IN THE UNITED STATES DISTRICT COURT

FOR THE SOUTHERN DISTRICT OF TEXAS, CORPUS CHRISTI DIVISION

DIAGNOSTIC AFFILIATES OF §

NORTHEAST HOU, LLC D/B/A § CIVIL ACTION NUMBER

24 HOUR COVIDRT-PCR §

LABORATORY §

§ _______________________

vs. §

§

UNITED HEALTH GROUP, INC.; §

UNITED HEALTHCARE SERVICES, §

INC.; §

UNITED HEALTHCARE BENEFITS §

OF TEXAS, INC.; §

UNITED HEALTHCARE OF TEXAS, §

INC.; §

UMR, INC.; §

OPTUMHEALTH CARE SOLUTIONS, §

INC.; §

AMERICAN INTERNATIONAL §

GROUP, INC. MEDICAL PLAN; §

ANADARKO PETROLEUM CORP. §

HEALTH BENEFIT PLAN; §

APPLE INC. HEALTH AND WELFARE §

BENEFIT PLAN; §

GROUP HEALTH AND WELFARE §

PLANS(ARAMARK UNIFROM SERVICES); §

AT&T UMBRELLA BENEFIT §

PLAN NO. 1; §

AT&T UMBRELLA BENEFIT §

PLAN NO. 3; §

BAKER HUGHES, A GE COMPANY §

WELFARE BENEFITS PLAN; §

BAYLOR COLLEGE OF MEDICINE §

HEALTH AND WELFARE BENEFITS §

PLAN; §

BROOKDALE SENIOR LIVING, INC. §

WELFARE PLAN; §

C.H ROBINSON COMPANY GROUP §

HEALTH MAJOR MEDICAL PLAN; §

CALPINE CORPORATION §

EMPLOYEE BENEFIT PLAN; §

CATERPILLAR INC. GROUP §

INSURANCE MASTER TRUST; §

2:21-cv-131

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 1 of 89

Page 2 of 89

CELANESE HEALTH AND WELFARE §

BENEFITS PROGRAM; §

CENTERPOINT ENERGY GROUP §

WELFARE BENEFITS PLAN FOR §

RETIREES; §

CITGO PETROLEUM CORPORATION §

DEFINED CONTRIBUTION §

MASTER TRUST; §

DELTA ACCOUNT BASED §

HEALTHCARE PLAN; §

ENVISION HEALTHCARE §

CORPORATION WELFARE §

BENEFITS PLAN; §

H&E EQUIPMENT SERVICES INC. §

BENEFIT PLAN; §

FLOUR EMPLOYEE BENEFIT §

TRUST PLAN; §

FRESENIUS MEDICAL CARE §

TRAVELLING NURSES HEALTH AND §

WELFARE BENEFITS PLAN; §

GEICO CORP. CONSOLIDATED §

WELFARE BENEFITS PROGRAM; §

GEOSPACE TECHNOLOGIES §

WELFARE BENEFIT PLAN; §

HUDSON GROUP (HG) INC. §

EMPLOYEE BENEFITS PLAN; §

IQOR HEALTH AND §

WELFARE PLAN; §

JONES LANG LASALLE GROUP §

BENEFITS PLAN; §

KELLOGG BROWN & ROOT, INC, §

WELFARE BENEFITS PLAN; §

KINDER MORGAN, INC. MASTER §

EMPLOYEE WELFARE PLAN; §

LEXICON PHARMACEUTICALS INC. §

COMPREHENSIVE WELFARE §

BENEFITS PLAN; §

LINEAGE LOGISTICS LLC §

BENEFITS PLAN; §

LOCKTON, INC. WELFARE §

BENEFITS PLAN; §

M/I HOMES, INC. HEALTH, LIFE AND §

DENTAL WELFARE PLAN; §

MAERSK INC. ACTIVE NONUNION §

HEALTH AND WELFARE PLAN; §

THE MALLINCKRODT §

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 2 of 89

Page 3 of 89

PHARMACEUTICALS WELFARE §

BENEFIT PLAN; §

MOTIVA ENTERPRISES LLC §

HEALTHAND WELLNESS BENEFIT §

PLAN; §

NOVO NORDISK INC. WELFARE §

BENEFIT PLAN; §

PETSMART SMARTCHOICES §

BENEFIT PLAN; §

PROCTER AND GAMBLE RETIREE §

WELFARE BENEFITS PLAN; §

RAILROAD EMPLOYEES NATIONAL §

HEALTH FLEXIBLE SPENDING §

ACCOUNT PLAN; §

RAISING CANES USA HEALTH AND §

WELFARE BENEFITS WRAP PLAN; §

REPUBLIC SERVICES INC. §

EMPLOYEE BENEFIT PLAN; §

REPUBLIC NATIONAL DISTRIBUTING §

COMPANY, LLC WELFARE §

BENEFITS PLAN; §

SAIA MOTOR FREIGHT LINE LLC §

EMPLOYEE PREFERRED §

PROVIDER PLAN; §

SIEMENS CORPORATION GROUP §

INSURANCE AND FLEXIBLE §

BENEFITS PROGRAM; §

SKADDEN, ARPS, SLATE, MEAGHER §

& FLOM PARTNERS’ WELFARE §

BENEFITS PLAN; §

SKYWEST INC. CAFETERIA PLAN; §

SOUTHWEST AIRLINES CO. §

WELFARE BENEFIT PLAN; §

SPIRIT AIRLINES INC. HEALTH §

AND WELFARE BENEFITS PLAN; §

SWISSPORT NORTH AMERICA §

HOLDINGS, INC. HEALTH & §

WELFARE PLAN; §

TARGA RESOURCES LLC WELFARE §

BENEFITS PLAN; §

TEXAS CAPITAL BANCSHARES §

INC. EMPLOYEE BENEFIT PLAN; §

TEXTRON NON-BARGAINED §

WELFARE BENEFITS PLAN; §

ADECCO, INC WELFARE §

BENEFITS PLAN; §

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 3 of 89

Page 4 of 89

T-MOBILE USA, INC. EMPLOYEE §

BENEFIT PLAN; §

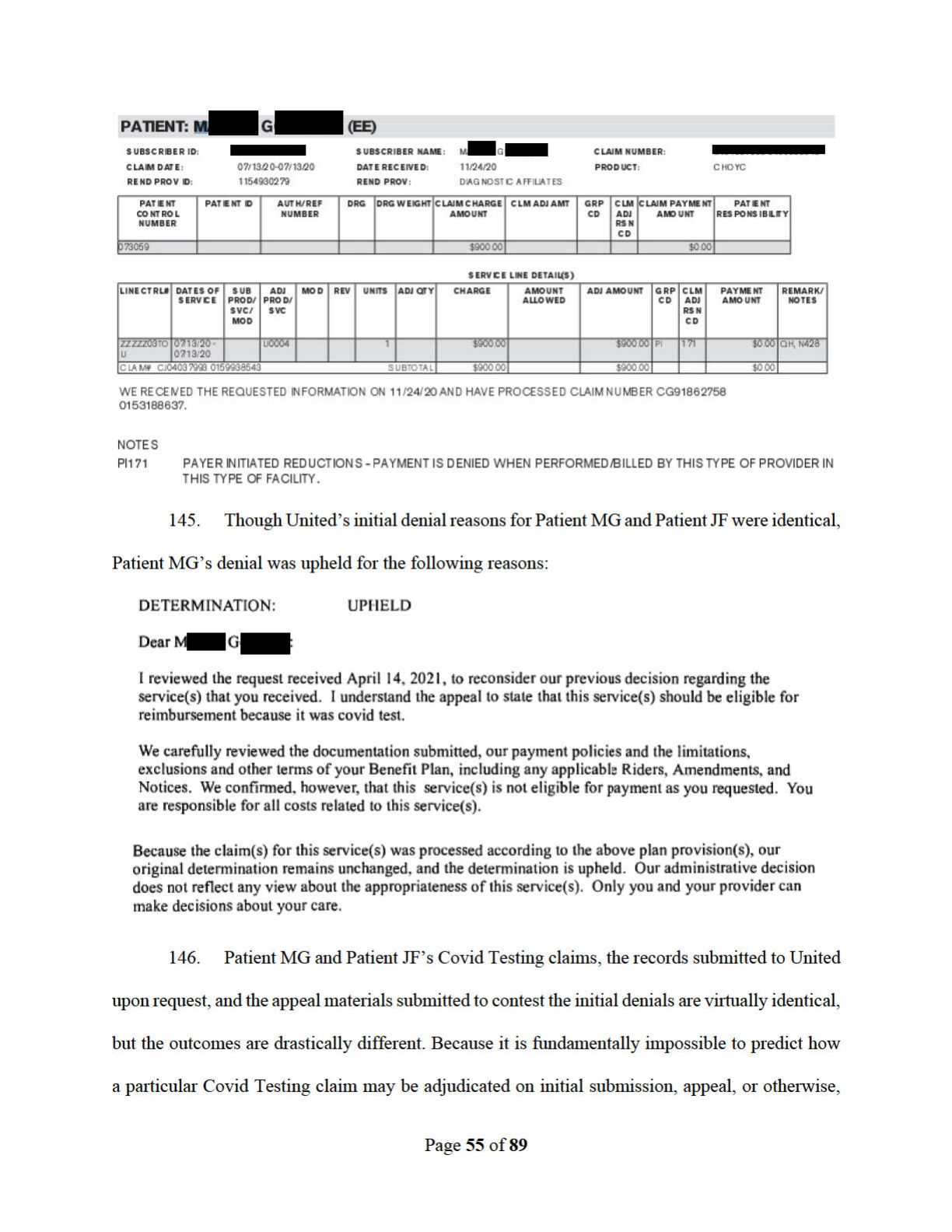

TRANSOCEAN GROUP WELFARE §

BENEFIT PLAN; §

UHS WELFARE BENEFITS PLAN; §

UNITEDHEALTH GROUP §

VENTURES, LLC HEALTH AND §

WELFARE BENEFIT PLAN; §

VALERO ENERGY CORPORATION §

RETIREE BENEFITS PLAN; §

VALMONT INDUSTRIES INC. §

WELFARE BENEFIT PLAN; §

WALGREENS HEALTH AND §

WELFARE PLAN; §

WCA MANAGEMENT COMPANY, §

LP WELFARE BENEFIT PLAN; §

WEBBER, LLC WELFARE §

BENEFIT PLAN; §

WINSTEAD PC FLEXIBLE §

BENEFIT PLAN; §

GROUP BENEFITS PLAN FOR §

EMPLOYEES OF WORLEYPARSONS §

CORPORATION §

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 4 of 89

Page 5 of 89

ORIGINAL COMPLAINT AND JURY DEMAND

Plaintiff Diagnostic Affiliates of Northeast Hou, LLC d/b/a 24 Hour Covid RT-PCR

Laboratory (“24 Hour Covid” or “Plaintiff”), by and through its attorneys, bring its Original

Complaint against United

1

and the Employer Plans

2

, and allege as follows:

INTRODUCTION

1. Plaintiff brings this action against United and the Employer Plans that United

administers because United has unjustifiably engaged in unconscionable and fraudulent conduct

during the COVID-19 public health emergency period in order to evade and circumvent its

obligations to fully cover all United Plan and Employer Plan members’ COVID-19 diagnostic

1

“United” refers to United Health Group, Inc., United Healthcare Services, Inc., United Healthcare Benefits of Texas,

Inc., United Healthcare of Texas, Inc., UMR, Inc., United Healthcare Services, Inc., OptumHealth Care Solutions,

Inc.

2

“Employer Plans” refer to American International Group, Inc. Medical Plan; Anadarko Petroleum Corp. Health

Benefit Plan; Apple Inc. Health And Welfare Benefit Plan; Group Health And Welfare Plans (Aramark Uniform

Services); AT&T Umbrella Benefit Plan No. 1; AT&T Umbrella Benefit Plan No. 3; Baker Hughes, A GE Company

Welfare Benefits Plan; Baylor College Of Medicine Health And Welfare Benefits Plan; Brookdale Senior Living, Inc.

Welfare Plan; C.H Robinson Company Group Health Major Medical Plan; Calpine Corporation Employee Benefit

Plan; Caterpillar Inc. Group Insurance Master Trust; Celanese Health And Welfare Benefits Program; Centerpoint

Energy Group Welfare Benefits Plan For Retirees; Citgo Petroleum Corporation Defined Contribution Master Trust;

Delta Account Based Healthcare Plan; Envision Healthcare Corporation Welfare Benefits Plan; H&E Equipment

Services Inc. Benefit Plan; Flour Employee Benefit Trust Plan; Fresenius Medical Care Travelling Nurses Health And

Welfare Benefits Plan; Geico Corp. Consolidated Welfare Benefits Program; Geospace Technologies Welfare Benefit

Plan; Hudson Group (HG) Inc. Employee Benefits Plan; IQOR Health And Welfare Plan; Jones Lang Lasalle Group

