DRAFT PROSPECTUS

Dated []

(To be updated on filing with ROC)

RISK IN RELATION TO THE ISSUE

This being the first issue of Equity Shares of the Company, there has been no formal market for the Equity Share of the Company. The face

value of the Equity Share is Rs 10/- and the Issue Price is 1.0 time of the face value at the lower end of the price band and 1.2 times

at the higher end of the price band. The Issue Price (has been determined and justified by the Lead Manager and the Issuer Company as

stated under the paragraph "Basis for Issue Price" on page no 39 of this Draft Prospectus) should not be taken to be indicative of the

market price of the Equity Shares after the Equity Shares are listed. No assurance can be given regarding an active or sustained trading in

the Equity Shares of the Company or regarding the price at which the Equity Shares will be traded after listing.

The Company has not opted for IPO grading.

GENERAL RISKS

Investments in Equity and Equity-related securities involve a degree of risk and investors should not invest any funds in this Issue unless

they can afford to take the risk of losing their investment. Investors are advised to read the risk factors carefully before taking an investment

decision in this Issue. For taking an investment decision, investors must rely on their own examination of the Company and the Issue

including the risks involved. The Equity shares offered in the Issue have not been recommended or approved by the Securities and Exchange

Board of India ("SEBI"), nor does SEBI guarantee the accuracy or adequacy of this Draft Prospectus. Specific attention of the investors is

invited to the section "Risk Factors" beginning on page vii of this Draft Prospectus.

ISSUER'S ABSOLUTE RESPONSIBILITY

The Company having made all reasonable inquiries, accepts responsibility for and confirms that this Draft Prospectus contains all information

with regard to the Company and the Issue, which is material in the context of the Issue, that the information contained in this Draft Prospectus

is true and correct in all material aspects and is not misleading in any material respect, that the opinions and intentions expressed herein are

honestly held and that there are no other facts, the omission of which makes this Draft Prospectus as a whole or any of such information or

the expression of any such opinions or intentions misleading in any material respect.

LISTING

The Equity Shares offered through this Draft Prospectus are proposed to be listed on the Bombay Stock Exchange Limited ("BSE") and the

National Stock Exchange of India Limited ("NSE"). The Company has received in-principle approvals from BSE and NSE vide their letters

dated [] and [], respectively for the listing of Equity Shares being issued in terms of this Draft Prospectus. For the purpose of this Issue,

BSE shall be the Designated Stock Exchange.

LEAD MANAGER TO THE ISSUE REGISTRAR TO THE ISSUE

BURNPUR CEMENT LIMITED

(Originally incorporated as Ashoka Concrete & Allied Industries Private Limited on June 19, 1986 with the Registrar of Companies, West Bengal Kolkata. The name of the Company was changed to

Burnpur Cement Private Limited on September 18, 2001. Subsequently the Company was converted into a Public Limited Company under section Sec. 44 of the Companies Act, 1956 on November

12, 2001 and the name of the Company was changed to Burnpur Cement Limited and a fresh Certificate of Incorporation obtained from the Registrar of Companies, West Bengal Kolkata.

For details of changes in Registered Office of the Company please refer to page no 9 of this Draft Prospectus.)

Registered Office: Cement house, Saradapally, Ashoknagar P.O. Asansol- 713304, Dist.: Burdwan (West Bengal), India

Tel.: (0341)2250663, 2250859/61/62; Fax: (0341) 2250860; E-mail: [email protected]; Website: www.burnpurcement.com;

Plant: Vill-Palasdiha Panchgachia Road P.O. - Kanyapur, Dist. Burdwan West Bengal Pincode-713341

Tel: (0341) 2250454, 2252965; Contact Person/Compliance Officer: Mr. Manoj Agarwal, Company Secretary

ISSUE PROGRAM

ISSUE OPENS ON : [] ISSUE CLOSES ON : []

PRESENT ISSUE

ISSUE OF 3,18,25,100 EQUITY SHARES OF RS. 10/- EACH FOR CASH AT A PREMIUM OF RS. [

] PER EQUITY SHARE AGGREGATING

TO RS. 3182.51 LACS (AT THE LOWER END OF THE PRICE BAND OF RS.10/-PER EQUITY SHARE) AND RS. 3819.01 LACS (AT THE

HIGHER END OF THE PRICE BAND OF RS. 12/-PER EQUITY SHARE) (HEREINAFTER REFERRED TO AS "THE ISSUE")

OFFER THROUGH THIS DRAFT PROSPECTUS

2,19,00,000 EQUITY SHARES OF RS. 10/- EACH FOR CASH AT A PREMIUM OF RS. [] PER EQUITY SHARE. THE ISSUE COMPRISES A

RESERVATION FOR ELIGIBLE EMPLOYEES OF UPTO 10,95,000 EQUITY SHARES OF RS.10/- EACH (HEREINAFTER REFERRED TO AS

THE "EMPLOYEE RESERVATION PORTION") AND THE NET ISSUE TO THE PUBLIC OF 2,08,05,000 EQUITY SHARES OF RS.10/- EACH

(HEREINAFTER REFERRED TO AS THE "NET ISSUE")

PRESENT ISSUE WOULD CONSTITUTE 74.02% OF THE FULLY DILUTED POST-ISSUE PAID UP CAPITAL OF THE COMPANY. THE NET

ISSUE TO THE PUBLIC WOULD CONSTITUTE 48.39% OF THE FULLY DILUTED POST ISSUE PAID UP CAPITAL OF THE COMPANY.

Price Band: Rs. 10/- to Rs. 12/- per Equity Share of Rs. 10/- each

The Company will determine the Issue Price before filing the Prospectus with RoC

SREI CAPITAL MARKETS LIMITED

'Vishwakarma', 86 C, Topsia Road (South)

Kolkata - 700 046, West Bengal, India

Tel : +91 33 3987 3810/3845

Fax: +91 33 3987 3861/3863

E-mail: [email protected]

Website: www.srei.com

NICHE TECHNOLOGIES PRIVATE LIMITED

D-511, Bagree Market, 71, B R B Basu Road

Kolkata - 700 001, West Bengal, India

Tel : +91 33 2234 3576/2235 7271/7270

Fax: +91 33 2215 6823

E-mail: [email protected]

Website: www.nichetechpl.com

ii

TABLE OF CONTENTS

TITLE

PAGE NO.

SECTION I

DEFINITIONS AND ABBREVIATIONS

Conventional / General Terms i

Issue Related Terms i

Technical and Industry Terms iii

Abbreviations iii

SECTION II

RISK FACTORS

Certain Conventions; Use of Market Data

v

Forward Looking Statements

v

Risk Factors

vii

SECTION III

INTRODUCTION

Summary 1

The Issue 6

Summary of Financial Data 7

General Information 9

Capital Structure 14

Objects of the Issue 25

Basic Terms of Issue 37

Basis for Issue Price 39

Statement of Tax Benefits

42

SECTION IV ABOUT THE COMPANY

Industry Overview 51

Business Overview

66

Brief History Of The Company And Other Corporate Matters

90

Management And Organization

94

Promoters And Their Background 106

Related Party Transactions 110

Currency Of Presentation 110

Dividend Policy 110

SECTION V

FINANCIAL INFORMATION

Auditors Report & Restated Statement of Accounts 112

Financial And Other Information Of Companies, firms

Promoted/Controlled by the Promoters

142

Management Discussion And Analysis Of The Financial

Condition And Results Of The Operations

150

SECTION VI LEGAL AND OTHER INFORMATION

Outstanding Litigations and Defaults 161

Material Developments

163

Government Approvals and Licenses 164

SECTION VII OTHER REGULATORY AND STATUTORY DISCLOSURES 166

SECTION VIII

ISSUE RELATED INFORMATION

Terms of the Issue 174

Issue Procedure 178

SECTION IX MAIN PROVISIONS OF THE ARTICLES OF ASSOCIATION

OF THE COMPANY

197

SECTION X OTHER INFORMATION

Material Contracts and Documents for Inspection

233

Declaration 235

i

SECTION I: DEFINITIONS AND ABBREVIATIONS

Conventional/General Terms

Terms Description

“Burnpur Cement

Limited ” or

“Burnpur” or “the

Issuer Company” or

“the Issuer” or “the

Company” or “we” or

“us” or “our

Company” or “BCL”

Unless the context otherwise requires, refers to, Burnpur Cement Limited,

a public limited company incorporated under the Companies Act and

having its registered office at Cement house, Saradapally, Ashoknagar,

P.O. Asansol- 713304, West Bengal, India.

