lease of 30 days or more. The trend observed in the last two years indicating an influx of

“zoomers” does not preclude those rented for a month or more, that effectively have

resulted in a loss of units available to the local workforce.

Additionally, as reported in the Mountain Migration report, families were moving into their

second home residences as a result of COVID shutdowns. This does not necessarily

indicate a loss of second homes, as many maintained their primary residence elsewhere.

Western Spaces, LLC Crested Butte Market Study October 2022

36

While the ratio of second homeownership has not changed, the use may have. This trend

can attribute to the general increase in busyness around the area and around town.

Demand Estimates

This section quantifies the size of the market and the capture rates for the proposed units

taking into consideration the number of households residing within the market area by

income and household size and in-migration of households from outside the market area.

This demand calculation uses a conservative method, considering only existing households.

It is assumed that, with growth, demographics and preferences will remain much the same.

In market analysis it is not necessary to consider households that might move in unless

major events, like a large tech company moving into a community, are planned.

Two market areas were considered for both ownership and rental. The North Valley is

defined as Census Tract 9638, the geography north of Almont extending through Mt.

Crested Butte. This approach is consistent with the primary market area used for the

Anthracite Place Market Study in 2014.The secondary market (South Valley) includes

Census Tracts 9636 and 9637 including Almont, City of Gunnison, and parts of Taylor

Canyon and east of Gunnison.

The potential market for deed restricted homes in the North Valley primarily consists of

persons who already live in or near the market area. Very little movement up valley of

families from the South Valley should be expected. Results from the 2016 Household

Survey in Gunnison County showed there is not strong interest from residents living in the

South Valley to move to the North Valley (10%).

For this calculation, data from the 2016 Household Survey is used to distribute potential

owner and renter households. Respondents to the 2016 survey were asked whether they

wanted to buy or rent a different residence and which community they preferred. For the

many renter households planning to move within the Valley (56%), most would prefer to

become homeowners (71%).

Western Spaces, LLC Crested Butte Market Study October 2022

37

Rental Estimate

There is total potential demand for between 40 and 82 rental units in the North Valley

generated by households with incomes between 60 and 120% AMI.

Tiers of capture rates are used to create a range of potential housing price points.

• The largest gap for rental units is between 60 and 80% AMI, where there is almost

no inventory and affordable rents fall below market rate rents.

• Rents affordable to 80% to 100% AMI start to overlap with market rents, particularly

for smaller units; however, availability is very limited.

• Households between 100 and 120% AMI can afford payments that exceed market

rents, thus smaller capture rates are used. Some households in this category also

approach the ability to purchase and are captured in the ownership calculations.

• The demographic over 120% AMI price point is not included in this calculation, as

that typically exceeds affordable/workforce housing needs and are well above local

market rent levels.

North Valley Capture Rates – For Rent

60 to 80%

80 to 100%

100 to 120%

Total

Max Affordable Monthly Payment

2-person HH

$1,000 -

$1,300

$1,300 - $1,600

$1,600 - $2,000

-

Eligible Households

93

120

54

267

In Migration - 10% of South Valley

eligible renters

23

14

5

42

Total Eligible Households

116

134

60

310

Capture Rate - Conservative

20%

10%

5%

13%

Number of potential units at

conservative Capture Rate

23

13

3

40

Capture Rate - Mid

30%

15%

10%

20%

Number of potential units at mid

Capture Rate

35

20

6

61

Capture Rate - Aggressive

40%

20%

15%

27%

Number of potential units at

aggressive Capture Rate

46

27

9

82

Western Spaces, LLC Crested Butte Market Study October 2022

38

Ownership Estimate

There is total potential demand for between 50 and 81 ownership units generated by

households with incomes between 100 and 180% AMI.

Tiers of capture rates are used to create a range of potential housing price points.

• For ownership units affordable to households making between 100 and 120% AMI, a

lower capture rate is used to account for mortgage and down payment availability.

• Households between 100 and 150% are where the largest gap exists.

• Households between 150 and 180% AMI begin to overlap slightly with market rate

housing, although there are currently no units for sale below $500,000.

North Valley Capture Rates – For Sale

100 to 120%

120 to 150%

150 to 180%

Total

Max Affordable Purchase Price

2-person HH

$360,000

$440,000

$540,000

-

Eligible Households

35

98

103

236

In Migration - 10% of South Valley

eligible renters

4

4

6

14

Total Eligible Households

38

102

109

249

Capture Rate - Conservative

10%

20%

15%

20%

Number of potential units at

conservative Capture Rate

4

30

16

50

Capture Rate - Mid

15%

30%

20%

23%

Number of potential units at mid

Capture Rate

6

31

22

58

Capture Rate - Aggressive

20%

40%

30%

33%

Number of potential units at

aggressive Capture Rate

8

41

33

81

Max Purchase Price assumes 30-yr fixed, 5.875% interest, 30% of income towards payment

Design and Development

The information for this section is from a combination of data sources, including secondary

data as well as primary data collected through interviews and focus groups.

Design/location/price decisions should be based upon the characteristics and preferences

of households currently living in the valley who will likely lease or purchase most of the new

units.

Western Spaces, LLC Crested Butte Market Study October 2022

39

Decisions about the provision of rental and homeownership opportunities – number of

units, location, unit type, amenities, and pricing, will depend on policy and developer

decisions as to which segments of the potential market for each should be the focus.