Benefits Plan; Kellogg Brown & Root, Inc, Welfare Benefits Plan; Kinder Morgan, Inc. Master Employee Welfare

Plan; Lexicon Pharmaceuticals Inc. Comprehensive Welfare Benefits Plan; Lineage Logistics LLC Benefits Plan;

Lockton, Inc. Welfare Benefits Plan; M/I Homes, Inc. Health, Life And Dental Welfare Plan; Maersk Inc. Active

Nonunion Health And Welfare Plan; The Mallinckrodt Pharmaceuticals Welfare Benefit Plan; Motiva Enterprises

LLC Health and Wellness Benefit Plan; Novo Nordisk Inc. Welfare Benefit Plan Petsmart Smartchoices Benefit Plan;

Procter And Gamble Retiree Welfare Benefits Plan; Railroad Employees National Health Flexible Spending Account

Plan; Raising Canes USA Health And Welfare Benefits Wrap Plan; Republic Services Inc. Employee Benefit Plan;

Republic National Distributing Company, LLC Welfare Benefits Plan; Saia Motor Freight Line LLC Employee

Preferred Provider Plan; Siemens Corporation Group Insurance And Flexible Benefits Program; Skadden, Arps, Slate,

Meagher & Flom Partners’ Welfare Benefits Plan; Skywest Inc. Cafeteria Plan; Southwest Airlines Co. Welfare

Benefit Plan; Spirit Airlines Inc. Health And Welfare Benefits Plan; Swissport North America Holdings, Inc. Health

& Welfare Plan; Targa Resources LLC Welfare Benefits Plan; Texas Capital Bancshares Inc. Employee Benefit Plan;

Textron Non-Bargained Welfare Benefits Plan; Adecco, Inc Welfare Benefits Plan; T-Mobile USA, Inc. Employee

Benefit Plan; Transocean Group Welfare Benefit Plan; UHS Welfare Benefits Plan; UnitedHealth Group Ventures,

LLC Health And Welfare Benefit Plan; Valero Energy Corporation Retiree Benefits Plan; Valmont Industries Inc.

Welfare Benefit Plan; Walgreens Health And Welfare Plan; WCA Management Company, LP Welfare Benefit Plan;

Webber, LLC Welfare Benefit Plan; Winstead PC Flexible Benefit Plan; Group Benefits Plan For Employees Of

Worleyparsons Corporation.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 5 of 89

Page 6 of 89

testing (“Covid Testing”) services and to reimburse Plaintiff, an out-of-network (“OON”)

laboratory, for bona fide Covid Testing services offered to these same members in accordance with

a Congressionally set methodology established and supported by the Families First Coronavirus

Response Act (the “FFCRA”), the Coronavirus Aid, Relief, Economic Security Act (the “CARES

Act”), Texas Department of Insurance Commissioner’s Bulletin B-0017-20, and other Federal and

Texas authorities and guidance.

2. The importance of Covid Testing during a worldwide pandemic cannot be

overlooked as it is the best mitigation mechanism in place to identify and curtail the spread of the

COVID-19 virus. Due to the urgent need to facilitate the nation’s response to the public health

emergency posed by COVID-19, Congress passed the FFCRA and the CARES Act to, amongst

other things, address issues pertaining to the costs of and access to Covid Testing during the

COVID-19 pandemic.

3. United and the Employer Plans’ conduct (or lack thereof as it pertains to the

Employer Plans) has undermined national efforts made to mitigate the spread of the COVID-19

virus as it has caused Plaintiff, and other similarly situated OON providers, to shutter specimen

collection and testing locations and to potentially stop offering Covid Testing services altogether.

United’s misprocessing and denials of Covid Testing claims is nearing an insurmountable financial

loss for Plaintiff and has caused Plaintiff to hemorrhage its own funds to cover such financial

losses.

4. United has not only mis-adjudicated almost every single Covid Testing claim

submitted by Plaintiff on behalf of members of United Plans and Employer Plans administered by

United, but has, in fact, denied the vast majority of Covid Testing claims that Plaintiff has

submitted, the reasons for which are to be detailed throughout the course of this Original

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 6 of 89

Page 7 of 89

Complaint.

5. United’s fraudulent behavior, in its capacity as an insurer and third-party claims

administrator, and the Employer Plans’ failures to oversee and regulate United’s behavior (despite

being provided with notice and an opportunity to remedy United’s behavior) has had a material

adverse effect on the nation’s response to the COVID-19 pandemic as it has largely diminished

access to testing, shifted financial responsibility for the cost of Covid Testing to the members of

United Plans and Employer Plans, and, in the event of any future pandemics requiring the

cooperation and the joint efforts of licensed medical facilities and professionals (e.g. Plaintiff),

providers who have fallen victim to United’s predatory practices will be hesitant and less likely to

participate in any such future Federal and/or State efforts, in turn, jeopardizing any future

pandemic responses.

6. Plaintiff has incessantly attempted to contact United to inform it of its unlawful

practices, has attempted to negotiate an agreed amount/rate to be reimbursed for Covid Testing

services with United, and has provided notice to all Employer Plans of United’s unlawful practices.

However, all attempts by Plaintiff to amicably resolve this matter have failed, and Plaintiff is now

left with no other option than to file this lawsuit against all Defendants.

7. By way of this lawsuit, Plaintiff seeks to: (i) hold United accountable for its

fraudulent and unlawful practices, and Employer Plans responsible for their failures to monitor

and check United on its practices despite being provided with notice of such misconduct; (ii)

ensure Plaintiff is properly reimbursed for its efforts to provide a public service in response to the

COVID-19 public health emergency; and (iii) act as a safeguard against future unlawful practices

instituted by United, Employer Plans, and other insurers and health plans in the event of other

national public health emergencies.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 7 of 89

Page 8 of 89

NATURE OF THE CLAIMS

8. Plaintiff is a CLIA certified high complexity laboratory that has requested

emergency use authorization under Section 564 of the Federal Food, Drug, and Cosmetic Act;

therefore, has all authorizations and/or approvals necessary to render and be reimbursed for Covid

Testing services.