Articles/Articles of

Association/AOA

The Articles of Association of Burnpur Cement Limited as amended from

time to time.

Auditors The statutory auditors of the Company, viz. M/s N K Agarwal & Co.,

Chartered Accountants.

Board/Board of

Directors

The Board of Directors of the Company or a committee constituted thereof.

Companies Act/ the

Act

The Companies Act, 1956, as amended from time to time.

Director(s) Director(s) of the Burnpur Cement Limited, from time to time, unless

otherwise specified.

Equity Shares Equity shares of the Company of face value of Rs.10/- each unless

otherwise specified in the context thereof.

Group

Companies/Firms

BCL Developers.

Memorandum/MOA/

Memorandum of

Association

The Memorandum of Association of Burnpur Cement Limited.

Promoter(s) Shall mean jointly Mr. Ashok Gutgutia, Mrs. Shashi Gutgutia, Insight

Consultants Private Limited, Bharat Cement Private Limited and Goyal Auto

Distributors Private Limited

Promoters’ Group As defined in Explanation II of Clause 6.8.3.2 of SEBI (Disclosure and

Investor Protection) Guidelines, 2000 and amendments thereof Promoters’

Group includes:

Asha Devi Bhartia

A.K. Gutgutia & Sons

R.A. Gutgutia & Co.

Income Tax Act The Income Tax Act, 1961, as amended from time to time

Fiscal/FY/ Financial

Year

Twelve months ending March 31st of a particular year unless otherwise

specified.

You, Your, Yours Unless the context otherwise requires, refers to, investors

Issue Related Terms

Term Description

Allotment Issue or transfer of Equity Shares pursuant to the Offer, to the

successful applicants in the issue.

Allottee The successful applicant to whom the Equity Shares are being/have been

issued.

Applicant Any prospective investor who makes an application for Equity Shares in

terms of this Draft Prospectus

Application Form The Form in terms of which the investors shall apply for the Equity

Shares of the Company

Banker(s) to the

Issue

[●]

ii

BSE Bombay Stock Exchange Limited

Committee Committee of the Board of Directors of the Company authorized to take

decisions on matters related to/incidental to this issue

Depositories Act The Depositories Act, 1996, as amended from time to time.

Depository A depository registered with SEBI under the SEBI (Depositories and

Participants) Regulations, 1996, as amended from time to time.

Depository Participant

/DP

A Depository Participant as defined under the Depositories Act, 1996..

Designated Stock

Exchange

Bombay Stock Exchange Limited

Eligible Employees Means a permanent employee of the Company or the Director(s) of the

Company other than promoter Director who Indian Nationals, based in

India and is an Employee of the Company as on the date of filing the

Prospectus with the RoC is physically present in India on the date of

submission of the Application Form.

Employee

Reservation Portion

The portion of the Issue comprising upto 10,95,000 Equity Shares

Equity Shareholders Person(s) holding equity share(s) of the Company unless otherwise

specified in the context thereof

Fresh Issue/ Issue/

Public Issue/ Offer

Public Issue of 2,19,00,000 Equity Shares of Rs. 10/- each for cash at at

a premium of Rs. [•] per equity share, in terms of this Draft Prospectus

Indian GAAP Generally Accepted Accounting Principles in India.

Issue Opening Date

The date on which the issue Opens for subscription (i.e., (•), 2007)

Issue Closing Date

The date on which the issue Closes for subscription (i.e., (•), 2007)

Issue Period The period between the Issue Opening Date and Issue Closing Date and

includes both the dates.

Issue Price The price at which Equity Shares will be issued by the Company in

terms of this Draft Prospectus i.e. Rs. (•) per share. The Issue Price will

be decided by the Company in consultation with the Lead Manger prior

to filing of the Prospectus with the RoC.

IPO Initial Public Offering

Issuer Burnpur Cement Limited

Lead Manager/LM Lead Manager to the Issue, in this case being SREI Capital Markets

Limited.

Mutual Funds Means Mutual Funds registered with SEBI under the SEBI (Mutual Funds)

Regulations, 1996, as amended from time to time.

Net Issue/Offer to

Public/Net Issue

The Issue of 2,08,05,000 Equity Shares of Rs.10/- each.

Non-Institutional

Investors

All investors that are not Qualified Institutional Buyers or Retail

Individual Investors and who have applied for Equity Shares for an

amount more than Rs. 1,00,000/-.

NSE National Stock Exchange of India Limited.

OCB / Overseas

Corporate Body

Means and includes an entity defined in Clause (xi) of Regulation 2 of

the Foreign Exchange Management (Deposit) Regulations, 2000 and

which was in existence on the date of commencement of the withdrawal

of general permission to Overseas Body Corporate Regulations, 2003

and immediate prior to such commencement was eligible to undertake

transactions pursuant to the general permission granted under the

Foreign Exchange Management (Deposit) Regulations, 2000.

Offer Document/

Prospectus

The Prospectus filed with RoC in accordance with the provisions of

section 60 of the Companies Act containing inter alia the Issue Price and

the number of Equity Shares to be issued and certain other information.

Public Issue Account In accordance with Section 73 of the Companies Act, 1956, an account

opened with the Banker(s) to the Issue to receive monies for the Public

Issue.

Qualified Institutional

Public financial institutions as defined in Section 4A of the Companies

iii

Buyers or QIBs Act, FIIs, Scheduled Commercial Banks, Mutual funds registered with

SEBI, Venture Capital Funds registered with SEBI, Foreign Venture

Capital Investors registered with SEBI, State Industrial Development

Corporations, Insurance Companies registered with the Insurance

Regulatory and Development Authority(IRDA), Provident Funds with

minimum corpus of Rs. 2500 lacs, Pension Funds with a minimum corpus

of Rs. 2500 lacs, and Multilateral and Bilateral development financial

institutions.

Registrar of

Companies/ RoC

Registrar of Companies, West Bengal, Kolkata situated at “Nizam

Palace”, 2nd

MSO Building, 2nd floor, 234/4, A J C Bose Road, Kolkata-

700020

Registrar / Registrar

to the Issue

Being the Registrar appointed for the Issue, in this case being Niche

Technologies Private Limited having its registered office at D-511,

Bagree Market, 71, B R B Basu Road Kolkata – 700 001, West Bengal

India

Retail Individual

Investors.

“Retail Individual Investor” means an individual investor (including HUF

and NRIs) who applies for securities of or for a value of not more than

Rs.1,00,000/-.)

SCML/SREI SREI Capital Markets Limited a public limited company incorporated

under the provisions of the Companies Act and with its registered office

at ‘Vishwakarma’, 86C, Topsia Road (South), Kolkata – 700046

Stock Exchanges BSE and NSE

SEBI The Securities and Exchange Board of India constituted under the SEBI

Act, 1992.

Underwriters

[•]

Underwriting

Agreement

The agreement dated [•] between the Underwriters and the Company to

be entered into before the filing of Prospectus with the RoC.

