Investor briefing | November 2023

The Reinvention Ahead

1

Forward-Looking Statements

Except for the historical information and discussions contained herein, statements in this presentation

may constitute “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995 relating to our operations, results of operations and other matters that are based on

our current expectations, estimates, assumptions and projections. Words such as “may,” “will,”

“should,” “likely,” “anticipates,” “expects,” “intends,” “plans,” “projects,” “believes,” “estimates,”

“positioned,” “outlook” and similar expressions are used to identify these forward-looking statements.

Any statements other than statements of historical fact may be forward-looking statements. For details

on the uncertainties and other factors that may cause our actual future results to be materially different

than those expressed in our forward-looking statements, see the uncertainties and other factors

discussed under the “Risk Factors” heading in our most recent annual report on Form 10-K, quarterly

reports on Form 10-Q and other documents filed with or furnished to the Securities and Exchange

Commission. We do not undertake to update our forward-looking statements. This presentation also

includes certain forward-looking projected financial information that is based on current estimates and

forecasts. Actual results could differ materially. Forward-looking and other statements herein may also

address our corporate responsibility progress, plans, and goals (including environmental matters), and

the inclusion of such statements is not an indication that these contents are necessarily material to

investors or required to be disclosed in our filings with the Securities and Exchange Commission. In

addition, historical, current, and forward-looking sustainability-related statements may be based on

standards for measuring progress that are still developing, internal controls and processes that

continue to evolve, and assumptions that are subject to change in the future.

2

Sourcing &

Procurement

Build

Digital

Core

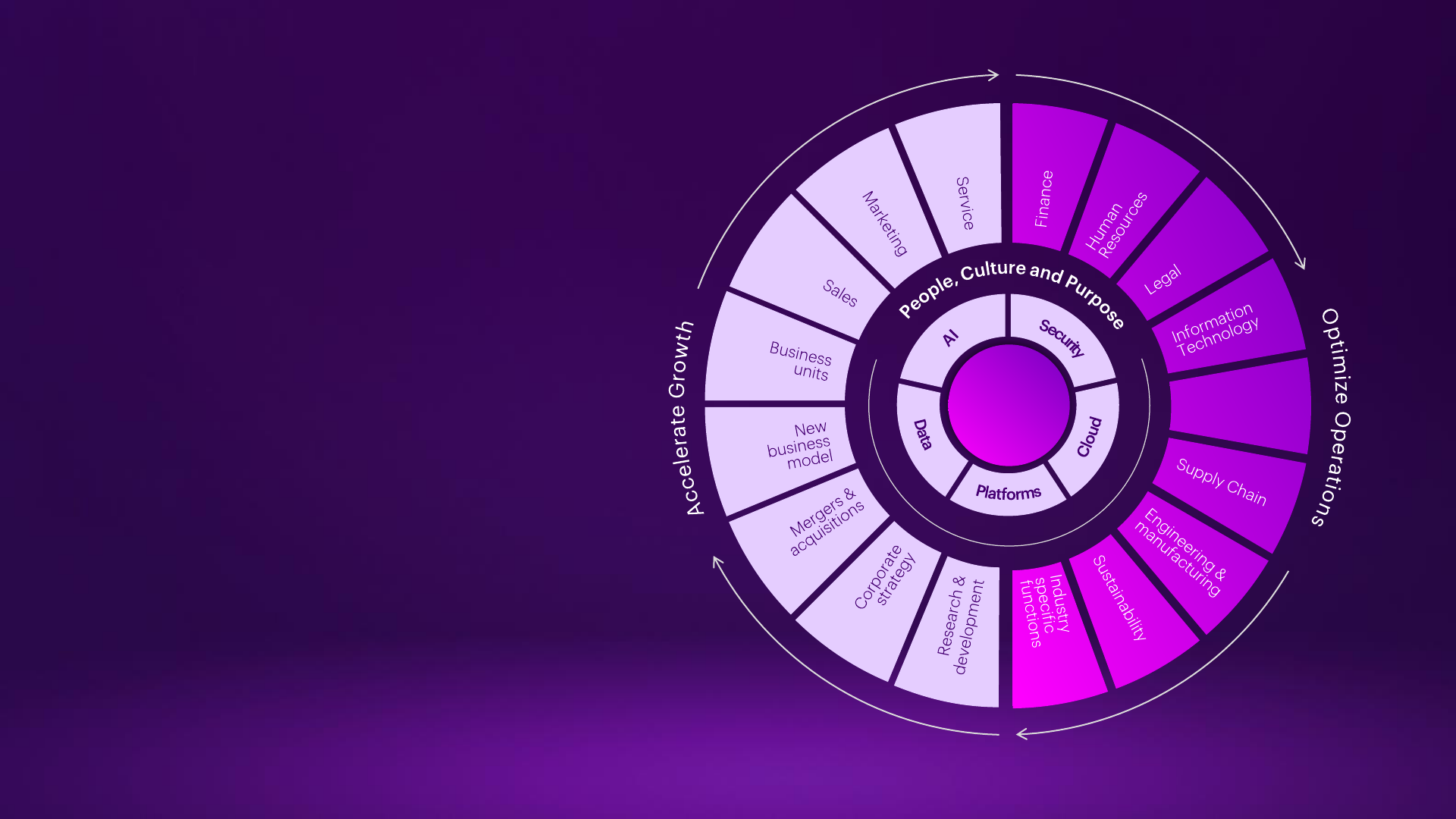

Our strategy

is to help our

clients reinvent

33

It starts with a strong

digital core

Build

Digital

Core

4

Our strategy

is to help our

clients reinvent

Waves of Enterprise Transformation

Centralized/

Distributed

Computing

Internet &

Global IT

Digital

Business

Intelligent

Reinvention

Key

Technologies

1980s 1990s 2000s 2010s 2020s 2030s+1970s

Client Server

Mainframe

PC

eCommerce

ERP/CRM

Internet/Web 1.0

Mobile

Analytics

Social

Cloud

AI and Robotics

Metaverse

Cloud Continuum

Quantum

….