3

At the height of the pandemic Plaintiff operated seven specimen collection sites

located across the States of Texas and Louisiana, and partnered with employers and independent

school districts across Texas to render Covid Testing services to employees, teachers, students,

and other staff members.

4

9. United provides health insurance and/or benefits to members of United Plans

pursuant to a variety of health benefit plans and policies of insurance, including employer-

sponsored benefit plans and individual health benefit plans.

10. United also serves in the trusted role of third-party claims administrator for self-

funded health plans, including the Employer Plans that are named as Defendants in this Original

Complaint.

11. Under ordinary circumstances, not all health plans insured or administered by

United offer its members with access to OON providers and facilities. However, pursuant to

Section 6001 of the FFCRA, as amended by Section 3201 of the CARES Act, all group health

plans and health insurance issuers offering group or individual health insurance coverage are

required to provide benefits for certain items and services related to diagnostic testing for the

detection or diagnosis of COVID-19 without the imposition of cost-sharing, prior authorization,

3

See 21 U.S.C. § 360bbb–3.

4

Humble ISD Expands Options for Student Covid Testing (https://www humbleisd net/covid19studenttesting);

Humble ISD expands free COVID-19 testing options to provide easier access for students

(https://communityimpact.com/houston/lake-houston-humble-kingwood/education/2021/01/07/humble-isd-expands-

free-covid-19-testing-options-to-provide-easier-access-for-students/).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 8 of 89

Page 9 of 89

or other medical management requirements when such items or services are furnished on or after

March 18, 2020, for the duration of the COVID-19 public health emergency regardless of whether

the Covid Testing provider is an in-network or OON provider.

5

12. Furthermore, Section 3202(a) of the CARES Act provides that all group health

plans and health insurance issuers covering Covid Testing items and services, as described in

Section 6001 of the FFCRA must reimburse OON providers in an amount that equals the cash

price for such Covid Testing services as listed by the OON provider on its public internet website

or to negotiate a rate/amount to be paid that is less than the publicized cash price.

13. United has intentionally disregarded its obligations to comply with its requirements

to cover Covid Testing services without the imposition of cost-sharing and other medical

management requirements pursuant to Section 6001 of the FFCRA and, in the instances Plaintiff

is reimbursed for its Covid Testing services, has failed to reimburse Plaintiff in accordance with

Section 3202(a) of the CARES Act. These violations are made to financially benefit United and,

by acting in its own self-interests, has also caused the Employer Plans to be in violation of the

FFCRA, the CARES Act, Employee Retirement Income Security Act of 1974 (“ERISA”)

6

, and

applicable State law.

14. United has set up complex processes and procedures: (i) to deny or underpay claims

for arbitrary reasons; (ii) to force Plaintiff into a paperwork war of attrition in hopes of wearing

down Plaintiff to the point of collapse through continuous inundation of Plaintiff’s financial and

operational resources; (iii) that have turned United’s internal administrative appeals procedures

into a kangaroo court where facts and law have no relevance, thus, rendering the administrative

appeals process functionally meritless; (iv) to disinform its members, the Employer Plans and other

5

See CMS FAQ Parts 42, 43, and 44, The FFCRA and the CARES Act.

6

29 U.S.C. § 1001 et seq.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 9 of 89

Page 10 of 89

self-funded health plans that it administers, Plaintiff and other similarly situated OON providers,

the general public, and Federal and State regulators of its obligations to adjudicate Covid Testing

claims in accordance with the FFCRA and the CARES Act; and (v) to ultimately engage in

unscrupulous and fraudulent conduct for its own financial benefit during this public health

emergency.

15. United’s schemes and misconduct also violate the Racketeer Influenced and

Corrupt Organizations Act, 18 U.S.C. §§ 1961-1968 (“RICO”). United has engaged in a pattern of

racketeering activity that includes, but may not be limited to, the embezzlement and/or conversion

of welfare funds and the repeated and continuous use of mails and wires in the furtherance of

multiple schemes to defraud as detailed through this Original Complaint.

16. Furthermore, because Employer Plans have contracted with United to act as their

third-party claims administrator, the Employer Plans, through their silence and inaction, are dually

liable for United’s violations of the FFCRA, the CARES Act, and ERISA pursuant to 29 U.S.C.

§ 1105(a).

PARTIES

17. Plaintiff Diagnostic Affiliates of Northeast Hou, LLC d/b/a 24 Hour Covid RT-

PCR Laboratory is a limited liability company organized under the laws of the State of Texas, with

its company headquarters located at 22751 Professional Drive, Kingwood, Texas 77339. Plaintiff

has lawful standing to bring in all claims asserted herein.

18. Defendant UnitedHealth Group, Inc. is a publicly traded Delaware corporation with

its principal place of business in Minneapolis, Minnesota. It issues health insurance and

administers group health plans nationally through its various wholly-owned and controlled

subsidiaries, including but not limited to United Healthcare Services, Inc. UnitedHealth Group,

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 10 of 89

Page 11 of 89

Inc. may be served with process by serving its registered agent for service The Corporation Trust

Company, 1209 Orange Street, Wilmington, Delaware 19801.

19. Defendant United Healthcare Services, Inc. is a corporation organized under the

laws of the State of Minnesota, with its principal place of business in Minnetonka, Minnesota. It

is a foreign for-profit corporation operating in the State of Texas, and it issues health insurance

and administers plans that are funded by plan sponsors in Texas. It is a wholly-owned subsidiary

of UnitedHealth Group, Inc. United Healthcare Services, Inc. may be served with process by

serving its registered agent for service CT Corporation System, 1010 Dale Street N, St. Paul,

Minnesota, 55117-5603.

20. Defendant United Healthcare Benefits of Texas, Inc. is a corporation organized

under the laws of the State of Texas, with its principal place of business in Austin, Texas. It is a

for-profit corporation operating in the State of Texas, and its issues health insurance and

administers plans that are funded by plan sponsors in Texas. It is a wholly-owned subsidiary of

UnitedHealth Group, Inc. United Healthcare Benefits of Texas, Inc. may be served with process

by serving its registered agent for service CT Corporation System, 350 North St. Paul Street, Dallas

Texas 75201.

21. Defendant UnitedHealthcare of Texas, Inc. is a corporation organized under the

laws of the State of Texas, with its principal place of business in Austin, Texas. It is a for-profit

corporation operating in the State of Texas, and its issues health insurance and administers plans

that are funded by plan sponsors in Texas. It is a wholly-owned subsidiary of UnitedHealth Group,

Inc. UnitedHealthcare of Texas, Inc. may be served with process by serving its registered agent

for service CT Corporation System, 350 North St. Paul Street, Dallas Texas 75201.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 11 of 89

Page 12 of 89

22. Defendant UMR, Inc. is a corporation organized under the laws of the State of

Wisconsin, with its principal place of business in Wausau, Wisconsin. It is a foreign for-profit

corporation operating in the State of Texas and administers plans that are funded by plan sponsors

in Texas. It is a wholly-owned subsidiary of UnitedHealth Group, Inc. UMR, Inc. may be served

with process by serving its registered agent for service Commissioner of Insurance, 333 Guadalupe

Street, Austin, Texas 78701.

24. Defendant OptumHealth Care Solutions, Inc. is a corporation organized under the

laws of the State of Minnesota, with its principal place of business in Eden Prairie, Minnesota. It

is a foreign for-profit corporation operating in the State of Texas and administers plans that are

funded by plan sponsors in Texas. It is a wholly-owned subsidiary of UnitedHealth Group, Inc.

OptumHealth Care Solutions, Inc. may be served with process by serving its registered agent for

service Commissioner of Insurance, 333 Guadalupe Street, Austin, Texas 78701.

25. Defendant American International Group, Inc. Medical Plan (the “AIG Plan”) is

a self-funded health plan subject to ERISA. The AIG Plan may be served with process by serving

its Plan Administrator, Justin Orlando and/or Megan Moran, at 175 Water Street, 21

st

Floor, New

York, New York 10038.

26. Defendant Anadarko Petroleum Corp. Health Benefits Plan (the “Anadarko” Plan)

is a self-funded health plan subject to ERISA. The Anadarko Plan may be served with process by

serving its Plan Administrator, Madeline N. Pfahler, at Human Resources Department 5 Greenway

Plaza, Suite 110 Houston, TX 77046-0521.

27. Defendant Apple Inc. Health and Welfare Benefit Plan (the “Apple Plan”) is a self-

funded health plan subject to ERISA. The Apple Plan may be served with process by serving its

Plan Administrator, Grace Gippetti Munson, at One Apple Park Way Cupertino, CA 95014.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 12 of 89

Page 13 of 89

28. Defendant Group Health and Welfare Plans (Aramark Unifrom Services) (the

“Aramark plan”) is a self-funded health plan subject to ERISA. The Aramark Plan may be served

with process by serving its Plan Administrator, Cheryl Heimer, at 115 N First St Burbank, CA

91502-1856.

29. Defendant AT&T Umbrella Benefit Plan No. 1 (the “AT&T No. 1 Plan”) is a self-

funded health plan subject to ERISA. The AT&T Plan may be served with process by serving its

Plan Administrator, Paul W. Stephens, at Po Box 132160 Dallas, TX 75313-2160.