Glossary of Technical and Industry Terms

Term Description

Kcal Kilo calories

KVA Kilo Volt Ampere

KWh Kilowatt hours

MnTPA Million tons per annum

MPa Mega Pascal

Mnt Million Tons

Mw Mega Watt

OPC Ordinary Portland Cement

Petcoke Petroleum Coke

PPC Pozzolona Portland Cement

PSC Portalnd Slag Cement

TPD Tons per day

TPH Tons per hour

Abbreviation of General Terms

Term Description

AGM Annual General Meeting.

AS Accounting Standards as issued by the Institute of Chartered Accountants

of India.

AY Assessment Year

BIFR Board for Industrial & Financial Reconstruction

CAGR Compounded Annual Growth Rate.

CDSL Central Depository Services (India) Limited.

DIP Guidelines SEBI (Disclosure & Investor Protection) Guidelines, 2000, as amended

ECS Electronic Clearing System

EGM Extraordinary general meeting

EPS Earnings per Share

ESOP Employee Stock Option Plan

Face Value Value of paid up equity capital per Equity Share

iv

FCNR Account Foreign Currency Non Resident Account

FEMA Foreign Exchange Management Act, 1999, as amended from time to time,

and the Regulations framed there under for the time being in force.

FI Financial Institution

FII/Foreign

Institutional Investor

Foreign Institutional Investor (as defined under SEBI (Foreign Institutional

Investors) Regulations, 1995), registered with SEBI under applicable laws

in India.

FIPB Foreign Investment Promotion Board

FY/ Fiscal Financial year ending on March 31

FDI Foreign Direct Investment

GAAP Generally accepted accounting principles

GoI The Government of India

HNI High Net-worth Individual

HUF Hindu Undivided Family

IPO Initial Public Offering

INR/ Rs Indian Rupees

ISO 9001:2000 International Standard Organisation 9001:2000 Certification Standard

I.T. Act The Income Tax Act, 1961, as amended.

MoU Memorandum of Understanding

NAV Net Asset Value

NRE Account Non-Resident External Account.

NRI Non-Resident Indian, as defined under Foreign Exchange Management

(Transfer or Issue of Security by a Person Resident Outside India)

Regulations, 2000, as amended.

NRO Account Non Resident Ordinary Account

NSDL National Securities Depository Limited

P/E Price earning ratio

PAN Permanent Account Number

PAT Profit after Tax

PBDT Profit Before Depreciation and Tax

PBIDT Profit Before Interest, Depreciation and Tax

PBT Profit Before Tax

R&D Research and Development.

RBI The Reserve Bank of India.

RONW Return on Net Worth

RTGS Real Time Gross Settlement

Rs. Indian National Rupee

SCRA Securities Contracts (Regulation) Act, 1956 as amended

SCRR Securities Contracts (Regulation) Rules, 1957, as amended.

SEBI Securities and Exchange Board of India.

SEBI Act Securities and Exchange Board of India Act, 1992 as amended

SEBI Takeover

Regulations

Securities and Exchange Board of India (Substantial Acquisition of Shares

and Takeover) Regulations, 1997, as amended.

SEBI Guidelines Means the extant Guidelines for Disclosure and Investor Protection issued

by Securities and Exchange Board of India, constituted in the Securities

and Exchange Board of India Act, 1992 (as amended, called Securities

and Exchange Board of India (Disclosure and Investor Protection)

Guidelines, 2000)

SSI Small scale Industries

Sq. mt. Square Metre

Sq. ft. Square Feet

TAN Tax Deduction Account Number

v

SECTION II: RISK FACTORS

Certain Conventions, Use of Market Data

Unless stated otherwise, the financial data in this Draft Prospectus is derived from the restated

financial statements as of and for the years ended March 31, 2002, 2003, 2004, 2005 and 2006

and for the nine months ended December 31, 2006 prepared in accordance with Indian GAAP, the

Companies Act, 1956 and restated in accordance with SEBI Guidelines, as stated in the report of

the Statutory Auditors, M/s N K Agarwal & Co., Chartered Accountants, included on page no. 112

of this Draft Prospectus. The fiscal year commences on April 1st of a year and ends on March

31st of the following year. In this Draft Prospectus, unless the context otherwise requires, all

references to one gender also refers to another gender and the word "Lakh" or "Lac" means "one

hundred thousand" and the word "million" means "ten lac" and the word "Crore" means "ten

million". In this Draft Prospectus, any discrepancies in any table between the total and the sums

of the amounts listed are due to rounding off.

All references to “India” contained in this Draft Prospectus are to the Republic of India. All

references to “Rupees” or “Rs.” are to Indian Rupees, the official currency of the Republic of

India.

Market and Industry Data used throughout this Draft Prospectus has been obtained from

publications available in the public domain and internal Company reports. These publications

generally state that the information contained therein has been obtained from sources believed to

be reliable but their accuracy and completeness are not guaranteed and their reliability cannot be

assured. Although the Company believes that the industry data used in this Draft Prospectus is

reliable, it has not been independently verified. Similarly, internal Company reports, while

believed by the Company to be reliable, have not been verified by any independent source.

Forward-Looking Statements And Market Data

This Draft Prospectus contains certain “forward-looking statements”. These forward looking

statements can generally be identified by words or phrases such as “aim”, “anticipate”, “believe”,

“expect”, “estimate”, intend”, “objective”, “may”, “plan”, “project”, “shall”, “will” “will continue”,

“will pursue” or other words or phrases of similar import. Similarly, statements that describe

Company’s objectives, strategy, plans or goals are also forward-looking statements.

All forward-looking statements are subject to risks, uncertainties and assumptions about the

Company that could cause actual results to differ materially from those contemplated by the

relevant forward-looking statement. Important factors that could cause actual results to differ

materially from the expectations include, among others:

• General economic and business conditions;

• Company’s ability to successfully implement its strategy and its growth and expansion

plans and technological changes;

• Factors affecting the Cement industry;

• The ability to modify and enhance the product offerings based on customer needs and

evolving technologies;

• The ability to retain the existing clients and acquire new clients;

• Changes in the pricing policies or those of the competitors;

• Inadequate availability of Raw Materials;

• Increasing competition in the Cement industry;

• Increases in labour costs, raw materials prices, prices of plant & machineries and

insurance premia;

• Manufacturers’ defects or mechanical problems with Company’s plant & machineries or

incidents caused by human error;

• Cyclical or seasonal fluctuations in the operating results;

• Amount that the Company is able to realise from the clients;

• Changes in laws and regulations that apply to the cement industry;

• Changes in fiscal, economic or political conditions in India;

• Social or civil unrest or hostilities with neighboring countries or acts of international

terrorism;

• Changes in the interest rates and tax laws in India.

• The Company’s ability to meet its capital expenditure requirements.

vi

For further discussion of factors that could cause Company’s actual results to differ, please see

the section entitled “Risk Factors” included in this Draft Prospectus. In the light of inherent risks

and uncertainties, the forward-looking statements, events and circumstances discussed in this

Draft Prospectus might not occur and are not guarantees of future performance.

Neither the Company, it’s Directors and Officers, any member of the Issue Management Team

nor any of their respective affiliates has any obligation to update or otherwise revise any

statements reflecting circumstances arising after the date hereof or to reflect the occurrence of

underlying events, even if the underlying assumptions do not come to fruition. In accordance

with SEBI requirements, for purposes of the Issue, the Company and the Lead Manager to the

Issue will ensure that investors in India are informed of material developments relating to the

business until such time as the grant of listing and trading permission by the Stock Exchanges.

vii

RISK FACTORS

An investment in the Equity Shares involves a high degree of risk. The investors should carefully

consider all information in this Draft Prospectus, including the risks and uncertainties described

below, before making an investment in the Equity Shares. If any of the following risks or any of

the other risks and uncertainties discussed in this Draft Prospectus actually occur, the Company’s

business, financial condition and future results of operations could suffer, the trading price of its

Equity Shares could decline, and the investors may lose all or part of their investment.