5

$1B

FY2012

Cloud

$32B

FY2023

$2B

FY2014

$3.5B

FY2015

$4.5B

FY2016

$6.5B

FY2017

$9B

FY2018

$11B

in FY2019

$12B

FY2020

$26B

FY2022

$18B

FY2021

Accenture Cloud Revenue

$31B incremental

36% CAGR

(FY12-FY23)

Catching the Wave:

Accenture Cloud Journey

2023

20082005

First cloud-

related patent

granted

Strategic

growth

initiative

launched

2011

#1 position in SaaS

(Salesforce)

2015

First public cloud

business group

established

2018

Accenture

90% in

cloud

2020

Accenture

Cloud First

launched -

$3B

investment

20% of

workloads in

the cloud

$ 32B cloud

business

40% of workloads

in the cloud

2002

FY02 to FY12 = 7% FY13 to FY23 = 10%

Accenture

CAGR

2011

Leader position in

SaaS (Salesforce)

2015

First public cloud

business group

established

2018

Accenture

90% in

cloud

2020

Accenture

Cloud First

launched -

$3B

investment

20% of

workloads

in the cloud

39 cloud-related acquisitions

Cloud revenues and CAGR percentages are approximated and may be modified to reflect periodic changes in definitions

6

Customer

The Digital Core: Significant Opportunity Ahead

Platforms Security

60%

potential

remaining

Data & AI

90%

potential

remaining

Cloud

80%

potential

remaining

65%

potential

remaining

86%

potential

remaining

Digital

Manufacturing

95%

potential

remaining

7

Cloud: 25-40% of workloads are in the cloud (Everest Group); only 20% are modernized (Accenture Research)

Data & AI: Accenture Research

Platforms: Accenture research (approximate based on select platforms)

Security: World Economic Forum

Customer: Only 14% of organizations responding to the 2021 Gartner Cross-Functional Customer Data Survey indicated they have achieved a 360-degree customer view of the customer. Gartner®, Apply Customer Data Management Technologies to Create Better Customer Experiences, 2023.

GARTNER is a registered trademark and service mark of Gartner, Inc. and/or its affiliates in the U.S. and internationally and is used herein with permission. All rights reserved.

Digital Mfg: Everest Group

Source: Technology Finance, External validation from Industry Analyst (PAC) for calendar year 2022

Emerging

Key Partners

#1

ACN Market Position

~2X

market share of

closest competitor

Ecosystem

partners

Our Leading Ecosystem Partners

8

*Facts for FY23

Innovate

to anticipate

the waves

100 innovation hubs

35 years of

Labs leadership

Invest at Scale

$1.3B in R&D

investments

$1.1B in training

and development

$2.5B across

25 acquisitions

~$5B investments

Ecosystem

leadership

#1 partner for

our leading

ecosystem

partners

55+ Ventures

Breadth

of services

A leader among

Forbes’ World’s

Best Management

Consulting Firms

#1 in Tech

Services,

by Everest

#1 digital agency

in all disciplines,

by Ad Age

Industry

expertise

13 industry groups

Partnered with top

100 clients for 10+ years

106 clients

with quarterly

bookings $100M+

300 Diamond clients

Our Proven Reinvention Formula

9

Gen AI client

projects*

300

Gen AI sales*

$300M

The Age of AI, Powered by Gen AI

15+ years

leading in AI

1545+

AI patents

& patents

pending

Doubling AI

talent to 80K

AI Navigator for

Enterprise

Accenture

Center for

Advanced AI

Data & AI

Investment

$3B

GenAI Adoption

Challenges for CXOs**

**Accenture CXO Pulse Survey; September 2023

46%

view getting the data

strategy right as top

issue

32%

rank talent scarcity

(skills and people) as

a concern

*For FY23

10

GenAI to become $1.3T

market by 2032

- Bloomberg -

Cognitive

Infrastructure

opportunity

Marketing and

Customer Support

Finance Human Resources

IT and Coding Knowledge Management

Gen AI: Two Speed Approach

11

Building Capabilities

Retail

Assortment Optimization

Insurance

Intelligent Underwriting

Life sciences

Generative Drug Discovery

Energy

Capital Projects

Early Value Opportunities

Strategic Bets

Responsible AI

Realities of Gen AI

for our Clients

It’s early, but moving fast

Driving demand for digital core,

especially data readiness

Business value focus

Clients taking two-speed approach:

quick hits and strategic bets

It’s not just about the tech.

Importance of change and

transformation

12

Enduring approach

to shareholder

value creation

…while delivering

360˚ value to all our

stakeholders

Grow faster than the market

and take share

Strong earnings growth with

sustainable margin expansion

while investing at scale

Strong cash flow

Disciplined capital allocation

Significant return to shareholders

13