30. Defendant AT&T Umbrella Benefit Plan No. 3 (the “AT&T No. 3 Plan”) is a self-

funded health plan subject to ERISA. The AT&T Plan may be served with process by serving its

Plan Administrator, Paul W. Stephens, at Po Box 132160 Dallas, TX 75313-2160.

31. Defendant Baker Hughes, A GE Company Welfare Benefits Plan (the “Baker

Hughes Plan”) is a self-funded health plan subject to ERISA. The Baker Hughes Plan may be

served with process by serving its Plan Administrator, Bernard Casey Makel, at 17021 Aldine

Westfield Houston, TX 77073.

32. Defendant Baylor College of Medicine Health and Welfare Benefits Plan (the

“Baylor Plan”) is a self-funded health plan subject to ERISA. The Baylor Plan may be served with

process by serving its Plan Administrator, Angela Garcia and/or Tamara Norris, at C/O Accounting

One Baylor Plaza Bcm200 Houston, TX 77030.

33. Defendant Brookdale Senior Living, Inc. Welfare Plan (the “Brookdale Plan”) is a

self-funded health plan subject to ERISA. The Brookdale Plan may be served with process by

serving its Plan Administrator, Diane Johnson May, at 6737 W Washington Street Suite 2300

Milwaukee, WI 53214.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 13 of 89

Page 14 of 89

34. Defendant C.H Robinson Company Group Health Major Medical Plan (the

“Robinson Plan”) is a self-funded health plan subject to ERISA. The Robinson Plan may be served

with process by serving its Plan Administrator, John Donovan, at 14701 Charlson Rd, Eden Prairie,

Mn 55347-5076.

35. Defendant Calpine Corporation Employee Benefit Plan (the “Calpine Plan”) is a

self-funded health plan subject to ERISA. The Calpine Plan may be served with process by

serving its Plan Administrator, Tonja Benjamin, at 717 Texas Ave. Suite 1000 Houston, TX 77002.

36. Defendant Caterpillar Inc. Group Insurance Master Trust (the “Caterpillar Plan”)

is a self-funded health plan subject to ERISA. The Caterpillar Plan may be served with process

by serving its Plan Administrator, Todd Bisping, at 510 Lake Cook Road Deerfield, IL 60015.

37. Defendant Celanese Health and Welfare Benefits Program (the “Celanese Plan”)

is a self-funded health plan subject to ERISA. The Celanese Plan may be served with process by

serving its Plan Administrator, Jose A Motta, at 222 West Las Colinas Boulevard Suite 900N

Irving, TX 75039.

38. Defendant Centerpoint Energy Group Welfare Benefits Plan for Retirees (the

“Centerpoint Plan”) is a self-funded health plan subject to ERISA. The Centerpoint Plan may be

served with process by serving its Plan Administrator, Carla A. Kneipp, at 1111 Louisiana Street

Houston, TX 77002-5230.

39. Defendant Citgo Petroleum Corporation Defined Contribution Master Trust (the

“Citco Plan”) is a self-funded health plan subject to ERISA. The Citco Plan may be served with

process by serving its Plan Administrator, James R. Shoemaker, at Po Box 4689 Houston, TX

77210-4689.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 14 of 89

Page 15 of 89

40. Defendant Delta Account Based Healthcare Plan (the “Delta Plan”) is a self- funded

health plan subject to ERISA. The Delta Plan may be served with process by serving its Plan

Administrator, Greg Tahvonen, at 1030 Delta Boulevard Atlanta, GA 30354.

41. Defendant Envision Healthcare Corporation Welfare Benefits Plan (the “Envision

Plan”) is a self-funded health plan subject to ERISA. The Envision Plan may be served with

process by serving its Plan Administrator, Donald King, at 1A Burton Hills Boulevard Nashville,

TN 37215.

42. Defendant H&E Equipment Services Inc. Benefit Plan (the “H&E Plan”) is a self-

funded health plan subject to ERISA. The H&E Plan may be served with process by serving its

Plan Administrator, Angela Broocks, at 7500 Pecue Ln Baton Rouge, LA 70809-5107.

43. Defendant Flour Employee Benefit Trust Plan (the “Flour Plan”) is a self-funded

health plan subject to ERISA. The Flour Plan may be served with process by serving its Plan

Administrator, Stacy Dillow, at 6700 Las Colinas Boulevard Irving, TX 75039.

44. Defendant Fresenius Medical Care Travelling Nurses Health and Welfare Benefits

Plan (the “Fresenius Plan”) is a self-funded health plan subject to ERISA. The Fresenius Plan may

be served with process by serving its Plan Administrator, Steven Covino, at 920 Winter Street

Waltham, MA 02451.

45. Defendant Geico Corp. Consolidated Welfare Benefits Program (the “Geico

Plan”) is a self-funded health plan subject to ERISA. The Geico Plan may be served with process

by serving its Plan Administrator, H. A. White and/or J.C Stewart, at C/O Corporation Tax

Division One Geico Plaza Washington, DC 20076.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 15 of 89

Page 16 of 89

46. Defendant Geospace Technologies Welfare Benefit Plan (the “Geospace Plan”) is

a self-funded health plan subject to ERISA. The Geospace Plan may be served with process by

serving its Plan Administrator, Lacey Rice, at 7007 Pinemont Dr Houston, TX 77040-6601.

47. Defendant Hudson Group (HG) Inc. Employee Benefits Plan (the “Hudson Plan”)

is a self-funded health plan subject to ERISA. The Hudson Plan may be served with process by

serving its Plan Administrator, William Wolf, at One Meadowlands Plaza, 6th Floor East

Rutherford, NJ 07073.

48. Defendant IQOR Health and Welfare Plan (the “IQOR Plan”) is a self-funded

health plan subject to ERISA. The IQOR Plan may be served with process by serving its Plan

Administrator, Ian Carroll, at 200 Central Ave 7th Fl St Petersburg, FL 33701-3566.

49. Defendant Jones Lang Lasalle Group Benefits Plan (the “JLL Plan”) is a self-

funded health plan subject to ERISA. The JLL Plan may be served with process by serving its Plan

Administrator, Tim Quitmeyer, at 200 East Randolph Street Chicago, IL 60601.

50. Defendant Kellogg Brown & Root, Inc, Welfare Benefits Plan (the “KBR Plan”)

is a self-funded health plan subject to ERISA. The KBR Plan may be served with process by

serving its Plan Administrator, Valerie Hulse, at 601 Jefferson Street, Suite 2916 Houston, TX

77002.

51. Defendant Kinder Morgan, Inc. Master Employee Welfare Plan (the “Kinder

Morgan Plan”) is a self-funded health plan subject to ERISA. The Kinder Morgan Plan may be

served with process by serving its Plan Administrator, T. Mark Smith, at 1001 Louisiana Street,

Suite 1000, Houston, TX 77002.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 16 of 89

Page 17 of 89

52. Defendant Lexicon Pharmaceuticals Inc. Comprehensive Welfare Benefits Plan

(the “Lexicon Plan”) is a self-funded health plan subject to ERISA. The Lexicon Plan may be

served with process by serving its Plan Administrator, Jefferey L. Wade, at 8800 Technology

Forest Pl the Woodlands, TX 77381-1160.

53. Defendant Lineage Logistics LLC Benefits Plan (the “Lineage Plan”) is a self-

funded health plan subject to ERISA. The Lineage Plan may be served with process by serving

its Plan Administrator, Sean Vanderelzen, at 17911 Von Karman, Suite 400 Irvine, CA 92614.

54. Defendant Lockton, Inc. Welfare Benefits Plan (the “Lockton Plan”) is a self-

funded health plan subject to ERISA. The Lockton Plan may be served with process by serving its

Plan Administrator, Janet O’Connor, at 444 w. 47th Street Suite 900 Kansas City, MO 64112.

55. Defendant M/I Homes, Inc. Health, Life and Dental Welfare Plan (the “M/I

Homes Plan”) is a self-funded health plan subject to ERISA. The M/I Homes Plan may be served

with process by serving its Plan Administrator, Karla Cupp, at 4131 Worth Avenue Columbus,

OH 43219.

56. Defendant Maersk Inc. Active Nonunion Health and Welfare Plan (the “Maersk

Plan”) is a self-funded health plan subject to ERISA. The Maersk Plan may be served with process

by serving its Plan Administrator, Jennifer M. Swartz, at 180 Park Avenue Florham Park, NJ 07932.

57. Defendant the Mallinckrodt Pharmaceuticals Welfare Benefit Plan (the

“Mallinckrodt Plan”) is a self-funded health plan subject to ERISA. The Mallinckrodt Plan may

be served with process by serving its Plan Administrator, Cathryn Beisel, at 675 Mcdonnell

Boulevard Hazelwood, MO 63042.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 17 of 89

Page 18 of 89

58. Defendant Motiva Enterprises LLC Health and Wellness Benefit Plan (the

“Motiva Plan”) is a self-funded health plan subject to ERISA. The Motiva Plan may be served

with process by serving its Plan Administrator, Dennis Fox, at 500 Dallas St 4th Fl Houston, TX

77002-4800.

59. Defendant Novo Nordisk Inc. Welfare Benefit Plan (the “Novo Plan”) is a self-

funded health plan subject to ERISA. The Novo Plan may be served with process by serving its

Plan Administrator, Pamela Gottlieb, at 800 Scudders Mill Road Plainsboro, NJ 08536.