Unless specified or quantified in the relevant risk factors below, the Company is not in a position

to quantify the financial or other implications of any of the risks mentioned hereunder.

Materiality

The Risk factors have been determined on the basis of their materiality. The following factors

have been considered for determining the materiality.

1. Some events may not be material individually but may be found material collectively.

2. Some events may have material impact qualitatively instead of quantitatively.

3. Some events may not be material at present but may be having material impacts in

future.

Internal Risk Factors:

1. The company’s business is dependent upon its ability to source sufficient limestone

for its operations.

Management Perception

The company would be able to meet most of its requirement of limestone, the key raw

material for cement production, from mines which are located near its proposed plant. The

proposed cement plant located in Hazaribag district is near rich sources of

limestone. The

Company has entered into an lease agreement dated 26

th

September, 2006 with M/s Pandya

Minerals ffor mining limestone. These leased mines have an area of 8.53 acres at village

Kadhu P.S. Ramgarh. Jharkhand. Limestone shall be mined on the basis of the JV agreement

with Pandya Mines and the MOU with Government of Jharkhand (GOJ), As per the MOU with

the GOJ, the State Government shall assist the Company to source limestone as per the

requirements of the Company. The Company has already made an application to the GOJ for

grant to mining lease for mining limestone on the 27

th

of September, 2006 and is awaiting

grant of the said mining rights from the GOJ.

Although the Company believes that its mining rights are sufficient to meet current and

future production levels, in case the mining rights granted by GOJ or Joint Venture agreement

with Pandya Mines are revoked or are not renewed upon its expiry, or significant restrictions

on the usage of the rights are imposed or applicable environmental standards are

substantially increased, the Company’s abilities to operate its plant could be effected which

could materially and adversely affect the financial condition and results of operations.

2. The Company is dependent upon the continued supply of coal, gypsum and other

raw materials and fuel, the supply and costs of which can be subject to significant

variation.

Management Perception

The Company would be relying on a number of domestic suppliers to provide certain raw

materials, including gypsum and additives for the proposed plant. The Company would also

be

dependent on various domestic suppliers for the supply of coal. If the Company is unable

to obtain adequate supplies of raw materials or fuel in a timely manner or on acceptable

commercial terms, or if there are significant increases in the cost of these supplies, the

business and results of operations may be materially and adversely affected. As per the MOU

with the Government of Jharkhand (GOJ), the GOJ will assist the Company in sourcing raw

materials. The Company, however, based on its experience in the region is confident that

such an occasion would not arise, on account of its multiple supplier profile.

viii

3. The Company depends on its own distribution network for the sale of its products.

Management Perception

The Company’s products are currently marketed through a distribution network comprising of

around 525 distributor/dealers/C&F Agents and 21 market organizers who in turn sell the

products to end users such as contractors, retailers, and the like. The Company also markets

its products directly to institutions and Corporate bodies. Since the dealers/distributors/C&F

agents have day-to-day contact with customers, the Company is exposed to the risk of its

dealers/distributors/C&F agents failing to adhere to the standards set for them in respect of

sales and after-sales service, which in turn could affect customer’s perception of the

Company’s brand and products. If the competitors of the Company provide better commercial

terms to the dealers, they may be persuaded to promote the products of the Competitors

instead of the products of the Company.

4. Disruptions in supply and transportation could affect the business of the Company.

Management Perception

The production of cement is dependent on a steady supply of various raw materials. These

inputs would be transported to the Company’s existing plant at Asansol & the proposed unit

at Hazaribagh, Jharkhand by road and cement is transported to the customers by both road

and rail. Transport of the inputs and finished products is subject to various bottlenecks and

other hazards beyond the control of the Company. An increase in the price of transportation

or interruptions in transportation of the inputs or finished products could have an adverse

effect on the business, financial condition and results of operations. Transportation strikes by

members of various Indian truckers’ unions have had in the past, and could have in the

future, an adverse effect on the receipt of supplies and delivery of the products by the

Company. In addition, cement is a perishable product as its quality deteriorates upon contact

with moisture over a period of time. Therefore, prolonged storage or exposure to moisture

during transport may result in such cement stocks being written off. Although the Company

has not encountered any significant disruption to the supply and transportation of inputs and

finished products till date, no assurance can be given that any such disruption will not occur

in the future. The Company typically uses third party transportation providers for the supply

of raw materials and for delivery of its products to the customers. In addition, transportation

costs have been steadily increasing. Continuing increases in transportation costs or

unavailability of transportation services for the products may have an adverse effect on on

the Company’s business and results of operations.

5. Rise in Input Costs may affect profitability

The input costs of the products of the Company may increase due to various reasons. In case

the Company is not able to pass on such increase to the consumers because of competition or

otherwise, it may affect the profitability of the Company.

Management Perception

The Company constantly endeavours to procure raw materials and packing materials at the

lowest prices using its long-term association with the suppliers and constantly developing

new sources. The Company also follows prudent pricing policy to keep the costs under check.

The risk on account of price fluctuation in raw material is reduced to a significant extent by

passing incremental raw material cost to the prices of finished products thereby insulating the

Company from fluctuation in raw material prices. Profitability will depend upon the extent up

to which the company is able to pass on the burden of rise in the price of raw material to the

consumers.

6. The operations of the Company are subject to manufacturing risks and may be

disrupted by a failure in the manufacturing facilities.

Management Perception

The manufacturing operations of the Company could be disrupted for reasons beyond the

control of the Company. These disruptions may include extreme weather conditions, fire,

natural catastrophes or raw material supply disruptions. The manufacturing facilities are also

ix

subject to operating risks, such as the breakdown or failure of equipment, power supply or

processes, performance below expected levels of output or efficiency, obsolescence, labour

disputes, natural disasters, industrial accidents and the need to comply with the directives of

relevant government authorities. Any significant manufacturing disruption could adversely

affect the ability of the Company to make and sell products, which could have a material

adverse effect on the business, financial condition and results of operations of the Company.

The Company is in the process of setting up a Clinkerisation and cement grinding plant at

Patratu in Hazaribag by incurring significant capital expenditure. The Company’s expansion

plans involve risks and difficulties, many of which are beyond its control and accordingly

there can be no assurance that the Company will be able to complete its plans on schedule or

without incurring additional expenditures. The Company’s success will inter alia depend on,

its ability to assess potential markets, control input costs and maintain sufficient operational

and financial controls. There can be no assurance that the Company’s expansion plans will

result in it achieving the production levels that it expects to. The Company’s future results of

operations may be adversely affected if it is unable to implement its growth strategies

successfully.

7. The business and future results of operations of the Company may be adversely

affected if the Company is unable to set up the proposed plant at Patratu,

Jharkhand.

Management Perception

The Company is in the process of setting up a Clinkerisation and Cement grinding plant of

800 TPD expendable to 1600 TPD at Patratu Jharkhand to start its production capacity by

incurring significant capital expenditure. The Company proposes to manufacture Clinker,

Ordinary Portland Cement (OPC), Portland Pozzolona Cement (PPC) and Portland Slag

Cement (PSC). The Company expects to incur significant capital expenditure for the proposed

plant. There exist other risks associated with such major projects, such as time overrun, cost

overruns, delays in implementation and changes in market conditions etc. The business and

future results of operations of the Company may be adversely affected if the Company is

unable to set up the proposed cement plant within the stipulated time.

8. The results of operations could be adversely affected by strikes, work stoppages or

increased wage demands by the employees or the inability of the Company to

attract and retain skilled personnel.

Management Perception

As of March 31, 2007, the Company had 86 permanent employees. While the Company

considers the current labour relations to be good, there can be no assurance that the

Company will not experience future disruptions to its operations due to disputes or other

problems with its work force, which could adversely affect its business and future results of

operations.