60. Defendant Petsmart Smartchoices Benefit Plan (the “Petsmart Plan”) is a self-

funded health plan subject to ERISA. The Petsmart Plan may be served with process by serving

its Plan Administrator, Chris Stillman, at 19601 North 27th Avenue Phoenix, AZ 85027.

61. Defendant Procter and Gamble Retiree Welfare Benefits Plan (the “Proctor and

Gamble Plan”) is a self-funded health plan subject to ERISA. The Proctor and Gamble Plan may

be served with process by serving its Plan Administrator, Kyle Schiedler, at Procter and Gamble

Tax Division P.O. Box 599 Cincinnati, OH 45201.

62. Defendant Railroad Employees National Health Flexible Spending Account Plan

(the “Railroad Plan”) is a self-funded health plan subject to ERISA. The Railroad Plan may be

served with process by serving its Plan Administrator, Brendan M. Brandon, 251 - 18TH Street,

South, Suite 750, Arlington, VA 22202.

63. Defendant Raising Canes USA Health and Welfare Benefits Wrap Plan (the

“Raising Canes Plan”) is a self-funded health plan subject to ERISA. The Raising Canes Plan may

be served with process by serving its Plan Administrator, Ashlee Glock, 6800 Bishop Road Plano,

TX 75024.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 18 of 89

Page 19 of 89

64. Defendant Republic Services Inc. Employee Benefit Plan (the “Republic

Services Plan”) is a self-funded health plan subject to ERISA. The Republic Services Plan may be

served with process by serving its Plan Administrator, Ann Reed, 18500 North Allied Way

Phoenix, AZ 85054.

65. Defendant Republic National Distributing Company, LLC Welfare Benefits Plan

(the “Republic National Plan”) is a self-funded health plan subject to ERISA. The Republic

National Plan may be served with process by serving its Plan Administrator, Shannon Dacus,

One National Drive, S.W. Atlanta, GA 30336.

66. Defendant Saia Motor Freight Line LLC Employee Preferred Provider Plan (the

“Saia Plan”) is a self-funded health plan subject to ERISA. The Saia Plan may be served with

process by serving its Plan Administrator, Kristy Roger, 11465 Johns Creek Parkway Suite 400

Johns Creek, GA 30097.

67. Defendant Siemens Corporation Group Insurance and Flexible Benefits Program

(the “Siemens Plan”) is a self-funded health plan subject to ERISA. The Siemens Plan may be

served with process by serving its Plan Administrator, Ewout Naarding, 170 Wood Ave. South

Iselin, NJ 08830.

68. Defendant Skadden, Arps, Slate, Meagher & Flom Partners’ Welfare Benefits Plan

(the “Skadden Plan”) is a self-funded health plan subject to ERISA. The Skadden Plan may be

served with process by serving its Plan Administrator, Joseph M. Penko, Lisa Gross, One

Manhattan West New York, NY 10001-8602.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 19 of 89

Page 20 of 89

69. Defendant Skywest Inc. Cafeteria Plan (the “Skywest Plan”) is a self-funded

health plan subject to ERISA. The Skywest Plan may be served with process by serving its Plan

Administrator, Robert J. Simmons, 444 South River Road St. George, UT 84790.

70. Defendant Southwest Airlines Co. Welfare Benefit Plan (the “Southwest Plan”) is

a self-funded health plan subject to ERISA. The Southwest Plan may be served with process by

serving its Plan Administrator, Julie Weber, 2702 Love Field Drive, Hdq-6tx Dallas, TX 75235.

71. Defendant Spirit Airlines Inc. Health and Welfare Benefits Plan (the “Spirit Plan”)

is a self-funded health plan subject to ERISA. The Spirit Plan may be served with process by

serving its Plan Administrator, Carolyn Hernandez, 2800 Executive Way Miramar, FL 33025.

72. Defendant Swissport North America Holdings, Inc. Health & Welfare Plan (the

“Swissport Plan”) is a self-funded health plan subject to ERISA. The Swissport Plan may be served

with process by serving its Plan Administrator, Giancarlo Ladaga, 45025 Aviation Drive Dulles,

VA 20166.

73. Defendant Targa Resources LLC Welfare Benefits Plan (the “Targa Plan”) is a self-

funded health plan subject to ERISA. The Targa Plan may be served with process by serving its

Plan Administrator, Jennifer Kneale, 811 Louisiana St. Suite 2100 Houston, TX 77002.

74. Defendant Texas Capital Bancshares Inc. Employee Benefit Plan (the “Texas

Capital Plan”) is a self-funded health plan subject to ERISA. The Texas Capital Plan may be served

with process by serving its Plan Administrator, Mandy Barrera, 2000 Mckinney Ave Ste 700

Dallas, TX 75201.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 20 of 89

Page 21 of 89

75. Defendant Textron Non-Bargained Welfare Benefits Plan (the “Textron Plan”) is a

self-funded health plan subject to ERISA. The Textron Plan may be served with process by serving

its Plan Administrator, Joyce Lafond, 40 Westminster Street Providence, RI 02903.

76. Defendant Adecco, Inc Welfare Benefits Plan (the “Adecco Plan”) is a self-funded

health plan subject to ERISA. The Adecco Plan may be served with process by serving its Plan

Administrator, Brian P. Evans, 10151 Deerwood Park Blvd Building 200, Suite 400 Jacksonville,

FL 32256.

77. Defendant T-Mobile USA, Inc. Employee Benefit Plan (the “T-Mobile Plan”) is a

self-funded health plan subject to ERISA. The T-Mobile Plan may be served with process by

serving its Plan Administrator, Kate Blaylock, 12920 Se 38th Street Bellevue, WA 98006.

78. Defendant Transocean Group Welfare Benefits Plan (the “Transocean Plan”) is a

self-funded health plan subject to ERISA. The Transocean Plan may be served with process by

serving its Plan Administrator, Nathaniel Peneguy, P.O. Box 10342, 36C Dr. Roy's Drive Bermuda

House, 4th Floor Cayman Islands, Grand Cayman 1-1003 KY KY.

79. Defendant UHS Welfare Benefit Plan (the “UHS Welfare Plan”) is a self-funded

health plan subject to ERISA. The UHS Welfare Plan may be served with process by serving its

Plan Administrator, Virginia Cullinan, 367 South Gulph Road King of Prussia, PA 19406.

80. Defendant UnitedHealth Group Ventures, LLC Health and Welfare Benefit Plan

(the “UnitedHealth Group Plan”) is a self-funded health plan subject to ERISA. The UnitedHealth

Group Plan may be served with process by serving its Plan Administrator, Rob Webb, 9900 Bren

Road East Mn008-B217 Minnetonka, MN 55343.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 21 of 89

Page 22 of 89

81. Defendant Valero Energy Corporation Retiree Benefits Plan (the “Valero Plan”) is

a self-funded health plan subject to ERISA. The Valero Plan may be served with process by serving

its Plan Administrator, Christina Jennings, P.O. Box 696000 San Antonio, TX 78269, One Valero

Way MS E1T San Antonio, TX 78249.

82. Defendant Valmont Industries Inc. Welfare Benefit Plan (the “Valmont Plan”) is a

self-funded health plan subject to ERISA. The Valmont Plan may be served with process by

serving its Plan Administrator, Jennifer Paisley, One Valmont Plaza Omaha, NE 68154.

83. Defendant Walgreen Health and Welfare Plan (the “Walgreen Plan”) is a self-

funded health plan subject to ERISA. The Walgreen Plan may be served with process by serving

its Plan Administrator, Todd Bajek, 102 Wilmot Road MS#122H Deerfield, IL 60015

84. Defendant WCA Management Company, LP Welfare Benefit Plan (the “WCA

Plan”) is a self-funded health plan subject to ERISA. The WCA Plan may be served with process

by serving its Plan Administrator, Joe Saad, 1330 Post Oak Boulevard, 7th Floor Houston, TX

77056.

85. Defendant Webber, LLC Welfare Benefit Plan (the “Webber Plan”) is a self-

funded health plan subject to ERISA. The Webber Plan may be served with process by serving

its Plan Administrator, Jared Branch, 1725 Hughes Landing Blvd Suite 1200 The Woodlands, TX

77380.

86. Defendant Winstead PC Flexible Benefit Plan (the “Winstead Plan”) is a self-

funded health plan subject to ERISA. The Winstead Plan may be served with process by serving

its Plan Administrator, Lydia Dillon, 2728 N Harwood Street Suite 500 Dallas, TX 75201.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 22 of 89

Page 23 of 89

87. Defendant Group Benefits Plan for Employees of Worleyparsons Corporation (the

“Worleyparsons Plan”) is a self-funded health plan subject to ERISA. The Worleyparsons Plan

may be served with process by serving its Plan Administrator, Jennifer Miller, 2675 Morganton

Road, Reading, PA 19607-9676.

JURISDICTION ANE VENUE

88. This Court has federal question subject matter jurisdiction over this matter pursuant

to 28 U.S.C. § 1131, as Plaintiff asserts federal claims against United and Employer Plans in

Counts I, II, and III, under the FFCRA, the CARES Act, and ERISA.

89. This Court also has federal question subject matter jurisdiction over this matter

pursuant to 28 U.S.C. § 1131, as Plaintiff asserts federal claims against United in Count IV, under

RICO.

90. This Court also has supplemental jurisdiction over Plaintiff’s state law claims

against United, in Counts V, VI, VII, VIII, and IX because these claims are so related to Plaintiff’s

federal claims that the state law claims form a part of the same case or controversy under Article

III of the United States Constitution. The Court has supplemental jurisdiction over these claims

pursuant to 28 U.S.C. § 1367(a).

91. Venue is appropriate in this Court under 28 U.S.C. § 1391(b)(2) because a

substantial portion of the events giving rise to this action arose in this District.

[INTENTIONALLY LEFT BLANK]

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 23 of 89

Page 24 of 89

BACKGROUND AS TO THE FFCRA AND THE CARES ACT

92. Pursuant to Section 319 of the Public Health Service Act, on January 31, 2020, the

Secretary of Health and Human Services (“HHS”) issued a determination that a Public Health

Emergency exists and has existed as of January 27, 2020, due to confirmed cases of COVID-19

being identified in this country.

7

93. On March 13, 2020, the President issued Proclamation 9994 declaring a National

Emergency concerning the COVID-19 outbreak with a determination that a national emergency

exists nationwide, pursuant to Section 501(b) of the Robert T. Stafford Disaster Relief and

Emergency Assistance Act.

94. To facilitate the nation’s response to the COVID-19 pandemic, Congress passed

the FFCRA and the CARES Act to, amongst other things, require group health plans and health

insurance issuers offering group or individual health insurance coverage to: (i) provide benefits

for certain items and services related to diagnostic testing for the detection or diagnosis of COVID-

19 without the imposition of any cost-sharing requirements (i.e. deductibles, copayments, and

coinsurance) or prior authorization or other medical management requirements;

8

and (ii) to

reimburse any provider for COVID-19 diagnostic testing an amount that equals the negotiated rate

or, if the plan or issuer does not have a negotiated rate with the provider (e.g. Plaintiff), the cash

price for such service that is listed by the provider on its public website in accordance with 45 CFR

§ 182.40.

9

95. To further clarify to issuers and health plans their legal expectations when

processing a claim for Covid Testing in accordance with the FFCRA and the CARES Act, the

7

See https://www.phe.gov/emergency/news/healthactions/phe/Pages/2019-nCoV.aspx (Determination that a Public

Health Emergency Exists).

8

Pub. L. No. 116-127 (2020).

9

Pub. L. No. 116-136 (2020).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 24 of 89

Page 25 of 89

Department of Labor (“DOL”), the Department of Health and Human Services (“HHS”), and the

Department of the Treasury (the “Treasury”) (collectively, the “Departments”) jointly prepared

and issued a series of Frequently Asked Questions (“FAQs”) to address any stakeholder questions

or concerns pertaining to the proper adjudication of Covid Testing claims. The following FAQs

summarize the health plan and issuers’ obligations as it pertains to covering and paying for Covid

Testing services during the public health emergency:

The Departments FAQ, Part 42, Q1: Which types of group health plans and health insurance

coverage are subject to section 6001 of the FFCRA, as amended by section 3201 of the CARES

Act?

Section 6001 of the FFCRA, as amended by section 3201 of the CARES Act, applies to group

health plans and health insurance issuers offering group or individual health insurance coverage

(including grandfathered health plans as defined in section 1251(e) of the Patient Protection and

Affordable Care). The term “group health plan” includes both insured and self-insured group health

plans. It includes private employment-based group health plans (ERISA plans), non-federal

governmental plans (such as plans sponsored by states and local governments), and church plans.

“Individual health insurance coverage” includes coverage offered in the individual market through

or outside of an Exchange, as well as student health insurance coverage (as defined in 45 CFR

147.145).

10

The Departments FAQ, Part 42, Q3: What items and services must plans and issuers provide

benefits for under section 6001 of the FFCRA?

Section 6001(a) of the FFCRA, as amended by Section 3201 of the CARES Act, requires plans and

issuers to provide coverage for the following items and services:

(1) An in vitro diagnostic test as defined in section 809.3 of the title 21, Code of Federal

Regulations, (or its successor regulations) for the detection of SARS-CoV-2 or the diagnosis of

COVID-19, and the administration of such a test, that - …

B. The developer has requested, or intends to request, emergency use authorization

under section564 of the Federal Food, Drug, and Cosmetic Act (21 U.S.C. 360bbb-3), unless and

until the emergency use authorization request under such section 564 has been denied or the

developer of such test does not submit a request under such section within a reasonable

timeframe;…

11

10

See https://www.cms.gov/files/document/FFCRA-Part-42-FAQs.pdf.

11

Id.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 25 of 89

Page 26 of 89

The Departments FAQ, Part 42, Q6: May a plan or issuer impose any cost-sharing requirements,

prior authorization requirements, or other medical management requirements for benefits that

must be provided under section 6001(a) of the FFCRA, as amended by section 3201 of the CARES

Act?

No. Section 6001(a) of the FFCRA provides that plans and issuers shall not impose any cost-sharing

requirements (including deductibles, copayments, and coinsurance), prior authorization

requirements, or other medical management requirements for these items and services. These items

and services must be covered without cost sharing when medically appropriate for the individual,

as determined by the individual’s attending healthcare provider in accordance with accepted

standards of current medical practice.

12

The Departments FAQ, Part 42, Q7: Are plans and issuers required to provide coverage for

items and services that are furnished by providers that have not agreed to accept a negotiated rate

as payment in full (i.e., out-of-network providers)?

Yes. Section 3202(a) of the CARES Act provides that a plan or issuer providing coverage of items

and services described in section 6001(a) of the FFCRA shall reimburse the provider of the

diagnostic testing as follows: …

2. If the plan or issuer does not have a negotiated rater with such provider, the plan or issuer

shall reimburse the provider in an amount that equals the cash price for such service as listed by

the provider on a public internet website, or the plan or issuer may negotiate a rate with the provider

for less than such cash price…

13

The Departments FAQ, Part 43, Q9: Does Section 3202 of the CARES Act protect participants,

beneficiaries, and enrollees from balance billing for a COVID-19 diagnostic test?

The Departments read the requirement to provide coverage without cost sharing in section 6001 of

the FFCRA, together with section 3202(a) of the CARES Act establishing a process for setting

reimbursement rates, as intended to protect participants, beneficiaries, and enrollees from being

balance billed for an applicable COVID-19 test. Section 3202(a) contemplates that a provider of

COVID-19 testing will be reimbursed either a negotiated rate or an amount that equals the cash

price for such service that is listed by the provider on a public website. In either case, the amount

the plan or issuer reimburses the provider constitutes payment in full for the test, with no cost

sharing to the individual or other balance due. Therefore, the statute generally precludes balance

billing for COVID-19 testing. However, section 3202(a) of the CARES Act does not preclude

balance billing for items and services not subject to section 3202(a), although balance billing may

be prohibited by applicable state law and other applicable contractual agreements.

14

12

Id.

13

Id.

14

See https://www.cms.gov/files/document/FFCRA-Part-43-FAQs.pdf; See also FAQ Part 43 Q12: … Because the

Departments interpret the provisions of section 3202 of the CARES Act as specifying a rate that generally protects

participants, beneficiaries, and enrollees from balance billing for a COVID-19 test (see Q9 above), the requirement to

pay the greatest of three amounts under the regulations implementing section 2719A of the PHS Act is superseded by

the requirements of section 3202(a) of the CARES Act with regard to COVID-19 diagnostic tests that are out-of-

network emergency services. For these services, the plan or issuer must reimburse an out-of-network provider of

COVID-19 testing an amount that equals the cash price for such service that is listed by the provider on a public

website, or the plan or issuer may negotiate a rate that is lower than the cash price.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 26 of 89

Page 27 of 89

The Departments FAQ, Part 44, Q1: Under the FFCRA, can plans and issuers use medical

screening criteria to deny (or impose cost sharing on) a claim for COVID-19 diagnostic testing for

an asymptomatic person who has no known or suspected exposure to COVID-19?

No. The FFCRA prohibits plans and issuers from imposing medical management, including

specific medical screening criteria, on coverage of COVID-19 diagnostic testing. Plans and issuers

cannot require the presence of symptoms or a recent known or suspected exposure, or otherwise

impose medical screening criteria on coverage of tests.

When an individual seeks and receives a COVID-19 diagnostic test from a licensed or authorized

health care provider, or when a licensed or authorized health care provider refers an individual for

a COVID-19 diagnostic test, plans and issuers generally must assume that the receipt of the test

reflects an “individualized clinical assessment” and the test should be covered without cost sharing,

prior authorization, or other medical management requirements.

15

The Departments FAQ, Part 44, Q3: Under the FFCRA, are plans and issuers required to cover

COVID-19 diagnostic tests provided through state- or locality-administered testing sites?

Yes. As stated in FAQs Part 43, Q3, any health care provider acting within the scope of their license

or authorization can make an individualized clinical assessment regarding COVID-19 diagnostic

testing. If an individual seeks and receives a COVID-19 diagnostic test from a licensed or

authorized provider, including from a state- or locality-administered site, a “drivethrough” site,

and/or a site that does not require appointments, plans and issuers generally must assume that the

receipt of the test reflects an “individualized clinical assessment.”

16

The Departments FAQ, Part 44, Q5: What items and services are plans and issuers required to

cover associated with COVID-19 diagnostic testing? What steps should plans and issuers take to

help ensure compliance with these requirements?