The Company’s ability to meet future business challenges depends on its ability to attract and

recruit talented and skilled personnel. It faces strong competition to recruit and retain skilled

and professionally qualified staff. The loss of key personnel or inability to manage the

attrition levels in different employee categories may materially and adversely impact

business, the Company’s ability to grow and its control over various business functions.

9. The Eastern India cement market is highly competitive.

Management Perception

The Company’s primary markets are the Eastern States of India namely West Bengal, Bihar

and Jharkhand

. Some of the competitors of the Company are larger than the Company and

have financial resources and thus may be able to deliver products on more attractive terms

or may be able to invest larger amounts of capital into their business, including greater

expenditure for better and more efficient production capabilities. These competitors may limit

the opportunity of the Company to expand its’ market share and may compete with it on

pricing of products. The business, financial condition and prospects of the Company could be

x

adversely affected if it is unable to compete with its competitors and sell cement at

competitive prices.

With increased thrust and emphasis given by the Government and private sector to

construction activities and infrastructure development, the demand for cement is going to be

ever-increasing. The Compay therefore foresees no let up in demand for Company’s products.

10. Non availability of power could disrupt the operations for the proposed project.

Management Perception

The power requirement for running the proposed clinkerisation and cement grinding plant

would be obtained from the existing 33 KV HT lines of Damodar Valley Corporation by tapping

the same, application for the same would be made by the Company to the concerned

authorities in due course. The Company has already obtained the required power connection

for the construction period. The Company would also be taking necessary precautionary back

up measures such as D.G. set.

11. The Company has not started recruiting the manpower for the proposed plant.

Management perception

The Company does not foresee any difficulty in recruiting the required manpower in time for the proposed

plant expansion project. The Company has currently on its payrolls experienced manpower

whose services shall also be used for the proposed project. Trained manpower in the

managerial, supervisory and skilled categories are expected to be easily available. Personnel

in the semi skilled and unskilled categories are proposed to be employed from nearby

villages/towns.

12. The proposed project of the Company would be partially funded from this Public

Issue. Any delay/failure of the same, may adversely impact the implementation of

the project and cost overrun.

Management Perception

The Company requires significant capital to finance its proposed project which would be

partly funded through the IPO. In case there is a delay in Public Issue/failure of the same, the

Company would have to make alternate funding arrangements through an equitable mix of

secured/unsecured loans, private placement of equity and contribution from the promoters.

13. There may arise production problems on account of possible flaws in design

estimates.

Management Perception

The Company has appointed Development Consultants Private Limited as engineering

consultants who would be providing design, drawing, technology and would be monitoring the

project and ensure successful commissioning of the Plant. Development Consultants Private

Limited have a past experience in handling projects of such magnitude.

14. The Company’s sustained growth depends on its ability to attract and retain skilled

Personnel. Failure of the Company to attract and retain skilled personnel could

adversely affect the Company’s growth prospects

Management Perception

The Company has devised a sound human resource policy to develop and retain its key

management personnel and talent and the Company has been able to retain significant part

of its manpower talent.

15. There may be Time and Cost overrun in the Proposed Project

The Company, as regards this Project, has made certain assumptions on the time frame by

which the Project will be completed. While adequate contingency provisions have been made

xi

while assessing the capital cost of the project, the costs are subject to fluctuations in future

due to hike in input cost, higher levies etc. Also, the disbursement of the loans is contingent

on the satisfaction of certain conditions such as clearance from SEBI etc. In case there is a

delay in complying with any of the conditions, it may result in time and cost over run, which

in turn may adversely impact the future profitability.

Management Perception

The proposed project would be under the overall supervision of Development Consultants

Private Limited (DCPL). The contractor for construction would be appointed by the Company

in consultation with DCPL. The Company has identified M/s ThyssenKrupp Industries India

Pvt. Limited, one of the reputed suppliers of cement equipments, for supplying main Plant &

Machinery to set up a clinkerisation and Cement grinding unit at a capacity of 800TPD

expendable to 1600 TPD at Patratu in Jharkhand. The Company has already received the land

allotment and land development is in progress. The Company does not foresee any delay in

the overall completion of the work and hopes to conduct its trial run and commercial

production as per schedule.

16. Competence of the Promoters in handling Project of this size is yet to to be tested.

Further, the promoters have no past experience in handling a cement clinkerisation

unit.

The cost of the project is Rs.12090 lakhs, including public issue expenses. Although the

promoters have past experience of running a grinding unit, their competence in running a

cement clinkerisation unit remains to be demonstrated. An equity investor is therefore faced

with an uncertainty of performance by the management.

Management Perception

The promoters of the Company have considerable experience of having run this business

successfully and profitably in the cement sector for nearly 15 years. The Company has also

on board senior and experienced Professionals who have the experience of setting up &

running similar facilities in the past. Moreover, the promoters view the present optimistic

scenario and economic growth in the country and the corporate sector as an opportunity to

enlarge the scale of the operations of the Company. Please refer page no. 106 for profile of

the promoters and page no. 104 for experience of key managerial personnel.

17. The Company is yet to place orders for the plant and machinery relating to the

project.

Management Perception

The Company has floated enquiries for all the equipments, plant and machineries, and the

quotations from various parties have already been received. Development Consultants Private

Limited (DCPL) would be assisting the Company in selecting the right vendors for supply of

plant and machineries.

18. The operations of the Company are subject to Environmental, health and safety

hazards.

Management Perception

The operations of the Company are subject to various risks associated with the production of

cement. These hazards can cause injury and/or loss of life, severe damage to, and

destruction of, property and equipment, and environmental damage, and may result in the

suspension of operations and the imposition of civil and criminal liabilities on the Company.

The Company proposes to set up the project while conforming to all pollution control and

safety norms as stipulated by State Pollution Control Board.

19. The Company’s operations and consequently its revenues could be adversely

affected by under utilization or mis utilization of its existing as well as proposed

capacity

xii

Management Perception

Effective utilization of capacities is a key factor in the Company’s ability to generate revenue.

The Company proposes to set up a new Integrated Cement Plant at Patratu, Hazaribag to

increase its manufacturing capacities. The Company constantly strives to scale up its

operations based on capacity utilization of its facilities on a long-term basis.

20. Further equity offerings may lead to dilution of equity and impact its market price

The Company may require further infusion of funds to satisfy its capital needs and future

growth plans, which it may not be able to procure. Any future equity offerings by the

Company may lead to dilution of equity and may affect the market price of its Equity Shares.

Management Perception

In the near future, there are no plans to issue further equity shares. In case the Company

decides to raise additional funds through the issuance of equity, the same would be done for

further value creation for the shareholders of the Company and after taking adequate consent

from them.

21. The Company’s dependence on its promoters is tremendous, and any inability on

the part of the promoters to contribute to the growth and business of the Company

may affect its performance.

Management Perception

The Company is dependent on the experience and efforts of its promoters, as is applicable to

any other company/industry. However, the Company has been in this business for over 15

years. The promoters’ family has been associated with the Company and its business since

inception. The promoters have been involved with critical functions like development of the

product, marketing, and other operations of the Company. The Company also has a qualified

team of marketing executives, finance professionals and professionals in other functional

domains who are involved in the day-to-day operations of the Company. This reduces the

company’s dependence on the promoters to manage the operations of the company.

22. Legal proceedings:

The Company, directors and promoter are involved in certain legal proceedings. The

Company may need to make provisions in its financial statements, which could increase its

expenses and its current liabilities. The Company can give no assurance that these legal

proceedings will be decided favourably. Any adverse decision may have a significant effect on

the Company’s business and results of operations.

a. Legal proceedings instituted against the directors/officers of the Company and the

monetary amount involved in these cases is given in the following table:

Type of litigation Total number of

pending cases

Remarks and amount involved

Criminal Case 1 Special Court, Burdwan. Under Section

151 of the Electricity Act, 2003 read with

Section 190(1)(a) of the Code of Criminal

Procedure for a commission of Offence

punishable under Section 135 of the

Electricity Act, 2003 pertaing to theft of

energy

b. The Company is involved in the following legal proceedings for tax demands :

A classification of the legal proceedings instituted by the Company and the monetary

amount involved in these cases is given in the following table:

xiii

Type of Litigation Amount

Involved

(in Rupees)

Financial Implication Status

Sales Tax 4507639.10 Provisions in financial

statements required, if

legal proceedings not

decided in Company’s

favour.