… Plans and issuers should maintain their claims processing and other information technology

systems in ways that protect participants, beneficiaries, and enrollees from inappropriate cost

sharing and should document any steps that they are taking to do so…

17

96. To supplement the FAQs publicized by the Departments, the Internal Revenue

Service (the “IRS”) issued Notice 2020-15 pertaining to high deductible health plans (“HDHPs”)

and expenses related to COVID-19 to provide members of HDHPs (including those HDHPs

insured or administered by United) the confidence that Covid Testing will be covered, in full, by

their HDHP. Notice 2020-15 states as follows:

15

See https://www.cms.gov/files/document/faqs-part-44.pdf.

16

Id.

17

Id.

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 27 of 89

Page 28 of 89

[d]ue to the unprecedented public health emergency posed by COVID-19, and the

need to eliminate potential administrative and financial barriers to testing for and

treatment of COVID-19 [emphasis added], a health plan that otherwise satisfies the

requirements to be an HDHP under section 223(c)(2)(A) will not fail to be an

HDHP merely because the health plan provides medical care services and items

purchased related to testing for and treatment of COVID-19 prior to the satisfaction

of the applicable minimum deductible.

97. In addition to the federal guidance publicized by the Departments, the Texas

Department of Insurance (“TDI”) issued Commissioner’s Bulletin # B-0017-20, which also

pertains to coverage for COVID-19 testing and network adequacy. In this Bulletin, TDI mandates

exclusive provider networks (“EPOs”) and health maintenance organizations (“HMOs”) to comply

with the Covid Testing adjudication requirements of the FFCRA and the CARES Act, and

“instructs health plans to pay a provider’s negotiated rate or, if a health plan does not have a

negotiated rate with the provider, pay the provider’s publicly available cash price for testing

[emphasis added].”

18

[INTENTIONALLY LEFT BLANK]

18

In an inquiry posed by Plaintiff to TDI pertaining to the applicability of Commissioner’s Bulletin #B-0017-20 to

PPO and POS plans, TDI states the following: “Yes, it is TDI’s position that PPO and POS plans must also comply

with FFCRA and the ‘CARES Act’ … Commissioner’s Bulletin #B-0017-20 made it expressly clear that in-network

based plans, “insurers offering exclusive provider networks (EPOs) and health maintenance organizations (HMOs)…

fall within the federal definitions for group health plans or health insurance issuers offering group or individual health

insurance coverage.” Presumably, the purpose of the bulletin was to expressly clarify for network-based plans such as

EPOs and gated HMO plans our expectation to protect consumers regardless of network affiliation, as contemplated

by the CARES Act and by Texas’ laws. PPO and EPO issuers are subject to but not limited to Texas Insurance Code

(TIC) Chapter 1301. HMOs may issue POS plans as required under TIC Chapter 1273. As PPO and POS plans are

captured under the terms “issuer”, “HMO”, “group health plans”, “health insurance issuers”, and “individual health

insurance coverage”; PPO and POS plans are not excluded from compliance.”

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 28 of 89

Page 29 of 89

UNITED’S PUBLIC-FACING REPRESENTATIONS REGARDING COMPLIANCE

WITH THE FFCRA, THE CARES ACT, AND OTHER APPLICABLE AUTHORITIES

98. Since the start of the public health emergency and Congress’s passing of the

FFCRA and the CARES Act, United has consistently made public-facing representations

regarding its obligations to comply with the requirements of the FFCRA and the CARES Act and

to process Covid Testing claims accordingly. These representations can be found on United’s

websites and other publications.

99. The following are public-facing statements made by United on its websites and

other publications regarding its obligations to process Covid Testing service claims in accordance

with the FFCRA and the CARES Act:

Our Response to COVID-19

19

[INTENTIONALLY LEFT BLANK]

19

https://www.uhc.com/health-and-wellness/health-topics/covid-19/our-response (June 16, 2021).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 29 of 89

Page 30 of 89

COVID-19 Testing and Cost Share Guidance

20

COVID-19 Testing, Treatment, Coding & Reimbursement

21

20

https://www.uhcprovider.com/en/resource-library/news/Novel-Coronavirus-COVID-19/covid19-testing/covid19-

testing-guidance.html (June 16, 2021).

21

https://www.uhcprovider.com/en/resource-library/news/Novel-Coronavirus-COVID-19/covid19-testing.html

(June 16, 2021).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 30 of 89

Page 31 of 89

United Healthcare COVID-19 Billing Guide

22

Your Questions Answered

23

COVID-19 Temporary Provisions

24

22

https://www.uhcprovider.com/content/dam/provider/docs/public/resources/news/2020/covid19/UHC-COVID-19-

Provider-Billing-Guidance.pdf (June 16, 2021).

23

https://www.uhc.com/health-and-wellness/health-topics/covid-19/your-questions-answered (June 16, 2021).

24

https://www.uhcprovider.com/content/dam/provider/docs/public/resources/news/2020/covid19/COVID-19-Date-

Provision-Guide.pdf (June 16, 2021).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 31 of 89

Page 32 of 89

Understanding COVID-19 Testing and Treatment Coverage

25

United FAQ Regarding All Savers

26

[INTENTIONALLY LEFT BLANK]

25

https://www.uhc.com/health-and-wellness/health-topics/covid-19/coverage-and-resources (June 16, 2021).

26

https://www.uhc.com/content/dam/uhcdotcom/en/B2B-Newsletters/b2b-pdf/covid-19/faqs-all savers.pdf (June 16,

2021).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 32 of 89

Page 33 of 89

United FAQ Regarding Federal Guidance

27

United FAQ Regarding ASO – Business Disruption and Stop Loss Support

28

27

https://www.uhc.com/content/dam/uhcdotcom/en/B2B-Newsletters/b2b-pdf/covid-19/faqs-federal guidance.pdf

(June 16, 2021).

28

https://www.uhc.com/content/dam/uhcdotcom/en/B2B-Newsletters/b2b-pdf/covid-19/faqs

aso business disruption and stop loss.pdf (June 16, 2021).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 33 of 89

Page 34 of 89

United FAQ Regarding Products and Programs

29

[INTENTIONALLY LEFT BLANK]

29

https://www.uhc.com/content/dam/uhcdotcom/en/B2B-Newsletters/b2b-pdf/covid-19/faqs-

programs and products.pdf (June 16, 2021).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 34 of 89

Page 35 of 89

United FAQ Regarding Testing

30

30

https://www.uhc.com/content/dam/uhcdotcom/en/B2B-Newsletters/b2b-pdf/covid-19/faqs-testing.pdf (June 16,

2021).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 35 of 89

Page 36 of 89

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 36 of 89

Page 37 of 89

31

United FAQ Regarding Claims and Appeals

32

100. Despite these numerous public-facing representations directed towards its

members, to health plans that it administers (including the Employer Plans), and providers of

Covid Testing services (e.g., Plaintiff), United’s actions and conduct, to be detailed below, shows

its intentional disregard for complying with all applicable authorities.

31

The CDC’s Covid Testing provider/laboratory search function identifies Plaintiff as an eligible lab and testing site

to receive Covid Testing. Further, United’s Covid Testing provider/laboratory search functions also lead to Plaintiff’s

laboratory and testing locations.

32

https://www.uhc.com/content/dam/uhcdotcom/en/B2B-Newsletters/b2b-pdf/covid-19/faqs-claims.pdf (June 16,

2021).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 37 of 89

Page 38 of 89

FACTUAL ALLEGATIONS COMMON TO ALL COUNTS

a. The Improper Record Request Scheme and the Imposition of Prohibited Medical

Management Requirements

101. As explained above, Section 6001 of the FFCRA expressly prohibits the imposition

of medical management requirements as a condition of coverage and reimbursement for Covid

Testing services regardless of whether the testing provider is in-network or OON.

102. However, despite this prohibition, United implemented an unlawful scheme that

consists of improper, irrelevant, and burdensome medical record requests to Plaintiff for the sole

purpose of denying as many claims for bona fide Covid Testing services submitted by Plaintiff as

possible (the “Improper Record Request Scheme”). The details of United’s Improper Record

Request Scheme are set forth below.

i. Details of United’s Improper Record Request Scheme

103. Regardless of the fact that Plaintiff is a CLIA certified high complexity laboratory,

holds all proper FDA emergency use authorizations and approvals necessary, and is identified by

the CDC and Texas Department of State Health Services Covid Testing locator functions as a

qualified laboratory to render Covid Testing services, United deployed its Improper Record

Request Scheme against Plaintiff with the intended purpose of placing barriers and denying Covid

Testing claims for its own financial benefit.

104. Since the time Plaintiff commenced with submitting Covid Testing claims to

United for reimbursement, United almost immediately responded with sending identical pre-

payment record request letters to Plaintiff for the following materials:

• Physician’s orders for the laboratory test, including any standing orders and/or

provider custom panel orders, whether for the ordering provider or all referring

providers;

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 38 of 89

Page 39 of 89

• Laboratory testing method, specimen type, and test results related to all billed

services;

• CLIA Documentation (certificates, licenses, permits, etc.);

• Manufacturer and model number of the testing equipment used for billed

services; and

• Manufacturer and brand information for all test supplies used for billed

services.

105. United’s request for the aforementioned records for almost every claim submitted

conflicts with the presumption created by FFCRA, the CARES Act, and supportive guidance that

all Covid Testing claims submitted to issuers or health plans for reimbursement are medically

appropriate, ordered by a licensed medical professional, and that the receipt of the test reflects an

“individualized clinical assessment”.

33

These record requests conflict with this presumption and is

an overly burdensome and improper condition of payment to Plaintiff.

106. Of important note, aside from a copy of a signed order form from a medical

professional establishing the need for Covid Testing, the rest of the records/materials requested by

United on almost every single claim are not unique to that particular Covid Testing claim. Instead,

requests for laboratory testing methods, CLIA documentation, and testing equipment and supplies

information should be directly made to the provider of such services and should not be used to

expand the scope by which pre-payment record request denials may be made by United on a claim-

by-claim basis.

33

The Departments FAQ, Part 44, Q3: Under the FFCRA, are plans and issuers required to cover COVID-19

diagnostic tests provided through state- or locality-administered testing sites?

Yes. As stated in FAQs Part 43, Q3, any health care provider acting within the scope of their license or authorization

can make an individualized clinical assessment regarding COVID-19 diagnostic testing. If an individual seeks and

receives a COVID-19 diagnostic test from a licensed or authorized provider, including from a state- or locality-

administered site, a “drivethrough” site, and/or a site that does not require appointments, plans and issuers generally

must assume that the receipt of the test reflects an “individualized clinical assessment.”

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 39 of 89

Page 40 of 89

107. Furthermore, when United made medical record requests on a claim-by-claim basis

to Plaintiff, United’s Special Investigations Unit (the “SIU”) simultaneously made the same record

requests directly to Plaintiff on October 8, 2020, and November 16, 2020, for the purpose of

“confirming the logistics and the capability of the laboratory to provide services to UHC [United]

patients.”

34

As part of United SIU’s investigation, the following information and materials were

requested:

• Laboratory Identification Information (e.g., Name, NPI, EIN, Address);

• CLIA Certification Information and Scope of Laboratory Services;

• Laboratory Director and Other Personnel Information;

• Premises and Security Information; and

• Laboratory Equipment and Supplies Information.

108. The requested information and materials were provided to United on November 17,

2020.

35

Since this date, United has not contacted Plaintiff regarding any supplemental or

subsequent requests, made any additional inquiries regarding the legitimacy of Plaintiff, expressed

any concerns about Plaintiff and its ability to render Covid Testing services, nor informed Plaintiff

about the status of its investigation. In fact, Plaintiff inquired with United’s SIU regarding the

status of the investigation and notified United’s SIU that if no response was received within a set

time period, the SIU investigation shall be de facto closed.

36

United’s SIU did not respond.

109. Given that United’s claim-by-claim record requests and United’s SIU record

request both commenced in October 2020, Plaintiff reasonably assumed, as would any reasonably

prudent person, that the purpose of the requests were to confirm that Plaintiff is a qualified lab

34

See Exhibit A (United SIU Record Request Letters dated October 8, 2020, and November 16, 2020).

35

See Exhibit B (United SIU Record Request Proof of Submission on November 17, 2020).

36

See Exhibit C (Plaintiff Email to United re the Status of SIU Investigation dated May 19, 2021).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 40 of 89

Page 41 of 89

capable of rendering Covid Testing services. Therefore, Plaintiff complied with both the claim-

by-claim and UHC SIU requests. However, even though Plaintiff directly provided United’s SIU

with the information and materials that were requested and provided substantially similar materials

on the claim-by-claim requests, United unreasonably continued with making the same generic

requests for information by the thousands which leads Plaintiff to believe that United has not even

reviewed the materials provided and is purposefully leading Plaintiff along.

110. The thousands upon thousands of requests for the same information and materials

specific to the qualifications and abilities of Plaintiff has overwhelmed and inundated Plaintiff;

thus, allowing United to deny thousands of claims on the technicality that Plaintiff did not provide

the requested records within the time period prescribed by United despite the same materials and

information being provided to United and its SIU nearly 2,000 times.

111. Furthermore, even when Plaintiff does submit records to United on claim-specific

requests, United has created arbitrary criteria to review records that are inconsistently applied for

the purpose of denying or substantially underpaying on the majority of Covid Testing claims that

Plaintiff has provided requested records for. The arbitrary records review process in furtherance

of the Improper Record Request Scheme is explained below.

ii. United’s Arbitrary and Inconsistent Review of Requested Records

112. Because Plaintiff only provides Covid Testing services and no other laboratory

services, Plaintiff is in the unique position that all claims being electronically submitted to United

via the HCFA-1500 forms are uniformly constructed and submitted. Given the uniformity of the

Covid Testing services and the electronic claims being submitted to United coupled with the

Federal and State mandates that require United to process Covid Testing claims submitted by OON

providers in a very singular fashion, Plaintiff’s very reasonable expectation was that all Covid

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 41 of 89

Page 42 of 89

Testing claims should be paid at Plaintiff’s cash price since United, to date, has not even attempted

to negotiate an amount to be paid despite Plaintiff’s good faith attempts to do so.

113. Leaving aside the unlawful and burdensome nature of United’s Improper Record

Request Scheme, Plaintiff also assumed that compliance with United’s claim-by-claim record

requests would lead to a consistent review and adjudication of Plaintiff’s Covid Testing claims

since all Covid Testing claims and requested records submitted to United are the same or

substantially similar. That is far from the case.

114. By way of example, below are two Covid Testing claims submitted to United where

United also requested records from Plaintiff for that particular claim. Despite the same Covid

Testing services being provided to these two patients, who are members of health plans either

insured or administered by United and the same records being submitted to United on behalf of

these two members’ claims, United’s adjudication of these claims had two different outcomes.

115. Patient JF received Covid Testing services from Plaintiff on July 31, 2020, and is a

member of an HMO plan that is fully-insured by United and subject to the jurisdiction of TDI;

therefore, this particular Covid Testing claim should be adjudicated in accordance with TDI

Commissioner’s Bulletin No. B-0017-20 which mandates compliance with the FFCRA and the

CARES Act. A copy of Patient JF’s electronic HCFA-1500 claims form is copied below:

[INTENTIONALLY LEFT BLANK]

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 42 of 89

Page 43 of 89

116. Upon receipt of Patient JF’s claim, United requested records from Plaintiff, and

those records were submitted to United on November 6, 2020.

37

Surprisingly, United allowed and

paid the full cash price on this claim; however, for the Covid Testing claim detailed below, the

37

See Exhibit D (Medical Records Submitted to United on Patient JF’s Claim).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 43 of 89

Page 44 of 89

outcome of the record review is completely different despite the fact that the HCFA 1500 forms

and the records submitted to United being the same.

117. Patient MM also received Covid Testing services from Plaintiff on July 31, 2020,

and is a member of an PPO plan that is fully-insured by United and subject to the jurisdiction of

TDI; therefore, like Patient JF’s claim, this particular Covid Testing claim should also be

adjudicated in accordance with TDI Commissioner’s Bulletin No. B-0017-20 which mandates

compliance with the FFCRA and the CARES Act. A copy of Patient MM’s electronic HCFA-1500

claims form is copied below:

[INTENTIONALLY LEFT BLANK]

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 44 of 89

Page 45 of 89

118. Upon receipt of Patient MM’s claim, United requested records from Plaintiff and

those records were submitted to United on November 12, 2020.

38

Instead of adjudicating Patient

MM’s Covid Testing claim in the same manner as Patient JF’s claim, United denied the claim for

38

See Exhibit E (Medical Records Submitted to United on Patient MM’s Claim).

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 45 of 89

Page 46 of 89

the following reasons:

119. It is clear that Patient MM’s claim does not lack information or billing errors, and

the records provided to United are not incomplete or deficient because Patient JF’s claim did not

lack information or have any billing errors, nor did the records submitted to United on Patient JF’s

claim lack any information or were deficient in any way.

120. In furtherance of its Improper Record Request Scheme, United makes the following

misrepresentations to Patient MM and other United members’ whose claims are denied for the

same or similar reasons:

Case 2:21-cv-00131 Document 2 Filed on 06/29/21 in TXSD Page 46 of 89

Page 47 of 89

121. United makes these misrepresentations to Patient MM and other United members,

whose claims are denied for the same or similar reasons, despite knowing that these comments are

categorically false. These misrepresentations are meant to make a scapegoat of Plaintiff to United

members and to health plans that United administers (e.g. Employee Plans) when members’ claims

are denied for purported issues or deficiencies with claim submissions and/or Plaintiff’s medical

records.

122. Plaintiff contacted United on May 21, 2021, specifically regarding the

inconsistency of how Patient JF and Patient MM’s Covid Testing claims were adjudicated. By the

United representative’s own admission, there are no differences between Patient JF and Patient

MM’s claim, and Patient MM’s claim should have been adjudicated in the same manner as Patient

JF’s claim.

123. The United representative informed Plaintiff that the Patient MM’s claim would be

reprocessed and paid in accordance with Patient JF’s claim within 15 days from the date of the

call, but, as of the date of this Original Complaint, Patient MM’s claim remains denied.

124. The United representative further explains that claims and the records provided in

response to each record request may not be reviewed under one singular approach, and, if reviewed

under one singular approach, that each United representative tasked with reviewing the Covid

Testing claims has different learning curves. Therefore, no level of consistency in the adjudication

of Covid Testing claims can be achieved, even if those same claims are identical to one another.

125. United’s failures to provide proper training, policies, and instructions to its