Pending before

the West Bengal

Appellate &

Revisional Board

For more information regarding litigations, please refer to the section titled “Outstanding

Litigations and Defaults” beginning on page no. 161 of this Draft Prospectus.

23. Contingent Liability as on 31

st

December, 2006

As per the Audited Financial Statements, the Company has certain contingent liabilities,

which, if determined against it in future, may impact its financial position, adversely. Details

of the contingent liabilities as on December 31, 2006 are given in the following table:

Rs. in Lakhs

Brief Particulars As at

December 31, 2006

Sales tax Demand 45.08

WBSEB 99.00

Outstanding Bank Guarantee * 18.46

Total 162.54

* The outstanding bank guarantees of Rs. 18.46 lacs as mentioned above are covered to the

extent of Rs. 11.95 lacs by fixed deposits in the name of the Company and its promoters.

24. Payment or benefit to Promoter Director

The Registered/Corporate Office of the Company situated at Cement House, Saradapally,

Ashoknagar P.O. Asansol- 713304, Dist.: Burdwan, West Bengal and a part of the factory

premises situated at Vill-Palasdiha, Panchgachia Road P.O. – Kanyapur, Dist. Burdwan West

Bengal Pincode-713341 is owned by Mr. Ashok Gutgutia, Promoter and Vice Chairman &

Managing Director of the Company and has been taken on rent by the Company.

25. Any inability to manage the Company’s growth could disrupt its business and

reduce profitability.

The Company has experienced significant growth in revenues in the past years and expects

this growth to place significant demands on both its management and resources. This will

require the Company to continuously evolve and improve its operational, financial and

internal controls across the organisation. In particular, continued expansion increases the

challenges involved in:

Recruiting, training and retaining sufficient skilled technical, sales and management

personnel;

Maintaining high levels of customer satisfaction; and

Developing and improving the Company’s internal administrative infrastructure,

particularly the financial, operational and other internal systems.

Management Perception

The Company has demonstrated its ability to grow the business and its flexibility in scaling its

operations to various levels as is evident from turnover trends in the last few years. Internal

and administrative processes and systems have also undergone tremendous change keeping

with the requirements and growth patterns. The company feels that in the future and keeping

in perspective its past track records, it will be able to grow operations at a continued pace

and adapt its organisation based on its evolving business strategies

xiv

26. The Company may not have adequate insurance to cover any and all losses incurred

in its business operations.

Management Perception

The Company maintains insurance coverage in such amounts and against such risks, which it

believes, are in accordance with industry practice.

However, such insurance may not be adequate to cover all conceivable losses or liabilities

that may arise from operations, and the Company may, in the future, not be able to maintain

insurance of the types or at levels which it deems necessary or adequate or at rates which it

considers reasonable.

27. The Company significant indebtedness and the conditions and restrictions imposed

by our financing agreements could adversely affect our ability to conduct our

business and operations.

28. Due to high transportation costs, the Company may not market its products outside

Esatern India.

External Risk Factors:

1. The Indian Cement Industry is cyclical and affected by a number of factors, which

are beyond the control of the Company.

Management Perception

The Indian cement industry is cyclical in nature. In recent years, cement prices and

profitability of cement manufacturers have fluctuated significantly in India, depending upon

overall supply and demand. A number of factors influence supply and demand for cement,

including production, overcapacity, general economic conditions, in particular, activity levels

in certain key sectors such as housing and construction, competitors’ actions and local, State

and Central Government policies, which in turn may affect the prices and margins the

Company and other Indian cement manufacturers can realize.

2. Slowdown of the Indian economy and in particular Eastern India could affect the

operations of the Company.

Management Perception

Due to the significant impact of transportation costs on overall costs, cement manufacturing

and sale in India is largely regional in nature. The production facility of the Company is

located at Asansol in the State of West Bengal in Eastern India, and it sells its cement to

customers in Eastern India. Economic conditions and the level of growth in Eastern India

therefore have a direct impact on its business and results of operations, including the level of

demand and the prices for its products and the availability and prices of transport and raw

materials.

3. The cement business is seasonal in nature.

Management Perception

The sale of cement is adversely affected by difficult working conditions during monsoon which

restrict construction activities. Accordingly, revenues recorded in the first half of the financial

year between April and September are traditionally lower, compared to revenues recorded

during the second half of the financial year. During periods of curtailed construction activity

due to adverse weather conditions, the Company may continue to incur operating expenses,

but its revenues from sale of its products may be delayed or reduced.

4. The Cement Industry is dependent upon the Government Policy on Infrastructure

development.

The business of the company is dependent to a large extent on the implementation of the

central and state budget allocations to the infrastructure sector. The liberalization policy of

xv

the Government and incentives offered by it has spurred the growth of opportunities in the

field of Infrastructure and particularly road sector giving rise to increased demand for

cement. Adverse changes if any, in the Government policy could thus affect the company's

business prospects.

5. The Indian Cement Industry is fragmented which may result in decline in cement

prices.

Management Perception

Currently, the cement industry in India is highly fragmented as compared to those in other

cement producing countries. Though the share of cement production of the top eight cement

companies in India has risen to 60% in the year ended March 31, 2006 there are still over 45

different cement companies in India which have less than 2 million tonnes cement capacity.

The Company is subject to competition from numerous regional competitors. Such producers

have mayin the past tried try to gain a the market share by discounting lowering their prices,

which may putting pressure on the Company and other leading cement companies to lower

prices as well, so as to maintain their respective market shares.

6. Taxes and other levies imposed by the Government of India or State Governments

relating to the Company’s business may have a material adverse effect on the

demand of its products

Management Perception

Taxes and other levies imposed by the Central or State Governments that affect the industry

include Customs duties, Excise duty and Central and State sales tax / value added tax. These

taxes and levies affect the cost of production of cement. An increase in any of these taxes or

levies, or the imposition of new taxes or levies in future, may have a material adverse impact

on the business, profitability and financial condition of the Company.

7. The cement industry is subject to various environmental and other regulations. Any

significant change in the regulations may result in additional cost and reduction in

profitability.

Management Perception

The Company’s cement operations are subject to various Central and State environmental

laws and regulations relating to the control of pollution in the locations where it operates. In

particular, the discharge or emissions of chemicals, dust or other pollutants into the air, soil

or water that exceed permitted levels are strictly monitored by the Central and State

Governments. There can be no assurance that compliance with such environmental laws and

regulations will not result in a curtailment of production or a material increase in the costs of

production or otherwise have a material adverse effect on the financial condition of the

Company and future results of operations. Environmental laws and regulations in India have

been increasing in stringency and it is possible that they will become significantly more

stringent in the future. Stricter laws and regulations, or stricter interpretation of the existing

laws and regulations, may impose new liabilities on the Company or result in the need for

additional investment in pollution control equipment, either of which could affect its business,

financial condition or future prospects.

8. Any further issuance of equity shares by the Company may adversely affect the

trading price of the Equity Shares.

Management Perception

Any future issuance of equity shares by the Company or any future issuance of convertible

securities by the Company, may significantly affect the trading price of its equity shares.

Such issuances of equity shares and convertible securities may dilute the position of investors

in the Equity Shares and could adversely affect the market price of the Equity Shares.

9. Factors beyond the management's control

xvi

Political, Economical and Social unrest, terrorist attacks, civil disturbances and regional

conflicts in the country could adversely affect the business of the Company. Natural

calamities and adverse weather conditions could have a negative impact on business of the

Company.

10. Natural calamities and acts of violence involving Indian and other countries.

Floods, earthquakes, terrorist attacks and other acts of violence or war/destruction involving

India and other countries could adversely affect the Country’s business and economy, and

consequently reflect on the Company’s business.

Management Perception

The consequences of any of the above are unpredictable and the Company may not be able

to foresee events that could have a material adverse effect on its business, financial condition

or results of operations.

11. After this Issue, the price of the Equity Shares may be highly volatile, or an active

trading market for the Equity Shares may not develop

The prices of the Company’s Equity Shares on the Indian stock exchanges may fluctuate after

this Issue.

Management Perception

Fluctuations in equity share prices on the Indian stock exchanges may result from several

factors, including:

a. Volatility in the Indian and global securities market

b. Results of operations and performance of the Company

c. Performance of the competitors, the Indian Cement industry and the perception in

the market about investments in the Cement sector

d. Adverse media reports on Burnpur or the Industry segments in which the company

operates

e. Changes in the estimates of the Company’s performance or recommendations by

financial analysts

f. Significant developments in India’s economic liberalisation and deregulation policies

g. Significant developments in India’s fiscal and environmental regulations

There has been no public market for the Company’s Equity Shares and the prices of the

Equity Shares may fluctuate after this Issue. There can be no assurance that an active

trading market for the Equity Shares will develop or sustain after this Issue, or that the prices

at which the Equity Shares are initially traded will correspond to the prices at which the

Equity Shares will trade in the market subsequent to this Issue.

12. Stability in policies and political situation

The Company’s performance is linked to the stability of policies and the political situation in

India

Management Perception

The role of the Indian Central and State Governments in the Indian economy on producers,

consumers and regulators has remained significant over the years. Since 1991, the

Government of India has pursued policies of economic liberalization, including significantly

relaxing restrictions on the private sector. Any political instability could delay the reform of

the Indian economy and could have a material adverse effect on the market for Company’s

shares. Protests against privatisation could slowdown the pace of liberalization and

deregulation. The rate of economic liberalization could change, and specific laws and policies

affecting companies in the cement sector, foreign investment, currency exchange rates and

other matters affecting investment in Company’s securities could change as well. A significant

change in India’s economic liberalization and deregulation policies could disrupt business and

economic conditions in India and thereby affect Company’s business.

xvii

Notes to Risk Factors

1. Issue of 3,18,25,100 equity shares of Rs.10 each for cash at a premium of Rs.[•] per

equity share aggregating to Rs. 3182.51 lacs (at the lower band of the issue price of Rs.

10/-per equity share) and Rs. 3819.01 lacs (at the higher band of the issue price of Rs.

12/-per equity share). The issue through this Draft Prospectus comprises of 2,19,00,000

equity shares of Rs.10 each for cash consisting of a reservation for eligible employees of

upto 10,95,000 equity share of Rs.10/- each (hereinafter referred to as the “employee

reservation portion”) and a net issue to the public of 2,08,05,000 equity shares of

Rs.10/- each.

2. The net worth of the Company was Rs. 1081.61 lacs as at March 31, 2006 and Rs.

1423.59 lacs as at December 31, 2006 as per the restated financial statements under

Indian GAAP.

3. The Book Value per Equity Share of Rs.10/- each was at Rs. 12.59 as at March 31, 2006

and Rs. 16.57 as at December 31, 2006, as per the restated financial statements under

Indian GAAP.

4. The average cost of acquisition of Equity Shares of the Promoters are as follows:

Sr.

No.

Name of Promoter Avg. Cost of

Acquisition of Equity

Share (Rs.)

1 Mr. Ashok Gutgutia 2.23

2 Mrs. Shashi Gutgutia 10.00

3 Insight Consultants Private Limited 10.74

4 Bharat Cement Private Limited 10.00

5 Goyal Auto Distributors Private Limited 10.00

5. For details of the Company’s related party transactions, please refer to the section titled

“Related Party Transactions” on page 110.

6. Trading in Equity Shares for all investors shall be in dematerialised form only.

7. Investors are advised to refer to the paragraph on "Basis for Issue Price" on page no. 39

of this Draft Prospectus before making an investment in this Issue.

8. Investors may please note that in the event of over-subscription, allotment shall be made

on a proportionate basis. For more information please refer to the section titled “Basis of

Allotment” beginning from page no. 191 of the Draft prospectus.

9. Any clarification or information relating to the Offer shall be made available by the Lead

Manager, and the Company to the investors at large and no selective or additional

information would be available for a section of investors in any manner whatsoever.

Investors may contact the Lead Manager or the Compliance Officer for any

complaints/clarifications / information pertaining to the Offer.

10. Investors are advised to refer to the section titled “Basis for the Offer Price” on page 39

of this Draft Prospectus before making any investment in this issue.

11. The Promoters/ Directors/ Key Managerial Personnel are interested to the extent of the

normal remuneration, reimbursement of the expenses incurred, or benefits such as sitting

fees and those relating to their respective shareholdings in the Company.

12. There are no relationships with Statutory Auditors to the Company other than auditing

and certification of financial statements.

13. In addition to the LM, the Company is obliged to update the Draft Prospectus and keep

the public informed about any material changes till listing and trading commences in

respect of the shares issued through this Draft Prospectus.

xviii

14. None of the Promoters, Promoter Group has undertaken transactions in the shares of the

Company from the last six months in the last six months preceding the date on which the

Draft Prospectus is filed with SEBI.

15. The investors are advised to refer the Paragraph on promoter’s background and past

financial performance of the Company before making an investment in the proposed

issue.

16. The company, its directors, company's associates or group companies have not been

prohibited from accessing the capital market under any order or direction passed by

SEBI.

17. The promoters, their relatives, issuer, group companies, associate companies are not

detained as willful defaulters by RBI/Government authorities and there are no violations

of securities laws committed in the past or pending against them.

1

SECTION III: INTRODUCTION

Summary

You should read the following summary together with the Risk Factors beginning from page no.

vii of this Draft Prospectus and the more detailed information about Burnpur Cement Limited and

its financial data included in this Draft Prospectus.

Industry Overview

The cement industry is a core sector and one of the kingpins for the growth of the country.

Cement is one of the most basic construction materials, and hence, an essential item for the

infrastructure development of the country.

The evolution of the cement industry in India can be broadly classified into three periods: The

period up to partial decontrol (up to 1982), the period up to total decontrol (1982-89) and the

period after total decontrol (after 1989 to date). The following table summarizes the events in the

cement industry.

Events during the period of government control

Period Events

1942 FOR (free on rail) destination price of cement fixed on a cost plus basis.

1946-1952 Cost of production of ACC used as a basis for fixing cement prices. Freight

equalisation system introduced simultaneously.

1958 Introduction of three-tier retention price scheme, whereby retention prices

are decided based on the age of the plant and technology employed.

Jan-66 Price and distribution controls lifted.

Jan-68 Price and distribution controls re-imposed.

Apr 1969 - May 1979

Period of single price regime; total distribution control.

Cement industry grew at around 4.0 per cent during this period as against

the high growth rates in the past.

Sep-77 Government guarantees 12 per cent post-tax return on the net worth of

new cement companies.

Events during the period of partial decontrol

Period Events

Feb-82 Companies allowed to sell 33 per cent of their production in the open market,

while price and distribution controls enforced for the remaining production

1985-86 Proportion of cement for free market sale increased to 50 per cent.

Events post decontrol

Period Events

Mar-89 Price and distribution controls removed completely.

Jul-91 Industrial licensing abolished for new capacities.

The cement industry in India has grown steadily since 1914, when the first cement unit of 1000

tonnes was set up at Porbandar. The growth in the industry has followed the pattern of economic

growth, i.e., moderate to low growth during the fifties, the sixties and the seventies and high

growth during the eighties & the nineties. Since decontrol of cement, the industry showed

characteristics symptoms of free market conditions, where producers build capacities ahead of

demand in the expectation of capturing the future demand.

Indian Cement Industry Structure

The cement industry in India is estimated at 125 million tonnes (2004-05) by volume. The

domestic cement industry is highly fragmented, with over 50 cement players and more than 120

2

manufacturing plants. This apart, the industry is highly regionalized, as cement units are

concentrated in clusters, close to the limestone deposits. Competition is also regionalized since

the low-value of the commodity makes transportation over long distances uneconomical.

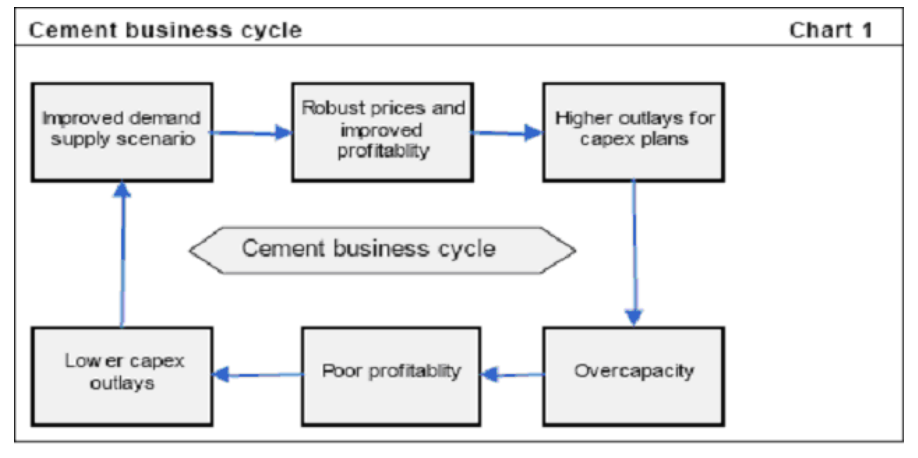

Like in most commodity industries, the business cycle in the cement industry follows a set

pattern. When the demand-supply gap narrows, price realizations improve and companies

increase their capex outlays for building capacities and increasing their market shares. As

capacities start bunching up, overcapacity starts creeping-in and player profitability deteriorates.

This constraints further capacity additions, which results in lower capex outlays

and, over a period of time, helps in improving the business scenario. Most of the large companies

with high level of financial flexibility are the first to take off in good times as they are

continuously looking at improving their market share.

Players

The main players in the cement industry are the raw material suppliers, manufacturers,

distributors and end-users. Given below is a brief summary of the characteristics of each party.

Raw Material Suppliers

Most of the main raw material suppliers are either in the public sector domain or controlled by the

central or state Governments. As the cement companies, generally enter into prospecting/mining

lease with the respective state Governments, the Government generally controls the prices. Most

of the cement companies are assigned quarterly linkages for coal (fuel) from specific coalfields.

The cement industry accounts for only 3% of the total coal requirements.

Power is purchased from the respective State Electricity Boards. Arising from the lack of

availability of quality power, cement companies have been increasingly using captive power to

augment their requirements.

(Source : Financial Appraisal Note – SBI Capital Markets Limited)

For further details, see the section on ‘Industry Overview’ beginning from page no 51

of the Draft Prospectus.

Business Overview

Burnpur Cement Limited (BCL) is one of the established cement manufacturers of Eastern India

having its market presence in West Bengal, Jharkhand and Bihar. BCL started operations in

October 1991 with a small cement plant with 30 TDP capacity in Asansol. Expansion of facilities

over the years has resulted in a capacity of 1000 TDP of cement making. For its consistent and

continuous endeavours, the company has received ISO-9001:2000 certification in January, 2004

The Company has also been certified by the Bureau of Indian Standards for its quality and has

been certified IS 455 : 1989

3

BCL is a professionally managed company. The Company has achieved a turnover of Rs. 25.85

crores in FY 2005-06.

The Company started operations in the cement industry in October 1991 with a small cement

plant of 30 TPD in Asansol to produce Portland Slag Cement conforming to IS 455:1989. The

production phase was ushered in with the commissioning of the Plant in October, 1991. A slow

and steady commissioning of other units led to a gradual stepping up of production over the

years. Expansion of facilities over the years has resulted in a capacity of 1000 TPD of cement

making. The Company has earned brand recognition for consistent product quality, customer

satisfaction, marketing network etc. For its consistent and continuous endeavors the company

has received ISO-9001:2000 in 2004.

The capacity of the grinding unit has not been optimally utilized due to non-availability of clinker.

Considering the constraints in availability of raw material (clinker) and also for planned expansion

in the cement sector the company has decided to set up an 800 TPD expandable to 1600 TPD

Clinkerisation and Cement grinding unit at Patratu Hazaribagh, Jharkhand which is approximately

3.0 km away from Patratu Thermal Power Station and about 10-15 kms from vast limestone

deposits.

For further details, see the section on ‘Business Overview’ beginning from page no 66

of the Draft Prospectus.

Competitive Strengths

The Company believes that the following are the principal competitive strengths which

differentiate the Company from other Cement manufacturing Companies.

• The Company has experienced promoters

The promoters of the Company have past experience and are well versed in the cement

industry. They are in this business since 1991.

• The Company has presence & brand image in Eastern India cement market:

The cement industry in India is region-focused due to the high transportation costs and

proximity to limestone mines. With an ongoing developmental phase in the areas of

infrastructure driven by demand for cement from construction, increased spending on

infrastructure by the state and central governments and development of special economic

zones and real estate demand, there would be a more demand in Eastern India for cement

from the construction sector. The Company believes that it is well positioned to take

advantage of this demand being the one of the key manufacturers in Eastern India and also

due to the Company’s proposed new project at Patratu which will address the expected

demand growth.

Further, the Company believes that its brand name and reputation provide the Company

with a competitive advantage in ensuring that cement dealers carry the products.

• The Company will have access to quality raw material and fuel for its proposed

unit :

Two critical materials for the cement production are Limestone as raw material and coal as

fuel. Limestone deposits of good quality having CaO (calcium Oxide) of around 46.74% are

spread over a large area within 10-15 kms from the proposed project site of the Company.

Coal having Calorific value of 4500 Kcal /Kg. and ash content as low as 30.06% is available

in plenty in Jharkhand The nearest place of coal from the proposed plant is Bhurkunda

which is approx. 12 km from the proposed project site. Access to quality limestone and

coal used in production of cement at near by locations, would help the Company to produce

cement at competitive prices.The Company has access to reserves of limestone which the

Company believes are sufficient to sustain the operations both existing and future. Further,

the manufacturing plants being in close proximity to the limestone reserves, results in

lower transportation costs. The Company has entered into a Joint Venture agreement with

Pandya Mines for supply of limestone. The Company has also made an application to the

4

Government of Jharkhand for grant to mining lease for mining limestone on the 27

th

of

September, 2006 and is awaiting grant of the said mining rights from the Government of

Jharkhand.

• The Company follows an Established raw materials policy:

The Company procures its raw materials directly from reputed manufactures and suppliers

which helps the company to establish an efficient supply chain at competitive prices and

ensures delivery on-time. The management of the Company places significant emphasis on

the sourcing and logistics for raw material. The Company is able to source key raw

materials close to the factory resulting in reduction of transportation costs.

• The Company’s marketing and distribution network is in place:

The Company has a wide distribution network in Eastern India. The Company has around

525 dealers/distributors/C&F agents all across the states of West Bengal, Bihar and

Jharkhand. The Company believes that this network and the cordial relationships that it

enjoys with the dealers/distributors/C&F agents enables the Company to market and

distribute its cement widely and efficiently in every district of the region.

• Experience and technical know-how:

The Company has over 15 years of experience in the Indian cement industry, which it